Medical Imaging Outsourcing Market Size and Trends

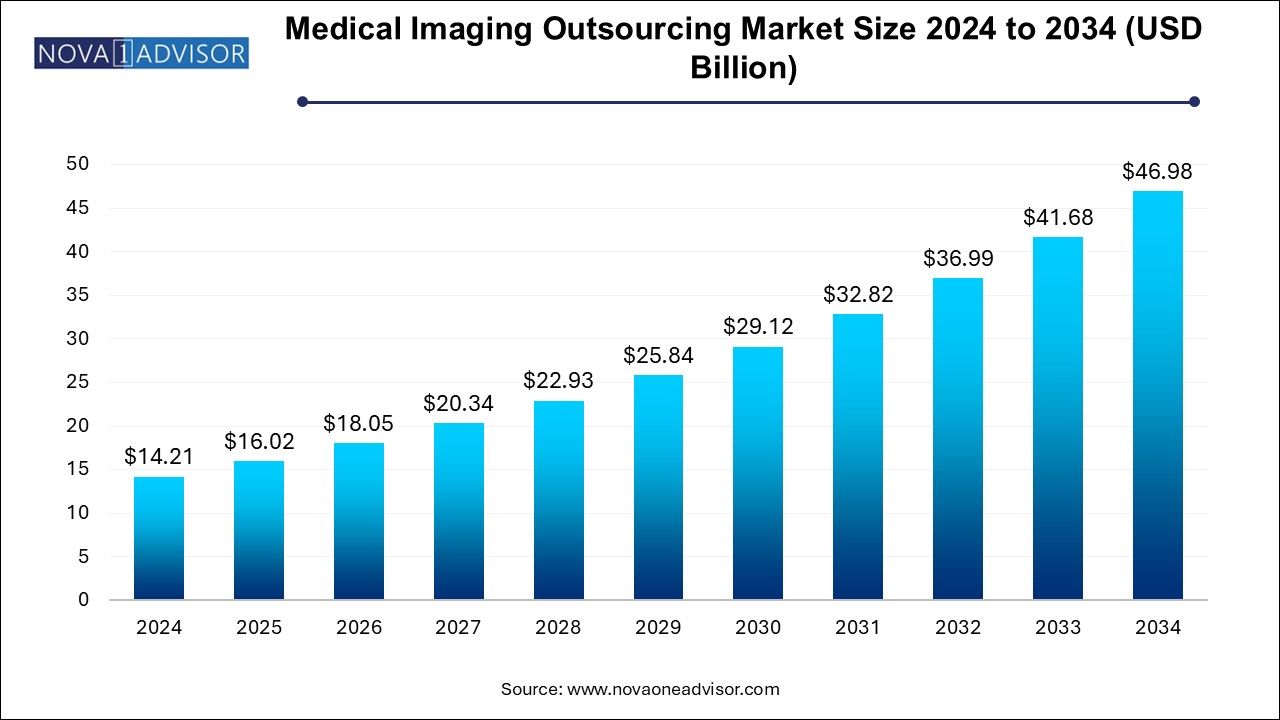

The medical imaging outsourcing market size was exhibited at USD 14.21 billion in 2024 and is projected to hit around USD 46.98 billion by 2034, growing at a CAGR of 12.7% during the forecast period 2025 to 2034.

Medical Imaging Outsourcing Market Key Takeaways:

- The Magnetic Resonance Imaging (MRI) segment dominated the market with a revenue share of 30.7% in 2024.

- The Computed Tomography (CT) segment is projected to grow at the highest CAGR of 13.3% over the forecast period.

- The diagnostic imaging segment dominated the market with the largest revenue share in 2024.

- The teleradiology segment is projected to grow at the highest CAGR over the forecast period.

- The hospitals & clinics segment dominated the market with the largest revenue share in 2024

- The interventional imaging centers segment is projected to grow at the highest CAGR over the forecast period.

- North America medical imaging outsourcing market held the highest revenue share of 42.3% in 2024.

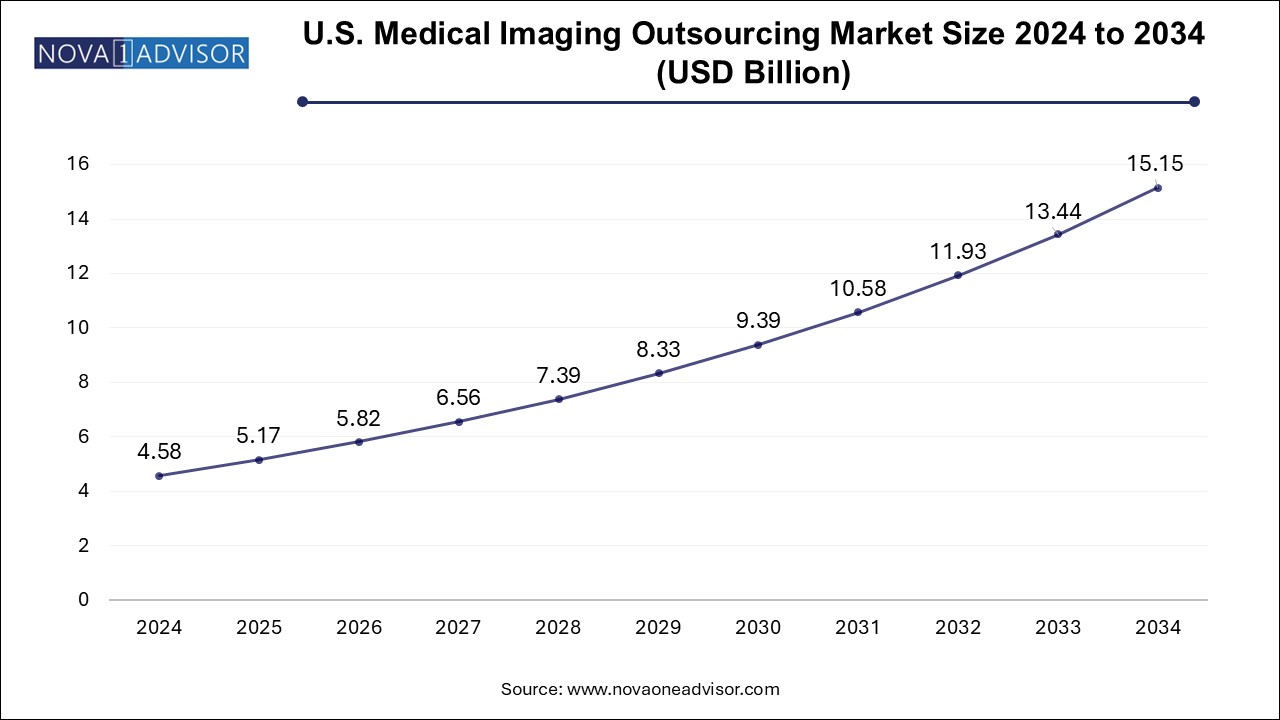

U.S. Medical Imaging Outsourcing Market Size and Growth 2025 to 2034

The U.S. medical imaging outsourcing market size is evaluated at USD 4.58 billion in 2024 and is projected to be worth around USD 15.15 billion by 2034, growing at a CAGR of 11.48% from 2025 to 2034.

North America continues to dominate the global medical imaging outsourcing market, driven by a well-established healthcare system, high imaging utilization rates, and widespread adoption of digital imaging technologies. The U.S. leads in teleradiology infrastructure, with many hospitals and imaging centers outsourcing to national and offshore vendors for after-hours or subspecialty interpretations.

Asia Pacific is the fastest-growing region, supported by increasing imaging demand, expanding medical infrastructure, and a growing pool of trained radiologists. Countries like India, China, Singapore, and South Korea are becoming regional hubs for outsourced teleradiology services, providing cost-effective reporting to hospitals in Europe, the Middle East, and North America.

Additionally, the rise of private diagnostic chains, investment in AI startups, and government-backed digital health initiatives (e.g., India’s Ayushman Bharat Digital Mission) are catalyzing market growth. As the region bridges the imaging quality gap with global standards, it is also emerging as a destination for clinical trial imaging services and remote diagnostics in rural populations.

Market Overview

The medical imaging outsourcing market is experiencing unprecedented growth as healthcare providers increasingly look for cost-effective, scalable, and technologically advanced solutions to manage their imaging workloads. Medical imaging outsourcing refers to the delegation of imaging services such as image acquisition, interpretation, storage, and analysis to third-party providers, including teleradiology firms, diagnostic centers, and specialized imaging service vendors.

This shift is driven by a confluence of factors, including rising imaging volumes due to the global burden of chronic diseases, shortages of qualified radiologists, the need for 24/7 imaging access, and the rapid advancement of imaging technologies like artificial intelligence (AI) and machine learning (ML). Outsourcing allows hospitals, clinics, and research institutions to access expert radiological interpretation and cutting-edge technologies without bearing the full cost of equipment procurement, staff training, or infrastructure development.

As healthcare systems globally become more digitally connected, medical imaging outsourcing is also playing a central role in enhancing diagnostic speed, accuracy, and patient care continuity. The industry is evolving from simple off-site reporting services to integrated diagnostic platforms that provide cloud-based image management, AI-powered analytics, and telehealth-enabled collaboration. With increasing demand for teleradiology, international cross-border diagnostic partnerships, and clinical research support, the global medical imaging outsourcing market is poised for continued expansion.

Major Trends in the Market

-

Increasing Adoption of Teleradiology Platforms for Remote and After-Hours Reporting

-

Integration of AI and Deep Learning in Image Interpretation Services

-

Rising Outsourcing by Hospitals in Rural and Underserved Areas to Address Radiologist Shortages

-

Globalization of Imaging Services: Cross-Border Radiology Networks

-

Use of Cloud-Based PACS (Picture Archiving and Communication Systems) for Seamless Image Access

-

Growing Emphasis on Subspecialty Reporting (e.g., Neuro, MSK, Cardiac Imaging)

-

Expansion of Outsourcing in Clinical Trials for Imaging Biomarkers

-

Cost Optimization Strategies in Hospitals and Diagnostic Chains

-

Increased Demand for Imaging Support in Telemedicine Consultations

-

Consolidation Among Imaging Service Providers to Offer Full-Spectrum Outsourcing

Report Scope of Medical Imaging Outsourcing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 16.02 Billion |

| Market Size by 2034 |

USD 46.98 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 12.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Alliance Medical Limited; Flatworld Solutions Inc; MetaMed; North American Science Associates, LLC; Shields MRI; ProScan Imaging, LLC; RadNet Inc; TOSHIBA CORPORATION; Hitachi High-Tech Corporation; CANON MEDICAL SYSTEMS CORPORATION. |

Market Driver: Escalating Demand for Imaging and Radiologist Shortages

A major driver propelling the medical imaging outsourcing market is the growing global demand for medical imaging services amidst an acute shortage of skilled radiologists. With an aging population and increasing prevalence of chronic illnesses like cancer, cardiovascular disease, and neurological disorders, the demand for diagnostic imaging has surged significantly.

However, many countries—especially in rural areas or emerging markets—face shortages in trained radiologists and subspecialty experts. Even in developed nations, radiology departments are overburdened with increasing imaging volumes and staffing constraints. Outsourcing offers an immediate and effective solution, providing access to expert interpretation services, often on a 24/7 basis, without the logistical limitations of in-house staffing. This driver is especially potent in emergency departments, night shifts, and tertiary care hospitals, where timely imaging review is critical to patient outcomes.

Market Restraint: Data Privacy and Security Concerns

Despite its benefits, a critical restraint to widespread outsourcing is data privacy and security concerns. Medical imaging involves the transmission and storage of highly sensitive patient health data, which is governed by strict regulations such as HIPAA (in the U.S.), GDPR (in Europe), and regional data protection frameworks across Asia and the Middle East.

The outsourcing of imaging services, particularly across borders or to cloud platforms, raises concerns regarding unauthorized access, data breaches, and regulatory compliance. Healthcare providers may hesitate to share patient data with external vendors due to fears of cyberattacks or data misuse. Although vendors are investing in encryption, blockchain, and secure access technologies, the perception of risk remains a major barrier, particularly in markets with strict regulatory environments.

Market Opportunity: Rise of AI-Integrated Imaging Outsourcing Services

A transformative opportunity in this market lies in the integration of artificial intelligence (AI) and machine learning into outsourced imaging services. AI algorithms have proven effective in detecting anomalies across imaging modalities such as CT, MRI, X-ray, and ultrasound with speed and precision, often assisting or augmenting human interpretation.

Imaging service providers are now leveraging AI to triage cases, prioritize urgent findings (e.g., stroke, pneumothorax), and automate repetitive tasks like measurements, lesion detection, and bone age assessment. For instance, AI-assisted chest X-ray reading solutions can flag abnormalities within minutes, helping radiologists focus on critical cases.

The deployment of AI not only improves turnaround times but also enhances reporting accuracy and consistency. As AI becomes embedded in cloud-based PACS and RIS platforms, outsourcing firms that provide “AI-as-a-service” along with radiology interpretations will gain a competitive edge, particularly in high-volume hospital networks and research-based institutions.

Medical Imaging Outsourcing Market By Product Type Insights

The Magnetic Resonance Imaging (MRI) segment dominated the market with a revenue share of 30.7% in 2024, driven by the complexity of image interpretation and the need for specialized expertise. MRI scans are commonly used in neurology, orthopedics, and cardiovascular applications, where accuracy in soft tissue contrast is critical. As imaging centers expand MRI capacity, outsourcing the analysis to experienced neuro- or musculoskeletal radiologists enhances diagnostic accuracy and efficiency, particularly in outpatient and sports medicine settings.

The Computed Tomography (CT) segment is projected to grow at the highest CAGR of 13.3% over the forecast period, CT scans are widely used across specialties including oncology, trauma, neurology, and pulmonary medicine, due to their ability to provide detailed cross-sectional images. The increasing number of trauma cases, stroke evaluations, and cancer staging has resulted in high imaging volumes, particularly in emergency settings where immediate reads are vital.

Medical Imaging Outsourcing Market By Application Insights

The diagnostic imaging segment dominated the market with the largest revenue share in 2024, as the majority of outsourcing services are focused on the interpretation of routine and specialized scans for disease detection, treatment planning, and follow-up. Hospitals and imaging centers outsource diagnostic reads to ensure consistent quality and rapid reporting—especially in high-volume settings like cancer centers, trauma hospitals, and general imaging clinics.

The teleradiology segment is projected to grow at the highest CAGR over the forecast period supported by global digitization, PACS-RIS integration, and growing investments in telehealth infrastructure. Teleradiology allows seamless transmission of imaging data across borders, connecting providers in low-resource or rural areas with radiology experts in real time. Companies offering 24/7 teleradiology services with AI-enabled prioritization and multilingual reporting capabilities are gaining significant traction in both emerging and developed economies.

Medical Imaging Outsourcing Market By End-use Insights

The hospitals & clinics segment dominated the market with the largest revenue share in 2024, as they are the primary sources of medical imaging and rely heavily on external partners for image reporting and storage solutions. Large hospital networks often contract with multiple vendors for radiology, interventional, and nuclear imaging interpretation, enabling them to meet clinical demand without overwhelming in-house teams.

However, interventional imaging centers are experiencing the fastest growth in outsourcing due to increasing demand for minimally invasive procedures and image-guided diagnostics. These centers benefit from outsourced pre- and post-procedure imaging reviews, real-time teleconsultation, and AI support for vascular or oncology interventions. As image-guided surgery and interventional cardiology expand, outsourcing in this niche is projected to rise sharply.

Some of the prominent players in the medical imaging outsourcing market include:

Medical Imaging Outsourcing Market Recent Developments

-

March 2025: RadNet Inc. partnered with an AI software firm to integrate lung cancer detection algorithms into its outsourced imaging workflows, enabling faster and more accurate chest CT reads.

-

February 2025: Teleradiology Solutions (India) announced its expansion into Africa and the Middle East by establishing a diagnostic reporting center in Nairobi, Kenya, to serve under-resourced hospital networks.

-

January 2025: Medica Group (UK) introduced a new remote MRI interpretation service focused on orthopedic and neuroimaging subspecialties, targeting private and NHS diagnostic centers.

-

December 2024: Everlight Radiology (Australia) implemented a blockchain-enabled imaging transmission platform to enhance data security and compliance in international teleradiology.

-

November 2024: USARAD Holdings Inc. signed a strategic agreement with a network of rural hospitals in the U.S. Midwest to deliver 24/7 emergency CT and X-ray reporting via cloud-based PACS.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the medical imaging outsourcing market

By Product Type

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- X-ray

- Nuclear Medicine

- Other Modality

By Application

- Diagnostic Imaging

- Interventional Imaging

- Teleradiology

- Research and Clinical Trials

By End Use

- Hospitals & Clinics

- Interventional Imaging Centers

- Other End Use

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)