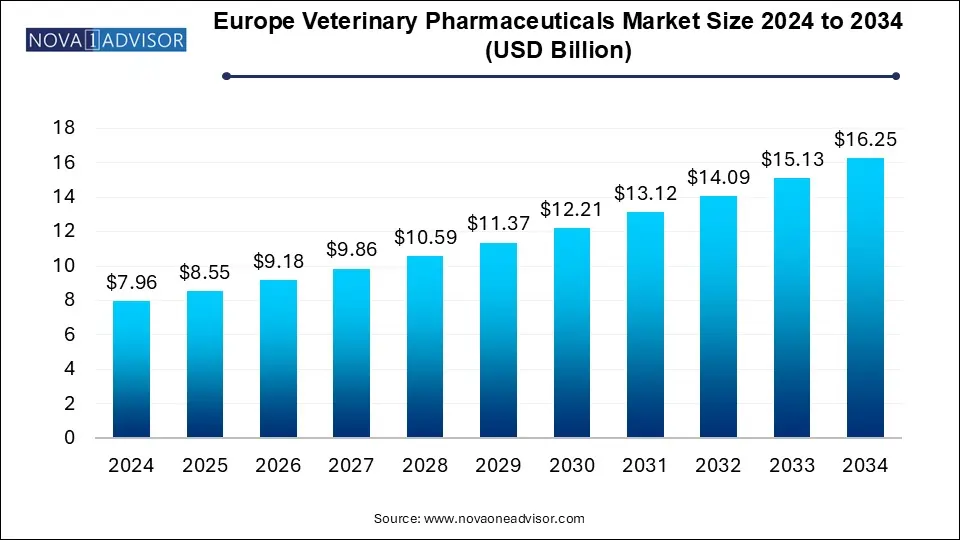

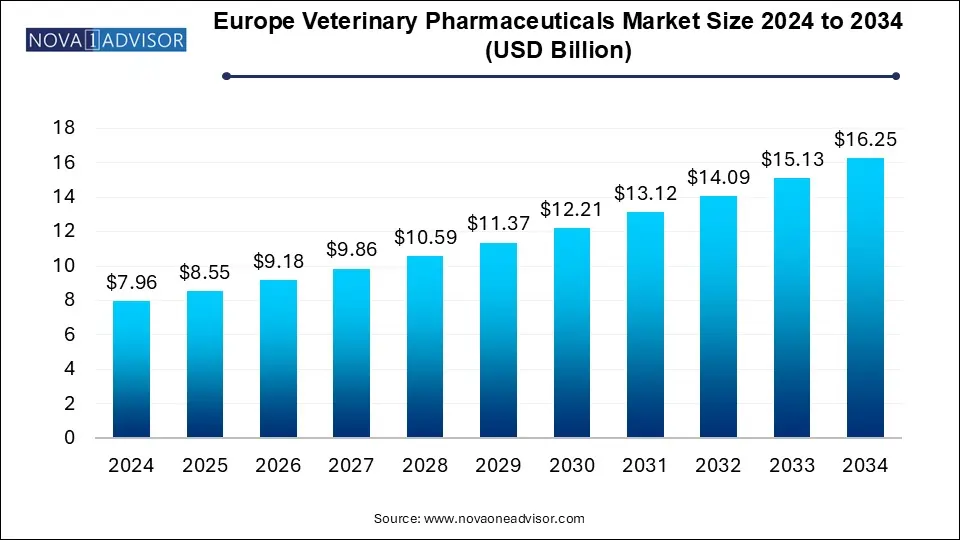

Europe Veterinary Pharmaceuticals Market Size and Growth

The Europe veterinary pharmaceuticals market size was exhibited at USD 7.96 billion in 2024 and is projected to hit around USD 16.25 billion by 2034, growing at a CAGR of 7.4% during the forecast period 2025 to 2034.

Europe Veterinary Pharmaceuticals Market Key Takeaways:

- In terms of animal type, the companion animals segment held the largest revenue share in 2024.

- The livestock animals segment is expected to grow at the fastest CAGR during the forecast period.

- In terms of mode of administration, the parenteral segment held the largest revenue share in 2024.

- In terms of distribution channel, the veterinary hospitals and clinics segment held the largest revenue share in 2024.

- The digital or e-commerce segment is anticipated to grow at the fastest CAGR over the forecast period.

- In terms of product, the anti-infective segment held the largest revenue share of 40.0% in 2024

- In 2020, the anti-infectives and parasiticides segments of Zoetis together accounted for 36% of the company’s revenue.

- The UK dominated the market in 2024 with the largest revenue share of 10.75%.

- The Netherlands is anticipated to grow at the fastest CAGR of 9.4% during the forecast period.

Market Overview

The Europe Veterinary Pharmaceuticals Market is experiencing a robust transformation, driven by increasing pet ownership, expanding livestock industries, and evolving consumer awareness regarding animal health and welfare. Veterinary pharmaceuticals, encompassing a range of therapeutic and preventive drugs, are essential in treating diseases, preventing infections, managing chronic conditions, and enhancing productivity among companion and livestock animals. As European societies continue to emphasize animal welfare and biosecurity, the demand for innovative and effective veterinary drugs has intensified across the continent.

The European market is a critical pillar in the global veterinary pharmaceutical ecosystem. With advanced research infrastructure, a strong regulatory framework led by the European Medicines Agency (EMA), and established pharmaceutical giants, the region has emerged as a pioneer in veterinary drug development. Moreover, Europe’s stringent animal welfare laws and rising focus on antimicrobial resistance are shaping industry priorities towards safer, more targeted, and sustainable treatment options.

In recent years, the market has also benefited from the integration of digital platforms, including e-pharmacies, enabling easier access to medications for both pet owners and livestock farmers. The convergence of biotechnology, data analytics, and personalized veterinary care further positions the region for long-term growth. However, despite these favorable dynamics, regulatory hurdles, cost-intensive R&D, and growing scrutiny around antibiotic use in animals present challenges that industry players must navigate carefully.

Major Trends in the Market

-

Surge in Pet Ownership: The COVID-19 pandemic prompted a significant increase in pet adoptions across Europe, especially dogs and cats, creating a sustained demand for veterinary pharmaceuticals focused on companion animals.

-

Biologics and Immunotherapies Gaining Traction: The market is witnessing rising adoption of biologic drugs like vaccines, monoclonal antibodies, and immune modulators for more effective and targeted treatment options.

-

Antimicrobial Stewardship Programs: Regulatory bodies are implementing stringent guidelines to limit antibiotic misuse in animals, pushing pharmaceutical companies to develop alternatives and narrow-spectrum antimicrobials.

-

E-commerce Penetration in Veterinary Sales: Online platforms and telemedicine services are transforming the distribution landscape, making veterinary pharmaceuticals more accessible, particularly in rural areas.

-

Personalized Veterinary Medicine: Diagnostic advancements are paving the way for precision treatments based on the genetic and physiological profiles of animals, especially in companion animal care.

-

Expansion of Livestock Healthcare Infrastructure: Government-supported animal health initiatives are fueling pharmaceutical uptake among livestock farmers, especially in nations with strong agri-food sectors like Germany and France.

-

Focus on Pain Management: Increasing awareness regarding animal pain and discomfort is driving demand for anti-inflammatory and analgesic drug categories.

Report Scope of Europe Veterinary Pharmaceuticals Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 8.55 Billion |

| Market Size by 2034 |

USD 16.25 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Animal Type, Product, Mode of Administration, Distribution Channel, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

Europe |

| Key Companies Profiled |

Merck & Co., Inc.; Ceva; Vetoquinol; Zoetis Services LLC; Boehringer Ingelheim International GmbH; Elanco; Virbac; Calier; Bimeda Corporate; Prodivet pharmaceuticals sa/nv |

Key Market Driver: Rising Companion Animal Ownership and Humanization

One of the most significant growth drivers in the Europe Veterinary Pharmaceuticals Market is the rising trend of companion animal ownership and the growing humanization of pets. Over the past decade, European households have increasingly viewed pets as family members, leading to a surge in expenditure on animal healthcare, nutrition, and well-being.

Countries like the United Kingdom, Germany, and France have witnessed double-digit growth in pet care spending, with pharmaceuticals forming a substantial part of the budget. According to the European Pet Food Industry Federation (FEDIAF), there are over 340 million pets in Europe, and the pet population continues to grow steadily. This trend has amplified the demand for preventive medications, chronic disease treatments, and wellness products. Consequently, pharmaceutical companies are focusing more on product innovation for companion animals such as chewable formulations, extended-release drugs, and flavor-enhanced pills to meet consumer preferences. The growing emotional bond between pet owners and animals is directly translating into higher adoption of veterinary pharmaceuticals across the continent.

Key Market Restraint: Stringent Regulatory Environment

Despite promising growth prospects, the Europe Veterinary Pharmaceuticals Market faces a substantial restraint in the form of stringent regulatory oversight. The European Medicines Agency (EMA), in conjunction with national regulatory authorities, imposes rigorous standards for drug approval, safety evaluations, and post-marketing surveillance. These regulations are particularly stringent for antimicrobial and hormone-based products, given the increasing concern around antimicrobial resistance and environmental safety.

The high cost and extended timelines associated with regulatory compliance can deter smaller firms and startups from entering the market. Moreover, variations in national regulations across EU countries often necessitate localized registration processes, adding to the operational complexity and cost. While these regulations are critical for ensuring public and animal health, they can slow down product commercialization and restrict market agility.

Key Opportunity: Advancements in Biologics and Veterinary Immunotherapies

A notable opportunity for growth lies in the development and commercialization of biologics and immunotherapeutic drugs. Biologics, such as vaccines, monoclonal antibodies, and recombinant proteins, are revolutionizing veterinary care by offering more precise, effective, and sustainable treatment options. These therapies are particularly effective against complex chronic conditions, autoimmune diseases, and infections that are resistant to conventional drugs.

Europe, with its world-class biotech research ecosystem and progressive regulatory support for innovative therapies, is ideally positioned to lead the biologics segment. For instance, companies like Zoetis and Boehringer Ingelheim are investing heavily in developing monoclonal antibodies for allergic dermatitis in dogs and respiratory infections in livestock. The adoption of such advanced therapies also aligns with the EU’s “One Health” initiative, which aims to balance human, animal, and environmental health through integrated solutions. As biologics gain wider clinical acceptance and regulatory approvals, this segment is expected to significantly augment the overall market trajectory.

Europe Veterinary Pharmaceuticals Market By Animal Type Insights

Companion animals dominated the market in 2024, driven by the increasing humanization of pets and the subsequent rise in veterinary spending by pet owners. Among companion animals, dogs accounted for the largest share due to their higher susceptibility to orthopedic, dermatologic, and parasitic disorders, which necessitate regular pharmaceutical intervention. Cats followed closely, with notable growth in treatments for chronic kidney disease, diabetes, and anxiety-related conditions. Horses, while representing a niche market, have shown steady demand for performance-related medications, especially in regions with equestrian sports culture like France and the UK.

Livestock animals, particularly cattle and pigs, are expected to be the fastest-growing segment due to the rising emphasis on food safety and zoonotic disease prevention. The implementation of European Union regulations on antimicrobial use in food-producing animals has led to increased demand for safer, more targeted treatments. Poultry and aquatics, included under ‘Others,’ are gaining traction with innovations in mass drug administration and vaccine development. This segment’s growth is further supported by government subsidies and rising meat consumption in Eastern and Southern Europe, especially in countries like Poland and Italy.

Europe Veterinary Pharmaceuticals Market By Mode of Administration Insights

Oral administration continues to dominate the market due to its convenience, wide acceptance, and suitability for mass medication. Palatable formulations, including chewables and flavored tablets, are particularly popular among pet owners. For livestock, medicated feed additives and boluses are widely used to ensure ease of administration and dosage accuracy. Oral drugs also reduce stress and handling risks compared to invasive procedures, making them ideal for chronic disease management.

Topical and parenteral modes are growing swiftly, especially in cases requiring immediate effect or localized treatment. Injectable antibiotics, painkillers, and vaccines are vital in clinical settings, especially for larger animals and emergency treatments. Meanwhile, topical applications such as creams, sprays, and pour-on parasiticides are becoming more sophisticated and easier to use, gaining popularity among livestock

Europe Veterinary Pharmaceuticals Market By Distribution Channel Insights

Veterinary hospitals and clinics are the leading distribution channel, bolstered by professional guidance, trust in prescriptions, and integrated health services. These institutions are the first point of contact for pet owners and farmers seeking diagnosis and treatment, creating consistent demand for pharmaceuticals. Furthermore, clinics often maintain in-house pharmacies, facilitating immediate access to medication.

Digital or e-commerce platforms represent the fastest-growing channel, fueled by convenience, rising digital literacy, and wider availability of veterinary products online. Platforms like Pets at Home (UK) and Zooplus (Germany) have expanded their product offerings and streamlined delivery logistics. Particularly during and post-COVID, e-commerce has seen exponential growth as consumers increasingly opt for home delivery and virtual consultations.

Europe Veterinary Pharmaceuticals Market By Product Insights

Parasiticides emerged as the dominant product segment, owing to the high prevalence of parasitic infections in both companion and livestock animals. The convenience of broad-spectrum parasiticides and growing resistance to older formulations are encouraging the development of next-gen products. Oral chewables and spot-on formulations for flea and tick prevention have witnessed massive uptake, particularly among dog and cat owners. Moreover, endo-parasiticides used for deworming livestock are in constant demand among cattle and pig farmers to ensure herd health and product quality.

Anti-inflammatory and analgesics are the fastest-growing segments, driven by rising awareness of pain management in animals. Chronic conditions like osteoarthritis, post-surgical recovery, and trauma-related inflammation are pushing veterinarians and owners to seek long-term, tolerable solutions. The growth is also being fueled by the increased availability of NSAIDs (non-steroidal anti-inflammatory drugs) tailored for veterinary use, including extended-release injections and transdermal gels.

Country Insights

The United Kingdom represents one of the most mature and dynamic veterinary pharmaceutical markets in Europe. With a pet population exceeding 20 million and a substantial livestock farming sector, the UK has a diverse demand profile encompassing both companion and food-producing animals. The Veterinary Medicines Directorate (VMD) plays a crucial role in regulating drug approvals and monitoring safety, ensuring a robust framework for pharmaceutical growth.

Over the past year, the UK government has launched initiatives aimed at combating antimicrobial resistance, including funding for research into alternatives to antibiotics in livestock. The country is also witnessing a rise in insurance coverage for pet health, encouraging owners to seek advanced treatments. Companies like Dechra Pharmaceuticals, headquartered in the UK, are expanding their R&D footprint to cater to this growing demand. Additionally, the UK's vibrant e-commerce landscape and high internet penetration have fostered the growth of digital veterinary platforms.

Some of the prominent players in the Europe veterinary pharmaceuticals market include:

Recent Developments

-

Zoetis announced the expansion of its manufacturing facility in Louvain-la-Neuve, Belgium, in March 2025, focusing on monoclonal antibody production for companion animals, reinforcing its leadership in veterinary biologics.

-

Boehringer Ingelheim received EMA approval in January 2025 for a novel anti-inflammatory injectable for equine use, enhancing its portfolio in equine healthcare.

-

Dechra Pharmaceuticals, a UK-based firm, finalized the acquisition of veterinary dermatology specialist Med-Pharmex in February 2025, aiming to strengthen its product offerings in skin disease therapeutics.

-

Elanco Animal Health launched a new oral parasiticide for dogs across Europe in April 2025, featuring a chewable, single-dose monthly regimen that has gained quick traction in retail and clinical settings.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Europe veterinary pharmaceuticals market

By Animal Type

-

- Dogs

- Cats

- Horses

- Others (Small Mammals, Birds)

-

- Pigs

- Cattle

- Sheep & Goats

- Others (Poultry, Aquatics)

By Product

- Parasiticides

- Anti-infectives

- Anti-inflammatory

- Analgesics

- Others

By Mode of Administration

- Oral

- Parenteral

- Topical

- Others (Inhalation, Carrier)

By Distribution Channel

- Veterinary Hospitals & Clinics

- Pharmacies & Retail Stores

- Digital or E-commerce

By Country

-

- UK

- Germany

- France

- Italy

- Spain

- Poland

- Netherlands

- Hungary

- Denmark

- Sweden

- Portugal