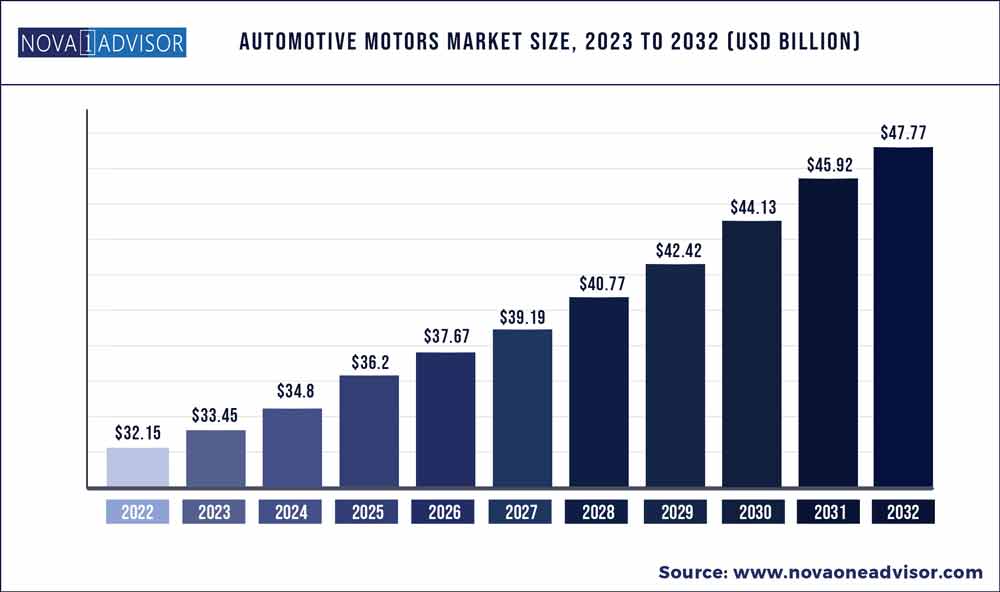

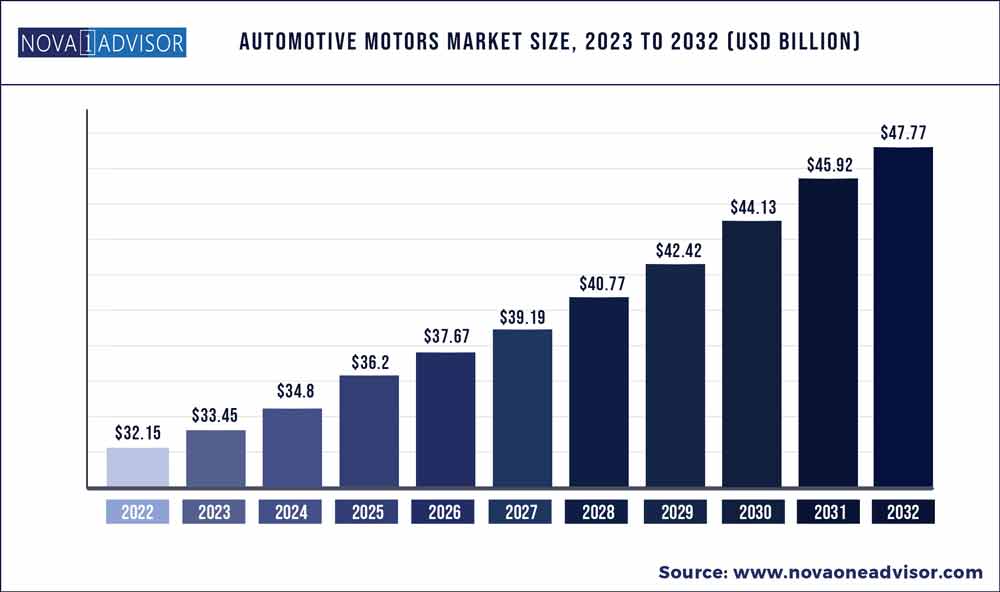

The global automotive motors market size was exhibited at USD 32.15 billion in 2022 and is projected to hit around USD 47.77 billion by 2032, growing at a CAGR of 4.04% during the forecast period 2023 to 2032.

Key Pointers:

- By type, the DC brushed motors segment contributed highest revenue share of over 45% in 2022.

- By vehicle type, the passenger cars segment hit 40% revenue share in 2022.

- By function, the comfort & convenience segment held 55% revenue share in 2022.

- Asia-Pacific region contributed revenue share of over 44% in 2022.

- Germany automotive motors market size was accounted at USD 3.26 billion in 2022 and growing at a CAGR of 5.3% from 2023 to 2032.

- China Automotive Motors market size was reached at USD 5.18 billion in 2022 and it is expected to grow at a CAGR of 4.11% from 2023 to 2032.

- India automotive motors market was worth around at USD 2.19 billion in 2022 and is expected to grow at a CAGR of 5.6% from 2023 to 2032.

Factors such as rising demand for low emission ICE vehicles, increasing consumer spending on safety and comfort features in automobiles and the growing trend of electrificantion of automobiles along with the growing demand for premium vehicles will lead to a growth in the automotive motors market. The global recovery from the pandemic and will also be a major factor leading to a stable growth in demand for these motors.

Automotive Motors Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 33.45 Billion

|

|

Market Size by 2032

|

USD 47.77 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 4.04%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Application, Vehicle Type, Technology, Function, Motor Type

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Continental AG, Nidec Corporation, Robert Bosch GmbH, Johnson Electric Holdings Ltd., Denso Corporation, Mitsubishi Electric Corporation. Siemens AG, Borgwarner Inc., Mitsuba Corporation, Magna International, Valeo S.A., Mahle Group, REIL Electricals India Limited, PMP Auto Components Pvt. Ltd., SAIC Motor Corporation Limited

|

Market Dynamics:

Driver: Rising demand for safety systems to boost automotive motors market

Automotive safety norms are evolving in developing countries due to legislation for active and passive safety systems, which mandate the installation of safety systems in passenger cars. This considerably increases the installation of safety systems such as ABS and ESC per vehicle and thus, increases the demand for electric motors. Safety features are enhanced by ABS, ESC, and brake assist motors platforms, which provide high power density and reliability for all vehicles, including hybrid and electric car braking systems. Advanced compact pedal adjuster motors are designed to provide the highest uniformity in the smallest package to enhance driver control and comfort. All these features are increasing the comfort and performance of a vehicle, subsequently driving the demand for automotive motors. Most active safety features in automobiles use automotive motors as part of their systems. ABS, ESC, and AEB use these motors directly or as part of their systems. The ECU works with engine motor systems in the vehicle for their use. The ABS system also uses motors for its operations as part of the setup. Autonomous emergency braking works with brake motors for their operations. Thus, the growing use of these motors in safety systems would drive the automotive motors market.

Restraint: Automobiles with advanced features (using more motors) to have more weight and cost compared to basic models

Due to stringent environmental norms and rising demand for vehicles with better fuel efficiency, automotive suppliers are looking at lighter components for weight reduction, which would help meet the demand for lower emissions and better mileage. Tier II suppliers are developing low-weight raw materials through technological advancements without compromising the structural strength of the components. However, due to stiff competition in pricing, motor manufacturers cannot pass on the benefit to their customers. The tier I suppliers and OEMs focus on improving vehicle efficiency and cost optimization of motors-related technologies. However, commercializing them in the mass market is one of the key restraints for the automotive motors market. Nowadays, automobiles with more advanced features have been growing in demand in the mid-priced and luxury segments. They have better features than a decade back and use more automotive motors than base car models.

Opportunity: Growing demand for luxury vehicles to present growth opportunity

Several economies around the world have recovered from the 2008 recession. Higher growth rates have been observed in developing countries such as China and India. The standard of living has also improved in developing countries, with a considerable rise in spending power. German auto brands such as Mercedes-Benz, BMW, and Audi dominate the global luxury car market. The change in consumer preferences has increased the demand for better products, which has positively affected the sales of premium cars across the globe. The automotive division of BMW recorded growth in 2019, despite the slowdown in the global automotive market. The division registered a growth of 6.8% in 2019 due to increasing deliveries in the luxury car segment. Its subsidiary, Rolls Royce, sold 5,100 units, an increase of 21.6%, compared to 4,194 units a year earlier, while the production volume increased by 25.3%. Similarly, the group sold more BMW branded vehicles in 2019 than in 2018. In 2020 and 2021, there was a decline in the luxury segment due to an overall reduction in vehicle sales due to the pandemic. In 2021, the sales of the BMW Group grew by 8.4% compared to 2020. Meanwhile, the sales of Mercedes Benz fell by around 5% in 2021 compared to 2020. On the other hand, Audi decreased sales by just 0.7% compared to 2020. However, they are expected to grow at a fast rate in the coming years. Features like safety innovations are first introduced in the luxury and premium car segments, and this rise in sales would act as a driver for the automotive motors market.

Challenge: Fluctuating prices of raw materials to pose challenge to market

The raw materials used in manufacturing motors include steel bars and copper wires. Motor manufacturers and suppliers are concerned about access to materials and price volatility. Fluctuations in the cost of raw materials are restraining the growth of the global automotive motors market. Also, manufacturers have long-term supply contracts that prevent them from taking the cost advantage of decreasing materials prices. In such cases, if the price of the commodity or the material falls, the manufacturers do not have the upper hand and lose the cost advantage. Raw material prices had hit the automotive motor market severely due to an increase in prices of copper by around 40%, plastic by around 38%, and stainless steel by around 47% in 2020 compared to 2019. Thus, since 2023, the prices of automotive motors have risen by around 8-10% by applicability. The Ukraine-Russia war further led to an increase in the cost of raw materials, which is expected to negatively impact the market and the overall automotive industry. The copper market grew much faster than aluminum, tin, lead, nickel, and zinc in 2021, with around 12% growth before the impact of the Ukraine-Russia war. The market was further impacted by the onset of the war, along with global supply chain disruptions in some parts of the world.

Passenger cars to be the largest market by vehicle type during the forecast period

Owing to rapid globalization and the economic growth of emerging countries such as Brazil and India, the standard of living of consumers has improved in the recent decade. The increase in disposable income of consumers has pushed the demand for passenger cars, which, in turn, has driven the growth of the automotive motors market. The adoption of fuel-efficient vehicles has driven the demand for advanced motor technologies. This has also led to a growing demand for comfort motors in automobiles and strengthened the market. The increased demand for safety systems in emerging markets can be attributed to improving road safety standards, supporting legislation, and consumer awareness. Additionally, several countries in Europe, North America, and Asia Pacific have introduced regulations that mandate the incorporation of various types of safety features in the passenger cars segment. Thus, the mandates contribute to the demand for safety motors in upcoming passenger cars.

Motors for Power Antenna will be the fastest-growing segment by application during the forecast period

An antenna is used for radio function in cars. They can be operated manually or electrically (power antenna). Power antennas retract and raise electrically with a single touch button or automatically after turning on the car or radio. This retraction and raising function is done with the help of a motor installed in its assembly. The power antenna assembly includes a DC motor, antenna, gear assembly, housing, electric components or connections, and a round coil. However, most of the OEMs have stopped providing antennas in modern cars, as there are not required anymore for the radio function. With the growing trend of developing smart and connected systems in automobiles for both comfort and safety provisions, the demand for power antenna motors will increase rapidly in the coming years.

Asia Pacific is expected to be the fastest-growing market in the forecast period.

In recent years, the automotive industry has witnessed higher growth in terms of vehicle production in Asia Pacific than in the matured markets of Europe and North America. Asia Pacific has emerged as a hub for automotive production, given the nascent stage of the market, state-promoted support, and cost advantages for OEMs. Low automobile market penetration and increased vehicle production in this region offer attractive market opportunities to automobile manufacturers and automotive components and equipment suppliers. This is mainly attributed to the production expansions made by automobile manufacturers to cope with rising demand as well as to comply with the fuel-efficiency norms and regulations. The growth in the market is also attributed to the growing focus of international and domestic players in the Asia Pacific market. The low production cost of automotive motors in the region is also a major reason for the rise in the growth rate.

Implementing new technologies, setting up more manufacturing plants, and creating a value-added supply chain between the manufacturers and material providers have created a vast opportunity for the growth of the automotive motors market in the region. Aisin Corporation (Japan), Denso (Japan), Johnson Electric (China), Mitsubishi Electric (Japan), Hitachi (Japan), and Mikuni Corporation (Japan) have a dominant presence in the region. The automotive industry in Asia Pacific is expected to see significant growth in the next few years. The market is expected to grow proportionally to the regional automotive market.

Some of the prominent players in the Automotive Motors Market include:

- Continental AG (Germany)

- Nidec Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Johnson Electric Holdings Ltd. (Hong Kong)

- Denso Corporation (Japan)

- Mitsubishi Electric Corporation (Japan). Siemens AG (Germany)

- Borgwarner Inc. (U.S.)

- Mitsuba Corporation (Japan)

- Magna International (Canada)

- Valeo S.A. (France)

- Mahle Group (Germany)

- REIL Electricals India Limited (India)

- PMP Auto Components Pvt. Ltd. (India)

- SAIC Motor Corporation Limited (China)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Automotive Motors market.

By Application

- Power Antenna Motor

- Alternator

- Electric Parking Brake

- Fuel pump Motor

- Sunroof Motor

- Wiper Motor

- Starter Motor

- Electric Power Steering

- Engine Cooling Fan

By Vehicle Type

- Heavy Commercial Vehicles

- Passenger Cars

- Electric two-Wheeler

- Light Commercial Vehicle

- Two-Wheeler

- Plug in Hybrid Electric Vehicle

- Battery Electric Vehicle

By Technology

- Pulse-width modulation (PWM)

- Direct torque control (DTC)

- Others

By Function

- Performance

- Comfort & Convenience

- Safety & Security

By Motor Type

- Stepper Motor

- Brushless DC Motor

- DC brushed Motor

- Traction Motor

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)