Multiplex Detection Immunoassays Market Size and Growth 2025 to 2034

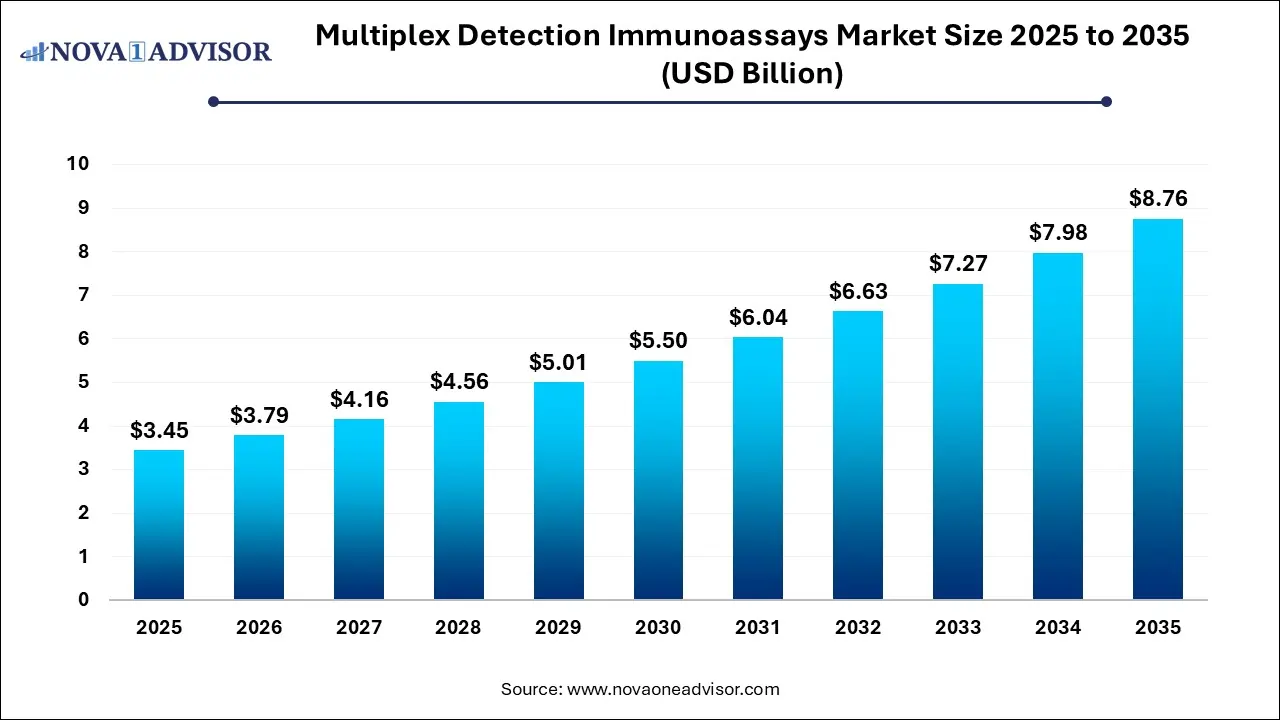

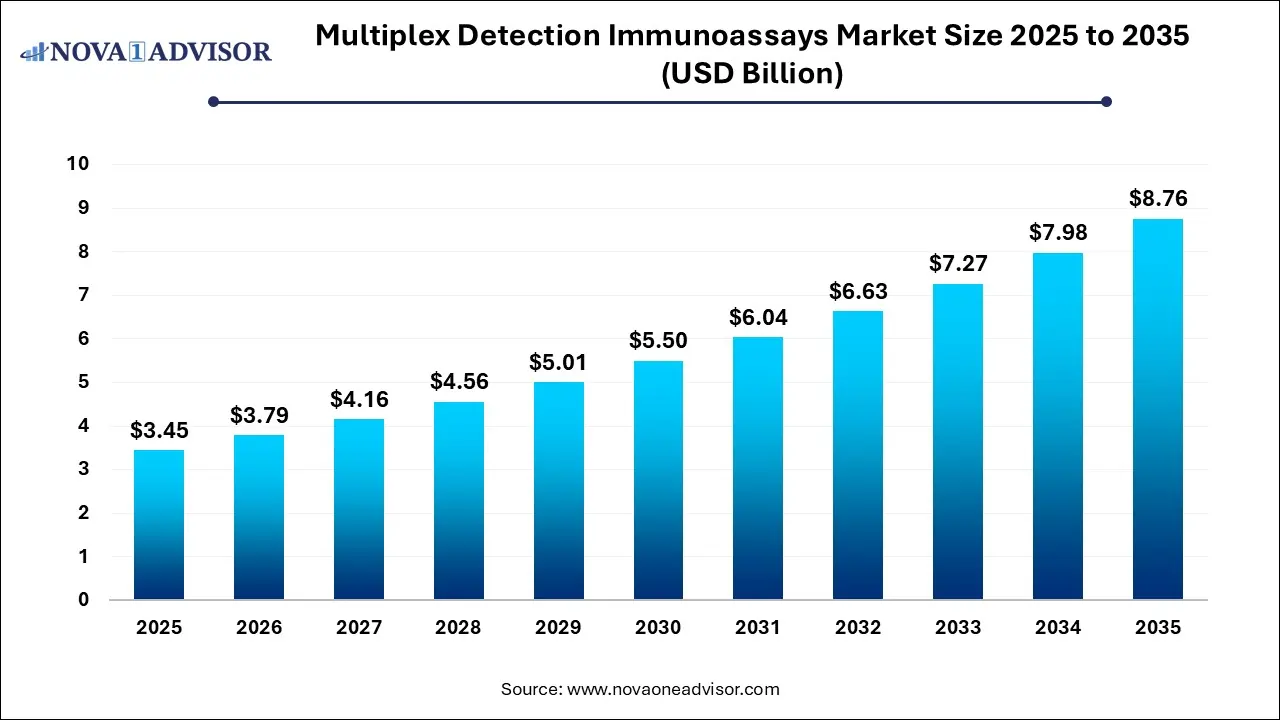

The global Multiplex Detection Immunoassays market gathered revenue around USD 1.8 Billion in 2025 and market is set to grow USD 3.7 Billion by the end of 2035. The global Multiplex Detection Immunoassays market is estimated to expand at a modest CAGR of 9.7% during the prediction period 2025 to 2035.

Key Takeaways

- By type, the blends protein arrays segment dominated the multiplex detection immunoassay market.

- By type, the planar assay segment is expected to rise with the highest CAGR during the forecast period.

- By technique, the protein-based techniques segment held the largest share of the multiplex detection immunoassay market.

- By technique, the nucleic acid-based techniques segment is expected to grow with the highest CAGR during the forecast period.

- By application, the infectious disease testing segment dominated the industry.

- By application, the research & development segment is expected to grow with the highest CAGR during the forecast period.

- By end user, the pharmaceutical & biopharmaceutical companies segment held the largest share of the immunoassay industry.

- By end user, the clinical research organizations segment is expected to grow with the highest CAGR during the forecast period.

Multiplex immunoassays provide sufficient analytical performance to evaluate serum biomarkers that complement each other in the detection of a larger number of patient samples. The use of differentially detectable beads of different regions enables simultaneous identification and quantification of multiple analytes in the same sample allowing the individual immunoassays to be multiplexed.

In terms of assay type, the global multiplex detection immunoassays market has been bifurcated into planar assay and bead-based assay. The planar assay segment has been split into blends protein arrays (multiplexed ELISA) and antibody arrays. The bead-based assay sub-segment has been segregated into magnetic bead-based and non-magnetic bead-based. The planar assay segment accounted for prominent share of the global multiplex detection immunoassays market in 2020. The segment is anticipated to expand at a high CAGR during the forecast period, owing to rise in the need and demand for diagnosis by patients.

Based on technique, the global multiplex detection immunoassays market has been divided into nucleic acid-based techniques, protein-based techniques, and biosensor-based techniques. The protein-based techniques segment held a significant share of the global multiplex detection immunoassays market in 2020. In terms of application, the global multiplex detection immunoassays market has been classified into disease testing, food contamination testing, research & development, and veterinary disease testing. The research & development segment accounted for major share of the global multiplex detection immunoassays market in 2020.

This research report purposes at stressing the most lucrative growth prospects.The aim of the research report is to provide an inclusive valuation of the Multiplex Detection Immunoassays market and it encompasses thoughtful visions, actualities, industry-validated market findings, historic data, and prognoses by means of appropriate set of assumptions and practice. Global Multiplex Detection Immunoassays market reportaids in comprehendingmarket structure and dynamics by recognizing and scrutinizing the market sectors and predicted the global market outlook.

Multiplex detection immunoassays market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rapid investment by biotech companies for advancing research and development of DNA-based therapies coupled with rising incidences of autoimmune diseases globally.

- Major Investors: Numerous market players are actively entering this market, drawn by collaborations, R&D and business expansion. Several biopharma companies such as Bio-Rad Laboratories, Thermo Fisher Scientific, Luminex Corporation and some others have started investing rapidly for developing advanced disease testing methodologies.

- Startup Ecosystem: Various startup brands are engaged in developing numerous types of immunoassays for the end-users. The prominent startup companies dealing in multiple detection immunoassays comprises of Archira Labs, Nanostics, StadaDX and some others.

Report Scope of Multiplex Detection Immunoassays Market

Report Coverage

|

Details |

| Market Size in 2026 |

USD 3.79 Billion |

Market Size by 2035

|

USD 8.76 Billion |

| Growth Rate From 2025 to 2035 |

CAGR of 9.77%

|

| Base Year |

2024

|

| Forecast Period |

2025 - 2035

|

| Segments Covered |

Assay Type,Technique,Application,End User |

| Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| Companies Mentioned |

Hoffmann-La Roche Ltd., QIAGEN, Merck KGaA, Microsynth AG, Bio-Rad Laboratories, Thermo Fisher Scientific, Luminex Corporation, and Becton, Dickinson and Company. |

Rise in Demand for Clinical Diagnosis Applications to Propel Market Growth

Multiplex detection immunoassays are increasingly being used in a wide range of applications, including infectious disease testing, food contamination testing, veterinary disease testing, and R&D activities. The increasing demand for multiplex detection immunoassays for clinical diagnosis is expected to accelerate the development of multiplex detection immunoassays in the upcoming years– a factor that is set to fuel the growth of the market for global multiplex detection immunoassays during the assessment period. Prosthetic joint replacements are primarily used to enhance the quality of life, restore the joint function, and improve mobility. Although prosthetic joint replacement is a globally accepted treatment, prosthetic joint infection is one of the major causes of knee arthroplasties, which makes early diagnosis critical. This is set to drive the demand for multiplex detection immunoassays.

As a measure to prevent prosthetic joint infection, a number of immunoassays are available to assist in the early detection of infections out of which, lateral flow multiplex detection immunoassay is at the forefront in terms of adoption due to the low-costs, speed, and simplicity.

Point-of-care Testing to Aid Market Growth

The noteworthy surge in the demand for point of care diagnostic devices for rapid initial screening in various non-laboratory setting is another factor that is anticipated to provide a considerable boost to the growth of the global multiplex detection immunoassays market during the assessment period. The demand for ‘near-patient tests’ is on the rise, owing to its high patient convenience. Some of the most widely used point-of-care tests include blood glucose tests, drug screenings, and food pathogens. At present, a range of point-of-care immunoassays is available to determine the presence of various pathogens and substances, and efforts are being made to improve the quality and performance of the same, thus driving the multiplex detection immunoassays market during the assessment period.

Researchers Focus on Development of Multiplex Immunoassay for Simultaneous Detection of Human Coronaviruses

The outbreak of the COVID-19 pandemic is projected to have a strong impact on the growth of the global multiplex detection immunoassays market. Research and development activities are expected to gain considerable traction across the global multiplex detection immunoassays market during the ongoing COVID-19 health crisis. At present, scientists and researchers are increasingly focusing on the development of multiplex serologic assays to enable swift detection and surveillance of known human coronaviruses. Research and development activities are anticipated to set the tone for the growth of the global multiplex detection immunoassays market in the upcoming years.

High Prevalence and Increase in Incidence Rate of Chronic and Infectious Diseases: Key Driver of Multiplex Detection Immunoassays Market

- Diagnosis of infectious and chronic diseases is a leading application of in vitro diagnostics. Life science reagents (both biological and chemical) are an integral and vital part of any diagnostic test. The emergence and outbreak of various infectious diseases has created challenges and opportunities for researchers to develop new diagnostic tools and tests for early diagnosis and prevention of diseases.

- According to the World Health Organization (WHO), chronic diseases are projected to account for nearly three-quarters of all deaths globally in 2020, with 75% of deaths due to ischemic heart disease (IHD), 75% due to stroke, and 70% owing to diabetes likely to occur in developing countries. The number of people with diabetes in the developing countries is estimated to increase by over 2.9 times, from 84 million in 1995 to 228 million in 2025.

- Globally, 65% of the burden of chronic diseases is projected to occur in developing countries. Prevalence of cardiovascular diseases is higher in India and China than in all the economically developed countries in the world put together.

- According to the WHO, chronic disease prevalence is expected to rise by 57% by 2020. Healthcare expenditure increases, sometimes exponentially, with each additional chronic condition with greater specialist physician access, emergency department presentations, and hospital admissions.

- Chronic and infectious diseases have been a major driver of healthcare costs, while also impacting workforce patterns, including absenteeism. According to the Centers for Disease Control, in the U.S. alone, chronic diseases account for nearly 76% of aggregate healthcare spending, or an estimated US$ 5,300 per person annually.

- According to the Centers for Disease Control and Prevention, 6 in 10 adults in the U.S. have a chronic disease. Chronic diseases are likely to affect an estimated 164 million people in the U.S., nearly half (49%) of the population of the country, by 2025. Prevention and management of chronic diseases are best performed by multidisciplinary teams in primary care and public health. According to Project HOPE: The People-to-People Health Foundation, Inc., the number of people with chronic mental disorders could increase from 31 million to 48 million, by 2023. Similar increases are projected for virtually every common chronic condition.

Laboratory Consolidation and Demand for Laboratory Integration and Automation: Key Driver of Multiplex Detection Immunoassays Market

- Increase in operational costs, stringent rules and regulations, decrease in reimbursements, lack of quality workforce, and intense competition in the industry are the major challenges hospitals and diagnostic laboratories face currently

- Cost per test and revenue of diagnostic laboratories have been declining in the past few years; however, the volume is projected to rise, owing to increase in geriatric population and surge in demand for preventive treatment and drug monitoring

- Apart from economic constraints, other issues that small- and mid-volume laboratories face are quality and service issues, volatility in test volumes, and ad hoc test assays. Large laboratories are utilizing this opportunity to consolidate their position in the market.

- Numerous global conglomerates are expanding their base in emerging regions through mergers and acquisitions in the clinical laboratories segment. Unilabs, a clinical laboratory conglomerate based in Switzerland, operates through 110 laboratories located in over 10 countries in Europe. Quest Diagnostics has presence in countries in Asia Pacific such as India and China. India-based SRL Diagnostics has presence in countries in South Africa and Southeast Asia.

- Consolidation among laboratories is boosting test volumes, which is leading to the adoption of complete laboratory automation and integration. Large sample processing capacity, large parameters testing in short time, high throughput, minimum requirement of labor, integrated quality control & data storage, and integrated quality control and validation facility are the major factors projected to propel the global multiplex detection immunoassay market during the forecast period.

Segmental Analysis

By Type Insights

The blends protein assays segment held the largest share of the multiplex detection immunoassay market. The growing adoption of blends protein assays by food science/nutrition and medical diagnostics sector has driven the market expansion. Additionally, numerous advantages of these assays including high speed and simplicity, sensitivity, accuracy and precision and some others is contributing to the industry in a positive direction.

The planar assay segment is expected to grow with the highest CAGR during the forecast period. The rising use of planar assays from the biotechnology companies and diagnostic laboratories has driven the market growth. Moreover, several benefits of these assays such as reduced matrix interference, cost-effectiveness, off-line hyphenation and some others is expected to drive the growth of the multiplex detection assay market.

By Technique Insights

The protein-based techniques segment dominated the multiplex detection immunoassay market. The growing focus of biopharma companies to adopt protein-based technique for developing advanced therapies has boosted the market expansion. Additionally, technological advancements in the diagnostics sector is playing a prominent role in shaping the industrial landscape.

The nucleic acid-based techniques segment is expected to rise with the highest CAGR during the forecast period. The rising emphasis of biotech companies for adopting nucleic-based techniques for developing a wide range of therapeutics has driven the market growth. Additionally, rapid investment by government for strengthening the healthcare sector is expected to drive the growth of the multiplex detection assay market.

By Application Insights

The infectious disease testing segment led the industry. The growing use of bead-based assays for detecting infectious diseases has boosted the market expansion. Moreover, the increasing prevalence of COVID-19, common cold, flu, chickenpox, and measles, strep throat, tuberculosis, urinary tract infections, malaria and some others is driving the market growth.

The research & development segment is expected to expand with the highest CAGR during the forecast period. The growing investment by biotechnology companies for opening up new research and development centers has driven the market growth. Also, technological advancements in the biotechnology research centers is playing a vital role in shaping the industrial landscape.

By End User Insights

The pharmaceutical & biopharmaceutical companies segment dominated the industry. The rise in number of biopharma companies in several nations including the U.S., China, Qatar and some others has boosted the market growth. Additionally, rapid investment by government for strengthening the pharma industry is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among medical device companies and pharma brands to develop new types of assays is expected to propel the growth of the multiplex detection immunoassay market.

The clinical research organizations segment is expected to rise with the fastest CAGR during the forecast period. The growing adoption of antibody assays by clinical research organizations in developed nations has driven the market expansion. Also, rise in number of biotech research startups coupled with technological advancements in the research centers is playing a vital role in shaping the industry in a positive direction. Moreover, collaborations among clinical research centers and public sector entities to develop multiplex detection assay is expected to foster the growth of the multiplex detection immunoassay market.

By Regional Analysis

What are the drivers of the multiplex detection immunoassays market in North America?

The growing cases of cancers in several countries such as the U.S., Canada, Mexico and some others has increased the demand for advanced therapeutics, thereby driving the industrial expansion. Additionally, numerous government initiatives aimed at developing the biotechnology sector is contributing to the market in a positive manner. Moreover, the presence of several market players such as Spear Bio, BioIVT, Thermo Fisher Scientific and some others is expected to drive the growth of the multiplex detection immunoassays market in this region.

U.S. multiplex detection immunoassays market trends:

The rising emphasis of biotech companies for developing advanced therapeutics to treat complex diseases has boosted the market growth. Additionally, technological advancements in the healthcare sector coupled with rapid prevalence of chronic diseases is playing a prominent role in shaping the industrial landscape.

Why Europe is a significant contributor of the multiplex detection immunoassays market?

The increasing emphasis of biopharma companies to open up new research and development centers in several nations such as UK, France, Germany, Italy and some others has boosted the market growth. Also, rapid investment by government for providing free healthcare to the citizens is contributing to the industry in a positive manner. Moreover, collaborations among market players and diagnostics centers to use immunoassays for enhancing testing in patients is expected to accelerate the growth of the multiplex detection immunoassays market in this region.

UK multiplex detection immunoassays market analysis:

The rapid expansion of the biopharma sector coupled with numerous government initiatives aimed at enhancing food safety has boosted the market expansion. Additionally, the presence of several biotechnology startups along with rise in number of hospitals is contributing to the industry in a positive manner.

What made Asia Pacific to be a major contributor of the multiplex detection immunoassays industry?

The increasing cases of autoimmune diseases in numerous countries including China, India, Japan, South Korea and some others has driven the market expansion. Additionally, technological advancements in the biotech sector coupled with rise in number of government hospitals is playing a positive role in shaping the industrial landscape. Moreover, the presence of several biopharma companies such as Takeda Pharmaceutical, Sun Pharmaceutical Industries, BeiGene and some others is expected to propel the growth of the multiplex detection immunoassays market in this region.

China multiplex detection immunoassays market analysis:

The growing prevalence of viral diseases has increased the demand for advanced therapeutics to provide instant relief in patients has boosted the market growth. Also, the integration of advanced technologies such as AI and IoT in the medicine production sector is shaping the industrial landscape.

What is the role of Latin America in the multiplex detection immunoassays industry?

Latin America has played a prominent role in the multiplex detection immunoassays market. The increasing prevalence of infectious diseases in numerous countries such as Argentina, Brazil, Peru and some others has driven the industrial expansion. Additionally, rapid investment by biopharma brands to open new laboratories coupled with rise in number of diagnostics centers is expected to foster the growth of the multiplex detection immunoassays market in this region.

Brazil multiplex detection immunoassays industry trends

The growing demand for RNA therapies from the veterinary sector due to surging cases of animal disorders has driven the market growth. Additionally, numerous government initiatives aimed at developing the pharma industry is contributing to industry in a positive manner.

Why Middle East and Africa held a notable share of the multiplex detection immunoassays market?

Middle East and Africa held a notable share of the multiplex detection immunoassays industry. The growing demand for planar assays and antibody arrays from the biopharma companies in several countries including UAE, Saudi Arabia, Qatar, South Africa and some others has driven the market expansion. Moreover, technological advancements in the CROs along with rapid investment by government for strengthening the healthcare sector is expected to drive the growth of the multiplex detection immunoassays market in this region.

UAE multiplex detection immunoassays market analysis

The rising emphasis of the biotechnology companies to enhance research and development of nucleic-acid therapies has driven the market growth. Also, rapid expansion of the food and beverage sector coupled with increasing government initiatives for developing the pharma sector is a prominent factor of the industrial expansion.

Significant Market Participants Operational in the Multiplex Detection Immunoassays Market are:

- Hoffmann-La Roche Ltd

- QIAGEN, Merck KGaA

- Microsynth AG

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Luminex Corporation

- Becton

- Dickinson and Company

Unravelling the Critical Segments

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects includingproduct type, application/end-user, and region. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for period 2021 to 2035 and covers subsequent region in its scope:

By Assay Type

- Planar Assay

- Blends Protein Arrays (Multiplexed ELISA)

- Antibody Arrays

- Bead-based Assay

- Magnetic Bead-based

- Non-magnetic Bead-based

By Technique

- Nucleic Acid-based Techniques

- Protein-based Techniques

- Biosensor-based Techniques

By Application

- Disease Testing

- Infectious Disease Testing

- Autoimmune Disease Testing

- Other Diseases Testing

- Food Contamination Testing

- Research & Development

- Veterinary Disease Testing

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Clinical Research Organizations

- Food & Beverages Industry

- Academic & Research Institutes

- Diagnostic Centers

- Others

By Regional Outlook

North America

Europe

- Germany

- United Kingdom

- Italy

- France

- Rest of EU

Asia Pacific

- China

- India

- Japan

- Southeast Asia

- Rest of APAC

Central & South America

- Brazil

- Argentina

- Rest of Central & South America

Middle East and Africa

- GCC

- North Africa

- South Africa