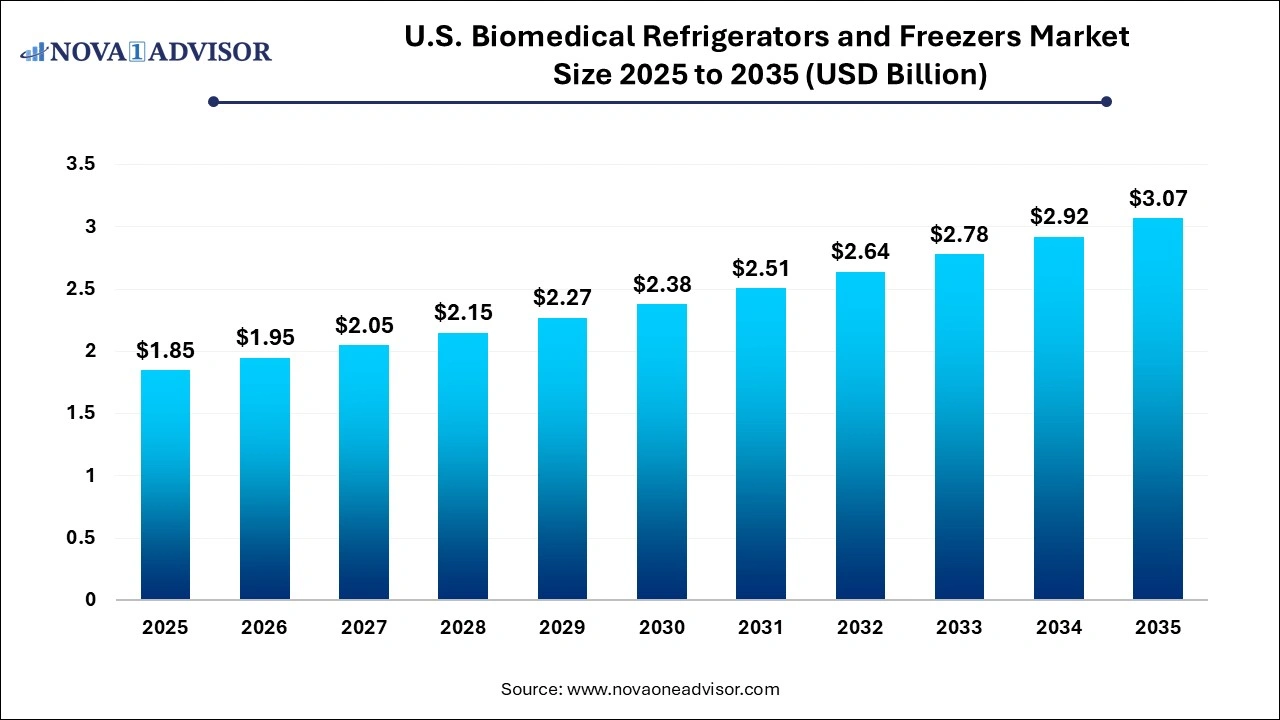

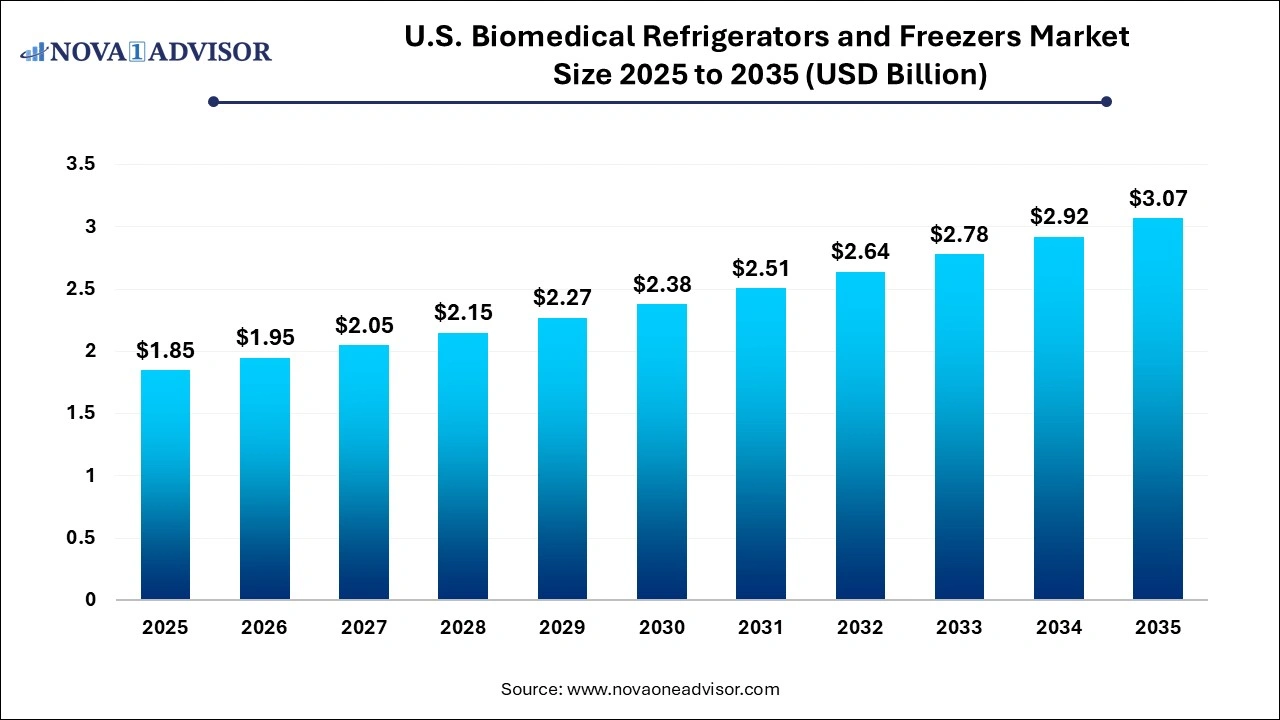

U.S. Biomedical Refrigerators and Freezers Market Size and Growth 2026 to 2035

The U.S. biomedical refrigerators and freezers market size was exhibited at USD 1.85 billion in 2025 and is projected to hit around USD 3.07 billion by 2035, growing at a CAGR of 5.21% during the forecast period 2026 to 2035.

U.S. Biomedical Refrigerators and Freezers Market Key Takeaways:

- The blood bank refrigerators segment led the share in the U.S. biomedical refrigerators and freezers market.

- The U.S. biomedical refrigerators and freezers market size from blood bank refrigerators is projected to record more than 5.19% CAGR through 2035.

- The research labs segment is expected to hold a 9.4% share of the U.S. biomedical refrigerators and freezers industry by 2035.

- The U.S. biomedical refrigerators and freezers market size from the hospitals end-use segment is anticipated to register more than 4.9% CAGR up to 2035.

U.S. Biomedical Refrigerators and Freezers Market Outlook

- Market Growth Overview: The U.S. biomedical refrigerators and freezers market is expected to grow significantly between 2025 and 2034, driven by the increased biopharmaceutical innovation, rising chronic diseases, expansion in pharmaceutical research and academic labs requiring advanced storage, and decentralized clinical trials.

- Sustainability Trends: Sustainability trends involve energy efficiency and cost reduction, eco-friendly refrigerants, and sustainable cooling technologies.

- Major Investors: Major investors in the market include Thermo Fisher Scientific Inc., PHP Holding Corporation, Haier Biomedical, Stirling Ultracold, and Eppendorf SE.

Artificial Intelligence The Next Growth Catalyst in U.S. Biomedical Refrigerators and Freezers

AI is transforming the U.S. biomedical refrigerators and freezers industry by enabling intelligent, IoT-connected, and data-driven storage solutions that enhance sample integrity and compliance. Key applications include AI-powered predictive maintenance, which analyzes sensor data to forecast equipment failure, reducing downtime and protecting valuable samples from loss. Furthermore, AI optimizes energy consumption by adjusting cooling cycles based on usage patterns and environmental factors, addressing the industry's need for sustainability.

Value Chain Analysis of the U.S. Biomedical Refrigerators and Freezers Market

- Raw Material & Component Sourcing (Upstream):This stage involves sourcing high-performance, durable, and energy-efficient materials required to maintain strict temperature tolerances, such as specialized refrigerants, vacuum insulation panels, high-grade steel, and electronic controllers.

- Manufacturing and Assembly (Midstream): Manufacturers transform raw materials into finished, certified cold chain products, including laboratory refrigerators, ULT freezers (-86°C), and blood bank fridges.

Key Players: Thermo Fisher Scientific Inc., Helmer Scientific Inc., Stirling Ultracold (BioLife Solutions), and Follett Products.

- Quality Assurance & Regulatory Compliance (Midstream): This critical stage involves rigorous testing for compliance with FDA regulations, EPA standards for refrigerants, and ISO certifications to ensure temperature stability, security, and reliability.

Report Scope of the U.S. Biomedical Refrigerators and Freezers Market

|

Report Coverage

|

Details

|

|

Market Size in 2026

|

USD 1.95 Billion

|

|

Market Size by 2035

|

USD 3.07 Billion

|

|

Growth Rate from 2026 to 2035

|

CAGR of 5.21%

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026 to 2035

|

|

Segments Covered

|

By Product, By End-use

|

|

Key companies profiled

|

Panasonic Healthcare Corporation, Aegis Scientific, Lab Research Products

|

U.S. Biomedical Refrigerators and Freezers Market Segment Analysis

How did the blood bank refrigerators segment dominate in the U.S. biomedical refrigerators and freezers market?

The blood bank refrigerators segment is dominated by the high demand for blood transfusions resulting from increased surgeries and chronic diseases. This expansion is underscored by stringent regulatory compliance from entities like the FDA and AABB, which mandates investment in advanced, reliable equipment for maintaining cold chain integrity and preventing spoilage. Consequently, the industry is seeing rapid technological adoption of IoT-enabled smart monitoring and AI-driven predictive maintenance to ensure safe blood preservation from donation through transfusion.

U.S. Biomedical Refrigerators and Freezers Market Companies

- Panasonic Healthcare Corporation: Panasonic (PHCbi) is a major manufacturer in the U.S. market, providing high-performance, energy-efficient biomedical freezers and refrigerators, including ultra-low temperature (ULT) models using inverter technology.

- Aegis Scientific: Aegis Scientific contributes to the U.S. market by providing specialized, high-performance biomedical refrigerators and freezers designed for critical sample and vaccine storage.

- Lab Research Products: Lab Research Products offers a range of laboratory-grade refrigerators and freezers, focusing on specialized, cost-effective solutions for the storage of reagents, samples, and vaccines.