Surgical Microscopes Market Size and Research

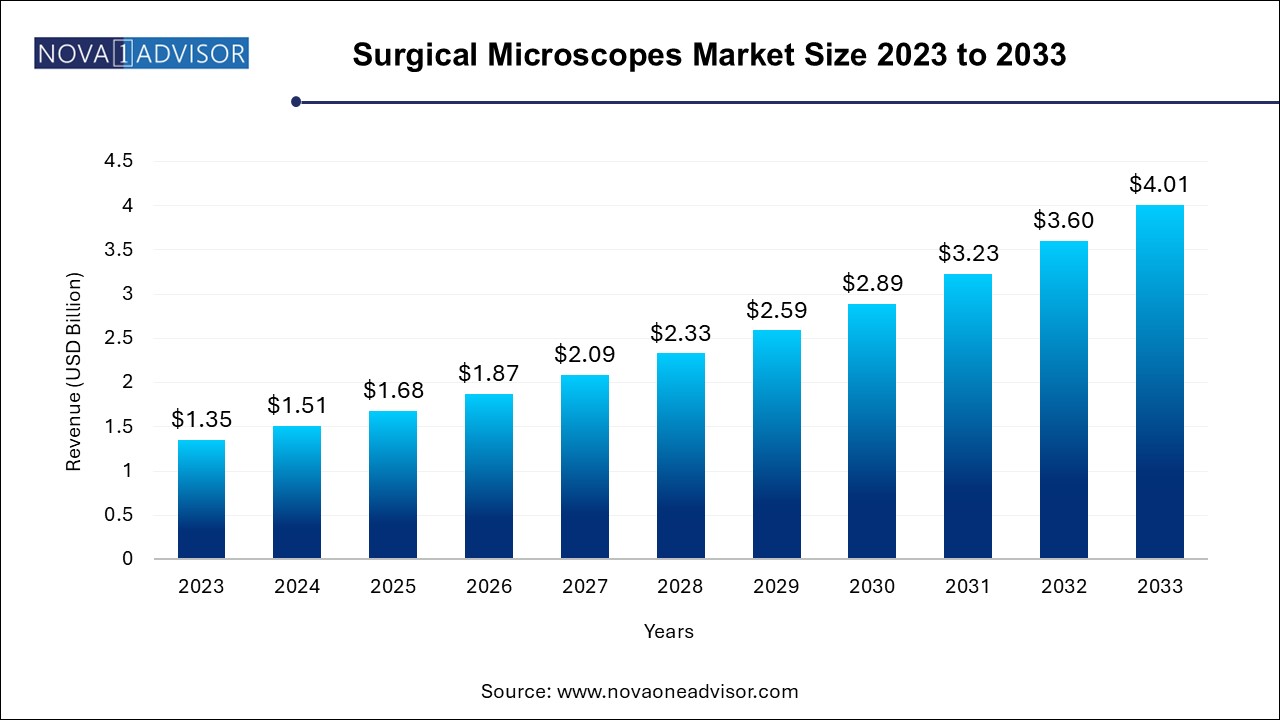

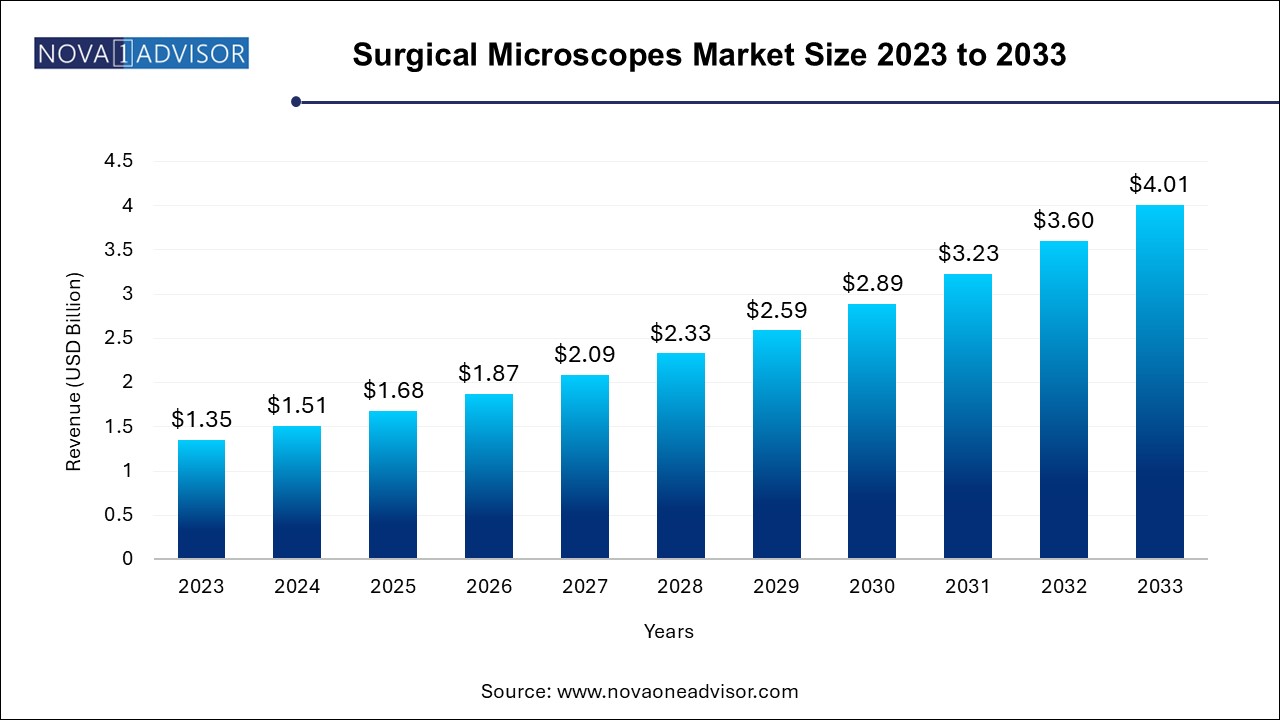

The surgical microscopes market size was exhibited at USD 1.35 billion in 2023 and is projected to hit around USD 4.01 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2024 to 2033.

Surgical Microscopes Market Key Takeaways:

- Based on type, the on-casters segment dominated the market with a revenue share of 79.80% in 2023.

- The ophthalmology segment held the largest revenue share and accounted for the largest revenue share in 2023,

- The ENT surgery segment is anticipated to exhibit an exponential CAGR during the forecast period.

- The neurosurgery and spine surgery segment held the second largest share during the forecast period.

- In terms of end-use, the hospital segment dominated the global market with a market share in 2023.

- The physician clinics and other settings segment are expected to register the fastest compound annual growth rate from 2024 to 2033.

- North America dominated the global market with a market share of 39.25% in 2023.

- Asia Pacific is anticipated to register the fastest CAGR during the forecast period.

Market Overview

The global surgical microscopes market has evolved rapidly over the past decade, propelled by technological innovations, heightened surgical precision demands, and the shift toward minimally invasive procedures. Surgical microscopes are optical devices that offer magnification, illumination, and visualization for intricate surgeries, enabling surgeons to operate with increased accuracy and reduced error margins. Their importance spans a broad spectrum of specialties, from neurosurgery and ophthalmology to plastic and reconstructive surgeries.

As healthcare systems globally embrace precision medicine and advanced surgical practices, the adoption of surgical microscopes has become integral in enhancing patient outcomes. Integration of features like 3D imaging, fluorescence visualization, and robotics is redefining the surgical experience, allowing for greater control and efficiency. Moreover, the aging global population has increased the incidence of age-related conditions such as cataracts, degenerative spine disorders, and neurovascular diseases, further amplifying the need for sophisticated surgical visualization systems.

The market is also witnessing rising interest in outpatient and physician-operated clinics, especially in ophthalmology and ENT applications, creating new demand verticals. Coupled with favorable reimbursement scenarios in developed economies and ongoing investments by governments and private entities into healthcare infrastructure, the market outlook remains optimistic.

Major Trends in the Market

-

Integration of Augmented Reality (AR) and Artificial Intelligence (AI): AI-driven microscopes are assisting in real-time decision-making, and AR overlays are being employed to guide surgical navigation.

-

Growth of Ambulatory Surgical Centers (ASCs): With an increasing number of procedures shifting from hospitals to outpatient settings, compact and mobile surgical microscopes are in high demand.

-

Rising Preference for Minimally Invasive Surgeries (MIS): Surgical microscopes that support endoscopic and minimally invasive surgeries are increasingly being adopted for quicker recovery and lower complications.

-

Hybrid Operating Rooms: The expansion of hybrid ORs in tertiary care hospitals is spurring the use of high-end surgical microscopes compatible with imaging and robotic systems.

-

Customization and Modular Systems: Manufacturers are offering modular designs to cater to specific surgical requirements across diverse specialties.

-

Fluorescence-guided Microsurgery: Especially relevant in neurosurgery and oncology, these systems improve intraoperative visualization of tumors and critical structures.

-

Telemicroscopy and Remote Collaboration Tools: The COVID-19 pandemic accelerated interest in telemedicine and remote surgery observation, influencing microscope connectivity features.

Report Scope of Surgical Microscopes Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.51 Billion |

| Market Size by 2033 |

USD 4.01 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled |

Carl Zeiss Meditec AG; Olympus Corporation; Leica Microsystems; Alcon, Inc.; Takagi Seiko Co., Ltd.; TOPCON CORPORATION; Seiler Instrument, Inc.; haag-streit.com; ARI Medical Technology Co., Ltd.; Synaptive Medical; Chammed Co, Ltd. |

Market Driver: Technological Advancements in Optics and Imaging Systems

One of the primary drivers fueling the surgical microscopes market is the continuous evolution in imaging and optical technologies. Companies are developing advanced microscopes that feature 4K and 3D visualization, motorized zoom, and multi-axis positioning to meet the precision demands of contemporary surgeries. For instance, in complex neurosurgical procedures, surgeons require real-time, high-definition images to navigate critical areas like the brainstem or spinal cord. High-end surgical microscopes equipped with fluorescence filters allow better differentiation between healthy and diseased tissues, improving surgical outcomes. Moreover, features like hands-free operation, voice control, and robotic arm integration not only enhance ergonomics but also reduce surgical time and fatigue, leading to increased productivity in the OR.

Market Restraint: High Cost of Surgical Microscopes and Maintenance

Despite their advantages, the high acquisition and maintenance costs associated with surgical microscopes present a substantial barrier, particularly for small- and medium-sized healthcare providers. Advanced microscopes can range from tens to hundreds of thousands of dollars, depending on the sophistication and features. Additionally, periodic maintenance, servicing, calibration, and upgrades add to operational costs. In price-sensitive markets such as Latin America and certain parts of Asia-Pacific, this economic burden may limit market penetration. Moreover, the lack of skilled personnel to operate and maintain such complex instruments can further hinder adoption, especially in rural or underserved regions.

Market Opportunity: Surge in Demand for Ophthalmic Surgeries in Emerging Markets

Emerging economies in Asia-Pacific and Africa are experiencing a notable rise in demand for cataract and retinal surgeries due to an aging population, rising diabetes prevalence, and increased awareness of visual impairments. According to the World Health Organization, cataracts remain the leading cause of blindness globally, and most of these cases are in low- and middle-income countries. Governments and NGOs are increasingly funding eye care camps and public-private partnerships to deliver vision-restoring surgeries to underserved populations. This surge in ophthalmic procedures creates an enormous opportunity for affordable, portable, and easy-to-operate surgical microscopes. Companies offering cost-effective solutions tailored to the unique needs of these regions are likely to capture significant market share.

Surgical Microscopes Market By Type Insights

On caster microscopes are the most widely adopted due to their portability, ease of use, and compatibility across various operating environments. Their flexible design allows surgeons to move the device between operating rooms and specialties, making them ideal for multi-disciplinary hospitals. These systems offer customizable focal lengths, integrated camera modules, and multi-user capabilities, appealing to larger healthcare facilities seeking versatility without compromising optical quality.

Ceiling-mounted microscopes, while more expensive and less mobile, are witnessing the fastest growth. These are preferred in high-volume hospitals and specialized operating rooms due to their space-saving configuration and unobstructed floor area. With the rise of hybrid ORs and neurosurgical suites that require fixed infrastructure, ceiling-mounted systems are increasingly integrated with surgical robots, navigation platforms, and advanced imaging software. Their ergonomic benefits and suitability for long-duration surgeries also contribute to growing demand.

Surgical Microscopes Market By Application Insights

Ophthalmology has long held the dominant share in the surgical microscopes market, largely due to the high global prevalence of cataracts and the relatively shorter and high-volume nature of ophthalmic procedures. These surgeries demand precise and magnified views of the eye’s delicate structures, making surgical microscopes indispensable. The affordability of ophthalmic microscopes compared to those used in neurosurgery and the presence of numerous public and private eye care centers globally also support this dominance.

However, neurosurgery and spine surgery applications are growing at the fastest rate. These specialties demand advanced visualization tools for deep-seated and intricate structures of the brain and spine. Surgical microscopes for these procedures are often embedded with features like fluorescence imaging, motorized zoom, and integrated video documentation, facilitating accuracy during tumor resection, vascular surgeries, and spinal decompressions. The increasing prevalence of neurodegenerative disorders and traumatic spinal injuries is further propelling this growth.

Surgical Microscopes Market By End Use Insights

Hospitals remain the primary end users of surgical microscopes, thanks to their comprehensive surgical capabilities, larger budgets, and access to advanced infrastructure. Most high-complexity procedures, especially neurosurgeries and reconstructions, are performed in hospitals where advanced equipment is justified. Additionally, hospitals often invest in high-end microscopes that support interdisciplinary collaboration, training, and integration with electronic medical records.

On the other hand, physician clinics and other outpatient settings are emerging as promising growth avenues, particularly in ophthalmology, ENT, and dental surgeries. The global trend toward decentralizing surgical care and reducing inpatient burdens is making these clinics invest in compact and mobile microscope units. Moreover, advancements in portable and user-friendly microscopes with plug-and-play functionality are making adoption easier for smaller facilities with limited space and resources.

Surgical Microscopes Market By Regional Insights

North America, particularly the United States, dominates the surgical microscopes market due to a combination of advanced healthcare infrastructure, high healthcare expenditure, and strong presence of key market players like Alcon, Leica Microsystems, and Zeiss. The region’s emphasis on technological adoption and surgical precision in areas like spinal surgeries and ENT procedures contributes significantly to the high market share. Moreover, favorable reimbursement policies for microsurgeries, increasing number of outpatient surgical centers, and growing demand for minimally invasive techniques continue to sustain North America's lead.

Asia-Pacific is the fastest growing market, driven by expanding healthcare access, improving surgical expertise, and rising prevalence of chronic diseases. Countries like India, China, and Japan are making substantial investments in healthcare modernization, which includes upgrading surgical tools and training surgeons. The growing incidence of vision disorders and spine-related ailments due to aging and lifestyle changes is accelerating demand for surgical microscopes. Additionally, increased medical tourism in countries like Thailand and Malaysia is attracting investments in high-end surgical technologies, further bolstering regional growth.

Some of the prominent players in the surgical microscopes market include:

Surgical Microscopes Market Recent Developments

-

February 2025: Leica Microsystems launched the PROvido S surgical microscope, enhancing its capabilities in neurosurgery with advanced apochromatic lens technology and fluorescence guidance modes.

-

October 2024: ZEISS Meditec AG unveiled updates to its KINEVO 900 platform during the CNS Annual Meeting, showcasing AI-assisted image recognition for improved intraoperative decisions.

-

July 2024: Alcon introduced its new ophthalmic surgical microscope, LuxOR LX4, in select Asian markets, targeting high-volume cataract surgery centers with improved red reflex enhancement.

-

March 2024: Takagi Seiko Co., Ltd. announced the expansion of its manufacturing plant in Japan to increase production of ophthalmic microscopes amid rising regional demand.

-

January 2024: Haag-Streit Group entered a strategic partnership with a U.S.-based telehealth startup to integrate real-time remote viewing capabilities into its surgical microscopes for training and consulting purposes.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the surgical microscopes market

Type

- On Casters

- Wall Mounted

- Tabletop

- Ceiling Mounted

Application

- Neurosurgery and Spine Surgery

- ENT Surgery

- Dentistry

- Gynecology

- Urology

- Ophthalmology

- Plastic & Reconstructive Surgeries

- Other Surgeries

End Use

- Hospital

- Physician Clinics and Other Settings

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)