U.S. Gastric Cancer Diagnostics Market Size and Trends 2026 to 2035

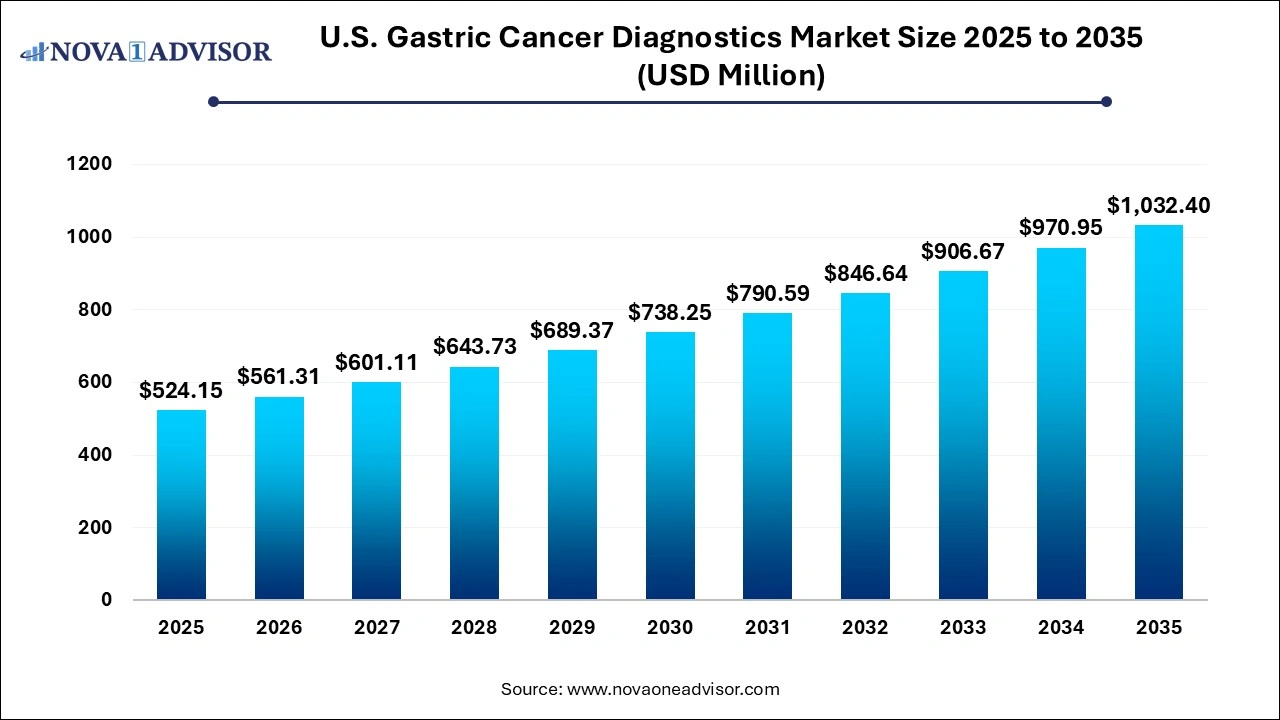

The U.S. gastric cancer diagnostics market size is calculated at USD 524.15 million in 2025, grows to USD 524.15 million in 2025, and is projected to reach around USD 1032.4 million by 2035, and growing at a CAGR of 7.01% from 2026 to 2035. The U.S. gastric cancer diagnostics market growth is driven by rising need for early detection, technological innovations, and increased morbidity and mortality rates due to gastric cancers.

U.S. Gastric Cancer Diagnostics Market Key Takeaways

- By product, the reagents and consumables segment dominated the market with the largest share in 2025.

- By product, the instruments segment is expected to show the fastest growth over the forecast period.

- By disease type, the adenocarcinoma segment held the largest market share in 2025.

- By disease type, the gastric lymphoma segment is expected to show significant growth in the market during the forecast period.

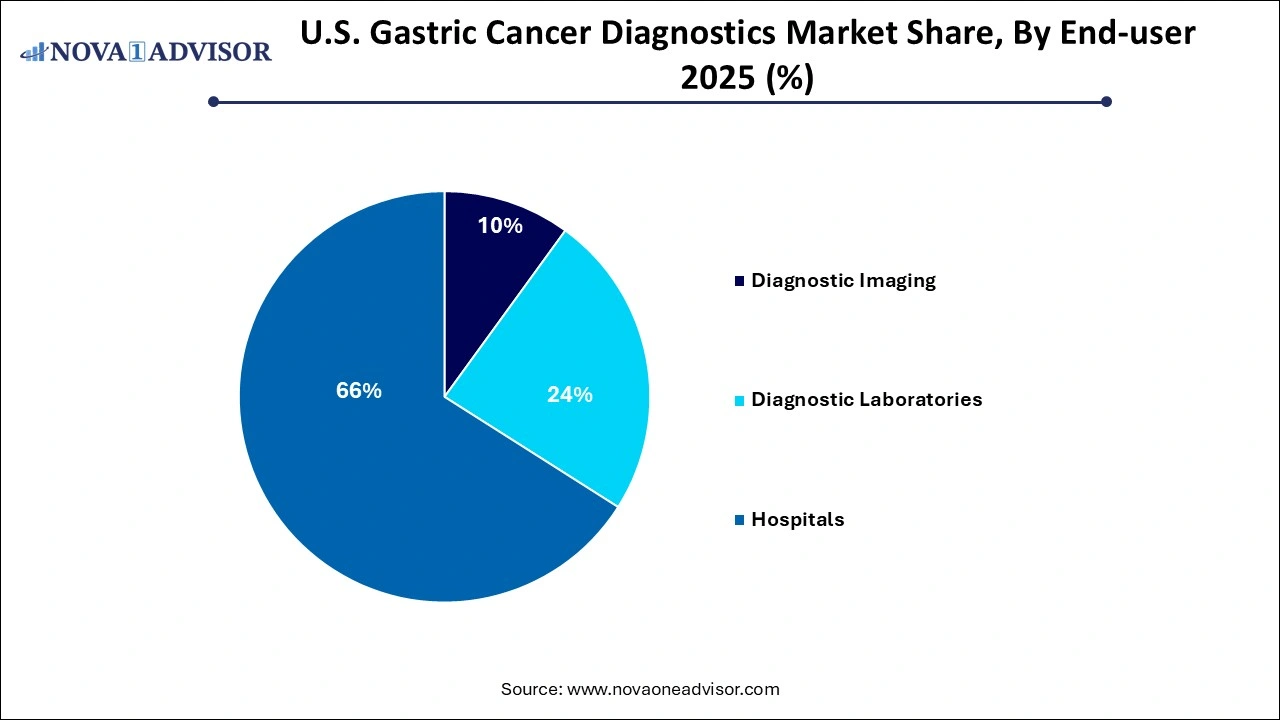

- By end-use, the hospitals segment generated the highest market revenue in 2025.

- By end-use, the diagnostic laboratories segment is expected register the fastest CAGR over the forecast period.

What Fuels Expansion of the U.S. Gastric Cancer Diagnostics Market?

Gastric cancer diagnostics involves a combination of biopsies, endoscopic procedures and imaging tests for diagnosis. One of the most common method used for detection of stomach cancer is upper endoscopy with biopsy which allows doctors to visually examine the lining of the stomach and collect tissue samples for analysis. Additionally, barium swallow X-rays, CT scans, endoscopic ultrasound, staging laparoscopy and blood tests are some of the other diagnostic tools used for gastric cancer diagnosis.

Rising gastric cancer incidences, increasing awareness among patients, improvements in diagnostic technologies and aging population are fuelling the expansion of the U.S. gastric cancer diagnostics market.

What Are the Key Trends in the U.S. Gastric Cancer Diagnostics Market in 2025?

- In May 2025, Cizzle Bio, Inc., entered into an agreement with the Doctors Hospital in the Cayman Islands for providing its exclusive CIZ1B lung cancer test and DEX-G2 gastric cancer test intended for use in hospital’s clinical laboratory. The tests will offer early and precise detection of these cancers for patients.

- In March 2025, the American Gastroenterological Association (AGA) issued updated guidance, Gastric Cancer Screening 2025: Updated American Guidelines & Early Detection for screening and surveillance, identification of individuals at high-risk with focus on effective methods for early gastric cancer detection.

Where is AI Finding Applications in the U.S. Gastric Cancer Diagnostics Market?

Artificial intelligence (AI) in the U.S. gastric cancer diagnostics market is significantly impacting the accuracy and speed of detection. In endoscopy, AI algorithms can be applied for analyzing endoscopic images for early detection of gastric cancer as well as for optimizing narrow-band imaging (NBI) technique to improve the contrast and clarity of images. Digitized pathology slides can be analyzed with AI algorithms for identifying cancerous cells and assessing tumor characteristics. Non-invasive screening methods such as analysis of volatile cancer diagnostics (VOCs) with AI from a patient’s breath can potentially assist in detection of gastric cancer.

Report Scope of U.S. Gastric Cancer Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 561.31 Million |

| Market Size by 2035 |

USD 1032.4 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 7.01% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, Disease Type, End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Exact Sciences Corporation, Freenome Holdings Inc., GE Healthcare, Guardant Health, Illumina, Inc, Natera, Inc,PathAI, Inc, QIAGEN, Thermo Fisher Scientific |

Market Dynamics

Drivers

Rising Gastric Cancer Incidences

According to the American Cancer Society, approximately 30,300 new cases and 10,780 deaths will occur due to stomach cancer in the U.S. in 2025. Various risk factors such as chronic and recurrent Helicobacter pylori infections, Epstein-Barr virus, dietary habits, gastroesophageal reflux, obesity, smoking and genetic associations are listed as key factors leading to gastric cancer incidences in U.S. Increasing emphasis on early detection and promotion of gastric cancer screening programs through initiatives led by the U.S. government agencies like the National Institutes of Health (NIH) as well as increasing investments by private sectors are driving the market growth.

Restraints

Lack of Screening Programs and High Diagnostic Costs

Gastric cancer is a rare disease in the U.S. in comparison to other type of prevalent cancers such as breast, lung, prostate and colorectal cancer. Low rates, difficulties in detection at early stages, and lack of recognition and nationwide screening programs can potentially restrict the market growth. Additionally, high costs of advanced diagnostic technologies such as AI-powered imaging, liquid biopsies and next-generation sequencing (NGS) techniques as well as lack of standardized reimbursement policies can financially limit patient access to these diagnostic procedures.

Opportunities

Advancements in Diagnostic Modalities

To address the issue of late stage diagnosis of gastric cancers in the U.S., various diagnostic companies and research organizations are focused on development of new modalities such as AI-powered endoscopy and liquid biopsies for increasing the detection rates of early gastric cancer (EGC). Rising focus on creating accurate and non-invasive diagnostic tools for gastric cancer diagnostics with deployment in targeted screening programs, especially in high-risk individuals across the U.S. is creating opportunities for market growth.

Segmental Insights

How Reagents and Consumables Segment Dominated the Market in 2025?

By product, the reagents and consumables segment captured the largest market share in 2025. Reagents and consumable products are essential for preparing samples, staining and analysis in several diagnostic procedures such as immunohistochemistry, histopathology and molecular testing. The segment’s market dominance is driven by high and frequent demand in hospitals and diagnostic laboratories, rising adoption of automated platforms, increasing gastric cancer incidences and expanding early detection programs across the U.S. Continuous advancements in development of specialized reagents are encouraging personalized treatment approaches.

By product, the instruments segment is expected to register the fastest growth during the forecast period. Various instruments such as biopsy tools, endoscopic devices, imaging systems like MRI (Magnetic Resonance Imaging) and ultrasound as well as molecular diagnostics equipment used for detecting molecular or genetic markers linked to gastric cancer are deployed for diagnosis purposes. Furthermore, rising demand for advanced endoscopic systems, need for automated pathology instruments, increased emphasis on early detection and focus on developing targeted therapies for improving patient life outcomes are the factors driving the market growth of this segment.

What Made Adenocarcinoma the Dominant Segment in 2024?

By disease type, the adenocarcinoma segment dominated the market with the largest share in 2025. Adenocarcinoma originates from the mucous-producing gland cells present in the deepest lining of the stomach and is one of the most common type of gastric cancer in the U.S., accounting for approximately 90 to 95% of all cases. Specialized diagnostic requirements such as biopsy followed by histopathological examination and molecular profiling like next-generation sequencing (NGS), immunohistochemistry and liquid biopsies for detection of biomarkers to enable targeted therapies for gastric adenocarcinoma are driving the market growth. Additionally, growing focus on personalized medicine, issuance of new clinical guidelines, rising adoption of advanced diagnostic technologies in clinical practice and increased approvals by the FDA are fuelling the market expansion.

- For instance, in October 2024, Roche declared the U.S. Food and Drug Administration’s (FDA’s) approval for its VENTANA CLDN18 (43-14A) RxDx Assay for immunohistochemistry (IHC) companion diagnostic to determine CLDN18 protein expression in tumors of patients with gastric or gastroesophageal junction (GEJ) adenocarcinoma.

By disease type, the gastric lymphoma segment is expected to grow significantly in the market over the forecast period. Gastric lymphoma types such as mucosa-associated lymphoid tissue (MALT) lymphoma and diffuse large B-cell lymphoma (DLBCL) are the most common types and account for almost 5% of all stomach cancers in the U.S. The cancer originates from the lymphatic tissue of the stomach and involves various diagnostic tests such as imaging techniques like PETCT scans, endoscopic biopsies with immunohistochemistry, Helicobacter pylori testing and endoscopic ultrasound (EUS) for specific identification of the extent of the disease. Increasing awareness of these rare type of cancers in oncologists and gastroenterologists as well as rising prevalence, especially in older individuals is creating the need and driving the adoption of advanced diagnostic tools for early detection and timely management of the disease.

Why Did the Hospitals Segment Dominate the Market in 20254?

By end-use, the hospitals segment accounted for the largest market share in 2025. Hospitals offer comprehensive care and specialized services such as initial consultations, access to advanced diagnostic procedures, multidisciplinary team discussions, chemotherapy and others for diagnosis, treatment and management of gastric cancers which drives the dominance of this segment. Advanced diagnostics modalities such as image-guided biopsies and advanced imaging techniques primarily available in hospitals are creating the need for consumables, reagents and other types of services for streamline diagnostic workflows, ultimately boosting the market growth of this segment. Conduction of clinical trials and increased research capabilities of hospitals involving academic and comprehensive cancer centers are creating opportunities for market growth.

By end-use, the diagnostic laboratories segment is expected to expand rapidly during the predicted timeframe. Diagnostic laboratories are central to analysis of specimens and confirmation of gastric cancers through biopsies. Adoption of advanced technologies such as NGS platforms and immunohistochemistry equipment, shift towards liquid biopsies, focus on identification of specific biomarkers such as HER2 expression and Microsatellite Instability (MSI) as well as development of non-invasive diagnostic methods are the factors driving the market growth of this segment. Stringent regulatory guidelines for diagnostic laboratories in the U.S. such as the CLIA certification, integration of R&D and access broad range of diagnostic services provided by diagnostic laboratories are contributing to the market expansion.

Country-Level Analysis

U.S. is a major contributor to the gastric cancer diagnostics market. Presence of advanced healthcare infrastructure with state-of-the-art diagnostic modalities, increasing number of sophisticated diagnostic service providers, integration of digital technologies, rising healthcare expenditure and growing geriatric population are driving the market growth. Diagnostic companies in the U.S. are focused on advancing and developing innovative techniques and tools for early detection of gastric cancer to address unmet medical needs. Supportive regulatory frameworks, government initiatives and increased focus on patient education through public health campaigns are creating a favourable environment for market growth in the U.S.

Some of The Prominent Players in The U.S. Gastric Cancer Diagnostics Market Include:

- Exact Sciences Corporation

- Freenome Holdings Inc.

- GE Healthcare

- Guardant Health

- Illumina, Inc

- Natera, Inc

- PathAI, Inc

- QIAGEN

- Thermo Fisher Scientific

Recent Developments in the U.S. Gastric Cancer Diagnostics Market

- In March 2025, Paige, a leading provider of next-generation AI technology, introduced its Paige GI Suite which is an AI-powered diagnostic application developed for assisting pathologists in detection and assessment of over 40 GI-related conditions in the gastrointestinal (GI) tract such as Barrett’s oesophagus, inflammatory bowel disease, cancers and gastritis.

- In January 2025, Geneoscopy Inc., a life sciences company, successfully raised $105 million in a Series C funding round led by Bio-Rad Laboratories and others. The funding will support the launch of Colosense which is a next-generation, non-invasive gastrointestinal diagnostic test designed for screening colorectal cancer.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Gastric Cancer Diagnostics Market.

By Product

- Reagents & Consumables

- Instruments

By Disease Type

- Adenocarcinoma

- Gastric lymphoma

- Others

By End-use

- Diagnostic Imaging

- Diagnostic Laboratories

- Hospitals