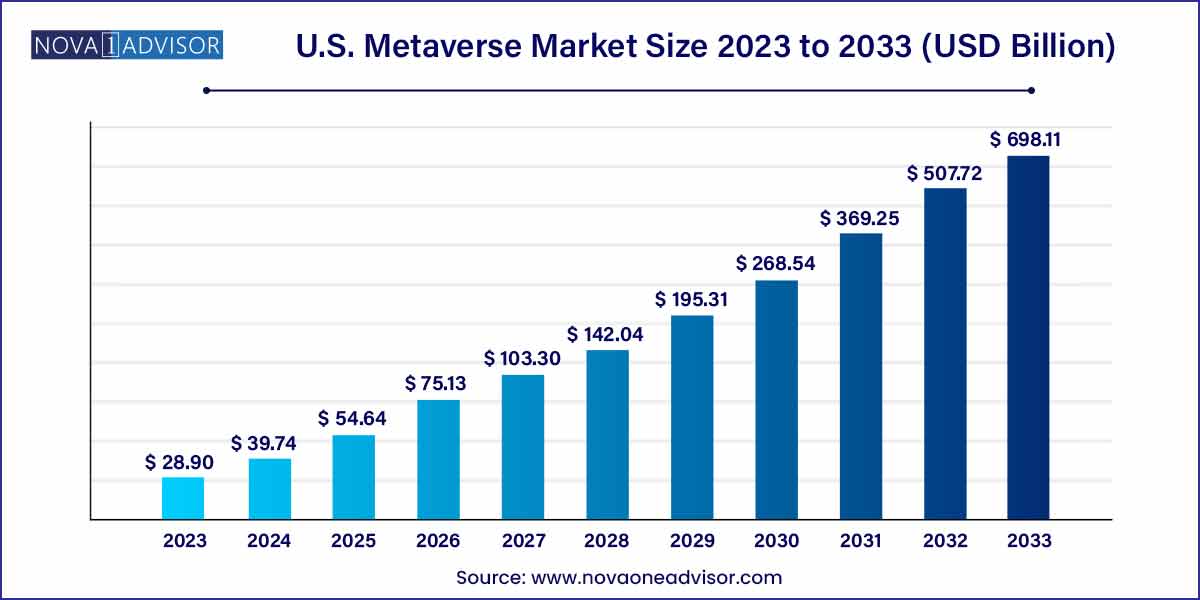

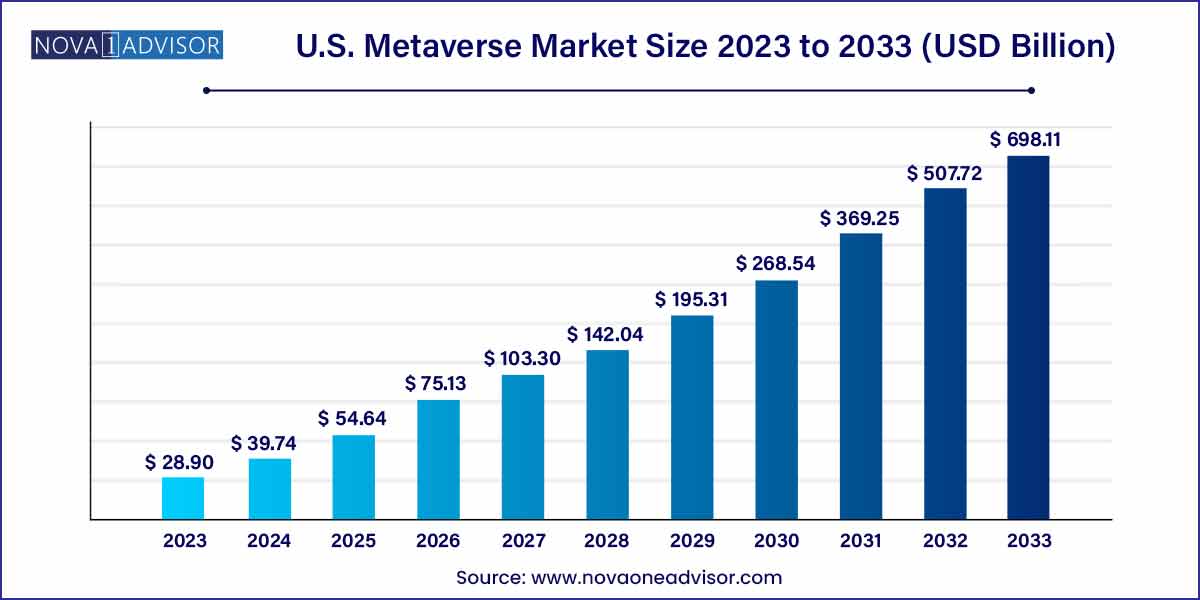

The U.S. metaverse market size was estimated at USD 28.90 billion in 2023 and is projected to hit around USD 698.11 billion by 2033, growing at a CAGR of 37.5% during the forecast period from 2024 to 2033.

Key Takeaways:

- The software segment accounted for over 39.9% of the U.S. market in 2023

- The services segment is expected to grow considerably over the forecast period.

- The desktop segment accounted for the largest revenue share of over 41.19% in 2023

- The headsets segment is expected to propel considerably over the forecast period.

- The virtual reality (VR) and augmented reality (AR) technology contributed to the largest revenue share of over 34.9% in 2023.

- The gaming segment held the leading revenue share of over 26.9% of the U.S. market in 2023

- The BFSI industry is assessed to account for the largest revenue in 2023

- The tourism & hospitality industry is expected to offer numerous growth opportunities to the stakeholders over the forecast period.

Market Overview

The U.S. Metaverse Market stands at the forefront of digital transformation, fusing augmented reality (AR), virtual reality (VR), blockchain, and artificial intelligence (AI) to create immersive and interconnected virtual environments. The metaverse is not a single platform or product, but rather a convergence of technologies enabling persistent, shared, and decentralized 3D virtual worlds.

Within the U.S., a market deeply rooted in tech innovation and consumer adoption, the metaverse has become a focal point across sectors like gaming, entertainment, retail, finance, education, healthcare, and defense. With the proliferation of immersive hardware, high-speed networks, and interoperable digital platforms, companies are investing billions to build virtual ecosystems that extend physical presence into the digital realm.

The U.S. government and private entities are also exploring metaverse technologies for training simulations, virtual defense environments, and collaborative R&D, signifying long-term utility beyond entertainment. From Silicon Valley giants like Meta, Google, and Apple, to blockchain innovators and AR/VR startups, the metaverse landscape in the U.S. reflects a mix of established tech powerhouses and agile disruptors.

Major Trends in the Market

-

Convergence of AR/VR and Blockchain: Development of decentralized virtual platforms secured by blockchain and powered by immersive XR interfaces.

-

Enterprise and Industrial Metaverse Adoption: Companies creating digital twins for remote collaboration, training, and product prototyping.

-

Rise of Creator Economies: Tools and platforms enabling users to build, sell, and monetize digital assets, avatars, and experiences.

-

Immersive Retail and eCommerce: Retailers adopting 3D storefronts, virtual try-ons, and NFT integrations to enhance shopping experiences.

-

Advances in AI-driven Avatars and NPCs: Integration of natural language processing and machine learning into metaverse inhabitants.

-

Shift Toward Interoperable Platforms: Focus on cross-platform functionality and persistent identity across multiple virtual worlds.

-

Digital Real Estate Boom: Tokenization and leasing of virtual land within platforms like Decentraland and The Sandbox.

| Report Attribute |

Details |

| Market Size in 2024 |

USD 39.74 Billion |

| Market Size by 2033 |

USD 698.11 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 37.5% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, platform, technology, application, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Meta Platforms, Inc.; NVIDIA Corporation; Epic Games, Inc.; Roblox Corporation; Unity Technologies, Inc.; Active Theory; Microsoft; Google LLC; Inoru; Maticz Technologies Private Limited |

Key Market Driver: Expansion of Immersive Digital Ecosystems

The primary driver fueling the U.S. metaverse market is the growing demand for immersive digital ecosystems that replicate real-world experiences in virtual environments. Consumers and businesses alike are seeking platforms that provide social interaction, commerce, entertainment, and work collaboration without the physical limitations of geography or infrastructure.

For instance, Fortnite, beyond being a game, has evolved into a platform for live concerts, film screenings, and digital fashion drops. Companies like Nike and Gucci are experimenting with metaverse showrooms and limited-edition digital wearables. Similarly, the education sector is adopting platforms like Roblox Education and ENGAGE VR for virtual learning and student collaboration.

The acceleration of remote work and hybrid lifestyles post-pandemic has significantly enhanced the relevance of metaverse tools in daily life, driving enterprise-level investments in virtual conferencing, training modules, and workplace simulation environments.

Key Market Restraint: Interoperability and Standardization Challenges

A pressing restraint in the U.S. metaverse market is the lack of standardization across platforms, leading to interoperability challenges. Unlike the internet built on common protocols (HTTP, TCP/IP) metaverse platforms today often operate as closed ecosystems with proprietary avatars, currencies, and assets.

This fragmentation makes it difficult for users to maintain a persistent identity or carry digital assets between different virtual worlds. For developers and creators, lack of cross-platform SDKs and APIs creates inefficiencies and limits content scalability.

Moreover, regulatory ambiguity around digital asset ownership, user data governance, and cross-border virtual commerce adds further complexity. These challenges necessitate collaboration between tech providers, policymakers, and standards organizations to develop open metaverse protocols similar to W3C for the web.

One of the most transformative opportunities lies in the integration of metaverse technologies in enterprise collaboration and healthcare delivery. Enterprises are adopting metaverse platforms for remote meetings, product design simulations, employee onboarding, and virtual collaboration, enabling improved productivity and cost savings.

In healthcare, immersive environments are being used for surgical simulations, therapy, rehabilitation, and patient education. For instance, platforms like Osso VR and XRHealth are developing FDA-compliant immersive healthcare applications. With digital health and telemedicine gaining traction, the metaverse is poised to offer next-generation interfaces for remote care, virtual clinics, and mental health treatment.

The potential to blend real-time biometric data with interactive virtual settings is opening new paradigms in personalized medicine, chronic disease management, and patient engagement.

Segmental Analysis

By Product

Infrastructure dominates the U.S. metaverse market, forming the digital backbone required to run immersive, persistent, and responsive environments. This includes high-performance chips and processors (e.g., NVIDIA Omniverse, Qualcomm Snapdragon XR2), low-latency network capabilities (5G/6G), cloud and edge computing for real-time rendering, and cybersecurity layers to protect user data and digital assets.

Software is the fastest-growing product category, especially with the rise in asset creation tools, virtual platforms, and avatar development suites. Platforms like Unity and Unreal Engine are empowering creators with advanced rendering tools and APIs, while startups like Ready Player Me offer customizable, cross-platform avatars. The demand for intuitive, low-code/no-code tools for metaverse content creation is surging.

Desktop platforms dominate current usage due to their accessibility, processing power, and integration with professional software suites. Many enterprise and gaming platforms first launch desktop-based versions before extending to other devices.

Headsets are the fastest-growing platform, driven by the surge in affordable XR devices like Meta Quest 3, PlayStation VR2, and Apple Vision Pro. These devices offer unmatched immersion, spatial awareness, and physical interaction. As headset prices drop and field-of-view, battery life, and processing improve, adoption is expected to broaden across both consumer and enterprise segments.

By Technology

Virtual Reality (VR) and Augmented Reality (AR) dominate the metaverse tech stack, enabling fully immersive and overlay-driven experiences. AR is particularly popular for mobile and retail applications, while VR powers gaming, simulation, and telepresence solutions.

Blockchain is rapidly growing, enabling decentralized ownership, identity, and value exchange in the metaverse. Use cases include NFTs for digital ownership, cryptocurrencies for in-world transactions, and smart contracts for creator royalties and DAO governance. Platforms like Decentraland, The Sandbox, and Axie Infinity are blockchain-native metaverse applications reshaping digital economies.

By Application

Gaming dominates the U.S. metaverse application landscape. Platforms like Roblox, Fortnite, and Rec Room attract millions of users with social gaming experiences and user-generated content. The convergence of gaming, social media, and live entertainment within the same platform is setting a precedent for multi-purpose virtual worlds.

Online shopping and digital marketing are the fastest-growing applications, with major retailers experimenting in virtual showrooms, try-on experiences, and NFT commerce. Companies like Walmart and Nike have launched branded metaverse experiences, while advertising agencies explore 3D billboards, branded events, and influencer avatars to reach Gen Z consumers in immersive settings.

By End-use

Media and entertainment dominate the end-use segment. Metaverse applications in film previews, music concerts (e.g., Travis Scott’s Fortnite concert), virtual fan meetups, and 3D streaming are drawing huge audiences. Celebrities and influencers are creating digital twins to host events and sell virtual merchandise.

Education and healthcare are the fastest-growing sectors. Universities and edtech platforms are launching virtual campuses with real-time lectures, labs, and peer collaboration tools. In healthcare, therapeutic applications, virtual surgical training, and remote consultations in 3D environments are reshaping patient interaction and clinical workflows.

Country-Level Analysis

In the United States, the metaverse market is bolstered by the presence of major tech firms, robust venture capital funding, and a digitally native consumer base. Companies like Meta, Microsoft, Apple, NVIDIA, Epic Games, Unity, and Roblox are investing heavily in platform development, hardware innovation, and content ecosystems.

Regulatory bodies are actively evaluating digital identity standards, cross-platform taxation, and virtual commerce regulation, signaling institutional recognition of the metaverse's economic impact.

Cultural trends like remote work, esports, online learning, and digital collectibles have embedded metaverse behaviors into everyday life. The U.S. is also a leading exporter of metaverse content, influencing global adoption and innovation through platforms headquartered domestically.

Recent Developments

-

April 2025 – Meta Platforms Inc. announced the beta launch of Horizon Workrooms 2.0, a VR-enabled workplace with AI avatars, spatial audio, and Zoom integration.

-

March 2025 – Apple Inc. revealed new software features for Vision Pro, enabling immersive e-commerce and live sports viewing partnerships with the NBA and Amazon.

-

February 2025 – Epic Games raised $1.2 billion in new funding to expand Unreal Engine capabilities for metaverse content creation, with a focus on digital twins and persistent experiences.

-

January 2025 – Roblox Corporation partnered with 10+ U.S. universities to deploy immersive educational environments supporting STEM education and social learning.

-

December 2024 – NVIDIA launched Omniverse Cloud for creators and enterprises, providing tools to simulate real-world physics, lighting, and AI avatars in virtual workspaces.

- Meta Platforms, Inc.

- NVIDIA Corporation

- Epic Games, Inc.

- Roblox Corporation

- Unity Technologies, Inc.

- Active Theory

- Google LLC

- Microsoft Corporation

- Inoru

- Maticz Technologies Private Limited

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Metaverse market.

By Product

- Infrastructure

- Chips & Processors

- Network Capabilities

- Cloud & Edge Infrastructure

- Cybersecurity

- Hardware

- Holographic Displays

- eXtended Reality (XR) Hardware

- Haptic Sensors & Devices

- Smart Glasses

- Omni Treadmills

- AR/VR Devices

- Others

- Software

- Asset Creation Tools

- Programming Engines

- Virtual Platforms

- Avatar Development

- Services

- User Experiences (Events, Gaming, etc.)

- Asset Marketplaces

- Financial Services

By Platform

By Technology

- Blockchain

- Virtual Reality (VR) & Augmented Reality (AR)

- Mixed Reality (MR)

- Others

By Application

- Gaming

- Online Shopping

- Content Creation & Social Media

- Events & Conference

- Digital Marketing (Advertising)

- Testing And Inspection

- Others

By End-use

- Aerospace & Defense

- Education

- Healthcare

- Tourism And Hospitality

- BFSI

- Retail

- Media & Entertainment

- Automotive

- Others