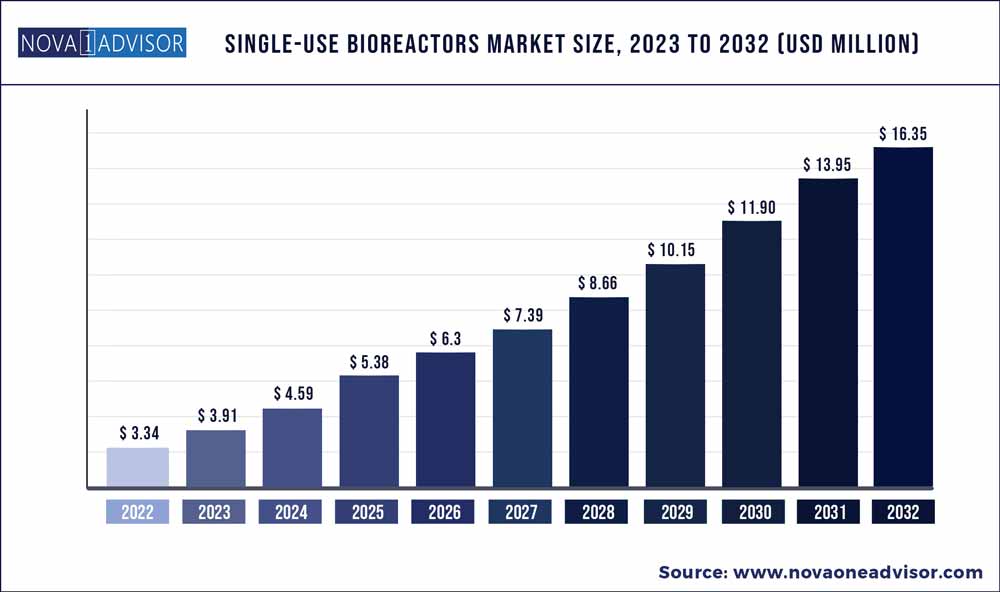

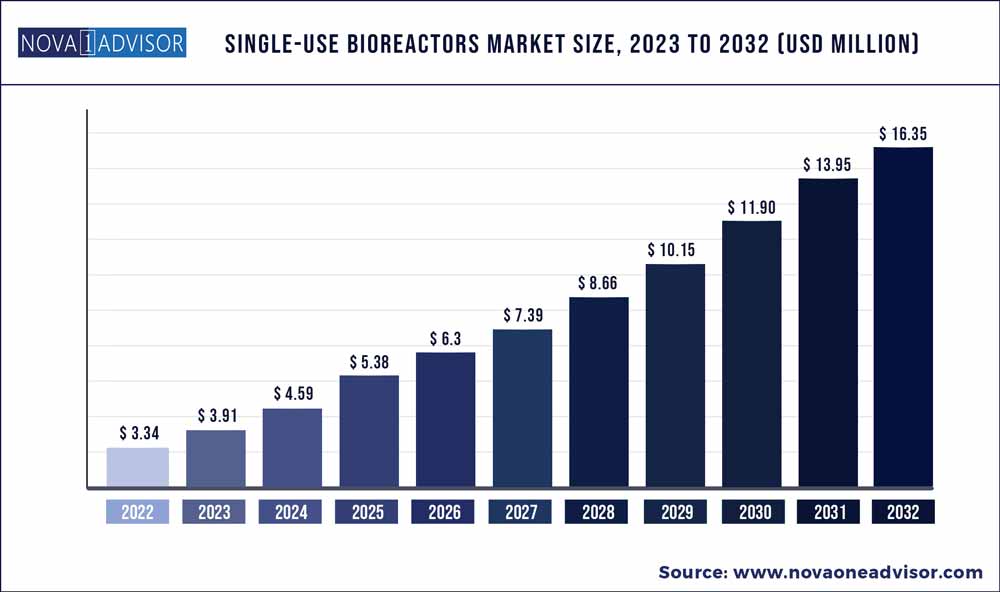

The global Single-use Bioreactors market size was exhibited at USD 3.34 billion in 2022 and is projected to hit around USD 16.35 billion by 2032, growing at a CAGR of 17.21% during the forecast period 2023 to 2032.

Key Pointers:

- The single use bioreactor systems segment captured the largest market share of above 81.19% in 2022.

- Stirred tank bioreactors accounted for the largest share of 80.21% in 2022.

- The mammalian cells segment accounted for the largest share of 80.82% in 2022.

- The vaccines segment accounted for the largest share of 27.95% in 2022.

- In 2022, the research and development (R&D)/process development segment accounted for an 80.29% share of the market.

- The lab-scale production segment held the largest revenue share of 35.71% in 2022.

- The CMOs & CROs segment accounted for a significant share of 38.69% in 2022

- Asia Pacific is estimated to witness the fastest CAGR of 17.63% throughout the forecast period.

Single-use Bioreactors Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 3.91 Billion

|

|

Market Size by 2032

|

USD 16.35 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 17.21%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Product, type, type of cell, molecule type, application, end-use, usage type, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

Sartorius Stedim Biotech; Thermo Fisher Scientific; Danaher; Merck KgaA; Celltainer Biotech BV; Getinge AB; Eppendorf AG; Cellexus; PBS Biotech Inc.; Distek Inc.; ABEC; Able Corporation & Biott Corporation; G&G Technologies Inc.; Solida Biotech GmbH; Satake Chemical Equipment Mfg., Ltd.; Stobbe Pharma GmbH; bbi-biotech GmbH

|

The rising demand for biopharmaceuticals, coupled with increasing investments in single-use technologies, the market for single-use bioreactors is expected to witness significant growth throughout the forecast period.

Furthermore, the COVID-19 outbreak has positively impacted the market for SUBs. The race to create an effective vaccine against the SARS-CoV-2 virus is being undertaken by numerous biopharmaceutical firms. As a result, the need for single-use bioreactors has drastically increased. For instance, in October 2020, ABEC supplied six 4,000 L single-use bioreactors to the Serum Institute of India, for the production of COVID-19 vaccines on a large scale at a reasonable cost.

The value of the product, the time required for product development and production, in addition to the criticality of the phase are now influencing the industry's propensity to employ single-use bioreactors. In addition, the medical industry has a significant demand for these single-use bioreactors. As a result, pharmaceutical companies use these reactors to make medicines without having to compromise on their quality.

The flexibility of using single-use bioreactors is one of their main benefits. The growing trend toward multi-drug facilities necessitates the manufacture of various medications utilizing the same facility, in the shortest amount of time, and for the least amount of money. Thus, it will increase the demand for single-use bioreactors and further fuel market growth.

Additionally, the market for SUBs is anticipated to increase quickly because of considerable prospects from emerging countries, the demand for customized medicine, and an anticipated rise in bio-similar production in the U.S. For instance, around USD 110 billion worth of biologics were anticipated to lose their patent protection by 2020. The demand for biosimilars is therefore expected to rise in the coming years as a result of mounting pressure to lower healthcare costs and regulatory certainty about biosimilars, further driving the market growth.

However, the administration of single-use bioreactors-related challenges and worries about leachable and extractable are most likely to impede the single-use bioreactors market's expansion over the anticipated time. The single-use bioreactors market is likely to benefit from new opportunities brought on by license termination and emerging markets. Despite this, the market is primarily driven by the growing single-use bioreactor usage among startups and small businesses, technological developments in SUBs, and the benefits offered by these products.

Additionally, SUBs have been used more frequently lately in contemporary biopharmaceutical operations. This is mainly because of their exceptional capacity to increase flexibility, decrease investment, and regulate operational expenses. Furthermore, single-use bioreactors have a wide range of uses in academic and industrial laboratories, including drug discovery, pharmaceutical, environmental, and life science research for the production of vaccines, antibodies, cell culture, and biofuels, among other things. Thus, it will increase demand and further boost market growth.

Product Insights

The single use bioreactor systems segment captured the largest market share of above 81.19% in 2022. Single-use bioreactor systems are widely used in biopharmaceutical manufacturing processes that require high product yield. The versatility, cost-effectiveness, and high mass production capability of single-use bioreactors would increase demand for the products leading to rapid market growth.

Furthermore, the rising demand for quick development, and greater production of new bio-therapeutics including vaccines, antibodies, enzymes, and hormones, in addition to an increase in the product quantities that can be produced in these bioreactors, contributes to the market's ongoing expansion. In addition, an increase in the focus of key manufacturers on offering small-scale bioreactors will fuel segment growth over the next few years.

Type Insights

Stirred tank bioreactors accounted for the largest share of 80.21% in 2022. The benefits offered by these bioreactors include good oxygen transfer and fluid mixing ability, easy scale-up, low operating costs, compliance with cGMP requirements & alternative impellers. These factors have led to the highest penetration of stirred tank bioreactors in the market.

The availability of wave-induced bioreactors will increase in the coming years, boosting the market growth. In addition, for the past ten years, Wave Biotech AG has sold the original wave SUBs BIOSTAT RM. In 2019, the business unveiled the second version, BIOSTAT RM II, which has more sophisticated features & offers enhanced control of temperature and driving system. The demand for wave-induced SUBs is anticipated to increase due to these manufacturing developments during the forecast period. Therefore, such type of advancements by the manufacturers will drive segmental growth in the forecast period.

Type of Cell Insights

The mammalian cells segment accounted for the largest share of 80.82% in 2022. This can be attributed to the significant penetration of this cell type in the creation of biopharmaceutical therapies and the commercial success of recombinant proteins made from mammalian cells. As per BioProcess International, 85.0% of biopharmaceutical candidates in clinical development are made using mammalian cell cultures.

Yeasts are dependable eukaryotic hosts for the synthesis of heterologous proteins and offer special benefits in the generation of therapeutic recombinants. Growing attention given by several scientists and research organizations to the use of yeast cells in clinical or therapeutic settings will drive market expansion during the projected timeframe. For instance, research published by NCBI in June 2021 examined cutting-edge techniques and approaches for synthesizing heterologous medicinal proteins from yeast genes.

Molecule Type Insights

The vaccines segment accounted for the largest share of 27.95% in 2022. This is majorly attributed to the COVID-19 outbreak, which has resulted in an urgent need for the development of virus vaccines. According to Bioplan Associates, the use of single-use systems in the commercial manufacturing of vaccines is anticipated to rise sharply. Many biopharmaceutical companies are actively engaged in the quick development of COVID-19 vaccines in response to the pandemic.

Additionally, the gene modified cells segment is expected to expand at the fastest CAGR of 18.14% during the review period. The growing field of cell and gene therapies is anticipated to accelerate the uptake of SUBs in this market. For instance, in January 2021, Sartorius and RoosterBio, Inc. teamed up to improve the production capabilities for gene and cell therapies. The partnership aims to increase the manufacturing of regenerative medicines. Such an ongoing and continuous increase in the adoption of single-use systems is anticipated to drive market growth.

Application Insights

In 2022, the research and development (R&D)/process development segment accounted for an 80.29% share of the market. Single-use bioreactor utilization in process development is a driving force behind market expansion. For instance, according to an article published in 2020 by American Pharmaceutical Review, the industry has employed about 71.2% of single-use bioreactors for process development.

Furthermore, every component of the bioprocessing sector uses single-use systems. According to the American Pharmaceutical Review, single-use system devices are used for clinical or process development in about 85.0% of the operations. This exhibits the majority of single-use bioreactors in both clinical manufacturing and R&D.

The bioproduction sector is expected to attain the fastest CAGR of 17.93% and is anticipated to see significant use of single-use bioreactors in the near future, due to the numerous benefits they provide. The use of disposable reactors, from the lab to the industrial, has increased as a result of significant developments in bioreactor designs, sensor systems, and stirring motors.

Usage Insights

The lab-scale production segment held the largest revenue share of 35.71% in 2022. In the biopharmaceutical business, disposable bioreactors are frequently employed in preclinical & clinical research. It is anticipated that growing single-use technology acceptance would have a substantial impact on segment growth in cell-based therapy research and vaccine production.

Throughout the forecast period, it is anticipated that the large-scale production category would experience significant expansion at a CAGR of 18.37%. This is due to the quickly expanding market demand for the commercial production of biopharmaceutical goods and the growth of manufacturing capacity to accommodate these demands. For instance, Wuxi Biologics introduced a 36,000L bio manufacturing line in February 2021, employing nine 4,000L single-use bioreactors.

In addition, to enable the scale-up, companies such as Thermo Fisher Scientific and ABEC launched large-volume single-use bioreactors in the market. In recent years, Thermo Fisher introduced its 5000-L single-use bioreactor and ABEC launched its 4000-L and 6000-L single-use bioreactors.

End-use Insights

The CMOs & CROs segment accounted for a significant share of 38.69% in 2022 and it is also expected to be the fastest-growing segment during the study period. The demand for supply production capacity as well as quick awareness campaign change-overs is more among CMOs. As a result, they use a broader range of single-use components and systems. With the increasing trend of outsourcing, CROs & CMOs are more likely to adopt single-use bioreactors.

On the other hand, pharmaceutical and biopharmaceutical companies are estimated to witness significant growth. According to estimates, 66.0% of biopharmaceutical companies use disposable bioreactors in their routine operations. Furthermore, strategic activities by key market players offer lucrative opportunities in the review period. For instance, BioCentriq and Pall Corporation worked together in July 2021 to clinically manufacture Zolgensma, an FDA-approved gene therapy, utilizing an iCELLis fixed bed bioreactor.

Regional Insights

North America dominated the regional market with a share of 34.33% in 2022. This is explained by the fact that the region has well-established biopharmaceutical companies and key operating players. Additionally, the region's increased production capacity has added to the market expansion. For instance, Thermo Fisher Scientific stated in September 2021 that it would build a new manufacturing facility specifically for single-use bioprocessing products.

Asia Pacific is estimated to witness the fastest CAGR of 17.63% throughout the forecast period. According to estimates, Asian businesses, including both domestic contenders and global behemoths, are building approximately half of all new bioprocessing facilities worldwide. In the near future, this is anticipated to significantly fuel single-use bioreactors market expansion in the Asia Pacific.

Some of the prominent players in the Single-use Bioreactors Market include:

- Sartorius Stedim Biotech

- Thermo Fisher Scientific

- Danaher

- Merck KgaA

- Celltainer Biotech BV

- Getinge AB

- Eppendorf AG

- Cellexus

- PBS Biotech Inc.

- Distek Inc.

- ABEC

- Able Corporation & Biott Corporation

- G&G Technologies Inc.

- Solida Biotech GmbH

- Satake Chemical Equipment Mfg., Ltd.

- Stobbe Pharma GmbH

- bbi-biotech GmbH

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Single-use Bioreactors market.

By Product Scope

- Single-use bioreactor systems

- Up to 10L

- 11-100L

- 101-500L

- 501-1500L

- Above 1500L

- Single-use media bags

- Single-use Filtration Assemblies

- Other Products

By Type

- Stirred-tank SUBs

- Wave-induced SUBs

- Bubble-column SUBs

- Other SUBs

By Type of Cell

- Mammalian Cells

- Bacterial Cells

- Yeast Cells

- Other Cells

By Molecule Type

- Monoclonal Antibodies

- Vaccines

- Gene Modified Cells

- Stem Cells

- Other Molecules

By Application

- Research and Development (R&D) or Process Development

- Bioproduction

- End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical & Biopharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

By Usage Type

- Lab-scale Production

- Pilot-scale Production

- Large-scale Production

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)