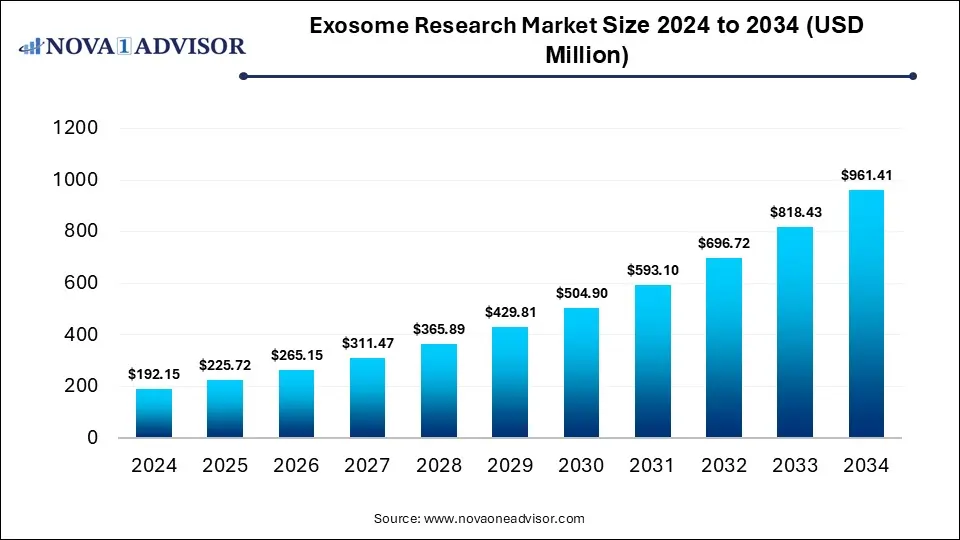

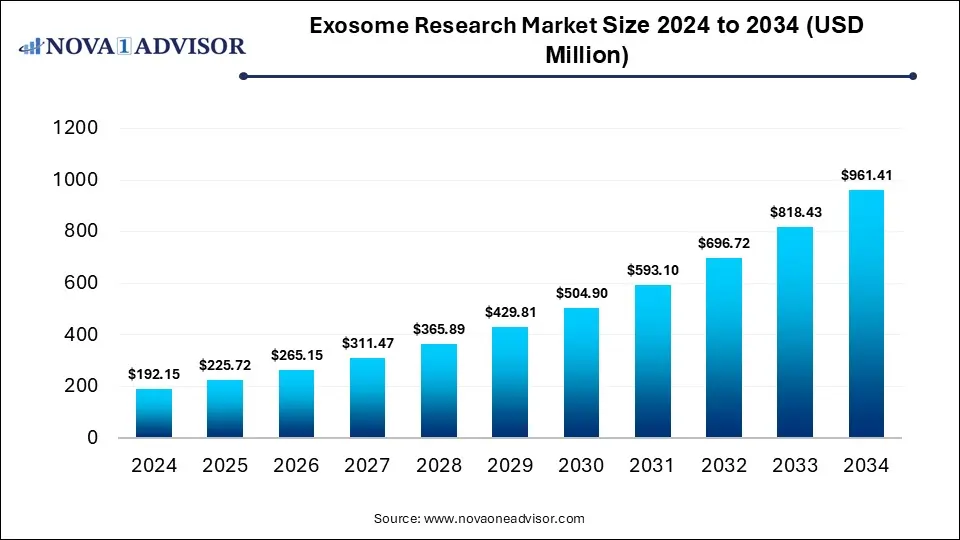

Exosome Research Market Size and Growth 2025 to 2034

The global exosome research market size is calculated at USD 192.15 million in 2024, grows to USD 225.72 million in 2025, and is projected to reach around USD 961.41 million by 2034, expanding at a CAGR of 17.47% from 2025 to 2034. The market is growing due to rising interest in their role as biomarkers for early detection and therapeutic application. Increasing investment in precision medicine and drug delivery also drives market expansion.

Exosome Research Market Key Takeaways

- North America dominated the exosome research market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product type, the reagents and kits segment held the largest market share in 2024.

- By product type, the RNA/DNA extraction kits segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the cancer research segment led the market with the largest revenue share in 2024.

- By application, the drug delivery systems segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By workflow, the isolation segment held the highest market share in 2024.

- By workflow, the microfluidics-based isolation segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the academic & research institutes segment dominated the market in 2024.

- By end user, the pharmaceutical & biotechnology companies segment is expected to grow at the fastest CAGR in the market during the forecast period.

How is the Exosome Research Market Evolving?

Exosomes research is the study of tiny extracellular vesicles released by cells to understand their role in cell communication, disease mechanisms, and potential use in diagnostics and therapies. Incresing government funding and supportive regulatory initiatives are encouraging innovations, while the demand for non-invasives are encouraging innovations, while the demand for non-invasive diagnostic tools boosts adoption. Startups and established players are launching specialized kits, reagents, and platforms for exosome analysis, further enhancing accessibility. Moreover, rising collaborations across research institutes worldwide are fostering breakthroughs, shaping the market into a key segment of advanced biomedical research.

What are the Key trends in the Exosome Research Market in 2024?

- In March 2025, Coya Therapeutics, Inc., a clinical-stage biotech firm, expanded its platform to advance regulatory T cell-derived exosome (Treg exosome) therapies, aiming to address chronic inflammation linked to neurodegenerative conditions.

- In February 2025, ExoLab Italia, a biotech startup from L’Aquila specializing in plant-derived exosomes, raised €5 million in Series A funding to support large-scale production and global expansion.

How Can AI Affect the Exosome Research Market?

AI can reshape the market by enabling predictive modeling of exosome behavior, supporting virtual simulations for drug testing, and reducing reliance on traditional trial-and-error methods. It can also uncover hidden patterns in cross-disease exosome communication, fostering novel therapeutic insights. Moreover, AI-powered automation in exosome imaging, sorting, and quantification enhances accuracy and scalability. By integrating real-world evidence with laboratory data, AI strengthens translational research, accelerating the path from discovery to clinical and commercial applications.

Report Scope of Exosome Research Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 225.72 Million |

| Market Size by 2034 |

USD 961.41 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 17.47% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product Type, By Application, By Workflow, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific, Bio-Techne Corporation, System Biosciences (SBI), QIAGEN, NanoView Biosciences, Miltenyi Biotec, Danaher Corporation, Exosome Diagnostics, Lonza, Norgen Biotek Corp, Malvern Panalytical, NanoFCM, Creative Biolabs, AMS Biotechnology, Evox Therapeutics, HansaBioMed Life Sciences, Diagenode, Exosomics, Aruna Bio, Labcorp Drug Development |

Market Dynamics

Driver

Growing Demand for Non-Invasive Diagnostics

The push for non-invasive diagnostics drives exosome research as it aligns with the global shift towards patient-friendly and preventive healthcare. Exosome-based tests enable continuous monitoring of disease progression without repeated invasive procedures, improving treatment personalization and compliance. Additionally, healthcare systems benefit from reduced hospitalization and procedural costs, making such diagnostics more sustainable. This growing preference for safer, quicker, and more accessible testing methods positions exosome research as a crucial contributor to next-generation diagnostic solutions.

- For Instance, In April 2024, Cancers published a review on how urinary extracellular vesicles (including exosomes) are used for diagnosis and active surveillance of prostate cancer.

Restraint

Lack of Standardized Isolation and Characterization Methods

The absence of standardized isolation and characterization methods acts as a restraint in the exosome research market because it hampers reproducibility and consistency across studies. Different labs using varied protocols produce exosomes with inconsistent purity, size, and content, complicating comparative analysis and clinical validation. This variability slows the development of reliable diagnostics and therapeutics, increases research costs, and poses challenges for regulatory approvals, ultimately limiting large-scale adoption and commercialization of exosome-based technologies in healthcare.

Opportunity

Development of exosome-based Therapeutic and Drug Delivery Systems

The advancement of exosome-based therapeutics and drug delivery offers a significant future opportunity as it enables the engineering of customized vesicles for targeted treatment, enhancing efficacy while minimizing systemic exposure. Innovations in scalable production and bioengineering techniques allow exosomes to carry diverse therapeutic cargos, including acids and small molecules. With growing interest from pharmaceutical companies and increasing clinical trials exploring exosome-mediated therapies, this field has the potential to transform drug delivery approaches and expand applications across oncology, neurology, and regenerative medicine.

- For Instance, In November 2024, Capricor Therapeutics showcased its StealthX™ exosome platform at the AAEV Annual Meeting, demonstrating improved delivery of gene therapies for Duchenne muscular dystrophy, highlighting exosomes’ potential in targeted therapeutics.

Segmental Insights

How does the Reagents & Kits Dominate the Exosome Research Market in 2024?

In 2024, the reagents & kits segment led the market because they enable efficient scaling of experiments and support high-throughput analysis. Their user-friendly design reduces the need for specialized equipment and technical expertise, making them accessible to a wider range of labs. Growing collaborations between kit manufacturers and research institutions, along with increasing investment in exosome-based diagnostics and therapeutics, further boosted demand, solidifying this segment's strong market presence.

The RNA/DNA extraction kit segment is projected to grow rapidly as researchers increasingly rely on exosomal nucleic acids for early disease detection and therapeutic monitoring. Rising interest in non-invasive liquid biopsies and genetic profiling fuels demand for reliable extraction tools. Innovations in faster, more sensitive, and contamination-free extraction methods further enhance usability, while expanding applications across oncology, neurology, and infectious disease research make these kits a preferred choice for both academic and commercial laboratories worldwide.

Exosome Research Market By Product Type, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Instruments |

80.7 |

93.9 |

109.24 |

127.08 |

147.82 |

171.92 |

199.94 |

232.5 |

270.33 |

314.28 |

365.34 |

| Reagents & Kits |

99.92 |

116.47 |

135.76 |

158.23 |

184.41 |

214.9 |

250.43 |

291.81 |

340 |

396.12 |

461.48 |

| Software Tools & Platforms |

11.53 |

15.35 |

20.15 |

26.16 |

33.66 |

42.98 |

54.53 |

68.8 |

86.39 |

108.03 |

134.6 |

Why Did the Cancer Research Segment Dominate the Market in 2024?

In 2024, the cancer research segment dominated the exosome research market because exosomes are increasingly used to identify novel therapeutic targets and understand tumor microenvironments. Their ability to reflect molecular changes in cancer cells makes them valuable for drug development and personalized treatment strategies. Growing collaboration between research institutes and biotech companies to develop exosome-based cancer therapies, along with rising funding for oncology research, further contributed to the segment’s highest revenue share in the market.

The drug delivery system segment is projected to grow rapidly as exosomes gain attention for their ability to cross biological barriers, such as the blood-brain barrier, enabling the delivery of drugs to hard-to-reach tissues. Rising investment in personalized and precision medicine, along with innovations in scalable and bioengineered exosome platforms, supports their use in novel therapeutic approaches. This combination of versatility, safety, and targeted delivery drives the segment’s fastest growth in the forecast period.

What made the Isolation Segment Dominant in the Exosome Research Market in 2024?

In 2024, the isolation segment dominated the market because efficient and high-yield isolation is essential for large-scale studies and clinical applications. With increasing use of exosomes in drug development, cancer diagnostics, and personalized medicine, researchers require robust and scalable isolation methods. Innovations in kit-based and automated isolation techniques that reduce processing time and sample loss further boosted adoption, making the isolation segment the largest contributor to market revenue during this period.

The microfluidics-based isolation segment is projected to grow rapidly as it enables compact, cost-effective, and scalable exosome separation suitable for clinical and laboratory settings. Its ability to integrate multiple processes, such as sorting, detection, and analysis on a single chip, reduces time and labor. Increasing focus on personalized medicine and high-throughput screening, along with growing investments in lab-on-a-chip technologies, further accelerates adoption, positioning microfluidics as a leading workflow for next-generation exosome research.

Why Did the Academic & Research Institutes Segment Dominate the Market in 2024?

The academic & research institute segment led the exosome research market because these organizations are primary adopters of emerging exosome technologies for exploratory studies, method development, and preclinical research. Their focus on innovation, collaborations with biotech companies, and access to advanced laboratories enable early implementation of new reagents, kits, and analytical tools. Additionally, the growing emphasis on translational research and training programs in molecular diagnostics and regenerative medicine further drives the demand for exosome-based platforms within academic and research settings.

The pharmaceutical & biotechnology company segment is projected to grow rapidly as companies focus on translating exosome research into commercial products and clinical applications. Increasing demand for targeted therapies, innovative drug delivery platforms, and companion diagnostics drives investment in exosome technologies. Furthermore, strategic partnerships, licensing agreements, and funding for clinical trials enable faster development and market entry, making pharmaceutical and biotech firms the fastest-growing end-users in the exosome research market.

Exosome Research Market By End User, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Academic & Research Institutes |

88.39 |

102.48 |

118.79 |

137.67 |

159.53 |

184.82 |

214.08 |

247.92 |

287.0366 |

332.293 |

384.57 |

| Pharmaceutical & Biotechnology Companies |

53.8 |

64.1 |

76.36 |

90.95 |

108.3 |

128.94 |

153.49 |

182.68 |

217.38 |

258.62 |

307.65 |

| Clinical Laboratories |

17.29 |

20.54 |

24.39 |

28.97 |

34.39 |

40.83 |

48.47 |

57.53 |

68.28 |

81.02 |

96.14 |

| Hospitals |

13.45 |

15.57 |

18.03 |

20.87 |

24.15 |

27.94 |

32.31 |

37.37 |

43.2 |

49.92 |

57.68 |

| CROs & CDMOs |

11.53 |

13.99 |

16.97 |

20.56 |

24.88 |

30.09 |

36.35 |

43.89 |

52.95 |

63.84 |

76.91 |

| Others |

7.69 |

9.03 |

10.61 |

12.46 |

14.64 |

17.19 |

20.2 |

23.72 |

27.87 |

32.74 |

38.46 |

Regional Insights

How is North America contributing to the Expansion of the Exosome Research Market?

In 2024, North America led the market because of its robust ecosystem of biotech startups and research collaborations focused on innovative diagnostics and therapeutics. Widespread adoption of cutting-edge laboratory equipment, high awareness of exosome applications among clinicians, and strong intellectual property protection further supported growth. Additionally, increasing clinical trials and commercialization initiatives for exosome-based therapies and diagnostics in the region boosted demand, reinforcing North America’s position as the largest revenue contributor in the global market.

How is Asia-Pacific Accelerating the Exosome Research Market?

Asia-Pacific is projected to grow fastest in the market due to the rising number of biotech startups and contract research organizations focusing on innovative exosome-based solutions. Lower operational costs, increasing healthcare investments, and supportive regulatory reforms encourage R&D expansion. Additionally, growing demand for advanced diagnostics and targeted therapies, along with collaborations between local and international companies, accelerates technology adoption, positioning the region as a rapidly emerging hub for exosome research and commercialization.

Exosome Research Market By Regional, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

71.1 |

82.61 |

95.98 |

111.51 |

129.52 |

150.43 |

174.69 |

202.84 |

235.49 |

273.36 |

317.27 |

| Europe |

53.8 |

62.52 |

72.65 |

84.41 |

98.06 |

113.9 |

132.28 |

153.61 |

178.36 |

207.06 |

240.35 |

| Asia Pacific |

49.96 |

60.04 |

72.12 |

86.59 |

103.91 |

124.64 |

149.45 |

179.12 |

214.59 |

256.99 |

307.65 |

| Latin America |

9.61 |

11.51 |

13.79 |

16.51 |

19.76 |

23.64 |

28.27 |

33.81 |

40.41 |

48.29 |

57.68 |

| Middle East and Africa (MEA) |

7.69 |

9.03 |

10.61 |

12.46 |

14.64 |

17.19 |

20.2 |

23.72 |

27.87 |

32.74 |

38.46 |

Top Companies in the Exosome Research Market

Recent Developments in the Exosome Research Market

- In March 2025, U.S.-based biotech firm EVast Bio reached a milestone by performing the world’s first human trial of small extracellular vesicles (sEVs), or exosomes, with their EVA-100 therapy for osteoarthritis.

- In January 2024, FUJIFILM Wako Pure Chemical Corporation launched the MassivEV™ EV Purification Column PS and Purification Buffer Set, designed to enable efficient, high-purity isolation of extracellular vesicles, supporting advanced exosome research.

Segments Covered in the Report

By Product Type

- Instruments

- Ultracentrifuges

- Nanoparticle Tracking Analyzers

- Flow Cytometers

- Others

- Reagents & Kits

- Isolation Kits

- Labeling & Detection Kits

- RNA/DNA Extraction Kits

- Antibodies

- Others

- Software Tools & Platforms

- Services

- Custom Isolation Services

- Exosome Profiling Services

- Exosome Engineering Services

- Others

By Application

- Cancer Research

- Neurodegenerative Disease Research

- Cardiovascular Disease Research

- Infectious Disease Research

- Drug Delivery Systems

- Biomarker Discovery

- Others

By Workflow

- Isolation

- Ultracentrifugation

- Size-exclusion Chromatography

- Immunoaffinity Capture

- Microfluidics-based Isolation

- Precipitation

- Others

- Characterization

- NTA (Nanoparticle Tracking Analysis)

- Western Blotting

- Electron Microscopy

- DLS (Dynamic Light Scattering)

- ELISA

- Others

- Profiling

- Proteomics

- Genomics

- Lipidomics

- Others

By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Clinical Laboratories

- Hospitals

- CROs & CDMOs

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)