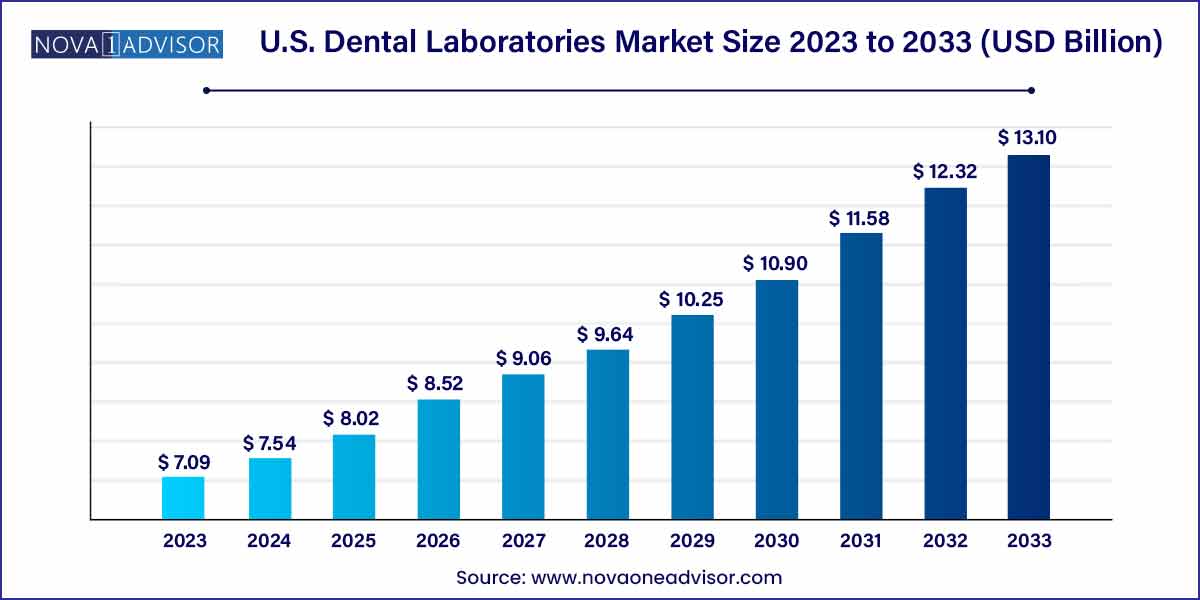

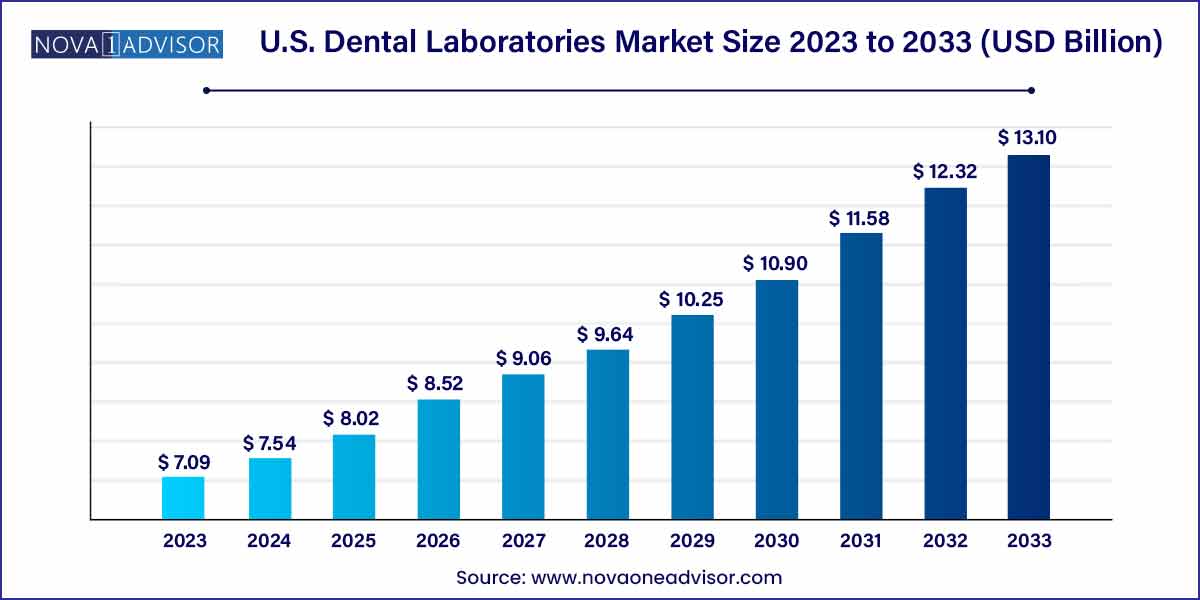

The U.S. dental laboratories market size was estimated at USD 7.09 billion in 2023 and is projected to hit around USD 13.10 billion by 2033, growing at a CAGR of 6.33% during the forecast period from 2024 to 2033.

Key Takeaways:

- Oral care segment led dental laboratories market and accounted for 27.75% of global revenue in 2023.

- The orthodontic segment is expected to show lucrative growth during the forecast period.

- Metal ceramics segment dominated the market with a significant revenue share

- System and parts dominated the market with a revenue share of 35.97%.

- The CAD/CAM materials segment is expected to experience significant growth over the forecast period.

- The crowns segment led the U.S. dental laboratories market with a share of around 30.3% in 2023

- The bridges segment is anticipated to witness lucrative growth over the forecast period.

Market Overview

The U.S. dental laboratories market plays a critical role in the delivery of modern dental healthcare by fabricating restorative and therapeutic dental products such as crowns, bridges, dentures, implants, and orthodontic devices. These laboratories serve as essential support systems for dentists and dental clinics, turning clinical impressions and digital scans into custom-made dental prosthetics and appliances.

Driven by increasing demand for aesthetic dentistry, rising oral healthcare awareness, and a growing elderly population, dental laboratories are experiencing a surge in both volume and complexity of services. The U.S. is among the most advanced markets globally in terms of technological integration in dental laboratories, particularly in digital dentistry, including CAD/CAM systems, 3D printing, and AI-driven dental prosthesis design.

The shift from analog to digital workflows is redefining the role of dental labs. Labs are evolving from small-scale, manual operations into technology-enabled centers capable of producing high-precision dental restorations with faster turnaround times. The increase in dental insurance coverage, expanding cosmetic dental procedures, and growing demand for minimally invasive restorations are further fueling this transition.

Major Trends in the Market

-

Digitalization of Dental Laboratories: Increasing adoption of CAD/CAM, intraoral scanners, and 3D printing technologies.

-

Rising Demand for Cosmetic and Aesthetic Dentistry: Driven by consumer demand for whiter teeth, better alignment, and natural-looking restorations.

-

Outsourcing and Consolidation of Dental Labs: Smaller labs are merging or outsourcing to large-scale operations for efficiency and scalability.

-

Increased Use of Biocompatible and Aesthetic Materials: Growth in zirconia, lithium disilicate, and resin-based materials for durability and appearance.

-

Direct-to-Lab Scanning From Clinics: Reducing time between diagnosis and prosthetic delivery by enabling seamless lab-clinic integration.

-

Sustainability in Lab Operations: Adoption of environmentally friendly materials, energy-efficient equipment, and digital storage replacing physical models.

-

Regulatory Emphasis on Traceability and Quality: Increasing scrutiny on lab-manufactured prosthetics, especially imported devices.

U.S. Dental Laboratories Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 7.54 Billion |

| Market Size by 2033 |

USD 13.10 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.33% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, equipment |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Envista Holdings Corporation; Dentsply Sirona; A-dec Inc.; Straumann AG; Henry Schein, Inc.; Champlain Dental Laboratory, Inc.; Knight dental design; National Dentex Corporation; 3M Health Care; Dental Services Group |

Market Driver: Technological Advancements in Dental Prosthetics Manufacturing

A major driver of growth in the U.S. dental laboratories market is the integration of advanced manufacturing technologies such as CAD/CAM systems, 3D printing, milling equipment, and dental scanners. These technologies significantly reduce production time, increase precision, and minimize human error, which leads to better patient outcomes.

For example, traditional crown fabrication could take several days, but with digital impressions and in-lab CAD/CAM systems, crowns can now be produced within 24 hours. This has not only accelerated clinical workflows but also improved customization, repeatability, and product quality.

Moreover, additive manufacturing (3D printing) has expanded capabilities in producing clear aligners, surgical guides, dentures, and frameworks, reducing material wastage and labor costs. These technologies are also making it feasible for labs to work with a wider range of restorative materials with high consistency and biocompatibility.

Market Restraint: High Capital Investment and Skilled Labor Shortages

Despite technological progress, one of the key restraints in the U.S. dental laboratories market is the high initial investment cost associated with digital transformation. Setting up a fully digital lab with 3D printers, CAD/CAM systems, dental lasers, and scanning equipment can cost hundreds of thousands of dollars an unaffordable sum for small and mid-sized labs.

Moreover, these high-tech devices require specialized knowledge. Many dental technicians, especially those trained in traditional methods, face a steep learning curve in adapting to digital workflows. The shortage of digitally skilled dental technicians in the U.S. market slows the pace of adoption, limits scalability, and may compromise production quality in labs that lack adequate training resources.

Smaller labs may find it difficult to compete with larger, consolidated players who benefit from economies of scale, better vendor partnerships, and access to continuous training and innovation.

Market Opportunity: Growth in Aging Population and Edentulism Rates

A notable opportunity in the U.S. dental laboratories market is the growing need for restorative dental services among aging populations, particularly those above the age of 60. The prevalence of edentulism (partial or complete tooth loss), periodontal disease, and other age-related dental issues is significantly higher in older adults, driving the demand for dentures, crowns, bridges, and implants.

According to CDC data, nearly one in five adults over 65 have lost all their teeth. As life expectancy increases and seniors seek to maintain quality of life, aesthetic appearance, and proper nutrition, demand for functional and aesthetic dental restorations is expected to surge.

In addition, government-funded insurance programs like Medicare Advantage are increasingly expanding coverage for dental services, while private insurers are introducing senior-specific plans. These demographic and policy factors make the elderly a critical target group for dental laboratories to focus on.

Segments Insights

By Product

Restorative products dominate the U.S. dental laboratories market, comprising crowns, bridges, inlays, onlays, and implants. These are among the most commonly requested lab-fabricated dental restorations due to high prevalence of decay, fractures, and tooth loss. Restorative dentistry represents the core function of most dental labs and benefits significantly from CAD/CAM workflows and 3D milling techniques.

Orthodontic products are growing rapidly, driven by increasing adoption of clear aligners and other removable orthodontic appliances. With rising awareness about dental aesthetics and alignment among both adults and teenagers, labs are being tasked with producing aligners, retainers, and splints. Digital orthodontics has gained traction, particularly with DTC aligner companies and general dentists offering orthodontic solutions.

By Material

CAD/CAM materials dominate, particularly zirconia, lithium disilicate, and PMMA, which are compatible with modern digital workflows. These materials offer high strength, aesthetic value, and biocompatibility, making them suitable for crowns, bridges, veneers, and implant frameworks. Labs benefit from using pre-shaded, pre-sintered blocks that reduce processing time and waste.

Traditional all-ceramic materials are also growing, particularly due to demand for more natural-looking and metal-free restorations. Patients increasingly prefer all-ceramic solutions for anterior restorations due to their translucency and aesthetics. Though more technique-sensitive than CAD/CAM materials, improvements in handling and layering techniques continue to drive their usage.

By Equipment

Dental radiology equipment and integrated CAD/CAM systems dominate due to their role in digital imaging, model designing, and seamless production. Scanners integrated with design software help technicians visualize anatomical structures and occlusion, while milling machines and printers manufacture prosthetics to precise specifications. CAD/CAM systems are now standard in high-end labs and growing in smaller setups.

3D printing systems are the fastest-growing segment, especially for clear aligners, denture bases, and surgical guides. Their cost-efficiency, material flexibility, and minimal manual intervention make them ideal for small batch production and customized dental parts. Investment in this segment is driven by the rise in demand for clear aligners and same-day dental solutions.

By Prosthetic Type

Crowns dominate the prosthetic type segment, as they are the most common restoration for fractured or root canal-treated teeth. Labs produce single-unit and multi-unit crowns from materials like zirconia, metal-ceramics, and lithium disilicate. Custom shading and polishing are key value additions offered by labs in this category.

Clear aligners are the fastest-growing prosthetic type, due to their popularity among teens and adults seeking discreet orthodontic correction. Labs are either partnering with aligner brands or setting up in-house aligner manufacturing using thermoplastic sheets and 3D printers. As the market for aesthetic orthodontics grows, so does the demand for rapid, affordable, and well-designed aligners fabricated by labs.

Country-Level Analysis

The United States has a mature dental laboratories market supported by a strong network of dental professionals, academic institutions, and healthcare infrastructure. The American Dental Association (ADA) and National Association of Dental Laboratories (NADL) have played pivotal roles in standardizing quality, education, and best practices across the industry.

States like California, Florida, New York, and Texas lead in terms of lab density, fueled by large urban populations, cosmetic dentistry demand, and presence of dental schools. The shift toward DSOs (Dental Service Organizations) has created more structured and scalable demand for lab services, particularly for prosthetics and aligners.

Insurance reimbursement models, increased private dental spending, and digital innovation are accelerating the expansion of dental lab services nationwide. Moreover, lab-to-clinic communication through digital case management platforms is improving transparency, reducing remakes, and elevating treatment satisfaction.

Recent Developments

-

April 2025 – Glidewell Dental launched an AI-based workflow system that integrates with dentists' intraoral scanners for real-time crown design and manufacturing instructions.

-

March 2025 – National Dentex Labs (NDX) acquired a 3D printing startup specializing in clear aligners to expand its orthodontic offering across 30 states.

-

February 2025 – Argen Corporation announced a new line of monolithic zirconia blocks optimized for ultra-aesthetic anterior restorations.

-

January 2025 – Modern Dental USA entered a strategic partnership with a leading DSO to provide full-service lab support for over 500 dental clinics.

-

December 2024 – Zahn Dental introduced a new educational program for digital dental technicians, focusing on CAD/CAM design and 3D printing.

Key U.S. Dental Laboratories Companies:

- Envista Holdings Corporation

- Dentsply Sirona

- A-dec Inc.

- Straumann AG

- Henry Schein, Inc.

- Champlain Dental Laboratory, Inc.

- Knight dental design

- National Dentex Corporation

- 3M Health Care

- Dental Services Group

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Dental Laboratories market.

By Product

- Restorative

- Orthodontic

- Endodontic

- Oral care

- Implant

By Material

- Metal Ceramics

- Traditional All Ceramics

- CAD/CAM Materials

- Plastic

- Metals

By Equipment

- Dental Radiology Equipment

- Dental Lasers

- System and Parts

- 3D Printing Systems

- Integrated CAD/CAM Systems

- Other Systems and Parts

- Laboratory Machines

- Casting Machines

- Milling Equipment

- Furnaces

- Articulators

- Other Laboratory Machines

- Dental Scanners

- Others

By Prosthetic Type

- Bridges

- Crowns

- Veneers

- Dentures

- Clear Aligners