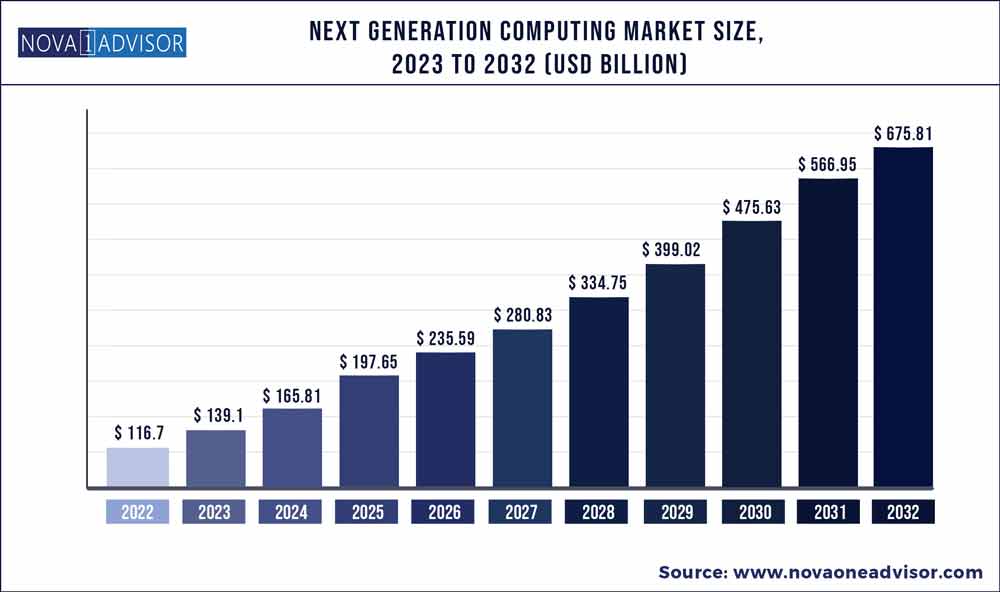

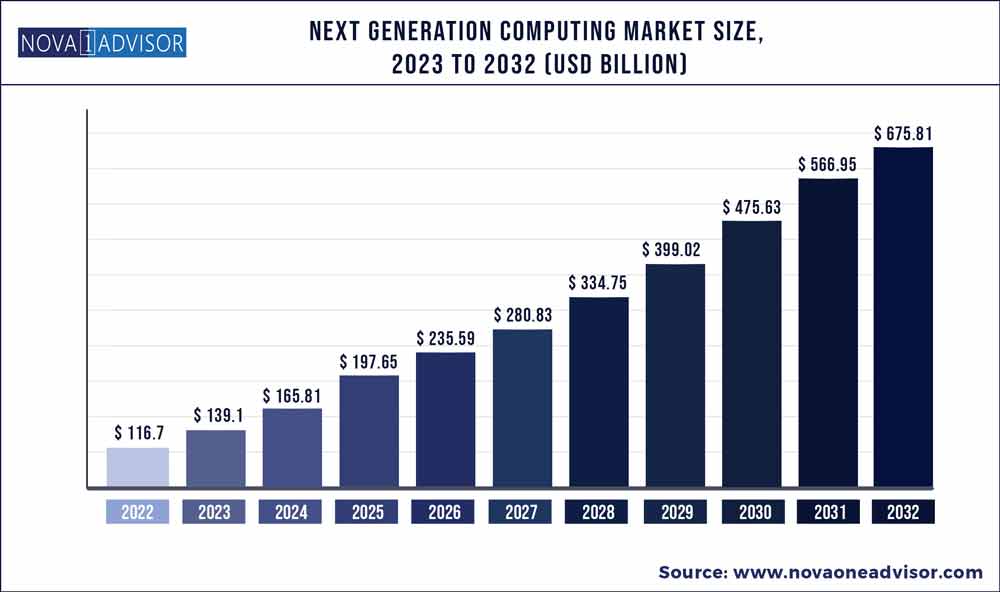

The global next ceneration computing market size was exhibited at USD 116.7 billion in 2022 and is projected to hit around USD 675.81 billion by 2032, growing at a CAGR of 5.10% during the forecast period 2023 to 2032.

Key Pointers:

- North America dominated the global industry in 2022 and accounted for the maximum share of more than 35.65% of the overall revenue.

- Asia Pacific, on the other hand, is expected to register the fastest growth rate during the forecast period.

- The hardware component segment dominated the industry in 2022 and accounted for the maximum share of more than 51.09% of the overall revenue.

- The cloud computing type segment dominated the industry in 2022 and accounted for the largest share of more than 51.10% of the overall revenue.

- The on-premise deployment segment dominated the global industry in 2022 and accounted for the largest share ofmore than 59.80% of the overall revenue.

- The large-size enterprises segment dominated the industry in 2022 and accounted for the largest share of 58.7% of the over revenue.

- The BFSI end-use segment dominated the industry in 2022 and accounted for the largest share of more than 21.50% of the overall revenue.

Next Generation Computing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 139.1 Billion |

| Market Size by 2032 |

USD 675.81 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 5.10% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Component, Type, Deployment, Organization Size, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

IBM; Google; Amazon Web Services, Inc.; Intel Corp.; Atos SE; Microsoft; Hewlett Packard Enterprise Development LP; NVIDIA Corp.; Cisco Systems Inc.; Advanced Micro Devices, Inc.; Dell Inc.

|

Next generation computing industry device is fundamentally different than conventional & supercomputers. It is also called high performance computing and uses technology based on quantum phenomena. Unlike classical computers, it uses quantum bits to process the data. In addition, next generation computing performs complex calculations proficiently when compared with classical computers and this factor majorly fuels growth of the next-generation computing market. Furthermore, it finds its applications in aerospace & defense, BFSI, healthcare & life science, energy & utilities, manufacturing, IT & telecom, and other industries.

Numerous factors such as rise in investments in next generation computing technology, growth in demand for high performance computing, and increase in demand for next-gen computing from medical research and financial markets drive the next generation computing market growth. Moreover, surge in demand for cloud services, owing to the COVID-19 pandemic drives the growth of the global next-gen computing market. However, high operational challenges and issues regarding stability and error correction hinder the next generation computing market share globally.

The report focuses on growth prospects, restraints, and analysis of the global next-generation computing market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global next-generation computing.

Conventional computers can solve normal problems at moderate speed with good accuracy across various industries as in the aerospace industry next-generation computing helps to run complex simulations around wing aerodynamics. Manufacturers are adopting to run complex simulations to support the testing of new products before they enter large-scale development. Similarly, fintech firms run highly complex risk analyses and create models to help them spot fraud. The oil and gas sector is dependent on HPC to perform special analyses and test reservoir models in order to locate resources.

On the contrary, high-performance computers possess capabilities to solve complex problems at a faster rate compared to conventional and supercomputers. In addition, computers, which are accessible at present have certain limitations as they are limited by their processors, storage capacity, and latency problems, which creates demand for high-performance computing. High-performance computing uses Quantum Processing Units (QPU) to process data in a few seconds and provides infinite storage, owing to which various industries are adopting and developing high-performance computing technology.

Moreover, there is an increase in demand for high-performance computing for optimization, simulation, data modeling & analysis, and machine & deep learning as they contain huge amounts of complex data. NASA is focused on several high-performance computing technology investments to analyze massive data collected about the universe for research to find safe methods for space traveling in the future. For instance, in June 2022, NASA’s High-Performance Spaceflight Computing (HPSC) project is developing flight computing technology that will provide technical management of the design and delivery of computing chips. This factor is expected to drive the growth of the next-generation computing market globally.

Some of the prominent players in the Next Generation Computing Market include:

- IBM

- Google

- Amazon Web Services, Inc.

- Intel Corporation

- Atos SE

- Microsoft

- Hewlett Packard Enterprise Development LP

- NVIDIA Corporation

- Cisco Systems Inc.

- Advanced Micro Devices, Inc

- Dell Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Next Generation Computing market.

By Component

- Hardware

- Software

- Services

By Type

- High-Performance Computing

- Quantum Computing

- Cloud Computing

- Edge Computing

- Others

By Deployment

- Cloud

- On-premise

- Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

- Small and Medium Sized Enterprises (SMEs)

- Large Size Enterprises

By End-use

- Automotive & Transportation

- Energy & Utilities

- Healthcare

- BFSI

- Aerospace & Defense

- Media & Entertainment

- IT & Telecom

- Retail

- Manufacturing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)