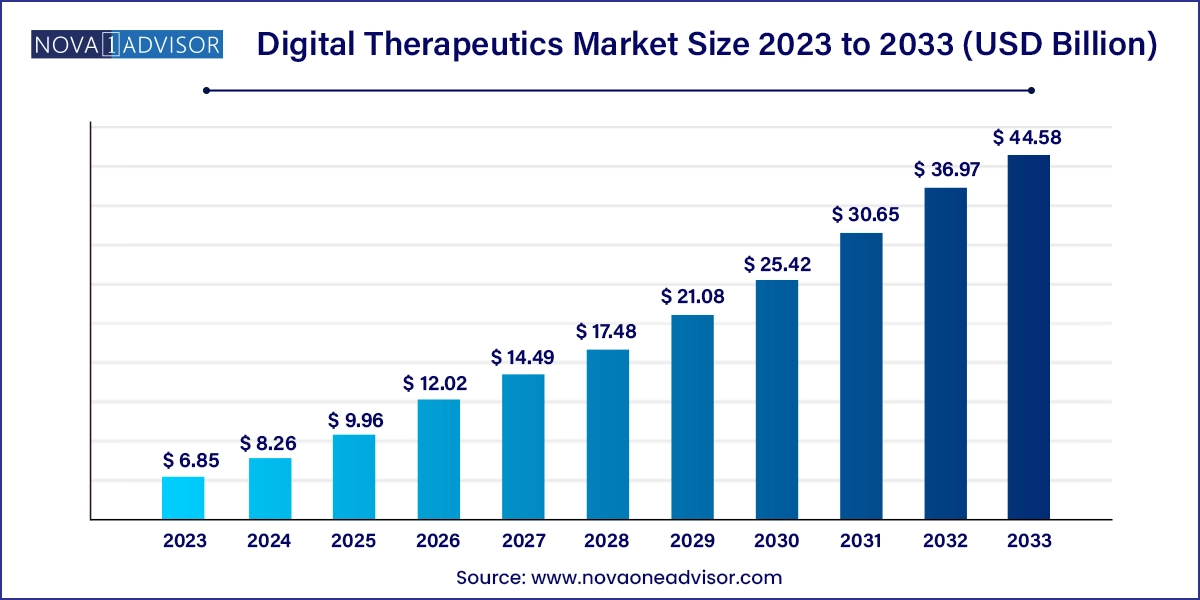

Digital Therapeutics Market Size and Growth

The global digital therapeutics market size was valued at USD 6.85 billion in 2023 and is projected to surpass around USD 44.58 billion by 2033, registering a CAGR of 20.6% over the forecast period of 2024 to 2033.

Digital Therapeutics Market Key Takeaways

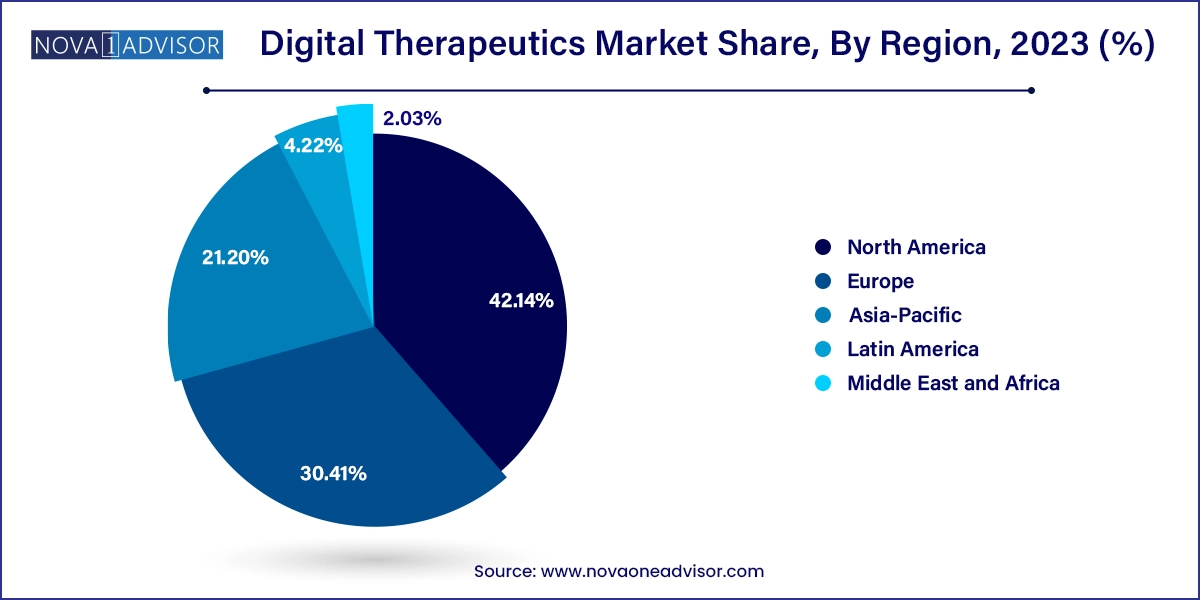

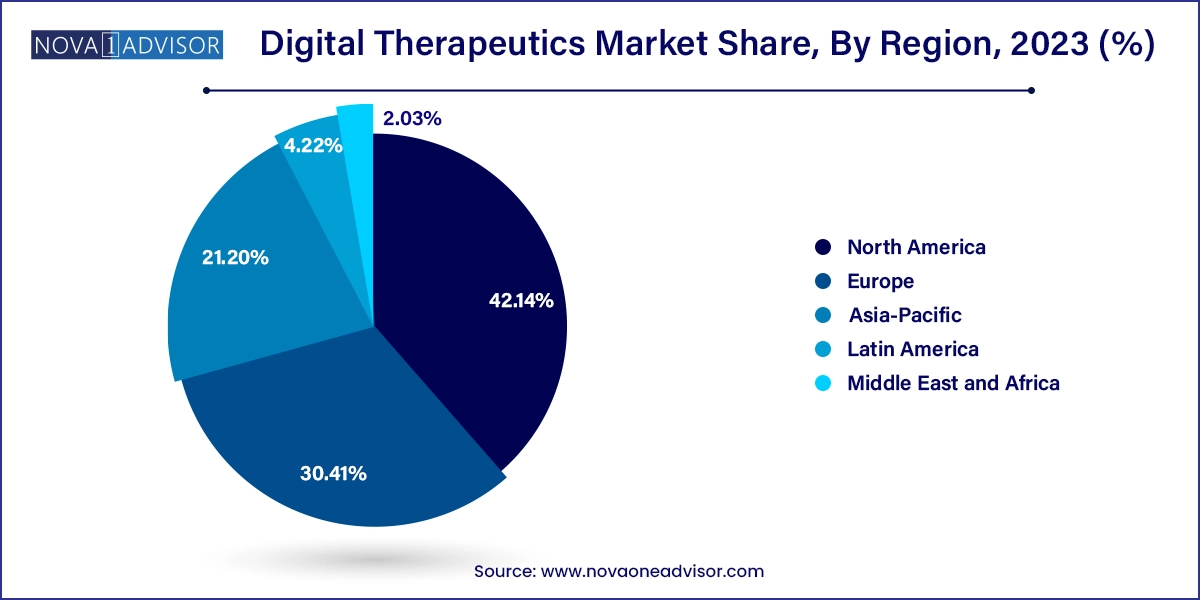

- North America dominated the market with a revenue share of 42.14% in 2023.

- Asia Pacific is anticipated to witness substantial growth, with the fastest CAGR of 29.4% over the forecast period.

- The diabetes segment dominated the market with the largest market share of 29.33% in 2023 and is expected to register the fastest CAGR of 28.9% over the forecast period.

- Based on end-use, the market is segmented into providers, patients, employers, payers, and others. The patient segment held the largest market share of 35.08% in 2023.

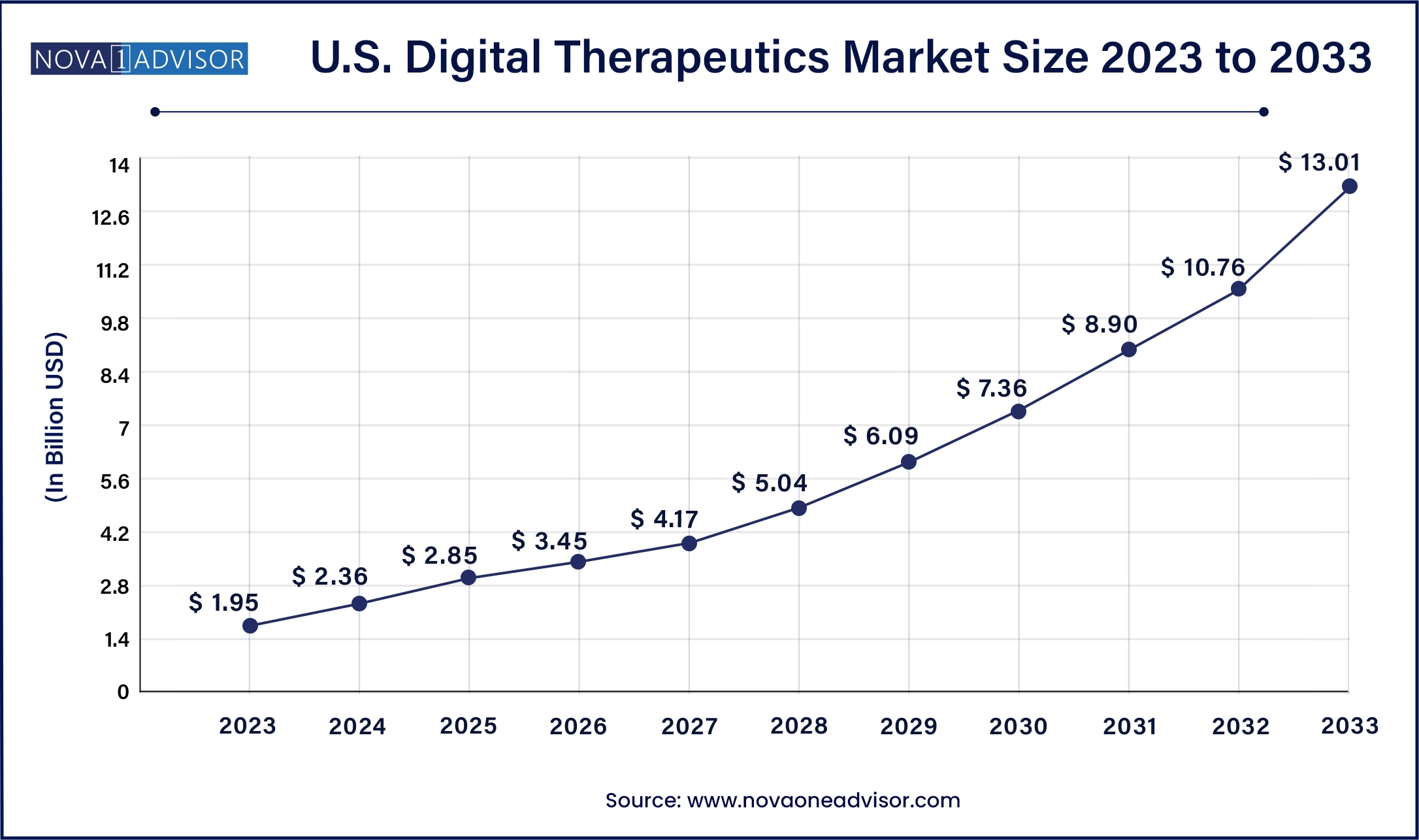

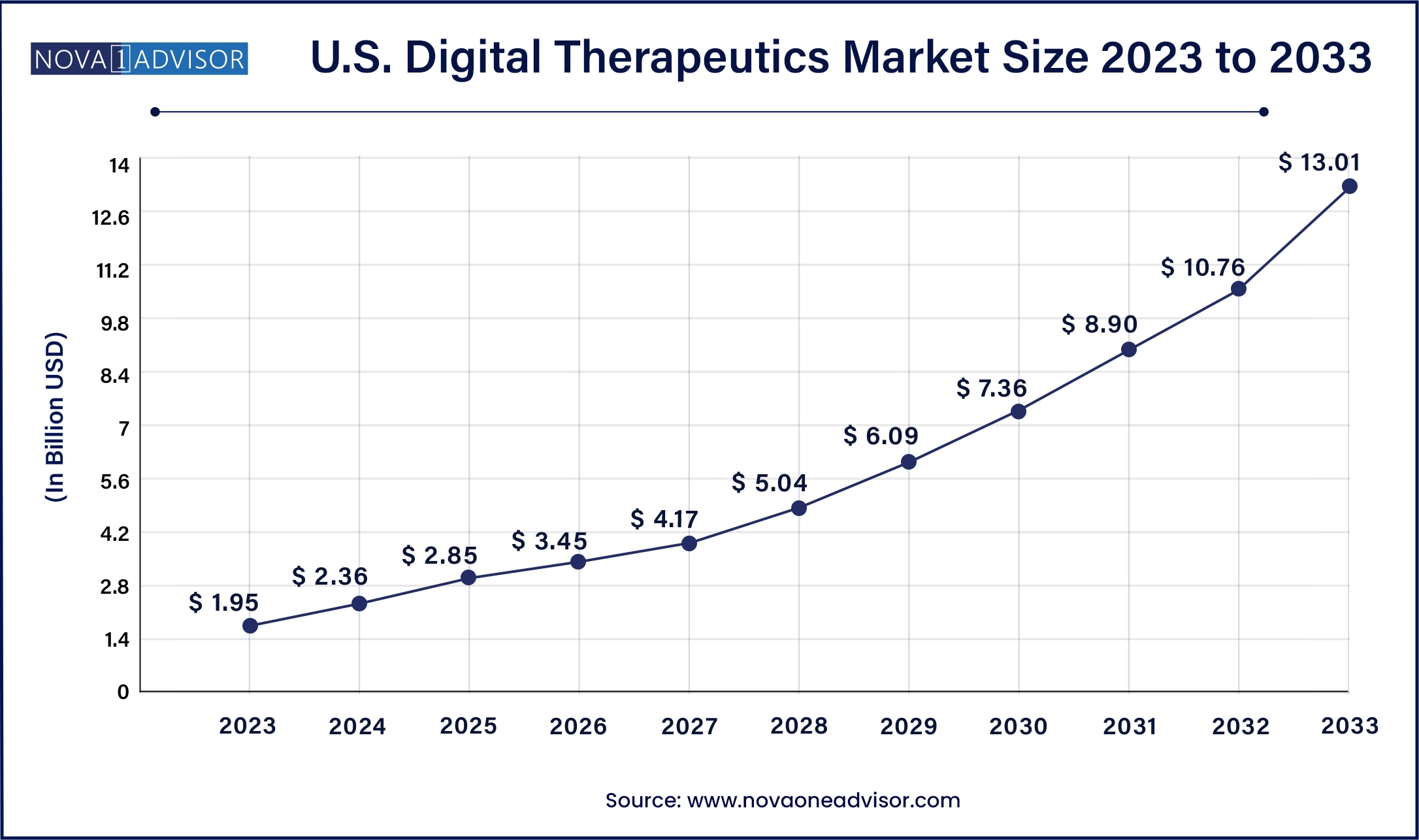

U.S. Digital Therapeutics Market Size and Growth 2024 to 2033

The U.S. digital therapeutics market size was estimated at USD 1.95 billion in 2023 and is projected to hit around USD 13.01 billion by 2033, growing at a CAGR of 20.9% during the forecast period from 2024 to 2033.

North America dominated the market with a revenue share of 42.14 % in 2023. The overall market in the region is expected to grow significantly over the forecast period owing to favorable reimbursement scenarios focused on improved tracking and diagnosis, and improved quality of life through increased use of digital health products. Moreover, strategic initiatives undertaken by key players in this region, such as new product launches and mergers & acquisitions, are expected to result in lucrative growth.

Asia Pacific is anticipated to witness substantial growth, with the fastest CAGR of 29.4% over the forecast period due to high demand for IT services and increased government spending on healthcare. Furthermore, demand for healthcare IT systems has been increasing as they enable efficient management of hospitals' clinical, financial, and administrative aspects. A rise in smartphone penetration, an increase in demand for effective healthcare, and improved Internet access are the underlying factors facilitating a rapid increase in Asia Pacific's digital therapeutics industry.

Market Overview

The Digital Therapeutics (DTx) market represents a groundbreaking advancement in healthcare delivery, where evidence-based software solutions are designed to prevent, manage, or treat medical disorders. Unlike traditional wellness applications, DTx products undergo rigorous clinical evaluations and regulatory approvals, ensuring they deliver clinically validated outcomes. The blending of healthcare, digital innovation, and personalized patient engagement positions DTx as a pivotal force in reshaping modern medicine.

Fueled by rising chronic disease prevalence, increased smartphone penetration, and an urgent need for scalable healthcare solutions, DTx is rapidly gaining acceptance among healthcare providers, payers, and patients alike. Conditions such as diabetes, obesity, central nervous system disorders, cardiovascular diseases, and respiratory issues are among the leading areas where DTx interventions are proving transformative.

Major pharmaceutical and technology companies are increasingly forming partnerships to integrate DTx into their broader healthcare offerings. Regulatory bodies like the U.S. FDA and Europe's CE marking are also creating dedicated pathways to approve digital therapeutics, further legitimizing their use in clinical settings. As healthcare systems globally shift towards value-based care models, digital therapeutics promise to enhance treatment adherence, improve patient outcomes, and reduce overall healthcare expenditures.

Furthermore, during the COVID-19 pandemic, the value proposition of digital therapeutics became even clearer, as remote monitoring, behavioral interventions, and telehealth-based treatments saw explosive growth, ushering in a "digital-first" healthcare mindset that continues to persist.

Major Trends in the Market

-

Integration with Wearable Devices: DTx products increasingly connect with smartwatches, fitness trackers, and biosensors for real-time health monitoring and personalized feedback.

-

Focus on Mental Health Applications: Depression, anxiety, PTSD, and other mental health conditions are becoming major targets for DTx intervention platforms.

-

Partnerships Between Pharma and Tech Companies: Collaborations are on the rise to embed DTx into traditional pharmaceutical pipelines, expanding therapeutic offerings.

-

Insurance Reimbursement Expansion: Health insurance providers are progressively including DTx products in coverage plans, boosting accessibility and credibility.

-

Artificial Intelligence (AI) and Machine Learning (ML) Enhancement: AI-driven algorithms are improving the customization, effectiveness, and engagement rates of digital therapies.

-

Shift Toward Prescription Digital Therapeutics (PDTs): Regulatory approval of prescription-only DTx products is validating their clinical significance and differentiating them from wellness apps.

-

Rise of Chronic Disease Management Platforms: Long-term conditions such as diabetes and hypertension are increasingly being managed with integrated digital therapeutic platforms.

-

Emphasis on Pediatric Applications: Growing development of DTx solutions focused on children with ADHD, autism spectrum disorders, and pediatric diabetes.

Digital Therapeutics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 8.26 Billion |

| Market Size by 2033 |

USD 44.58 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 20.6% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Product, By Application, and By Sales Channel, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Fitbit Health Solutions, 2MORROW, Inc., Medtronic Plc., Livongo Health, Inc., Pear Therapeutics, Inc., Omada Health, Inc., Resmed, Inc. (Propeller Health), Proteus Digital Health, Inc., Welldoc, Inc.,Voluntis, Inc., Canary Health Inc., Noom, Inc., Mango Health Inc., and Dthera Sciences among others. |

Digital Therapeutics Market Market Dynamics

An increasing incidence of chronic diseases significantly contributes to market growth. As per CDC’s National Center for Chronic Disease Prevention and Health Promotion, 6 in 10 American adults suffer from a chronic disease, while 4 out of 10 adults have 2 or more chronic diseases. In February 2022, Chronic Care Complete was launched by Teladoc Health, Inc., which represents the novel solution for complete chronic condition management that aims to improve healthcare outcomes. Additionally, health issues such as cancer, cardiovascular disorders, chronic kidney disease, diabetes, chronic lung disease, and Alzheimer's have been considered to be the leading causes of mortality and disability in the United States.

Growing regulatory initiatives are anticipated to propel standardization and R&D in the market over the forecast period. The Software Pre-Cert Pilot Program is part of the FDA's Digital Health Innovation Action Plan intended to imply a more efficient governing oversight of software-based medical devices (SaMD) developed by manufacturers. The program aims to develop an efficient regulatory oversight for assessing organizations to establish trust that they can develop high-quality Software-as-a-Medical-Device (SaMD) products. For instance, initiatives, such as the National Digital Health Mission (NDHM), are expected to accelerate the adoption rate of the e-healthcare model in India.

Digital Therapeutics Market By Product Type Insights

The Software segment dominated the Digital Therapeutics market, commanding the largest share owing to the proliferation of smartphone apps, web-based platforms, and cloud-hosted health management systems. Software-based DTx solutions offer scalability, ease of updates, personalized engagement, and seamless integration with electronic health records (EHRs). Solutions like Pear Therapeutics’ reSET app for substance use disorder or Noom’s behavioral weight loss program exemplify the potential of software-driven therapies to reach millions of patients without geographic limitations.

Software products also offer flexible deployment models—standalone apps, modules within broader health ecosystems, or integrations with provider systems—giving users and healthcare professionals versatile engagement pathways. The ability to gather and analyze real-time patient data further enhances the therapeutic value of these platforms.

Meanwhile, the Device segment is witnessing faster growth due to the rise in connected medical devices that enhance the effectiveness of digital therapies. Devices such as smart glucose monitors, wearable ECGs, and respiratory monitoring tools are increasingly bundled with DTx software to create holistic therapeutic ecosystems. The integration of devices improves treatment personalization, enables automated data collection, and boosts clinical outcomes, particularly for chronic disease management and remote patient monitoring.

Digital Therapeutics Market By Application Insights

Diabetes was the dominating application segment within the digital therapeutics market. The chronic nature of diabetes, combined with its high global prevalence, demands continuous lifestyle management, adherence monitoring, and personalized interventions all perfectly suited for digital delivery. DTx platforms like BlueStar by Welldoc and Onduo by Verily have demonstrated substantial reductions in HbA1c levels among patients, validating their clinical efficacy and driving adoption by providers and payers.

The scalable nature of diabetes-focused DTx programs also makes them attractive for population health management strategies, especially in markets like the U.S., India, and China, where diabetes incidence is skyrocketing.

Conversely, Central Nervous System (CNS) diseases are poised to be the fastest-growing application area. Mental health conditions such as depression, anxiety, PTSD, ADHD, and insomnia have witnessed a surge in prevalence post-pandemic, spotlighting the need for accessible, scalable treatment options. Prescription DTx products like Pear Therapeutics’ Somryst (for chronic insomnia) and Akili Interactive’s EndeavorRx (for ADHD) have already gained regulatory approvals, paving the way for explosive growth in digital CNS interventions.

Digital Therapeutics Market By Sales Channel Insights

The Business-to-Business (B2B) segment dominated the sales channel in the DTx market, primarily because of increasing adoption by healthcare providers and employers. Healthcare institutions view DTx platforms as valuable tools for improving patient engagement, managing population health, and achieving better clinical outcomes in value-based care models. Employers, on the other hand, are integrating digital therapeutics into employee wellness programs to reduce healthcare costs and boost workforce productivity.

Notably, employers like CVS Health and large healthcare networks such as the Mayo Clinic have piloted or integrated DTx solutions into their service offerings, highlighting B2B’s dominance.

The Business-to-Consumer (B2C) segment, however, is projected to grow the fastest. Increasing patient awareness, the democratization of healthcare apps, and the rise of self-managed care are driving direct patient engagement with DTx solutions. Patients are increasingly downloading DTx apps independently, subscribing to digital health programs, or using remote therapy platforms without intermediaries. The COVID-19 pandemic accelerated this trend, normalizing telehealth and remote behavioral interventions among broader demographics.

Digital Therapeutics Market By End-use Insights

The Patients segment dominated the DTx market as end-users increasingly seek personalized, convenient, and accessible therapeutic options. Patients are drawn to DTx platforms for their ability to deliver self-managed care, real-time feedback, remote access, and gamified experiences that enhance engagement. From lifestyle management apps for diabetes to cognitive behavioral therapy (CBT) programs for depression, patients are becoming active participants in their health journeys through digital means.

Meanwhile, the Providers segment is set to grow fastest, fueled by the shift toward integrated, technology-enabled care delivery models. Hospitals, clinics, and primary care providers are increasingly incorporating DTx solutions into their care protocols to enhance chronic disease management, improve treatment adherence, and achieve better outcomes under value-based reimbursement systems.

Digital Therapeutics Market Top Key Companies:

- Fitbit Health Solutions

- 2MORROW, Inc.

- Medtronic Plc.

- Livongo Health, Inc.

- Pear Therapeutics, Inc.

- Omada Health, Inc.

- Resmed, Inc. (Propeller Health)

- Proteus Digital Health, Inc.

- Welldoc, Inc.

- Voluntis, Inc.

- Canary Health Inc.

- Noom, Inc.

- Mango Health Inc.

- Dthera Sciences

Recent Developments

-

April 2025 – Pear Therapeutics announced a partnership with Novartis to develop new prescription digital therapeutics targeting rare neurological conditions.

-

March 2025 – Akili Interactive expanded its ADHD DTx platform EndeavorRx to additional European countries after receiving CE certification for broader use.

-

February 2025 – Propeller Health launched a next-generation respiratory disease management platform integrating AI-based predictive analytics for asthma and COPD patients.

-

January 2025 – Happify Health raised $73 million in Series D funding to accelerate the development of digital therapeutics for mental health and chronic disease management.

-

December 2024 – Welldoc unveiled a new AI-driven personalized coaching feature for its diabetes management app BlueStar, improving user engagement and glycemic control outcomes.

Digital Therapeutics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Digital Therapeutics market.

By Product

By Sales Channel

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Healthcare Provider

- Employer

- Others

By Application

- Obesity

- Diabetes

- Central Nervous System (CNS) Disease

- Gastrointestinal Disorder (GID)

- Cardiovascular Disease (CVD)

- Smoking Cessation

- Respiratory Disease

- Others

By End-use

- Patients

- Providers

- Payers

- Employers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)