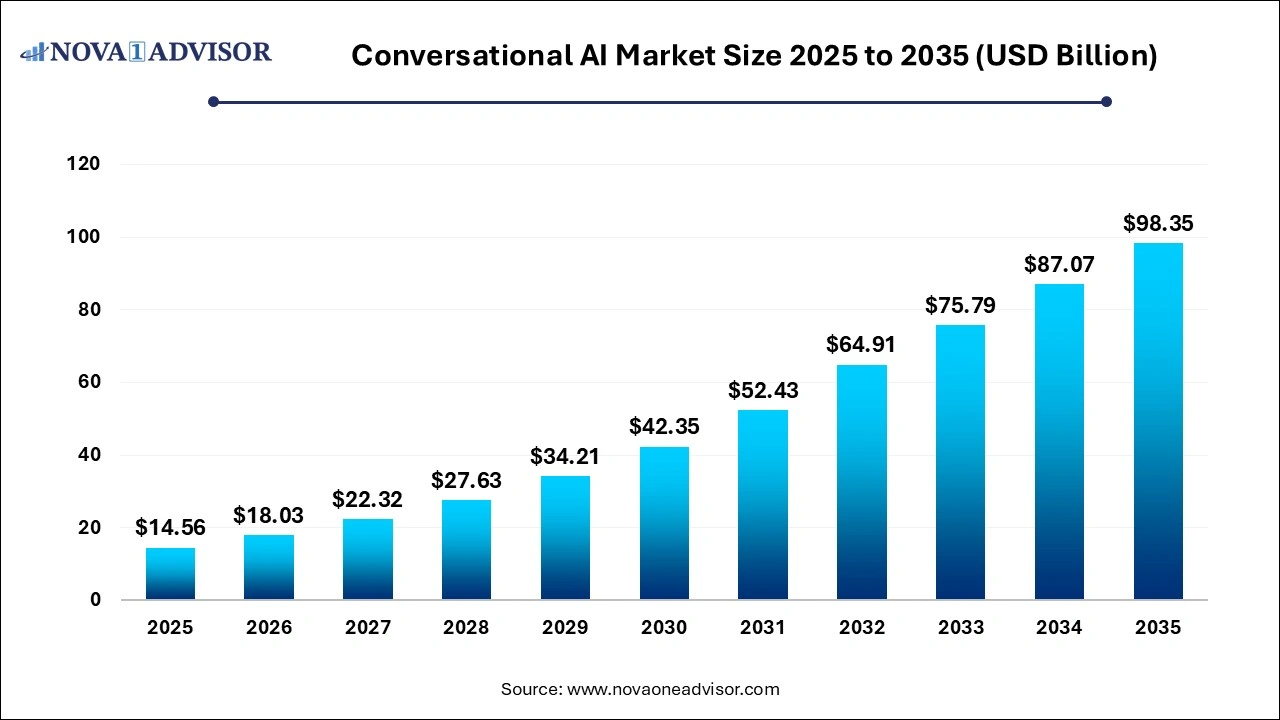

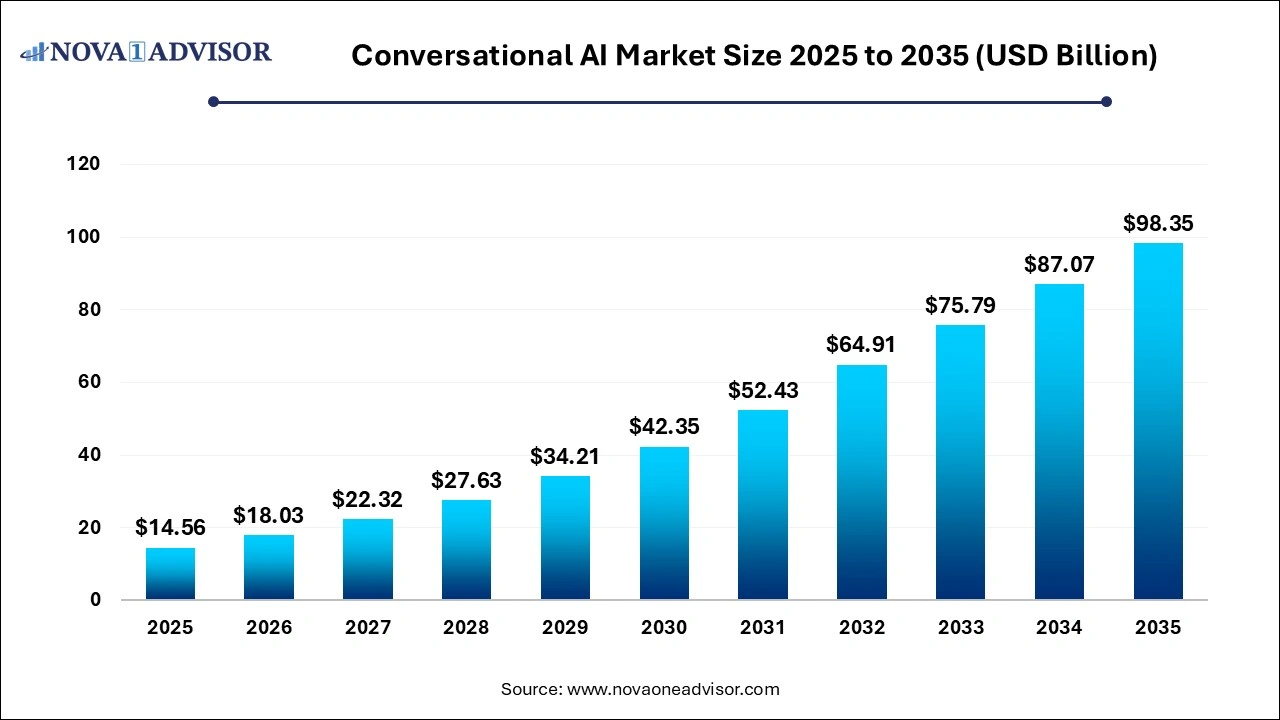

Conversational AI Market Size and Growth 2026 to 2035

The global conversational AI market size was exhibited at USD 14.56 billion in 2025 and is projected to hit around USD 98.35 billion by 2035, growing at a CAGR of 21.05% during the forecast period 2026 to 2035.

Key Pointers:

- North America dominated the share of more than 32% in 2025.

- The Asia Pacific region is projected to witness the highest growth during the forecast period

- The solutions segment held the largest revenue share of over 61.5% in 2025.

- The chatbots segment accounted for a dominant share of over 66.7% in 2025.

- The on-premise segment held the dominant share of over 61.0% in 2025.

- The NLP (Natural Language Processing) segment held the leading revenue share of more than 46% in 2025.

- The retail and e-commerce segment held a leading revenue share of more than 21.0% in 2025.

Conversational AI Market Outlook

- Market Growth Overview: The conversational AI market is expected to grow significantly between 2026 and 2035, driven by the rapid developments in natural language processing, enhanced customer experience, and integration of the omnichannel.

- Sustainability Trends: Sustainability trends involve green data centers and infrastructure, AI-driven ESG reporting and compliance, and ethical AI and social sustainability.

- Major Investors: Major investors in the market include Microsoft, Google, NVIDIA, Amazon, Meta, Salesforce, and Cisco.

Conversational AI Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 14.56 Billion |

| Market Size by 2035 |

USD 98.35 Billion |

| Growth Rate from 2026 to 2035 |

CAGR of 21.05% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Component, By Type, By Deployment, By Technology, By End-user |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The market growth is primarily influenced by the rising adoption of advanced AI technologies and consumer interaction via multiple platforms. It indicates that businesses and their customers view technology as a mode to expand their businesses.

With the growing market penetration of conversational AI as a crucial technology, it is significant that companies set the correct parameters and objectives while adopting chatbots or virtual assistants. Rapidly growing e-commerce and digitalization have been providing favorable conditions for the requirement of customer support service. Omnichannel Deployment, enhanced customer care 24/7, real-time customized service, and the decreased cost to serve customers boost market penetration of AI globally. In October 2022, Jio platform's Haptik introduced a new enterprise CX Platform to enable Conversational AI solutions. This platform aids brands in building Intelligent Virtual Assistants in a low code environment and going live within just a few days.

The growing ‘Chat first’ method by the service sector and technological enhancements like natural language processing are anticipated to boost the market growth. In November 2022, ZeroShotBot launched new conversational AI technology, which normalizes chatbots for companies of all sizes. ZeroShotBot provides a new technology for building chatbots that don’t need training data, permitting anybody with zero coding experience to generate a chatbot that is fully functional algorithms. Moreover, in January 2020, AWS created Amazon Lex chatbot integration, available in Amazon Connect in the Asia Pacific (Sydney) AWS. This chatbot assists consumers in scheduling an appointment, changing passwords, and bringing up requested account balances. Instead of calling out a number from a list of options, this is done by vocalizing a prompt.

Although, the requirement of trained professionals to handle conversational AI, along with a lack of knowledge about conversational AI, hinders the penetration of conversational AI. Providing a top-quality digital experience is a higher priority for businesses, and consumers like their voices to be heard. The growth of conversational AI now provides companies with the customer experience and the power to resolve complex queries and inquiries quickly and effectively.

Conversational AI is far from a new phenomenon nowadays. Both consumers and companies have grown more accustomed to the profitable outcomes of fast, enhanced, 24/7 customer support service, permitting many businesses to serve on the promise of enhanced technologies to improve customer satisfaction, lower costs, and increase revenues. Product managers access the capabilities to manufacture a successful Intelligent Virtual Assistant (IVA) with emerging AI advancements.

Key players in the market are focused on strategic collaborations and partnerships to enhance their products and service offerings and expand the consumer base. For instance, Yellow.ai and Tech Mahindra together work to develop next-gen conversational-AI technologies, as part of the deal, to upgrade omnichannel competencies like Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Supply Chain Management (SCM), and Human Resources Management System (HRMS).

Conversational AI Market Segmental Insights

By Component

The solutions segment growth is driven by the easy integration of both cloud and on-premise solutions into existing digital infrastructures, allowing companies across BFSI, healthcare, and e-commerce to rapidly deploy scalable, sophisticated virtual agents. Consequently, continuous technological advancements in flexibility and integration have cemented conversational AI's role as an essential tool for delivering seamless, secure customer interactions across all digital touchpoints.

The services segment is driven by enterprises' internal skill gaps. This reliance on external consultants is accelerated by the rise of the AI-as-a-Service (AIaaS) model, which necessitates ongoing managed services for continuous optimization and model retraining post-deployment.

By Type

The AI chatbots segment growth is driven by widespread adoption across high-demand sectors like BFSI and e-commerce, where enhanced context and sentiment analysis allow for increasingly human-like, personalized interactions. The versatility of these applications across various industries cements chatbots as a critical, cost-efficient tool for delivering seamless, round-the-clock service.

The intelligent virtual assistants’ segment is driven by the integration of sophisticated Large Language Models (LLMs) and Generative AI, enabling highly dynamic, human-like conversations across a range of applications. This technological leap is meeting the high demand for enhanced, personalized customer experience (CX) and 24/7 service in high-stakes sectors like BFSI and healthcare.

By Deployment

The cloud-based segmentation growth is fueled by leveraging the unparalleled scalability and low upfront costs of AWS, Google, and Microsoft platforms. This deployment model enables businesses to integrate real-time NLP advancements and manage global customer data seamlessly across CRM and CCaaS ecosystems.

By Technology

The natural language processing segmentation growth is fueled by advancements in generative and transformer-based neural networks. Modern NLP models provide the accuracy and contextual understanding required to process massive, unstructured datasets and deliver highly personalized enterprise-level applications. This improved capability streamlines operations from customer service to clinical documentation, cementing NLP's role as the core engine that transforms raw user input into actionable business intelligence.

The automatic speech recognition segment is driven by the integration of AI/ML, which delivers high accuracy across various accents and complex terminology. This rapid expansion of use cases, from real-time transcription to specialized healthcare documentation, is fueled by the accessibility of cloud-based APIs and a strategic push for more natural, voice-activated user experiences.

By End-user

The retail and e-commerce segment growth is driven by rapid digital transformation and the need for personalized experiences, such as AI-driven product recommendations and dynamic pricing engines. Consequently, the retail sector is embedding AI as a core component of its sales strategy, meeting the high consumer demand for immediate, personalized online shopping interactions.

The healthcare and life science segment is revolutionizing global education by integrating specialized AI agents directly into Electronic Health Records (EHRs) and wearable ecosystems. Providers are automating high-stakes workflows from patient triage to complex medical record mining. This digital transformation not only drives massive operational cost reductions but also fundamentally enhances diagnostics and early detection, establishing AI as the primary interface for 24/7, personalized remote care.

Regional Analysis

How did North America dominate in the conversational AI market?

North America continues to anchor its position as the dominant global hub for conversational AI, commanding over a third of the market share through the concentration of industry titans and high-density tech corridors. This leadership is sustained by an unparalleled venture capital ecosystem that captured over 80% of global GenAI funding, fueling the rapid maturation of NLP and machine learning infrastructures.

Asia Pacific conversational AI market trends

The Asia Pacific region is the world's fastest-growing conversational AI market, fueled by a multi-billion-dollar investment surge in China and India to localize multilingual NLP solutions. The strategic shift toward Agentic and Generative AI is transforming traditional retail and finance workflows into high-efficiency, context-aware ecosystems powered by 5G and cloud integration.

Key Players in the Conversational AI Market

- Google: Google uses Natural Language Processing (NLP) through Gemini and Dialogflow. This powers conversational agents across Android, Google Search, and cloud solutions. They focus on customer service to proactively solve problems.

- Microsoft: Microsoft integrates generative AI into productivity tools via Microsoft 365 Copilot. They offer the Azure AI Bot Service for creating and deploying custom chatbots. Their focus allows enterprises to build specialized AI agents, with an emphasis on responsible AI.

- Amazon Web Services, Inc. (AWS): AWS provides infrastructure and tools, such as Amazon Lex and Amazon Q. These enable developers to build and deploy conversational interfaces in voice and text. Their technology is used for developing AI-powered contact centers and integrating generative AI.

- IBM: IBM uses the Watson Assistant platform. This platform enables enterprises to build and deploy conversational agents for specific industries. They focus on trustworthy AI, ensuring solutions are secure and can handle complex tasks.

- Oracle: Oracle embeds AI-driven digital assistants into its Oracle Fusion Cloud Applications. This automates customer support, sales, and HR tasks. These assistants improve efficiency and automate inquiries.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global conversational AI market.

By Component

- Solutions

- Managed Services

- Professional Services

- Training and Consulting

- System Integration and Implementation

- Support and Maintenance

By Type

- Chatbots

- Intelligent virtual assistant (IVA)

By Deployment

By Technology

- Natural Language Processing (NLP)

- ML and Deep Learning

- Automatic Speech Recognition (ASR)

By End-user

- BFSI

- Healthcare

- IT and Telecom

- Retail and eCommerce

- Education

- Media and Entertainment

- Automotive

- Others (Government, Hospitality, Manufacturing, etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)