U.S. Veterinary Artificial Insemination Market Size and Growth

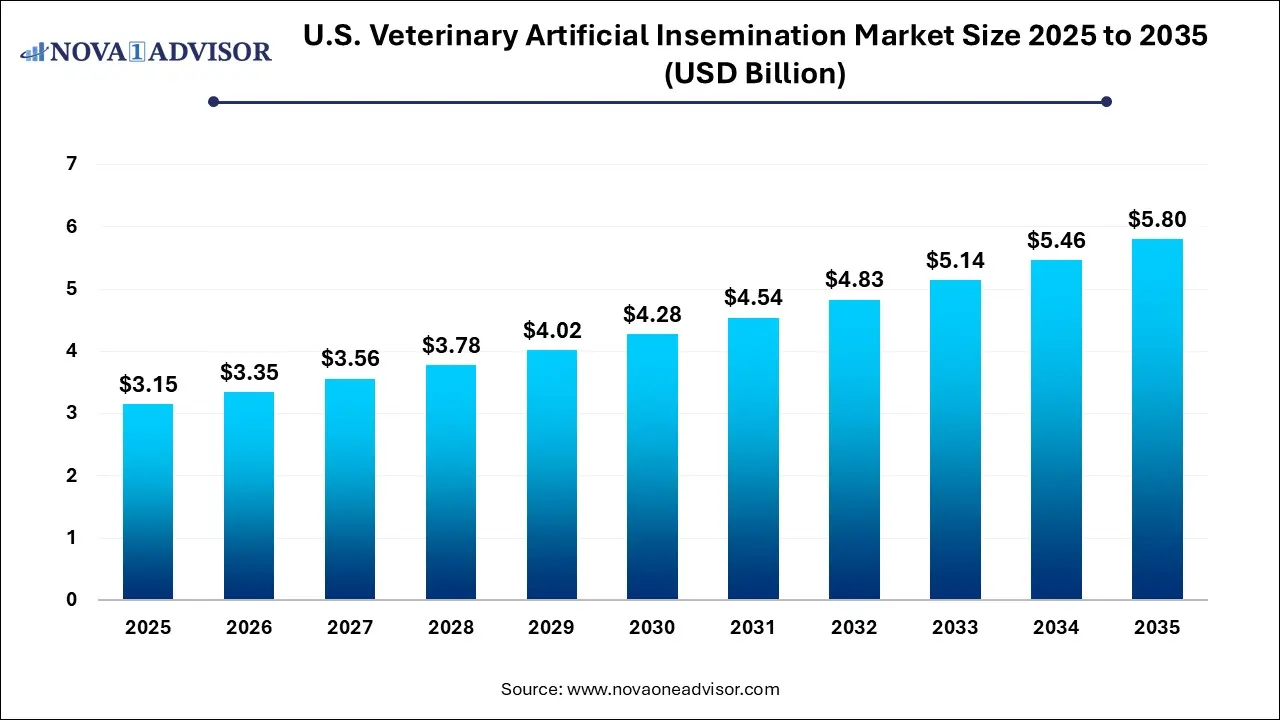

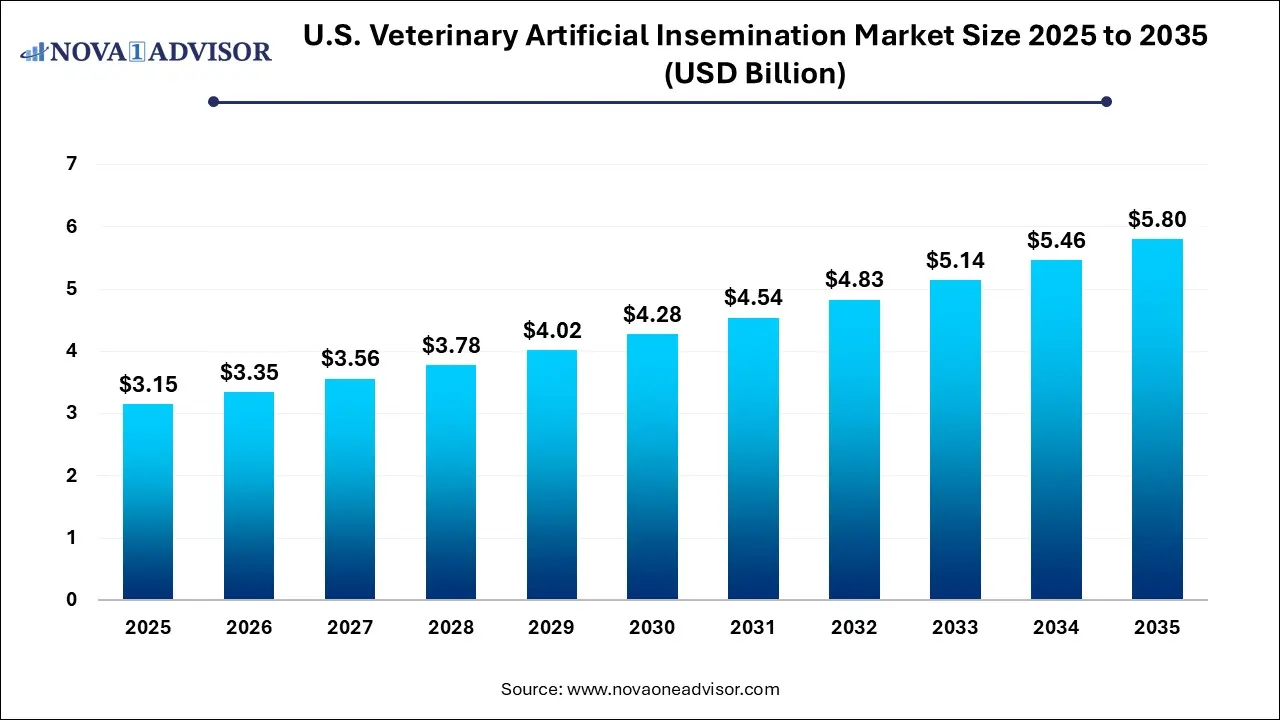

The U.S. veterinary artificial insemination market size was exhibited at USD 3.15 billion in 2024 and is projected to hit around USD 5.80 billion by 2035, growing at a CAGR of 6.3% during the forecast period 2026 to 2035.

Key Takeaways:

- The services segment dominated the market with a share of 41.87% in 2025.

- The private segment accounted for the largest revenue share of the market in 2025

- The swine segment is estimated to grow the fastest at a CAGR of 7.4%.

Market Overview

The U.S. veterinary artificial insemination (AI) market is an evolving segment of the broader animal reproductive health industry, showing consistent growth driven by the rising demand for livestock productivity, genetic advancement, and improved animal health management. Artificial insemination is a reproductive technique involving the deliberate introduction of sperm into a female's uterus or cervix to achieve pregnancy without natural mating. It has been widely adopted across the livestock industry especially in bovine, swine, and equine breeding due to its ability to enhance genetic quality, reduce the spread of sexually transmitted infections among animals, and optimize breeding schedules.

Over the past decade, the U.S. has seen increasing adoption of AI across both large-scale and smallholder farms, supported by government programs, private veterinary services, and technological advancements in cryopreservation, semen sexing, and AI delivery equipment. Semen sexing, for instance, allows farmers to predetermine the sex of offspring, a particularly valuable advantage in the dairy and beef sectors where gender selection can influence productivity and profitability. The market’s expansion is further supported by the growing awareness among farmers about animal genetics and reproduction technologies, as well as a rising number of private AI service providers.

The application of AI in animals is particularly critical in the U.S., where efficient livestock management is a key economic driver. With increased consumption of meat and dairy products, particularly post-pandemic recovery, coupled with a push towards sustainable farming practices, the veterinary AI market is poised for robust growth. This market not only reflects the convergence of veterinary medicine, biotechnology, and agriculture but also highlights the changing priorities in animal husbandry toward scientific and data-driven breeding methods.

Major Trends in the Market

-

Increased Use of Sexed Semen: Farmers are increasingly opting for sexed semen to ensure female calf production in dairy farming, which has a direct impact on milk yield profitability.

-

Expansion of AI Services in Rural Regions: Public-private partnerships and mobile AI services are expanding outreach in remote and underserved farming communities.

-

Rising Popularity of Swine AI in Commercial Farming: Commercial pork producers are adopting AI to increase herd productivity and improve genetic quality.

-

Integration of AI with Genetic Testing: Advanced diagnostics are now used in conjunction with AI procedures to select superior sires and ensure high conception rates.

-

Technological Innovations in Semen Preservation: Developments in cryogenic storage and semen extender solutions are improving the viability of semen during transportation and storage.

-

Growth of Subscription-Based AI Services: Companies are offering bundled AI packages, including semen, equipment, and service visits, on a subscription basis to large-scale farms.

-

Veterinary Telemedicine for Reproductive Monitoring: Use of telehealth platforms for reproductive cycle monitoring and fertility management is growing, especially in remote areas.

Report Scope of U.S. Veterinary Artificial Insemination Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.71 Billion |

| Market Size by 2034 |

USD 4.61 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Solutions, Animal type, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Genus; URUS Group LP; CRV; SEMEX; IMV Technologies; Select Sires Inc.; Swine Genetics International; Shipley Swine Genetics; Stallion AI Services Ltd; STgenetics |

Market Driver: Increasing Demand for High-Quality Livestock Production

One of the primary drivers of the U.S. veterinary AI market is the growing demand for high-quality and high-yield livestock to meet the increasing consumption of animal-based products. The U.S. ranks among the top consumers and exporters of beef, pork, and dairy products. With rising global competition and consumer demand for premium meat and dairy, livestock producers are under pressure to enhance herd productivity, improve genetic traits, and reduce disease prevalence. Artificial insemination offers a cost-effective and efficient method to achieve these goals. For instance, the ability to selectively breed cattle with desirable traits such as high milk yield, rapid weight gain, or disease resistance has become a cornerstone of modern animal farming in the U.S. This not only improves profitability for farmers but also supports sustainable livestock management practices.

Market Restraint: Limited Access in Small and Marginal Farms

Despite the technological and economic advantages of AI, its adoption remains limited among small and marginal farmers, particularly in less developed agricultural zones. The high initial investment in AI equipment, lack of technical knowledge, and inadequate veterinary infrastructure present significant barriers. Furthermore, logistical challenges such as semen storage and timely insemination services in remote regions often result in lower conception rates, discouraging farmers from investing in AI. In addition, the reluctance to transition from traditional breeding practices due to cultural or knowledge gaps further restrains market growth at the grassroots level.

Market Opportunity: Growth of Custom AI Solutions and Mobile Veterinary Services

An emerging opportunity in the U.S. veterinary AI market is the development of customized AI solutions integrated with mobile veterinary services. Several startups and agri-tech companies are now offering on-demand insemination services tailored to specific herd sizes and breeding cycles. These services include digital estrus detection, automated breeding calendars, and AI technician dispatch systems. For instance, cloud-based platforms that schedule inseminations based on real-time reproductive data can improve timing accuracy and conception success. This is particularly useful for mid-sized farms lacking in-house veterinary resources but looking to optimize breeding performance. With mobile units equipped with semen storage and ultrasound devices, veterinarians can now service multiple farms in a region, making AI more accessible and affordable.

Segmental Analysis

By Solutions Outlook

The semen segment dominated the U.S. veterinary AI market, accounting for the largest revenue share in 2025 due to the growing adoption of advanced semen processing and storage technologies. Among semen types, sexed semen is experiencing rapid growth, as it allows for gender-specific breeding especially valuable in the dairy industry where female calves are economically favorable. Companies like ABS Global and STgenetics are at the forefront of producing and distributing high-quality sexed semen, offering improved conception rates and advanced genetic selection tools. The demand for normal semen remains steady in the swine and equine industries, where gender selection is not always a priority.

The equipment & consumables segment is expected to witness the fastest growth during the forecast period, propelled by continuous innovation in AI gun designs, ultrasound monitors, and cryopreservation systems. The integration of user-friendly AI devices suitable for self-insemination on farms is helping reduce dependency on technicians. Additionally, improvements in consumables like catheters, extenders, and detection kits are enhancing efficiency and reducing procedural costs. The demand is also driven by public and private veterinary programs offering affordable kits and training to local farmers.

By Animal Type Outlook

Bovine segment dominated the animal type market due to its large-scale adoption of AI in the dairy and beef industries. With dairy operations increasingly relying on AI to improve milk yield and reduce calving intervals, bovine AI accounts for the lion’s share of revenue. Most major players focus on genetic advancement in cattle, with an emphasis on traits such as mastitis resistance, feed conversion efficiency, and reproductive longevity. The adoption of AI has become routine in commercial dairy herds, supported by accessible semen banks and trained personnel.

Swine is the fastest-growing animal segment, fueled by increasing pork production and the need for better genetic control in breeding herds. AI in swine is favored due to its ability to allow a single ejaculate to inseminate multiple sows, enhancing cost efficiency. Furthermore, the relatively simple anatomy of swine makes the AI process more straightforward and repeatable. Producers are increasingly recognizing AI as a tool for disease control, particularly in high-biosecurity environments.

By Distribution Channel Outlook

Private distribution channels dominate the market as most AI services in the U.S. are provided by private veterinary practitioners, breeding companies, and agribusiness firms. These players offer comprehensive packages including semen, equipment, technician services, and genetic consulting, making them a one-stop solution for livestock breeders. The flexibility and customer-centric approach of private services contribute to their dominance, especially among commercial farms.

Public distribution channels are expanding at a rapid pace, largely due to government-funded livestock development programs and extension services. Public institutions and agricultural universities are playing a key role in offering subsidized AI programs, particularly in under-served regions. These programs aim to bridge the knowledge gap and offer affordable access to high-quality breeding services, contributing to a more inclusive market expansion.

Country-Level Analysis

In the U.S., Midwestern states like Wisconsin, Iowa, and Minnesota lead the veterinary AI market, primarily due to their dense concentration of dairy and beef farms. Wisconsin, for instance, has long been a center for dairy innovation and has seen early adoption of AI technologies. The presence of advanced breeding companies, educational institutions, and trained veterinary professionals further supports market dominance in the region.

Southern and Western states, such as Texas and California, are emerging as the fastest-growing markets due to their large-scale livestock operations and the increasing adoption of swine and equine AI. The rise of niche farming practices and high-value livestock breeds in these regions is encouraging more farmers to invest in AI. Additionally, favorable state-level livestock policies and access to mobile veterinary services are accelerating market penetration.

Some of The Prominent Players in The U.S. veterinary artificial insemination market Include:

- Genus

- URUS Group LP

- CRV

- SEMEX

- IMV Technologies

- Select Sires Inc.

- Swine Genetics International

- Shipley Swine Genetics

- Stallion AI Services Ltd

- STgenetics

Recent Developments

-

March 2025 – STgenetics launched a next-gen semen sorting platform that improves sorting efficiency and conception success rates. The technology was introduced as part of its “GenX Plus” initiative to increase female calf yield in dairy farming.

-

January 2025 – Select Sires Inc. announced a strategic partnership with an agri-tech firm to develop AI monitoring software for livestock farms. The collaboration aims to integrate estrus detection sensors with AI scheduling algorithms.

-

November 2024 – ABS Global unveiled a new line of sexed semen optimized for high-altitude farming environments, targeting cattle breeders in mountainous states such as Colorado and Utah.

-

August 2024 – Genex Cooperative expanded its mobile AI units across the southern U.S., offering on-site services including semen delivery, technician-assisted insemination, and real-time genetic consulting.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Solutions

- Equipment & Consumables

- Semen

By Animal Type

- Bovine

- Swine

- Ovine & Caprine

- Equine

- Other Animals

By Distribution Channel