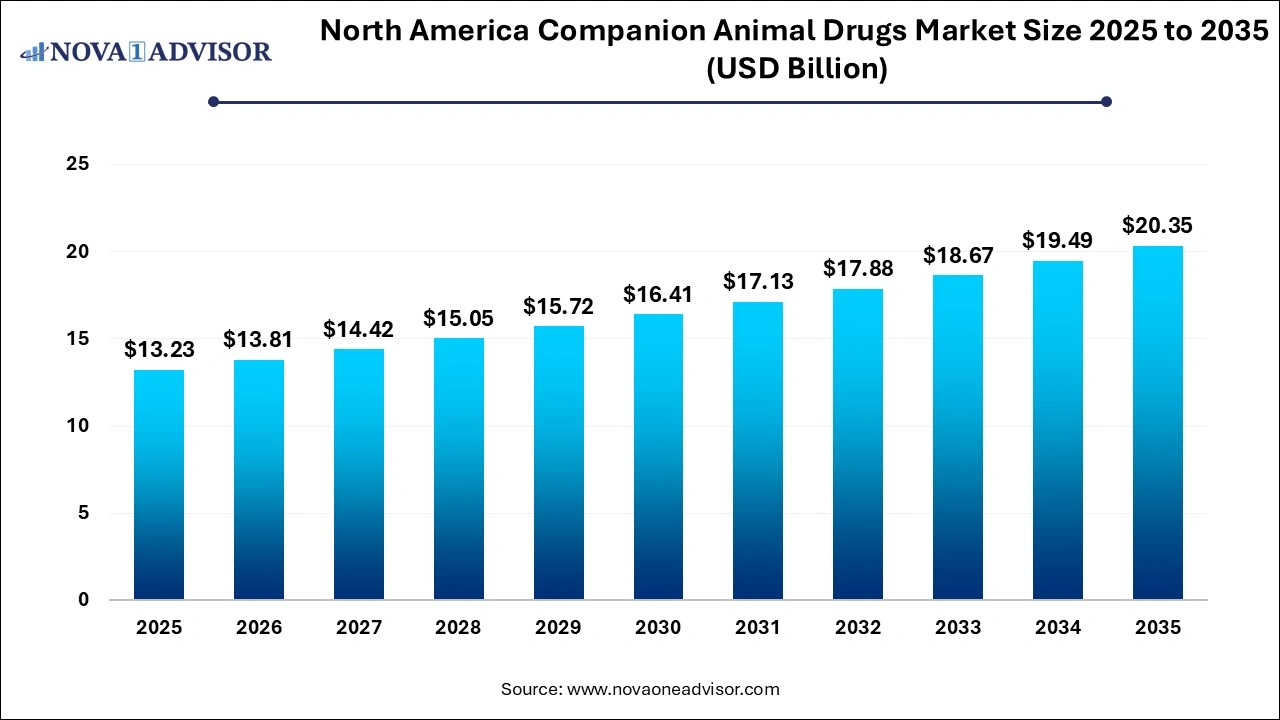

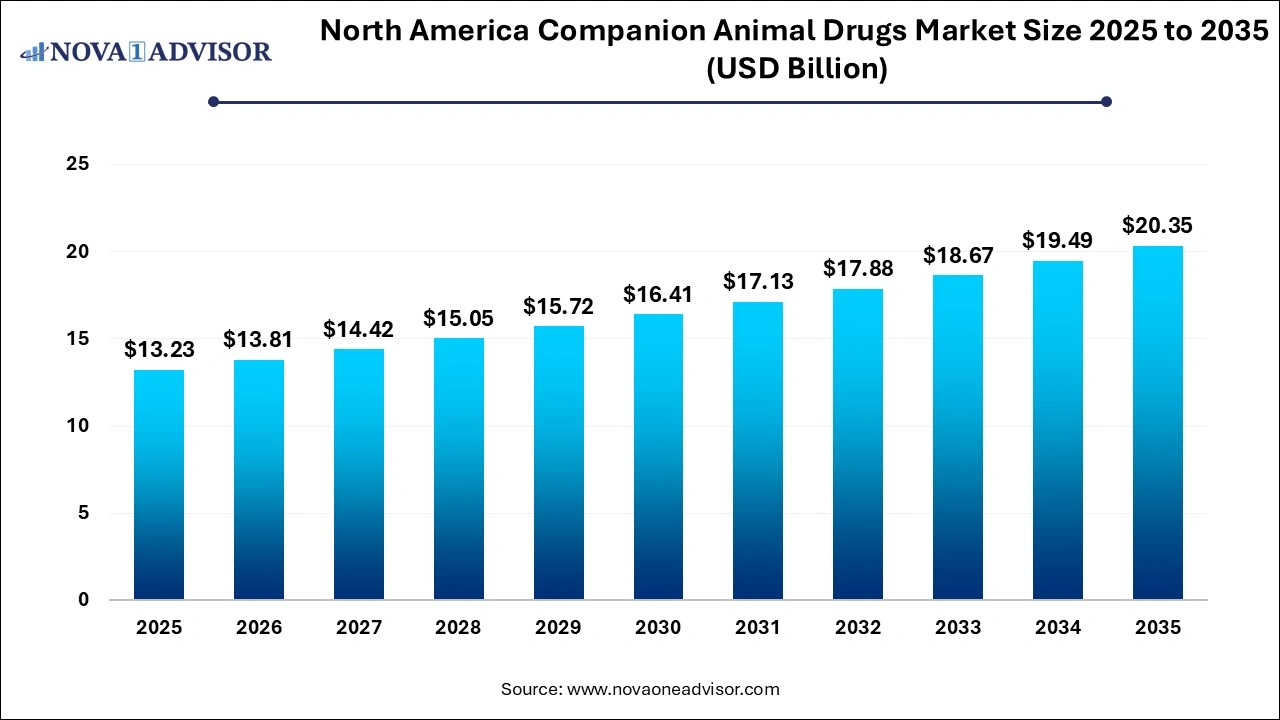

North America Companion Animal Drugs Market Size and Growth 2026 to 2035

The North America companion animal drugs market size was exhibited at USD 13.23 billion in 2025 and is projected to hit around USD 20.35 billion by 2035, growing at a CAGR of 4.4% during the forecast period 2026 to 2035.

Artificial Intelligence: The Next Growth Catalyst in North America Companion Animal Drugs

AI is significantly transforming the North American companion animal drugs industry by accelerating drug discovery and optimizing the development of specialized therapeutics for pets. By analyzing vast datasets, machine learning algorithms allow researchers to identify promising compounds faster, reducing both R&D timelines and costs. Furthermore, AI facilitates the creation of personalized treatment plans by integrating genetic data and medical histories, allowing veterinarians to tailor drugs for individual pets.

Value Chain Analysis of the North America Companion Animal Drugs Market

- R&D and Drug Discovery (Upstream): This foundational stage focuses on discovering new molecules, formulations, and biologicals tailored for dogs, cats, and horses, including monoclonal antibodies for pain and allergy management.

Key Contributors: Zoetis Inc., Elanco Animal Health, Boehringer Ingelheim, Merck Animal Health, Virbac, and Dechra Pharmaceuticals PLC.

- Active Pharmaceutical Ingredients (API) Manufacturing: This stage involves the production of raw active compounds, which are often specialized to meet strict FDA regulatory standards in North America.

Key Contributors: Zoetis Inc., Merck Animal Health, Elanco, Phibro Animal Health Corporation, Alivira Animal Health Limited, Fabbrica Italiana Sintetici S.p.A. (FIS), and SUANFARMA.

- Formulation and Finished Dosage Manufacturing: APIs are transformed into finished products like tablets, vaccines, injections, and topical treatments (spot-on or creams) at manufacturing sites, with an increasing focus on sustainable and specialized, sterile production.

Key Contributors: Zoetis, Boehringer Ingelheim, Elanco, Merck, Ceva Santé Animale, and Virbac.

Report Scope of the North America companion animal drugs Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 102.32 Billion |

| Market Size by 2035 |

USD 102.32 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 14.43% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Product Type, By Distribution Channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

North America Companion Animal Drugs Market Segmental Insights

By Product Type Insights

How did the Parasiticides segment dominate in the North America Companion Animal Drugs market?

The parasiticide segment continues to dominate the companion animal market as pet humanization drives owners to prioritize year-round preventative care. The high incidence of fleas, ticks, and heartworms ensures a constant demand for long-acting, broad-spectrum treatments that offer superior efficacy and ease of use

The vaccines segment, driven by the rising trends of pet humanization and preventive care, combined with a growing awareness of zoonotic diseases, is fueling a surge in demand for comprehensive animal vaccinations. Technological advancements, such as the development of safer and more efficacious recombinant and DNA-based vaccines, have improved targeted immunity.

By Distribution Channel Insights

How did the veterinary hospitals segment hold the major revenue share in the North America Companion Animal Drugs market?

The veterinary hospitals remain the dominant distribution channel by providing an integrated care model that combines expert diagnosis with immediate medication dispensing. These facilities serve as the primary access point for advanced, prescription-only therapies, including the latest monoclonal antibodies for chronic conditions like canine arthritis.

The pharmacies and drug stores represent the fastest-growing distribution channel for companion animal medications, fueled by the rapid expansion of pet-specific e-commerce and auto-ship convenience. This growth is accelerated by the integration of telehealth services and digital tools, such as app reminders and smart dispensers, which significantly improve owner compliance for chronic and preventive care.

North America Companion Animal Drugs Market Companies

- Zoetis Inc.: As the world's largest animal health company, Zoetis provides a vast range of pet vaccines, parasiticides (like Simparica Trio), and treatments, driving innovation with new products and digital tools to enhance pet care.

- Merck & Co., Inc. (Merck Animal Health): A leading player, Merck offers essential vaccines (like Nobivac) and parasiticides (like Bravecto), ensuring comprehensive health solutions for dogs and cats, contributing significantly to preventative care.

- Bayer AG (Animal Health): Bayer strengthens the market with parasiticides (like Advantage/Advantix) and skin treatments, expanding its footprint in flea, tick, and parasite control, especially after acquiring Merck Animal Health's U.S. business.

- Eli Lilly & Co. (Elanco Animal Health): Through Elanco, they provide diverse pet medications for pain (Galliprant), parasites, and infections, plus vaccines, meeting the growing demand for advanced veterinary care.

- Sanofi (Merial): Though its animal health unit was acquired by Boehringer Ingelheim, Merial's legacy included vital parasiticides (like Frontline/Heartgard), remaining significant in the market through its integration into Boehringer's portfolio.

- Ceva Santé Animal: Ceva contributes through its strong focus on vaccines (like Rabisin), parasiticides, and innovative areas like pet behavior (Feliway/Adaptil), offering specialized solutions.