U.S. Dental Services Market Size and Trends 2026 to 2035

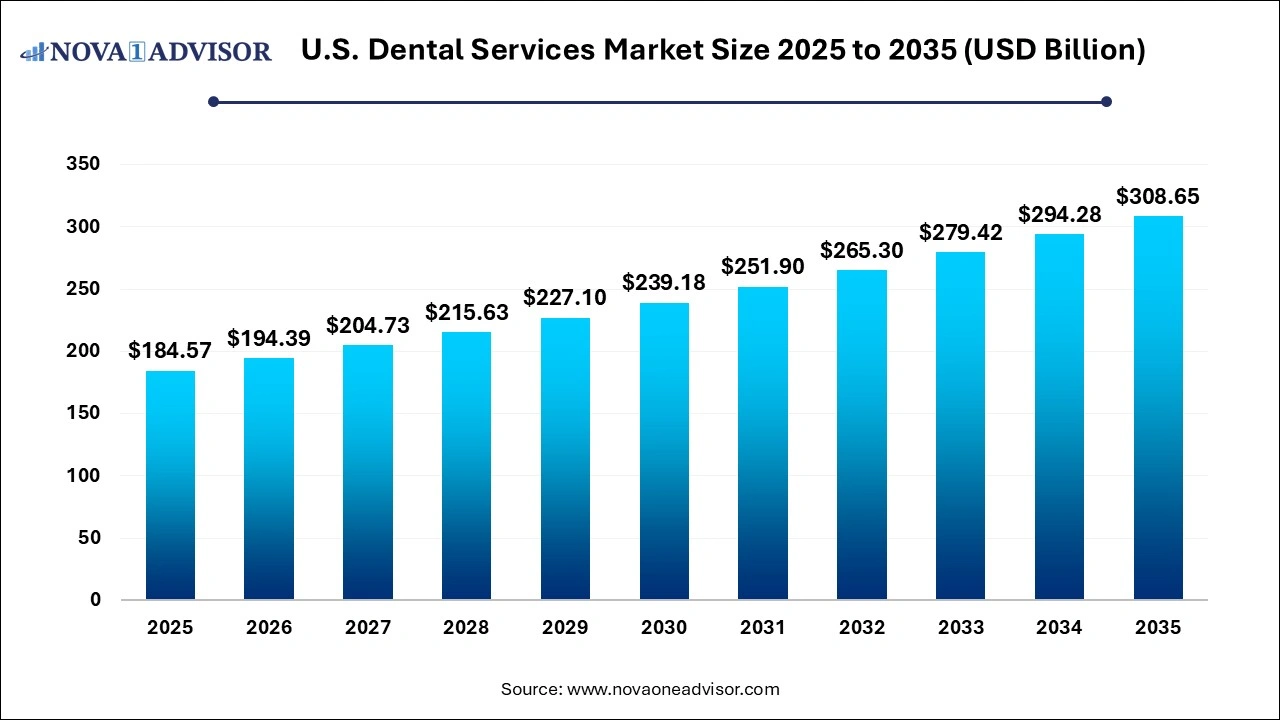

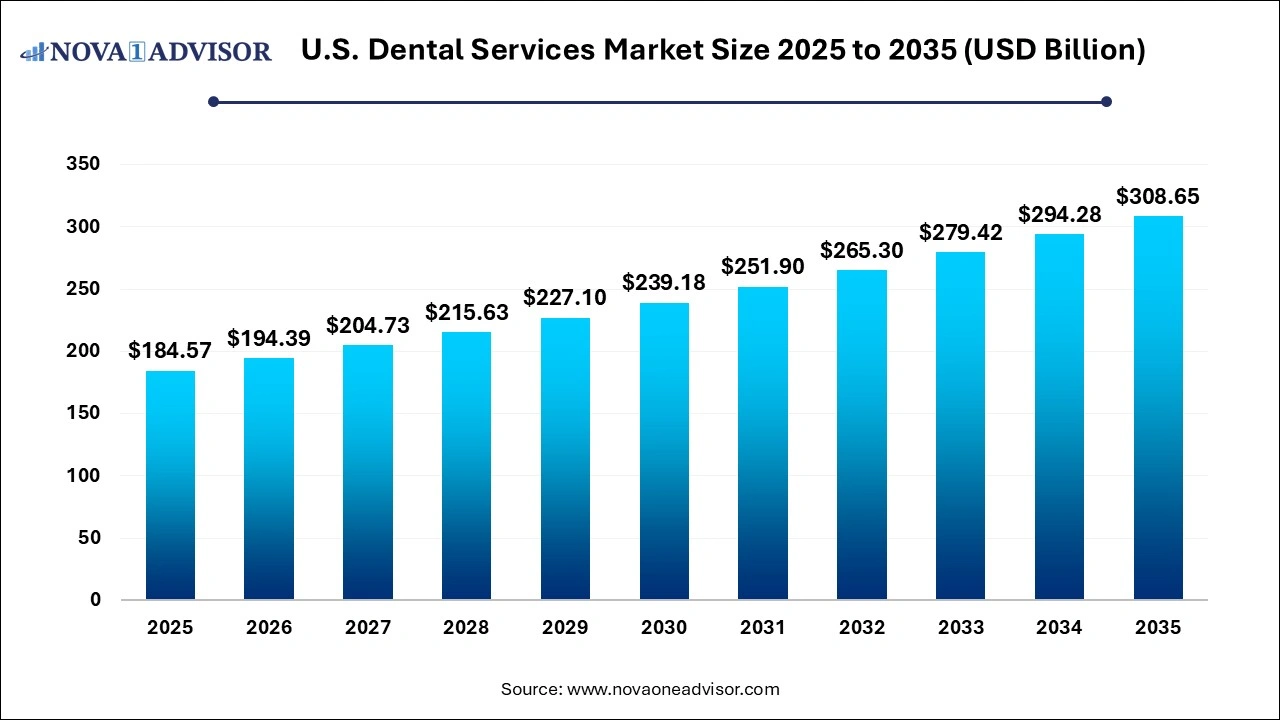

The US dental services market size was exhibited at USD 184.57 billion in 2025 and is projected to hit around USD 308.65 billion by 2035, growing at a CAGR of 5.28% during the forecast period 2026 to 2035.

Key Takeaways

- By service type, diagnostic and preventive services dominated the market in 2025.

- By service type, cosmetic dentistry is expected to be the fastest growing segment during the forecast years.

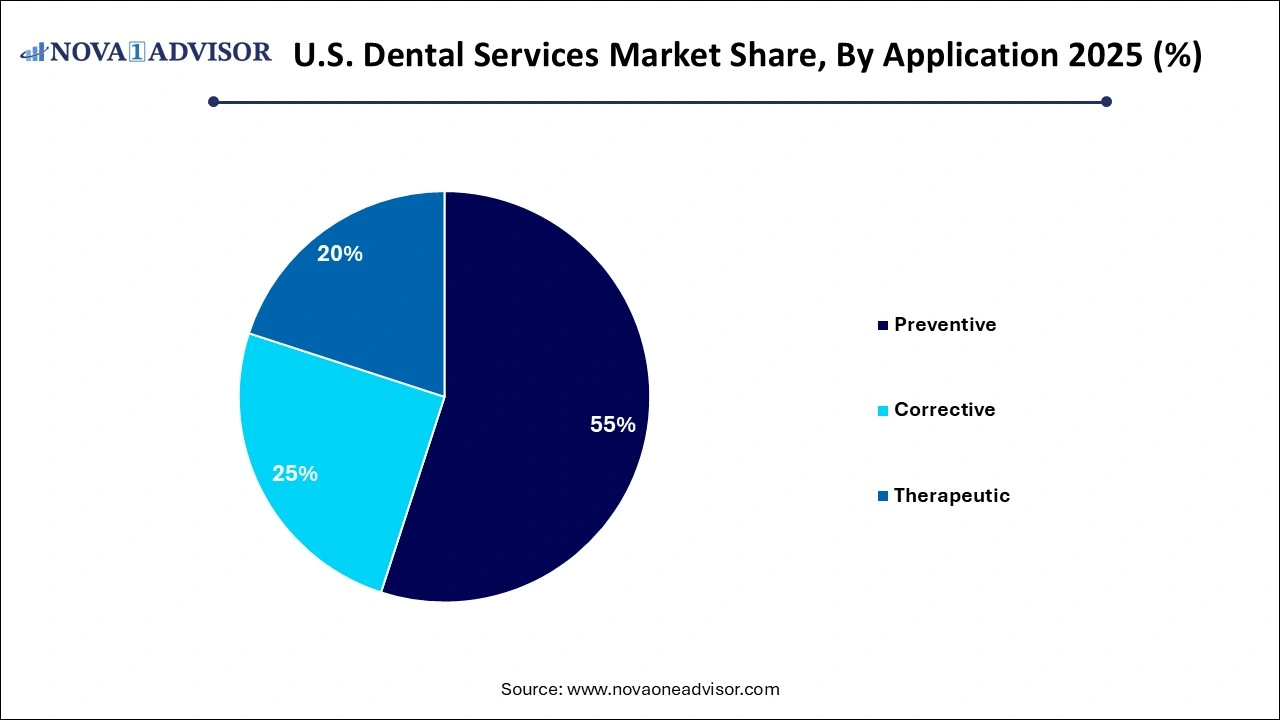

- By application, the preventive segment led the market as of this year.

- By application, the corrective segment is seen to have the fastest growth rate.

- By end user, dental clinics held the largest market share as of this year in 2025.

- By end user, hospitals are estimated to be the fastest growing segment throughout the forecast period.

What are Dental Services?

Dental services refer to the range of healthcare services that are provided by dental professionals to diagnose, treat and prevent oral health problems. These types of services include a variety of treatments, including routine checkups, cleanings, restorative procedures and specialized treatments for oral diseases. Dental services are crucial for maintaining good oral hygiene, preventing tooth decay and ensuring the overall health of the mouth, gums and teeth. These services can be offered in general dentistry or through specialized areas such as orthodontics, periodontics and oral surgery.

Dental services are important as they help maintain oral health, prevent dental issues, and treat problems before they become more serious. Regular dental care can help prevent conditions such as cavities, gum disease, and tooth loss, all of which can affect a person’s overall health. Studies show that oral health is also linked to overall well-being, and issues like untreated gum disease have been linked to serious conditions like heart disease and diabetes.

What are the Key Trends in the Market?

- Integration of Artificial Intelligence: The incorporation of AI in diagnostics, treatment planning, and patient management is a key trend in today’s market. It helps in enhancing the efficiency and accuracy of dental services.

- Focus on Minimally Invasive Procedures: The market is witnessing an increasing preference for minimally invasive dental procedures, driven by patient demand for faster recovery and less discomfort. Advancements in materials and technologies are also seen supporting minimally invasive treatments.

- Green Dentistry Practices: Growing awareness regarding environmental sustainability is driving the adoption of green dentistry practices, including eco-friendly materials and energy-efficient technologies.

- Cosmetic Dentistry and Aesthetic Procedures: The market is witnessing a growing demand for cosmetic dentistry and aesthetic procedures such as smile enhancement and appearance-driven dental treatments.

- Preventive and Personalized Dental Care: There is a shift towards more preventive and personalized dental care, which creates opportunities for services like preventive screenings, personalized treatment plans and customized oral health education.

What is the Impact of AI in this field?

Artificial intelligence and machine learning continue to revolutionize the dental services market and enhancing patient treatment outcomes. AI and ML both can help in screening and early detection of dental disorders, enabling dentists to take timely action. They can also analyze and interpret imaging data and reduce manual errors.

AI-powered diagnostic tools nowadays are helping dentists detect misalignments, cavities and oral cancer at much earlier stages. Algorithms are able to analyze complex imaging data with impressive accuracy and offer assessments in real time. This has been a game-changing aspect to ensure prevention and deploy proactive treatment plans. AI can also offer tailored education, treatment plans in order to provide extra support to patients. AI-driven chatbots and virtual assistants are also gaining traction in today’s market. They are already being used to answer frequently asked questions, provide post treatment care instructions and offer personalized recommendations based on the patient’s unique dental profile. Through all these factors, we can say that the next generation of AI solutions are not set to replace dentists, but are there only to amplify their expertise, acting as a trusted ally and allowing them to make more data-driven decisions while simultaneously educating and their patients, thus making their.

Report Scope of U.S. Dental Services Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 194.39 Billion |

| Market Size by 2035 |

USD 308.65 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.28% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Services, Application, End-Use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Aspen Dental Management Inc., Heartland Dental, Pacific Dental Services, Align Technology, DentaQuest, InterDent, Inc., National Health Service England, The British United Provident Association Limited, Coast Dental, Dental Service Group |

U.S. Dental Services Market Dynamics

Driver

Increased Focus on Aesthetic Dentistry and Oral Health

The growing emphasis on aesthetic dentistry is a key driver that is revolutionizing the dental services market. Procedures such as teeth whitening, veneers and orthodontics are gaining popularity in the market, driven by social media influences and the desire for a better, improved self-image. This trend is likely to continue in the upcoming years, as advancements in technology make these procedures more accessible and affordable. As the demand for aesthetic services rises, dental practices may increasingly incorporate these offerings into their service portfolios, thus diversifying their revenue and enhancing their competitiveness.

There is also a rising awareness of oral health among the US population, which is driving demand for advanced dental services. Educational campaigns and initiatives by health organizations continue to emphasize on the importance of maintaining oral hygiene, which has led to increased visits to dental professionals. As more and more people prioritize their oral health, the dental services market will witness steady growth and development in the near future.

Restraint

High Costs

Despite various growth prospects, the US dental services market does have its fair share of restraints. High cost remains to be a significant barrier to accessing dental services for a large portion of the U.S. population. Many dental procedures especially cosmetic, orthodontic and implant-related are only partially covered by insurance or there are chances that they are excluded altogether.

Even regular routine care such as cleanings, fillings and X-rays can be quite expensive for individuals, especially if they do not have any health insurance. This problem is especially pronounced in underserved rural areas and among low-income groups. All these financial barriers slow down market entry, making widespread adoption a challenge.

Opportunity

Technological Advancements

The dental services market is opening up new avenues of opportunity due to rapid technological advancements in dental equipment. Innovations such as digital imaging, laser dentistry and 3D printing are helping in enhancing diagnostic accuracy and treatment efficiency. The integration of CAD/CAM technology allows for the creation of precise dental restorations in a single visit, which significantly helps in improving patient satisfaction. These advancements not only streamline operations but also reduce the time patients spend in the chair, thus encouraging more individuals to seek regular dental care. As technology continues to evolve, the dental services market is set to grow even more.

Additionally, rising tele-dentistry platforms are making it easier for patients in remote areas to access care and for providers to offer initial consultations or post-procedure follow up sessions. AI-powered treatment planning is also greatly enhancing precision and reducing human error.

U.S. Dental Services Market Segmental Insights

By Service Insights

Which service type dominated the market in 2025?

Diagnostic and preventive services dominated the market in 2025. These services include cleanings, oral exams, X-rays, fluoride treatments, and sealants. Most insurance plans do cover these types of services, making them widely accessible and affordable. Additionally, national awareness programs and campaigns continue to emphasize prevention and regular check ups. Dental chains and DSOs also use preventive services as a way to build patient loyalty and recommend advanced procedures.

The cosmetic dentistry segment is seen to be the fastest-growing service segment throughout the forecast period. Advancements in smile design, tooth-colored materials, and laser contouring have made cosmetic procedures more appealing, less painful, and more accessible. Teeth whitening, porcelain veneers, and composite bonding are now common procedures that are offered in both, general as well as specialty clinics. This trend is due to the influence of celebrities and social media influencers, who have normalized cosmetic dental procedures.

By Application Insights

Which application led the market as of this year?

Preventive applications led the market as of this year. These types of services include dental check-ups, professional cleanings, sealants and fluoride applications, which are critical for people of all ages, whether they be children, adolescents or older adults. Public health initiatives, school dental programs and private insurance policies are seen to cover preventive procedures at low or almost no cost, which drives a steady stream of patient visits.

Corrective applications are expected to be growing at the fastest pace. This segment includes orthodontic treatments, dental implants, fillings and bridge procedures that are aimed at correcting functional or structural dental issues. The increased demand for Invisalign and similar aligners, as well as full-mouth implant solutions for edentulous patients are key contributors to the segment’s growth. As these procedures become more advanced and accessible with the help of financing plans, the growth trajectory is expected to accelerate even more.

By End Use Insights

Which end user held the largest market share in 2025?

The dental clinics segment held the largest market share in 2025. These clinics prioritize the most important types of care, all the way from basic to emergency services. They also provide affordable services to patients. The segment’s dominance can be attributed to their favorable infrastructure, presence of trained professionals and the availability of specialized equipment. Favorable regulatory frameworks also help facilitate the development of dental clinics in the region.

The hospitals segment is projected to expand at the fastest rate during the forecast period. Many people prefer visiting hospitals for their dental treatment due to favorable reimbursement policies and the presence of multidisciplinary experts. Hospitals provide the support of central or core services that can help with diagnosis and treatment, as well as opportunities for dentistry practice to interact with other clinical and surgical specialties, thus making them a popular choice.

U.S. Country-Level Analysis

Within the United States, dental service utilization is not uniform across all states and demographics. Urban and suburban regions such as California, New York, Texas, and Florida have high concentrations of dental providers, advanced care facilities, and access to specialty services. These states also lead in cosmetic and implant dentistry due to their affluent populations and lifestyle-driven demand.

In contrast, rural states and underserved communities such as parts of Appalachia and the Deep South struggle with provider shortages, limited insurance coverage, and low oral health literacy. Initiatives like the Health Resources and Services Administration’s (HRSA) National Health Service Corps dental provider program aim to address these disparities by incentivizing dentists to work in rural areas.

Furthermore, pediatric oral health initiatives have gained traction in states like Vermont and Oregon, where early intervention programs in schools are helping reduce long-term dental complications. Meanwhile, states like Colorado and Arizona have emerged as hubs for dental tourism due to competitive pricing and high-quality care, particularly in border regions.

Some of the prominent players in the US dental services market include:

- Aspen Dental Management Inc.

- Heartland Dental

- Pacific Dental Services

- Align Technology

- DentaQuest

- InterDent, Inc.

- National Health Service England

- The British United Provident Association Limited

- Coast Dental

- Dental Service Group

Recent Developments

- In May 2025, Wellfit Technologies, Inc. announced its partnership with Careington International Corporation to acquire Careington’s Launch Loyalty dental membership plan business unit. The agreement provides for the continued servicing of Launch Loyalty customers by Careington as the companies work together to integrate Wellfit’s plans technology offerings to enhance customer and member experiences.

- In November 2025, in honor of Veterans Day, Case Western Reserve University School of Dental Medicine will offer discounted dental care to veterans and military personnel at the school’s dental clinic. The offer includes a dental exam, X-rays and cleaning for about $35, and is open only to new patients who are veterans or military personnel. In addition, patients who sign up for a comprehensive treatment plan will receive a $100 voucher for future dental services.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the US dental services market

By Services

- Cosmetic Dentistry

- Endodontic Procedures

- Periodontal Dentistry

- Orthodontic and Periodontic Services

- Diagnostic and Preventive Services

- Oral and Maxillofacial Surgery

By Application

- Preventive

- Corrective

- Therapeutic

By End-Use