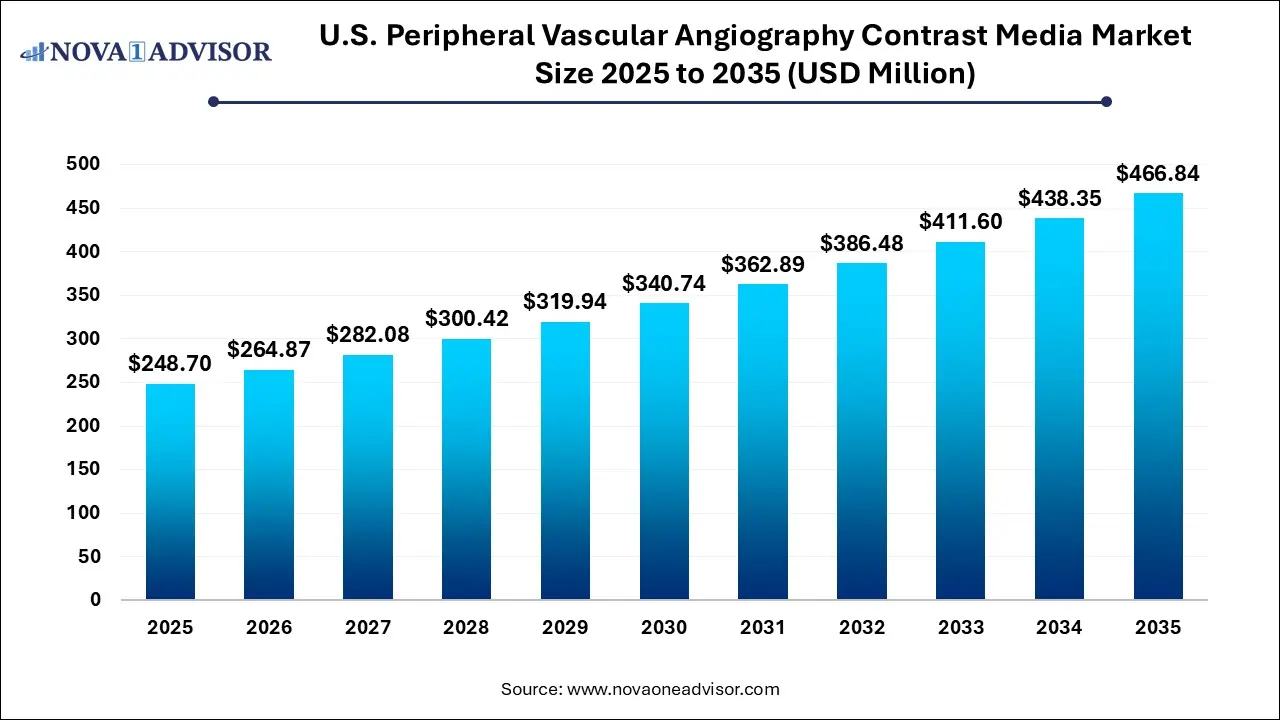

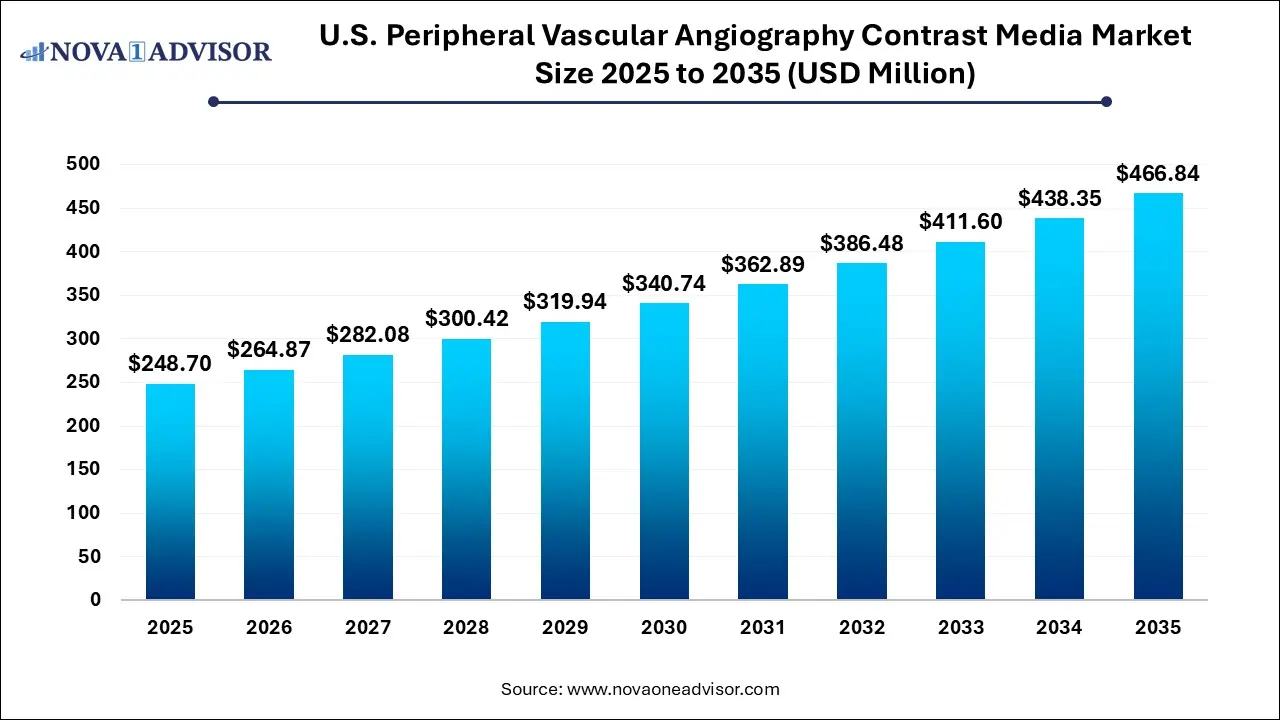

The U.S. peripheral vascular angiography contrast media market size was exhibited at USD 248.7 million in 2025 and is projected to hit around USD 466.84 million by 2035, growing at a CAGR of 6.5% during the forecast period 2026 to 2035.

Market Overview

The U.S. peripheral vascular angiography contrast media market has grown steadily over the past decade, propelled by advancements in diagnostic imaging technologies and the increasing prevalence of peripheral vascular diseases (PVDs). Peripheral vascular angiography is a critical diagnostic procedure that allows healthcare professionals to visualize blood vessels outside of the heart and brain, including arteries and veins in the limbs, neck, and abdomen. The use of contrast media during angiographic procedures is essential to enhance the clarity and detail of vascular structures, helping clinicians detect blockages, aneurysms, stenosis, and other vascular abnormalities with greater precision.

Contrast agents serve as the backbone of these procedures, improving diagnostic accuracy and enabling timely intervention. The market in the United States is witnessing dynamic growth driven by the rising geriatric population, which is at a higher risk of developing vascular complications. Additionally, the increasing incidence of diabetes, hypertension, and obesity—key risk factors for peripheral artery disease (PAD)—is fueling demand for diagnostic imaging and, in turn, contrast media.

Furthermore, the transition toward non-invasive and minimally invasive diagnostic methods has led to the widespread adoption of contrast-enhanced imaging across hospitals, diagnostic imaging centers, and even outpatient clinics. Innovations in contrast agent formulation—such as the development of low-osmolality and iso-osmolar agents—have reduced the risk of side effects and improved patient safety, expanding their use among high-risk populations. Leading manufacturers are also investing in AI-powered imaging software, integrated contrast delivery systems, and sustainable production practices to meet the growing demand and environmental regulations.

Major Trends in the Market

-

Increased Use of Low- and Iso-osmolar Contrast Agents: Safer agents are being adopted to reduce the risk of nephrotoxicity, especially in patients with pre-existing kidney conditions.

-

Rising Popularity of Non-Iodinated and Gadolinium-Free Agents: Due to allergy concerns and regulatory scrutiny, alternatives like microbubble-based contrast are gaining attention.

-

Adoption of AI-Integrated Imaging Platforms: Artificial intelligence is being incorporated to automate image interpretation and optimize contrast usage.

-

Personalized Contrast Dosing Protocols: Institutions are moving toward tailored contrast dosing to enhance diagnostic quality while reducing risk.

-

Eco-friendly and Sustainable Manufacturing Initiatives: Manufacturers are exploring greener contrast media production techniques to align with environmental policies.

-

Miniaturization of Imaging Equipment: Portable and point-of-care imaging is creating new demand for compact contrast agent formats.

-

Surge in Ambulatory and Outpatient Imaging Procedures: Shift from inpatient to outpatient imaging is reshaping purchasing patterns of contrast agents.

-

Integration of Dual-Energy CT Scanners: These systems improve image contrast with lower doses of agents, driving interest in optimized media.

-

Collaborations Between Pharma and Device Makers: Joint development of contrast delivery systems integrated with imaging hardware is gaining momentum.

| Report Coverage |

Details |

| Market Size in 2026 |

USD 264.87 Million |

| Market Size by 2035 |

USD 466.84 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 6.5% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Modality, Product, End Use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Guerbet; Bracco; Bayer; GE HealthCare; Fresenius Kabi USA; Lantheus Holdings, Inc. |

Market Driver: High Prevalence of Peripheral Vascular Diseases

A major driver for the U.S. peripheral vascular angiography contrast media market is the high and rising prevalence of peripheral vascular diseases, particularly peripheral artery disease (PAD). PAD affects more than 8.5 million people in the United States, with a higher incidence among individuals aged 65 and above. The condition is characterized by narrowed arteries that reduce blood flow to the limbs, and it is often associated with serious complications such as ulcers, infections, and even limb amputation if left untreated.

Early and accurate diagnosis of PAD and related vascular conditions is vital to improving patient outcomes. Angiography, augmented by high-quality contrast agents, plays a pivotal role in evaluating the extent and location of arterial blockages. With the U.S. population aging rapidly and lifestyle diseases like diabetes and smoking-related disorders remaining prevalent, the demand for peripheral vascular diagnostics is escalating. This trend is driving hospitals and imaging centers to invest in enhanced imaging modalities that rely on contrast media for precise visualization. Consequently, the increased disease burden is directly stimulating the expansion of the contrast media market.

Market Restraint: Risk of Adverse Reactions and Regulatory Scrutiny

Despite market growth, a significant restraint is the potential for adverse reactions associated with contrast media use, including allergic responses, nephrogenic systemic fibrosis (NSF), and contrast-induced nephropathy (CIN). Patients with renal impairment, diabetes, or cardiovascular conditions are particularly at risk. For instance, iodinated contrast agents used in CT and X-ray imaging can cause renal toxicity, necessitating cautious administration and pre-procedure screening. Similarly, gadolinium-based agents used in MRI have been linked to NSF in patients with poor kidney function.

This safety concern has prompted the U.S. Food and Drug Administration (FDA) to issue multiple warnings and guidelines regarding the appropriate use of contrast agents. As a result, healthcare providers must adhere to stringent protocols, which can increase operational complexity and delay diagnostic procedures. In some cases, alternative imaging modalities may be preferred, reducing the utilization of contrast-enhanced scans. Moreover, the legal and financial risks associated with adverse events can deter smaller institutions from expanding their use of contrast media.

Market Opportunity: Technological Advancements in Imaging Modalities

One of the most promising opportunities in the market stems from the ongoing advancements in imaging technologies, particularly the integration of contrast media with next-generation modalities such as dual-energy CT, contrast-enhanced ultrasound (CEUS), and AI-driven MRI platforms. These technologies enable higher image resolution with lower volumes of contrast agents, improving diagnostic performance while enhancing patient safety.

For example, CEUS using microbubble contrast media is emerging as a non-toxic, radiation-free alternative to conventional methods, particularly in vascular imaging and oncology. Additionally, the development of AI-assisted CT and MRI tools allows for real-time image optimization, automated contrast dose calculation, and enhanced lesion detection. This fusion of software intelligence with contrast-enhanced imaging not only streamlines workflow but also opens new avenues for precision diagnostics. Companies investing in R&D to create contrast agents compatible with these technologies will likely see significant market traction in the coming years.

By Product: CT/X-ray Imaging Dominated; Ultrasound Imaging Is Fastest-Growing

CT/X-ray imaging held the largest share in the U.S. peripheral vascular angiography contrast media market, primarily due to its widespread clinical use, high diagnostic accuracy, and rapid imaging capabilities. CT angiography (CTA) is commonly used to detect stenosis, aneurysms, and occlusions in peripheral arteries. Iodinated contrast agents are routinely employed in CTA procedures, offering clear and detailed visualization of blood vessels. The rapid turnaround time and accessibility of CT imaging make it a preferred choice in emergency settings and among elderly patients requiring quick diagnoses.

Ultrasound, particularly contrast-enhanced ultrasound (CEUS), is emerging as the fastest-growing product segment. CEUS uses microbubble-based contrast agents to enhance vascular imaging, offering real-time dynamic visualization of blood flow without radiation exposure. This modality is especially beneficial in pediatric, renal-compromised, or pregnant patients where conventional imaging may pose risks. Additionally, CEUS has gained popularity in evaluating deep vein thrombosis, arterial stenosis, and tumor vascularity. Its safety profile, portability, and lower cost make it an increasingly attractive alternative in outpatient and point-of-care settings.

By Modality: Iodinated Contrast Media Dominated; Microbubble Agents Are the Fastest-Growing

Iodinated contrast media dominate the U.S. market due to their widespread use in CT and X-ray imaging procedures. These agents offer excellent radiographic density and have been the standard in angiography for decades. Their applications span across coronary, cerebral, and peripheral vascular imaging. The development of newer-generation, low-osmolality iodinated agents such as iohexol and ioversol has helped mitigate concerns related to nephrotoxicity and allergic reactions, supporting their continued dominance.

Microbubble contrast agents represent the fastest-growing modality, primarily fueled by the expanding use of contrast-enhanced ultrasound (CEUS). These agents consist of gas-filled bubbles encapsulated in lipid or protein shells, which enhance ultrasound signals. They are particularly useful in vascular imaging, as they enable real-time assessment of blood flow and perfusion without systemic side effects. Regulatory approvals and increasing research supporting the safety and efficacy of microbubble-based contrast are expected to propel this segment forward. Moreover, their potential use in targeted drug delivery and theranostics adds an additional layer of market potential.

By End Use: Hospitals Dominate; Diagnostic Imaging Centers Are the Fastest-Growing

Hospitals remain the dominant end users of contrast media for peripheral vascular angiography. Equipped with advanced imaging infrastructure and multidisciplinary diagnostic teams, hospitals perform the majority of angiographic procedures, particularly in cases of acute vascular emergencies, trauma, and complex interventions. The availability of CT, MRI, and hybrid angiography suites within hospitals facilitates comprehensive diagnosis and treatment under one roof. Moreover, the presence of inpatient services allows for safe monitoring of high-risk patients undergoing contrast-enhanced imaging.

However, diagnostic imaging centers are emerging as the fastest-growing end-use segment, fueled by the shift toward outpatient imaging and patient preference for quicker, cost-effective diagnostics. These centers often specialize in advanced imaging services and operate with optimized scheduling, enabling high patient throughput. The expansion of freestanding imaging centers across suburban and rural regions of the U.S. is also contributing to segment growth. As insurers increasingly promote outpatient services to reduce healthcare spending, the volume of contrast-enhanced procedures performed in imaging centers is expected to surge.

-

GE HealthCare

-

Bracco Diagnostics Inc.

-

Bayer AG

-

Guerbet Group

-

Lantheus Medical Imaging

-

nanoPET Pharma GmbH

-

Trivitron Healthcare (Contrast Agent Distribution)

-

Taiyo Nippon Sanso Corporation (Microbubble Development)

-

iMAX Diagnostic Imaging

-

Subhra Pharma Private Ltd. (Emerging supplier)

-

In February 2024, GE HealthCare announced the launch of its new iodinated contrast agent, Omnipaque Flex, in the U.S., designed for use in both vascular and non-vascular imaging applications. The product features enhanced patient comfort and reduced osmolality.

-

In October 2023, Bracco Diagnostics expanded its production facility in Monroe Township, New Jersey, to increase the domestic supply of its iodinated contrast media, addressing prior supply chain concerns experienced during the COVID-19 pandemic.

-

In July 2023, Lantheus Medical Imaging received FDA approval for a new microbubble contrast agent, Lumason+, for expanded use in CEUS for vascular and liver imaging applications.

-

In April 2023, Guerbet and IBM Watson Health announced the continuation of their AI-driven collaboration to develop intelligent contrast management solutions for vascular imaging.

-

In March 2023, Bayer launched its updated MEDRAD Stellant FLEX CT injection system in the U.S., designed to work seamlessly with Bayer's contrast agents and software for optimized CT angiography.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. peripheral vascular angiography contrast media market

By Product

- CT/X-ray

- Magnetic Resonance Imaging

- Ultrasound

By Modality

- Iodinated Contrast Media

- Gadolinium-based Contrast Media

- Microbubble

By End Use

- Hospitals

- Diagnostic Imaging Centers

- Research Institutes

- Others