Alzheimer’s Disease Diagnostics Market Size and Trends 2026 to 2035

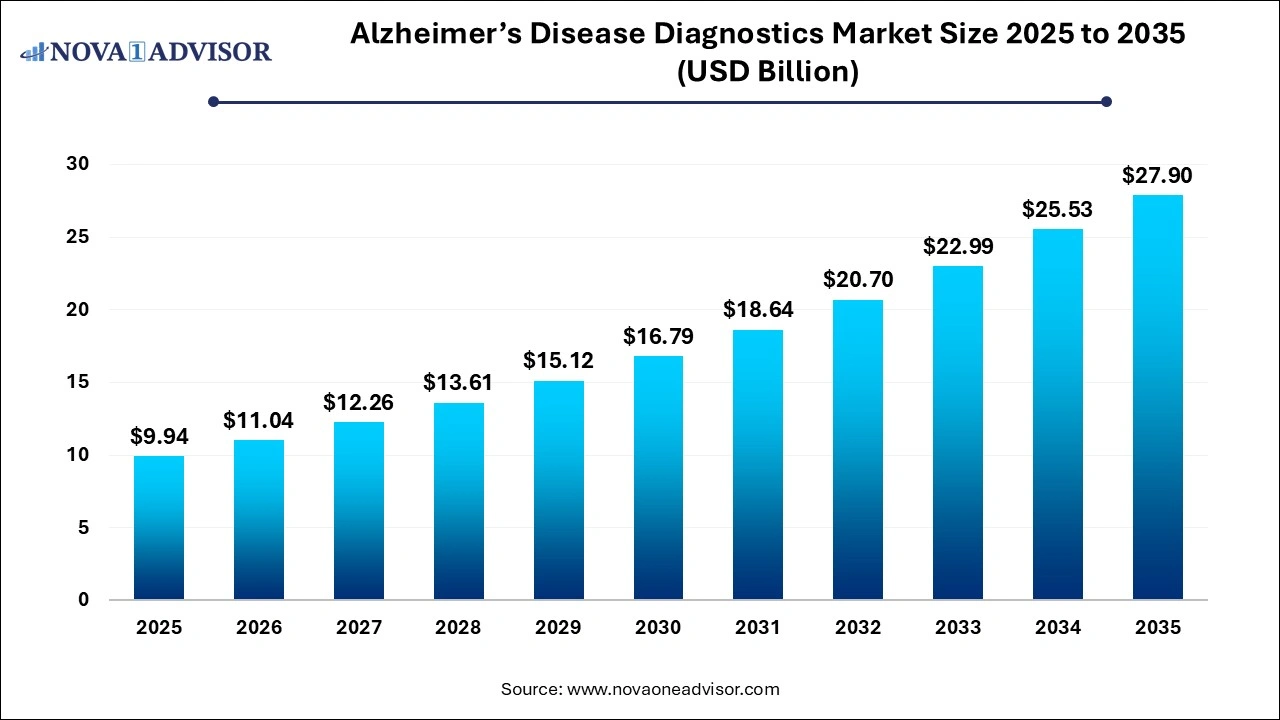

The global Alzheimer’s disease diagnostics market size is calculated at USD 9.94 billion in 2025, grows to USD 11.04 billion in 2026, and is projected to reach around USD 27.90 billion by 2035, growing at a CAGR of 10.87% from 2026 to 2035. Rising regulatory approvals, innovative product launches, research funding and increased emphasis on early screening are driving the growth of the Alzheimer’s disease diagnostics market.

Alzheimer’s Disease Diagnostics Market Key Takeaways

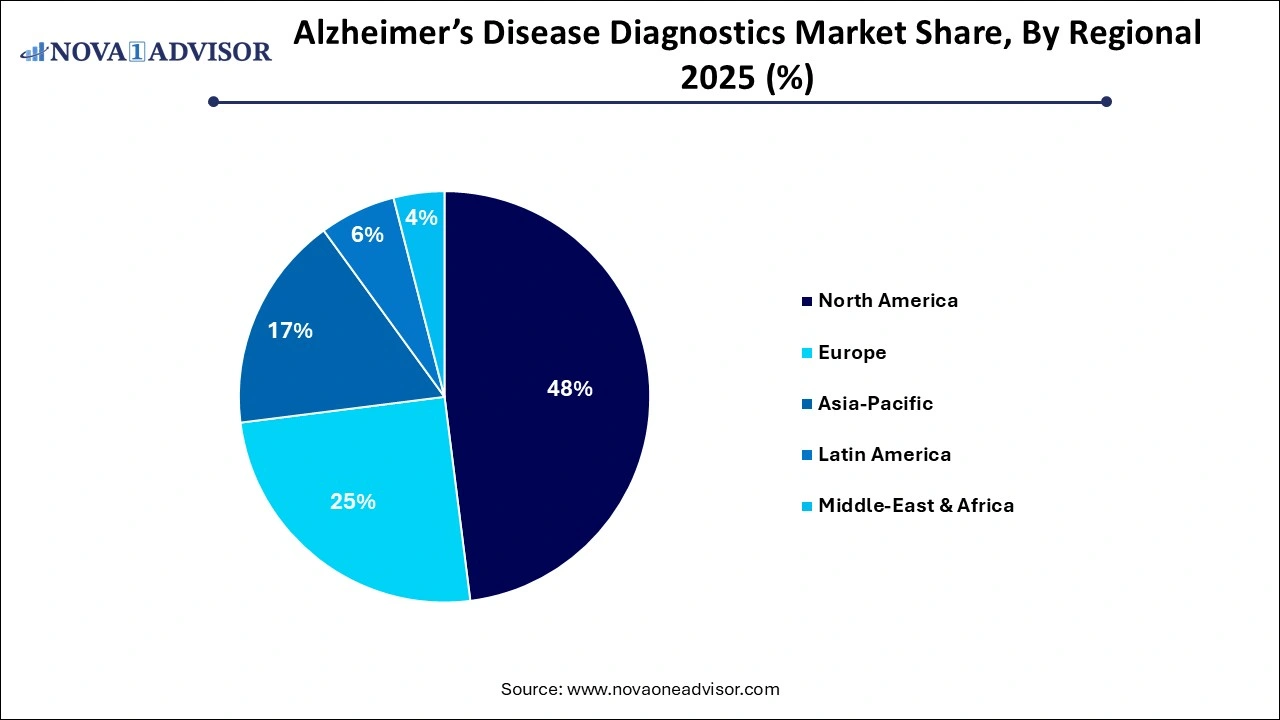

- North America dominated the highest with market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By diagnostic technique, the imaging techniques segment dominated the market with the largest share in 2024.

- By diagnostic technique, the biomarkers segment is expected to show the fastest growth during the forecast period.

- By type, the diagnostic segment accounted for the biggest market share in 2024.

- By end-use, the academic and research institutes segment held the largest market share in 2024.

- By end-use, the hospitals segment is expected to register fastest growth during the forecast period.

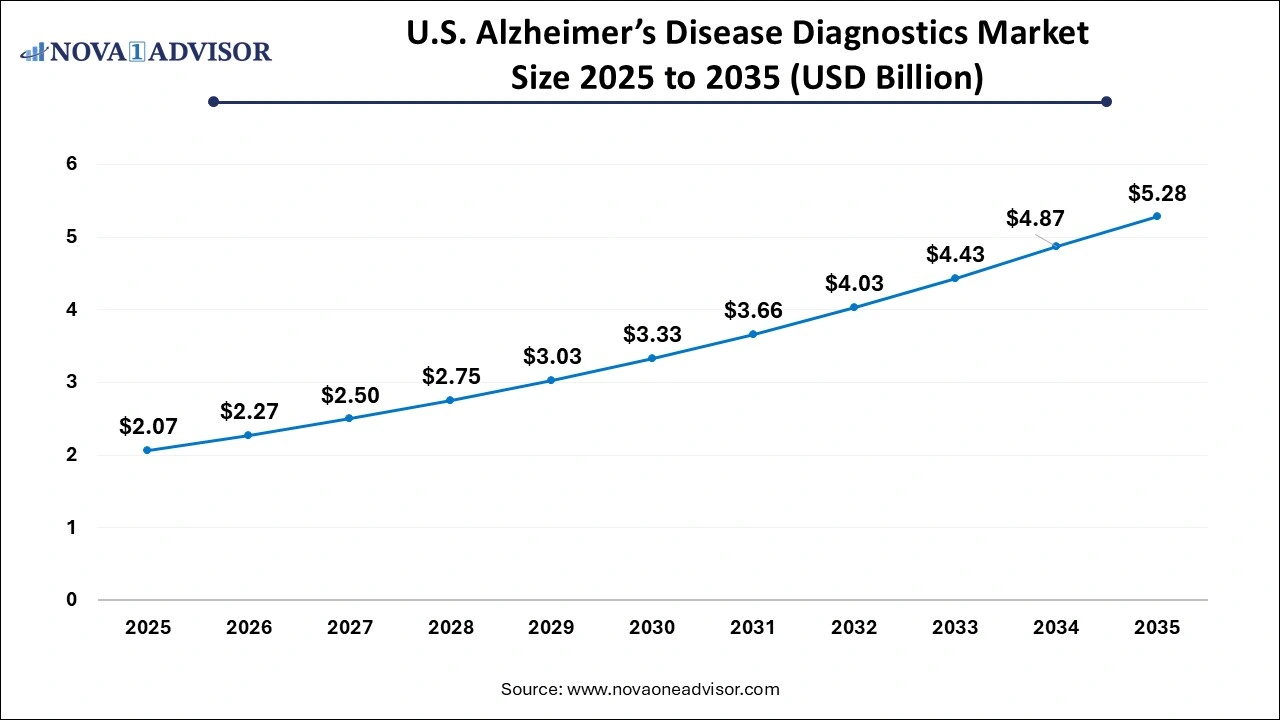

U.S. Alzheimer's Disease Diagnostics Market Size and Growth 2026 to 2035

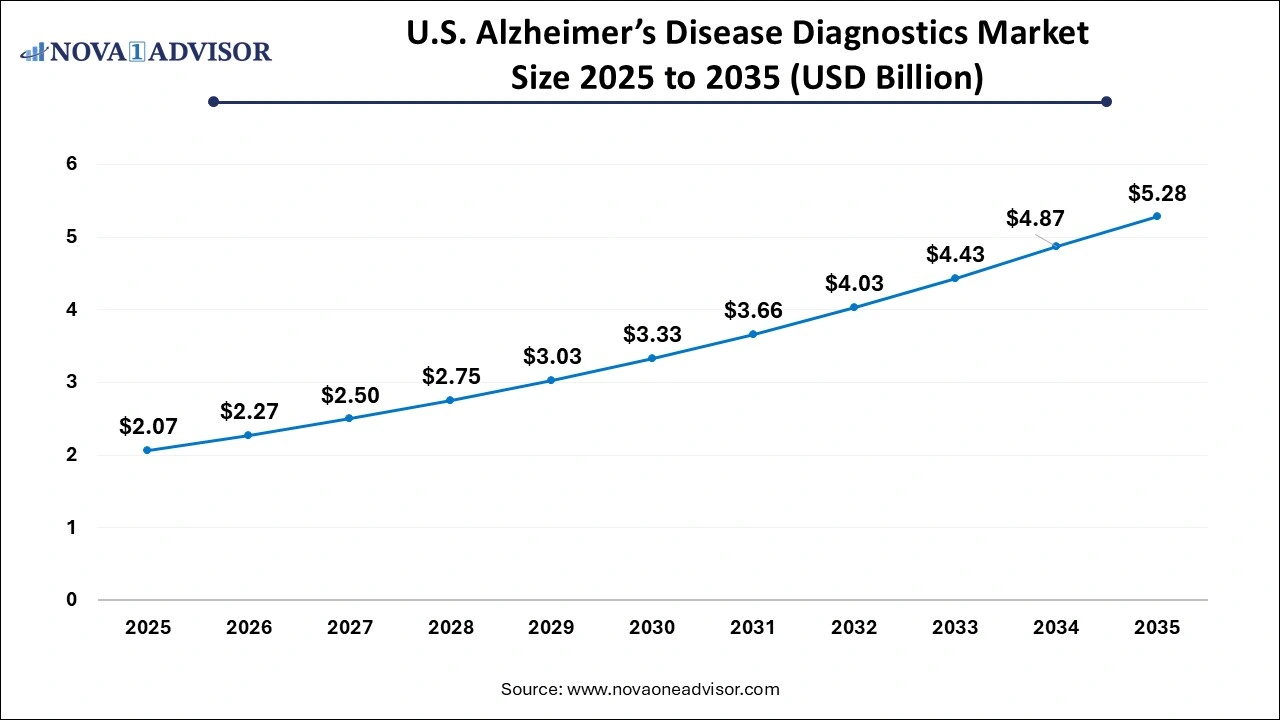

The U.S. Alzheimer's Disease Diagnostics Market size is calculated at USD 2.07 billion in 2025 and is expected to reach nearly USD 5.28 billion in 2035, accelerating at a strong CAGR of 9.82% between 2026 to 2035.

Why is North America Dominating the Global Alzheimer’s Disease Diagnostics Market?

Why is North America Dominating the Global Alzheimer’s Disease Diagnostics Market?

North America dominated the global Alzheimer’s disease diagnostics market generating the highest revenue in 2025. Aging demographics with increasing incidences of Alzheimer’s disease, well-developed healthcare infrastructure, substantial funding in R&D, increased awareness for early detection and access to advanced diagnostic technologies are the factors driving the region’s market dominance. Furthermore, ongoing clinical trials, accelerated regulatory approvals by the FDA, favourable reimbursement policies and increased healthcare spending are bolstering the market growth. According to the facts and figures provided by the Alzheimer’s Association, over 7 million Americans are living with Alzheimer’s and nearly 12 million Americans are providing unpaid care for people with Alzheimer’s or other type of dementia in 2025.

What Drives Expansion of Alzheimer’s Disease Diagnostics Market in Asia Pacific?

Asia Pacific is anticipated to witness the fastest growth in the market over the forecast period. The region’s market growth is driven by rising investments for advancing healthcare and research infrastructure, increased cases of Alzheimer’s disease in the rapidly aging and huge population, initiatives by governments and adoption of advanced diagnostic techniques for early diagnosis. Increased public awareness, rise in R&D activities and expanding capabilities of diagnostic companies in the region are fuelling the market expansion.

U.S. Alzheimer’s disease diagnostics market trends

The growing adoption of CSF biomarkers by diagnostics centers to enhance diagnosis of Alzheimer’s disease has driven the market expansion. Additionally, the presence of several market players coupled with technological advancements in the hospitals is playing a prominent role in shaping the industry in a positive manner.

China Alzheimer’s disease diagnostics market analysis

The rising demand for AI-enabled diagnostics solutions for treating Alzheimer’s disease coupled with numerous government initiatives aimed at developing the diagnostics sector has boosted the market expansion. Also, the rise in number of healthcare startups coupled with surging focus of diagnostics providers to enhance testing of Alzheimer’s disease is contributing to the industry in a positive direction.

Why Europe is a significant contributor of the Alzheimer’s disease diagnostics market?

Europe is a significant contributor of the AI in medical imaging industry. The growing prevalence of Alzheimer’s disease in several nations including Germany, France, UK, Italy and some others has boosted the market expansion. Also, rapid investment by government for strengthening the healthcare sector is expected to drive the growth of the Alzheimer’s disease diagnostics market in this region.

Germany Alzheimer’s disease diagnostics market analysis

The rising adoption of CSF biomarkers and genetic testing methodology for detecting Alzheimer’s disease has boosted the market expansion. Also, rise in number of psychiatric hospitals coupled with rapid adoption of IoT-enabled screening solutions in the diagnostics centers is playing a prominent role in shaping the industrial landscape.

What is the role of Latin America in the Alzheimer’s disease diagnostics market?

Latin America has played a prominent role in the Alzheimer’s disease diagnostics market. The surging cases of Alzheimer’s disease among the old-age population across numerous countries including Brazil, Argentina, Venezuela, Peru and some others has accelerated the market growth. Additionally, rapid investment by market players for conducting trails among human is expected to drive the growth of the Alzheimer’s disease diagnostics market in this region.

Argentina Alzheimer’s disease diagnostics market trends

The rising adoption of AI-enabled diagnostics solutions for detecting Alzheimer’s disease in patients has driven the market expansion. Also, rapid investment by government for constructing brain hospitals is playing a crucial role in shaping the industrial landscape.

Why Middle East and Africa held a notable share of the Alzheimer’s disease diagnostics market?

Middle East and Africa held a notable share of the industry. The increasing adoption of blood-based biomarkers for detecting Alzheimer’s disease in people of several nations such as UAE, Saudi Arabia, South Africa and some others has driven the market growth. Also, the presence of several market players coupled with rapid expansion of the healthcare sector is expected to drive the growth of the Alzheimer’s disease diagnostics market in this region.

UAE Alzheimer’s disease diagnostics market analysis

The growing emphasis of people to visit diagnostic centers on regular basis for enhancing full-body checkups has boosted the market expansion. Moreover, technological advancements in the mental health sector coupled with rise in number of private hospitals is playing a vital role in shaping the industrial landscape.

What Fuels the Expansion of the Alzheimer’s Disease Diagnostics Market?

Alzheimer’s disease (AD) is one of the globally leading cause of death creating the demand for effective diagnostic techniques and treatments. It is a progressive neurodegenerative disorder with no available cure and primarily affects memory and cognitive functions such as language and problem-solving. Early diagnosis, medications and supportive care can improve patient life quality.

The expansion of the Alzheimer’s disease diagnostics market is driven by the increased prevalence of AD in the older population, need for advanced and effective diagnostic tools, growing awareness for early diagnosis, supportive government initiatives and demand for non-invasive testing procedures. Rising investments in clinical trials and research studies by private organizations, charitable trusts and government as well as supportive regulatory frameworks are creating opportunities for market expansion.

What Are the Key Trends in the Alzheimer’s Disease Diagnostics Market in 2025?

- In May 2025, Fujirebio Diagnostics Inc., received the 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Lumipulse G pTau 217/β-Amyloid 1-42 Plasma Ratio in-vitro diagnostic (IVD) test intended for early assessment of amyloid pathology by measuring blood biomarkers of patients being diagnosed for Alzheimer’s disease.

- In June 2025, Agappe Diagnostics Ltd., announced setting up production of the U.S. FDA approved plasma-based biomarkers, namely Amyloid Beta 1-42 and phosphorylated Tau (pTau) 217 for Alzheimer’s diagnosis. The initiative launched by Agappe follows Fujirebio Diagnostics’ FDA clearance of the Lumipulse G pTau217/ß-Amyloid 1-42 Plasma Ratio test, further making it the first Indian company for manufacturing these advanced diagnostic tools.

Alzheimer’s disease diagnostics market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the technological advancements in the healthcare sector coupled with rising incidences of Alzheimer diseases in developed nations.

- Major Investors: Numerous market players are actively entering this market, drawn by partnerships, R&D and product launches. Several Alzheimer’s disease diagnostics companies such as Labcorb, Lantheus, Quanterix, Quest Diagnostics and some others have started investing rapidly for developing advanced diagnostics solutions for detecting Alzheimer’s disease.

- Startup Ecosystem: Various startup brands are engaged in developing smart diagnostics solutions for diagnosing Alzheimer’s disease. The prominent startup companies dealing in Alzheimer’s disease diagnostics comprises of BrainScope, Vimana, Ceribell and some others.

How is AI Influencing Alzheimer’s Disease Diagnostics?

Several diagnostic companies and medical devices manufacturers are integrating AI in their workflows for enhancing the efficiency and accuracy of diagnostic procedures. AI algorithms applied in Alzheimer’s disease diagnostics is enabling early detection and predicting progression of disease by analyzing neuroimaging data, genetic information and results of cognitive tests. Identification of genetic and proteomic biomarkers by deploying AI-powered models and integrating them with genetic data can lead to development of more personalized risk assessment strategies, targeted interventions and better understanding of biological pathways.

- For instance, in May 2025, Cortechs.ai, entered into a strategic alliance with Alzheimer's Network for Treatment and Diagnostics (ALZ-NET). The collaboration aims at improving quality of care for people with Alzheimer’s disease by integrating Cortechs.ai's advanced imaging platform, NeuroQuant® for ARIA with the strong real-world data network of ALZ-NET for advancing clinical decision-making, enhancing care delivery and development of future treatment guidelines.

Report Scope of Alzheimer’s Disease Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 11.04 Billion |

| Market Size by 2035 |

USD 27.90 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 10.87% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Diagnostics Technique, Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

C2N diagnostics, Fujirebio, F. Hoffmann-La Roche AG, Labcorb, Lantheus, Quanterix, Quest Diagnostics, Sysmex, Siemens Healthineers AG |

Alzheimer’s Disease Diagnostics Market Dynamics

Drivers

Rising Alzheimer’s Disease Burden

According to the World Health Organization’s (WHO’s) Global Dementia Observatory, about 55.2 million people across the globe are currently living with dementia and there are nearly 10 million new cases every year. Globally rising cases of age-related disease like Alzheimer’s in the older population is creating huge demand for advanced and precise diagnostics tools for early detection and monitoring disease progression. Moreover, increased awareness among the population regarding early diagnosis is enabling better management of symptoms and allowing timely interventions.

Restraint

High Costs of Advanced Diagnostics and Accessibility

Current advanced diagnostic techniques such as CSF (cerebrospinal fluid) analysis and neuroimaging techniques like PET scans are costly and can potentially limit accessibility to these tests for a broad range of population, especially in low- and middle-income countries. Additionally, limitations in reimbursement policies and no coverage for diagnostic tests provided by insurance companies is restricting the market growth.

Opportunities

Increased Emphasis on Development of Advanced Diagnostic Techniques

Several diagnostic companies, pharmaceutical industries, medical device manufacturers and technology providers are focused on development of non-invasive diagnostic tools with early and accurate disease detection features for improving patient outcomes and also slowing down progression of the disease. Latest advancements include development of non-invasive blood-based biomarkers, sophisticated neuroimaging techniques, and integration of AI and machine learning for enhanced image analysis and biomarker interpretation. Digital health solutions such as wearable devices, online platforms and mobile applications with real-time tracking of cognitive function and disease progression of patients are enabling remote monitoring and personalized medicine approaches.

Alzheimer’s Disease Diagnostics Market Segmental Insights

What Made Imaging Techniques the Dominant Segment in 2025?

By diagnostic technique, the imaging techniques segment held the largest market share in 2025. Well-established efficacy and clinical reliability of imaging techniques such as MRI (Magnetic Resonance Imaging), PET (Position Emission Tomography) and CT (Computed Tomography) scans are widely used for diagnosing and monitoring Alzheimer’s disease. Techniques like amyloid PET imaging, structural MRI, tau PET imaging and FDG-PET (Fluorodeoxyglucose PET) are enabling detection of hallmarks and tracking of Alzheimer disease progression.

Continuous advancements imaging technologies such as improvements in resolution and sensitivity of images, functional imaging techniques such as DTI (Diffusion Tensor Imaging) and fMRI (functional MRI), multimodal imaging as well as enhanced data analytics with integration of AI and machine learning. Furthermore, increased focus on early and accurate diagnosis, assessment of new treatments and selection of candidates of clinical trials by deploying imaging techniques are driving the market dominance of this segment.

By diagnostic technique, the biomarkers segment is expected to register the fastest growth over the forecast period. Biomarkers such as amyloid-beta, tau proteins and neurofilament light chain allow early and accurate diagnosis of Alzheimer’s disease. Researchers are widely using biomarkers in clinical trials for identifying patients that will benefit from new therapies like disease-modifying therapies. Rising research investments are enabling development of innovative blood-based biomarker offering various advantages such as affordability, high throughput and minimally invasive nature leading to increased patient acceptance. Additionally, increasing number of regulatory approvals, strategic collaborations among various companies and Alzheimer’s disease care organizations as well as government initiatives are fuelling the market expansion of this segment.

- For instance, in February 2025, C2N Diagnostics received the United Kingdom’s Medicines and Healthcare products Regulatory Agency (UK MHRA) medical device certification for its PrecivityAD2 Blood Test which will be used as an in-vitro diagnostic test for Alzheimer’s disease diagnosis.

Why Did the Diagnostic Segment Dominated the Market in 2025?

By type, the diagnostic segment dominated the market with the highest market share in 2025. The market dominance of this segment is driven by rising cases of Alzheimer’s disease, ongoing advancements in diagnostic technologies and demand for non-invasive techniques. Approvals of innovative disease-modifying therapies such as Lecanemab which is a monoclonal antibody targeting amyloid-beta protofibrils for treating early-stage Alzheimer’s disease is creating the need for early screening and diagnosis.

How Academic and Research Institutes Segment Dominated the Market in 2025?

By end-use, the academic and research institutes segment accounted for the largest market share in 2025. Academic institutes play an important role in the understanding of Alzheimer’s disease pathology such as identification of novel protein biomarkers and genetic biomarkers necessary for evaluating disease onset, early detection and development of accurate diagnostic techniques. Various universities and research institutes are focused on conducting exhaustive validation studies and clinical trials for testing the efficacy, specificity and sensitivity of new diagnostic technologies such as digital cognitive assessment tools and sophisticated biomarker analysis assays.

Additionally, funding allocated by charitable organizations and governments to academic and research institutes for advancing Alzheimer’s disease diagnostics research as well as increased collaborations with diagnostic and pharmaceutical companies are boosting the market growth of this segment.

By end-use, the hospitals segment is anticipated to show the fastest growth during the forecast period. The comprehensive infrastructure of hospitals with access to various resources for complete Alzheimer’s diagnostic tests such as advanced brain imaging equipment, meticulous neuropsychological assessment facilities and specialized laboratories for CSF and blood biomarker analysis which may not be available in certain diagnostic centers and small clinics. Multidisciplinary expertise which includes neurologists, radiologists, laboratory technicians, geriatricians and psychiatrists provided by hospitals enables holistic evaluation of patients with Alzheimer’s.

Moreover, quality care for complex cases and comorbidities, potential for identifying dementia cases during in-patient stays or emergency admissions, favourable reimbursement policies and insurance coverages as well as integration of R&D activities through clinical trials for innovative diagnostics and therapies are the factors expected to fuel the market growth of hospitals segment in the upcoming years.

Some of The Prominent Players in The Alzheimer’s Disease Diagnostics Market Include:

Recent Developments in the Alzheimer’s Disease Diagnostics Market

- In June 2025, Oxford Brain Diagnostics (OBD) announced the commercial launch of its patented Cortical Disarray Measurement (CDM) technology developed for globally advancing neurodegeneration diagnostics, further assisting healthcare providers with detection and monitoring of diseases like Alzheimer’s. The commercial rollout across healthcare sectors in the U.S. and UK is followed by FDA’s 510(k) clearance and UKCA self-certification of OBD’s patented technology.

- In April 2025, Lantheus Holdings, Inc., a prominent radiopharmaceutical company, announced the successful assessment of the sensitivity and specificity of its clinical-stage F18-labeled tau Positron Emission Tomography (PET) radiodiagnostic, MK-6240 (F18-florquinitau) by meeting its co-primary endpoints in two pivotal studies. Based on this successful evaluation, the company plans to filing a New Drug Application (NDA) submission to the U.S. Food and Drug Administration (FDA) by third quarter of 2025.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the alzheimer’s disease diagnostics market.

By Diagnostics Technique

-

- CSF Biomarkers

- Blood-Based Biomarkers

- Imaging Techniques

- Genetic Testing

- Cognitive Assessment Tests

By Type

- Triage

- Diagnosis

- Screening

By End-use

- Hospitals

- Diagnostic Laboratories

- Academic and Research Institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)