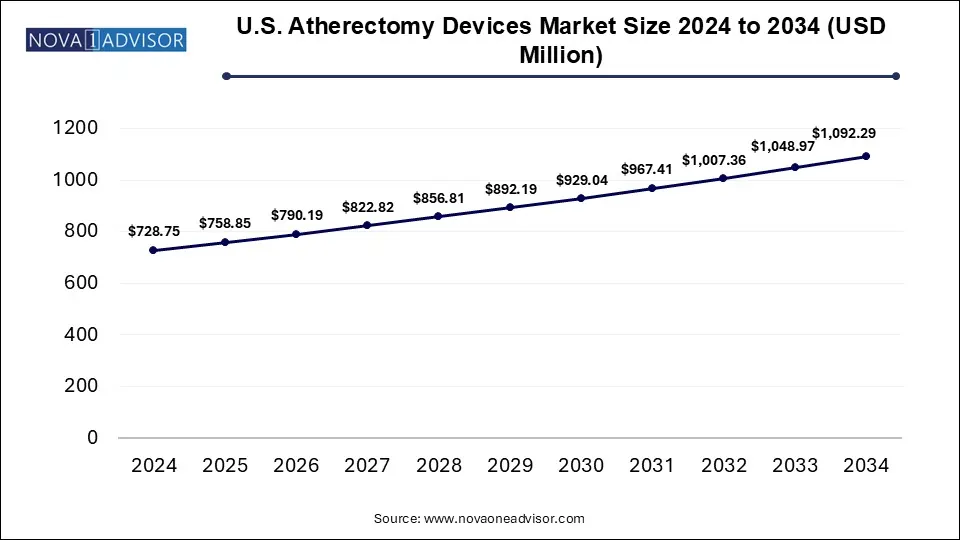

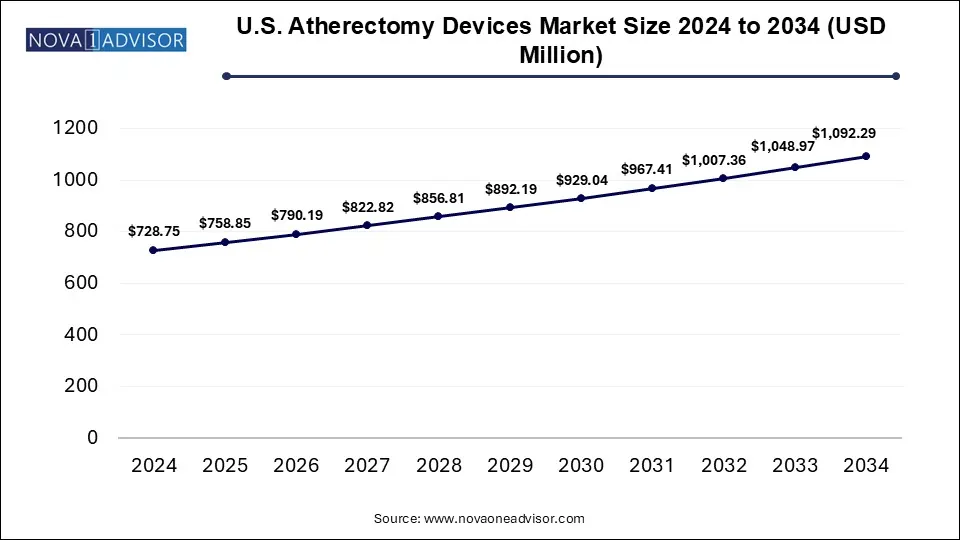

U.S. Atherectomy Devices Market Size and Growth

The U.S. atherectomy devices market size was exhibited at USD 728.75 million in 2024 and is projected to hit around USD 1,092.29 million by 2034, growing at a CAGR of 4.11% during the forecast period 2025 to 2034. The U.S. atherectomy devices market is driven by the rising incidences of cardiovascular diseases, increasing demand for minimally invasive procedures, ongoing clinical trials and favorable reimbursement policies.

U.S. Atherectomy Devices Market Key Takeaways:

-

In 2024, directional atherectomy systems held the leading position in the market, capturing approximately 38% of the total share.

-

The photo-ablative (Laser) atherectomy systems segment is projected to witness the highest compound annual growth rate (CAGR) of 6.3% throughout the forecast period.

-

The peripheral vascular segment emerged as the top revenue contributor, accounting for nearly 50% of the market share in 2024.

-

The neurovascular segment is anticipated to experience the fastest growth rate in the coming years.

-

The hospital segment dominated the market, representing around 54.0% of the total revenue share in 2024.

Market Overview

The U.S. atherectomy devices market is a crucial segment within the broader vascular intervention space, primarily focused on minimally invasive treatment options for atherosclerotic plaque removal. Atherectomy devices are designed to excise, vaporize, or abrade plaque buildup from arterial walls, restoring blood flow in patients suffering from peripheral arterial disease (PAD), coronary artery disease (CAD), and other vascular conditions. These devices are typically deployed in interventional cardiology, vascular surgery, and endovascular procedures.

In the U.S., the rising prevalence of cardiovascular diseases—driven by sedentary lifestyles, obesity, diabetes, and aging populations—has sharply increased demand for advanced atherectomy technologies. Patients with PAD or coronary artery disease often present with calcified or complex lesions that are not easily treatable through balloon angioplasty or stenting alone. Atherectomy offers a unique advantage by debulking lesions, improving stent delivery, and optimizing long-term outcomes.

Over the past decade, technological advancements such as orbital atherectomy, photo-ablative lasers, and ultra-high-speed rotational cutters have elevated procedural success rates and broadened the eligible patient base. At the same time, the U.S. medical device regulatory framework and strong reimbursement support from CMS have provided fertile ground for innovation, adoption, and clinical research in the atherectomy field.

As the shift toward outpatient care continues to gain momentum in the U.S., with more vascular procedures being performed in ambulatory surgical centers (ASCs), demand for compact, efficient, and cost-effective atherectomy devices is expected to rise. The outlook for this market remains positive, particularly as device manufacturers continue to expand indications and integrate smart technologies to enhance procedural precision.

Major Trends in the Market

-

Growing Preference for Minimally Invasive Vascular Procedures in Outpatient Settings

-

Technological Innovation in Device Design for Enhanced Lesion Crossing and Debulking

-

Integration of Atherectomy with Drug-Coated Balloon Angioplasty and Stenting Strategies

-

Increased Adoption of Orbital Atherectomy in Treating Calcified Peripheral Arteries

-

Shift Toward Laser Atherectomy in Refractory and In-Stent Restenosis Lesions

-

Emphasis on Operator Training and Simulation Platforms for Complex Lesion Management

-

Greater Focus on Reducing Radiation and Contrast Exposure During Procedures

-

Rising Investment in Clinical Trials to Expand Indications and Reimbursement Coverage

-

Mergers and Acquisitions Aimed at Expanding Atherectomy Device Portfolios

-

Data Integration and AI-Based Decision Support Tools for Personalized Procedural Planning

What Role Can AI Play in the U.S. Atherectomy Devices Market?

Artificial intelligence (AI) and machine learning models can be applied for analzying intravascular ultrasound (IVUS) images to predict effective reduction of potential areas by using rotational atherectomy in pre-procedural planning. Training AI models can enable identification of lesions, for characterizing plaque and to assess functional flow, leading to enhance diagnostic precision and improved treatment decisions for atherectomy procedures. Real-time guidance during procedures with AI-powered tools can potentially help in navigation, device control and to optimize plaque removal.

Report Scope of U.S. Atherectomy Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 758.85 Million |

| Market Size by 2034 |

USD 1,092.29 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 4.13% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Abbott, B. Braun SE, Boston Scientific Corporation, BD, AngioDynamics, Biomerics, Terumo Corporation, Medtronic, and Koninklijke Philips N.V. |

Market Driver: High Prevalence of Peripheral Arterial Disease and Cardiovascular Risk Factors

A primary driver of the U.S. atherectomy devices market is the high and growing burden of peripheral arterial disease (PAD). According to the CDC, PAD affects over 6.5 million Americans aged 40 years and older. PAD, often characterized by narrowed arteries due to plaque buildup, significantly increases the risk of heart attack, stroke, and limb amputation.

Atherectomy devices offer a minimally invasive option for plaque removal in patients with calcified or long-segment lesions that do not respond well to balloon angioplasty. In the U.S., where the aging population and high rates of diabetes, smoking, and hyperlipidemia contribute to PAD prevalence, the need for atherectomy-based interventions continues to grow. Hospitals and ASCs are increasingly investing in atherectomy technologies as they offer clinical and cost benefits by reducing the need for repeat procedures and improving stent placement outcomes.

The emergence of atherectomy as a frontline treatment strategy, particularly in complex or recurrent PAD cases, has positioned this technology as an essential component of interventional vascular therapy in the U.S. healthcare system.

Market Restraint: Procedural Cost and Risk of Embolic Complications

Despite its growing clinical utility, a key restraint in the U.S. atherectomy devices market is the relatively high cost of devices and procedures, which may limit widespread adoption, especially in lower-budget care settings. Atherectomy systems are more expensive than traditional angioplasty balloons or stents, and require specialized operator training and infrastructure, including imaging and embolic protection systems.

Moreover, atherectomy procedures are associated with a higher risk of embolic debris, which can lead to downstream ischemia or procedural complications if not managed with distal protection. This risk necessitates the use of adjunctive devices, adding to procedural complexity and cost. In some clinical settings, concerns over procedural duration, reimbursement limitations, and operator experience may restrict atherectomy use to specialized centers or more complex cases.

Efforts are ongoing to develop safer, cost-effective devices and to refine clinical protocols to mitigate these challenges. However, procedural economics and potential complications remain considerations in adoption decisions.

Market Opportunity: Growth of Ambulatory Care Centers for Vascular Procedures

A significant growth opportunity in the U.S. market lies in the rapid expansion of ambulatory surgical centers (ASCs) and office-based labs (OBLs) offering vascular interventions. These centers provide outpatient alternatives to hospital-based care, offering cost savings, shorter patient turnaround times, and improved patient satisfaction.

As CMS continues to support reimbursement for PAD and coronary procedures in ASCs, many physicians are shifting from hospitals to office-based settings. This creates a growing demand for compact, mobile, and easy-to-use atherectomy systems that can be deployed efficiently in outpatient environments.

Device manufacturers that develop portable platforms with simplified workflow, integrated imaging support, and lower disposable costs are well-positioned to serve this market. Additionally, strategic partnerships between device vendors and ASC networks offer avenues for market penetration and revenue growth.

U.S. Atherectomy Devices Market By Product Insights

Directional atherectomy systems dominated the market and accounted for a share of 38% in 2024. These systems, such as the Diamondback and Rotablator, use high-speed rotating burrs or cutters to ablate calcified or fibrotic plaque in both coronary and peripheral arteries. The precision and control offered by rotational atherectomy make them suitable for treating heavily calcified lesions where stent expansion may otherwise be compromised.

The photo-ablative (Laser) atherectomy systems segment is expected to register the fastest CAGR of 6.3% during the forecast period. Laser atherectomy systems employ ultraviolet light to vaporize plaque, thrombus, or fibrotic tissue without mechanical contact. Their non-mechanical nature reduces the risk of arterial dissection and makes them suitable for delicate neurovascular applications or in-stent restenosis (ISR) scenarios.

Technological advancements in laser control, depth targeting, and catheter compatibility are expanding the clinical indications for laser atherectomy in both coronary and peripheral settings. As device developers enhance usability and precision, the adoption of laser systems is expected to grow, particularly in high-risk or previously stented patients.

U.S. Atherectomy Devices Market By Application Insights

The peripheral vascular segment accounted for the largest market revenue share of 50% in 2024. PAD affects arteries in the lower extremities and often results in pain, mobility impairment, and ulceration. Atherectomy is increasingly used as a frontline or adjunctive therapy for restoring vessel patency in complex PAD cases.

In contrast, the neurovascular segment is emerging as the fastest-growing segment, driven by increased focus on treating cerebral atherosclerosis and intracranial stenosis with minimally invasive tools. Laser and low-profile directional atherectomy devices, when combined with embolic protection, are finding utility in stroke prevention and complex carotid artery interventions. As neurointerventional procedures become more sophisticated, the need for safe, precise, and neurologically compatible atherectomy tools is rising rapidly.

U.S. Atherectomy Devices Market By End Use Insights

The hospital segment accounted for the largest market revenue share of 54% in 2024. The U.S., accounting for a substantial share due to the complexity of procedures, infrastructure availability, and staffing expertise. Most high-risk and emergent vascular procedures—including those requiring intravascular imaging and multi-modality treatment—are still performed in hospital catheterization labs and hybrid operating rooms. Hospitals also handle a significant volume of Medicare and Medicaid patients, many of whom present with advanced vascular disease.

However, ambulatory care centers are the fastest-growing end-use segment, thanks to policy support, lower procedural costs, and patient convenience. ASCs and OBLs are increasingly equipped to perform complex peripheral interventions using atherectomy devices, particularly in stable PAD patients. With payer incentives and procedural efficiencies aligning, these centers are expected to account for a rising proportion of atherectomy device utilization in the coming years.

Country Insights

The United States holds a commanding position in the global atherectomy devices market, owing to its robust healthcare infrastructure, early adoption of interventional technologies, and favorable reimbursement policies. The prevalence of lifestyle-related vascular diseases and high procedural volumes supports continued demand for atherectomy systems.

Key states with dense populations, such as California, Texas, Florida, and New York, lead in procedural volume, while cardiovascular centers of excellence such as the Cleveland Clinic and Mayo Clinic contribute to clinical adoption, research, and training. The FDA's device innovation pathways and clinical trial initiatives provide an enabling regulatory environment for domestic and international manufacturers.

Recent shifts in CMS reimbursement for PAD procedures performed in office-based labs (OBLs) have further stimulated interest in atherectomy-capable outpatient centers. Meanwhile, concerns over medical device cost containment and outcomes-based payment models are prompting manufacturers to focus on clinical value and real-world evidence generation.

U.S. Atherectomy Devices Market Recent Developments

- In May 2025, Becton, Dickinson and Company (BD) announced plans to launch a multi-centre registry study, XTRACT, of the Rotarex atherectomy system engineered for removing the plaque and thrombus in peripheral arteries. The registry aims at estimating real-world outcomes for individuals with peripheral artery disease (PAD) with plans to enrol up to 600 subjects at almost 100 clinical sites across U.S.

- In January 2025, AngioDynamics Inc., started a multicentre, randomized controlled trial (RCT) study of the Auryon Atherectomy System Used in Combination with Standard Balloon Angioplasty Versus Standard Balloon Angioplasty Alone Treating Infrapopliteal Lesions in Subjects with Critical Limb Ischemia Below-the-Knee (AMBITION BTK).

- In November 2024, Royal Philips, a globally leading health technology company, enrolled its first patient in the U.S. THOR IDE clinical trial designed for treating peripheral artery disease (PAD). The innovative catheter developed by Philips uniquely combines intravascular lithotripsy and laser atherectomy into a single device, allowing physicians physicians to treat complex, calcified arterial lesions in a single procedure.

- In January 2024, AngioDynamics, Inc., declared the U.S. FDA’s approval for the Auryon XL Catheter which is a 225-cm radial access catheter designed for use with the Auryon Atherectomy System by expanding access points in atherectomy procedures, further mitigating access site complications and to accelerate patient recovery.

- In October 2023, Cardio Flow, Inc., received the 510 (k) clearance from the U.S. Food and Drug Administration (FDA) for its FreedomFlow Orbital Atherectomy Peripheral Platform.

Some of the prominent players in the U.S. atherectomy devices market include:

- Abbott

- B. Braun SE

- Boston Scientific Corporation

- BD

- AngioDynamics

- Biomerics

- Terumo Corporation

- Medtronic

- Koninklijke Philips N.V.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. atherectomy devices market

Product

- Directional Atherectomy Systems

- Orbital Atherectomy Systems

- Photo-ablative (Laser) Atherectomy Systems

- Rotational Atherectomy Systems

Application

- Peripheral Vascular

- Neurovascular

- Cardiovascular

End Use

- Hospitals

- Ambulatory Care Centers

- Others