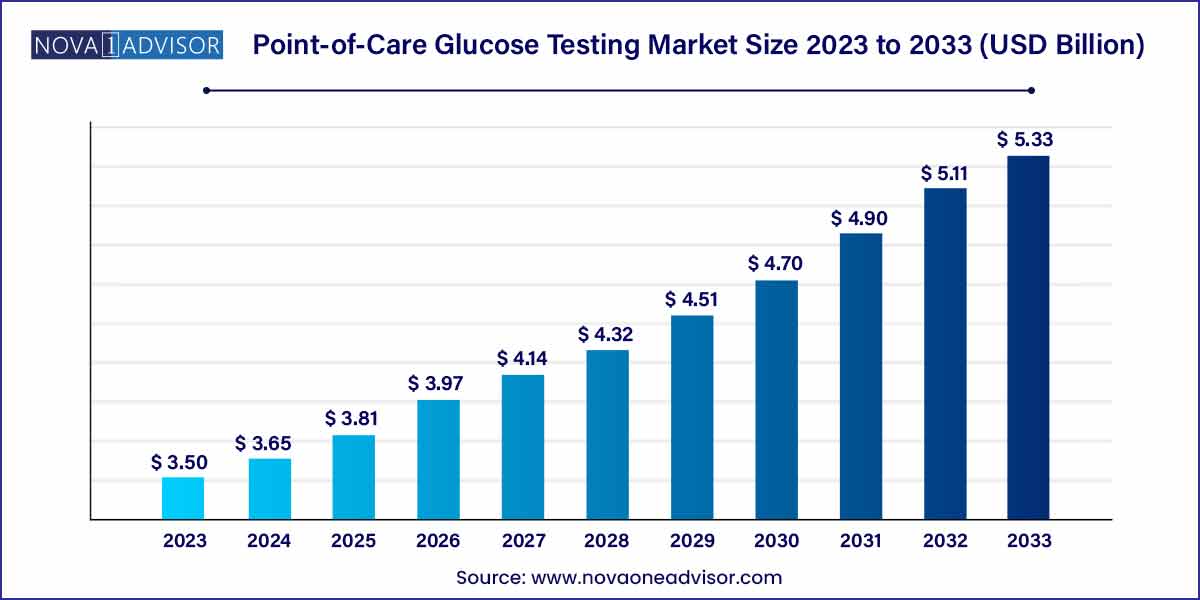

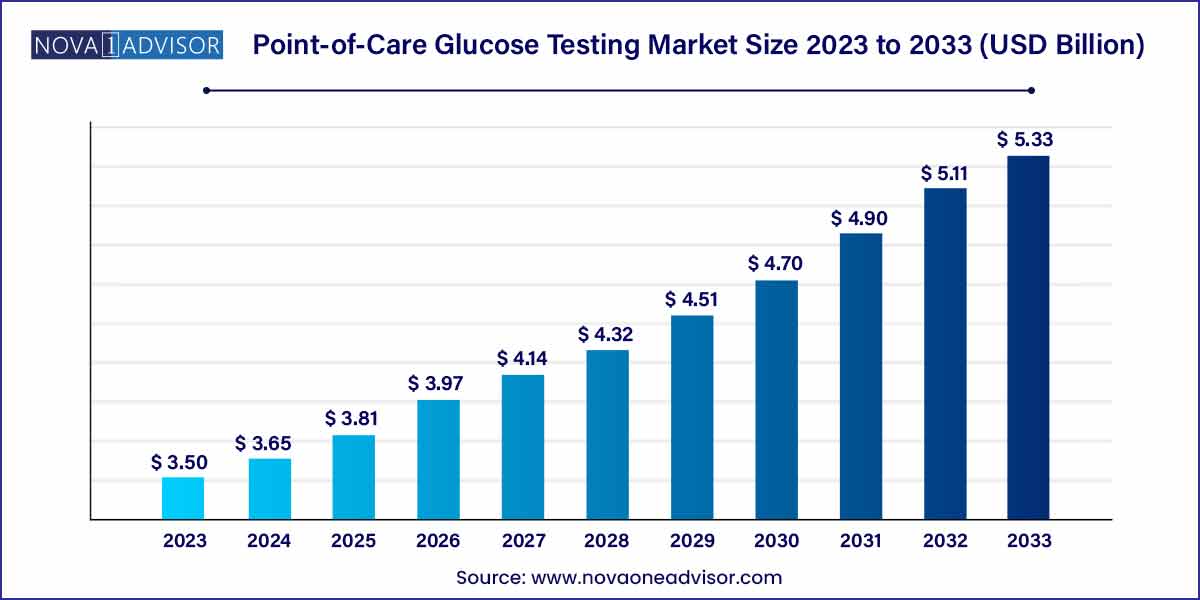

The global point-of-care glucose testing size was exhibited at USD 3.50 billion in 2023 and is projected to hit around USD 5.33 billion by 2033, growing at a CAGR of 4.3% during the forecast period of 2024 to 2033.

Key Takeaways:

- The other product segment accounted for the largest share of more than 54.6% of the global revenue in 2023 and will continue expanding at a steady CAGR during the forecast period.

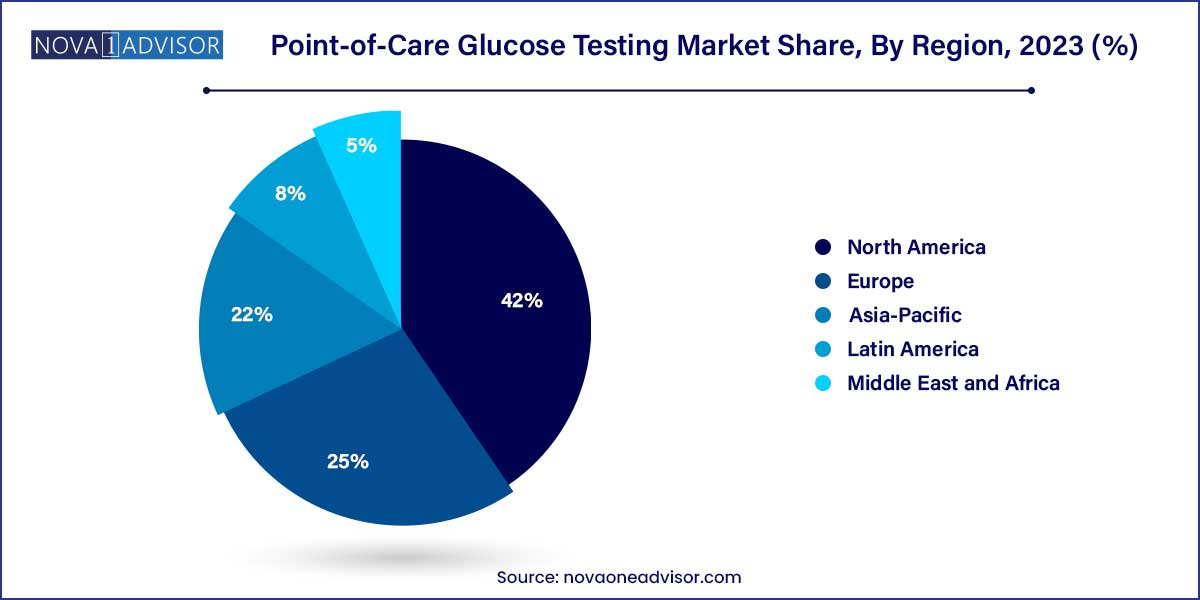

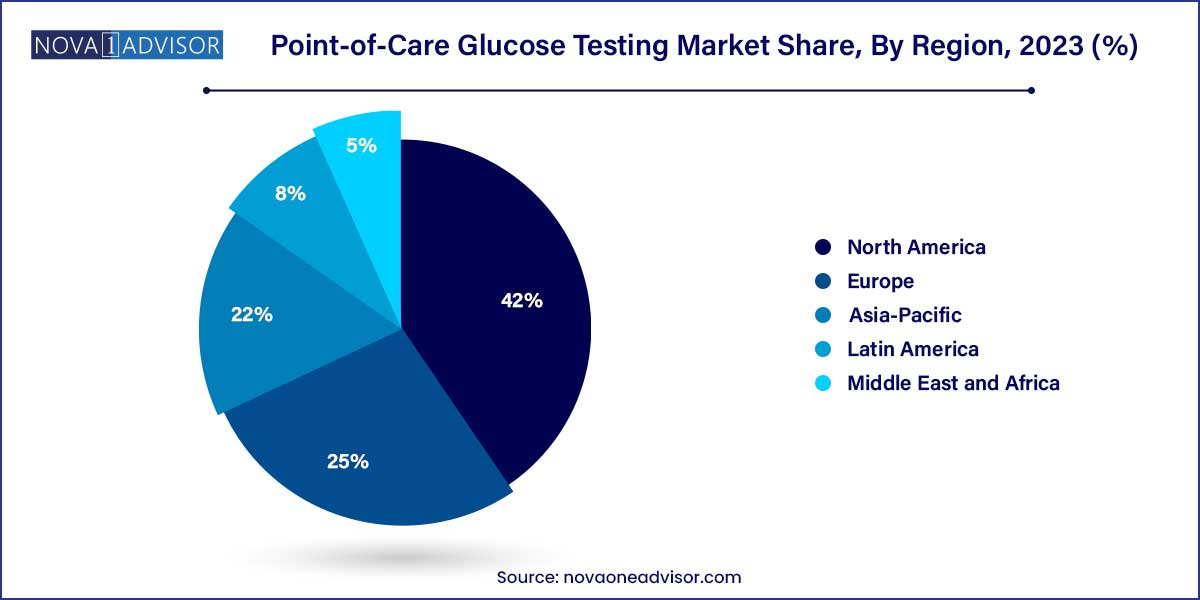

- North America dominated the global market in 2023. The regional market accounted for the largest share of over 42.0% of the overall revenue in the same year.

Market Overview

The Point-of-Care (POC) glucose testing market has become an essential part of the global diagnostics ecosystem, offering rapid and reliable blood glucose measurements in various healthcare and home settings. As the prevalence of diabetes continues to rise globally, POC glucose testing solutions provide a critical tool for effective disease management and early detection. Unlike traditional laboratory-based testing, POC devices allow for immediate results, enabling timely clinical decisions and patient self-management.

Technological innovations, increased patient awareness, and the demand for decentralized healthcare models are driving the widespread adoption of POC glucose testing. These devices have found their place in hospitals, clinics, pharmacies, and homes, offering convenience, accuracy, and speed. The market is highly dynamic, with leading companies continually enhancing their products through digital connectivity, data integration with electronic health records (EHRs), and non-invasive testing approaches.

With the global healthcare landscape emphasizing preventive care and chronic disease management, POC glucose testing is positioned as a cornerstone of personalized medicine. The growth trajectory is further amplified by governmental efforts to promote diabetes screening programs and the rising geriatric population.

Major Trends in the Market

-

Integration with Mobile Health Apps: Devices now sync with smartphones and apps for better diabetes management and remote monitoring.

-

Emergence of Non-Invasive Glucose Monitoring Technologies: Startups and major players are investing in developing non-invasive or minimally invasive glucose monitoring solutions.

-

Miniaturization and Portability: Devices are becoming smaller, more user-friendly, and easier to carry for real-time monitoring.

-

Adoption in Emerging Markets: Expansion into Asia-Pacific, Latin America, and the Middle East is gaining momentum due to the rising diabetic population.

-

Cloud-Connected Devices: Cloud-based data storage and sharing for remote monitoring by healthcare providers is growing.

-

Focus on Accuracy and Regulatory Compliance: Enhanced sensor technologies are improving test accuracy, meeting stricter regulatory standards.

-

Personalized Diabetes Management: Devices are being tailored to patient-specific needs, with customizable alerts and reports.

-

Retail and Pharmacy Expansion: Pharmacies and retail clinics are becoming important channels for point-of-care glucose testing solutions.

Point-of-Care Glucose Testing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.50 Billion |

| Market Size by 2033 |

USD 5.33 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd.; Abbott; Nipro; PlatInium Equity Advisors, LLC (Lifescan, Inc.); Nova Biomedical; ACON Laboratories; Trividia Health, Inc.; Prodigy Diabetes Care, LLC; Bayer AG/Ascensia Diabetes Care Holdings AG; EKF Diagnostics. |

Driver: Rising Global Prevalence of Diabetes

The single most significant driver for the POC glucose testing market is the surging prevalence of diabetes worldwide. According to the International Diabetes Federation, approximately 537 million adults were living with diabetes in 2021, a number expected to rise to 643 million by 2030.

The increasing incidence of Type 2 diabetes, largely due to aging populations, sedentary lifestyles, and unhealthy diets, is amplifying the need for regular glucose monitoring. Immediate glucose results allow patients and healthcare providers to adjust medications and dietary habits swiftly, minimizing complications such as neuropathy, nephropathy, and retinopathy. Furthermore, as diabetes becomes more prevalent among younger populations, the demand for portable, user-friendly POC devices is expected to climb steeply.

Restraint: Accuracy Concerns and Regulatory Challenges

While POC glucose testing offers speed and convenience, concerns regarding accuracy persist. Variations in readings due to environmental conditions, user error, device calibration issues, and hematocrit interference can impact clinical decision-making.

Regulatory agencies such as the U.S. FDA and the European Medicines Agency (EMA) are tightening accuracy requirements for glucose meters, especially those used in critical care settings. Achieving consistently high accuracy across different populations (e.g., neonates, anemic patients) presents a significant technical challenge. Compliance with rigorous regulatory standards increases development costs and can delay market entry, particularly for smaller players.

Opportunity: Technological Advancements in Sensor Technology

The field of biosensor technology presents a vast opportunity for innovation in POC glucose testing. Advances in nanotechnology, microfluidics, and electrochemical sensing are paving the way for highly sensitive, minimally invasive, and continuous glucose monitoring solutions.

For instance, Abbott’s FreeStyle Libre system offers continuous glucose monitoring with a sensor worn on the skin, eliminating the need for frequent finger sticks. Similarly, research into sweat-based and saliva-based glucose detection holds promise for non-invasive alternatives. Integration with artificial intelligence (AI) to predict glucose trends and offer personalized advice represents another frontier with significant market potential.

Product Insights

Accu-Chek Aviva Meter dominated the point-of-care glucose testing market in 2024, recognized for its high accuracy, user-friendly interface, and broad availability. Roche's Accu-Chek series remains a staple in hospitals, clinics, and homes, bolstered by comprehensive training and support systems. Its wide test strip availability, insurance coverage, and easy connectivity with diabetes management software contribute to its leadership.

Meanwhile, the Freestyle Lite by Abbott is expected to grow at the fastest rate. Its key advantages include small sample size requirements, no coding technology, and fast reading times. Freestyle Lite's popularity among pediatric and elderly patients who require less invasive testing solutions is driving its rapid adoption. Abbott's continuous innovation and marketing campaigns are enhancing visibility and boosting growth in both developed and emerging markets.

Additional Product Insights

Devices like Onetouch Verio Flex are gaining traction for their Bluetooth connectivity and real-time data sharing with healthcare providers. The Bayer CONTOUR system has also established a strong presence, particularly in Europe, known for its accuracy under various environmental conditions.

Accu-Chek Inform II and StatStrip are critical devices in hospital point-of-care testing due to their compliance with hospital infection control protocols and integration with electronic medical records (EMRs). The i-STAT handheld blood analyzer continues to serve niche critical care settings where comprehensive blood analysis, including glucose, is required.

Regional Insights

North America, particularly the United States, led the global POC glucose testing market in 2024. Several factors contribute to the region's dominance, including the high prevalence of diabetes, supportive reimbursement policies, robust healthcare infrastructure, and advanced technological adoption.

The U.S. has been at the forefront of deploying POC solutions across hospitals, outpatient clinics, and even in pharmacies. The integration of glucose meters with mobile apps and insurance companies' growing willingness to cover self-monitoring devices are propelling market growth. Major players such as Roche, Abbott, and LifeScan (a Johnson & Johnson subsidiary) maintain a strong presence with continuous innovation pipelines.

Asia-Pacific is poised to be the fastest-growing region during the forecast period. Countries such as China, India, and Japan are grappling with a diabetes epidemic fueled by rapid urbanization, dietary shifts, and genetic predispositions.

Government-led initiatives, like India's "Ayushman Bharat" program to enhance healthcare access, and China's Healthy China 2030 policy are emphasizing chronic disease management, boosting the demand for affordable POC glucose testing devices. Local manufacturers are also entering the market with cost-effective solutions, intensifying competition and further driving adoption.

Some of the prominent players in point-of-care glucose testing include:

- F. Hoffmann-La Roche Ltd.

- Abbott

- Nipro

- PlatInium Equity Advisors, LLC (Lifescan, Inc.)

- Nova Biomedical

- ACON Laboratories

- Trividia Health, Inc.

- Prodigy Diabetes Care, LLC

- Bayer AG/Ascensia Diabetes Care Holdings AG

- EKF Diagnostics

Recent Developments

-

March 2025: Abbott launched "FreeStyle Libre 4," an upgraded version featuring improved sensor accuracy, longer wear time, and advanced smartphone app integration.

-

February 2025: Roche Diagnostics announced a partnership with Apple Health to enhance connectivity between Accu-Chek devices and iOS health monitoring apps.

-

November 2024: LifeScan introduced "OneTouch Solutions," an integrated digital ecosystem that combines glucose monitoring with lifestyle coaching and telemedicine services.

-

September 2024: Nova Biomedical expanded its StatStrip line with enhanced critical care glucose analyzers featuring improved data transmission and cybersecurity protocols.

-

July 2024: Senseonics received regulatory approval for its 180-day implantable continuous glucose monitoring (CGM) system, "Eversense E3," strengthening non-invasive glucose monitoring solutions.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global point-of-care glucose testing.

Product

- Accu Check Aviva Meter

- Onetouch Verio Flex

- i-STAT

- Bayer CONTOUR Blood Glucose Monitoring System

- Freestyle Lite

- True Metrix

- Accu-Chek Inform II

- StatStrip

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)