North American Nuclear Medicine/Radiopharmaceuticals Market Size, Growth, Trends 2026 to 2035

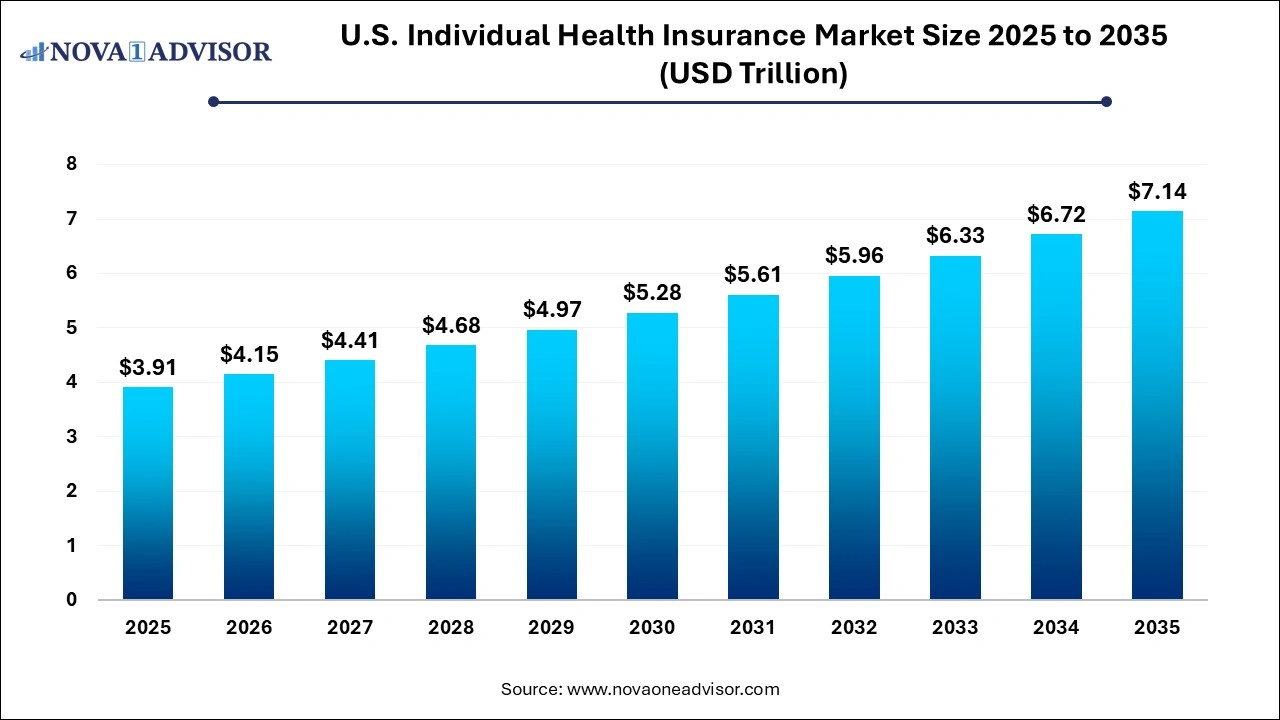

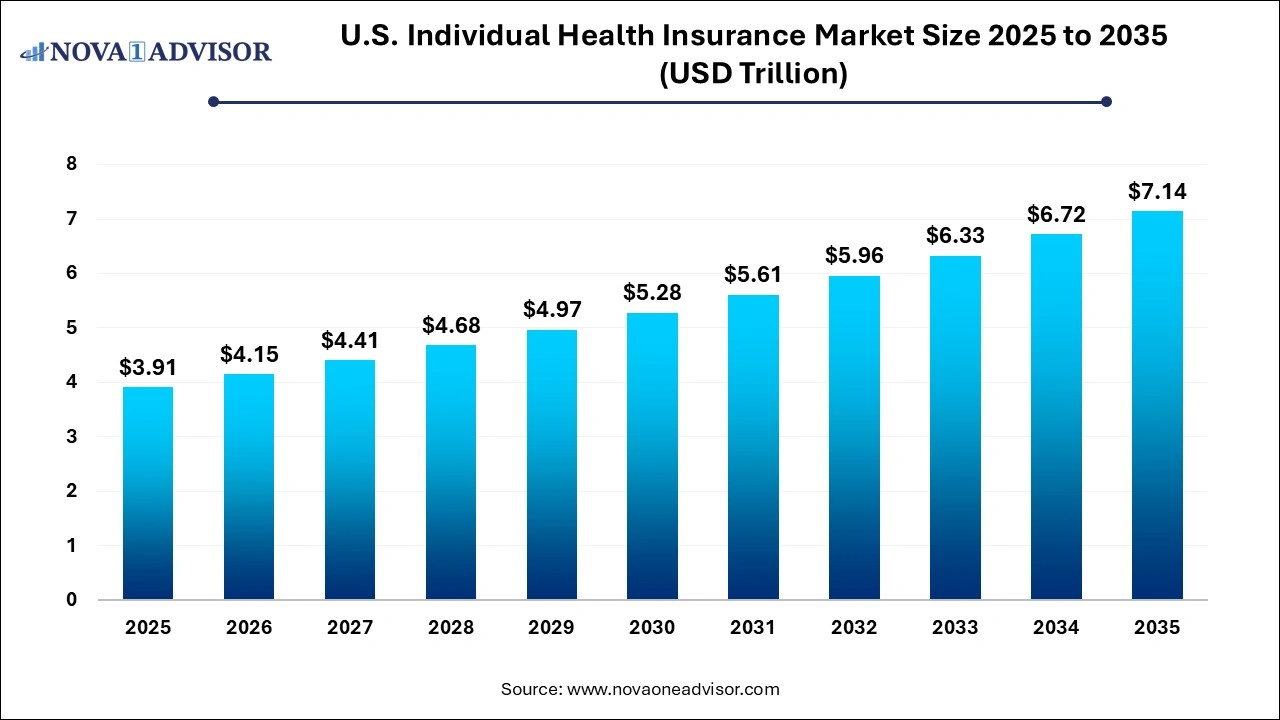

The north american nuclear medicine/radiopharmaceuticals market size was exhibited at USD 4.37 billion in 2025 and is projected to hit around USD 6.72 billion by 2035, growing at a CAGR of 4.4% during the forecast period 2026 to 2035.

Key Takeaways:

- The alpha emitters segment is expected to command the largest share of the therapeutic nuclear medicine market in 2025.

- Thyroid application segment is expected to register the highest growth during the forecast period

- Intravascular route of administration is expected to register the highest growth during the forecast period

- The US accounted for the largest share of the nuclear medicine market in 2025.

Growth in the market can primarily be attributed to factors such as the increasing incidence and prevalence of cancer & cardiac ailments and initiatives to lessen the demand-supply gap of Mo-99. However, the short half-life of radiopharmaceuticals reduces their potential adoption, while hospital budget cuts and high equipment prices are expected to limit market growth to a certain extent.

North American Nuclear Medicine/Radiopharmaceuticals Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 4.56 Billion |

| Market Size by 2035 |

USD 6.72 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 4.4% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Type, Application, Procedural Volume Assessment. Country |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Cardinal Health (US), GE Healthcare (US), Lantheus Medical Imaging (US), Nordion (Canada), NorthStar Medical Radioisotopes (US), Jubilant DraxImage (Canada), PharmaLogic (US), Institute of Isotopes Co., Ltd. (Hungary), SHINE Medical Technologies (US), and Global Medical Solutions (US). |

The alpha emitters segment is expected to command the largest share of the therapeutic nuclear medicine market in 2025

Based on type, the market is categorized into diagnostic and therapeutic nuclear medicine. The therapeutic nuclear medicine segment is further segmented into alpha emitters, beta emitters, and brachytherapy isotopes. In 2013, the FDA approved the first and only product for alpha emitters in the market, launched by Bayer AG under the name Xofigo (a Ra-223 dichloride molecule). The North American market for Ra-223 is expected to command the largest share owing to its targeted properties over beta emitters and being the only alpha-emitter product available in the market.

Thyroid application segment is expected to register the highest growth during the forecast period

Based on application, the North American nuclear medicine market is segmented into SPECT, PET, and therapeutic applications. The SPECT applications segment is further segmented into cardiology, bone scans, thyroid applications, pulmonary scans, and other SPECT applications. The thyroid applications segment is projected to register the highest growth rate in the forecast period. The high growth of this segment can be attributed to the increasing incidence and prevalence of thyroid disorders.

Intravascular route of administration is expected to register the highest growth during the forecast period

Based on procedural volume assessment, the market is segmented into SPECT, PET, and therapeutic procedures. The PET procedural volume segment by type is further segmented into F-18, Ru-82, and other PET Isotopes. The F-18 segment is expected to account for the largest share of the PET procedural volume assessment in 2022. The large share of this segment can be attributed to the increasing use of F-18 in diagnostic PET applications.

The US accounted for the largest share of the nuclear medicine market in 2025

Geographically, the North American market comprises of US and Canada. In 2025, the US accounted for the largest share of the nuclear medicine market. The large share can be attributed to the development of novel technologies for radioisotope production, government funding, and company initiatives in the country.

Some of the prominent players in the North American Nuclear Medicine/Radiopharmaceuticals Market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2035. For this study, Nova one advisor, Inc. has segmented the North American Nuclear Medicine/Radiopharmaceuticals market.

By Type

- Diagnostic Nuclear Medicine

- SPECT Radiopharmaceuticals

- Technetium-99m

- Thallium-201

- Gallium-67

- Iodine-123

- Other SPECT Isotopes

- PET Radiopharmaceuticals

- F-18

- Ru-82

- Other PET Isotopes

- Therapeutic Nuclear Medicine

- Alpha Emitters

- Beta Emitters

- Iodine-131

- Yttrium-90

- Samarium-153

- Lutetium-177

- Rhenium-186

- Other Beta Emitters

- Brachytherapy Isotopes

- Iodine-125

- Palladium-103

- Cesium-131

- Iridium-192

- Other Brachytherapy Isotopes

By Application

- Diagnostic Applications

- SPECT Applications

- Cardiology

- Bone Scans

- Thyroid Applications

- Pulmonary Scans

- Other SPECT Applications

- PET Applications

- Oncology

- Cardiology

- Neurology

- Other PET Applications

- Therapeutic Applications

- Thyroid Indications

- Bone Metastasis

- Lymphoma

- Endocrine Tumors

- Other Indications

By Procedural Volume Assessment

- Diagnostic Procedures

- SPECT Procedures

- PET Procedures

- Therapeutic Procedures

- Beta Emitter Procedures

- Alpha Emitter Procedures

- Brachytherapy Procedures

By Country