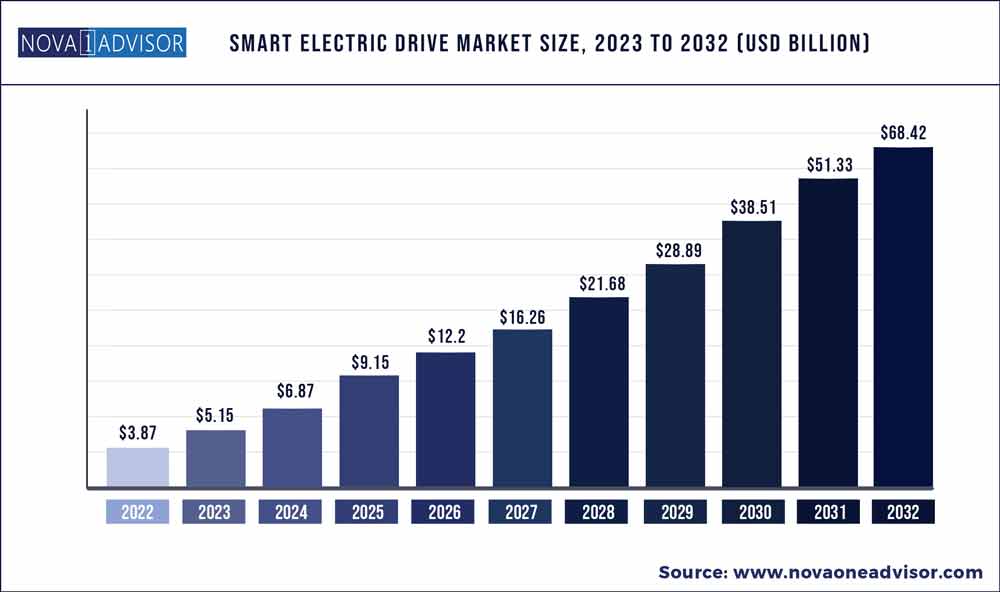

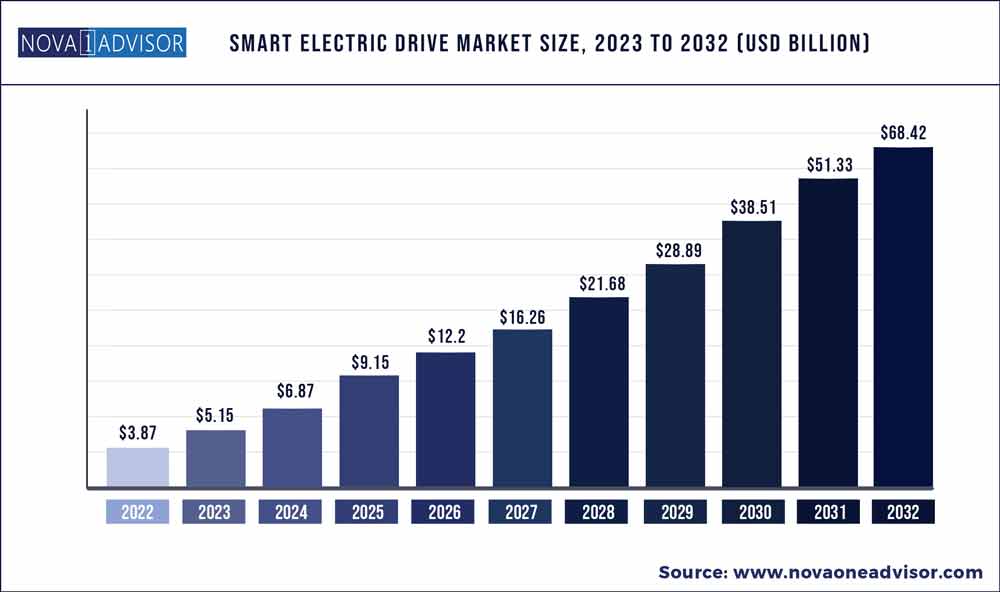

The global smart electric drive market size was exhibited at USD 3.87 billion in 2022 and is projected to hit around USD 68.42 billion by 2032, growing at a CAGR of 33.29% during the forecast period 2023 to 2032.

Key Pointers:

- Asia Pacific region accounted market share of over 36% in 2022.

- The all-wheel drive segment is growing at the CAGR of 40.1% from 2023 to 2032.

- The E-axle application segment generated 62% revenue share in 2022.

- The lithium-ion segment has garnered 35% revenue share in 2022.

Factors such as shift towards vehicle electrification, adoption of advanced technologies in electric vehicles, government policies supporting electric vehicle adoption and reducing cost of EV batteries will boost the demand for smart electric drive market. The growing concern for larger distance commuting using EV’s will also boost the market.

The COVID-19 pandemic has become a major concern for automotive EV stakeholders. Suspension of vehicle production and supply disruptions have brought the automotive electric vehicle industry to a halt. Lower vehicle sales post the pandemic will be a major concern for automotive EV OEMs for the next few quarters. The smart electric drive market, however, is expected to witness a significant boost in 2022 owing to the adoption of advance integrated components in a vehicle. Before that, lower EV vehicle sales and abrupt stoppage in the development of new technologies will result in slow growth of the smart electric drive market due to pandemic.

Smart Electric Drive Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 5.15 Billion

|

|

Market Size by 2032

|

USD 68.42 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 33.29%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Vehicle Type, EV Type, Application, Component, Drive Type, Commercial Vehicle Type, 2-Wheeler Type

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

ABB, Aisin Corporation, Allison Transmission, Borgwarner, Bosch, Continental Ag, Dana, Denso, GKN (Melrose), Hexagon AB, Hitachi, Huayu Automotive Electric System, Hyundai Mobis, Infineon Technologies, Jatco, Jing-Jin Electric Technologies, LG Electronics, Magna International, Mahle, Meidensha Corporation, Meritor, Nidec Corporation, Shanghai Automotive Smart Electric Drive, Siemens AG, Smesh E-Axle, ZF Group

|

Market Dynamics:

Driver: Lower operating costs of EV’s using smart electric drive technology

According to the US Energy Information Administration (EIA), 101.95 million barrels of gasoline per day was consumed in 2019 around the world. According to Forbes, prices of petrol in the international market has been on a rising trend over the years. The demand for petrol and diesel in the world is high as they non-renewable resources, which may get exhausted in the next few decades. Even though many treaties have been made to control price of petrol in the international market, prices have been on a rise over the years. As most countries import petrol, its usage contributes to lowering the balance of trade of the economy. The limited petroleum reserves and rising prices of the fuel have led automakers to consider alternative fuel sources for their vehicles.

The operating cost of electric vehicle drivetrains is lower than petrol and some other fuel alternatives. Along with environment conservation, this is a major factor for the growing demand for EVs in the market. This will drive the demand for the smart e-drive market in the coming years. The cost of usage of EVs can be as less as USD 0.4-0.6 per kWh as per EDF energy. This is much less compared to the average petrol price used to travel the same distance. This creates a major saving for EV users for daily vehicle use. Home charging can be costlier, many countries such as the US, the UK, Germany, and states offer subsidies for charging at home. This will lead to a faster increase in demand for electric trucks once price of EVs come down comparable to ICE vehicles.

Restraint: Higher cost of smart electric drive systems

The prices of electric vehicles have decreased over the last few years. For instance, Tesla reduced the price of its Model X by USD 3,000 to gain traction in the market. However, new and advanced technologies, for smart e-drive including e-axel, and e-wheel drive are still expensive. Due to their high cost, e-drive systems/modules are offered mostly in moderate-high ranged electric cars. Hence, the penetration of these technologies is limited to these vehicles. The cost of these assemblies is usually 10-15% higher compared to separate parts. The high cost of these components refrains manufacturers from adopting them on a large scale. The additional cost for adjusting the standard drivetrain products for specific EV’s further increases the cost of the electric drive system.

Opportunity: Rising demand for EVs to increase demand for the smart electric drive market

Leading markets for electric vehicles such as China, US, and Germany are investing significantly in Electric vehicles and EV charging infrastructure along with research & development for faster and efficient charging methods, longer ranged EV’s and lower cost batteries. They have also been investing in the development of electric drivetrain technology. Significant investments by automakers are expected to cater to the rising demand for EVs. Countries across North America and Europe along with many Asian countries adopted measures to reduce emissions in the coming decades and replace their vehicle fleets for lower emissions by varying amounts by 2035. This will lead to a very high demand for electric vehicles in the market along with a growing demand for EV’s and related industries including the smart electric drive market.

According to EV Volumes, in 2020, over 3.2 Billion EV’s sold in the global market. OEMs are offering a wide range of vehicles, from small hatchbacks such as Leaf to high-end sedans such as Tesla model 3. The wide range of product offerings has attracted a high number of consumers, resulting in an increased market for electric vehicles. For instance, in July 2021, Volkswagen announced it plans to make half of its vehicle sales EV’s by 2030 and aims to sell 450,000 EV’s globally in 2021. Similarly, Ford has invested USD 22 Billion to electrify its Mustang, F-150 and Transit models as well as developing new EV models. GM also announced on January 2021 plans to go all-electric by 2030 in US and 2035 globally and spent USD 27 billion for speeding up their EV development.

The Renault-Nissan-Mitsubishi alliance has also been developing their EV market. By January 2020, they had sold over 800,000 EV’s with top sellers like Nissan Leaf and Renault Zoe. The three companies will be sharing their EV platform. They announced on June 2021 to develop around 1 million electric cars a year by 2030. In July 2021, Stellantis also announced plans to expand its portfolio of EV’s by 2025 through an investment of USD 35.5 Billion. Further, Volvo Cars have announced to be fully electric by 2030 on March 2021. The demand for smart e-drive market will increase along with the demand for EV’s once the price of EV drivetrain components comes down and starts mass production to increase production volume in the market. Thus by 2026 and beyond, the demand for smart e-drives are expected to grow rapidly in the market.

Challenge: Inadequate charging infrastructure for electric vehicles in developing countries will reduce the potential of the smart electric drive market

To facilitate the widespread acceptance of plug-in hybrid electric vehicles (PHEVs) and all-electric vehicles (EVs), an adequately developed infrastructure of charging stations is required. Barring a few countries such as the US, Germany, the UK, France, and Japan, the development of this infrastructure is in the initial stage across the world. The number of charging stations and charging outlets is negligible due to the high cost associated with building the same. For instance, in Europe, one slow two plug charging station costs approximately USD 2,500 for the hardware alone. Thus, the governments of various countries are offering subsidies and tax exemptions on infrastructure development to reduce the set-up cost and promote the sales of EVs. For instance, the Japanese government started investing in the development of charging stations across the country in association with electric vehicle manufacturers such as Nissan, Mitsubishi, and Honda. Due to this partnership, Japan today has more charging stations (40,000) than fuel stations (34,000). As of March-2021, there are only 1800 charging stations in India. However, the electric mobility revolution in India has recently started to gain some momentum. The government of India recently announced the extension of the FAME II scheme and several states like Maharashtra, Gujarat, Rajasthan and Delhi have announced their own policies for the faster adoption of EVs. In India, the government is actively promoting the use of electric vehicles to meet the 2030 reduction target of vehicle emissions. However, manufacturers are restrained from entering the Indian electric vehicle market due to political instability in the country. Other major concerns include long battery charging time, cost competitiveness, and inadequate infrastructure. Only a very few manufacturers like Mahindra and Mahindra offer station-based outlets. Therefore, the use of electric vehicles is less due to lack of infrastructure development.

This has immensely hampered the growth potential of electric vehicles and their required components and systems in emerging countries. This will lead to the slower growth in demand for smart e-drive market in the world. Many new EV manufactures and some established players will slowly increase their demand for e-drivetrain equipment till they start manufacturing them in-house and will grow at a fast rate once the charging infrastructure has been set up.

E-wheel drive segment is estimated to account for the fastest market during the forecast period

E-wheel drive is a highly integrated electric drive installed in the rear wheels of cars. It combines all components needed for safe driving, acceleration, and deceleration. The components integrated into the drive include a cooling system, brake, controller, electric motor, and power electronics. One of the major benefits of e-wheel drive is enhanced vehicle space (up to 50% according to Green Car Congress) as many components are moved to the wheel. Gem Motors’ e-wheel drive system, for instance, has a 20% more efficient EV drivetrain system than conventional EV drivetrains. Some other top manufacturers of e-wheel drives include Nidec Corporation, Elaphe, Protean, and Schaeffer. With the application of e-wheel drive, a vehicle earlier meant for two people can now seat four people. Also, since the e-wheel drive is installed in the wheel, it delivers direct transmission, thus making driving fast and safe. The Ford Fiesta electric, for instance, is equipped with Schaeffler’s twin e-wheel drive that is installed in the rear wheel rim. E-wheel drive offers emission-free and dynamic driving. As the automotive industry is moving toward zero-emission vehicles and increasing the vehicle space for other applications, the e-wheel drive market is anticipated to witness rapid growth.

Front Wheel Drive is estimated to account for the largest market size during the forecast period

FWD vehicles have the engine, transmission, final drive gears, and differential, all in a single unit. FWD vehicles are usually lighter, on average, than either of their counterparts. Most modern-day sedans, particularly those in the medium and lower price ranges, feature FWD, as FWD cars are usually lighter and have the most weight over the front wheels. This provides a good balance for reliable traction. It also helps with braking. Additionally, superior traction helps them use fuel more efficiently, regardless of the engine size. FWD also has larger space for passengers and cargo. Due to the abovementioned advantages, the FWD segment has the highest market share as compared to the other two, which will ultimately boost the front wheel smart electric drive market for electric and hybrid vehicles.

Passenger Car segment is expected to be the largest market in the forecast period

A passenger car, as defined by the OICA, is a motor vehicle equipped with at least four wheels, comprising of not more than eight seats. The PC segment is the largest vehicle segment and can be categorized by vehicle type, and includes sedans, hatchbacks, station wagons, Sports Utility Vehicles (SUVs), Multi-Utility Vehicles (MUVs), and other car types. Passenger electric vehicles are passenger cars that run on electric power instead of using fuels like petroleum, diesel and others. They use electric motors and EV batteries along with other drivetrain components which power the vehicle’s propulsion system. Electric passenger car is the largest segment in the smart electric drive market in terms of value and is expected to witness significant growth during the forecast period. The demand for passenger cars has increased due to the increase in demand for electric vehicles. Countries such as China have a high demand for electric PCs, with 13% of all vehicle sales being EVs as of H1 2022. Due to the growing stringency of emission norms, European countries are planning to decrease their vehicle emissions by 2035. The availability of a wide range of models, upgraded technology, increasing customer awareness, and availability of subsidies and tax rebates are the major factors driving the market.

Some of the prominent players in the Smart Electric Drive Market include:

- ABB

- Aisin Corporation

- Allison Transmission

- Borgwarner

- Bosch

- Continental Ag

- Dana

- Denso

- GKN (Melrose)

- Hexagon AB

- Hitachi

- Huayu Automotive Electric System

- Hyundai Mobis

- Infineon Technologies

- Jatco

- Jing-Jin Electric Technologies

- LG Electronics

- Magna International

- Mahle

- Meidensha Corporation

- Meritor

- Nidec Corporation

- Shanghai Automotive Smart Electric Drive

- Siemens AG

- Smesh E-Axle

- ZF Group

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Smart Electric Drive market.

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- 2-Wheelers

By EV Type

By Application

- E-Axle

- E-Wheel Drive

- By Component

- EV Battery

- Electric Motor

- Inverter System

- E-Brake Booster

- Power Electronics

By Drive Type

- Front Wheel Drive

- Rear Wheel Drive

- All-Wheel Drive

By Commercial Vehicle Type

- Electric Buses

- Electric Trucks

By 2-Wheeler Type

- Electric Cycles

- Electric Motorcycles

- Electric Scooters

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)