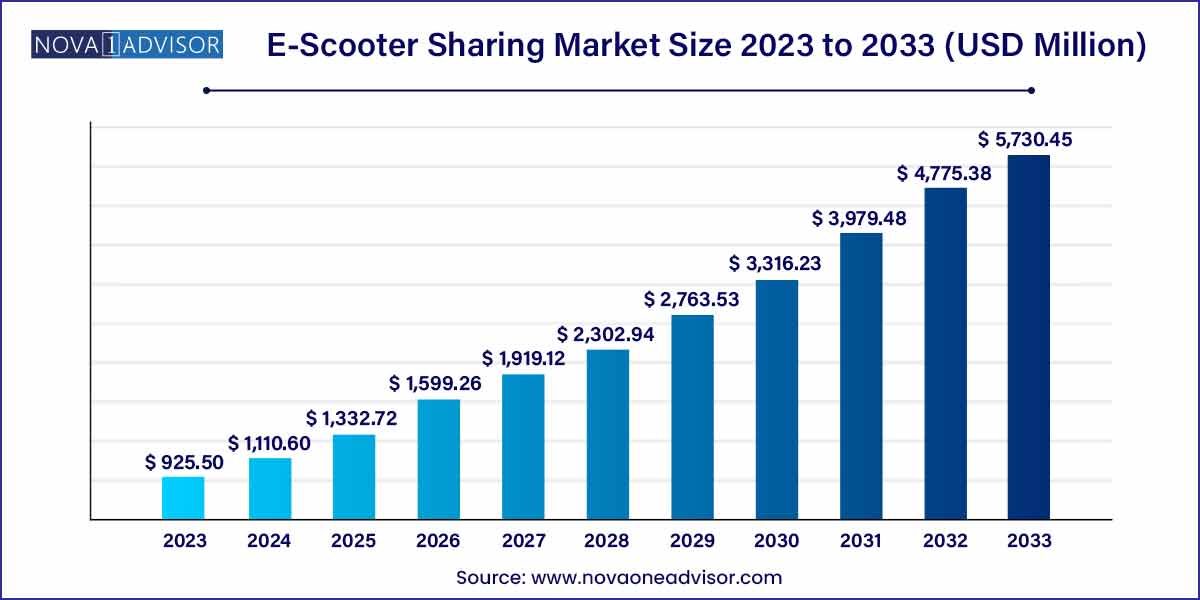

The global e-scooter sharing market size was exhibited at USD 925.50 million in 2023 and is projected to hit around USD 5,730.45 million by 2033, growing at a CAGR of 20.0% during the forecast period of 2024 to 2033.

Key Takeaways:

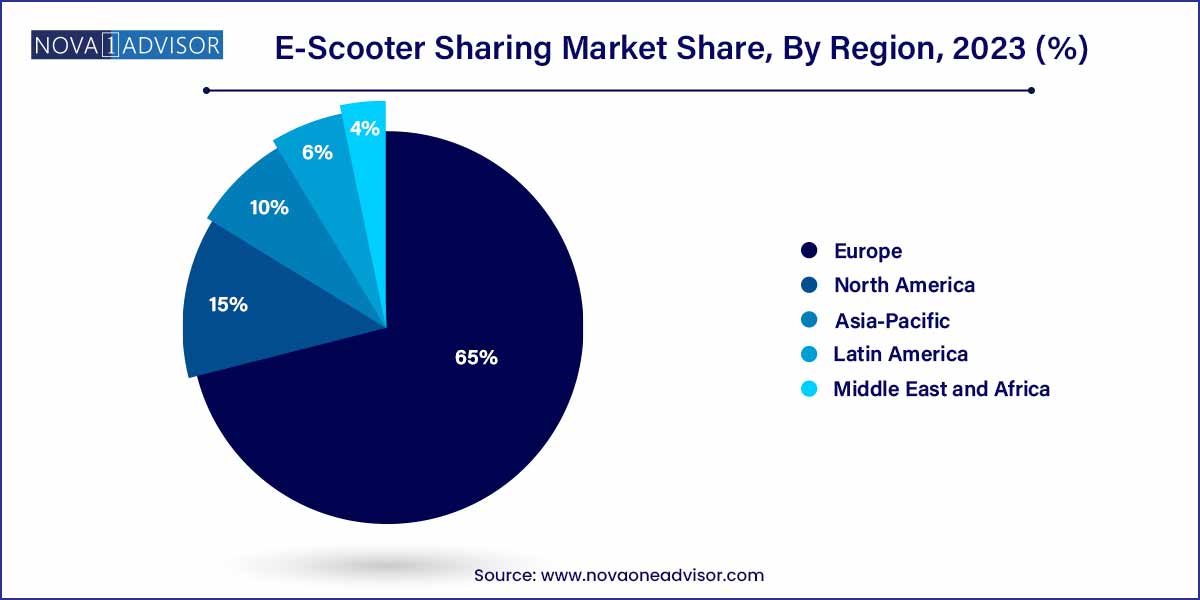

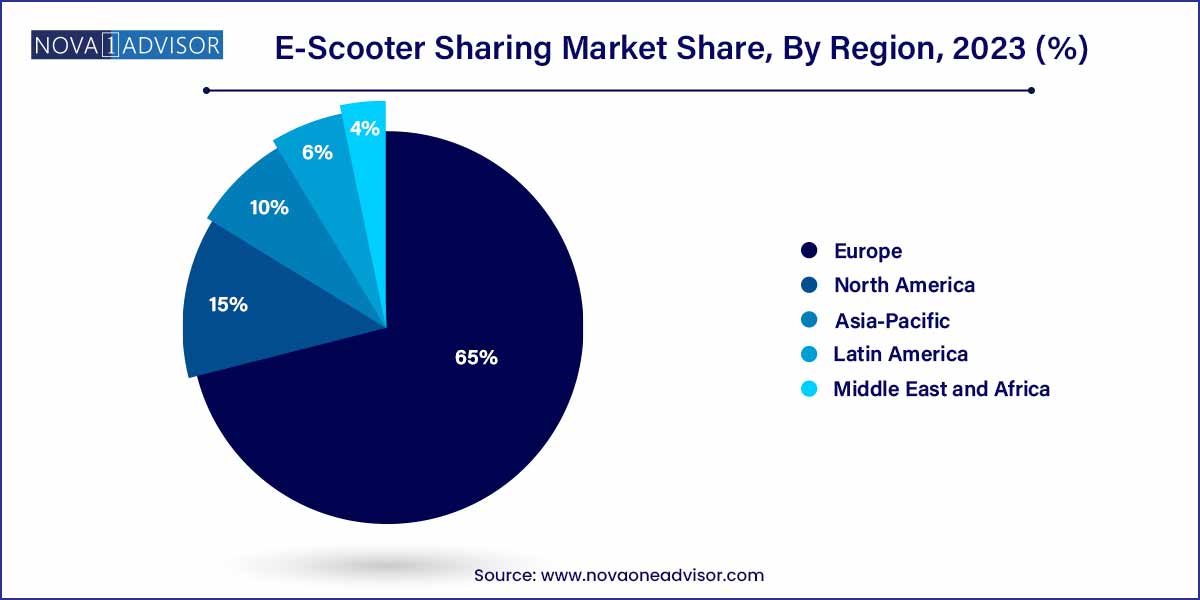

- Europe accounted for a revenue share of around 65% in 2023.

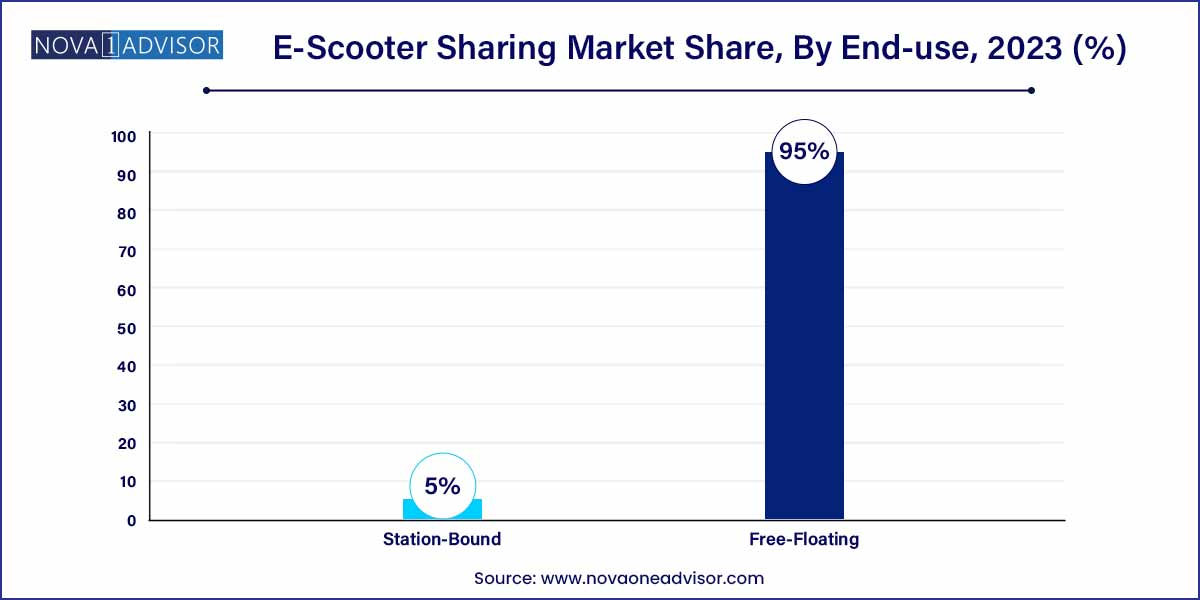

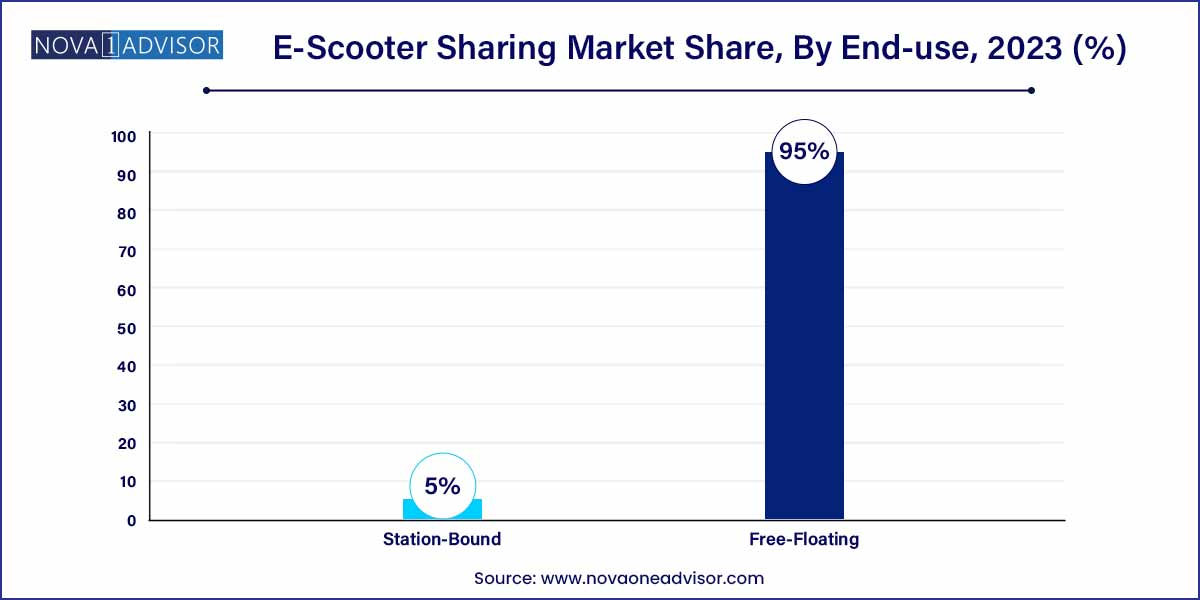

- The free-floating segment accounted for the largest revenue share of around 95% in 2023.

- The offline segment accounted for a revenue share of around 5% in 2023.

E-Scooter Sharing Market: Overview

The global e-scooter sharing market has emerged as a revolutionary force within urban mobility, offering a sustainable, flexible, and cost-effective alternative to traditional transportation systems. E-scooter sharing platforms provide users with the convenience of short-distance travel without the burden of ownership, effectively addressing last-mile connectivity issues prevalent in densely populated cities. These battery-powered scooters, accessible through smartphone apps, are an ideal solution for environmentally conscious commuters seeking to avoid traffic congestion and reduce their carbon footprint.

Over the past five years, the market has witnessed rapid growth, buoyed by advancements in battery technology, increasing smartphone penetration, supportive government policies encouraging micro-mobility, and a heightened focus on eco-friendly transportation solutions. Initiatives such as "Vision Zero" in the United States and the European Green Deal have further catalyzed demand for shared mobility services. As cities worldwide grapple with urbanization and pollution challenges, e-scooter sharing schemes offer a glimpse into the future of sustainable urban transportation.

Market participants are heavily investing in fleet expansion, technology upgrades, and strategic partnerships to solidify their presence. Despite regulatory hurdles and operational challenges, the market outlook remains highly promising, underpinned by the societal shift toward sustainable living and mobility-as-a-service (MaaS) models.

E-Scooter Sharing Market Growth

The growth of the e-scooter sharing market is propelled by various factors. Firstly, the increasing emphasis on environmental sustainability is driving demand for eco-friendly transportation solutions like e-scooter sharing, as consumers seek alternatives to traditional modes of commuting to reduce carbon emissions. Additionally, rapid urbanization and escalating traffic congestion in cities are compelling commuters to explore more efficient transportation options, contributing to the expansion of e-scooter sharing services. Moreover, the cost-effectiveness of e-scooter sharing compared to car ownership and other forms of transportation appeals to budget-conscious consumers, further fueling market growth. Furthermore, the convenience and flexibility offered by e-scooter sharing services as a first-mile/last-mile connectivity solution align with changing consumer preferences, particularly among tech-savvy Millennials and Gen Z, driving adoption rates.

E-Scooter Sharing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 925.50 Million |

| Market Size by 2033 |

USD 5,730.45 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 20.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Neutron Holdings, Inc.; Cityscoot; Cooltra Motosharing, S.L.U; Bird Global Inc.; Vogo Automotive Pvt. Ltd.; GoTo Global Mobility Ltd.; Lyft Inc.; VOI Technology. |

E-Scooter Sharing Market Dynamics

- Technological Advancements:

The e-scooter sharing market is witnessing rapid advancements in technology, particularly in areas such as IoT sensors, GPS tracking, and mobile applications. These technological innovations are enhancing user experience, improving fleet management efficiency, and ensuring safety. IoT sensors enable real-time monitoring of e-scooter performance and maintenance needs, while GPS tracking facilitates precise location tracking and geofencing to regulate scooter usage areas. Mobile applications provide users with convenient access to e-scooter rental services, allowing for seamless booking, payment, and navigation.

The regulatory environment plays a crucial role in shaping the growth trajectory of the e-scooter sharing market. Governments and local authorities are increasingly implementing regulations and guidelines to address safety concerns, parking management, and infrastructure requirements associated with e-scooter sharing services. While regulatory frameworks vary across regions, they often aim to strike a balance between promoting innovation and ensuring public safety and urban mobility. Collaborative efforts between e-scooter sharing operators, policymakers, and city planners are essential to establish clear regulatory guidelines that support the sustainable growth of the market while addressing community needs and concerns.

E-Scooter Sharing Market Restraint

One of the primary restraints facing the e-scooter sharing market is the persistent issue of safety concerns. Despite their popularity, e-scooters have been associated with a rising number of accidents and injuries, both for riders and pedestrians. Factors contributing to safety risks include inexperienced riders, lack of proper infrastructure such as dedicated lanes, and challenges in enforcing safety regulations. Moreover, the compact and agile nature of e-scooters can pose hazards when navigating congested urban environments. As a result, safety concerns have prompted regulatory scrutiny and public backlash in some regions, leading to restrictions or even bans on e-scooter sharing services.

Another significant restraint affecting the e-scooter sharing market is regulatory uncertainty and fragmentation. The rapid proliferation of e-scooter sharing services has outpaced the development of clear regulatory frameworks in many regions, leading to inconsistencies and ambiguity in rules governing e-scooter operations. This regulatory uncertainty creates challenges for e-scooter sharing operators, including compliance risks, operational limitations, and barriers to market entry. Additionally, varying regulations across different cities and countries further complicate expansion efforts and increase compliance costs for market players.

E-Scooter Sharing Market Opportunity

- Expansion into Emerging Markets:

One of the most promising opportunities for e-scooter sharing operators is the expansion into emerging markets. Emerging economies, characterized by rapid urbanization, growing populations, and increasing congestion, present fertile ground for the adoption of e-scooter sharing services. These markets often face challenges related to inadequate public transportation infrastructure and limited access to affordable mobility options, creating opportunities for e-scooter sharing operators to fill transportation gaps and address unmet consumer needs. By strategically entering emerging markets, e-scooter sharing companies can tap into new revenue streams, gain market share, and establish themselves as key players in the global urban mobility landscape.

- Integration with Multimodal Transportation Systems:

Another significant opportunity for the e-scooter sharing market lies in the integration with multimodal transportation systems. As cities increasingly embrace the concept of seamless and interconnected mobility, there is growing demand for integrated transportation solutions that combine various modes of transportation, such as e-scooters, bikes, public transit, and ridesharing services. E-scooter sharing operators can capitalize on this trend by collaborating with public transit agencies, ridesharing companies, and other mobility providers to offer integrated mobility solutions that enhance convenience, flexibility, and accessibility for commuters. By integrating e-scooter sharing services into existing transportation networks, operators can unlock new user segments, improve first-mile/last-mile connectivity, and promote sustainable urban mobility.

E-Scooter Sharing Market Challenges

Perhaps one of the most prominent challenges confronting the e-scooter sharing market is the issue of safety. E-scooters have been associated with a rising number of accidents and injuries, both to riders and pedestrians. Factors contributing to safety risks include inexperienced riders, inadequate rider education, lack of proper infrastructure such as designated lanes, and challenges in enforcing safety regulations. Additionally, the compact and agile nature of e-scooters can pose hazards when navigating congested urban environments. Safety concerns have prompted regulatory scrutiny and public backlash in some regions, leading to restrictions or even bans on e-scooter sharing services.

Another significant challenge facing the e-scooter sharing market is regulatory uncertainty and fragmentation. The rapid growth of e-scooter sharing services has outpaced the development of clear regulatory frameworks in many regions, resulting in inconsistencies and ambiguity in rules governing e-scooter operations. This regulatory uncertainty creates challenges for e-scooter sharing operators, including compliance risks, operational limitations, and barriers to market entry. Additionally, varying regulations across different cities and countries further complicate expansion efforts and increase compliance costs for market players.

Segments Insights:

Type Insights

Free-Floating e-scooter sharing dominated the type segment of the market. Free-floating systems, where scooters can be picked up and dropped off anywhere within a designated service area, offer unparalleled convenience and flexibility to users. This model minimizes operational complexities for users, encouraging greater adoption in urban environments. Companies like Lime, Bird, and Tier Mobility have championed this model, expanding across major cities in North America, Europe, and Asia. Free-floating e-scooters cater to spontaneous short trips and are especially popular among younger, tech-savvy commuters who value immediate access and flexibility.

Conversely, Station-Bound e-scooter sharing is witnessing the fastest growth. As city authorities seek to mitigate the chaos associated with randomly parked scooters, station-based models are gaining traction. Providers like Dott in Europe and Beam in Australia have introduced docking stations where users must park scooters, promoting orderly deployment and reducing urban clutter. This model also enhances battery charging and maintenance efficiency, improving operational sustainability. Additionally, partnerships with public transport hubs to set up docking stations are creating integrated mobility ecosystems that appeal to both regulators and riders.

Distribution Channel Insights

Online distribution dominated the distribution channel segment. Given that e-scooter sharing services are accessed predominantly through mobile applications, the online distribution model forms the backbone of this market. Smartphone apps enable users to locate, unlock, and pay for rides seamlessly, offering added features like route navigation, promotions, and real-time availability updates. The success of companies like Lime, Spin, and Voi is intrinsically linked to their intuitive and robust app platforms, making online channels indispensable to user acquisition and retention.

Nevertheless, Offline distribution is emerging as a fast-growing complementary channel. Some providers are establishing physical presence points, such as kiosks at airports, universities, and corporate campuses, where users can rent scooters manually or with assistance. This model caters to users unfamiliar with mobile apps or tourists without local SIM cards. Furthermore, collaborations with hotel chains, retail centers, and tourism boards to offer e-scooter rentals enhance brand visibility and accessibility, particularly in tourist-heavy cities

Regional Insights

Europe dominated the global e-scooter sharing market in terms of revenue and operational presence. European cities like Paris, Berlin, Madrid, and Rome have embraced micro-mobility as a key component of their urban transport strategies. Regulatory frameworks in the region have generally been more supportive, encouraging innovation while implementing safety standards. Companies like Tier Mobility (Germany), Voi Technology (Sweden), and Dott (Netherlands) are leading the European market, deploying extensive fleets and partnering with city councils to integrate e-scooters with public transit networks. The focus on sustainability, stringent emission targets, and urban livability initiatives continue to reinforce Europe's leadership in this domain.

Asia-Pacific is poised to be the fastest-growing region in the e-scooter sharing market. Rapid urbanization, worsening traffic congestion, and a tech-savvy young population are major drivers. Countries like China, India, Japan, and South Korea are witnessing a surge in micro-mobility initiatives. For example, Indian startups such as Yulu are capitalizing on government support for electric mobility and smart city initiatives. In China, players like Hello TransTech are scaling operations aggressively. Furthermore, favorable government policies aimed at reducing carbon emissions and promoting electric vehicle adoption are catalyzing market growth across the region.

Some of the prominent players in the E-scooter sharing market include:

- Neutron Holdings, Inc

- Cityscoot

- Cooltra Motosharing, S.L.U

- Bird Global Inc.

- Vogo Automotive Pvt. Ltd.

- GoTo Global Mobility Ltd.

- Lyft Inc.

- VOI Technology

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global e-scooter sharing market.

Type

- Free-Floating

- Station-Bound

Distribution Channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)