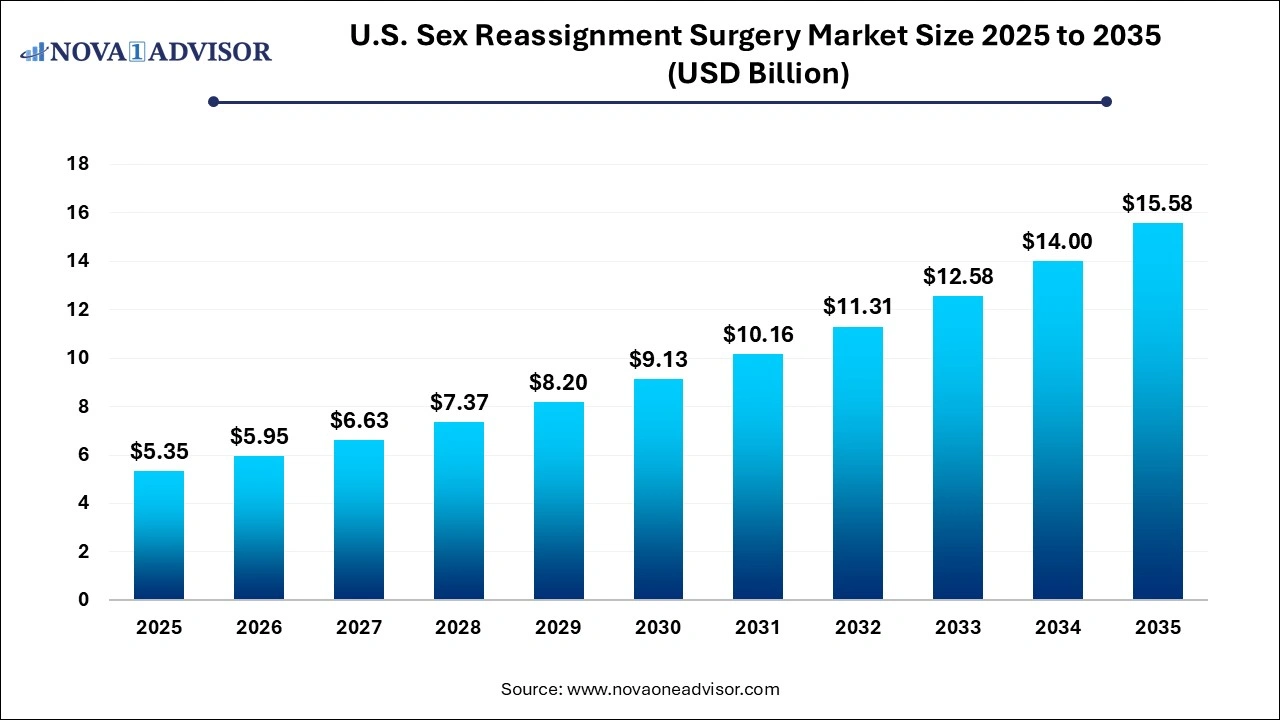

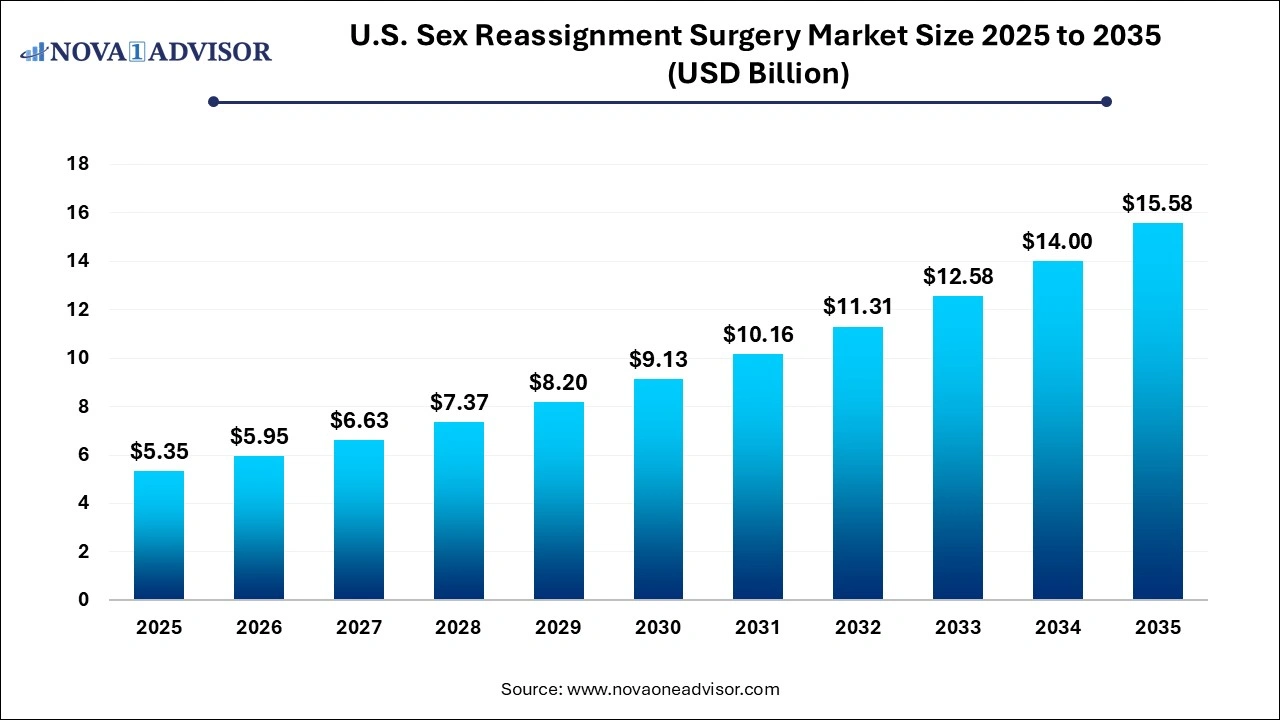

U.S. Sex Reassignment Surgery Market Size and Trends 2026 to 2035

The U.S. sex reassignment surgery market size valued at USD 5.35 billion in 2025 and is projected to hit USD 15.58 billion by 2035, growing at a CAGR of 11.28% from 2026 to 2035.

Key Takeaways:

- The mastectomy segment held the largest market share of 20.1% in terms of revenue in 2025.

- The augmentation mammoplasty segment is expected to witness the fastest CAGR of 12.98% over the forecast period.

- The FTM segment dominated the market with the largest revenue share of 60.0% in 2025.

- The MTF sex reassignment surgery is expected to witness the fastest CAGR of 12.9% during the forecast period.

U.S. Sex Reassignment Surgery Market Overview

The U.S. sex reassignment surgery market represents a rapidly evolving sector within the broader spectrum of transgender healthcare. As societal awareness and acceptance of transgender individuals grow, so too does the demand for gender-affirming medical interventions. Sex reassignment surgery (SRS), also referred to as gender-affirming surgery, comprises a wide array of surgical procedures that help individuals transition from one gender to another. These include procedures for both male-to-female (MTF) and female-to-male (FTM) transitions, covering surgeries like vaginoplasty, phalloplasty, facial feminization, and chest reconstruction.

In recent years, the market has experienced a marked surge in interest and growth, driven by changing legal landscapes, increasing insurance coverage for gender-affirming care, and advancements in surgical techniques. The expansion of training programs for surgeons, the growing presence of gender health clinics, and robust advocacy by LGBTQ+ communities have all contributed to market development.

Furthermore, the U.S. market is seeing strong participation from public and private healthcare institutions, specialized clinics, and academic medical centers offering these procedures. These entities often provide multidisciplinary services encompassing endocrinology, psychiatry, plastic surgery, and urology. Government initiatives and employer-based health plans have increasingly begun to incorporate SRS as a covered medical service, further normalizing and encouraging access.

Major Trends in the U.S. Sex Reassignment Surgery Market

-

Rising Insurance Coverage: An increasing number of private insurance plans and state Medicaid programs are covering gender-affirming surgeries.

-

Surge in Gender Clinics: Establishment of specialized gender health clinics offering integrated medical and psychological services.

-

Medical Tourism within the U.S.: Transgender individuals traveling interstate to access high-quality and affordable surgical services.

-

Technological Advancements: Use of robotics and 3D imaging in complex reconstructive surgeries.

-

Academic Inclusion: Expansion of gender-affirming surgery modules in medical school curricula.

-

Social Media Influence: Platforms like TikTok and Instagram raising awareness and providing peer support.

-

Increasing Transgender Population Disclosure: Growing number of individuals self-identifying as transgender due to social acceptance.

-

Mental Health Integration: Emphasis on pre- and post-surgical psychological support as part of holistic care.

Report Scope of The U.S. Sex Reassignment Surgery Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 5.95 Billion |

| Market Size by 2035 |

USD 15.58 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.28% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Gender Transition, Procedure |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Icahn School of Medicine at Mount Sinai; Cedars-Sinai; Moein Surgical Arts; Cleveland Clinic; Transgender Surgery Institute; Plastic Surgery Group of Rochester; Regents of the University of Michigan; CNY Cosmetic & Reconstructive Surgery; Boston Medical Center; The Johns Hopkins University; Kaiser Permanente; University of California, San Francisco Center of Excellence for Transgender Health; New York Presbyterian Hospital; Mayo Clinic (Transgender and Intersex Specialty Care Clinic) |

Key Market Driver

Expanding Insurance Coverage and Legal Protections

One of the most pivotal drivers of the U.S. sex reassignment surgery market is the expanding availability of insurance coverage for gender-affirming procedures. Over the last decade, several states have mandated that private insurers and Medicaid programs include transgender healthcare services, including surgery. The Affordable Care Act (ACA) and subsequent state-level policies have played critical roles in enhancing access. For instance, the Blue Cross Blue Shield plans in many states now cover procedures such as vaginoplasty and phalloplasty. This coverage eliminates the prohibitive out-of-pocket expenses that once made SRS inaccessible to many individuals. Legal protections against discrimination in healthcare settings have also reinforced trust in the system, encouraging more individuals to pursue surgery.

Key Market Restraint

Lack of Specialized Surgical Expertise

Despite the market's growth, a significant restraint remains the limited number of surgeons with advanced training in gender-affirming surgical techniques. These procedures are highly complex and often require years of specialized practice. As a result, wait times for surgery can stretch for months or even years, causing emotional distress and extended periods of gender dysphoria for patients. Moreover, the scarcity of experienced practitioners is exacerbated in rural or underserved areas, forcing individuals to travel long distances, incurring additional costs and logistical hurdles. This limited availability also places strain on the existing pool of surgeons, leading to burnout and potentially impacting the quality of care.

Key Market Opportunity

Integration of SRS into Academic Medical Centers and Training Programs

An emerging opportunity lies in the integration of SRS into academic medical curricula and residency programs. As societal and institutional attitudes shift, more medical schools and teaching hospitals are including gender-affirming surgeries as core competencies in plastic and reconstructive surgery residencies. For example, the University of California, San Francisco (UCSF) and Mount Sinai in New York have established comprehensive transgender health programs that include training future surgeons. This educational focus not only increases the number of qualified professionals in the field but also enhances awareness and sensitivity among all medical staff, creating a more inclusive healthcare environment.

By Procedure Insights

Vaginoplasty is the dominant procedure within the sex reassignment surgery market. It is often viewed as the cornerstone of MTF transitions, requiring skilled surgeons and offering high patient satisfaction. Vaginoplasty also receives significant attention in insurance policies, making it one of the most frequently performed and covered procedures. High demand, specialized surgical pathways, and an increasing number of success stories have elevated its market share. This procedure often includes accompanying services like electrolysis, dilators, and extended hospital stays, adding to the overall revenue contribution.

Meanwhile, Phalloplasty is projected to be the fastest-growing procedure. Once considered highly experimental and limited by poor outcomes, recent innovations in nerve grafting, flap design, and robotic assistance have drastically improved both function and aesthetic outcomes. Phalloplasty, often combined with scrotoplasty and urethral lengthening, is now being sought more frequently by FTM patients. Clinics are expanding their services to include phalloplasty consultations and aftercare, while organizations advocate for better insurance inclusion, propelling this segment’s growth trajectory.

By Gender Transition Insights

Male-to-Female (MTF) surgeries dominated the gender transition segment in terms of revenue. These surgeries often include multiple complex procedures such as vaginoplasty, facial feminization surgery, and breast augmentation. MTF procedures tend to be more sought after due to higher demand for visible external changes, particularly facial and breast features, which contribute heavily to the individual’s gender presentation in social contexts. Clinics offering comprehensive MTF transition packages attract patients nationwide, often with bundled pricing and pre/post-operative care, making this sub-segment a revenue leader.

On the other hand, Female-to-Male (FTM) surgeries are emerging as the fastest-growing segment. This growth is being propelled by rising awareness and improved surgical outcomes, particularly with advancements in phalloplasty and metoidioplasty techniques. Moreover, chest masculinization surgery (top surgery) is often the first gender-affirming procedure pursued by FTM individuals, due to its psychological impact and relative accessibility. The increasing number of younger individuals transitioning has also supported this sub-segment, as they seek timely interventions with minimal invasiveness and high functionality.

Country-Level Analysis United States

The U.S. stands at the forefront of the global sex reassignment surgery landscape due to a robust medical infrastructure, evolving legislative support, and the presence of experienced surgical professionals. The country has witnessed increasing state-level mandates that require insurance providers to cover gender-affirming treatments. For example, California and New York are among the states that have enacted comprehensive protections, ensuring equitable access to transgender healthcare.

Additionally, major metropolitan areas such as San Francisco, Los Angeles, New York City, and Chicago serve as hubs for specialized clinics. These cities offer multidisciplinary care, from endocrinology to psychiatry to surgical services, under one roof. The growing visibility of transgender rights in public discourse and inclusion in media further promotes acceptance and encourages more individuals to seek surgical transitions. Telehealth services have also emerged as a tool to expand access, especially for initial consultations and follow-ups in remote areas.

Some of the prominent players in the U.S. sex reassignment surgery market include:

- Icahn School of Medicine at Mount Sinai

- Cedars-Sinai

- Moein Surgical Arts

- Cleveland Clinic

- Transgender Surgery Institute

- Plastic Surgery Group of Rochester

- Regents of the University of Michigan

- CNY Cosmetic & Reconstructive Surgery

- Boston Medical Center

- The Johns Hopkins University

- Kaiser Permanente

- University of California, San Francisco Center of Excellence for Transgender Health

- New York Presbyterian Hospital

- Mayo Clinic (Transgender and Intersex Specialty Care Clinic)

Recent Developments

-

February 2025: Mount Sinai Center for Transgender Medicine and Surgery in New York announced a partnership with the Human Rights Campaign to advance educational efforts for gender-affirming healthcare.

-

January 2025: Kaiser Permanente announced the launch of a new telehealth program specifically designed for transgender and nonbinary patients seeking gender-affirming care.

-

December 2024: Cleveland Clinic performed its 100th gender-affirming surgery, highlighting the rapid growth and institutional focus on transgender healthcare.

-

November 2024: The University of California, San Francisco expanded its Gender Affirming Health Program to include pediatric consultations for trans youth planning for future surgeries.

-

October 2024: Plume, a digital health company specializing in transgender care, raised $24 million in Series B funding to expand its reach across more U.S. states.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. sex reassignment surgery market

Gender Transition

- Male-to-female

- Female-to-male

Procedure

- Augmentation Mammoplasty

- Voice Feminization Surgery

- Reduction Thyrochondroplasty

- Orchiectomy

- Vaginoplasty

- Chest Masculinization Surgery

- Scrotoplasty

- Hysterectomy

- Phalloplasty

- Mastectomy

- Metoidioplasty

- Facial Feminization Surgery