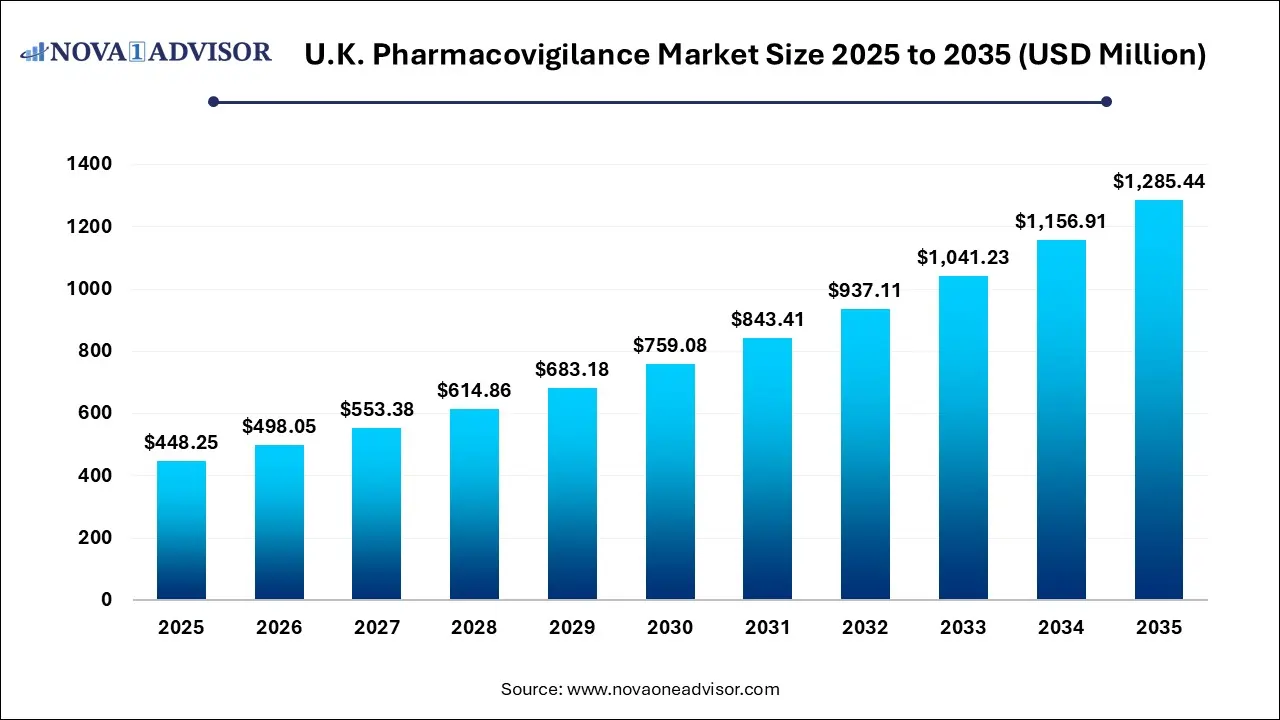

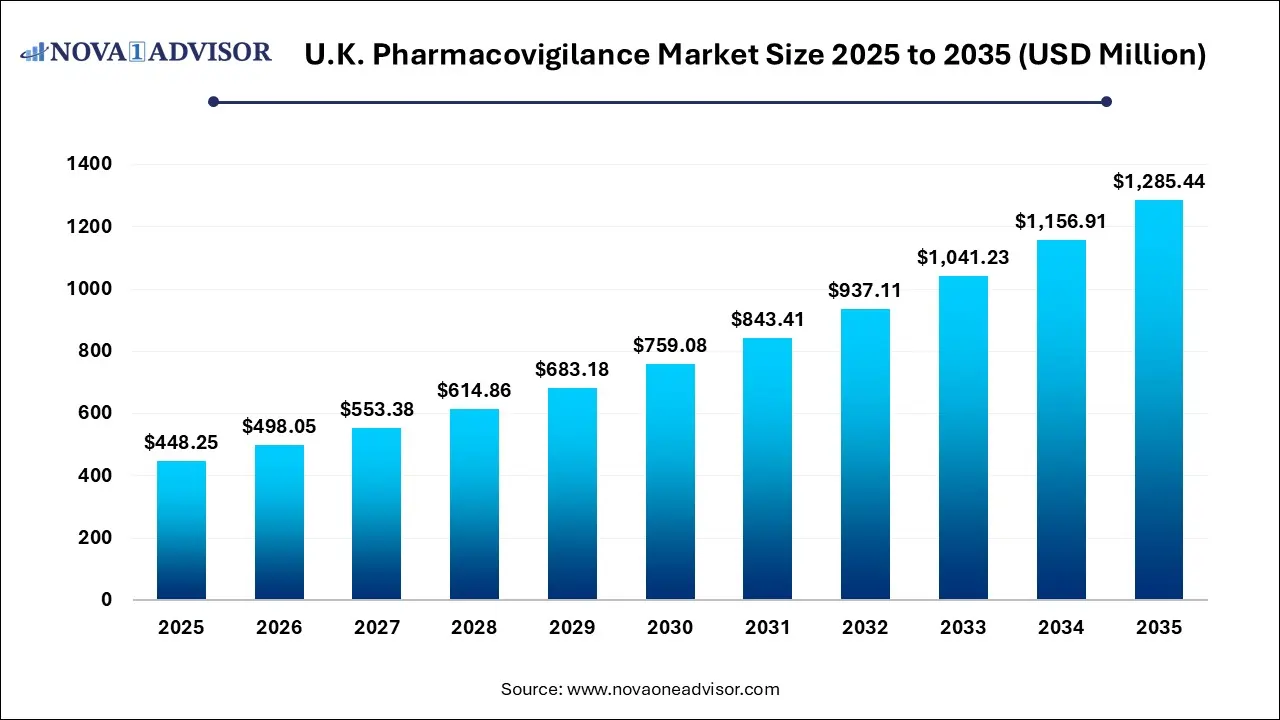

U.K. Pharmacovigilance Market Size and Growth 2026 to 2035

The U.K. pharmacovigilance market size was exhibited at USD 448.25 million in 2025 and is projected to hit around USD 1,285.44 million by 2035, growing at a CAGR of 11.11% during the forecast period 2026 to 2035.

Key Takeaways:

- The post-marketing or phase IV clinical trial segment led the market with a share of over 76.0% in 2025.

- The phase III segment is expected to witness lucrative growth over the forecast period.

- Contract outsourcing held the largest share of over 58.0% in 2025 and is expected to witness the fastest growth during the forecast period.

- The in-house segment is anticipated to witness moderate growth over the forecast period.

- Spontaneous reporting held the largest share of over 33.9% in 2025.

- Targeted spontaneous reporting is anticipated to witness the fastest growth in the forecast period.

- The oncology segment held the largest share of over 28.0% in 2025 and is expected to expand at the highest CAGR from 2026 to 2035.

- The neurology segment is expected to witness significant growth during the forecast period.

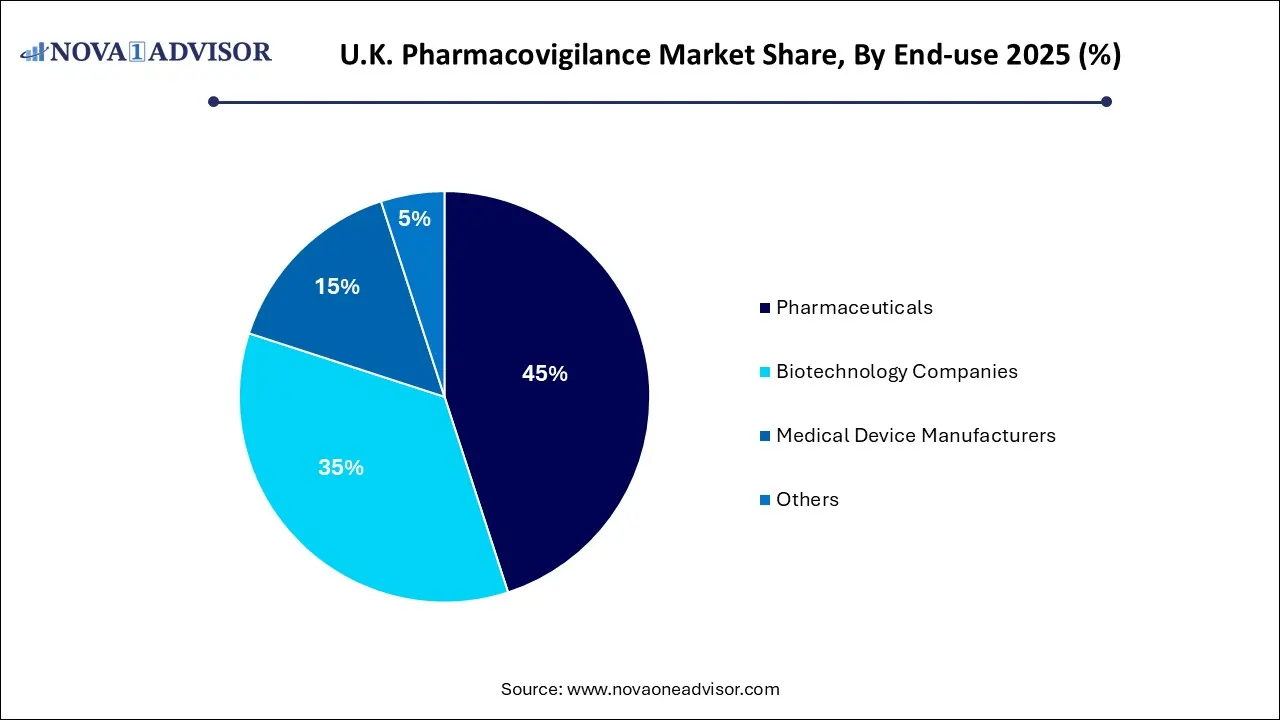

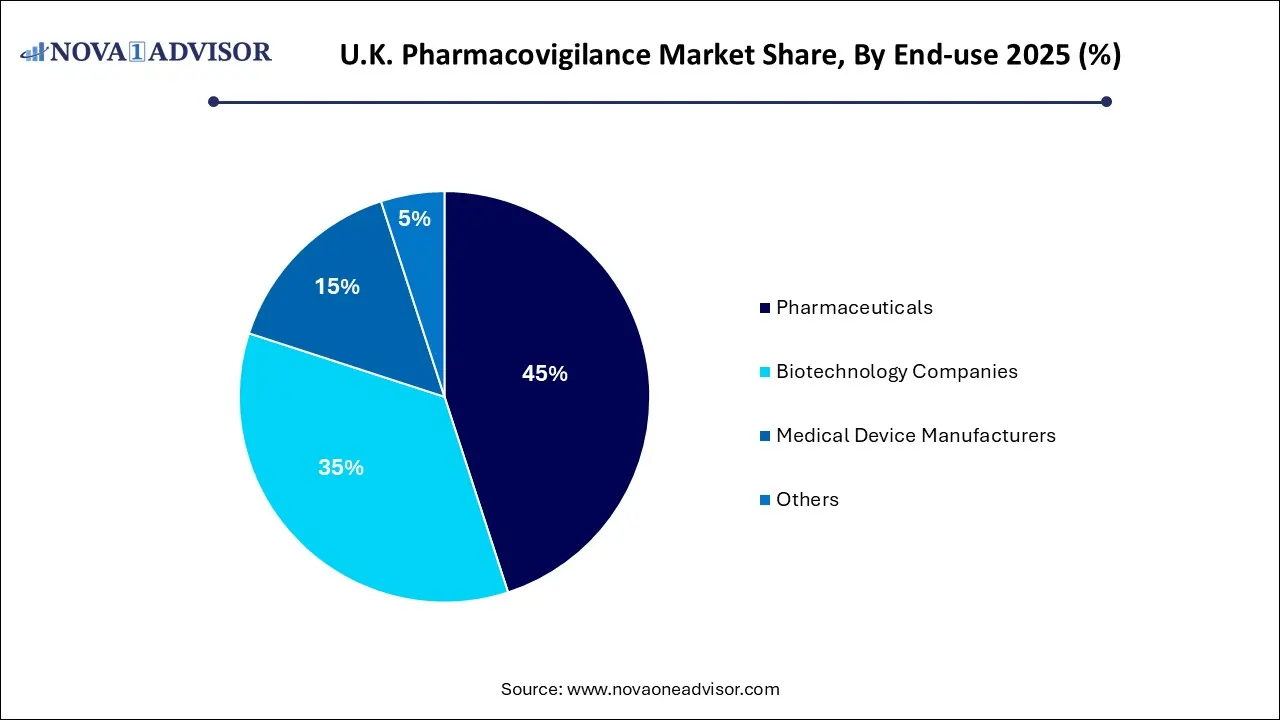

- The pharmaceuticals segment held the largest share of over 45.0% in 2025.

- The biotechnology companies segment is anticipated to witness the fastest growth over the forecast period.

- Signal detection dominated the market with a revenue share of over 38.0% in 2025.

Rising incidence of Adverse Drug Reactions (ADRs) owing to drug abuse and the prevalence of diseases that require a combination of drugs are major growth drivers of the overall market. In addition, an upward shift in the production of new drugs and the presence of a stringent government regulatory framework for drug safety are responsible for the significant growth of the market. Advancements in the development of ADR databases and information systems have enabled reporting accurate information, which can be further utilized by research professionals for prospective clinical studies, thereby fueling the overall demand for the market. Moreover, increasing drug development activities in areas, such as personalized medicines, biosimilars, orphan drugs, companion diagnostics, along with adaptive trial designs, are projected to boost the demand for pharmacovigilance (PV) services in the coming years. According to the Royal Society of Chemistry Position Paper, U.K. had been a world spearhead in medicines discovery and research with as a minimum 10 of the top-selling drugs globally having U.K.-trained PhD organic chemists as named originators.

The pandemic is changing the way the industry is handling ongoing or upcoming clinical trials. The pandemic has accelerated the need for remote and risk-based monitoring in clinical research, which, in turn, has augmented the acceptance of virtual trial technology. This technology was deployed to speed vaccine development and helped secure full-service COVID trials and new studies. The U.K. government has adopted progressive technologies to support the processing of adverse event reports relating to COVID-19 vaccines, paying Genpact U.K. USD 2.08 million (£1.5) to develop a powerful, vaccine-specific AI tool to sift through adverse drug reactions. The pandemic has shown how these new technologies can help corporations quickly and accurately navigate complex administrative necessities, particularly amid the influx of new data. For instance, ArisGlobal, through LifeSphere MultiVigilance, offers an end-to-end safety system with production-ready automation.

The U.K. has left the European Union and the Brexit transition period came to an end in December 2024. By the end of this period, the legal framework changed, disturbing all involved parties. Starting from January 2021, the U.K. will only have one main medication regulator-the Medicines and Healthcare products Regulatory Agency (MHRA), which will retain full accountability for pharmacovigilance. In November 2020, the MHRA delivered several documents that serve as guidelines to help affected parties, particularly Marketing Authorization Holders (MAH) in the whole country, to acclimate to the future scenario.

U.K. Pharmacovigilance Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 498.05 Million |

| Market Size by 2035 |

USD 1,285.44 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 11.9% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Service provider, Product life cycle, Type, Process flow, Therapeutic area, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Accenture; Cognizant; IBM Corporation; ArisGlobal; ICON plc.; Capgemini; IQVIA; TAKE Solutions Ltd.; PAREXEL International Corporation; BioClinica Inc. |

By Product Life Cycle Insights

The post-marketing or phase IV clinical trial segment led the market with a share of over 76.0% in 2025. During this phase, the safety and efficacy of the drug are analyzed on a real-time basis. In 2018, the pharmaceutical industry invested USD 7.22 billion (£5.5) in R&D in the country. The country strives to remain to be a leader in clinical research in conjunction with world-class research funders, research charities, the NHS, and global pharmaceutical businesses. Besides, the availability of market players in the country further supports the market growth. For instance, Sofpromed offers full clinical operations support to sponsors scheduling clinical trials in the country. The firm also aids pharmaceutical and biotechnology businesses around the globe to achieve rapid clinical trial start-up in the country, offering high-quality services in clinical operations, regulatory affairs, pharmacovigilance, biostatistics, data management, and drug logistics, among others.

The phase III segment is expected to witness lucrative growth over the forecast period. This phase is carried out for medicines that have conceded Phase I and II trials. These clinical trials often last a year or more and involve several thousand patients. This phase focuses on risk assessment during late-stage clinical development. In a nutshell, pharmacovigilance services have extensive applications in late Phase III clinical trial studies.

By Service Provider Insights

Contract outsourcing held the largest share of over 58.0% in 2025 and is expected to witness the fastest growth during the forecast period. Contract outsourcing helps to avoid high investments and fixed overhead costs, increase resource flexibility, and secure additional capacity. Besides, high costs to uphold required levels of compliance, infrastructure, and the availability of skilled and trained in-house resources will lead to an upsurge in outsourcing trends.

An increasing number of biotechnology and pharmaceutical corporations outsourcing their PV activities to service providers, such as contract research organizations, will further drive the contract outsourcing segment. For instance, in January 2021, Dr. Reddy’s Laboratories Ltd. has chosen ArisGlobal’s LifeSphere Signal and Risk Management system for its worldwide pharmacovigilance team. ArisGlobal is present across the globe through registered offices in the U.K., France, and others.

The in-house segment is anticipated to witness moderate growth over the forecast period because this is primarily conducted by key pharmaceuticals and biotechnology companies to maintain confidentiality and ensure continuous monitoring of the process of drug development and effective data management of collected information. Companies with an extensive product pipeline and portfolio and resource availability generally adopt in-house PV. The process requires specific skill sets and an experienced workforce, especially for adverse event reporting and new product launch processes. This is expected to serve this industry with growth potential in the forthcoming years.

By Type Insights

Spontaneous reporting held the largest share of over 33.9% in 2025 owing to the usability in integration with active and targeted reporting to give early safety signals of unknown medicine-related reactions. Spontaneous reporting during the post-marketing stage produces most drug safety data, yet more than clinical trials during drug development, thereby boosting demand.

Targeted spontaneous reporting is anticipated to witness the fastest growth in the forecast period. The benefits associated with it, such as better affordability, lower labor costs, and usage in routine monitoring, are expected to fuel the segment growth.

BY Therapeutic Area Insights

The oncology segment held the largest share of over 28.0% in 2025 and is expected to expand at the highest CAGR from 2026 to 2035. The increasing incidence of cancer resulted in accelerated R&D and clinical research. There are around 367,000 new cancer cases in the country each year, which is around 1,000 every day (2015-2017). In June 2019, Cancer Research U.K. chose Ideagen’s Q-Pulse and PleaseReview product.

The neurology segment is expected to witness significant growth during the forecast period. An increasing incidence of neurological disorders, such as epilepsy, schizophrenia, and Parkinson’s disease, resulted in the increased need for the development of new drugs with better efficacy and potency. Integrating more pharmacovigilance activities into drug development and the strategies implemented by pharmaceutical corporations further improve safety and prevent adverse events. This is eventually boosting the overall market growth.

By End-use Insights

The pharmaceuticals segment held the largest share of over 45.0% in 2025. As the pharmaceutical sector expands in size as well as its reach, it faces new and more complex challenges. This particularly reflects on PV groups, which must keep up with the advances in technology, product innovation, and changing regulatory requirements while at the same time bringing their risk management responsibilities. Outsourcing pharmacovigilance proves to be a cost-effective endeavor for companies, in turn, boosting the segment growth.

The biotechnology companies segment is anticipated to witness the fastest growth over the forecast period. Drug development, right from the beginning to the finished product, is a highly complex process. It scrutinizes every aspect of the drug, thereby offering adequate safety assurance at the time of approval. However, investigative studies tend to continue after approval to further ascertain the safety of new drugs for human consumption.

By Process Flow Insights

Signal detection dominated the market with a revenue share of over 38.0% in 2025. There is rising importance on signal management and signal detection in pharmacovigilance. Besides, the regulatory authority is increasingly looking for Marketing Authorization Holders to be able to establish a methodical and controlled process of signal management, thereby supporting market growth. Nowadays, Artificial Intelligence (AI) and big data are being used by companies for better assessment of signals.

The case data management segment is expected to witness the fastest growth over the forecast timeline. Nowadays, emerging technologies such as AI and machine learning are being widely used for case data management. These tools can be used to improve the reliability, quality, and availability of data by using historical information to train algorithms and offer automated insights. The U.K. National Health Service has identified massive potential savings by using analytics tools to make the maximum of its data.

Key Companies & Market Share Insights

The U.K. market is highly competitive with a considerable number of players accounting for a major revenue share. Some of the most notable market participants hold a considerable share in the market owing to their product offerings.

The market is highly fragmented with the presence of many small and large market players. This leads to high competition among market players to sustain their position. The key participants are involved in continuous product development, collaborations, partnerships, and alliances to augment market penetration. For instance, Ergomed plc publicized the acquisition of Ashfield Pharmacovigilance Inc, the U.S. operating subsidiary of UDG Healthcare plc, for a total cash consideration of $10 million. The acquisition will support the company to further develop its combined CRO and PV business worldwide, adding to the existing U.S. presence in its CRO business and offering a platform for potential growth in the North American region. Some prominent players in the U.K. pharmacovigilance market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.K. Pharmacovigilance market.

By Service Provider

- In-house

- Contract Outsourcing

By Product Life Cycle

- Pre-clinical

- Phase I

- Phase II

- Phase III

- Phase IV

By Type

- Spontaneous Reporting

- Intensified ADR Reporting

- Targeted Spontaneous Reporting

- Cohort Event Monitoring

- EHR Mining

By Process Flow

- Case Data Management

- Case Logging

- Case Data Analysis

- Medical Reviewing & Reporting

- Signal Detection

- Adverse Event Logging

- Adverse Event Analysis

- Adverse Event Review & Reporting

- Risk Management System

- Risk Evaluation System

- Risk Mitigation System

By Therapeutic Area

- Oncology

- Neurology

- Cardiology

- Respiratory Systems

- Others

By End-use

- Pharmaceuticals

- Biotechnology Companies

- Medical Device Manufacturers

- Others