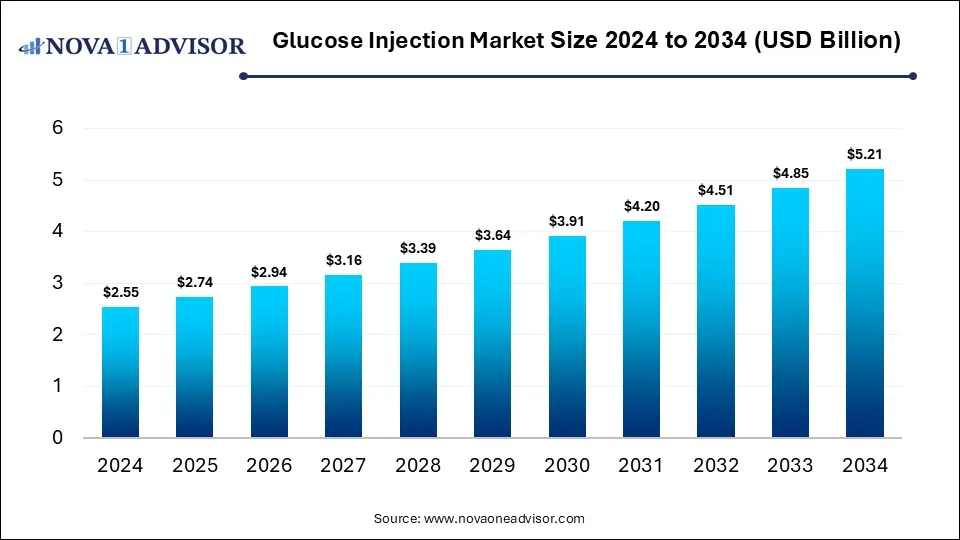

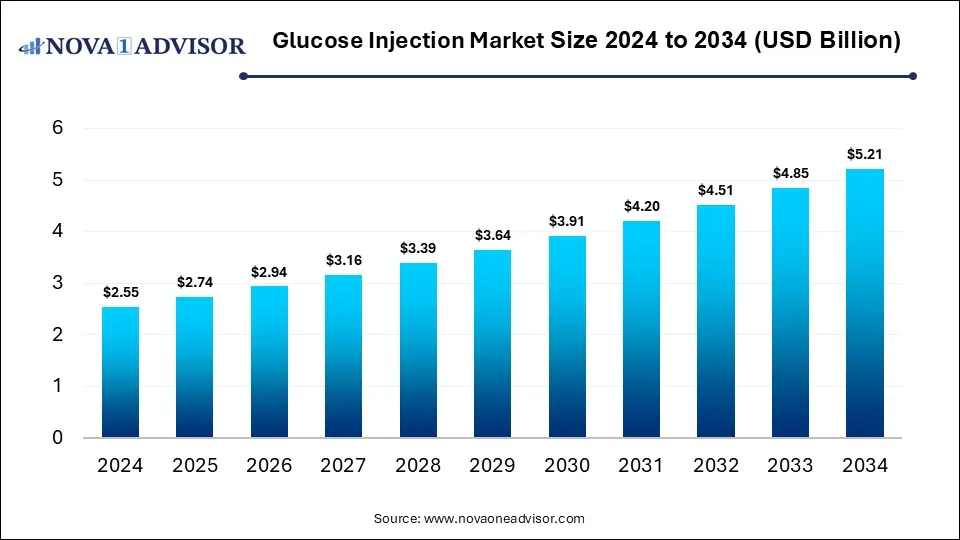

Glucose Injection Market Size and Growth 2025 to 2034

The global glucose injection market size was estimated at USD 2.55 billion in 2024 and is expected to reach USD 5.21 billion in 2034, expanding at a CAGR of 7.4% during the forecast period of 2025 and 2034. The market growth is driven by growing incidences of hypoglycemia, increasing surgical procedures, and greater demand for emergency and critical care support.

Glucose Injection Market Key Takeaways

- By region, North America held the largest share of the glucose injection market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By product type, the dextrose injection segment led the market in 2024.

- By product type, the fructose injection segment is expected to expand at the highest CAGR over the projected timeframe.

- By concentration, the dextrose solution segment led the market in 2024.

- By application, the emergency treatment segment dominated the market in 2024.

- By application, the nutritional support segment is expected to expand at the highest CAGR over the projection period.

- By distribution channel, the hospital pharmacies segment led the market in 2024.

- By end-user, the hospitals segment led the market in 2024.

Impact of AI on the Glucose Injection Market

AI is significantly revolutionizing the market by enabling demand forecasting, optimizing supply chain logistics, and improving inventory management in hospitals and pharmacies. AI-driven analytics help predict patient needs and treatment trends, ensuring the timely availability of glucose injections in critical care settings. Additionally, AI-powered diagnostic tools are enabling early detection and real-time monitoring of hypoglycemia, increasing the clinical use of glucose injections. In R&D, AI accelerates formulation analysis and regulatory compliance processes, helping manufacturers bring products to market faster. These advancements collectively improve efficiency, reduce waste, and enhance patient outcomes in emergencies and inpatient care.

Market Overview

The glucose injection market refers to the global industry involved in the production, distribution, and sale of glucose injections, sterile solutions of glucose administered intravenously to provide quick energy, treat low blood sugar (hypoglycemia), dehydration, and serve as a nutritional supplement in medical settings. Glucose injections are vital in emergency medicine, perioperative care, and for patients unable to consume oral glucose. Market growth is primarily driven by rising rates of diabetes and hypoglycemia, an increasing number of surgical procedures, and the growing demand for quick energy supplementation in hospital settings. Advancements in healthcare infrastructure, particularly in emerging markets, along with increased awareness of hypoglycemic management, are further fueling demand. The market growth is also driven by innovations in drug delivery, improvements in cold chain logistics, and rising product approvals.

- In February 2025, the FDA approved Merolog (insulin-aspart-szjj) as the first rapid-acting insulin biosimilar. The approval demonstrates a growing market for more affordable, generic versions of insulin, providing more options for patients.

What are the Major Trends in the Glucose Injection Market?

- Rising Use in Emergency and Critical Care Settings

Glucose injections are increasingly used in ICUs and emergency departments to manage acute hypoglycemia and shock. This trend is driven by the rising global burden of diabetes and trauma cases requiring immediate glucose administration.

- Growing Demand in Surgical and Postoperative Recovery

Glucose injections are widely used during and after surgeries to maintain energy levels and stabilize metabolic functions. As the number of surgeries increases worldwide, so does the demand for injectable glucose solutions.

- Shift Toward Ready-to-Use Prefilled Syringes

Hospitals and clinics are adopting prefilled glucose injection syringes for faster, more convenient, and safer administration. This reduces preparation time and risk of contamination, enhancing patient care efficiency.

- Increased Adoption in Geriatric and Pediatric Care

Glucose injections are frequently required in elderly and pediatric populations, who are more prone to nutritional deficiencies and hypoglycemia. The growing ageing population and pediatric care focus are expanding the market’s target base.

- Expansion in Emerging Markets

Rapid healthcare infrastructure development in Asia-Pacific, Latin America, and Africa is opening new opportunities for glucose injection manufacturers. Improved access to emergency care and rising health awareness are key growth drivers in these regions.

Report Scope of Glucose Injection Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.74 Billion |

| Market Size by 2034 |

USD 5.21 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product Type, By Concentration, By Application, By End-User, By Distribution Channel, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Growing Prevalence of Diabetes

The increased risk of hypoglycemia among diabetic patients, especially those on insulin or oral hypoglycemic agents, significantly drives the growth of the glucose injection market. Hypoglycemia, a potentially life-threatening condition, often requires immediate correction through fast-acting glucose sources, with injectable glucose being one of the most effective interventions in acute settings. As diabetes rates continue to climb, particularly in ageing populations and developing countries, the frequency of hypoglycemic episodes is also rising, amplifying demand for emergency glucose treatments. Hospitals, emergency services, and even home care providers are increasingly stocking injectable glucose to ensure rapid response.

- The global diabetes population surged from 200 million in 1990 to 830 million in 2022, with faster prevalence growth in low- and middle-income countries compared to high-income ones.

Growing Geriatric Population

Growing geriatric population, with metabolic disorders and weakened nutritional status, is raising the demand for glucose injections in hospitals and critical care. Glucose injections are commonly used to manage energy deficiencies, dehydration, and maintain metabolic balance, especially when oral intake is limited or impossible. Elderly patients in critical care or post-operative recovery frequently rely on intravenous glucose to stabilize their condition and support recovery. As healthcare systems worldwide see a surge in elderly admissions, particularly in ICUs and long-term care facilities, the demand for glucose injections rises accordingly. This demographic trend is a significant contributor to sustained market growth.

- By 2030, 1 in 6 people globally will be aged 60 or older, increasing from 1 billion in 2020 to 1.4 billion; by 2050, this population will double to 2.1 billion, with those aged 80+ tripling to 426 million.

Restraints

Regulatory Complexity

Regulatory complexity acts as a significant restraint on the growth of the glucose injection market, as these products must meet stringent safety, sterility, and quality standards due to their use in gene therapies and vaccines. Obtaining regulatory approvals involves rigorous validation, documentation, and compliance with Good Manufacturing Practices (GMP), which can be both time-consuming and expensive. Smaller companies and new entrants often face financial and operational barriers in scaling up production while adhering to these strict requirements. Delays in approval can hinder product launch timelines and limit the availability of manufacturing capacity.

Cost Issues

The production of biologics involves high expenses related to raw materials, complex manufacturing processes, sterilization, and specialized packaging. Additionally, maintaining a cold chain throughout storage and distribution further drives up costs, making these therapies less accessible in resource-constrained settings. These high operational costs often translate into elevated end-product prices, limiting widespread adoption and slowing market penetration. As a result, cost barriers hinder both commercial scalability and global reach, particularly in emerging healthcare markets.

Opportunities

Product Innovation

Advances such as ready-to-use formulations, pre-filled syringes, and preservative-free solutions reduce preparation time, minimize contamination risks, and improve patient outcomes. Innovations in packaging and stability also extend shelf life and simplify storage and transportation, making glucose injections more accessible, especially in remote or emergency settings. Additionally, tailored formulations for specific clinical needs, such as pediatric, geriatric, or critical care use, are expanding the market's reach. These improvements not only meet evolving clinical demands but also open doors for growth in both developed and emerging healthcare systems.

Development of Smart Infusion Pumps

A major opportunity in the glucose injection market lies in the development of smart infusion pumps. Smart infusion pumps and connected devices allow for accurate dosing and real-time monitoring of patients' glucose levels, reducing the risk of under- or over-administration. These technologies are particularly valuable in critical care and emergency settings, where rapid response and precision are vital. Additionally, integration with electronic health records (EHRs) and remote monitoring platforms supports better clinical decision-making and continuity of care. As digital health solutions become more widely adopted, they are driving demand for compatible, tech-enabled glucose injection systems, opening new avenues for innovation and market expansion.

How Macroeconomic Variables Influence the Glucose Injection Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth, increasing government and private healthcare spending, improving hospital infrastructure, and expanding access to medical treatments. As countries become more economically stable, they invest more in public health systems, which boosts demand for essential medical supplies like glucose injections. Conversely, in periods of economic downturn or low GDP growth, budget constraints may limit procurement and accessibility, particularly in low- and middle-income countries.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the market, increasing production costs and reducing consumers' purchasing power, especially in price-sensitive and low-income markets. As the cost of raw materials, packaging, and distribution rises, pharmaceutical companies may be forced to raise prices or face thinner profit margins. Additionally, tighter healthcare budgets and reimbursement challenges can limit patient access to premium formulations like enteric-coated aspirin, slowing overall market expansion.

Exchange Rates

Exchange rate fluctuations negatively affect the market, increasing the costs of raw materials, manufacturing, and distribution, which can lead to higher prices for healthcare providers and patients. These cost pressures often result in tighter healthcare budgets and reimbursement challenges, especially in low- and middle-income countries. Consequently, affordability and access to glucose injections may be limited, slowing market expansion.

Segment Outlook

Product Type Insights

Why Did the Dextrose Injection Segment Lead the Market in 2024?

The dextrose injection segment led the glucose injection market in 2024 due to its widespread use in treating hypoglycemia, dehydration, and as a key component of intravenous nutrition. Its versatility across various concentrations, especially 5% and 10%, made it the preferred choice in hospitals, ICUs, and emergency care settings. Dextrose injections are cost-effective, widely available, and supported by established clinical protocols, which further strengthens their dominance. Additionally, the rising prevalence of diabetes and increased surgical procedures globally drove higher demand for rapid glucose administration, favoring dextrose-based solutions. This combination of broad clinical utility, affordability, and high demand secured its leading market position.

The fructose injection segment is expected to expand at the highest CAGR in the coming years. This is mainly due to its emerging use in specialized clinical applications, particularly for patients with glucose intolerance or insulin resistance. Fructose, being metabolized independently of insulin, can offer an alternative energy source in certain metabolic conditions where dextrose may not be ideal. Growing research into targeted therapies and personalized medicine is also encouraging interest in alternative carbohydrate sources like fructose. Additionally, improvements in formulation and safety profiles are making fructose injections more viable for broader medical use. While still a niche segment, these factors are positioning it for rapid growth compared to the already mature dextrose segment.

Concentration Insights

What Made Dextrose Solution the Dominant Segment in the Glucose Injection Market?

The dextrose solution segment dominated the market with the largest share in 2024 and is likely to grow at the fastest rate in the upcoming period. This is mainly due to its extensive use in treating a wide range of conditions, such as hypoglycemia, dehydration, and as part of intravenous fluid therapy. Its availability in multiple concentrations, particularly 5% and 10%, makes it suitable for diverse clinical needs from routine hydration to emergency energy supplementation. Healthcare providers prefer dextrose solutions for their proven efficacy, low cost, and compatibility with other IV medications. The high demand across hospitals, ICUs, and surgical settings further strengthened its market leadership.

Application Insights

Why Did the Emergency Treatment Segment Lead the Market in 2024?

The emergency treatment segment led the glucose injection market in 2024 due to its critical role in managing acute conditions, such as hypoglycemia, insulin shock, and diabetic emergencies. Hospitals, emergency departments, and ambulance services extensively rely on glucose injections for immediate restoration of blood sugar levels, making them an indispensable component of emergency care. The rising global prevalence of diabetes and increased incidence of insulin-related complications have further amplified demand for rapid-acting glucose formulations. Moreover, the availability of glucose injections in multiple concentrations, such as Dextrose 10% and Dextrose 50%, ensures quick and effective treatment in life-threatening situations.

The nutritional support segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing demand for parenteral nutrition among patients who cannot consume food orally or enterally. Rising incidences of chronic diseases, cancer, gastrointestinal disorders, and post-surgical recovery cases are driving the need for glucose-based intravenous nutrition to maintain energy and metabolic balance. The expanding use of total parenteral nutrition (TPN) in intensive care units, along with the growing geriatric population and higher hospitalization rates, further supports this growth. Additionally, technological advancements in sterile formulations and the increasing adoption of home-based infusion therapies are enhancing the accessibility and safety of glucose injections for nutritional use.

Distribution Channel Insights

Why Did Hospital Pharmacies Hold the Largest Market Share in 2024?

The hospital pharmacies segment held the largest share of the glucose injection market in 2024 due to high and consistent demand for glucose injections in inpatient, surgical, and emergency care settings. Hospitals serve as the primary point of treatment for critical conditions such as hypoglycemia, dehydration, and metabolic imbalances, where glucose injections are frequently administered for rapid energy restoration. The presence of well-established procurement systems, bulk purchasing agreements, and 24/7 pharmacy operations ensures the uninterrupted availability of glucose products. Additionally, the growing number of hospital admissions and surgeries has further increased the utilization of glucose injections for parenteral nutrition and post-operative recovery.

The online pharmacies segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing adoption of digital healthcare platforms and e-commerce channels for medical supplies. The growing preference for convenient, contactless purchasing and home delivery of essential medicines has significantly boosted the popularity of online pharmacies. Additionally, the rising trend of home healthcare and chronic disease management, where patients require regular glucose injections or parenteral nutrition, supports higher online demand. Expanding internet penetration, improved digital payment systems, and favorable regulatory frameworks promoting telemedicine and e-pharmacy services are further fueling this growth.

End User Insights

Why Did the Hospitals Segment Lead the Market in 2024?

The hospital segment led the glucose injection market in 2024 due to its critical role in managing acute and high-risk medical conditions that require immediate and controlled glucose administration. Hospitals are the primary settings for treating emergencies such as severe hypoglycemia, trauma, surgeries, and critical illnesses, where intravenous glucose is essential for stabilizing patients and maintaining metabolic balance. The presence of trained medical professionals, advanced infusion systems, and continuous patient monitoring makes hospitals the most suitable environment for administering glucose injections safely and effectively. Additionally, rising hospital admissions driven by chronic diseases, diabetes, and surgical procedures contributed to higher demand.

The home care segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing shift toward decentralized and patient-centric healthcare. As chronic conditions like diabetes become more prevalent, patients and caregivers are seeking convenient, cost-effective treatment options that can be administered at home. Technological advancements, such as pre-filled syringes and easy-to-use injection kits, are making glucose administration safer and more accessible outside clinical settings. Additionally, the expansion of home healthcare services and telemedicine is enabling better support and monitoring for at-home treatment.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the glucose injection market while holding the largest share in 2024. The region’s dominance is primarily attributed to the advanced healthcare infrastructure, high prevalence of diabetes, and strong presence of leading pharmaceutical manufacturers. The region's well-established hospital systems and widespread access to emergency and critical care services ensured consistent demand for glucose injections in managing hypoglycemia and related conditions. Additionally, favorable reimbursement policies, higher healthcare spending, and rapid adoption of new medical technologies supported market growth. Ongoing public health initiatives and awareness campaigns around diabetes management further boost the use of injectable glucose.

The U.S. is a major contributor to the North American glucose injection market due to the advanced healthcare infrastructure and high burden of diabetes and related metabolic disorders. The country’s strong pharmaceutical industry, coupled with high hospital admission rates and widespread use of intravenous therapies, drives substantial demand for glucose injections. In addition, supportive government policies, favorable insurance coverage, and increased healthcare spending further reinforce its market leadership. The presence of key players, ongoing R&D activities, and rising launches of novel glucose injections also makes the U.S. a central hub for innovation.

- In August 2025, Lupin Limited launched Glucagon for Injection USP, 1mg/vial emergency kit in the U.S., bioequivalent to Eli Lilly’s version, for treating severe hypoglycemia in diabetic patients and as a diagnostic aid during radiologic exams.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for glucose injection. This is due to the rapidly expanding diabetic population, driven by lifestyle changes, urbanization, and ageing demographics. Countries like China and India are witnessing a surge in diabetes cases, increasing the demand for effective glucose management solutions, including injectable glucose for hypoglycemic emergencies. Additionally, improving healthcare infrastructure, rising healthcare expenditure, and greater awareness of diabetes treatment options are fueling market expansion. Government initiatives to improve access to essential medicines and the growth of private healthcare providers are further accelerating adoption. As more patients gain access to hospitals and home care services, the demand for glucose injections is expected to rise sharply across the region.

- In August 2025, Eli Lilly launched Mounjaro KwikPen in India, a once-weekly prefilled pen for diabetes available in six dose strengths, intensifying competition with Danish rival Novo Nordisk. This launch highlights the importance of user-friendly delivery systems in modern diabetes care.

China is a major player in the Asia Pacific glucose injection market due to its large diabetic population, growing elderly demographic, and rapidly developing healthcare infrastructure. The country has seen a sharp rise in hospital admissions and emergency care needs, where glucose injections are commonly used for managing hypoglycemia and nutritional support. Government initiatives to expand healthcare access, along with increased investment in domestic pharmaceutical manufacturing, have further boosted the availability and affordability of injectable treatments. These factors collectively position China as the dominant player in the region's glucose injection market.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Growth Factors |

Restraints |

Growth Overview |

| North America |

USD 1.1 Billion |

5.59% |

High diabetes prevalence, advanced healthcare systems, strong R&D |

High treatment costs, stringent regulations |

Dominated by advanced treatment adoption and strong pharma presence; steady growth expected |

| Europe |

USD 0.7 Million |

7.8% |

Aging population, government initiatives on diabetes care |

Reimbursement challenges, regulatory complexities |

Moderate growth driven by aging demographics and increasing chronic disease burden |

| Asia Pacific |

USD 0.6 Million |

9.93% |

Rising diabetes cases, improving healthcare infrastructure, increasing awareness |

Limited healthcare access in rural areas, cost sensitivity |

Fastest-growing region fueled by increasing population, urbanization, and government support |

| Latin America |

USD 0.2 Million |

3.75% |

Growing diabetic population, expanding healthcare access |

Economic constraints, limited infrastructure |

Moderate growth with increasing demand but challenged by economic and infrastructure barriers |

| Middle East & Africa |

USD 0.1 Million |

6.5% |

Increasing diabetes incidence, government health initiatives |

Poor healthcare infrastructure, affordability issues |

Emerging market with significant untapped potential, growth hindered by infrastructural gaps |

Glucose Injection Market Value Chain Analysis

1. Raw Material Sourcing

This stage involves procuring high-purity glucose and other essential pharmaceutical-grade ingredients. The quality of raw materials directly impacts the safety and efficacy of the glucose injection products, making supplier reliability and stringent quality checks crucial.

2. Manufacturing and Formulation

In this phase, raw glucose is processed and formulated into injectable solutions under strict sterile conditions. Advanced manufacturing techniques ensure the product meets regulatory standards for sterility, stability, and dosage accuracy, which is vital for patient safety.

3. Packaging and Sterilization

Post-manufacture, glucose injections are packaged in vials or prefilled syringes using aseptic packaging systems. Sterilization processes such as autoclaving or filtration are employed to maintain product integrity and prevent contamination during storage and transportation.

4. Distribution and Logistics

Efficient distribution channels, including cold chain logistics where necessary, are critical to ensure timely delivery of glucose injections to hospitals, clinics, and pharmacies. The supply chain must maintain product stability and comply with regulatory requirements across different regions.

5. Marketing and Sales

Pharmaceutical companies engage in marketing efforts targeted at healthcare professionals, hospitals, and distributors to promote the adoption of their glucose injection products. This stage often includes clinical education, product detailing, and participation in healthcare forums to build brand trust.

6. End-Use Application

The final stage involves the administration of glucose injections to patients for medical indications such as hypoglycemia treatment and diagnostic purposes. Proper usage by healthcare providers ensures optimal therapeutic outcomes and patient safety.

Glucose Injection Market Companies

Tier I: Market Leaders (40–50% cumulative share)

These companies dominate the glucose injection market by leveraging extensive product portfolios, global distribution networks, and strong R&D capabilities to meet diverse clinical needs worldwide. Their offerings span branded and biosimilar glucose injections and related diabetes therapies.

| Company |

Key Offerings |

| Novo Nordisk |

Leading insulin and glucose injection products with widespread global presence and innovation focus. |

| Eli Lilly and Company |

Extensive portfolio of insulin and glucose injection therapies, including rapid-acting biosimilars. |

| Sanofi |

Key diabetes care products including glucose injections, strong regional market penetration. |

Tier II: Established Players (30–35% cumulative share)

These companies hold significant market shares with focused regional strategies and specialized glucose injection products, often complementing diabetes care portfolios through biosimilars or generic offerings.

| Company |

Key Offerings |

| Becton, Dickinson and Company (BD) |

Injection devices and delivery systems integral to glucose injection administration. |

| Biocon |

Biosimilar insulin and glucose injection products targeting emerging markets with cost-effective solutions. |

| Ypsomed Holding |

Delivery systems and pen devices enhancing glucose injection usability in Europe and other markets. |

| Tonghua Dongbao Pharmaceutical |

Regional manufacturer of insulin and glucose injections catering primarily to Asian markets. |

Tier III: Emerging and Niche Players (15–20% cumulative share)

These players focus on niche markets, regional distribution, or specialized product formulations, contributing innovation and expanding access in less saturated markets.

| Company |

Key Offerings |

| Fresenius Kabi |

Glucose injection products and emergency kits focused on hospital and critical care settings. |

| Xeris Pharmaceuticals |

Novel glucagon formulations and ready-to-use injectable products for hypoglycemia treatment. |

| Torrent Pharmaceuticals |

Generic injectable glucose solutions catering mainly to India and neighboring regions. |

| Taj Pharmaceuticals |

Regional supplier of injectable glucose and diabetic care products targeting Africa and Asia-Pacific. |

Recent Developments

- In September 2025, Arecor Therapeutics partnered with Sequel Med Tech to integrate its high-concentration insulin AT278 (500U/mL) with Sequel’s twiist™ Automated Insulin Delivery system, while securing up to $11 million in non-dilutive funding from Ligand Pharmaceuticals.

- In August 2024, Abbott announced a partnership with Medtronic to integrate its FreeStyle Libre continuous glucose monitoring (CGM) technology with Medtronic's automated insulin delivery (AID) and smart insulin pen systems. This collaboration offers more integrated options for managing diabetes.

Segments Covered in the Report

By Product Type

- Dextrose Injection

- Fructose Injection

- Others

By Concentration

By Application

- Emergency Treatment

- Nutritional Support

- Fluid Replacement / Dehydration

- Other medical conditions / metabolic disorders

By End-User

- Hospitals

- Ambulatory Care Centers

- Home Care

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: Global Glucose Injection Market Size (USD Billion) by Product Type, 2024–2034

- Table 2: Global Glucose Injection Market Size (USD Billion) by Concentration, 2024–2034

- Table 3: Global Glucose Injection Market Size (USD Billion) by Application, 2024–2034

- Table 4: Global Glucose Injection Market Size (USD Billion) by End-User, 2024–2034

- Table 5: Global Glucose Injection Market Size (USD Billion) by Distribution Channel, 2024–2034

- Table 6: North America Market Size (USD Billion) by Product Type, 2024–2034

- Table 7: North America Market Size (USD Billion) by Concentration, 2024–2034

- Table 8: North America Market Size (USD Billion) by Application, 2024–2034

- Table 9: North America Market Size (USD Billion) by End-User, 2024–2034

- Table 10: North America Market Size (USD Billion) by Distribution Channel, 2024–2034

- Table 11: U.S. Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 12: Canada Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 13: Mexico Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 14: Europe Market Size (USD Billion) by Product Type, 2024–2034

- Table 15: Europe Market Size (USD Billion) by Concentration, 2024–2034

- Table 16: Germany Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 17: France Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 18: UK Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 19: Italy Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 20: Asia Pacific Market Size (USD Billion) by Product Type, 2024–2034

- Table 21: Asia Pacific Market Size (USD Billion) by Concentration, 2024–2034

- Table 22: China Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 23: Japan Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 24: India Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 25: South Korea Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 26: Southeast Asia Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 27: Latin America Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 28: Brazil Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 29: Middle East & Africa Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 30: GCC Countries Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 31: Turkey Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

- Table 32: Africa Market Size (USD Billion) by Product Type, Concentration & Application, 2024–2034

List of Figures

- Figure 1: Global Market Share by Product Type, 2024

- Figure 2: Global Market Share by Concentration, 2024

- Figure 3: Global Market Share by Application, 2024

- Figure 4: Global Market Share by End-User, 2024

- Figure 5: Global Market Share by Distribution Channel, 2024

- Figure 6: North America Market Share by Product Type, 2024

- Figure 7: North America Market Share by Concentration, 2024

- Figure 8: North America Market Share by Application, 2024

- Figure 9: North America Market Share by End-User, 2024

- Figure 10: North America Market Share by Distribution Channel, 2024

- Figure 11: U.S. Market Share by Product Type, 2024

- Figure 12: U.S. Market Share by Concentration, 2024

- Figure 13: U.S. Market Share by Application, 2024

- Figure 14: Canada Market Share by Product Type, 2024

- Figure 15: Canada Market Share by Concentration, 2024

- Figure 16: Canada Market Share by Application, 2024

- Figure 17: Mexico Market Share by Product Type, 2024

- Figure 18: Mexico Market Share by Concentration, 2024

- Figure 19: Mexico Market Share by Application, 2024

- Figure 20: Europe Market Share by Product Type, 2024

- Figure 21: Europe Market Share by Concentration, 2024

- Figure 22: Germany Market Share by Product Type, 2024

- Figure 23: Germany Market Share by Concentration, 2024

- Figure 24: France Market Share by Product Type, 2024

- Figure 25: France Market Share by Concentration, 2024

- Figure 26: UK Market Share by Product Type, 2024

- Figure 27: UK Market Share by Concentration, 2024

- Figure 28: Italy Market Share by Product Type, 2024

- Figure 29: Italy Market Share by Concentration, 2024

- Figure 30: Asia Pacific Market Share by Product Type, 2024

- Figure 31: Asia Pacific Market Share by Concentration, 2024

- Figure 32: China Market Share by Product Type, 2024

- Figure 33: China Market Share by Concentration, 2024

- Figure 34: Japan Market Share by Product Type, 2024

- Figure 35: Japan Market Share by Concentration, 2024

- Figure 36: India Market Share by Product Type, 2024

- Figure 37: India Market Share by Concentration, 2024

- Figure 38: South Korea Market Share by Product Type, 2024

- Figure 39: South Korea Market Share by Concentration, 2024

- Figure 40: Southeast Asia Market Share by Product Type, 2024

- Figure 41: Southeast Asia Market Share by Concentration, 2024

- Figure 42: Latin America Market Share by Product Type, 2024

- Figure 43: Latin America Market Share by Concentration, 2024

- Figure 44: Brazil Market Share by Product Type, 2024

- Figure 45: Brazil Market Share by Concentration, 2024

- Figure 46: Middle East & Africa Market Share by Product Type, 2024

- Figure 47: Middle East & Africa Market Share by Concentration, 2024

- Figure 48: GCC Countries Market Share by Product Type, 2024

- Figure 49: GCC Countries Market Share by Concentration, 2024

- Figure 50: Turkey Market Share by Product Type, 2024

- Figure 51: Turkey Market Share by Concentration, 2024

- Figure 52: Africa Market Share by Product Type, 2024

- Figure 53: Africa Market Share by Concentration, 2024