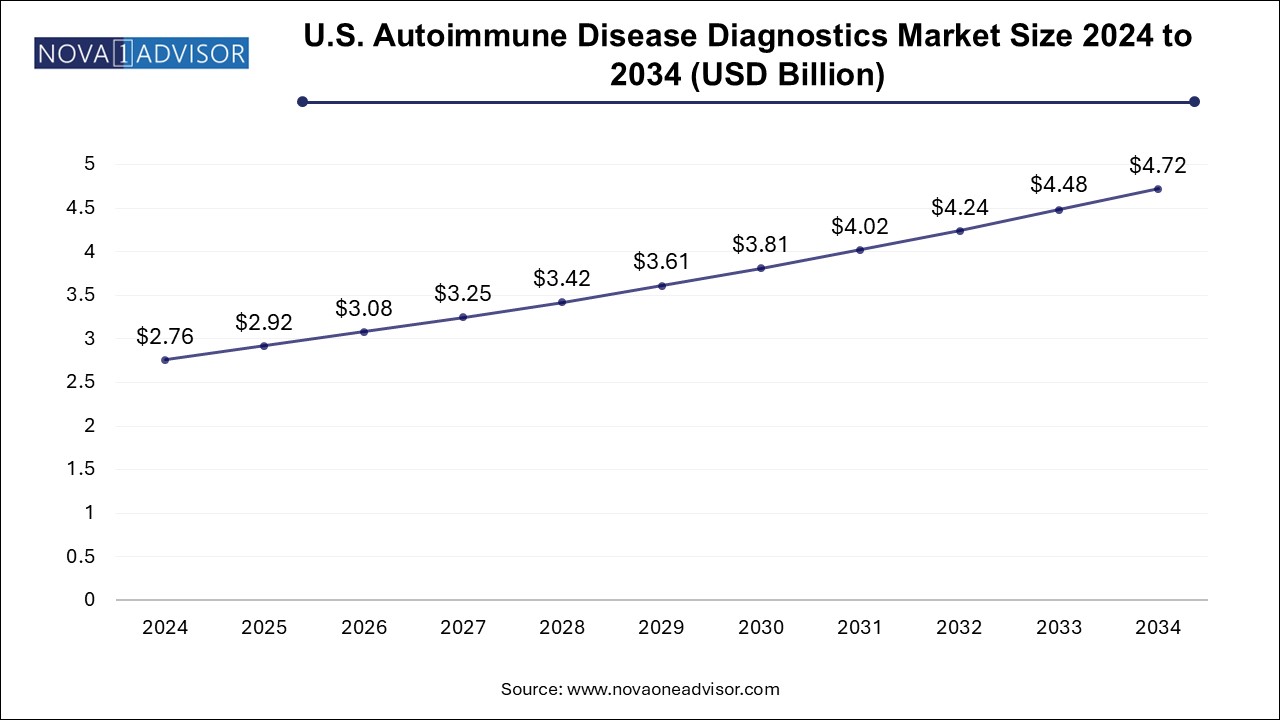

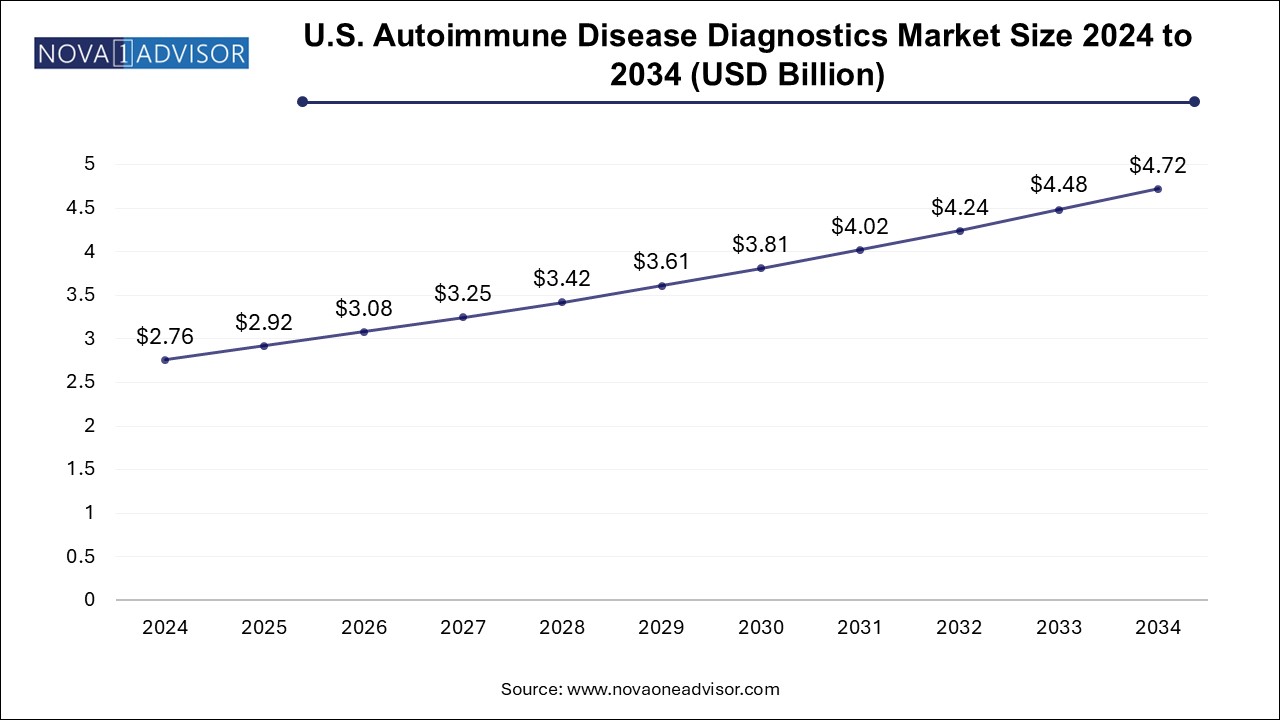

U.S. Autoimmune Disease Diagnostics Market Size and Growth

The U.S. autoimmune disease diagnostics market size was exhibited at USD 2.76 billion in 2024 and is projected to hit around USD 4.72 billion by 2034, growing at a CAGR of 5.4% during the forecast period 2025 to 2034.

Market Overview

The U.S. autoimmune disease diagnostics market stands as a critical component of the country's broader in vitro diagnostics (IVD) and immunology sectors. Autoimmune diseases—disorders in which the immune system mistakenly attacks the body’s own tissues—affect nearly 24 million people in the United States, with many more potentially undiagnosed. Conditions such as rheumatoid arthritis, systemic lupus erythematosus (SLE), multiple sclerosis, Hashimoto’s thyroiditis, and Type 1 diabetes have become increasingly prevalent, emphasizing the need for timely and accurate diagnosis.

Given the nonspecific and overlapping symptoms of autoimmune diseases, diagnosing these conditions remains complex and often delayed. Early-stage indicators can mimic infections, allergies, or even psychological disorders. The diagnostic process typically involves a combination of serological tests (e.g., ANA, CRP, RF), clinical assessments, imaging, and patient history, often requiring multiple consultations before a definitive diagnosis is reached. This diagnostic ambiguity underscores the importance of highly sensitive, specific, and standardized testing protocols.

The market in the U.S. is buoyed by rising awareness among both physicians and patients, increased incidence rates, an aging population, and continued innovation in diagnostic assay technologies. In particular, the integration of multiplexed autoantibody panels, next-generation sequencing, and AI-supported decision algorithms is redefining autoimmune diagnostics. Furthermore, government funding for autoimmune disease research, favorable reimbursement policies for diagnostic procedures, and the country’s strong diagnostic infrastructure contribute to the market's maturity and growth potential.

With chronic autoimmune diseases now ranked among the top ten leading causes of death in women under the age of 65 in the U.S., the focus on precision diagnostics and early intervention has never been more urgent. As biopharmaceutical pipelines expand into autoimmune therapeutics, diagnostics are becoming even more essential in patient stratification and monitoring treatment efficacy.

Major Trends in the Market

-

Rise in Autoimmune Disease Prevalence: Increasing incidence of both systemic and organ-specific autoimmune diseases, particularly among women.

-

Multiplex Assay Adoption: Use of multiplex platforms for simultaneous detection of multiple autoantibodies improving diagnostic efficiency.

-

Personalized Diagnostics Integration: Tailored diagnostic panels aligned with genetic predisposition and clinical presentation.

-

AI and Digital Pathology: Machine learning aiding in pattern recognition, particularly in ANA immunofluorescence and image-based diagnostics.

-

Shift Toward Early Screening Programs: Preventive healthcare policies encouraging testing in high-risk populations.

-

Increased Use of Point-of-Care Testing (POCT): Portable platforms gaining traction for RA and SLE biomarker detection outside centralized labs.

-

Growth in Molecular and Genomic Testing: Inclusion of gene expression and epigenetic markers as part of autoimmune disease risk assessment.

-

Strategic Collaborations: Diagnostic firms partnering with research institutes and biopharma companies to co-develop companion diagnostics.

Report Scope of U.S. Autoimmune Disease Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.92 Billion |

| Market Size by 2034 |

USD 4.72 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Test Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Abbott Laboratories; Biomerieux; Trinity Biotech; Bio-rad Laboratories; Thermo Fisher Scientific; BD Biosciences; Beckman Coulter; F. Hoffmann-La Roche Ltd.; Quest Diagnostics Inc.; Siemens Healthcare GmbH; Werfen |

Market Driver: Rising Prevalence of Autoimmune Disorders Across the U.S.

A major driver of the U.S. autoimmune disease diagnostics market is the escalating prevalence and recognition of autoimmune disorders. According to data from the National Institutes of Health (NIH), autoimmune diseases collectively affect more Americans than cancer or heart disease. This burden is particularly high among women, with certain conditions like lupus and multiple sclerosis showing significantly higher incidence in female populations.

Environmental factors, genetic predisposition, and lifestyle changes are contributing to this surge. Simultaneously, increased awareness and improved healthcare access are allowing more cases to be identified earlier than in previous decades. The growing number of patients requiring regular autoimmune screenings has driven demand for diagnostic solutions that are both reliable and scalable. This driver is further amplified by improved insurance coverage for autoimmune testing and the rise of specialty autoimmune diagnostic labs across the country.

Market Restraint: Diagnostic Complexity and Risk of False Positives

Despite strong demand, the market is hindered by diagnostic complexity and a high rate of false-positive results, particularly in serological testing. Autoimmune conditions often present with overlapping symptoms, and antibody-based assays—such as ANA and RF—can yield positive results in healthy individuals or in unrelated inflammatory conditions. This can lead to diagnostic uncertainty, unnecessary referrals, and even misdiagnosis.

Moreover, while advanced technologies are emerging, there remains a lack of standardization across laboratories in terms of assay methodology, interpretation criteria, and reference ranges. These inconsistencies not only complicate diagnosis but can also delay the start of appropriate treatment. As the market grows, ensuring diagnostic accuracy, reproducibility, and interpretive clarity remains an ongoing challenge that manufacturers and regulators must address.

Market Opportunity: AI-Driven Pattern Recognition and Predictive Testing

A key opportunity in the U.S. autoimmune disease diagnostics market lies in the integration of artificial intelligence (AI) and predictive algorithms to support earlier and more precise diagnosis. Autoimmune diseases often develop over months or years, and subtle clinical changes—when combined with historical lab data—can reveal patterns that precede clinical diagnosis. AI tools can synthesize vast datasets, analyze trends, and flag potential cases long before overt symptoms appear.

For example, in systemic lupus erythematosus (SLE), AI models have been trained to interpret ANA immunofluorescence patterns to improve sensitivity and specificity. Similarly, genomic and transcriptomic profiling combined with AI can enable risk stratification for Type 1 diabetes in at-risk pediatric populations. These technologies not only enhance diagnostic confidence but also support disease monitoring and treatment personalization. As adoption of AI-enabled diagnostics grows, U.S.-based startups and academic institutions are well-positioned to lead innovation.

U.S. Autoimmune Disease Diagnostics Market By Type Insights

Systemic autoimmune disease diagnostics dominated the market in 2024, owing to the widespread prevalence and clinical complexity of diseases like rheumatoid arthritis (RA), systemic lupus erythematosus (SLE), and ankylosing spondylitis. These diseases often involve multiple organ systems, necessitating a battery of tests, including ANA panels, anti-dsDNA, RF, and inflammatory markers. The chronic and relapsing-remitting nature of these conditions also supports sustained diagnostic demand for monitoring disease activity.

Localized autoimmune disease diagnostics are projected to be the fastest growing, driven by the increasing incidence of diseases such as Hashimoto’s thyroiditis and Type 1 diabetes. These conditions are frequently identified through routine screening, especially among high-risk groups. Improved awareness among primary care providers and endocrinologists, along with new biomarker discovery (e.g., GAD antibodies for T1D), is contributing to more frequent and earlier diagnoses. The segment’s growth is also supported by home-based glucose monitoring technologies that help detect autoimmune diabetes in early stages.

U.S. Autoimmune Disease Diagnostics Market By Test Type Insights

Antinuclear antibody (ANA) tests held the largest share of the market, due to their foundational role in screening for systemic autoimmune diseases like SLE and scleroderma. These tests are widely ordered as first-line diagnostics and are considered a standard protocol in rheumatology practice. Automated platforms have made ANA testing more accessible, while pattern interpretation still relies on immunofluorescence microscopy, often supplemented by AI tools.

Autoantibody tests are growing the fastest, particularly as biomarker research continues to yield novel, disease-specific autoantibodies such as anti-CCP (for RA), anti-Ro/SSA, and anti-La/SSB. These tests improve specificity and help in differential diagnosis. The rise in multiplex assay platforms that combine multiple autoantibodies into a single panel is further accelerating demand, especially in academic and reference laboratories.

U.S. Autoimmune Disease Diagnostics Market By End-use Insights

The Hospitals remained the leading end-use segment, given their comprehensive diagnostic infrastructure, volume of autoimmune-related referrals, and in-house laboratories. Hospital-based rheumatology, endocrinology, and immunology departments routinely conduct autoimmune panels for both inpatients and outpatients, supporting steady demand for test kits and reagents.

Diagnostic centers are the fastest-growing segment, fueled by decentralized testing, consumer-led health screening trends, and partnerships with digital health companies. Many specialty diagnostic labs now focus exclusively on autoimmune panels, offering tailored testing services and faster turnaround times. These centers often use automated immunoassay platforms and collaborate with rheumatologists and endocrinologists for test interpretation and patient triage.

Country-Level Analysis

The U.S. is uniquely positioned in the global autoimmune diagnostics market due to its robust healthcare infrastructure, significant disease burden, and technological leadership. Within the country, the Northeast region dominated the market, driven by its dense concentration of academic medical centers, specialized diagnostic laboratories, and high healthcare utilization rates. States like Massachusetts and New York serve as innovation hubs, housing major biotech and diagnostic firms focused on autoimmune testing.

The Southeast is anticipated to witness the fastest growth, owing to rising incidence rates, aging populations, and expanding diagnostic access through regional health systems. Increased awareness campaigns, Medicaid expansion in certain states, and local investments in diagnostic infrastructure are supporting market growth in this region. Furthermore, emerging autoimmune-focused research institutions in states like Florida and Georgia are driving innovation and collaboration with diagnostic developers.

U.S. Autoimmune Disease Diagnostics Market Recent Developments

-

In March 2025, Thermo Fisher Scientific launched a new multiplex autoantibody panel for lupus and Sjögren's syndrome, incorporating AI-assisted pattern recognition for faster lab turnaround.

-

In January 2025, Labcorp announced a strategic collaboration with a U.S. academic medical center to validate predictive autoimmune biomarkers for Type 1 diabetes and IBD.

-

In November 2024, Bio-Rad Laboratories introduced an automated immunofluorescence reader with integrated image analytics to enhance ANA test accuracy and reduce technician variability.

-

In September 2024, Quest Diagnostics expanded its autoimmune test menu through a partnership with an AI-driven diagnostics startup, enabling remote autoantibody screening services.

-

In July 2024, Abbott Laboratories secured FDA clearance for its next-generation CRP high-sensitivity assay designed for chronic inflammation monitoring in autoimmune patients.

Some of the prominent players in the U.S. autoimmune disease diagnostics market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. autoimmune disease diagnostics market

Type

- Systemic Autoimmune Disease Diagnostics

-

- Rheumatoid Arthritis

- Ankylosing Spondylitis Diagnostics

- Systemic Lupus Erythematosus (SLE)

- Others

- Localized Autoimmune Disease Diagnostics

-

- Multiple Sclerosis

- Type 1 Diabetes

- Hashimoto's Thyroiditis

- Idiopathic Thrombocytopenic Purpura

- Others

Test Type

- Antinuclear Antibody Tests

- Autoantibody Tests

- C-Reactive Protein (CRP)

- Complete Blood Count (CBC)

- Urinalysis

- Others

End-use

- Hospitals

- Diagnostic Centers

- Others

Regional

- West

- Midwest

- Northeast

- Southwest

- Southeast