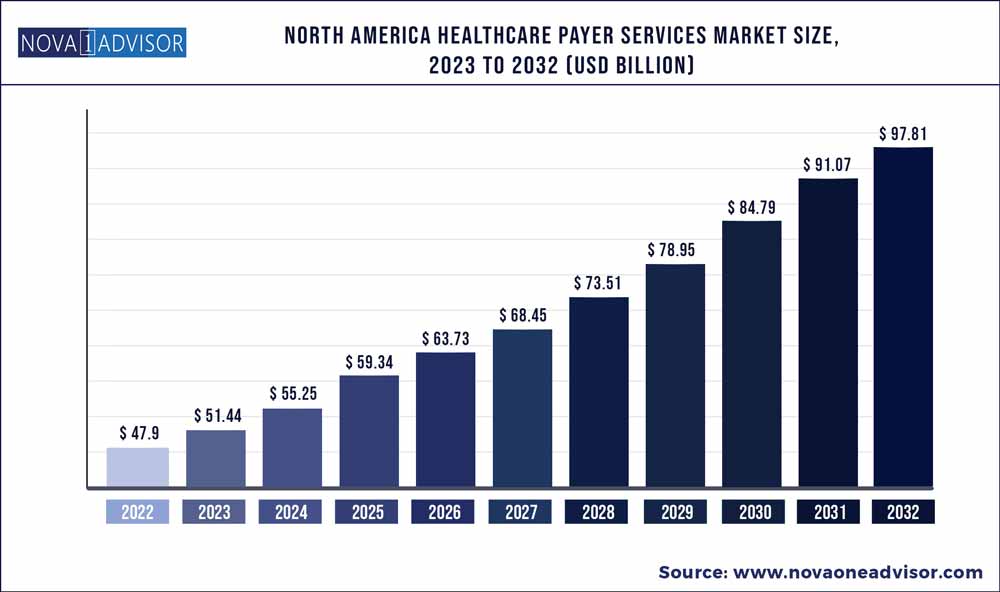

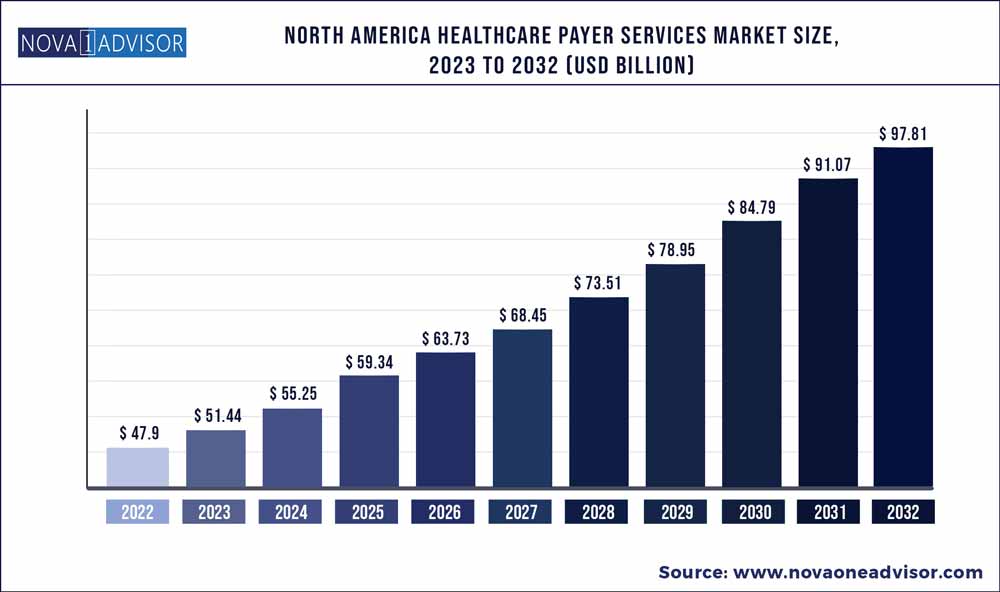

The global North America healthcare payer services market size was exhibited at USD 47.9 billion in 2022 and is projected to hit around USD 97.81 billion by 2032, growing at a CAGR of 7.4% during the forecast period 2023 to 2032.

Key Pointers:

- ITO Services dominated the service segment with a market share of 51.9 % in 2022.

- KPO healthcare payer services segment is expected at a lucrative CAGR of 10.6%

- The claims management services dominated the application segment in 2022 with a market share of 28.9%.

- Provider management services are anticipated to expand at the fastest CAGR of 8.8% during the forecast period.

- The private payers segment accounted for the majority revenue share of 58.9% in 2022.

- The public healthcare payer segment accounted for the fastest CAGR of 7.6% over the forecast period.

North America Healthcare Payer Services Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 51.44 Billion

|

|

Market Size by 2032

|

USD 97.81 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 7.4%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, growth factors and trends

|

|

Segments Covered

|

Services, application, end-use, country

|

|

Key companies profiled

|

Cognizant; Flatworld Solutions; Accenture; Xerox Corporation; WIPRO Ltd.; Infosys; IQVIA; Orion HealthCorp; Promantra; Medisys Data Solutions Inc.

|

The growing demand for healthcare IT services is predicted to stimulate the healthcare supply chain business process outsourcing market growth during the forecast period. Changes in regulatory scenarios and increasing pressure on the healthcare industries to decrease service costs are likely to increase the demand for healthcare supply chain business process outsourcing. Hence, the regional market is expected to witness significant growth during the forecast period.

The main drivers of this market are the rising demand for healthcare IT, changes in regulatory research, the presence of several healthcare policies, the growing disease burden, and the increasing adoption of health insurance policies.

The market for healthcare payer services in North America has been severely impacted by the COVID-19 outbreak. To overcome this, healthcare payer services have accelerated the adoption of telehealth, telemedicine hubs, and virtual care in North America. It has created opportunities for healthcare payers to offer new services and reach more patients, particularly in rural areas or among those with mobility issues. Telehealth allows for remote consultations and remote monitoring of patients, which can help reduce the burden on healthcare providers and improve the overall accessibility of healthcare.

The use of artificial intelligence (AI) and machine learning (ML) technologies can also help healthcare payers identify at-risk populations & develop targeted interventions. By analyzing large amounts of data, these technologies can help payers to identify patterns and predict patient outcomes, which can lead to improved patient outcomes, reduced costs, and increased efficiency in healthcare delivery. In addition, AI can be used to improve the accuracy of diagnoses, reduce misdiagnosis, and improve the overall quality of care.

Services Insights

ITO Services dominated the service segment with a market share of 51.9% in 2022. The major growth factors are increasing demand for innovative and advanced technologies, a rise in investment in AI technology, information that can be easily accessed, and a rise in involvement in healthcare decisions. In addition, the rising costs, stringent regulations, and growing customer base are also likely to promote healthcare organizations to look for IT or integrated services.

KPO healthcare payer services segment is expected at a lucrative CAGR of 10.7% due to the surge in demand for highly skilled professionals and the cost advantage associated with outsourcing high-end processes to service providers from developing economies. Moreover, the growing need in emerging economies for low-cost & high-skilled professionals for domain-specific core and noncore activities of the payer vertical is one of the crucial factors anticipated to propel the sector in the forecast period.

Application Insights

The claims management services dominated the application segment in 2022 with a market share of 28.9%. The presence of ACA and increasing overall healthcare expenditure are among some crucial factors that are driving the number of members enrolled in the Centers for Medicare and Medicaid Services. In addition, increase in patient load, improvements in healthcare coverage, and adoption of EHRs are further propelling the segment.

Provider management services are anticipated to expand at the fastest CAGR of 8.7% during the forecast period. This segment consists of provider credentialing, provider data management, contracting, and network management. Key factors contributing to segment growth include technological advancements in healthcare provider management services, increasing focus on improving quality care through payer requirements.

End-use Insights

The private payers segment accounted for the majority revenue share of 58.9% in 2022. This is attributed to the increasing private investment in the healthcare payer vertical and growing government support to promote private investment in the healthcare industry. For instance, according to Cambridge University, most Canadians hold the highest private insurance, primarily through employee benefits.

The public healthcare payer segment accounted for the fastest CAGR of 7.6% over the forecast period. Public healthcare payers are federal or state governments that provide coverage to make healthcare & medical services affordable for patients. Public payers provide financial protection to patients, thereby, minimizing any out-of-pocket spending on healthcare services. The various types of public-funded insurance include Medicare, Medicaid, and Children’s Health Insurance Program (CHIP).

Some prominent players in the North America healthcare payer services market are:

- Cognizant

- Flatworld Solutions

- Accenture

- Xerox Corporation

- WIPRO Ltd.

- Infosys

- IQVIA

- Orion HealthCorp

- Promantra

- Medisys Data Solutions Inc.

Segments Covered in the Report

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global North America healthcare payer services market.

By Services

- BPO Services

- ITO Services

- KPO Services

By Application

- Claims management services

- Integrated front office service and back office operations

- Member management services

- Provider management services

- Billing and accounts management services

- Analytics and fraud management services

- HR Services

By End-use

- Private Payers

- Public Payers

Country