U.S. Genome Editing Market Size and Growth 2026 to 2035

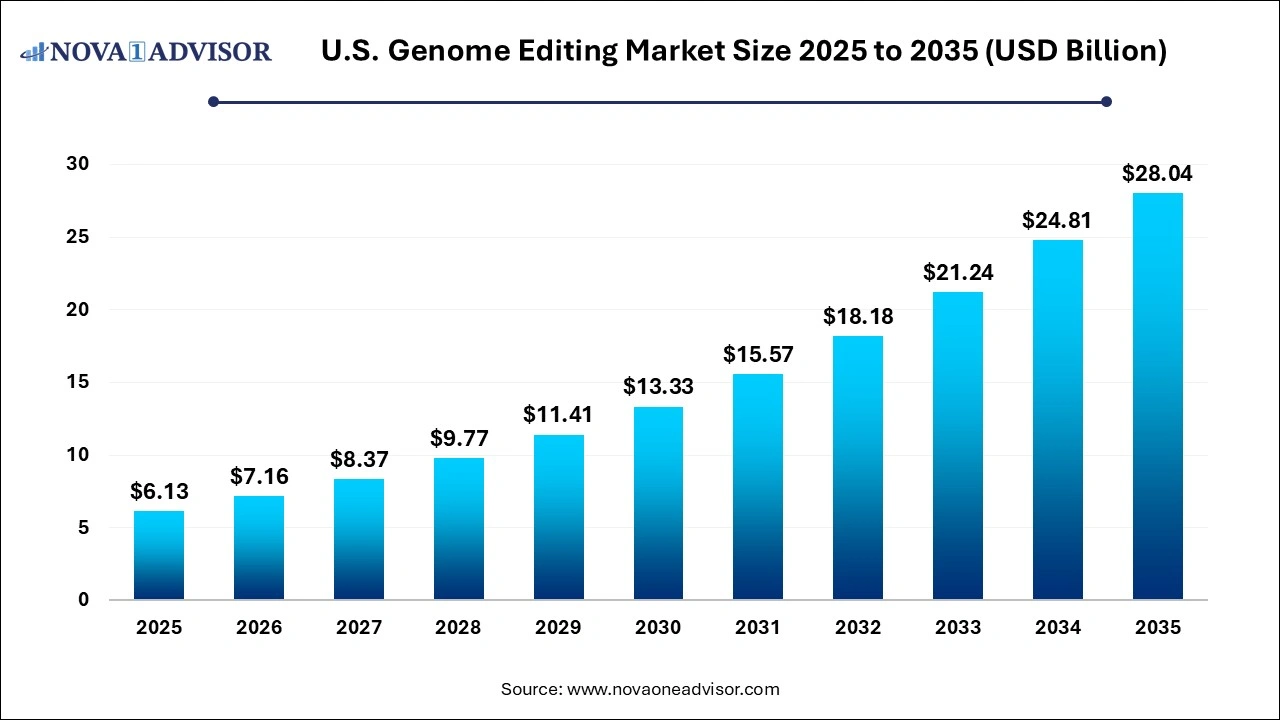

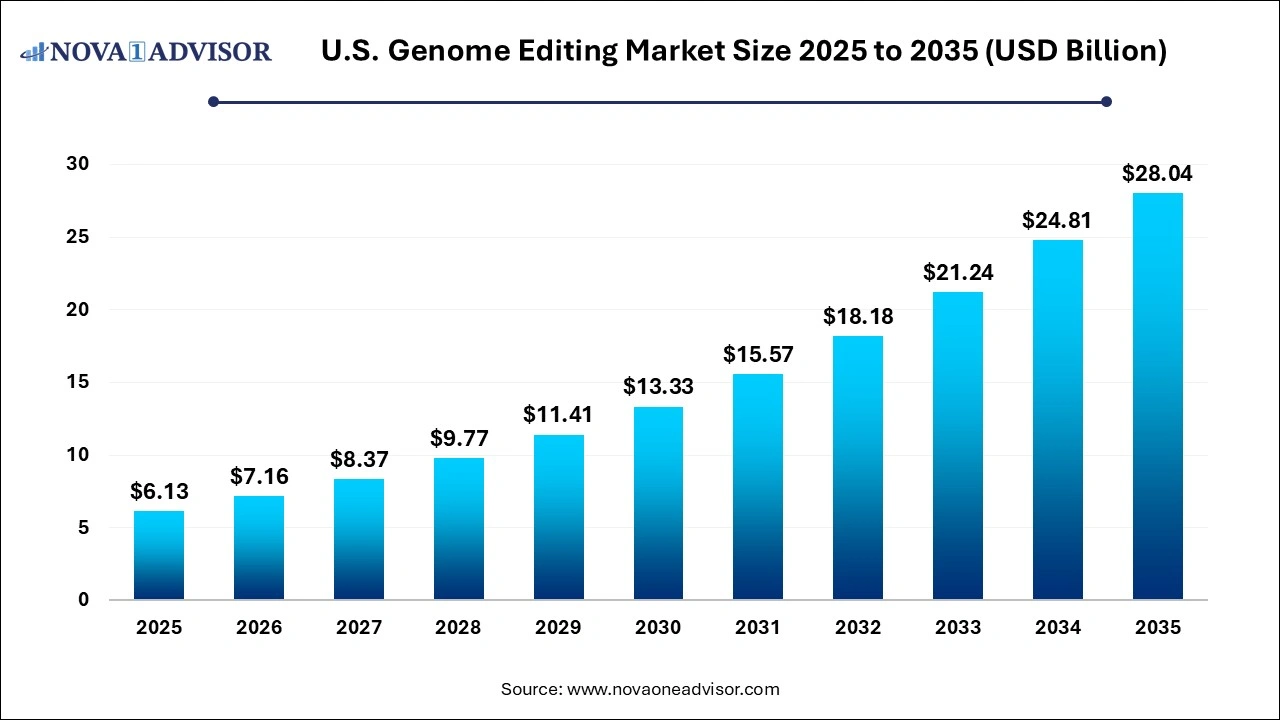

The U.S. genome editing market size was estimated at USD 6.13 billion in 2025 and is projected to hit around USD 28.04 billion by 2035, growing at a CAGR of 16.42% during the forecast period from 2026 to 2035.

U.S. Genome Editing Market Key Takeaways:

- Biotechnology and pharmaceutical companies dominated the market and accounted for the largest revenue share of 53% in 2025.

- Academic and research institutions are expected to grow at the fastest CAGR of 18.9% during the forecast period.

- Ex-vivo dominated the market and accounted for the largest revenue share of 51% in 2025.

- In-vivo segment is expected to grow at the fastest CAGR of 19.4% during the forecast period.

- CRISPR/Cas9 dominated the market and held the largest revenue share of 42% in 2025 and is expected to grow at the fastest CAGR during the forecast period.

- TALENs held the second-largest market share during the base year.

- Contract dominated the market with the largest revenue share of 66% in 2024 and is expected to grow at the fastest CAGR during the forecast period.

- In-house is projected to experience significant growth in the upcoming years.

- Genetic engineering dominated the market and held the highest revenue share of 69% in 2025 and is expected to grow at the fastest CAGR during the forecast period.

- Clinical application is expected to grow at the second fastest rate of CAGR 12.8% during the forecast period.

U.S. Genome Editing Market Overview

The U.S. genome editing market stands at the frontier of biomedical innovation, representing a paradigm shift in how scientists manipulate the genetic blueprint of living organisms. Genome editing refers to a suite of technologies that allow precise, efficient, and targeted modifications to DNA. Among these, CRISPR/Cas9 has emerged as the most transformative, enabling unprecedented control over gene expression and repair. These technologies have unlocked new opportunities in genetic disease correction, oncology, regenerative medicine, agricultural biotechnology, and synthetic biology.

The U.S. is the global epicenter for genome editing research and commercialization, hosting a majority of the world’s top biotech firms, academic research institutions, and clinical trial pipelines. Aided by progressive regulatory policies, strong venture capital support, and a robust intellectual property ecosystem, the U.S. market continues to attract substantial investment. From groundbreaking clinical trials for sickle cell disease and beta-thalassemia to agricultural innovations involving drought-resistant crops, genome editing has become a keystone of next-generation healthcare and sustainability solutions.

What sets the U.S. market apart is its dynamic integration of research with translational outcomes. Leading organizations such as Editas Medicine, Intellia Therapeutics, CRISPR Therapeutics, and Beam Therapeutics are pushing the envelope on both somatic and germline editing applications. Simultaneously, collaborations between universities like MIT and Stanford and federal agencies such as the NIH and DARPA continue to incubate cutting-edge solutions, positioning the market for sustained long-term growth.

Major Trends in the U.S. Genome Editing Market

-

CRISPR-Based Therapies in Clinical Trials: Clinical-stage therapies using CRISPR/Cas9 are progressing, with several entering Phase II/III for diseases like sickle cell and hereditary angioedema.

-

Base and Prime Editing Evolution: New CRISPR variants, including base editing and prime editing, are enhancing precision and reducing off-target effects, expanding therapeutic windows.

-

Ex-vivo Cell Therapies Expansion: Ex-vivo editing, particularly for CAR-T cell Therapy, is seeing increasing adoption in oncology pipelines across major pharmaceutical firms.

-

Synthetic Biology Convergence: Genome editing is merging with synthetic biology to create programmable cells and organisms with novel functions.

-

Non-viral Delivery Mechanisms: Lipid nanoparticles and electroporation are gaining favor over viral vectors, reducing immunogenic risks and improving scalability.

-

Increased Academic Licensing Deals: Universities are actively licensing IP for CRISPR tools, boosting commercialization potential for startups and biotechs.

-

Regulatory Advancements: The FDA is refining its approach to genome editing oversight, signaling greater clarity for therapeutic approvals.

-

Agri-biotech Resurgence: Edited crops such as CRISPR-modified tomatoes and mushrooms are gaining USDA clearance, enhancing food resilience and sustainability.

U.S. Genome Editing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 7.16 Billion |

| Market Size by 2035 |

USD 28.04 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 16.42% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology, Delivery Method, Mode, Application, End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units)

|

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Merck KGaA; Cibus; Recombinetics, Inc.; Sangamo; Editas Medicine; Precision Biosciences; CRISPR Therapeutics; Intellia Therapeutics, Inc.; Caribou Biosciences, Inc.; Cellectis S.A.; GenScript; AstraZeneca; Integrated DNA Technologies, Inc.; Egenesis Inc.; New England Biolabs; OriGene Technologies, Inc.; Lonza; Thermo Fisher Scientific, Inc. |

U.S. Genome Editing Market Segmental Insights

By End-use Insights

Biotechnology and pharmaceutical companies dominate the market, leveraging genome editing for drug discovery, target validation, and therapy development. Companies like Editas Medicine, Intellia, and CRISPR Therapeutics have robust pipelines for both monogenic and complex disorders. Their integration of genome editing into the drug development workflow from hit identification to IND submission ensures a seamless path to market. These firms are also partnering with big pharma, such as Regeneron and Novartis, to expand their therapeutic footprint.

Academic and government research institutions are the fastest-growing users, supported by federal grants and national research priorities. Universities are leveraging genome editing to explore gene function, develop disease models, and investigate regenerative pathways. The NIH's Somatic Cell Genome Editing (SCGE) program is a prime example, funding numerous U.S.-based institutions to develop safer and more efficient editing tools. This has created a vibrant ecosystem of discovery that fuels both foundational knowledge and translational innovation.

By Delivery Method Insights

Ex-vivo delivery methods currently dominate, particularly in cell-based therapies. In ex-vivo approaches, cells are extracted, genetically modified in a lab, and then reintroduced into the patient. This method allows for better quality control and precise editing before cell transplantation. CAR-T therapies and stem cell-based interventions often rely on this method. In the U.S., ex-vivo editing has been instrumental in hematological cancer treatments, with companies like Sangamo and Intellia using electroporation and viral vectors to deliver editing components into cells.

In-vivo delivery is emerging as the fastest-growing segment, fueled by the push for minimally invasive, systemic therapies. Companies are experimenting with lipid nanoparticles (LNPs), AAV vectors, and even engineered exosomes to deliver CRISPR components directly into tissues. Notably, Intellia Therapeutics has reported success with systemic CRISPR delivery for treating transthyretin amyloidosis (ATTR), a breakthrough that marked the world’s first clinical validation of in-vivo genome editing. The ability to reach hard-to-access tissues like the liver, lung, and brain makes this method a game-changer for rare and complex diseases.

By Technology Insights

CRISPR/Cas9 technology dominated the market, driven by its simplicity, cost-effectiveness, and precision. Widely adopted across both research and clinical settings, CRISPR/Cas9 enables double-stranded DNA breaks that facilitate gene knockout or insertion. This system has found applications in human disease modeling, drug discovery, and therapeutic editing. The U.S. biotech sector has embraced CRISPR as the gold standard, with several companies—such as Editas Medicine and CRISPR Therapeutics—advancing therapies based on this platform. Its scalability and adaptability to multiplex editing make it the most commercially viable technology to date.

Prime editing and base editing technologies are among the fastest-growing segments, often grouped under “Others” in technology classification. These next-generation tools offer the ability to make single nucleotide substitutions without inducing double-strand breaks, thereby minimizing genotoxicity. For instance, Beam Therapeutics is using base editing to develop treatments for sickle cell disease and alpha-1 antitrypsin deficiency. These tools are especially attractive for treating diseases caused by point mutations, which account for nearly two-thirds of genetic disorders. As academic institutions partner with biotech firms to translate these innovations, the segment is poised for explosive growth.

By Mode Insights

In-house mode of operation dominated the market, particularly among leading pharmaceutical and biotech companies that maintain internal R&D units. Owning the technology allows for greater control over the IP landscape, rapid iteration, and integration with proprietary data platforms. Major players like CRISPR Therapeutics and Beam Therapeutics follow this model, developing therapies from the ground up and advancing them through clinical trials. These firms often collaborate with academic labs for discovery while keeping development in-house to retain strategic flexibility.

Contract mode is the fastest-growing, driven by the need to reduce time-to-market and operational overhead. As the ecosystem matures, smaller firms and academic startups are turning to Contract Research Organizations (CROs) with specialized genome editing services. This model allows stakeholders to outsource specific components such as vector development, cell engineering, or preclinical validation without incurring long-term infrastructure costs. U.S.-based CROs like Charles River Laboratories and Labcorp are expanding their gene editing services to cater to this growing demand.

By Application Insights

Genetic engineering dominated the market and held the highest revenue share of 69% in 2024 and is expected to grow at the fastest CAGR during the forecast period. This is attributed to the fast-paced advancements in gene and stem cell therapy. CRISPR gene editing’s application in human induced pluripotent stem cells (hiPSCs) has significant implications for treating various diseases. Cell line engineering, a technique that alters cell genetics to modify or create organism traits, is widely used in biotechnology, gene therapy, and drug development research. It holds the potential to revolutionize medicine. The cell line engineering market is poised for rapid expansion due to technological progress and increasing demand for customized medical treatments.

Clinical application is expected to grow at the second fastest rate of CAGR 12.8% during the forecast period. The efficiency of CHO cell lines, often used in large-molecule medicine production, is being enhanced by CRISPR technology. This has propelled the biopharmaceutical industry forward, boosting the genome editing market. Genome editing technologies and genetic engineering hold substantial growth potential in medical areas such as diagnostics and drug development. For example, the effectiveness and safety of UCART123 are being evaluated in a clinical trial funded by Cellectis S.A. for patients with relapsed/refractory acute myeloid leukemia using TALEN gene-editing technology. The application of genome editing in drug discovery and development is expected to significantly increase due to the growing demand for innovative, powerful treatments for various diseases. Genome editing can create new medicines that target genes or gene pathways, potentially leading to more efficient and specialized disease treatments.

Country-Level Insights

The United States holds a commanding position in the global genome editing landscape due to its unrivaled scientific infrastructure, regulatory sophistication, and venture-backed biotech innovation. Federal initiatives like the NIH SCGE program and DARPA’s Safe Genes project demonstrate national-level commitment to advancing genome editing responsibly. In parallel, regulatory bodies like the FDA have provided frameworks for preclinical safety assessments, manufacturing standards, and clinical trial design specific to gene editing therapies.

U.S. states such as Massachusetts, California, and North Carolina serve as biotech hubs, housing top-tier universities, incubators, and venture funds. The U.S. market benefits from a mature patent framework that fosters innovation and safeguards intellectual property, enabling robust commercialization strategies. Moreover, strong public-private partnerships continue to accelerate clinical translation, with patients gaining access to cutting-edge therapies faster than ever before.

U.S. Genome Editing Market Recent Developments

-

March 2025: Editas Medicine announced a strategic leadership reshuffle to expedite its clinical programs, especially EDIT-301, a CRISPR therapy targeting sickle cell disease.

-

February 2025: Intellia Therapeutics received FDA fast-track designation for its in-vivo CRISPR therapy for hereditary angioedema, showing positive interim Phase II data.

-

January 2025: Beam Therapeutics began Phase I/II clinical trials for BEAM-101, a base editing therapy aimed at reactivating fetal hemoglobin in sickle cell patients.

-

November 2024: CRISPR Therapeutics and Vertex Pharmaceuticals submitted an IND for a new ex-vivo therapy targeting Type 1 diabetes using edited pancreatic islets.

U.S. Genome Editing Market Top Key Companies:

- Merck KGaA

- Cibus

- Recombinetics, Inc.

- Sangamo

- Editas Medicine

- Precision Biosciences

- CRISPR Therapeutics

- Intellia Therapeutics, Inc.

- Caribou Biosciences, Inc.

- Cellectis S.A.

- GenScript

- AstraZeneca

- Integrated DNA Technologies, Inc.

- Egenesis Inc.

- New England Biolabs

- OriGene Technologies, Inc.

- Lonza

- Thermo Fisher Scientific, Inc.

U.S. Genome Editing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Genome Editing market.

By Technology

- Meganucleases

- (CRISPR)/Cas9

- TALENs/MegaTALs

- ZFN

- Others

By Delivery Method

By Mode

By Application

- Genetic Engineering

- Cell Line Engineering

- Animal Genetic Engineering

- Plant Genetic Engineering

- Others

- Clinical Applications

- Diagnostics

- Therapy Development

By End-use

- Biotechnology & Pharmaceutical Companies

- Academic & Government Research Institutes

- Contract Research Organizations