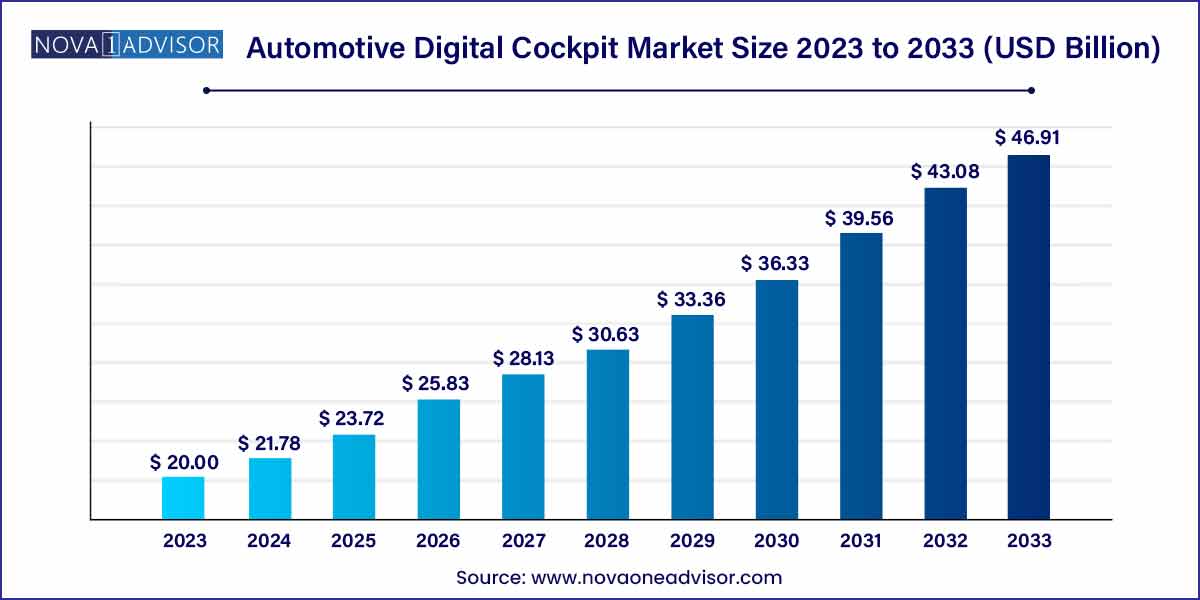

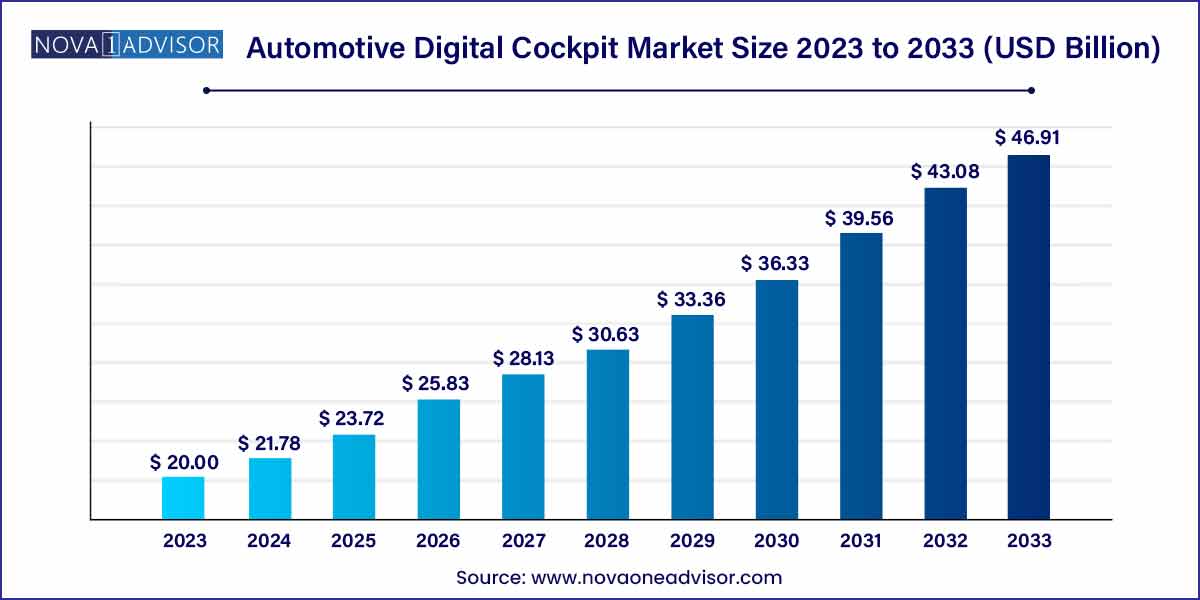

The global automotive digital cockpit market size was exhibited at USD 20.00 billion in 2023 and is projected to hit around USD 46.91 billion by 2033, growing at a CAGR of 8.9% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific dominated the market for the automotive digital cockpit and accounted for the largest revenue share of 52.0% in 2023.

- The driving monitoring system segment dominated the market for the automotive digital cockpit and accounted for the largest share of 48.3% in 2023, in terms of volume.

- The TFT-LCD display segment dominated the market for the automotive digital cockpit and accounted for the largest revenue share of over 55.0% in 2023.

- The passenger cars segment dominated the market for the automotive digital cockpit and accounted for the largest revenue share of more than 85.0% in 2023.

Automotive Digital Cockpit Market: Overview

In the dynamic landscape of automotive technology, the advent of digital cockpits stands as a testament to innovation and progress. Revolutionizing the driving experience, digital cockpits integrate advanced displays, infotainment systems, connectivity features, and driver assistance functionalities into a unified interface. This comprehensive overview delves into the intricate nuances of the automotive digital cockpit market, exploring its growth trajectory, key drivers, market segments, technological advancements, and future prospects.

Automotive Digital Cockpit Market Growth

The automotive digital cockpit market is experiencing robust growth, driven by several key factors. Firstly, there's a rising demand among consumers for enhanced in-car experiences, driven by the need for seamless connectivity, personalized user interfaces, and advanced entertainment options. Moreover, stringent safety regulations and the increasing emphasis on mitigating driver distraction have accelerated the integration of advanced driver assistance systems (ADAS) within digital cockpits. Features such as heads-up displays (HUDs), adaptive cruise control, and collision avoidance systems contribute significantly to market expansion by enhancing driver awareness and safety. Additionally, advancements in display technology, such as OLED and TFT-LCD displays, offer improved resolution, brightness, and design flexibility, further fueling market growth. As automotive manufacturers continue to prioritize innovation and technological advancement, the automotive digital cockpit market is poised for sustained expansion, shaping the future of in-car experiences for drivers worldwide.

Automotive Digital Cockpit Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 20.00 Billion |

| Market Size by 2033 |

USD 46.91 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Equipment, Display Technology, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; The Middle East and Africa |

| Key Companies Profiled |

Continental AG; Denso Corporation; Faurecia; Garmin Ltd.; HARMAN International; Hyundai Mobis; Panasonic Corporation (Panasonic Automotive Systems Europe GmbH); Pioneer |

Automotive Digital Cockpit Market Dynamics

- Evolving Consumer Preferences:

Consumer preferences in the automotive industry are undergoing a significant transformation, driven by the demand for seamless connectivity, personalized user experiences, and advanced technological features. In this context, the adoption of digital cockpits is witnessing an upsurge as they cater to these evolving preferences by offering intuitive interfaces, customizable layouts, and seamless integration with smartphones and other smart devices. Modern-day drivers seek in-car experiences that mirror the functionality and convenience of their digital lifestyles, prompting automotive manufacturers to prioritize the development and integration of advanced digital cockpit solutions.

- Technological Advancements and Innovation:

Technological advancements play a pivotal role in shaping the trajectory of the automotive digital cockpit market, with continuous innovation driving the evolution of cockpit design, functionality, and user experience. Manufacturers are investing heavily in research and development to introduce novel features such as augmented reality (AR) displays, gesture recognition, voice control, and biometric authentication systems. These advancements not only enhance the usability and intuitiveness of digital cockpits but also contribute to improving driver safety and comfort. Augmented reality displays, for instance, overlay digital information onto the real-world driving environment, providing drivers with enhanced navigation, hazard detection, and situational awareness. Similarly, gesture recognition and voice control functionalities offer intuitive means of interacting with the cockpit interface, reducing driver distraction and improving overall usability.

Automotive Digital Cockpit Market Restraint

- Cost and Affordability Challenges:

One of the primary restraints facing the automotive digital cockpit market is the cost associated with implementing advanced digital cockpit solutions. The integration of high-resolution displays, sophisticated infotainment systems, and advanced driver assistance features entails significant development and manufacturing expenses, ultimately contributing to higher vehicle production costs. As a result, consumers may be hesitant to embrace vehicles equipped with digital cockpits, particularly in price-sensitive segments of the market. Moreover, the cost of maintenance and repairs for digital cockpit components can be substantial, further impacting the total cost of ownership and potentially deterring potential buyers. Automotive manufacturers face the challenge of balancing the incorporation of innovative technologies with cost considerations to ensure that digital cockpit-equipped vehicles remain accessible and competitive in the marketplace.

- Complexity and Integration Issues:

Another significant restraint facing the automotive digital cockpit market relates to the complexity of integrating diverse components and systems within the cockpit environment. Digital cockpits encompass a wide array of features, including displays, infotainment systems, connectivity modules, and driver assistance functionalities, each requiring seamless integration and interoperability to deliver a cohesive user experience. However, the integration process can be inherently complex, involving compatibility issues, software bugs, and interoperability challenges that may hinder the seamless functioning of digital cockpit systems. Furthermore, the rapid pace of technological advancement and the proliferation of software-driven features add another layer of complexity, requiring continuous updates and maintenance to ensure optimal performance and reliability. Automotive manufacturers and suppliers must invest in robust testing and validation processes to mitigate integration risks and ensure that digital cockpit systems meet stringent quality and reliability standar

Automotive Digital Cockpit Market Opportunity

- Personalized User Experiences and Value-added Services:

The automotive digital cockpit market presents a significant opportunity for manufacturers to deliver personalized user experiences and value-added services that cater to the diverse needs and preferences of consumers. Digital cockpits offer a versatile platform for customization, allowing drivers to tailor their in-car environment according to their preferences for display layouts, infotainment content, connectivity options, and driver assistance features. By leveraging advanced data analytics and machine learning algorithms, automotive manufacturers can gain valuable insights into user behavior, preferences, and usage patterns, enabling them to deliver targeted content, recommendations, and services that enhance the overall driving experience. From personalized navigation routes and entertainment recommendations to proactive maintenance alerts and concierge services, digital cockpits enable a wide range of value-added offerings that differentiate vehicles in the competitive marketplace and foster brand loyalty among consumers.

- Integration with Emerging Technologies:

Another promising opportunity in the automotive digital cockpit market lies in the integration with emerging technologies such as artificial intelligence (AI), augmented reality (AR), and 5G connectivity. These technologies hold the potential to revolutionize the in-car experience by enabling new levels of interactivity, intelligence, and connectivity within digital cockpit environments. AI-powered virtual assistants can provide proactive assistance, anticipate user needs, and personalize recommendations based on contextual information and user preferences. Augmented reality displays can overlay digital information onto the real-world driving environment, offering enhanced navigation, hazard detection, and situational awareness. Furthermore, the rollout of 5G connectivity promises ultra-fast data transmission speeds, low latency, and high reliability, unlocking new possibilities for real-time content streaming, cloud-based services, and vehicle-to-everything (V2X) communication.

Automotive Digital Cockpit Market Challenges

- Complexity and Integration Issues:

One of the foremost challenges confronting the automotive digital cockpit market is the complexity associated with integrating a multitude of disparate components and systems into a cohesive and seamless user experience. Digital cockpits incorporate a wide array of features, including high-resolution displays, advanced infotainment systems, connectivity modules, and driver assistance functionalities, each requiring intricate integration and interoperability. Ensuring compatibility, reliability, and optimal performance across diverse hardware and software platforms presents a significant technical challenge for automotive manufacturers and suppliers. Furthermore, the rapid pace of technological innovation and the proliferation of software-driven features exacerbate integration issues, necessitating continuous updates, testing, and validation to address compatibility issues, software bugs, and interoperability challenges.

- Cybersecurity Risks and Data Privacy Concerns:

Another critical challenge facing the automotive digital cockpit market relates to cybersecurity risks and data privacy concerns associated with the increasing connectivity and digitization of vehicles. Digital cockpits rely on interconnected networks, sensors, and software systems to deliver advanced features such as remote diagnostics, over-the-air software updates, and cloud-based services, thereby exposing vehicles to potential cyber threats and vulnerabilities. Malicious actors could exploit security loopholes to gain unauthorized access to vehicle systems, compromise critical functions, or steal sensitive data, posing significant safety and privacy risks to drivers and passengers. Moreover, the collection, storage, and transmission of vast amounts of data within digital cockpit environments raise concerns about data privacy, ownership, and misuse, necessitating robust measures to safeguard consumer information and comply with regulatory requirements.

Segments Insights:

Equipment Insights

Digital instrument clusters dominated the automotive digital cockpit market in 2024, driven by their ability to replace traditional analog gauges with customizable digital displays. These clusters provide drivers with critical information—including speed, fuel economy, navigation, and ADAS alerts—in a highly legible, customizable format. Automakers across all vehicle categories, from luxury to mass market, are incorporating digital clusters to elevate the perceived value and user experience.

Conversely, driver monitoring systems (DMS) are the fastest-growing segment. With increasing regulatory mandates—such as the European Union’s General Safety Regulation (GSR) requiring DMS in new vehicles—automakers are integrating driver attention and fatigue detection systems into their cockpits. DMS technologies using cameras and sensors enhance safety by proactively alerting or intervening if driver inattention is detected, making them critical for both human-driven and semi-autonomous vehicles.

Display Technology Insights

TFT-LCD technology dominated the market, favored for its cost-effectiveness, mature manufacturing processes, and sufficient resolution for most automotive applications. TFT-LCDs offer reliable performance under varying lighting conditions and are widely used across digital instrument clusters, infotainment screens, and center displays.

Meanwhile, OLED displays are the fastest-growing segment. OLED technology offers superior contrast ratios, deeper blacks, thinner profiles, and flexible form factors, enabling curved or uniquely shaped displays. Premium automakers like Mercedes-Benz and Audi are pioneering OLED cockpit displays to create visually stunning, highly responsive user interfaces. As production costs gradually decline, OLED adoption is expected to broaden across more vehicle categories.

Vehicle Type Insights

Passenger cars dominated the automotive digital cockpit market, accounting for the largest share due to higher production volumes and greater consumer demand for in-vehicle connectivity and entertainment features. Automakers like Tesla, BMW, and Hyundai have made digital cockpits central to their vehicle identity, making these technologies highly visible and desirable among consumers.

On the other hand, commercial vehicles are the fastest-growing segment. As fleet operators prioritize safety, route optimization, and driver efficiency, digital cockpit solutions offering real-time navigation, telematics integration, and driver monitoring are becoming increasingly essential. Truck and bus manufacturers are investing in smart cockpits to enhance operational safety and compliance with evolving transpor

Regional Insights

Europe dominated the automotive digital cockpit market in 2024, owing to its early adoption of advanced automotive technologies, stringent safety regulations, and consumer preference for premium, tech-enabled vehicles. Automakers such as BMW, Mercedes-Benz, and Volkswagen Group are at the forefront of digital cockpit innovation, integrating AR-HUDs, voice assistants, and multi-screen setups across a wide range of models.

Asia-Pacific is the fastest-growing region, driven by booming automotive markets like China, Japan, and South Korea. China’s tech-savvy consumers demand high levels of in-car connectivity and innovation, pushing domestic OEMs like NIO, XPeng, and BYD to offer sophisticated digital cockpit experiences. Moreover, government initiatives supporting electric vehicles and autonomous driving further fuel regional investment in digital cockpit technologies.

Some of the prominent players in the automotive digital cockpit market include:

- Continental AG

- Denso Corporation

- Faurecia

- Garmin Ltd.

- HARMAN International

- Hyundai Mobis

- Panasonic Corporation (Panasonic Automotive Systems Europe GmbH)

- Pioneer Corporation

- Robert Bosch GmbH

- Visteon Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive digital cockpit market.

Equipment

- Digital Instrument Cluster

- Driving Monitoring System

- Head-up Display (HUD)

Display Technology

Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)