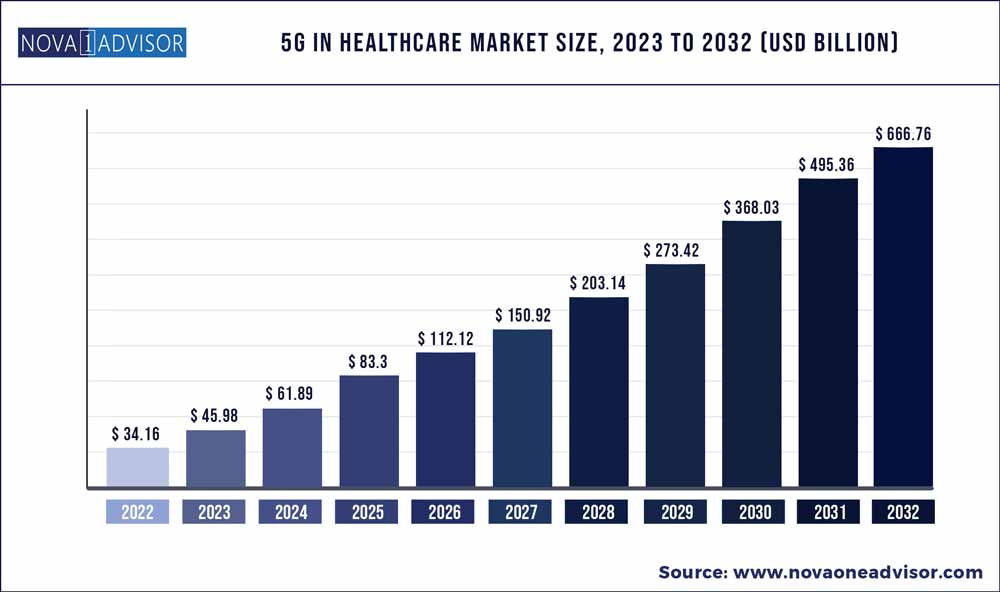

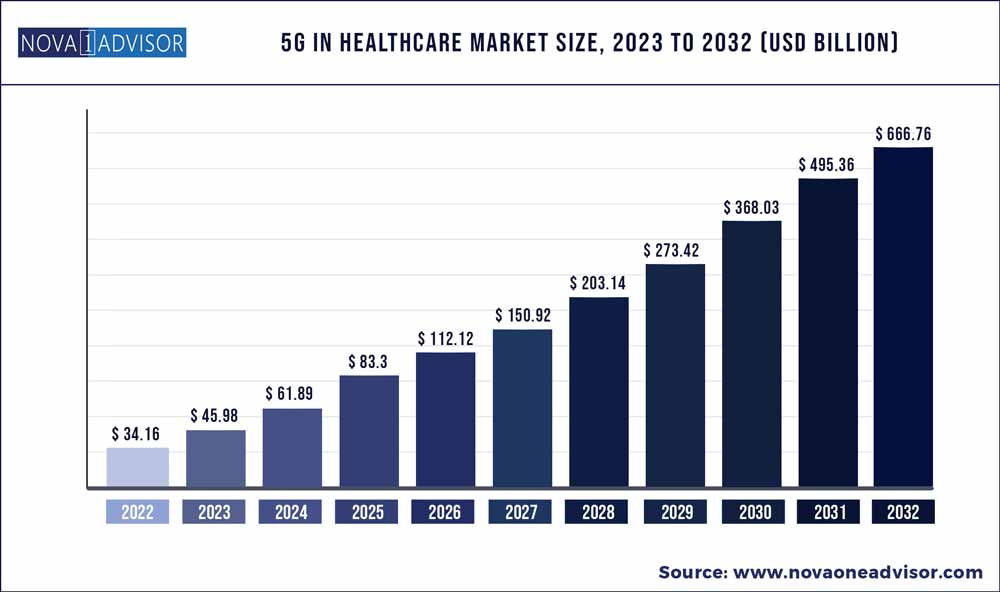

The 5G in healthcare market size was estimated at USD 34.16 billion in 2022 and is expected to surpass around USD 666.76 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 34.6% during the forecast period 2023 to 2032.

Key Takeaways:

- North America held the largest revenue share of over 37.0% in 2022

- Asia Pacific is expected to register the fastest growth rate of 36.7% over the forecast period

- The hardware segment held the largest revenue share of over 72.9% in 2022

- The services segment is anticipated to expand at the fastest CAGR of 35.8% during the forecast period.

- The remote patient monitoring segment accounted for the largest revenue share of over 62.0% in 2022

- The connected medical devices segment is expected to register the fastest growth rate of 36.3% from 2023 to 2032

- The healthcare payers segment is anticipated to expand at the fastest growth rate of 35.5% over the forecast period.

5G In Healthcare Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 45.98 Billion |

| Market Size by 2032 |

USD 666.76 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 34.6% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Component, Application, End-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

AT&T; Verizon; China Mobile International Limited; Quectel; Telit; Telus; Huawei Technologies Co., Ltd.; Cisco System Inc.; Orange; NEC Corporation |

The IoT ecosystem is developing and is expected to enable networks to connect billions of devices. The demand for a real-time network with faster internet access and greater bandwidth has been driven by the development of modern technologies such as artificial intelligence, wired, and wireless communications, and machine learning. Moreover, the market is driven by the increasing demand for wearable medical devices incorporated with 5G technology for real-time remote patient monitoring and the rising acceptance of robotic surgery and telehealth.

The COVID-19 pandemic had a positive impact on the market owing to the adoption of telehealth and remote patient monitoring by medical professionals, medical institutions, and hospitals during the pandemic to monitor isolated COVID-19 patients and stop the further spread of the virus by monitoring patients through remote patient monitoring methods. Since the integration of several low-power devices is required for patient remote monitoring, 5G services can be effectively used to develop a proper remote monitoring infrastructure for patients. Furthermore, government bodies and hospitals made efforts to deploy 5G during the COVID-19 pandemic. For instance, in February 2020, the U.S. Veterans Affairs (VA) Healthcare System deployed 5G in the hospital to treat patients using remote patient monitoring and promote the use of telemedicine.

The key players are adopting strategies such as partnerships, mergers and acquisitions, product and service launches, agreements, joint ventures, collaborations, and expansion to strengthen their position in the market. In February 2020, China's first 5G-capable remote emergency rescue system was constructed by the Second Affiliated Hospital of Zhejiang University School of Medicine and China Mobile Zhejiang. This system consists of many supporting technologies, including VR immersive diagnosis and therapy, 5G-enabled remote ultrasonography, and a 5G-enabled emergency rescue command center.

Component Insights

The hardware segment held the largest revenue share of over 72.9% in 2022 owing to the need for frequent replacement or up-gradation of the devices to make optimal use of the latest technologies in the market. Moreover, the advancement in technology and growing demand for ultra-high bandwidth, massive connectivity, and ultra-low latency are expected to offer an opportunity for the growth of the hardware segment.

The services segment is anticipated to expand at the fastest CAGR of 35.8% during the forecast period. The growth is attributed to the increased demand for better connectivity for medical devices, growing demand for faster and more reliable data transmission, and the need for improved mobile broadband and greater frequencies offered by 5G services.

Application Insights

The remote patient monitoring segment accounted for the largest revenue share of over 62.0% in 2022 owing to the rising geriatric population and a rise in the demand for remote health checkups. Remote patient monitoring is critical for chronic management and efficient and proactive healthcare service. The market for remote patient monitoring is further being driven by the high burden of COVID-19 cases, rising healthcare expenses, and the increased focus of consumers on individual health.

The connected medical devices segment is expected to register the fastest growth rate of 36.3% from 2023 to 2032 owing to increased demand for medical devices by consumers for daily health tracking, a rise in demand for telehealth devices, and the increasing trend of home healthcare.

End-use Insights

In 2022, the healthcare providers segment dominated the market with a revenue share of over 63.4%. This is attributed to the growing use of wearable medical devices with 5G technologies, increasing demand for better technologies, growing patient volume, and an increasing number of hospitals and ambulatory care centers. Based on end-use, the market is segmented into healthcare providers and healthcare payers.

The healthcare payers segment is anticipated to expand at the fastest growth rate of 35.5% over the forecast period. Payers include both public and commercial insurance companies. The growth of the segment is fueled by an increase in the number of policyholders for health insurance due to the COVID-19 pandemic.

Regional Insights

North America held the largest revenue share of over 37.0% in 2022 due to government initiatives for the deployment of 5G in healthcare and an increasing number of 5G-enabled medical devices. For instance, in August 2021, the Biden administration announced an investment totaling over USD 19 million to improve telehealth services in rural areas and to expand telehealth innovation and quality nationwide.

Asia Pacific is expected to register the fastest growth rate of 36.7% over the forecast period owing to the significant adoption of advanced technologies, enhanced network connectivity, and increased government programs for raising awareness regarding telehealth and penetration of 5G in the healthcare industry. For instance, in November 2020, the health operator IHH Healthcare along with the Chinese government launched a WeChat program as an initiative to strengthen telehealth.

Key Companies & Market Share Insights

Players are more focused on strategic partnerships with technology providers and product innovation. Furthermore, they are adopting strategies such as mergers and acquisitions, product and service launches, agreements, joint ventures, collaborations, and expansion to strengthen their position in the market. For instance, in February 2021, AT&T announced a partnership with Rush University System for Health, a Chicago-based academic health system, for testing AT&T Multi-Access Edge Computing (MEC) and other advanced network-related technologies in Rush hospitals for better operations and to improve patient and staff experience.

Similarly, in August 2020, Stasis Labs Inc., a patient monitoring platform, launched a mobile-connected remote patient monitoring platform for hospitals and outpatients in the U.S. The platform helps providers continuously monitor a patient without direct contact with the patient. Some prominent players in the global 5G in healthcare market include:

- AT&T

- Verizon

- China Mobile International Limited

- Quectel

- Telit

- Telus

- Huawei Technologies Co., Ltd.

- Cisco System Inc.

- Orange

- NEC Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the 5G In Healthcare market.

By Component

By Application

- Remote Patient Monitoring

- Connected Medical Devices

- AR/VR

- Connected Ambulance

- Asset Tracking

By End-use

- Healthcare Providers

- Healthcare Payers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)