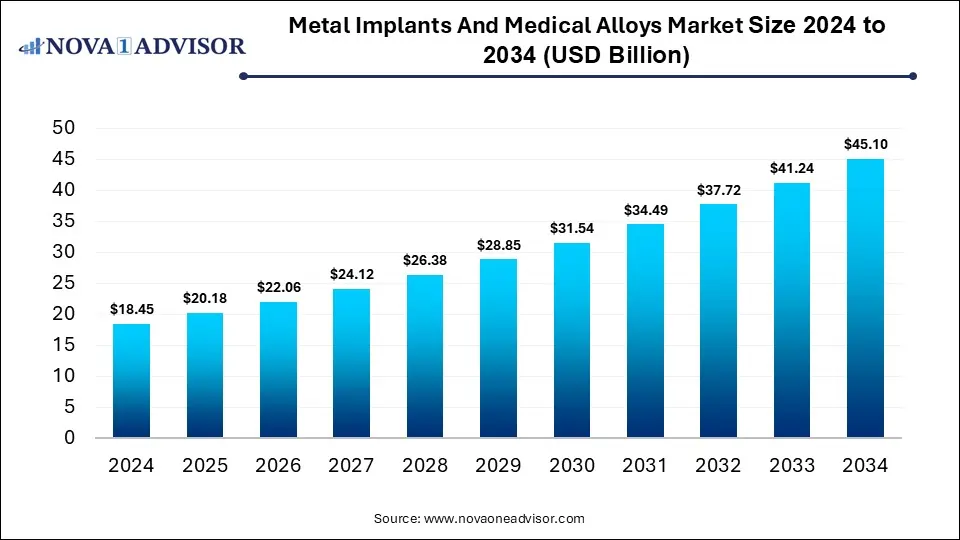

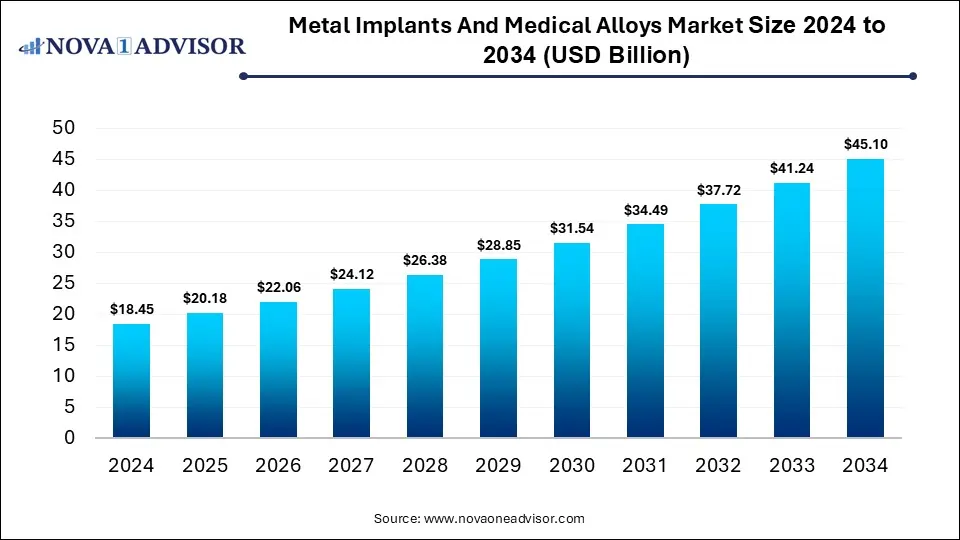

The global metal implants and medical alloys market size was estimated at USD 18.45 billion in 2024 and is expected to reach USD 45.10 billion in 2034, expanding at a CAGR of 9.35% over the forecast period of 2025-2034. The market growth is driven by rising orthopedic, dental, and cardiovascular procedures, accelerated by an aging global population, the increasing prevalence of chronic diseases, improvements in biomaterials (e.g., titanium & cobalt-chromium alloys), and advances in manufacturing technologies such as 3D printing and patient-specific implants.

- By region, North America held the largest share of the metal implants and medical alloys market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By product / implant type, the orthopedic implants segment led the market in 2024.

- By product / implant type, the custom / patient-specific implants segment is expected to expand at the highest CAGR over the projected timeframe.

- By material / alloy, the titanium & titanium alloys segment led the market in 2024.

- By material / alloy, the zinc & iron-based biodegradable alloys segment is expected to expand at the highest CAGR over the projection period.

- By manufacturing technology, the conventional manufacturing segment led the market in 2024.

- By application / indication, the arthroplasty / joint replacement segment led the market in 2024.

- By end user, the hospitals & surgical centers segment led the market in 2024.

AI is greatly improving product design, manufacturing accuracy, and clinical results. AI-powered modeling and simulation tools allow for the creation of customized implants with better biocompatibility and mechanical strength, lowering the risk of rejection and implant failure. In manufacturing, AI enhances 3D printing and material choices, ensuring consistent quality and cost savings. Additionally, AI uses predictive analytics and medical imaging to help surgeons plan implant placements more precisely. Overall, integrating AI is fostering innovation, efficiency, and personalization in the metal implants and medical alloys industry.

The market growth is fueled by the increasing prevalence of orthopedic and dental disorders, the expanding aging population, and advancements in additive manufacturing and surface modification technologies. Additionally, the demand for minimally invasive surgeries and personalized implant solutions continues to drive global market expansion. The metal implants and medical alloys market pertains to the industry involved in the development, production, and use of biocompatible metals and alloys in medical devices, implants, and surgical tools. These materials, such as titanium, stainless steel, and cobalt-chromium, provide high strength, corrosion resistance, and excellent compatibility with human tissues, making them suitable for orthopedic, dental, cardiovascular, and trauma repair applications. The advantages of metal implants include increased durability, a lower risk of infection, and quicker patient recovery.

Market Outlook

- Market Growth Overview: The metal implants and medical alloys market is expected to grow significantly between 2025 and 2034, driven by rising orthopedic and dental implant procedures, alongside advancements in biocompatible and corrosion-resistant materials. Increasing adoption of next-generation titanium, cobalt-chromium, and shape-memory alloys is enhancing implant performance, precision, and longevity across global healthcare systems.

- Sustainability Trends: Sustainability trends are driving innovation in the market through the development of eco-efficient manufacturing processes and recyclable, low-waste alloy compositions. Manufacturers are increasingly adopting energy-efficient melting, additive manufacturing, and closed-loop material recovery systems to minimize environmental impact. These efforts not only align with global sustainability goals but also enhance brand value, regulatory compliance, and long-term cost efficiency in medical device production.

- Major Investors: Major investors in the market include leading medical device companies such as Stryker, Zimmer Biomet, Johnson & Johnson (DePuy Synthes), Smith & Nephew, and Medtronic, alongside material specialists like Carpenter Technology and ATI Metals. These players invest heavily in R&D, advanced alloy formulation, additive manufacturing, and biocompatibility enhancements to improve implant performance and longevity. Their ongoing funding and technological collaboration with research institutions drive innovation, regulatory advancement, and global market expansion.

- Startup Economy: The startup economy in the market is gaining momentum, driven by emerging companies focusing on customized, 3D-printed implants, bioresorbable metal materials, and smart surface coatings. These startups are leveraging AI, nanotechnology, and advanced metallurgy to enhance biocompatibility and patient-specific design. Their agility and innovation are accelerating the market’s shift toward next-generation, sustainable, and precision-engineered implant solutions.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 20.18 Billion |

| Market Size by 2034 |

USD 45.10 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.35% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product / Implant Type, By Material / Alloy, By Manufacturing Technology, By Application / Clinical Indication, By End-User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Increasing Prevalence of Orthopedic and Dental Disorders

The growing prevalence of orthopedic and dental disorders is a major factor driving growth in the metal implants and medical alloys market. Rising cases of conditions such as osteoporosis, arthritis, and dental caries have increased the demand for durable, biocompatible implants to restore mobility and function. Metal alloys like titanium and cobalt-chromium are common choices due to their strength, corrosion resistance, and compatibility with human tissues. Additionally, the aging population, which is more susceptible to bone fractures and tooth loss, further enhances the need for orthopedic and dental implants. As a result, healthcare providers and manufacturers are increasingly focusing on innovative metal-based solutions to meet this growing clinical demand.

Advancement in Medical Alloy Technology

Advancements in medical alloy technology are significantly propelling the growth of the metal implants and medical alloys market by enhancing the performance, safety, and durability of implants. The development of next-generation alloys, such as titanium-niobium and cobalt-chromium-molybdenum, has improved corrosion resistance, biocompatibility, and mechanical strength. Innovations in surface modification and coating technologies further support better osseointegration and lower the risk of implant rejection. Additionally, integrating additive manufacturing (3D printing) with advanced alloy formulations enables customized, lightweight, and complex implant designs.

- In November 2023, the restor3d Total Talus Replacement (H230003), approved by the FDA, represents a major advancement in personalized orthopedic implant technology. Developed by restor3d, Inc., this 3D-printed implant is customized for each patient using CT scan data and manufactured from medical-grade cobalt-chromium alloy.

Restraint

High Cost of Metal Implants

High costs associated with metal implants hinder the growth of the market. Premium materials, such as titanium and cobalt-chromium alloys, are expensive to produce and process due to their complex manufacturing and quality assurance requirements. Additionally, advanced implant technologies, including custom 3D-printed designs and biocompatible coatings, further increase overall treatment costs. In developing regions, limited healthcare budgets and a lack of reimbursement policies make these implants less accessible to patients.

Opportunities

Emergence of Biodegradable Metal Alloys

The emergence of biodegradable metal alloys, such as magnesium, zinc, and iron-based materials, is creating immense opportunities in the metal implants and medical alloys market. These alloys gradually dissolve in the body after fulfilling their structural purpose, eliminating the need for secondary removal surgeries and reducing long-term complications. Their excellent biocompatibility and controlled degradation rates make them ideal for orthopedic fixation, cardiovascular stents, and pediatric implants. Continuous research into alloy composition, corrosion control, and mechanical optimization is expanding their clinical potential. As regulatory bodies increasingly support sustainable and patient-centric solutions, biodegradable metals are set to redefine the future landscape of medical implant materials.

Expansion in Emerging Economies

The expansion of healthcare infrastructure and rising disposable incomes in emerging economies such as India, China, Brazil, and Southeast Asian nations are creating substantial opportunities in the market. Growing access to advanced medical treatments and a surge in orthopedic and dental procedures are driving demand for high-quality implants. Governments and private investors are increasing funding for medical device manufacturing, local production facilities, and regulatory modernization, fostering market entry for global and regional players. Additionally, the rising geriatric population and improved insurance coverage are boosting procedural volumes. Together, these factors position emerging economies as high-growth regions for innovative and cost-effective metal implant and alloy solutions.

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. Higher national income levels enable increased healthcare spending, better hospital infrastructure, and broader access to advanced surgical procedures. As economies strengthen, both public and private healthcare investments rise, supporting greater adoption of high-quality metal implants and alloy-based medical devices.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the metal implants and medical alloys market by rising raw material costs, manufacturing expenses, and supply chain disruptions increase the overall price of implants, making them less affordable for patients and healthcare providers. These financial pressures also limit hospitals’ procurement budgets and delay elective surgeries, thereby slowing market expansion.

Exchange Rates

Exchange rate fluctuations can negatively affect, since many implant materials and medical devices are traded internationally, unfavorable currency movements can increase import costs for manufacturers and healthcare providers. This volatility affects pricing stability, profit margins, and accessibility of advanced implants, especially in developing regions reliant on imports.

By Product / Implant Type Insights

Why Did the Orthopedic Implant Segment Dominate the Metal Implants and Medical Alloys Market in 2024?

The orthopedic implants segment dominated the market with the largest share in 2024. This is due to the increasing elderly population and the rising incidence of age-related bone fractures, such as hip, femur, and spine fractures. Older adults often experience osteoporosis and reduced bone density, which increases the need for durable and biocompatible metal implants. Advanced alloys like titanium and cobalt-chromium are widely used in orthogeriatric implants for their strength, corrosion resistance, and compatibility with fragile bone structures. Furthermore, innovations such as minimally invasive fixation systems and patient-specific 3D-printed implants have improved surgical outcomes and recovery times.

The custom/patient-specific implants segment is expected to grow at the fastest CAGR during the projection period, driven by the increasing adoption of personalized and patient-specific medical solutions. Advances in 3D printing and computer-aided design (CAD) technologies allow manufacturers to produce implants that precisely match individual anatomical structures, improving comfort, fit, and surgical outcomes. Custom implants also reduce postoperative complications and the need for revision surgeries, making them highly preferred among healthcare professionals. Additionally, the growing demand for complex orthopedic, cranial, and dental reconstructions drives the use of custom metal alloys like titanium and cobalt-chromium.

Metal Implants And Medical Alloys Market By Product / Implant Type, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Orthopedic Implants |

5.17 |

5.67 |

6.22 |

6.83 |

7.49 |

8.22 |

9.02 |

9.90 |

10.86 |

11.92 |

13.08 |

| Spinal Implants |

2.77 |

3.01 |

3.27 |

3.55 |

3.85 |

4.18 |

4.54 |

4.93 |

5.36 |

5.82 |

6.31 |

| Dental Implants & Prosthetics |

2.21 |

2.44 |

2.69 |

2.97 |

3.27 |

3.61 |

3.97 |

4.38 |

4.83 |

5.32 |

5.86 |

| Cardiovascular Implants |

2.58 |

2.82 |

3.09 |

3.38 |

3.69 |

4.04 |

4.42 |

4.83 |

5.28 |

5.77 |

6.31 |

| Trauma & Fixation Devices |

1.85 |

2.00 |

2.16 |

2.34 |

2.53 |

2.74 |

2.97 |

3.21 |

3.47 |

3.75 |

4.06 |

| Craniofacial/Maxillofacial Implants |

1.66 |

1.80 |

1.94 |

2.10 |

2.27 |

2.45 |

2.65 |

2.86 |

3.09 |

3.34 |

3.61 |

| Custom / Patient-Specific Implants |

2.21 |

2.44 |

2.69 |

2.97 |

3.27 |

3.61 |

3.97 |

4.38 |

4.83 |

5.32 |

5.86 |

By Material / Alloy Insights

How Does the Titanium & Titanium Alloys Segment Lead the Market in 2024?

The titanium & titanium alloys segment led the metal implants and medical alloys market in 2024 due to their exceptional biocompatibility, strength-to-weight ratio, and corrosion resistance. Titanium’s ability to integrate with bone tissue through osseointegration makes it the preferred material for orthopedic, dental, and spinal implants. Its durability and non-reactive nature minimize the risk of implant rejection or allergic reactions, improving patient safety and long-term outcomes. Additionally, advancements in titanium alloy processing and surface modification technologies have enhanced implant performance and lifespan.

The zinc & iron-based biodegradable alloys segment is projected to grow at the highest CAGR in the coming years. This is mainly because of their ability to naturally dissolve in the body after completing their healing function, removing the need for secondary removal surgeries. These alloys, primarily composed of zinc and iron, offer excellent biocompatibility and support tissue regeneration, making them suitable for orthopedic and cardiovascular uses. Increased research into controlled degradation rates and mechanical strength has helped boost their clinical adoption.

By Manufacturing Technology Insights

What Made Conventional Manufacturing the Leading Segment in the Market in 2024?

The conventional manufacturing segment dominated the metal implants and medical alloys market in 2024 due to its broad adoption, established infrastructure, and proven reliability in producing high-quality medical components. Methods such as casting, forging, and machining are well-established for their consistency, mechanical strength, and ability to meet strict regulatory standards. These techniques are especially favored for mass-producing standard implants like orthopedic and dental devices, ensuring cost efficiency and scalability. Additionally, the extensive expertise and available skilled labor in traditional manufacturing processes make it a trusted choice among medical device producers.

The additive manufacturing segment is expected to expand at the highest CAGR in the coming years. This is primarily due to its ability to produce highly customized, complex, and patient-specific implants with superior precision. This technology enables lightweight structures, enhanced design flexibility, and optimized mechanical properties, which are difficult to achieve with traditional manufacturing methods. Additionally, additive manufacturing reduces material waste and production time, making it a cost-effective and sustainable solution for personalized healthcare. The growing adoption of 3D printing technologies in orthopedics, dentistry, and craniofacial applications, along with advancements in biocompatible metal powders such as titanium and cobalt-chromium alloys, further accelerates its growth.

By Application / Indication Insights

Why Did the Arthroplasty / Joint Replacement Segment Dominate the Market in 2024?

The arthroplasty / joint replacement segment led the metal implants and medical alloys market in 2024 due to the growing prevalence of joint disorders such as osteoarthritis, rheumatoid arthritis, and other degenerative bone diseases among the aging population. The rising number of hip, knee, and shoulder replacement surgeries has greatly increased demand for high-performance metal implants made from titanium, cobalt-chromium, and stainless-steel alloys. These materials provide excellent biocompatibility, durability, and corrosion resistance, ensuring long-term implant performance and improved patient mobility. Furthermore, advancements in implant design and surface coatings have improved bone integration and reduced revision rates.

The spinal disorders segment is expected to grow at the highest CAGR in the coming years. This is mainly due to the increasing occurrence of spinal injuries, degenerative disc diseases, and scoliosis among both aging and younger populations. The rising demand for spinal fusion procedures and motion-preserving implants is driving the use of advanced metal alloys that offer high strength, corrosion resistance, and biocompatibility. Technological advancements, such as 3D-printed titanium implants and bioresorbable alloys, are improving surgical accuracy and reducing recovery times, which further boosts adoption. Additionally, the rise in minimally invasive spinal surgeries and the availability of customized implant options are fueling strong market growth.

By End-User Insights

Why Did the Hospitals & Surgical Centers Segment Lead the Market in 2024?

The hospitals & surgical centers segment led the metal implants and medical alloys market in 2024, due to their vital role as primary treatment hubs for complex surgical procedures such as orthopedic reconstructions, joint replacements, and trauma repairs. These facilities have advanced infrastructure, skilled surgeons, and access to the latest medical technologies, enabling them to manage high patient volumes and a variety of implant needs. Their ability to perform both emergency and planned surgeries maintains consistent demand for high-quality metal implants made from titanium, stainless steel, and cobalt-chromium alloys. Additionally, increased healthcare spending, expanding hospital networks, and the rising prevalence of musculoskeletal disorders reinforce their market leadership in the global metal implants and medical alloys industry.

The ambulatory surgical centers segment is expected to grow at the highest CAGR in the coming years. This is mainly due to the increasing shift toward minimally invasive and same-day surgical procedures. ASCs offer cost-effective, high-quality care with shorter recovery times, making them an appealing alternative to traditional hospitals for elective orthopedic and dental implant surgeries. The adoption of advanced surgical technologies and biocompatible metal implants has allowed ASCs to safely and efficiently perform complex procedures such as spinal fixation, joint replacements, and dental restorations. Additionally, rising healthcare costs, favorable reimbursement policies, and patient preference for outpatient care are driving the rapid growth of ASCs, positioning this segment as a key driver in the market.

- In January 2025, Northtowns Ambulatory Surgery Center (NASC) became the second site globally to perform an anatomic total shoulder arthroplasty using the new OsseoFit™ Stemless Shoulder System. The procedure was conducted by Dr. Thomas R. Duquin of UBMD Orthopaedics & Sports Medicine, who also contributed to the development of the OsseoFit implant.

Metal Implants And Medical Alloys Market By End-User, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hospitals & Surgical Centers |

6.46 |

7.04 |

7.68 |

8.37 |

9.13 |

9.95 |

10.85 |

11.83 |

12.90 |

14.06 |

15.33 |

| Ambulatory Surgical Centers |

4.06 |

4.46 |

4.90 |

5.38 |

5.91 |

6.49 |

7.13 |

7.83 |

8.60 |

9.44 |

10.37 |

| Dental Clinics & Prosthodontists |

3.32 |

3.65 |

4.02 |

4.41 |

4.85 |

5.34 |

5.87 |

6.45 |

7.09 |

7.80 |

8.57 |

| Orthopedic & Trauma Centers |

2.77 |

3.01 |

3.27 |

3.55 |

3.85 |

4.18 |

4.54 |

4.93 |

5.36 |

5.82 |

6.31 |

| Contract Manufacturers / OEMs & Distributors |

1.85 |

2.02 |

2.21 |

2.41 |

2.64 |

2.88 |

3.15 |

3.45 |

3.77 |

4.12 |

4.51 |

By Regional Analysis

What Made North America the Dominant Region in the Market?

North America maintained dominance in the metal implants and medical alloys market while holding the largest share in 2024. The region’s dominance is attributed to its advanced healthcare infrastructure, strong presence of leading medical device manufacturers, and high adoption of technologically advanced implants. The region benefits from a large aging population and a high prevalence of orthopedic, spinal, and dental disorders, which significantly increase implant demand. Furthermore, robust R&D investments by key players such as Zimmer Biomet, Stryker, and Johnson & Johnson drive continuous innovation in metal implant materials and manufacturing techniques. Additionally, favorable regulatory frameworks, reimbursement policies, and high healthcare spending further reinforce North America’s position as the leading market region.

U.S. Metal Implants and Medical Alloys Market Trends

The U.S. is a major contributor to the market in North America due to the high rate of orthopedic and dental disorders, along with widespread use of advanced implant technologies in surgeries. The country also features top manufacturers and research institutions like Stryker, Zimmer Biomet, and Johnson & Johnson, which continually innovate and customize implant solutions. Furthermore, robust healthcare spending, favorable reimbursement policies, and early adoption of additive manufacturing and biocompatible alloys strengthen the U.S. market position.

- In the U.S., about one in five adults has arthritis. It affects over 58 million U.S. adults, half of them of working age, and is projected to affect 78 million by 2040.

What Makes Asia Pacific the Fastest-Growing Area in the Market?

Asia Pacific is expected to grow at the fastest rate in the coming years. This is due to rapid healthcare infrastructure development and increasing investments in medical device manufacturing. Rising incidences of orthopedic injuries, trauma cases, and dental disorders, particularly in countries like China and India, are driving higher demand for advanced metal implants. Additionally, the region’s expanding aging population and growing awareness of minimally invasive and reconstructive surgeries are fueling market adoption. Government initiatives promoting domestic production of medical implants and the availability of cost-effective manufacturing also make Asia Pacific a key hub for global implant production, contributing to its strong growth trajectory.

China Metal Implants and Medical Alloys Market Trends

China is a key player in the Asia Pacific metal implants and medical alloys market due to its rapidly growing healthcare infrastructure and strong domestic manufacturing capabilities. The country’s large population, combined with a rising incidence of orthopedic and dental conditions, is driving demand for advanced implant solutions. Additionally, government initiatives that support local medical device innovation and increased investments from both domestic and international companies have strengthened China’s position as a major producer and consumer of metal implants. The country’s increasing expertise in additive manufacturing and titanium-based alloys further boosts its leadership in the regional market.

How is the Opportunistic Rise of Europe in the Metal Implants and Medical Alloys Market?

Europe is experiencing a strategic growth in the market due to its established healthcare infrastructure and a rising elderly population, which increases the demand for orthopedic and dental implants. Strong government initiatives and favorable reimbursement policies further support the adoption of advanced implant technologies across the region. Additionally, Europe’s robust medical device manufacturing ecosystem, combined with growing investments in research and development, is encouraging innovation in high-performance and biocompatible alloys. The increasing prevalence of lifestyle-related musculoskeletal disorders and heightened patient awareness of advanced treatment options also drive market growth. Overall, these factors position Europe as a key growth region with ample opportunities for investment and innovation.

- In June 2025, Boston Scientific introduced its TAXUS Element Paclitaxel-Eluting Coronary Stent System in Europe. Made from a platinum-chromium alloy, the stent is designed for enhanced durability and visibility.

Germany Metal Implants and Medical Alloys Market Trends

Germany is leading the market in Europe due to its advanced healthcare infrastructure, strong medical device manufacturing base, and high adoption of cutting-edge implant technologies. The country benefits from robust R&D capabilities, favorable regulatory frameworks, and government support for healthcare innovation, which collectively accelerate the development and commercialization of high-quality metal implants and medical alloys. Additionally, Germany’s aging population and increasing incidence of orthopedic and musculoskeletal disorders drive strong domestic demand, further consolidating its leadership position in the European market.

Metal Implants And Medical Alloys Market By Region, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

7.4 |

8.1 |

8.9 |

9.8 |

10.8 |

11.8 |

13.0 |

14.3 |

15.7 |

17.2 |

18.9 |

| Europe |

5.5 |

6.0 |

6.6 |

7.2 |

7.8 |

8.5 |

9.3 |

10.1 |

11.0 |

12.0 |

13.1 |

| Asia Pacific |

2.8 |

3.0 |

3.4 |

3.7 |

4.1 |

4.5 |

4.9 |

5.4 |

6.0 |

6.6 |

7.2 |

| Latin America |

1.5 |

1.6 |

1.7 |

1.9 |

2.0 |

2.2 |

2.3 |

2.5 |

2.7 |

2.9 |

3.2 |

| Middle East & Africa |

1.3 |

1.4 |

1.5 |

1.6 |

1.7 |

1.9 |

2.0 |

2.2 |

2.3 |

2.5 |

2.7 |

1. Raw Material Sourcing & Alloy Production

This stage involves extracting and processing raw metals such as titanium, cobalt, chromium, stainless steel, and magnesium into high-purity, medical-grade alloys. These materials must meet strict standards for biocompatibility, corrosion resistance, and mechanical strength required for implants.

- Key Players: Carpenter Technology Corporation, ATI Specialty Alloys & Components, Fort Wayne Metals, and Sandvik AB.

2. Component Manufacturing & Design

In this stage, raw metal alloys are shaped, machined, and designed into implantable components like orthopedic screws, plates, dental posts, and joint replacements. Companies use conventional manufacturing and additive manufacturing (3D printing) to produce customized and complex geometries for patients.

- Key Players: Johnson Matthey, Zimmer Biomet, Stryker Corporation, and Smith+Nephew.

3. Assembly & Product Integration

The assembly stage integrates various metal components, surface coatings, and fixation systems into finished implant products. This phase focuses on ensuring precision, mechanical stability, and sterilization standards before the final approval.

- Key Players: DePuy Synthes (Johnson & Johnson), Medtronic, Zimmer Biomet, and Exactech Inc.

4. Quality Control, Testing & Regulatory Approval

All medical implants must undergo rigorous quality testing, including mechanical fatigue, biocompatibility, and corrosion resistance, before regulatory submission. Compliance with FDA, CE, and ISO 13485 standards ensures product safety and global market approval.

- Key Players: TÜV SÜD, SGS SA, UL Solutions.

5. Distribution & Supply Chain Management

Finished metal implants are supplied through specialized medical distributors, hospital procurement systems, and direct sales channels. Efficient supply chains are essential for ensuring sterile handling of products and fulfilling the demands of hospitals and surgical centers.

- Key Players: Medline Industries, Cardinal Health, Owens & Minor, and Henry Schein.

- Zimmer Biomet Holdings, Inc.

Zimmer Biomet is a global leader in orthopedic and dental implant manufacturing, offering advanced metal-based implants for joint, spinal, and trauma surgeries. The company continuously innovates with titanium and cobalt-chromium alloys, enhancing implant durability and biocompatibility.

Stryker is a major player specializing in orthopedic, spinal, and reconstructive implants made from medical-grade titanium and stainless-steel alloys. Its strong focus on additive manufacturing and personalized implant solutions drives market innovation and global adoption.

- Johnson & Johnson (DePuy Synthes)

DePuy Synthes, a subsidiary of Johnson & Johnson, designs and produces orthopedic and trauma implants using high-performance titanium and stainless steel alloys. The company leverages advanced manufacturing and surface modification technologies to improve implant integration and performance.

Smith+Nephew offers a diverse portfolio of orthopedic reconstruction, trauma, and sports medicine implants based on corrosion-resistant metal alloys. The firm’s innovation in lightweight, high-strength alloys supports faster patient recovery and longer implant life.

Medtronic develops metal-based spinal and cranial implants using titanium and cobalt-chromium alloys that enhance structural stability and biocompatibility. The company also integrates smart technologies and 3D printing to improve implant precision and patient outcomes.

- Carpenter Technology Corporation

Carpenter Technology is a key supplier of premium medical-grade alloys, including titanium, stainless steel, and cobalt-based materials, used in implant manufacturing. Its materials support improved fatigue strength, corrosion resistance, and long-term performance of medical devices.

- ATI Specialty Alloys & Components

ATI provides specialty metals and precision-engineered alloy solutions for surgical implants, orthopedic devices, and medical instruments. The company focuses on developing lightweight, high-strength alloys that meet stringent medical standards and regulatory requirements.

Fort Wayne Metals specializes in producing precision wires, rods, and bars made from titanium, nitinol, and stainless-steel alloys for medical implant applications. The company supports custom alloy development for orthopedic, cardiovascular, and dental implants.

- Sandvik AB (Sandvik Materials Technology)

Sandvik AB produces advanced stainless steels and titanium alloys optimized for surgical instruments and implants. The company’s focus on material purity and microstructure control ensures superior mechanical properties and biocompatibility.

Exactech develops innovative orthopedic implant systems and uses titanium and cobalt-chromium alloys for reconstructive surgeries. The company emphasizes precision engineering and surface coating technologies to improve implant fixation and longevity.

Recent Developments

- In April 2025, the restor3d launched new 3D-printed porous titanium implants designed to promote bone ingrowth, including a porous hip cup and reverse shoulder.

- In March 2025, Naton Biotechnology introduced the first laser 3D-printed total knee implant in China. The cobalt-chromium-molybdenum alloy provides enhanced strength and consistency.

The metal implants and medical alloys market demonstrates a robust growth trajectory, underpinned by accelerating technological advancements in biomaterials science and a pronounced uptick in orthopedic, dental, and cardiovascular implant procedures worldwide. Market expansion is being catalyzed by the convergence of additive manufacturing, precision metallurgy, and surface modification technologies, which collectively enhance biocompatibility, corrosion resistance, and mechanical integrity of implantable devices. Increasing geriatric demographics and the surging prevalence of degenerative and trauma-related conditions are driving sustained procedural volumes, while evolving regulatory frameworks are encouraging innovation in next-generation titanium, cobalt-chromium, and shape-memory alloys.

Strategically, the sector is poised for substantial opportunity creation as OEMs and material developers align towards customized, patient-specific implant solutions and lightweight, high-strength alloys optimized for long-term physiological integration. The emergence of AI-driven material design, nanostructured coatings, and bioresorbable metallic composites further positions the market at the cusp of transformational value creation, with significant potential for revenue expansion across both developed and emerging healthcare economies.

Segments Covered in the Report

By Product / Implant Type

- Orthopedic Implants

- Spinal Implants

- Dental Implants & Prosthetics

- Cardiovascular Implants

- Trauma & Fixation Devices

- Craniofacial/Maxillofacial Implants

- Custom / Patient-Specific Implants

By Material / Alloy

- Titanium & Titanium Alloys

- Cobalt-Chromium Alloys

- Stainless Steel

- Magnesium Alloys

- Zinc & Iron-Based Biodegradable Alloys

- NiTi / Nitinol

- Surface Coatings & Composite Layers

By Manufacturing Technology

- Conventional Manufacturing

- Additive Manufacturing

- Surface Treatment & Coating Technologies

- Hybrid Processes

By Application / Clinical Indication

- Arthroplasty / Joint Replacement

- Trauma & Fracture Repair

- Spinal Disorders

- Dental Rehabilitation

- Cardiovascular Interventions

- Reconstructive / Oncologic Surgery

By End-User

- Hospitals & Surgical Centers

- Ambulatory Surgical Centers

- Dental Clinics & Prosthodontists

- Orthopedic & Trauma Centers

- Contract Manufacturers / OEMs & Distributors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa