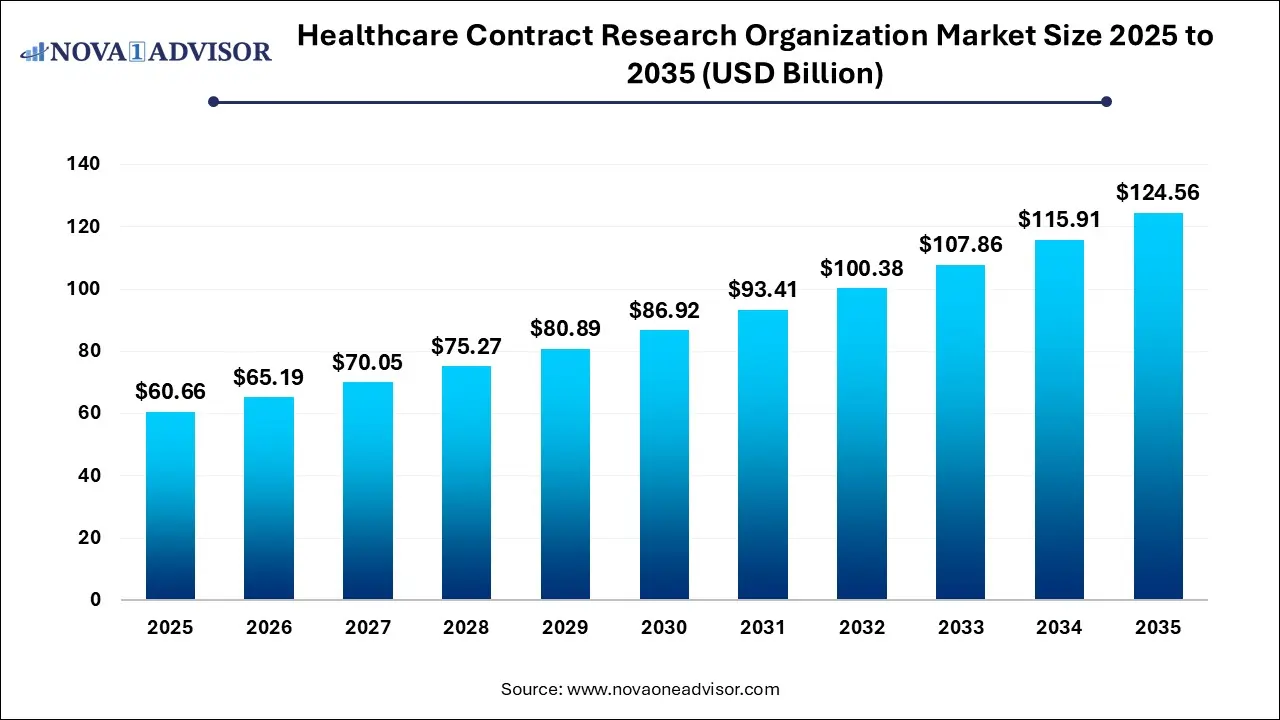

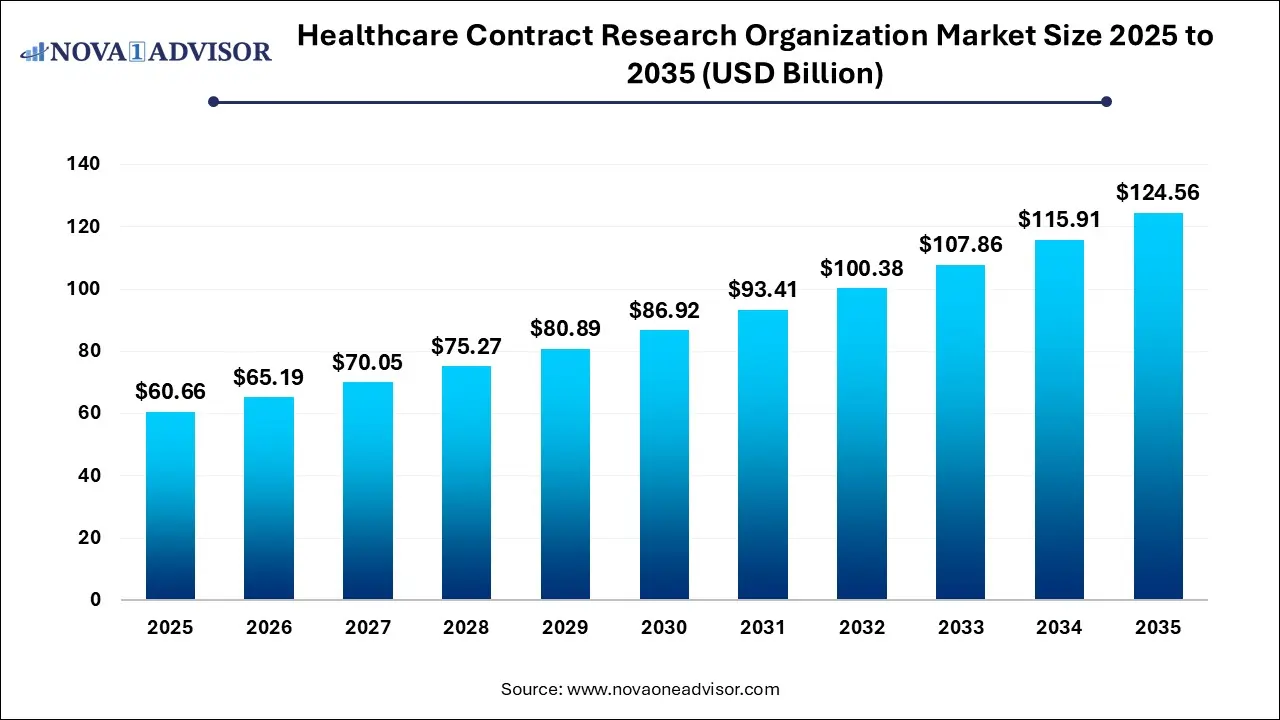

Healthcare Contract Research Organization Market Size and Growth 2026 to 2035

The global healthcare contract research organization market size is calculated at USD 60.66 billion in 2025, grows to USD 65.19 billion in 2026, and is projected to reach around USD 124.56 billion by 2035, growing at a CAGR of 7.46% from 2026 to 2035. The market is growing due to the increasing outsourcing of clinical trials and R&D by pharmaceutical and biotechnology companies. Rising demand for cost-efficient drug development further drives market expansion.

Key Takeaways

- North America dominated the healthcare contract research organization market with a revenue share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By type, the drug discovery segment led the market with the largest revenue share in 2025.

- By type, the clinical segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By service, the project management/clinical supply management segment held the largest market share in 2025.

- By service, the regulatory/medical affairs segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By therapeutic area, the oncology segment held the highest market share in 2025.

- By therapeutic area, the CNS disorders segment is expected to grow at the fastest CAGR in the market during the forecast period.

Strategic Overview of the Global Healthcare Contract Research Organization Industry

A healthcare contract research organization is a professional service provider that supports pharmaceutical, biotechnology, and medical device companies in conducting clinical trials, managing research processes, ensuring regulatory compliance, collecting and analyzing clinical data to accelerate drug and medical product development efficiently and cost-effectively. The healthcare contract research organization market is growing due to increasing demand for cost-efficient clinical trials, rising R&D investments, and the expansion of biological and personalized medicine. According to the WHO, over 150,000 clinical trials are conducted globally each year, with many outsourced to CROs for operational efficiency. Additionally, advancements in digital health technologies and the growing need for faster drug approvals are further driving the adoption of CRO services worldwide.

- For Instance, In October 2025, the CDC reported that nearly 90% of individuals aged 65 and older were living with at least one chronic disease, highlighting the growing healthcare burden.

Market Outlook

- Market Growth Overview: The healthcare contract research organization market is expected to grow significantly between 2025 and 2034, driven by the rising outsourcing and growing R&D investment, and complexity in clinical trials.

- Sustainability Trends: Sustainability trends involve a focus on green operations and infrastructures, sustainable clinical trial design, and sustainable sourcing.

- Major Investors: Major investors in the market include Novo Holdings, Pfizer Ventures, IQVIA, Labcorp, ICON, Syneos Health, and Charles River

- Startup Economy: The startup economy is focused on the agility and cost-efficiency, patient-centric models, and tech-forward innovation.

What are the Key trends in the Healthcare Contract Research Organization Market in 2025?

- In March 2025, the Central Drugs Standard Control Organization (CDSCO) introduced online registration for Clinical Research Organizations through the SUGAM portal, following the Health Ministry’s mandate for mandatory CRO registration.

- In November 2025, Novotech, a leading clinical CRO, formed a long-term partnership with Beijing Biostar Pharmaceuticals to accelerate clinical research by utilizing Novotech’s expertise and technology to advance Biostar’s development programs.

Impact of AI on the Healthcare Contract Research Organization Market?

Artificial Intelligence: The Next Growth Catalyst in Healthcare Contract Research Organization

AI is transforming the healthcare contract research organization (CRO) market by enhancing data analysis, patient recruitment, and clinical trial monitoring. According to the U.S. NIH, AI can reduce trial timelines by up to 30% through automated data processing and predictive modeling. It improves protocol design, identifies eligible participants efficiently, and minimizes human error, leading to faster, more accurate, and cost-effective clinical trials. This technological integration is driving greater efficiency and innovation across the CRO industry.

Report Scope of Healthcare Contract Research Organization Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 65.19 Billion |

| Market Size by 2035 |

USD 124.56 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.46% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Service, Therapeutic Area, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

CTI Clinical Trial & Consulting, PSI, Medpace, Ergomed, WuXi AppTec, Worldwide Clinical Trials, Medidata Solutions, Inc,Pharmaron GMBH, SGS SA, KCR S.A., Advanced Clinical Research Services, LLC, Pharm-Olam, LLC (Allucent), ICON Plc, Charles River Laboratories, Syneos Health, IQVIA Inc., GVK Biosciences Private Limited (Aragen), LabCorp, Parexel International Corporation, Thermo Fisher Scientific |

Market Dynamics

Driver

Rising R&D Investment

Rising R&D investments act as a major driver in the healthcare contract research organization market as pharmaceutical and biotechnology companies increasingly outsource clinical trials to reduce costs and accelerate drug development. According to the World Health Organization (WHO), global health R&D spending surpassed USD 240 billion in 2024, emphasizing the growing demand for specialized CRO services. These investments enable access to advanced technologies, expertise, and global trial networks, enhancing efficiency and innovation in clinical research.

Restraint

Stringent Regulatory Requirements and Complex Approval Processes

Stringent regulatory requirements and complex approval processes restrain the healthcare contract research organization market by increasing the time, cost, and complexity of conducting clinical trials. According to the U.S. FDA, obtaining trial approvals can take several months due to detailed protocol reviews, ethical clearance, and compliance checks. These processes slow down drug developments, require extensive documentation, and demand adherence to evolving guidelines, making it challenging for CROs to maintain efficiency and meet project timelines, thereby limiting market growth.

Opportunity

Adoption of Digital Health Platforms

The adoption of digital health platforms presents a significant future opportunity in the healthcare contract research organization market. These platforms enable remote patient monitoring, virtual clinical trials, and real-time data collection, improving trial efficiency and reducing costs. According to the U.S. FDA, digital health technologies have supported over 1,500 clinical studies by 2024, highlighting their growth impact. Integration such platforms allows CROs to enhance patient engagement, streamline operations, and deliver faster, more accurate clinical outcomes, driving market growth.

Segmental Insights

What made the Drug Discovery Segment Dominant in the Healthcare Contract Research Organization Market in 2025?

The drug discovery segment led the market in 2025 due to increasing outsourcing of preclinical and early-stage research by pharmaceutical and biotechnology companies. Rising R&D investments, coupled with the growing need for novel therapeutics to address chronic and rare diseases, have boosted demand for specialized CRO services. According to the World Health Organization (WHO), over 3,200 new drug candidates entered clinical development in 2024, driving the prominence of the drug discovery segment in the market.

The clinical segment is expected to register the fastest CAGR in the healthcare contract research organization (CRO) market due to increasing demand for outsourced clinical trials and patient-centric research. Rising prevalence of chronic diseases, growing focus on personalized medicine, and stringent regulatory requirements are driving pharmaceutical companies to partner with CROs for efficient trial management. According to the CTG, more than 12,500 new clinical studies were registered worldwide in 2024, emphasizing the rising reliance on CROs for efficient trial execution and accelerated drug development.

Healthcare Contract Research Organization Market By Type, 2024-2034 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| Drug Discovery |

7.86 |

8.39 |

8.94 |

9.54 |

10.18 |

10.85 |

11.57 |

12.34 |

13.16 |

14.03 |

14.96 |

| Pre-Clinical |

14.6 |

15.62 |

16.72 |

17.9 |

19.15 |

20.5 |

21.94 |

23.48 |

25.12 |

26.89 |

28.77 |

| Clinical |

33.69 |

36.32 |

39.16 |

42.2 |

45.49 |

49.04 |

52.86 |

56.97 |

61.42 |

66.19 |

71.35 |

How did Project Management/Clinical Management Supply Dominate the Healthcare Contract Research Organization Market in 2025?

The project management/ clinical supply management segment held the significant market share in 2025 due to the increasing complexity of global clinical trials and the need for study operations. Effective management of investigational products, site supplies, and timelines ensures trial continuity and data integrity. According to the U.S. FDA, over 1,200 multi-center trials were actively managed in 2024, highlighting the critical role of CROs in optimizing clinical supply chains and project executions.

The regulatory and medical affairs segment is expected to grow at the fastest CAGR in the healthcare CRO market during the forecast period due to increasing regulatory complexities and the need for compliance across the global market. Companies are outsourcing regulatory submission, safety reporting, and medical writing to CROs to accelerate approvals and reduce risks. In 2024, the International Council of Harmonisation (ICH) reported updates to over 250 guidelines affecting clinical trial conduct and approval processes, highlighting the growing need for specialized regulatory support, which drives the adoption of CRO services in this segment.

Why the Oncology Segment Dominated the Healthcare Contract Research Organization Market in 2025?

The oncology segment held the highest market share in the healthcare Cro market in 2025 due to rising global prevalence of cancer and increasing R&D investment in novel cancer therapies. According to the WHO, over 19 million new cancer cases were reported worldwide in 2024, fueling the need for extensive clinical trials. Pharmaceutical and biotechnology companies increasingly outsource oncology research to CROs for specialized expertise, advanced trial management, and access to patient populations, driving strong growth of the market.

The CNS disorders segment is expected to register the fastest CAGR in the healthcare CRO market during the forecast period due to the rising prevalence of neurological and psychiatric conditions, including Alzheimer’s, Parkinson’s, and depression. According to the World Health Organization (WHO), over 1 billion people globally were affected by CNS disorders in 2024, increasing demand for novel therapeutics. CROs are increasingly engaged to conduct specialized clinical trials, patient recruitment, and regulatory support, driving the growth of the market.

Regional Insights

How is North America contributing to the Expansion of the Healthcare Contract Research Organization Market?

North America dominated the market in 2025, due to its well-established pharmaceutical and biotechnology infrastructure, substantial R&D investments, and supportive regulatory environment. According to the U.S. National Institutes of Health (NIH), the region accounted for significant clinical trial activity, with thousands of ongoing studies in ongoing, CNS and rare diseases. The presence of government initiatives for drug development and innovation further reinforced North America’s leading position in the market.

- For Instance In September 2024, PharmaLegacy acquired BTS Research, a CRO specializing in preclinical pharmacology, to enhance its global research capabilities. The acquisition, based in San Diego, a major R&D hub, strengthens PharmaLegacy’s service offerings and expands its presence in the international clinical research community.

How is Asia-Pacific Accelerating the Healthcare Healthcare Contract Research Organization Market?

Asia Pacific is projected to grow at the fastest CAGR in the healthcare CRO market due to expanding biotechnology infrastructure, rising investments in personalized medicine, and increasing regulatory support for clinical research. In 2024, the Asia Pacific biopharma sector reported over 65billion in R&D expenditure, boosting demand for outsourced clinical and preclinical services. Additionally, the region’s large patient populations and cost-efficient trial operations make it an attractive destination for CROs, accelerating market growth during the forecast period.

U.S. Healthcare Contract Research Organization Market Trends

The U.S.’s boom in pharmaceutical and biotech companies increasingly relies on CROs for cost efficiency and expertise. Rising adoption of cloud-based EDC, AI, robotics, and RWD/RWE for efficiency and better insights is crucial, with a growing trend towards remote monitoring, virtual visits, and home healthcare to improve patient access and diversity.

China Healthcare Contract Research Organization Market Trends

China’s evolving regulations encourage innovation, empowering CROs to handle more complex tasks and support new drug developments, driving biopharma growth, and extensive use of AI, eClinica platforms, and telemedicine for efficiency and patient management.

How Did Europe Notably Grow in the Healthcare Contract Research Organization Market?

Europe’s robust healthcare infrastructure in nations like Germany and the UK, alongside the widespread adoption of AI and Decentralized Clinical Trial (DCT) technologies, aims to enhance trial speed and patient engagement. The market is also adapting to evolving European Medicines Agency (EMA) regulations and expanding into high-demand areas like biologics and real-world evidence (RWE) generation.

Germany Healthcare Contract Research Organization Market Trends

Germany's rapid shift toward AI-integrated data management and Decentralized Clinical Trials (DCTs) has significantly shortened recruitment timelines for specialized therapies. As pharmaceutical firms face massive patent cliffs, they are increasingly outsourcing complex pipelines in oncology and rare diseases to leverage CRO expertise in personalized medicine.

Healthcare Contract Research Organization Market By Regional, 2024-2034 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| North America |

24.72 |

26.31 |

28.01 |

29.81 |

31.73 |

33.77 |

35.93 |

38.24 |

40.68 |

43.28 |

46.04 |

| Europe |

15.72 |

16.77 |

17.89 |

19.08 |

20.35 |

21.7 |

23.15 |

24.68 |

26.32 |

28.06 |

29.92 |

| Asia Pacific |

12.35 |

13.63 |

15.04 |

16.57 |

18.26 |

20.1 |

22.11 |

24.31 |

26.72 |

29.35 |

32.22 |

| Latin America |

1.68 |

1.81 |

1.94 |

2.09 |

2.24 |

2.41 |

2.59 |

2.78 |

2.99 |

3.21 |

3.45 |

| Middle East and Africa (MEA) |

1.68 |

1.81 |

1.94 |

2.09 |

2.24 |

2.41 |

2.59 |

2.78 |

2.99 |

3.21 |

3.45 |

Value Chain Analysis of Healthcare Contract Research Organization Market

Drug Discovery & Preclinical Services: This initial stage involves early-stage R&D support, including compound screening, lead optimization, and in vitro and in vivo studies to assess initial safety and efficacy.

- Key Players: Charles River Laboratories, WuXi AppTec, Pharmaron, Labcorp (Covance).

Phase I Clinical Trials: These are the first-in-human studies, primarily focused on safety, dosage tolerance, and how a drug is metabolized and excreted (pharmacokinetics/pharmacodynamics).

- Key Players: ICON (Early Stage), Labcorp (Covance Early Phase), Celerion, Medpace.

Phase II/III Clinical Trials: This stage involves larger trials in patient populations to evaluate the drug's efficacy and optimal dosing (Phase II), followed by large-scale pivotal studies to confirm efficacy and monitor adverse events in a diverse population (Phase III).

- Key Players: IQVIA, ICON Plc, Parexel, Syneos Health, Medpace, Thermo Fisher Scientific (PPD).

Healthcare Contract Research Organization Market Companies

- CTI Clinical Trial & Consulting contributes to the healthcare Contract Research Organization (CRO) market by specializing in the clinical development of complex drugs and rare disease treatments, offering comprehensive support from early phase to commercialization.

- PSI contributes to the healthcare CRO market by delivering full-service clinical trial execution with a strong reputation for on-time delivery and enrollment, focusing on efficiency and quality across various therapeutic areas.

- Medpace contributes to the healthcare CRO market as a scientifically-driven, full-service clinical contract research organization that provides comprehensive drug and device development services, emphasizing therapeutic expertise and integrated laboratory services.

- Ergomed contributes to the healthcare CRO market by providing specialized pharmacovigilance (PV) and clinical development services, focusing on niche areas like oncology and rare diseases while maintaining strong service quality and compliance.

- WuXi AppTec contributes to the healthcare CRO market as a global leader in R&D and manufacturing services, offering integrated end-to-end solutions that help accelerate the discovery and development of new medicines.

- Worldwide Clinical Trials contributes to the healthcare CRO market by providing full-service clinical development capabilities, with particular expertise in complex therapeutic areas such as neuroscience, cardiovascular, and rare diseases.

- Medidata Solutions, Inc., contributes to the healthcare CRO market by providing a leading cloud-based platform for clinical development, offering technology solutions that optimize trial planning, execution, and data management for pharmaceutical and biotech companies.

Recent Developments in the Healthcare Contract Research Organization Market

- In September 2025, ACL Digital acquired Symbiance, a tech-focused CRO, to boost AI-driven clinical research, pharmacovigilance, and data services, enhancing its comprehensive global capabilities in life sciences and clinical trials.

- In September 2025, StarTrials expanded into major Asian markets, setting up offices and local collaborations to improve clinical trial management, patient recruitment, and data quality, boosting regional CRO capabilities and accelerating drug development.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the healthcare contract research organization market.

By Type

- Drug Discovery

- Target Validation

- Lead Identification

- Lead Optimization

- Pre-Clinical

- Clinical

- Phase I Trial Services

- Phase II Trial Services

- Phase III Trial Services

- Phase IV Trial Services

By Service

- Project Management/Clinical Supply Management

- Data Management

- Regulatory/Medical Affairs

- Medical Writing

- Clinical Monitoring

- Quality Management/ Assurance

- Bio-statistics

- Investigator Payments

- Laboratory

- Sterility Testing

- Container/Closure Testing

- Extractables and Leachable Testing

- Environmental Monitoring (Including Microbiology Testing)

- Disinfectant Efficacy Studies

- Others

- Patient And Site Recruitment

- Technology

- Others

By Therapeutic Area

- Oncology

- CNS Disorders

- Infectious Diseases

- Immunological Disorders

- Cardiovascular Diseases

- Respiratory Diseases

- Diabetes

- Ophthalmology

- Pain Management

- Others

By Molecule

- Pharmaceutical

- Small Molecules

- Biologics

- Medical Device

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)