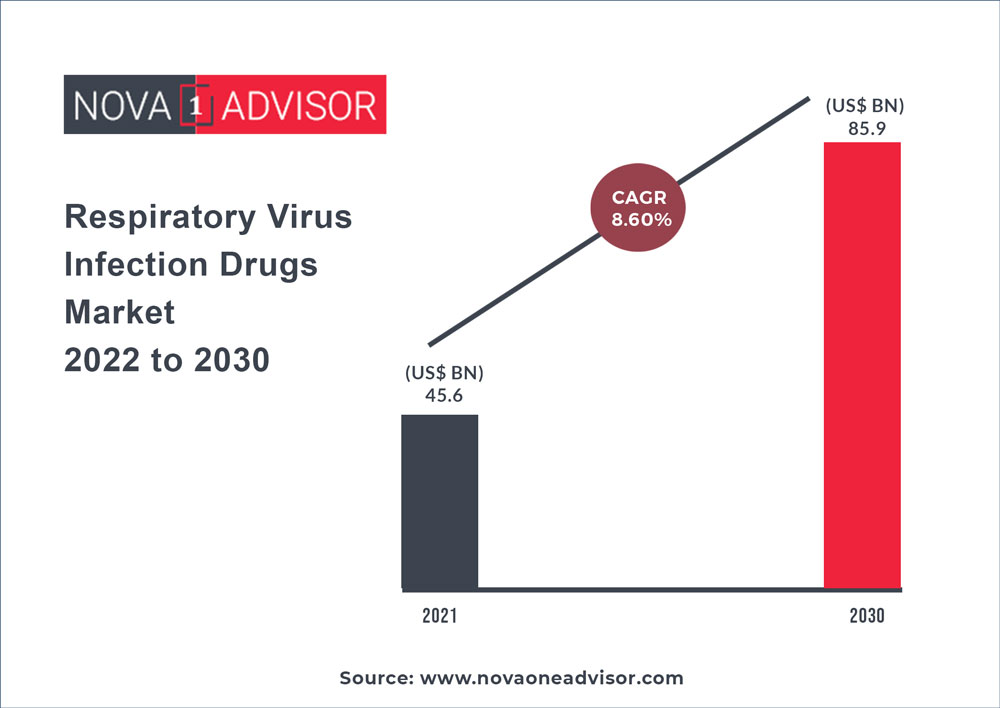

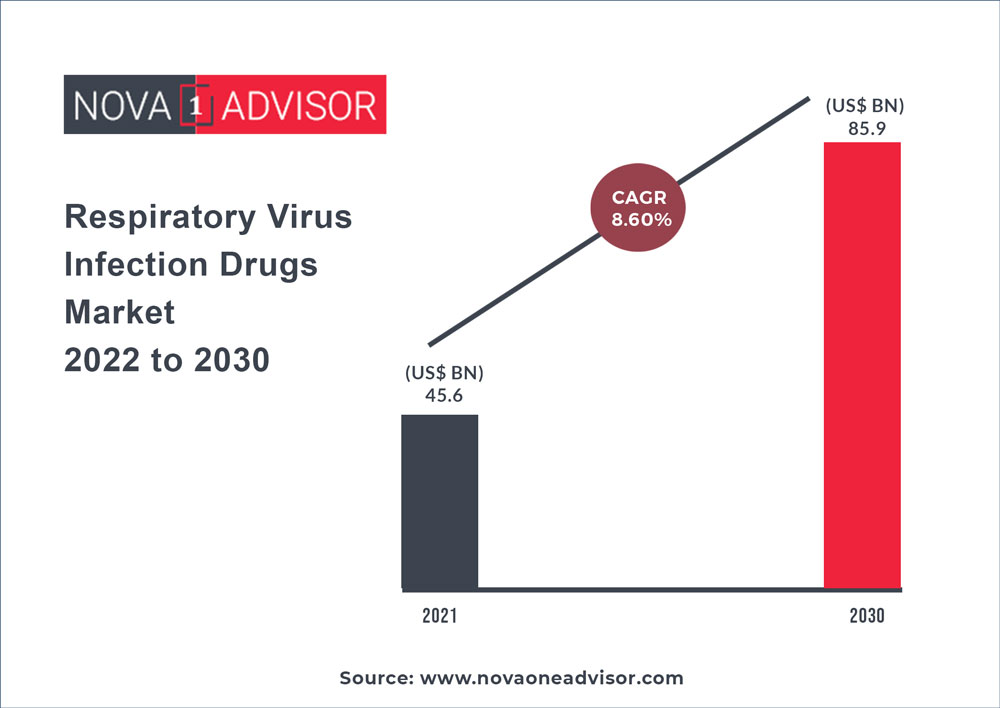

According to Nova one advisor, the global Respiratory Virus Infection Drugs market was valued at USD 45.6 billion in 2022 and it is expected to hit around USD 85.9 billion by 2030 with a CAGR of 8.6% during the forecast period 2022 to 2030. Respiratory virus infection is a type of infection of the airway and lungs caused by different types of virus. Viral respiratory infections (VRIs) include cold, flu, and bronchiolitis. Several medications are used for the treatment of respiratory virus infections including prescription and OTC.?

Surge in Adoption of Combination Therapy to Drive Respiratory Virus Infection Drugs Market

- Adoption of combination therapy is increasing, as it is more effective than the separate use of bronchodilator and corticosteroid. Moreover, the number of patients being successfully treated with combination therapy has increased.

- Regulatory authorities such as the FDA, the European Commission, and the Ministry of Health, Labor and Welfare (MHLW) have approved the use of combination drugs for the treatment of respiratory diseases such as asthma and COPD

- Steady rise in prevalence of respiratory virus infections across the globe leads to high demand for advanced therapeutics. This, in turn, is expected to propel the global respiratory virus infection drugs market.

Report Scope of the Respiratory Virus Infection Drugs Market

|

Report Coverage

|

Details

|

|

Market Size

|

USD 85.9 Billion by 2030

|

|

Growth Rate

|

CAGR of 8.6% from 2022 to 2030

|

|

Largest Market

|

North America

|

|

Fastest Growing Market

|

Asia Pacific

|

|

Base Year

|

2021

|

|

Forecast Period

|

2022 to 2030

|

|

Segments Covered

|

and Region,

|

|

Companies Mentioned

|

- GlaxoSmithKline plc

- Merck & Co., Inc.

- AstraZeneca

- Boehringer Ingelheim International GmbH

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Cipla, Inc.

- CHIESI Farmaceutici S.p.A.

- Orion Corporation

|

Intelligent AI, ML Algorithms Supporting COVID-19 Molecular Applications

The AI (Artificial Intelligence)-driven COVID-19 drug discovery is gaining increased popularity in the respiratory virus infection drugs market. Since the coronavirus has become an international health concern, there has been an unprecedented demand for drugs and vaccines. As such, AI holds promising potentials in quick identification of COVID-19 drugs. Thus, companies in the respiratory virus infection drugs market are collaborating with scientists and researchers to predict drugs and peptides that can be used as therapeutic medication for coronavirus treatment.

Pharmaceutical companies are increasing efforts to predict drugs directly from the sequences of infected patients, since they have a better affinity with the target. However, companies need to accelerate their testing capabilities in order to verify safety and feasibility to combat COVID-19. Intelligent algorithms based on machine learning (ML) and Big Data are supporting molecular applications.

Increase in Expenditure on Healthcare and Immunization Augments Respiratory Virus Infection Drugs Market

- Rise in healthcare expenditure increases the availability of better healthcare infrastructure, improves operational efficiency, and encourages awareness programs related to vaccination and treatment of diseases

- According to the World Health Organization, expenditure on immunization in 75 countries across the globe increased between 2005 and 2015. According to the National Health Expenditure Accounts (NHEA), healthcare expenditure in the U.S. in 2017 was 18.1% of the GDP.

Rise in R&D Helps Address Low Solubility of Favipiravir in Aqueous Media

The respiratory virus infection drugs market is expected to surpass a value of US$ 82.4 Bn by the end of 2030. However, individuals are becoming increasingly aware about the disadvantages and side effects of influenza drugs, namely favipiravir and baloxavir. Pharma companies need to address low solubility of favipiravir in aqueous media, which may reduce its efficacy in vitro. This indicates that pharma companies need to increase their R&D activities to prevent adverse events of drugs.

Pharma companies are focusing on discoveries in influenza virus polymerase complex. It has been found that influenza viruses are severe human pathogens that pose as a persistent threat to public health. Hence, companies in the respiratory virus infection drugs market are capitalizing on this issue to increase their R&D in influenza virus polymerase complex.

Efficient Drug Delivery via Nanotechnology Offers Growth Prospects in Clinical Practice

Companies in the respiratory virus infection drugs market are increasing their focus in nanomaterials designed for antiviral drug delivery of adenovirus infection. This has become important, since respiratory virus infections have become a global health problem causing a significant amount of mortality and morbidity in individuals. Emerging drug resistance and constant viral replication have led to the demand for nanotechnology in antiviral therapies, as nanomaterials offer unique physic-chemical properties ideal for the treatment of adenovirus infection.

Different nanomaterials such as nanosheres, liposomes, nanoparticles, nanogels, and the likes hold promising potentials for efficacious drug administration in order to improve patient outcomes. Companies in the respiratory virus infection drugs market are innovating in nanosuspensions and nanoemulsions to enable drug delivery of unique antiviral agents with prospects in clinical practice.

AI-based Multi-program Approach Enables Development of Successful Candidates for Antibiotic Resistance

The COVID-19 pandemic has brought startups in the respiratory virus infection drugs market under great emphasis. For instance, Vir Biotechnology— a specialist in immune therapeutics, is leveraging the advantages of AI and ML in influenza drug development. It has been found that infectious diseases have increased resistance to antibiotics. Startups in the respiratory virus infection drugs market are capitalizing on this opportunity to integrate AI and ML in common cold and influenza drug development.

In order to broaden their revenue streams, the U.S.-based tech startups are working on solutions to address antibiotic resistance in certain strains of influenza A, SARS-CoV-2, and tuberculosis. They are adopting a multi-program and multi-platform approach to develop successful candidates in order to tackle antibiotic resistance. Manufacturers are innovating in antibody platforms and T cell platforms to isolate rare antibodies and use them to boost the immune system.

State-of-art DAAs Holds Promising Potentials for RSV Treatment

The respiratory syncytial virus (RSV) is being associated with limited treatment options, resulting in millions of hospitalizations per year. Palivizumab, a monoclonal antibody, is considered as the gold standard for prophylaxis in high-risk infants. However, palivizumab and ribavirin are prone to limited efficacy and significant safety concerns. Hence, manufacturers in the respiratory virus infection drugs market are increasing their research in direct acting antiviral agents (DAAs) to target key steps in the viral life cycle.

It has been found that DAAs are producing landmark clinical studies, which involve nucleoside inhibitors. On the other hand, non-nucleoside inhibitors of replication are being reviewed in addition to inhibitors of other mechanisms. As such, pharma companies in the respiratory virus infection drugs market are taking giant strides in R&D pertaining to viral proteins or host cell factors for inhibition of viral replication.

Companies Forge Strategic Partnerships to Innovate in Treatment for LRTI in Infants

In vitro and in vivo model systems of the RSV disease are being highlighted in order to create novel drug targets. Companies in the respiratory virus infection drugs market are expanding their treatment options for lower respiratory tract infections (LRTI). For instance, Sanofi— a global biopharmaceutical company, announced that it received positive Phase 2b trial for nirsevimab, since it showed significant decline in medically attended lower respiratory tract infections. This involves increased hospitalization caused due to RSV in healthy preterm infants.

Single dose monoclonal antibodies are found to significantly reduce medically attended RSV LRTI infants through the full RSV season. Nirsevimad is being highly publicized as an extended half-life RSV monoclonal antibody. Companies are entering into strategic partnerships to innovate in treatments for LRTI in infants. Nirsevimab is gaining popularity as the new standard of care by offering innovative immunization for immediate and sustained protection for all infants during the first season of RSV.

Favipiravir and Boloxavir Approved for Influenza Treatment in Japan

Companies in the respiratory virus infection drugs market are increasing their production capabilities for anti-influenza drugs. Pharma companies in the respiratory virus infection drugs market are developing inhibitors of influenza virus polymerase, which are among the most promising types of drugs. Favipiravir and boloxavir are being approved for influenza treatment in Japan and the U.S. It has been found that favipiravir effectively and selectively inhibits the RNA dependent RNA polymerase of RNA viruses.

Patent Expiry of Branded Products and Availability of Generic Equivalents to Hamper Global Market

- Patents prevent other manufacturers from developing drugs that are being exclusively manufactured by the patent holder. Patent expiry of branded drugs has a significant impact on the pharmaceutical industry. It hampers the revenue generated from the sale of branded drugs and can affect the market share of a company. This, in turn, is likely to hamper the growth of the global respiratory virus infection drugs market.

- For instance, AstraZeneca’s Symbicort Turbuhaler went off-patent in Europe in 2019, whereas, GlaxoSmithKline plc’s Qvar, Singulair, and Diskus device patents have expired. This is projected to lead to dramatic decline in sales, thereby affecting market positions of the companies.

Respiratory Virus Infection Drugs Treatment Market: Key Developments

- Leading players in the global respiratory virus infection drugs market engage in regulatory approvals, development of technologically advanced products, launch of new products, and acquisition & collaborative agreements with other companies. These strategies are aimed at addressing unmet needs in the global respiratory virus infection drugs market, strengthening the product portfolio and investments in research & development. A few expansion strategies adopted by players in the global respiratory virus infection drugs market are:

- In May 2019, Merck & Co., Inc. announced plans to invest US$ 1 Bn in its manufacturing facility in Elkton, Virginia, the U.S.

- In September 2018, AstraZeneca and its partner Amgen, Inc. (Amgen) announced that the U.S. Food and Drug Administration (FDA) had granted Breakthrough Therapy Designation for tezepelumab for the treatment of severe asthma patients without an eosinophilic phenotype. This breakthrough therapy enabled the company to enhance its respiratory portfolio and treat a diverse population having severe asthma, including those ineligible for currently approved biologic therapies.

- In March 2018, Boehringer Ingelheim International GmbH announced that the indication for use of SPIRIVA Respimat (tiotropium Respimat) was extended. Regulatory authorities of the EU had accepted the add-on bronchodilator treatment therapy in patients aged 6 years and older with severe asthma who experienced one or more severe asthma exacerbations in the past year.

- The report on the global respiratory virus infection drugs market discussed individual strategies, followed by company profiles of manufacturers of respiratory virus infection drugs products

- The competition landscape section has been included in the report to provide readers with a dashboard view and a company market share analysis of key players operating in the global respiratory virus infection drugs market

Some of the prominent players in the Respiratory Virus Infection Drugs Market include:

- GlaxoSmithKline plc

- Merck & Co., Inc.

- AstraZeneca

- Boehringer Ingelheim International GmbH

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Cipla, Inc.

- CHIESI Farmaceutici S.p.A.

- Orion Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Nova one advisor, Inc. has segmented the global Respiratory Virus Infection Drugs market

Drug Type

- Antibiotics

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDS)

- Cough Suppressants

- Nasal Decongestants

- Others

Infection Type

- Respiratory Syncytial Virus (RSV) Infection

- Influenza Virus Infection

- Parainfluenza Virus Infection

- Adenovirus Infection

- Rhinovirus Infection

- Others

Route of Administration

Mode of Purchase

- Prescription-based Drugs

- Over-the-counter Drugs

Distribution Channel

- Hospital Pharmacies

- Drug Stores

- Retail Pharmacies

- Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the global Respiratory Virus Infection Drugs industry analysis from 2022 to 2030 to identify the prevailing Respiratory Virus Infection Drugs industry opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the global Respiratory Virus Infection Drugs industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Respiratory Virus Infection Drugs industry trends, key players, market segments, application areas, and market growth strategies.