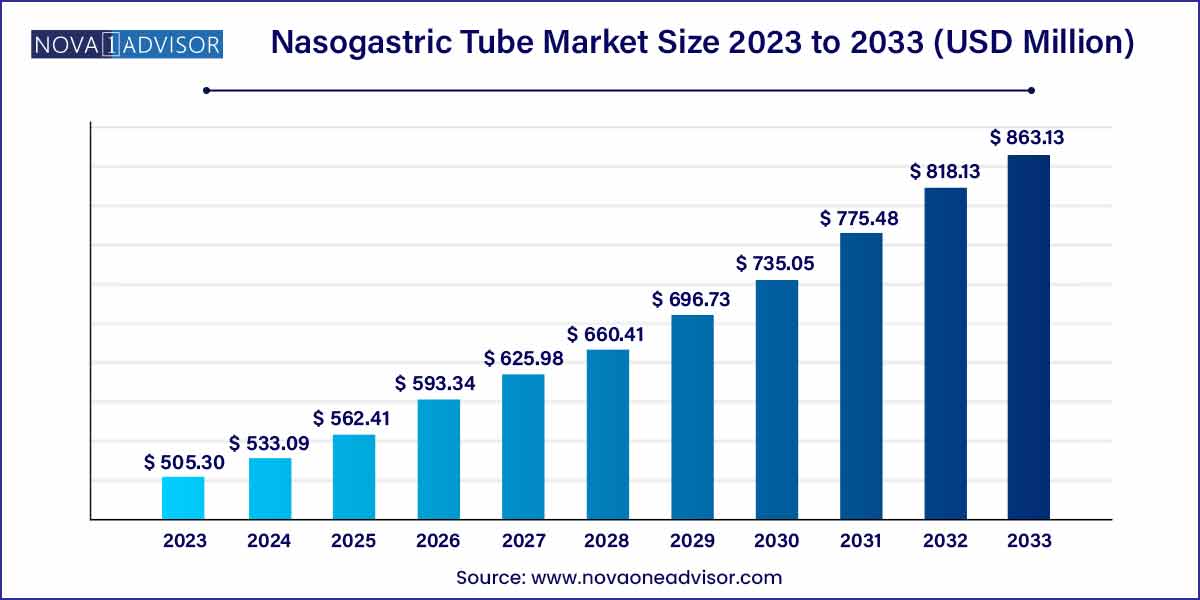

The global nasogastric tube market size was exhibited at USD 505.30 million in 2023 and is projected to hit around USD 863.13 million by 2033, growing at a CAGR of 5.5% during the forecast period 2024 to 2033.

Key Takeaways:

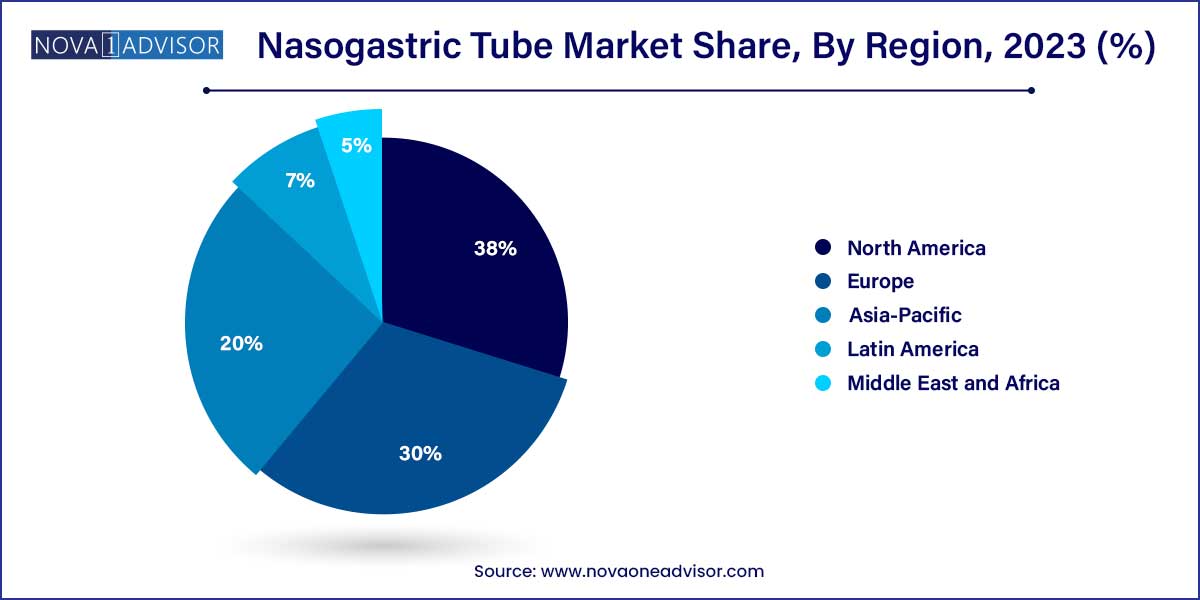

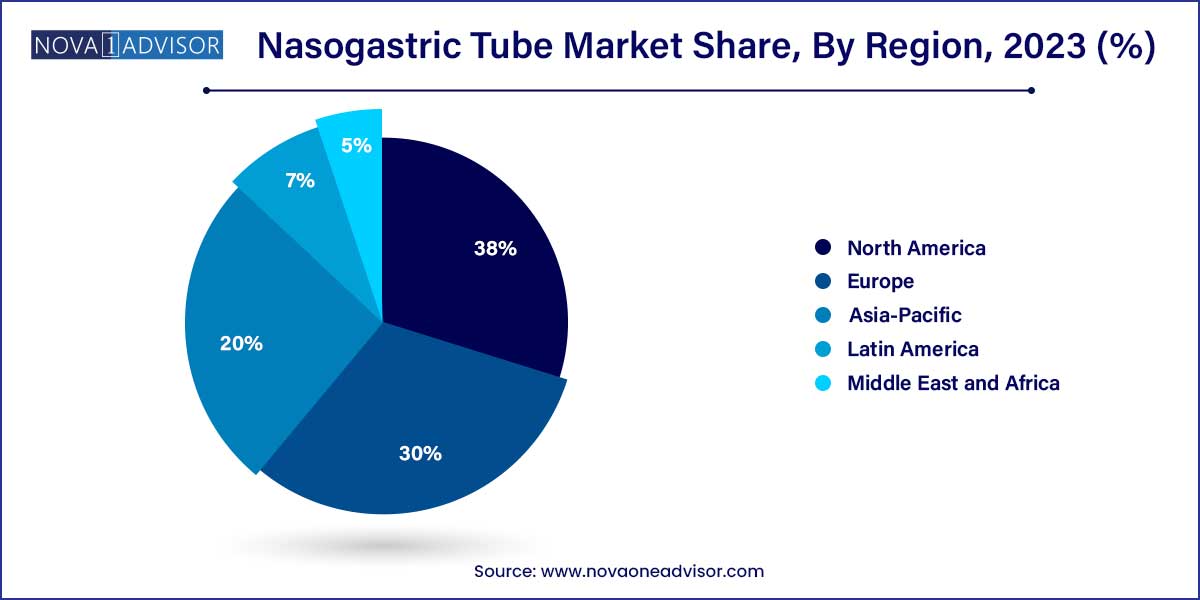

- North America accounted for the largest share of the nasogastric tube industry in 2023, with 38.0%.

- The adult segment held the largest share of the market in 2023, with 36.9%.

- The others segment is the fastest-growing segment in the market. It is expected to grow at a CAGR of 7.0% between 2024 and 2033.

- The small-bore feeding tube segment held the largest share of the market in 2023.

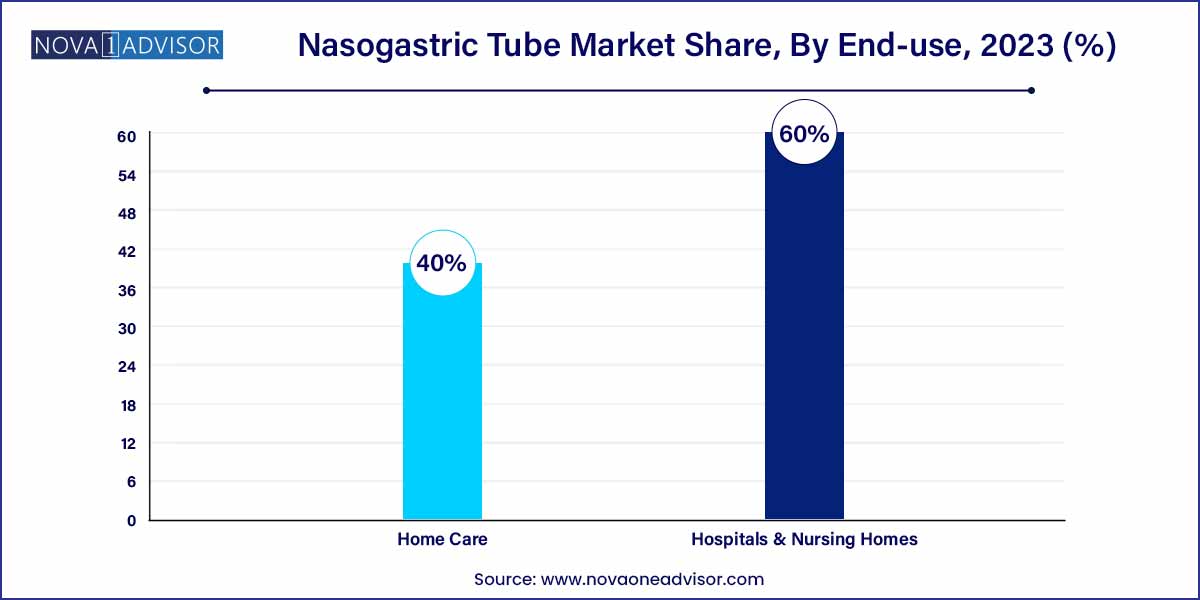

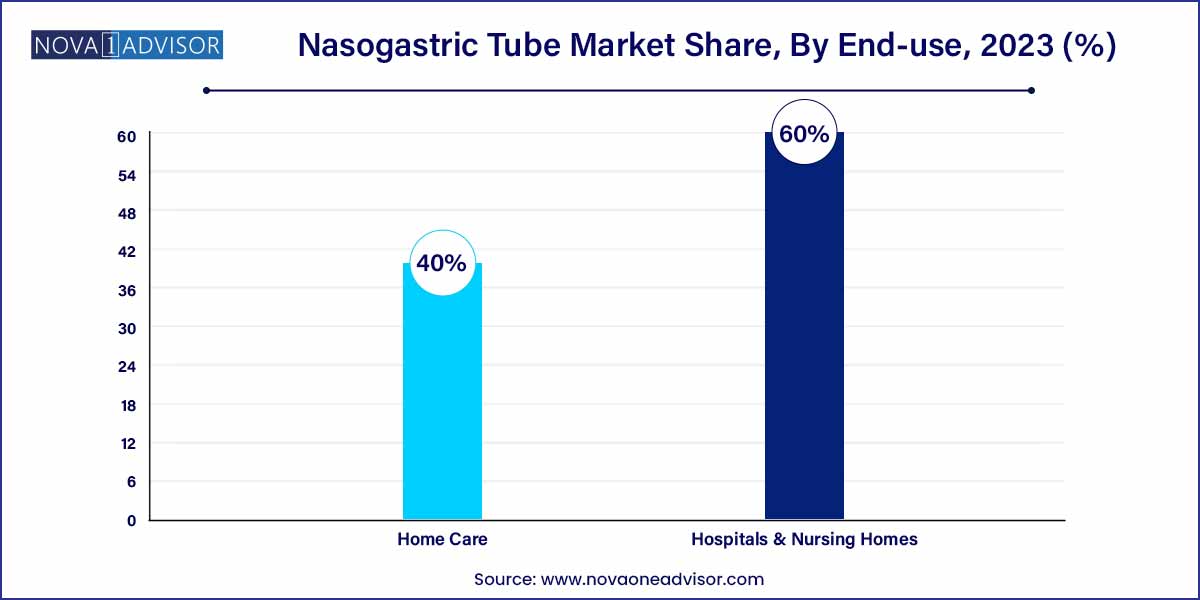

- The hospital segment held the largest share of the market in 2023, with a 60% share.

Nasogastric Tube Market: Overview

The nasogastric tube market is experiencing significant growth and evolution driven by advancements in medical technology, increasing prevalence of gastrointestinal disorders, and rising demand for enteral feeding solutions. Nasogastric tubes, commonly used in medical settings for enteral feeding, medication administration, and gastric decompression, play a pivotal role in patient care across various healthcare settings.

Nasogastric Tube Market Growth

The growth of the nasogastric tube market is influenced by several key factors. Firstly, the increasing prevalence of gastrointestinal disorders, including digestive system diseases and malnutrition, drives the demand for nasogastric tubes for enteral feeding and medication delivery. Secondly, advancements in tube design and material technology, such as anti-clogging mechanisms and softer materials for enhanced patient comfort, contribute to market expansion. Thirdly, the rising adoption of nasogastric tubes in various healthcare facilities, including hospitals, ambulatory surgical centers, and home healthcare settings, further propels market growth. Additionally, the growing geriatric population worldwide, coupled with the associated rise in chronic diseases requiring enteral feeding support, serves as a significant growth driver for the nasogastric tube market. Overall, these factors collectively contribute to the sustained growth and development of the nasogastric tube market, offering opportunities for manufacturers, healthcare providers, and stakeholders in the medical industry.

Nasogastric Tube Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 505.30 Million |

| Market Size by 2033 |

USD 863.13 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 5.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Patient Type, Indication, Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BD; QMD; Angiplast Pvt. Ltd.; Securmed; Vygon; Medtronic; Andersen Products Inc.; Cardinal Health; Poly Medicure Limited; Baihe Medical. |

Nasogastric Tube Market Dynamics

- Growing Incidence of Gastrointestinal Disorders:

The nasogastric tube market is witnessing significant growth due to the increasing prevalence of gastrointestinal disorders globally. Conditions such as gastrointestinal cancers, digestive system disorders, and malnutrition necessitate the use of nasogastric tubes for enteral feeding, medication administration, and gastric decompression. This rising incidence of gastrointestinal ailments fuels the demand for nasogastric tubes as essential medical devices, contributing to market expansion.

- Advancements in Tube Design and Material Technology:

Technological innovations have revolutionized nasogastric tube design and material technology, driving market growth. Manufacturers are developing tubes with features like anti-clogging mechanisms, radiopaque properties for accurate placement, and softer materials to enhance patient comfort. These advancements improve the efficacy and safety of nasogastric tubes, making them more appealing to healthcare providers and patients alike. As a result, the market experiences increased adoption of nasogastric tubes across various healthcare settings, further boosting its growth trajectory.

Nasogastric Tube Market Restraint

- Risk of Complications and Adverse Events:

Despite their widespread use, nasogastric tubes carry a risk of complications and adverse events. Improper placement or insertion technique can lead to complications such as nasal mucosal injury, aspiration pneumonia, tube dislodgement, and tube-related infections. These complications not only pose risks to patient safety but also result in additional healthcare costs and potential legal liabilities for healthcare providers.

- Patient Discomfort and Non-Compliance:

Nasogastric tubes can cause discomfort and distress to patients, particularly during insertion and while in place. Patients may experience nasal irritation, sore throat, nausea, and vomiting, leading to reduced tolerance and compliance with tube feeding regimens. Additionally, psychological factors such as anxiety and fear associated with nasogastric tube placement can further contribute to patient discomfort and non-compliance. Healthcare providers must address these challenges by implementing strategies to minimize patient discomfort, enhance education and support for patients undergoing nasogastric tube placement, and explore alternative enteral feeding methods where appropriate.

Nasogastric Tube Market Opportunity

- Rapidly Aging Population and Increased Healthcare Expenditure:

The nasogastric tube market stands to benefit from demographic trends, particularly the aging population and the associated rise in chronic diseases. As the elderly population grows globally, the prevalence of conditions requiring enteral feeding support, such as dysphagia, stroke, and neurodegenerative diseases, is expected to increase. This demographic shift presents a significant opportunity for nasogastric tube manufacturers to expand their market presence and cater to the growing demand for enteral feeding solutions.

- Technological Advancements and Product Innovation:

The nasogastric tube market is ripe for technological advancements and product innovation. Manufacturers are investing in research and development to enhance the safety, efficacy, and patient comfort of nasogastric tubes through innovations in design, materials, and functionalities. For instance, the development of nasogastric tubes with advanced features such as anti-clogging mechanisms, radiopaque properties, and integrated sensors for real-time monitoring represents a promising opportunity to meet the evolving needs of healthcare providers and patients. Moreover, the integration of digital health technologies, such as telemonitoring and smart feeding pumps, offers new avenues for improving the management and delivery of enteral nutrition, creating opportunities for market growth and differentiation.

Nasogastric Tube Market Challenges

- Regulatory Compliance and Quality Assurance:

.One of the primary challenges in the nasogastric tube market is ensuring regulatory compliance and maintaining high standards of quality assurance. Nasogastric tubes are classified as medical devices and are subject to stringent regulations and standards imposed by regulatory authorities such as the FDA (Food and Drug Administration) in the United States and the CE Marking in Europe. Manufacturers must navigate complex regulatory requirements, including product testing, certification, and documentation, to ensure compliance with safety and performance standards.

- Competitive Pricing Pressures and Cost Constraints:

The nasogastric tube market faces competitive pricing pressures and cost constraints, particularly in price-sensitive healthcare markets. Healthcare providers, including hospitals and long-term care facilities, often prioritize cost containment and seek cost-effective solutions without compromising quality or patient care. As a result, manufacturers may encounter challenges in maintaining profitability and market share while navigating pricing pressures and cost constraints. Moreover, the presence of numerous market players and the commoditization of nasogastric tubes further intensify competitive dynamics, compelling manufacturers to innovate, differentiate their products, and streamline operations to remain competitive in the market.

Segments Insights:

Patient Type Insights

Adult patients accounted for the dominant share in the nasogastric tube market, driven by the high prevalence of chronic diseases like cancer, stroke, CKD, and gastrointestinal disorders in this demographic. Adults particularly those above 40 are more likely to experience conditions such as dysphagia, gastric obstruction, or post-operative feeding needs that require nasogastric tube support. Hospitals frequently rely on NG tubes for pre- and post-surgical decompression and feeding in adult patients recovering from abdominal surgery, trauma, or respiratory illness.

This segment also benefits from the broader availability of customized NG tube sizes, insertion tools, and training programs tailored to adult physiology. With aging populations across North America, Europe, and Asia-Pacific, the demand for adult nasogastric feeding is expected to remain high in both acute and chronic care scenarios.

While adult patients dominate, the pediatric segment is witnessing rapid growth due to improvements in neonatal and pediatric care. Premature infants, children with congenital anomalies, and pediatric cancer patients often require NG tube support for nutritional needs during prolonged hospital stays or chemotherapy. Pediatric NG tubes are specifically designed for delicate anatomies, offering smaller diameters and softer materials to minimize discomfort.

Healthcare systems are increasingly focusing on reducing malnutrition in pediatric patients, particularly in low- and middle-income countries. Initiatives such as UNICEF’s nutrition programs often incorporate enteral feeding for severely undernourished children, supporting market expansion in this segment. As pediatric ICUs and specialty hospitals expand globally, the demand for safe, child-friendly NG tube systems continues to rise.

Indication Insights

Dysphagia the impaired ability to swallow emerged as the leading indication for nasogastric tube placement. The condition affects millions globally, especially among elderly populations, stroke survivors, and those with neurodegenerative diseases like Parkinson’s and ALS. Dysphagia significantly raises the risk of malnutrition and aspiration, making NG tube feeding a critical intervention for safe and adequate nutrition.

Clinicians frequently rely on NG tubes for both temporary and prolonged management of dysphagia, particularly during recovery periods. The market is also supported by increased clinical guidelines recommending early nutritional intervention in dysphagia cases. As awareness of the condition rises among clinicians and caregivers, NG tube usage in this indication is expected to remain strong.

Stomach and esophageal cancers represent a fast-growing indication category due to the rising incidence of gastrointestinal malignancies and their associated complications. Patients undergoing radiation or surgical treatment often face temporary or long-term inability to swallow, necessitating NG feeding support. Moreover, obstructions caused by tumor growth can prevent food passage, making decompression and feeding through NG tubes essential.

This segment is expanding rapidly in regions with high rates of gastric cancers, such as East Asia and parts of Eastern Europe. With early detection efforts and treatment improvements increasing survival rates, supportive care including enteral feeding is playing a more prominent role in oncology, thus accelerating market growth in this indication.

Type Insights

Small-bore feeding tubes held the majority share in the nasogastric tube market due to their enhanced patient comfort, flexibility, and suitability for long-term nutritional therapy. These tubes, usually made from polyurethane or silicone, are easier to tolerate for conscious patients and reduce the risk of nasal irritation or pressure ulcers. They are widely used in both hospital and home settings for continuous or intermittent feeding.

The popularity of small-bore tubes is further driven by their compatibility with pump feeding systems and their ability to deliver nutritional formulas, medications, and fluids without causing gastric discomfort. Their safety and versatility make them the preferred choice in critical care and recovery scenarios.

Large-bore NG tubes, while less common for feeding, are essential in gastric decompression, toxin removal, and emergency GI procedures. These tubes are commonly used in emergency rooms and intensive care units for patients with gastrointestinal obstructions, bleeding, or poisoning. They enable rapid aspiration of gastric contents and are critical in managing high-risk surgical cases.

The growth in surgical admissions, trauma cases, and acute GI conditions is supporting steady demand for large-bore NG tubes. As emergency and critical care capabilities expand globally, especially in middle-income countries, the large-bore tube segment is likely to see incremental growth.

End-use Insights

Hospitals and nursing homes dominated the nasogastric tube market, as these facilities manage the majority of acute and post-acute care patients requiring enteral feeding or decompression. NG tubes are commonly inserted in emergency departments, ICUs, surgical wards, and geriatric units. Hospitals typically have trained personnel and imaging tools to ensure safe placement and monitoring, making them the primary end-users.

Moreover, the institutional setting ensures close nutritional assessment, reducing complications related to malnutrition or tube misplacement. Nursing homes also rely heavily on NG tubes for elderly patients with advanced dementia or post-stroke dysphagia. Given the aging demographics in major economies, this end-user segment is projected to remain the backbone of the market.

Home care is the fastest-growing end-use segment as more patients with chronic conditions or terminal illnesses are opting for palliative and supportive care at home. NG tubes offer a temporary feeding solution that caregivers can manage with minimal training, especially for patients recovering from surgery, cancer treatment, or neurological conditions.

Technological improvements have led to the development of NG tubes with placement indicators, secure fittings, and easy-flush designs suitable for home use. Insurance coverage, remote monitoring tools, and caregiver education programs are also making home-based NG tube care more viable, fueling growth in this segment.

Regional Insights

North America emerged as the leading regional market for nasogastric tubes, driven by its advanced healthcare infrastructure, high prevalence of chronic diseases, and strong presence of leading medical device manufacturers. The United States leads with a high volume of hospitalizations related to stroke, cancer, and GI disorders all conditions requiring NG tube interventions.

Regulatory support, reimbursement policies for enteral nutrition, and established clinical guidelines further boost market penetration. The region also benefits from ongoing R&D investments, frequent product launches, and collaborations between hospitals and device makers to enhance patient outcomes through improved feeding technology.

Asia-Pacific is the fastest-growing region, fueled by rising healthcare investments, expanding hospital infrastructure, and a large aging population. Countries like China, India, Japan, and South Korea are seeing increased incidence of GI cancers, CKD, and malnutrition all driving demand for NG tubes.

Public health programs focusing on elderly care, neonatal survival, and chronic disease management are incorporating enteral feeding as a key component. Local manufacturing of cost-effective NG tubes, government initiatives to improve critical care, and medical tourism are additional growth enablers in this region. With rising awareness and healthcare accessibility, Asia-Pacific is expected to become a significant contributor to global revenue.

Some of the prominent players in the nasogastric tube market include:

- BD

- QMD

- Angiplast Pvt. Ltd.

- Securmed

- Vygon

- Medtronic

- Andersen Products Inc.

- Cardinal Health

- Baihe Medical

- Poly Medicure Limited

Recent Developments

-

Cardinal Health (April 2025): Introduced a new line of antimicrobial polyurethane nasogastric tubes aimed at reducing infection risk in ICU patients across North America.

-

Medtronic (March 2025): Announced a partnership with a leading Asian hospital group to expand access to pediatric NG tubes through localized manufacturing and training programs.

-

Vygon (February 2025): Launched a wireless-guided NG tube placement device in European hospitals, helping reduce misplacement incidents and improving patient safety.

-

Avanos Medical (January 2025): Reported a successful pilot study of their innovative sensor-based NG tube positioning technology, reducing the need for confirmatory X-rays.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global nasogastric tube market.

Patient Type

- Adult

- Pediatric

- Geriatric

Indication

- Stomach Cancer

- Esophageal Cancer

- IBD

- Chronic Kidney Disease

- Dysphagia

- Others

Type

- Small-bore feeding tubes

- Large-bore feeding tubes

End-Use

- Hospitals & Nursing Homes

- Home Care

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)