Europe Recombinant Protein Manufacturing Services Market Size and Growth

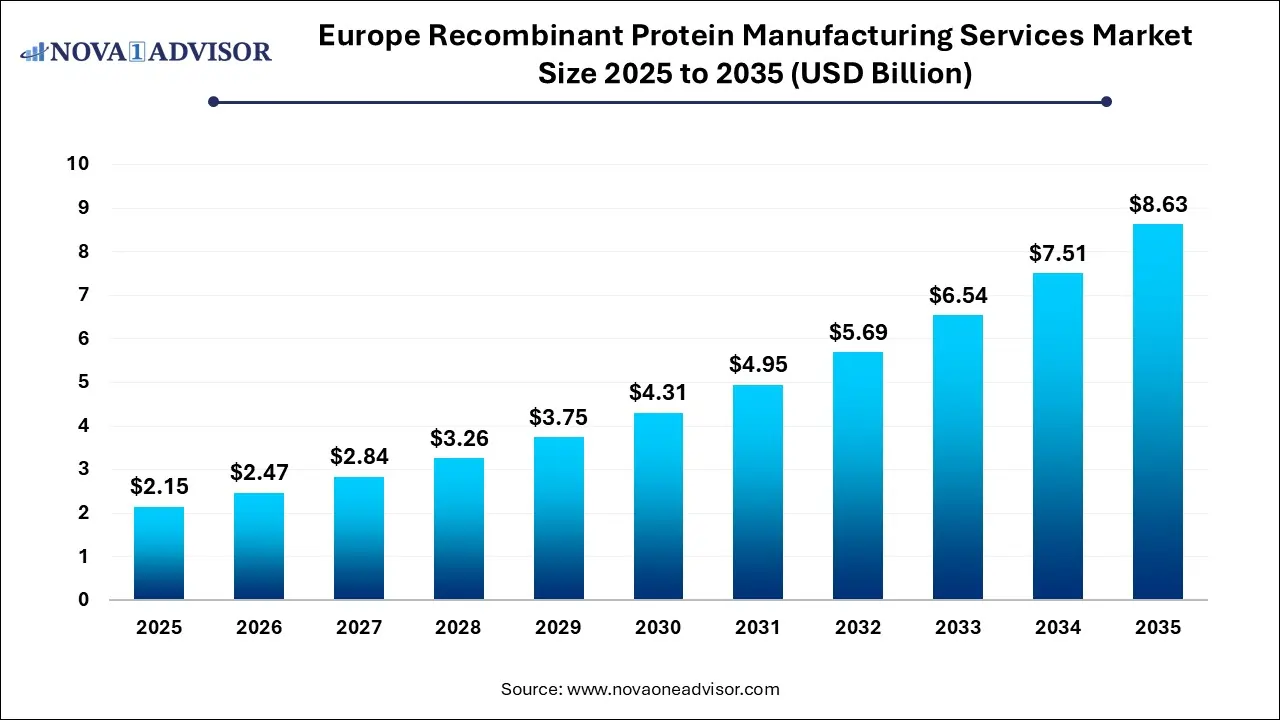

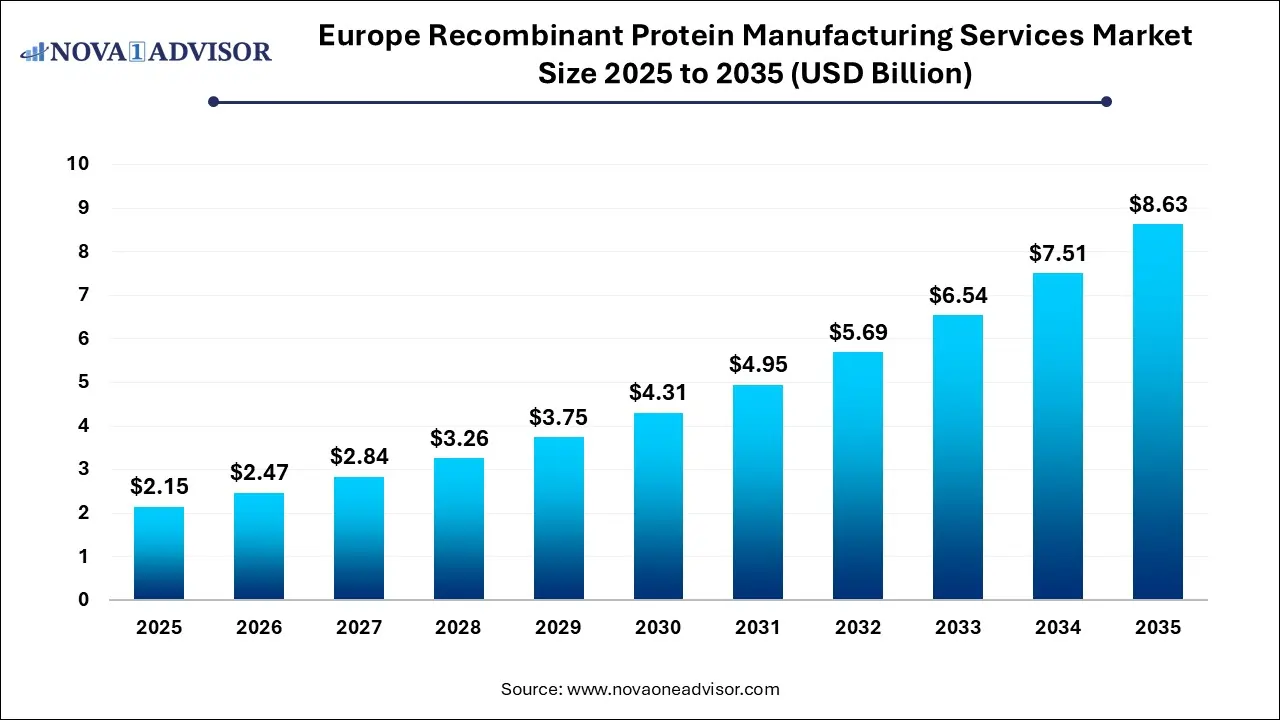

The Europe recombinant protein manufacturing services market size was exhibited at USD 2.15 billion in 2025 and is projected to hit around USD 8.63 billion by 2035, growing at a CAGR of 14.91% during the forecast period 2026 to 2035.

Europe Recombinant Protein Manufacturing Services Market Key Takeaways:

- Commercial production services was the largest revenue-generating segment with the dominant market share of 58.82% in 2025.

- The commercial production services segment is expected to witness the fastest CAGR of 16.39% over the forecast period.

- Mammalian host cell was the highest revenue-generating segment with the largest market share of 54.70% in 2025.

- On the other hand, the yeast & fungi segment is estimated to witness a significant CAGR of 16.29% over the forecast period.

- The pharmaceutical & biotechnology company segment held the largest market share of 80.0% in 2025.

- On the other hand, the academic & research institutes industry segment is estimated to witness a 17.34% CAGR during the forecast period.

- Germany held the dominant revenue share of 17.95% in 2025.

- The Netherlands is expected to experience the fastest CAGR of 21.94% over the forecast period.

Market Overview

The Europe Recombinant Protein Manufacturing Services Market is positioned at a pivotal juncture in the biopharmaceutical innovation ecosystem, catalyzed by a surge in biologics, the emergence of precision medicine, and the increasing reliance on outsourcing across drug development pipelines. Recombinant proteins engineered proteins produced by inserting the DNA encoding the protein into host cells are central to a wide array of applications including therapeutic protein production, vaccine development, and diagnostic assays.

In Europe, the demand for recombinant protein manufacturing services is escalating due to the growing clinical and commercial adoption of monoclonal antibodies, hormones, enzymes, cytokines, and fusion proteins. This shift is especially pronounced among small and mid-sized biotechs that lack the infrastructure for in-house production and instead partner with contract development and manufacturing organizations (CDMOs) that offer scalable, GMP-compliant, and host-cell-optimized services.

Europe's strong pharmaceutical legacy, state-supported research infrastructure, and focus on biosafety and regulatory harmonization (under EMA and EU GMP directives) make it a fertile landscape for recombinant protein service providers. Germany, Switzerland, and the UK are leading contributors to this market, supported by robust clinical research ecosystems and the presence of major biotech hubs. The post-pandemic emphasis on decentralized manufacturing and protein-based therapeutics further underscores the growing strategic value of these services.

Major Trends in the Market

-

Increased Outsourcing of Protein Manufacturing: Biopharmaceutical companies are increasingly partnering with CDMOs for speed, cost-efficiency, and regulatory expertise.

-

Adoption of Mammalian Cell Systems: CHO (Chinese Hamster Ovary) and HEK293 cells dominate due to their ability to produce human-like glycosylation patterns.

-

Advancements in Continuous Manufacturing: Adoption of continuous bioprocessing is improving yield, consistency, and cost-efficiency in protein production.

-

Expansion of Personalized Protein Therapeutics: Growing demand for proteins used in cancer immunotherapies and rare diseases is driving customized production requirements.

-

Sustainable and Animal-free Production: Rising preference for chemically defined, serum-free, and xeno-free media for ethical and reproducibility reasons.

-

Digital Biomanufacturing: Use of AI and machine learning in predictive modeling for protein expression, stability, and purification optimization.

-

Integration of Analytical and Regulatory Services: CDMOs are bundling manufacturing with bioanalytics, stability testing, and dossier support to streamline client workflows.

Report Scope of Europe Recombinant Protein Manufacturing Services Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 2.47 Billion |

| Market Size by 2035 |

USD 8.63 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 14.91% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Service Type, Host Cell, End-use, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

Europe |

| Key Companies Profiled |

Lonza; Boehringer Ingelheim International GmbH; FUJIFILM Diosynth Biotechnologies; Merck KGaA; Bruker (InVivo BioTech Services GmbH); Sino Biological, Inc.; GenScript; Kaneka corporation (Kaneka Eurogentec S.A); Polyplus Transfection (Xpress Biologics); Boster Biological Technology; Trenzyme GmbH |

Key Market Driver: Growing Pipeline of Biologics and Biosimilars in Europe

The strongest driver for recombinant protein manufacturing services in Europe is the rapidly expanding biologics and biosimilars pipeline. Over the past decade, the shift from small molecule drugs to large biologic entities has transformed pharmaceutical R&D strategies. Monoclonal antibodies, therapeutic enzymes, fusion proteins, and cytokines dominate drug pipelines across oncology, autoimmune diseases, and metabolic disorders.

Europe has seen a steady increase in the number of EMA-approved biologics and biosimilars, with Germany, France, and the UK hosting major centers of clinical and commercial activity. However, the complexity of protein expression, purification, and characterization especially for glycoproteins and fusion constructs requires deep technical expertise and specialized infrastructure. As a result, companies are increasingly turning to manufacturing service providers for cost-effective and scalable recombinant protein production. CDMOs offer advanced bioprocessing capabilities, rapid cell line development, and cGMP compliance, enabling pharmaceutical companies to accelerate development and reduce time-to-market.

Key Market Restraint: High Technical Complexity and Regulatory Compliance

While the market is poised for growth, it is restrained by the high technical and regulatory complexity inherent in recombinant protein production. Producing high-quality, bioactive recombinant proteins involves a multi-step process that includes gene design, host cell transfection, upstream and downstream processing, purification, and formulation. Each of these steps requires extensive optimization to maintain protein integrity, folding, and biological function.

Moreover, regulatory authorities such as the EMA impose stringent guidelines for process validation, batch reproducibility, contaminant control, and product characterization. These requirements are especially rigorous for clinical and commercial-grade products. Smaller service providers may lack the infrastructure or resources to maintain compliance across these parameters, which can hinder scalability and quality assurance. Additionally, variability in host cell performance and protein yield further adds to development risk and cost.

Key Market Opportunity: Expansion of Recombinant Protein Applications Beyond Therapeutics

An emerging opportunity in the Europe recombinant protein manufacturing services market lies in the expanding use of recombinant proteins in non-therapeutic domains, including industrial enzymes, agricultural biotechnology, and research-grade reagents. In academic and contract research settings, recombinant proteins are crucial for structural biology, enzymatic assays, and functional genomics.

For example, recombinant enzymes are widely used in diagnostics, food processing, and biofuel production. The European Green Deal and circular economy goals have also stimulated the use of recombinant proteins in sustainable agriculture and biodegradable polymers. Furthermore, the growing field of synthetic biology is opening new applications for designer proteins and molecular tools. Service providers that diversify into these adjacent segments can capture new revenue streams and mitigate dependency on clinical pipelines.

Europe Recombinant Protein Manufacturing Services Market By Service Type Insights

Pre-clinical & Clinical services dominate the market, driven by the growing demand for early-phase protein production for pharmacokinetic studies, toxicology testing, and IND-enabling studies. Biopharma companies outsource protein expression and characterization to CDMOs for quick turnaround and GMP readiness. These services often include pilot-scale production, stability testing, analytical characterization, and formulation development. In Europe, the rise of academic spin-offs and emerging biotechs has further stimulated demand for service providers that can support the transition from discovery to clinical scale.

Commercial production services are the fastest-growing segment, as an increasing number of biologics advance through regulatory approval and into the market. Long-term commercial contracts offer stability for CDMOs and require stringent batch-to-batch reproducibility, validated cleaning processes, and robust quality systems. With the growth in biosimilars and personalized protein therapeutics, commercial production demand is accelerating across Western Europe. Contract manufacturers are expanding GMP-certified facilities and investing in process intensification technologies to meet this need.

Europe Recombinant Protein Manufacturing Services Market By Host Cell Insights

Mammalian cells, particularly CHO and HEK293 lines, dominate the European market, as they are preferred for their ability to perform complex post-translational modifications, including glycosylation patterns critical for human therapeutics. These cells are widely used in monoclonal antibody and cytokine production. Mammalian systems offer higher biological relevance and product efficacy, though they are typically more expensive and slower in growth compared to microbial systems. Leading CDMOs in Switzerland and Germany specialize in mammalian expression platforms for both clinical and commercial production.

Yeast and fungi-based expression systems are the fastest-growing, especially for industrial enzyme production and vaccine antigens. These systems offer advantages in yield, scalability, and cost-effectiveness. Pichia pastoris and Saccharomyces cerevisiae are particularly popular for producing recombinant enzymes, subunit vaccines, and fermentation-based proteins. The food and agricultural sectors in France and the Netherlands are increasingly adopting yeast-expressed recombinant proteins, contributing to this segment’s rapid expansion.

Europe Recombinant Protein Manufacturing Services Market By End-use Insights

Pharmaceutical and biotechnology companies are the primary end-users, as they rely on recombinant protein services for drug development, manufacturing scale-up, and product launch. These companies require compliance with EU GMP standards, regulatory document support, and consistent product quality. The pharmaceutical hubs in Germany, the UK, and Switzerland are driving sustained demand, and large biopharma players are increasingly partnering with CDMOs for flexibility and speed in bringing new protein-based therapies to market.

Academic and research institutes represent the fastest-growing end-use segment, fueled by rising funding for proteomics, molecular biology, and synthetic biology research across Europe. Institutes in Denmark, Sweden, and the Netherlands are heavily engaged in structural biology and cell signaling studies, which require high-purity recombinant proteins for in vitro assays. These clients often seek small-batch, research-grade protein expression services with rapid turnaround and custom tags or labels for imaging and detection purposes.

Country Insights

Germany stands out as the largest and most influential market in the European recombinant protein manufacturing services landscape. As the continent’s leading biotech hub, Germany hosts a dense cluster of biopharmaceutical companies, academic research centers, and contract manufacturers. Cities such as Munich, Berlin, and Heidelberg are home to institutions like the Max Planck Institute and Fraunhofer Society, which actively collaborate with CDMOs for recombinant protein research and production.

Germany's highly regulated but innovation-friendly environment supports both early-stage and commercial protein manufacturing. CDMOs based in Germany are known for high compliance with EMA and FDA standards, making them attractive to global biopharma clients. Furthermore, the country’s robust infrastructure, availability of skilled bioprocess engineers, and access to public R&D funding make it a strategic node for both domestic and international companies looking to expand protein manufacturing capabilities.

Some of the prominent players in the Europe recombinant protein manufacturing services market include:

- Lonza

- Boehringer Ingelheim International GmbH

- FUJIFILM Diosynth Biotechnologies

- Merck KGaA

- Bruker (InVivo BioTech Services GmbH)

- Sino Biological, Inc.

- GenScript

- Kaneka corporation (Kaneka Eurogentec S.A)

- Polyplus Transfection (Xpress Biologics)

- Boster Biological Technology

- Trenzyme GmbH

Recent Developments

-

In March 2025, Lonza Group AG announced the expansion of its Visp, Switzerland facility to increase capacity for mammalian protein production, including next-generation antibodies and fusion proteins targeting the EU market.

-

Sartorius Stedim Biotech, based in Germany, introduced a new modular bioreactor system in April 2025 to support rapid scale-up of protein production using mammalian and microbial hosts.

-

In February 2025, Evotec SE signed a strategic agreement with a UK-based biotech firm to provide end-to-end protein manufacturing services for a novel cancer immunotherapy candidate.

-

Rentschler Biopharma SE opened a new innovation lab in January 2025 in Laupheim, Germany, dedicated to continuous bioprocessing and host cell optimization for complex protein therapeutics.

-

In May 2025, Polpharma Biologics (Poland) received EU GMP certification for its protein manufacturing plant, enabling expanded partnerships with Western European clients.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Europe recombinant protein manufacturing services market

By Service Type

- Pre-clinical & Clinical Services

- Commercial Production Services

By Host Cell

- Mammalian Cells

- Bacterial Cells

- Insect Cells

- Yeast & Fungi

- Others

By End-use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

By Country

-

- Germany

- UK

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Switzerland

- Netherlands