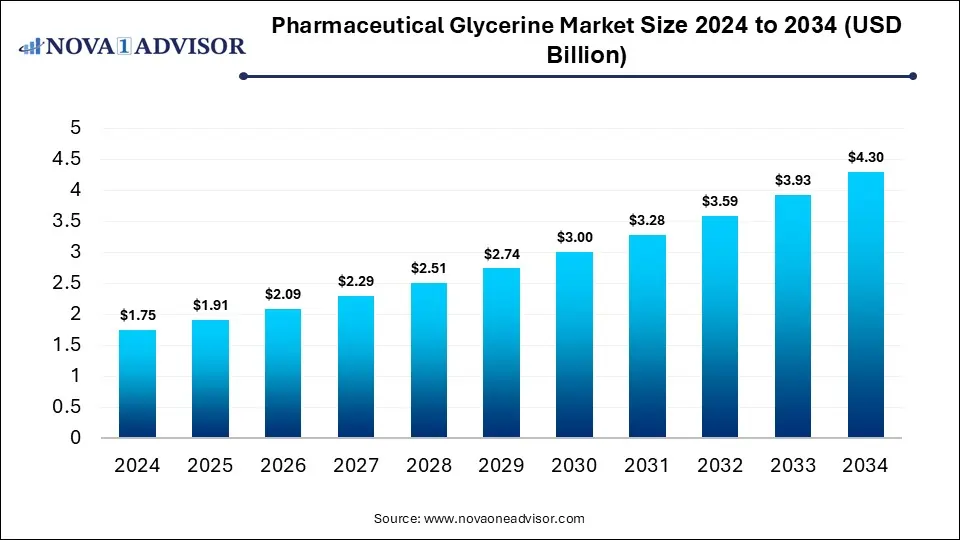

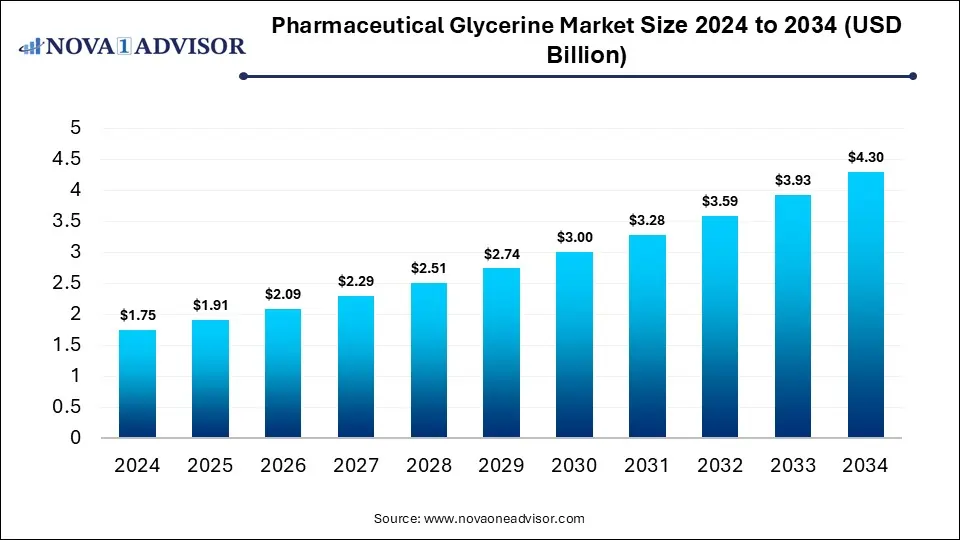

Pharmaceutical Glycerine Market Size, Share, and Trends 2025 to 2034

The global pharmaceutical glycerine market size is calculated at USD 1.75 billion in 2024, grows to USD 1.91 billion in 2025, and is projected to reach around USD 4.30 billion by 2034, growing at a CAGR of 9.4% from 2025 to 2034. The market is expanding due to rising use in drug formulation, capsules, and syrups as a stabilizer and humectant. Increasing demand for OTC medicines and personal care products further drives the growth of the market.

Pharmaceutical Glycerine Market Key Takeaways

- North America dominated the pharmaceutical glycerine market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the excipient segment led the market with the largest revenue share in 2024.

- By application, the glycerin as care product segment is expected to grow at the fastest CAGR in the market during the forecast period.

What are the significance of Pharmaceutical Glycerine?

Pharmaceutical glycerine is a refined, non-toxic, and water-soluble compound used as a solvent, sweetener, and humectant in medications, cosmetics, and personal care formulations. The pharmaceutical glycerine market holds significant importance due to its versatile applications in drug formulations, topical creams, oral syrups, and capsules. It acts as a stabilizer, humectant, and solvent, ensuring product consistency and patient safety. Its non-toxic and biocompatible nature makes it ideal for pharmaceutical and cosmetic use. Additionally, the growing demand for glycerine in personal care, nutraceuticals, and OTC products further enhances its market relevance and global expansion prospects.

- For Instance, In May 2024, Louis Dreyfus Company (LDC) inaugurated a new 55,000 tonnes-per-year glycerine refining plant and an edible oil packaging line in Lampung, Indonesia. Strategically positioned near export hubs, the facility aims to meet the rising global demand for USP-grade glycerine, projected to grow at a 2.5% CAGR through 2040. Complementing LDC’s operations in the U.S. and Germany, the expansion strengthens its presence in the pharmaceutical, personal care, and cosmetics sectors while boosting packaged edible oil exports.

What are the Key trends in the Pharmaceutical Glycerine Market in 2024?

- In December 2024, Louis Dreyfus Company (LDC) started building a 55,000 metric ton-per-year glycerin refining facility in Lampung, Indonesia, integrated with its palm oil and biodiesel operations to address growing pharmaceutical and cosmetic industry demand.

- In April 2024, Cremer Oleo introduced EXCiPACT™-certified pharmaceutical-grade vegetable glycerin that complies with GMP and GDP standards. Meeting USP, Ph.Eur., Halal, and Kosher certifications, it ensures complete supply-chain traceability for pharmaceutical, food, and personal care uses.

How Can AI Affect the Pharmaceutical Glycerine Market?

AI is transforming the market by optimizing production processes, improving quality control, and ensuring consistent purity levels. Through predictive analytics, AI enhances supply chain efficiency, reduces waste, and anticipates market demand. It also aids in process automation and real-time monitoring, ensuring compliance with pharmaceutical standards. Additionally, AI-driven data analysis supports product innovation and sustainability initiatives, helping manufacturers maintain high-quality, cost-effective, and eco-friendly glycerin for pharmaceutical and personal care applications.

Report Scope of Pharmaceutical Glycerine Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.91 Billion |

| Market Size by 2034 |

USD 4.30 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Application, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Cargill, Dow, Godrej Industries, Wilmar International Ltd, Kao Corporation, IOI corporation, Emery Oleochemicals, Aemetis, Oleon NV, Cremer Oleo GmbH &Co KG |

Market Dynamics

Driver

Growth in Personal Care and Cosmetic Products

The expanding personal care and cosmetic industry is driving the pharmaceutical glycerine market, as glycerine is widely used in moisturizers, lotions, and oral care products. With the global personal care market exceeding USD 530 billion in 2024, consumer preference for safe, natural, and biocompatible ingredients is rising. This trend increases demand for high-purity, pharmaceutical-grade glycerine, linked growth in cosmetics and personal care directly to the expanding use of glycerine in pharmaceutical and healthcare formulations.

Restraint

Volatile Raw Material Prices

Volatile raw material prices act as a restraint in the pharmaceutical glycerine market because glycerine production heavily relies on vegetable oils and petrochemical feedstocks, whose cost fluctuates due to seasonal variations, supply-demand imbalances, and global economic conditions. According to FAO data, global vegetable oil prices increased by over 15% in 2024, impacting glycerine production costs. These fluctuations can raise manufacturing expenses, reduce profit margins, and make consistent supply of high-purity pharmaceutical-grade glycerine challenging for manufacturers.

Opportunity

Rising Demand for Plant and Bio-Based Glycerine

The rising demand for plant-based and bio-based glycerine presents a significant future opportunity in the pharmaceutical glycerine market due to increasing consumer preference for natural, sustainable, and non-toxic ingredients. According to FAO data, global vegetable oil production reached over 220 million tonnes in 2024, providing a robust feedstock for bio-based glycerine. This trend supports the growth of eco-friendly, high-purity glycerine in pharmaceuticals, personal care, and nutraceuticals, aligning with regulatory emphasis on sustainable and safe excipients.

Segmental Insights

How does the Excipient Segment dominate the Pharmaceutical Glycerine Market in 2024?

In 2024, the excipients segment led the market due to its crucial role in drug formulation, acting as a stabilizer, humectant, and solvent in tablets, capsules, and syrups. According to the U.S. FDA, over 90% of approved oral and topical drug formulations incorporate excipients, driving demand. Increasing pharmaceutical manufacturing, rising chronic disease prevalence, and emphasis on patient-friendly formulations further reinforced excipients as the largest revenue-generating application segment.

The glycerine as a care products segment is expected to grow at the fastest CAGR in the pharmaceutical glycerine market due to rising consumer demand for natural moisturizing and skin-friendly ingredients. Glycerines humectant emollient properties make it essential in skincare, haircare, and cosmetic-free and sustainable products. Growing production of bio-based glycerine and innovation in cosmetic formulation further supported rapid market expansion during the forecast period.

Pharmaceutical Glycerine Market By Application, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Excipient |

1.22 |

1.33 |

1.45 |

1.58 |

1.71 |

1.86 |

2.03 |

2.21 |

2.4 |

2.61 |

2.84 |

| Glycerine as a care product |

0.53 |

0.58 |

0.65 |

0.71 |

0.79 |

0.88 |

0.97 |

1.08 |

1.19 |

1.32 |

1.46 |

Regional Insights

How is North America contributing to the Expansion of the Pharmaceutical Glycerine Market?

In 2024, North America dominated the market due to its robust manufacturing infrastructure, strong demand in pharmaceuticals, and focus on sustainable bio-based products. The region advanced production capabilities and increasing adoption of glycerine in various applications contributed to its leading position in the global market. This dominance is expected to continue, driven by ongoing investments and innovations in glycerine-based products.

How is Asia Pacific Accelerating the Pharmaceutical Glycerine Market?

Asia Pacific is projected to grow at the fastest CAGR in the market during the forecast period due to several key factors. The region rapid industrialization and increasing demand for pharmaceuticals and personal care products contribute to the rising need for glycerine. Additionally, the growing focus on sustainable and bio-based products aligns with glycerines natural origins, further driving its adoption. These combined factors position Asia Pacific as a significant growth area for the pharmaceutical glycerine market.

Pharmaceutical Glycerine Market By Regional, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

0.61 |

0.67 |

0.72 |

0.79 |

0.86 |

0.93 |

1.01 |

1.1 |

1.2 |

1.3 |

1.42 |

| Europe |

0.47 |

0.51 |

0.56 |

0.61 |

0.66 |

0.72 |

0.78 |

0.85 |

0.93 |

1.01 |

1.1 |

| Asia Pacific |

0.44 |

0.49 |

0.54 |

0.6 |

0.67 |

0.74 |

0.82 |

0.91 |

1.01 |

1.12 |

1.25 |

| Latin America |

0.12 |

0.13 |

0.15 |

0.16 |

0.18 |

0.2 |

0.22 |

0.24 |

0.27 |

0.29 |

0.32 |

| Middle East and Africa (MEA) |

0.1 |

0.11 |

0.12 |

0.13 |

0.14 |

0.15 |

0.16 |

0.17 |

0.19 |

0.2 |

0.21 |

Top Companies in the Pharmaceutical Glycerine Market

- Cargill

- Dow

- Godrej Industries

- Wilmar International Ltd

- Kao Corporation

- IOI corporation

- Emery Oleochemicals

- Aemetis

- Oleon NV

- Cremer Oleo GmbH &Co KG

Recent Developments in the Pharmaceutical Glycerine Market

- In October 2024, European biofuel producer Argent Energy inaugurated its largest European facility at the Port of Amsterdam, dedicated to manufacturing bio-based, technical-grade glycerin. The plant is designed to produce 50,000 tons annually, enhancing the supply of sustainable glycerin for industrial and pharmaceutical applications.

- In February 2024, the Solvent Extractors’ Association (SEA) proposed that imports of finished products, including stearic acid, soap noodles, oleic acid, and refined glycerin, be classified as restricted items to regulate and control their entry.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pharmaceutical glycerine market.

By Application

- Excipient

- Glycerine as a care product

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: Global Pharmaceutical Glycerine Market Size (USD Billion) by Application, 2024–2034

- Table 2: North America Market Size (USD Billion) by Application, 2024–2034

- Table 3: U.S. Market Size (USD Billion) by Application, 2024–2034

- Table 4: Canada Market Size (USD Billion) by Application, 2024–2034

- Table 5: Mexico Market Size (USD Billion) by Application, 2024–2034

- Table 6: Europe Market Size (USD Billion) by Application, 2024–2034

- Table 7: Germany Market Size (USD Billion) by Application, 2024–2034

- Table 8: France Market Size (USD Billion) by Application, 2024–2034

- Table 9: UK Market Size (USD Billion) by Application, 2024–2034

- Table 10: Italy Market Size (USD Billion) by Application, 2024–2034

- Table 11: Asia Pacific Market Size (USD Billion) by Application, 2024–2034

- Table 12: China Market Size (USD Billion) by Application, 2024–2034

- Table 13: Japan Market Size (USD Billion) by Application, 2024–2034

- Table 14: India Market Size (USD Billion) by Application, 2024–2034

- Table 15: South Korea Market Size (USD Billion) by Application, 2024–2034

- Table 16: Southeast Asia Market Size (USD Billion) by Application, 2024–2034

- Table 17: Latin America Market Size (USD Billion) by Application, 2024–2034

- Table 18: Brazil Market Size (USD Billion) by Application, 2024–2034

- Table 19: Middle East & Africa Market Size (USD Billion) by Application, 2024–2034

- Table 20: GCC Countries Market Size (USD Billion) by Application, 2024–2034

- Table 21: Turkey Market Size (USD Billion) by Application, 2024–2034

- Table 22: Africa Market Size (USD Billion) by Application, 2024–2034

List of Figures

- Figure 1: Global Pharmaceutical Glycerine Market Share by Application, 2024

- Figure 2: North America Market Share by Application, 2024

- Figure 3: U.S. Market Share by Application, 2024

- Figure 4: Canada Market Share by Application, 2024

- Figure 5: Mexico Market Share by Application, 2024

- Figure 6: Europe Market Share by Application, 2024

- Figure 7: Germany Market Share by Application, 2024

- Figure 8: France Market Share by Application, 2024

- Figure 9: UK Market Share by Application, 2024

- Figure 10: Italy Market Share by Application, 2024

- Figure 11: Asia Pacific Market Share by Application, 2024

- Figure 12: China Market Share by Application, 2024

- Figure 13: Japan Market Share by Application, 2024

- Figure 14: India Market Share by Application, 2024

- Figure 15: South Korea Market Share by Application, 2024

- Figure 16: Southeast Asia Market Share by Application, 2024

- Figure 17: Latin America Market Share by Application, 2024

- Figure 18: Brazil Market Share by Application, 2024

- Figure 19: Middle East & Africa Market Share by Application, 2024

- Figure 20: GCC Countries Market Share by Application, 2024

- Figure 21: Turkey Market Share by Application, 2024

- Figure 22: Africa Market Share by Application, 2024