U.S. Digital Therapeutics Market Size and Growth

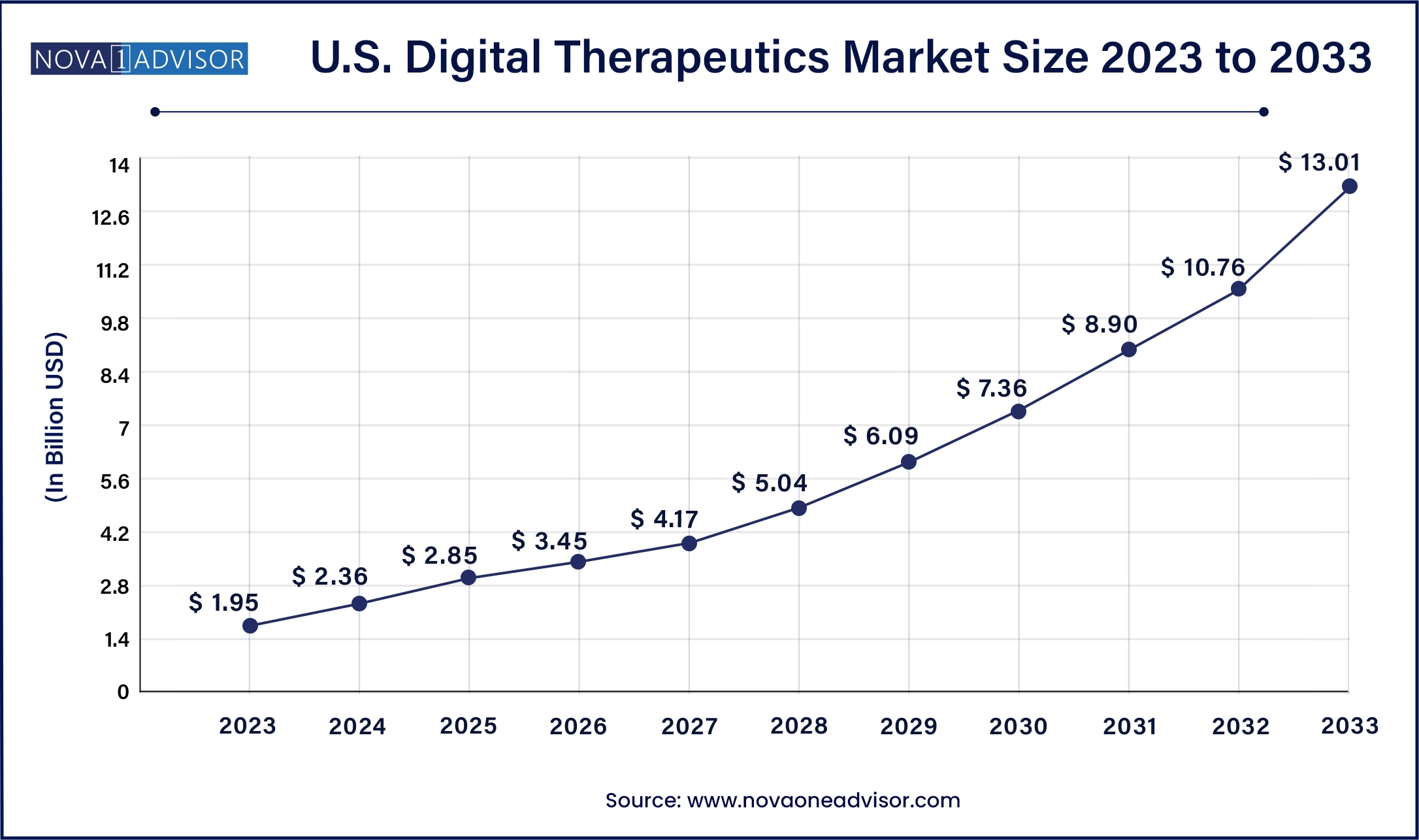

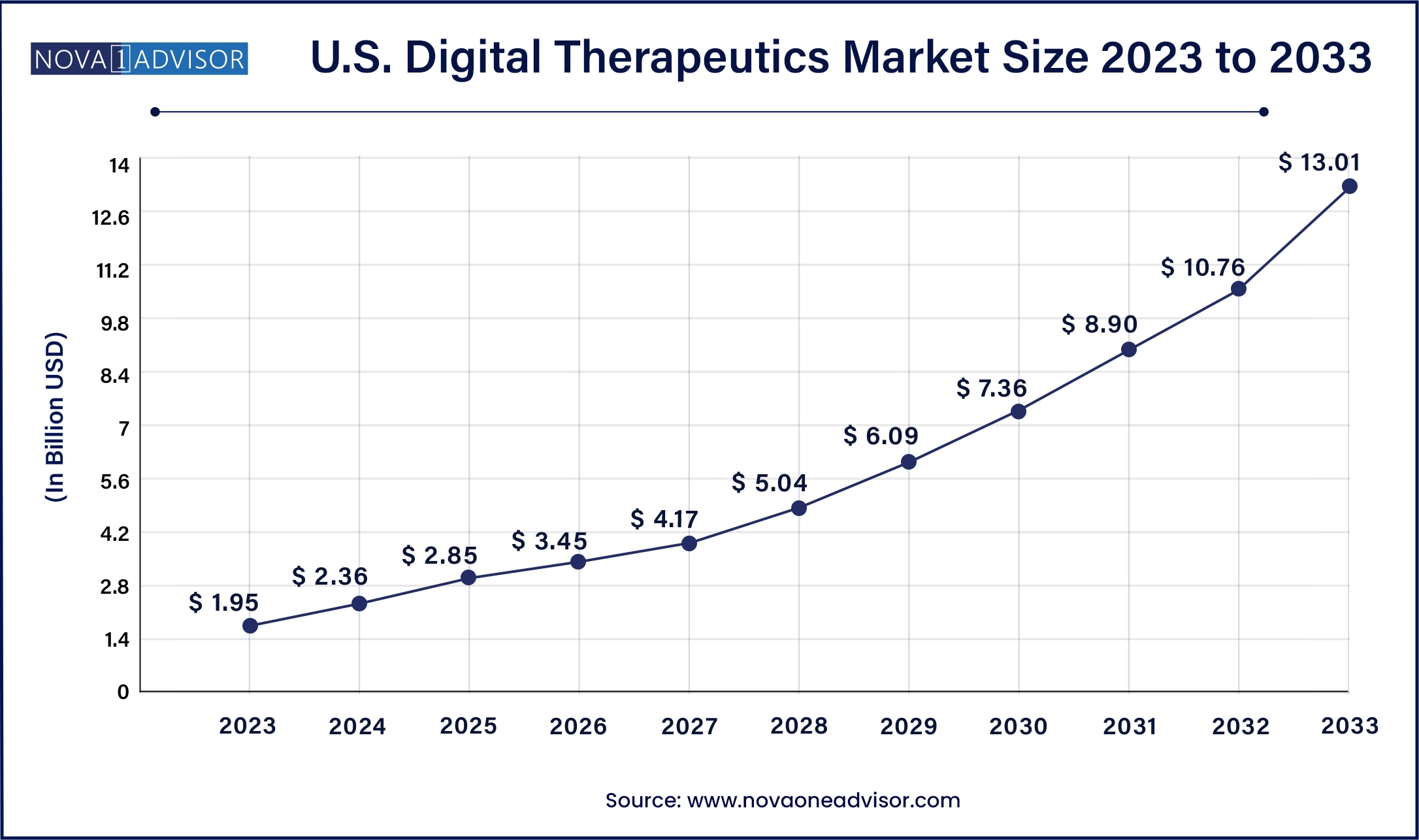

The U.S. digital therapeutics market size was valued at USD 1.95 billion in 2023 and is anticipated to reach around USD 13.01 billion by 2033, growing at a CAGR of 20.9% from 2024 to 2033.

U.S. Digital Therapeutics Market Key Takeaways

- Diabetes dominated the application segment in 2023 with more than 33.7% of the revenue share.

- On the basis of the product, the software segment is projected to hold the largest market share from 2024 to 2033.

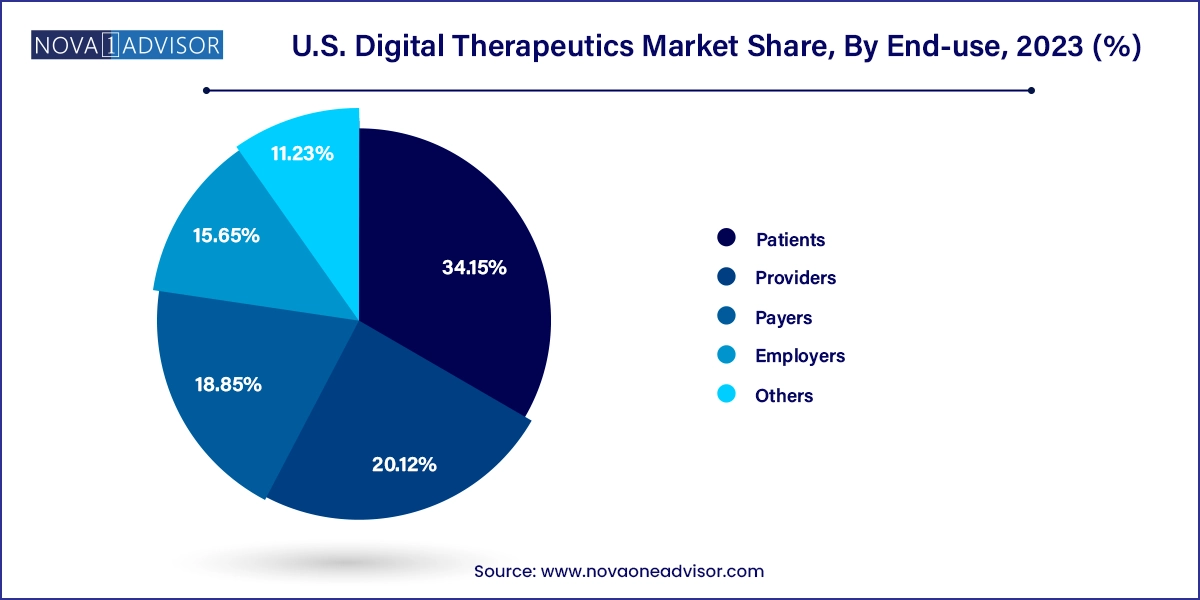

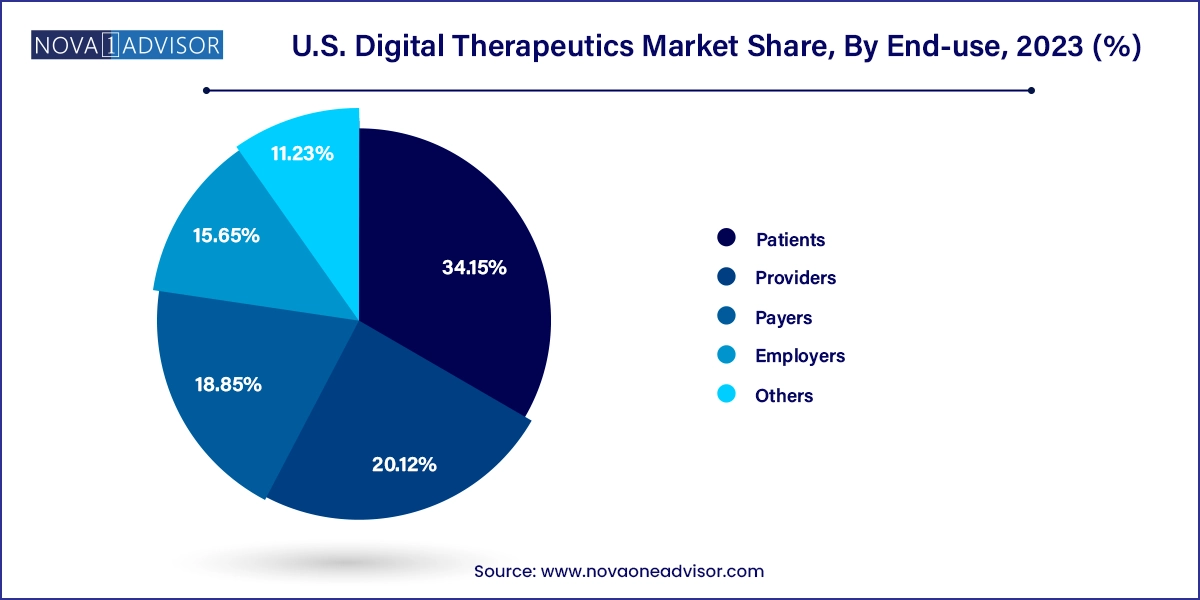

- The patient end-user segment dominated the overall market with more than 34.15% of the revenue share in 2023.

U.S. Digital Therapeutics Market Growth

The continuously changing digital landscape, rising consumerism in healthcare, the COVID-19 pandemic, and initiatives by key companies are some of the key factors fueling the market growth. In October 2021, Click Therapeutics, Inc. received USD 52 million in Series B funding from multiple investors. This enabled the development and commercialization of the company’s prescription digital therapeutic pipeline, while also helping the company advance its platform capabilities.

Technological advancements aiming to provide transformational healthcare solutions are further anticipated to assist the market growth in the near future. In June 2020, ATAI Life Sciences, in an attempt to enter the digital therapeutics space, launched the IntroSpect Digital Therapeutics platform. The company will provide DTx and precision psychiatry solutions in a probe to combat burgeoning mental health disorders.

The increasing number of smartphone users in the U.S. is another key factor driving the market growth. Awareness of smart health tracking is also expected to increase in the country due to the rapid proliferation of smart healthcare devices. Digital therapeutics can offer on-demand care to patients, with the ability to diagnose and treat patients earlier. Moreover, biopharmaceutical companies are collaborating with digital therapeutic providers to give patients a better quality of care, thereby propelling growth.

Despite the advantages of DTx services and a large smartphone user base in the U.S., it never experienced mass consumer adoption before the COVID-19 outbreak. The pandemic created a major growth opportunity for this technology. CMS and FDA have already mentioned the vital nature of virtual care services in the overall COVID-19 response strategy.

Social distancing and self-isolation have resulted in increased anxiety & stress. According to Mental Health America, there was nearly a 19% increase in clinical anxiety in the first week of February 2020, and around a 12% increase in the first two weeks of March. DTx therapies can help manage these conditions and provide evidence-based solutions. Companies such as BigHealth, Happify, Palo Alto Health Science, and Pear Therapeutics are constantly trying to increase their consumer base and reach out to more patients during this pandemic.

U.S. Digital Therapeutics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 2.36 Billion |

| Market Size by 2033 |

USD 13.01 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 20.9% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Application, By Product, and By End Use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Omada Health Inc., 2Morrow Inc., Teladoc Health, Inc, Pear Therapeutics (U.S), Inc., Fitbit Health Solutions, Welldoc, Inc, Click Therapeutics, Noom, Inc., Akili, Inc., Better Therapeutics, Inc. |

U.S. Digital Therapeutics Market Dynamics

Drivers

Rising demand for digital therapeutics

The demand for U.S. digital therapeutics is on the rise owing to increased penetration of digital healthcare applications and platforms due to the rapid adoption of smartphones, tablets, and smart wearables is likely to drive market growth in the coming years. The Rising prevalence of chronic diseases with the growing need to control the rising cost of healthcare facilities is another factor that is expected to drive the market growth. Furthermore, constantly changing digital platforms in many industries have encouraged consumers to use these digital platforms. Also, increased awareness about health and fitness are the major drivers that boost the market in the upcoming years.

Restrains

Data privacy concerns

The various health applications lack the necessary authorization raising issues about the product and data quality, patient privacy, security, and data use responsibly. Digital therapeutics providers have access to the patient’s information but are not permitted to share information about who is involved in the patient’s treatment. However, with the digital technologies to consolidate data, the patient’s information is at risk which can be accessed by any healthcare professional who is not involved in patients’ treatment procedure. As a result, data privacy issues are impeding the growth of the market during the forecast period.

Opportunities

Rising investments and strategic acquisition

Increased pharma investment and healthcare-focused start-ups are more likely to act as market drivers for digital therapeutics, influencing and shaping the future of digital therapeutics. There is also a positive trend for digital medication reimbursement, with 25% of organizations currently covering them and another 45% promising to do so in the future. Consolidation in the digital therapeutics sector is ongoing, with vendors expanding their market presence through strategic acquisitions and collaborations with pharmaceutical companies. Mergers and acquisitions are being used by global and prominent regional suppliers to enhance their market positions and extend their product ranges.

Furthermore, the growing emphasis on strategic acquisitions and the formation of collaborative partnerships among key stakeholders such as providers, payers, and the US federal government to meet prevalent unmet patient needs and provide supportive healthcare services in remote locations is contributing to the growth of the digital therapeutics market in the US. These strategic alliances will boost healthcare infrastructure utilization, enhance patient and physician interaction, and deliver improved disease management and patient access services.

COVID-19 Impact

Following the outbreak of the COVID-19 pandemic, the use of DTx applications in a variety of industries increased significantly. DTx offers one-of-a-kind solutions to meet healthcare needs, lowering the risk of COVID-19 exposure during a hospital visit. The COVID-19 pandemic joined other main drivers of DTx growth, including a greater emphasis on preventative healthcare, a high prevalence of chronic diseases, and more cheap devices as a result of technological advancements. DTx became a significant participant in the digital health sector after COVID, and its scope is anticipated to raise the US digital therapeutics market.

U.S. Digital Therapeutics Market By Application Insights

The diabetes segment has maintained dominance in the U.S. digital therapeutics market due to the high burden of the disease and the availability of proven DTx solutions. Platforms like BlueStar by Welldoc and Livongo provide clinically validated programs for glucose monitoring, lifestyle coaching, and medication adherence. These platforms have shown measurable improvements in patient HbA1c levels, earning them trust among endocrinologists and payers. With increasing healthcare costs associated with diabetes complications, employers and insurers are turning to DTx solutions as a preventive and cost-saving approach.

Conversely, mental health and respiratory diseases are emerging as the fastest-growing application areas. Digital solutions targeting conditions such as anxiety, depression, insomnia, and COPD have gained traction, especially post-pandemic. Pear Therapeutics' reSET and reSET-O for substance use disorder, and Propeller Health’s COPD management solution have proven the value of digital therapy. As awareness and de-stigmatization of mental illness rise, and as asthma and COPD management become more tech-driven, these segments are poised for accelerated adoption.

U.S. Digital Therapeutics Market By Product Insights

Software-based therapeutics dominate the product segment due to their scalability, cost-efficiency, and compatibility with smartphones and web platforms. These software solutions are often developed using behavioral science principles, gamification, and cognitive-behavioral therapy modules, making them user-friendly and engaging. Their ease of integration with healthcare systems and EHRs further solidifies their preference among healthcare providers. Additionally, software-only platforms often require fewer regulatory hurdles, expediting time-to-market.

Nevertheless, the devices segment is growing rapidly, driven by the increasing demand for integrated hardware-software solutions. Devices like connected inhalers, wearable biosensors, and even EEG headbands are being paired with digital therapeutic apps to provide continuous monitoring and feedback. Such integration improves data accuracy, real-time alerts, and patient engagement, particularly for chronic respiratory or cardiovascular conditions. Companies like Propeller Health and Biofourmis are innovating in this area, making device-based DTx a key focus for the next growth phase.

U.S. Digital Therapeutics Market By End-use Insights

Patients are the leading end-users in the U.S. digital therapeutics market. With the widespread ownership of smartphones and increasing health literacy, patients are more empowered to take control of their health through app-based interventions. Digital therapeutics provide convenience, privacy, and personalization, key factors driving patient adoption. Moreover, platforms that offer bilingual support and user-friendly interfaces ensure accessibility across diverse demographic segments. Programs like Noom (for weight loss) and Omada (for chronic care management) have seen high patient engagement and retention.

Employers represent the fastest-growing segment, primarily due to rising healthcare expenditure and the need to improve employee productivity. Many employers are now offering digital therapeutics as part of workplace wellness programs or Employee Assistance Programs (EAPs). For example, Johnson & Johnson and Amazon have partnered with DTx platforms to offer mental health and chronic care management tools to employees. These programs not only enhance employee well-being but also contribute to reducing absenteeism and insurance premiums.

Country-Level Analysis

The United States stands at the forefront of the global digital therapeutics revolution, attributed to a combination of robust digital infrastructure, progressive healthcare policies, and high disease burden. Key states like California, Massachusetts, and New York serve as innovation hubs, hosting many of the industry’s leading DTx startups and research institutions. These states also benefit from early adoption by healthcare systems and insurers. Additionally, Medicare Advantage plans in some states have started reimbursing DTx tools, furthering market penetration.

Consumer acceptance has significantly increased, especially among millennials and Gen Z, who are comfortable with mobile health apps and virtual care. Urban centers have higher uptake rates due to greater access to internet connectivity and advanced healthcare systems. Meanwhile, initiatives aimed at improving digital health access in rural areas are expected to increase penetration in underserved populations. With regulatory frameworks maturing and reimbursement models evolving, the U.S. is expected to remain the epicenter of digital therapeutics innovation and commercialization.

U.S. Digital Therapeutics Market Recent Developments

-

March 2025: Akili Interactive announced a new collaboration with a major U.S. health system to integrate its ADHD treatment platform, EndeavorRx, into pediatric behavioral care programs.

-

January 2025: Pear Therapeutics relaunched its reSET-O platform with new features targeting patient engagement and secured additional payer contracts in Ohio and Michigan.

-

December 2024: Biofourmis launched its FDA-cleared platform for heart failure monitoring in partnership with several large hospitals across Texas and Florida.

-

October 2024: Propeller Health released a next-gen sensor device for inhalers, improving real-time asthma tracking and sharing capabilities with physicians.

-

August 2024: Omada Health raised $100 million in a funding round led by Fidelity Investments to expand its integrated care programs across more chronic disease areas.

U.S. Digital Therapeutics Market Top Key Companies:

- Omada Health Inc.

- 2Morrow Inc.

- Teladoc Health, Inc

- Pear Therapeutics (U.S), Inc.

- Fitbit Health Solutions

- Welldoc, Inc

- Click Therapeutics

- Noom, Inc.

- Akili, Inc.

- Better Therapeutics, Inc

U.S. Digital Therapeutics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Digital Therapeutics market.

By Application

- Diabetes

- Obesity

- Central Nervous System Diseases

- Cardiovascular Disease (CVD)

- Respiratory Disease

- Smoking Cessation

- Gastrointestinal Disorder (GID)

- Others

By Product

By End Use

- Patients

- Providers

- Payers

- Employers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)