Immunohistochemistry Market Size and Trends 2026 to 2035

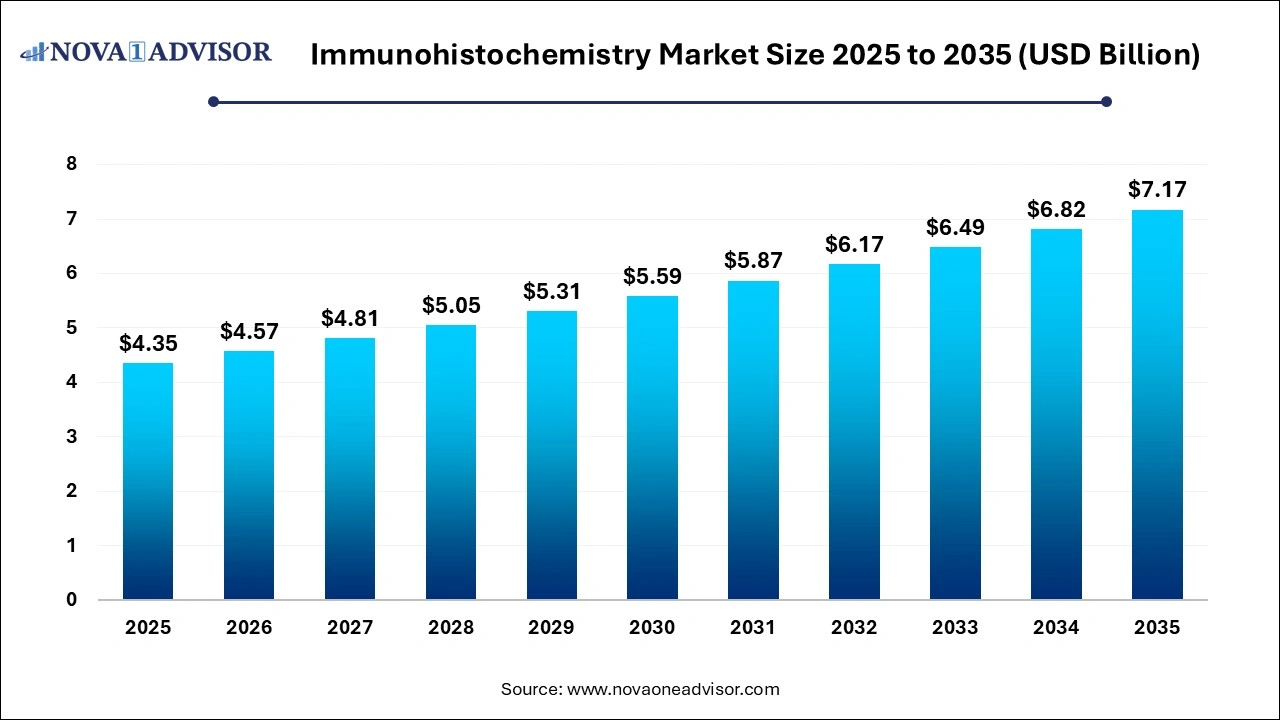

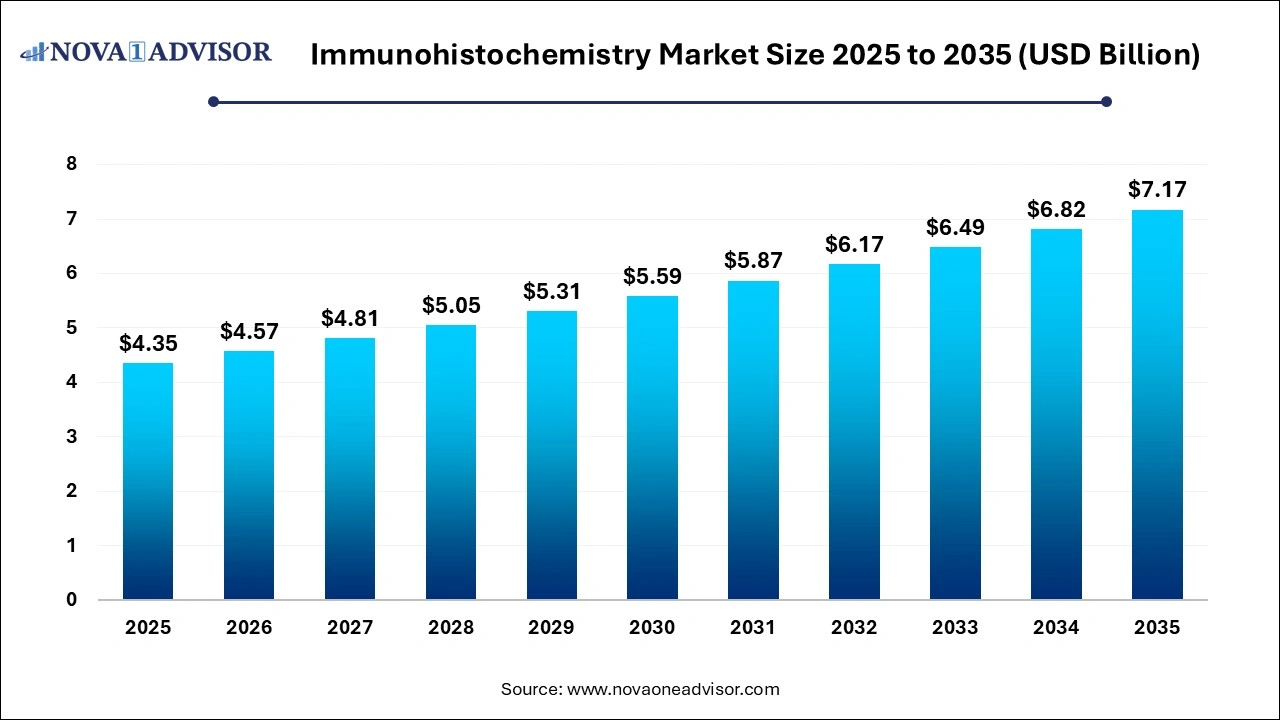

The global immunohistochemistry market size was valued at USD 4.35 billion in 2025 and is projected to surpass around USD 7.17

billion by 2035, registering a CAGR of 5.13% over the forecast period of 2026 to 2035. The market is growing due to the rising prevalence of cancer and chronic diseases, driving demand for accurate diagnostics. Additionally, advancements in biomarker research and automated IHC systems are boosting adoption across healthcare and research sectors.

Key Takeaways:

- North America dominated the immunohistochemistry market with the revenue shares in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the antibodies segment held the largest market share in 2025.

- By product, the kits segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the diagnostics segment dominated the market with a major revenue share in 2025.

- By application, the research segment is expected to grow at a significant rate in the market during the forecast period.

- By end user, the hospitals and diagnostics laboratories segment led the market in 2025.

- By end user, the research institutes segment is expected to grow at the fastest CAGR in the market during the forecast period.

Which Factors are Driving the Growth of the Immunohistochemistry Market?

Immunohistochemistry (IHC) is a laboratory technique used to detect specific antigens in tissue samples by applying antigen-antibody complexes, combined with staining, to visualize cellular components under a microscope. The growth of the immunohistochemistry market is fueled by the rising demand for early detection and precise pathologist analysis. Expanding applications of IHC in neuroscience, infectious diseases, and autoimmune disorders are broadening its scope beyond oncology. Technological progress, such as multiplex IHC and advanced imaging techniques, is improving diagnostic accuracy. Furthermore, growing healthcare infrastructure, rising awareness about personalized therapies, and the integration of IHC in academic and clinical research are significantly contributing to the market's expansion.

- For Instance, In December 2023, Biocare Medical introduced intelliPATH+, an upgraded version of its intelliPATH FLX staining system. Redesigned with user feedback and modern technology, the platform is now a fully open system, providing greater flexibility and efficiency for immunohistochemistry workflows.

What are the Key trends in the Immunohistochemistry Market in 2024?

- In June 2025, ALIKO SCIENTIFIC (Ikonisys SA) finalized an exclusive distribution deal with Menarini Diagnostics to supply rapid immunohistochemistry products across Italy.

- In November 2024, the FDA approved zanidatamab (Ziihera) for treating adults with HER2-positive (IHC 3+) biliary tract cancer that is unresectable or metastatic and previously treated. This decision underscores the value of immunohistochemistry in detecting HER2 overexpression and guiding targeted therapy, reinforcing its crucial role in advancing personalized cancer care.

How Can AI Affect the Immunohistochemistry Market?

AI is transforming the market by improving diagnostic accuracy through advanced image analysis and pattern recognition. It enables faster interpretation of complex tissue samples, reducing errors and enhancing efficiency for pathologists. AI-driven platforms also support biomarker discovery and personalized treatment decisions, strengthening precision medicine. Additionally, integration of AI with digital pathology systems streamlines workflows, increases scalability, and boosts research capabilities, making it a key driver of market growth and innovation.

Immunohistochemistry Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 4.57 Billion |

| Market Size by 2035 |

USD 7.17 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.13% |

| Base Year |

2025 |

| Forecast Period |

202 to 2035 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd.; Merck KGaA; Danaher Corporation; PerkinElmer, Inc.; Bio-Rad Laboratories, Inc.; Cell Signaling Technology, Inc.; Bio SB; Abcam plc.; Agilent Technologies, Inc. |

Immunohistochemistry Market Dynamics

Driver

Increasing Prevalence of Cancer and Chronic Diseases

The growing burden of cancer and chronic illness significantly drives the immunohistochemistry market as it creates a strong need for advanced diagnostic solutions. IHC helps pathology visualize protein expression in tissues, supporting accurate prognosis and therapy selection. As patient numbers rise, demand for tools that enable early detection, disease monitoring, and personalized treatment also increases. This expanding clinical reliance on IHC techniques is directly contributing to the steady growth of the market worldwide.

Restraint

High cost of Instruments, Reagents, and Automated Systems

The high cost of expenses associated with IHC equipment, specialized reagents, and automated technologies restricts market growth, as not all laboratories can afford these solutions. Smaller hospitals and diagnostic centers often struggle to invest in such advanced systems, leading to uneven adoption across regions. In addition, the recurring costs of consumables and the financial burden make testing more expensive for patients. This cost challenge creates barriers to wider accessibility and slows the expansion of immunohistochemistry services.

Opportunity

Advancements in Multiplex IHC Automated Staining Technologies

The development of multiple IHC and advanced automated staining systems creates strong growth opportunities by offering richer data from limited tissue samples and reducing annual workloads. These technologies allow pathologists to analyze multiple targets at once, improving the understanding of complex diseases and treatment responses. Automation further ensures consistency, faster turnaround times, and higher laboratory medicine and efficient diagnostics. Such innovations are set to drive future expansion of the IHC market.

- For Instance, In September 2024, researchers developed and validated two automated four-plex chromogenic IHC assays using the Ventana BenchMark ULTRA autostainer. These assays—targeting biomarkers such as TTF1, p40, PD-L1, CD8, and another panel for NSCLC, including ALK, ROS1, BRAFV600E, and NTRK—demonstrated a 95.4% concordance rate with traditional single-marker IHC methods, with strong intra-lab repeatability (R² = 0.96; P < 0.001).

Segmental Insights

How did Segment Antibodies Dominate the Immunohistochemistry Market in 2025?

The antibodies segment accounted for the largest share of the market in 2025 because of their extensive use in pathology and clinical diagnostics. Antibodies enable precise visualization of proteins in tissues, making them indispensable for disease detection and therapeutic decision-making. Rising demand for targeted therapies and companion diagnostics has further boosted their application. Additionally, innovations in antibody design and the availability of a wide range of specific receptors have reinforced their dominance in the market.

The kits segment is projected to witness the fastest growth as they offer a complete, pre-validated solution that enhances reliability and reproducibility in IGC testing. Their ease of use and compatibility with automated platforms make them ideal for high-throughput diagnostics and research workflows. Increasing preference for simplified workflows, along with the rising need for rapid and accurate disease detection, is driving laboratories and hospitals to adopt kits, supporting their strong growth trajectory in the coming years.

What Made the Diagnostics Segment Dominant in the Immunohistochemistry Market in 2025?

The diagnostics segment led the market in 2025 as healthcare providers increasingly relied on IHC for confirming disease origins and assessing tumor profiles. Its ability to deliver detailed insights at the molecular level made it essential in routine clinical practice. With the growing adoption of personalized medicine and the rising need for accurate patient stratification diagnostic application of IHC generated the highest revenue, firmly establishing this segment as the market leader.

The research segment is set to record the fastest CAGR as IHC is becoming a vital tool for expanding molecular mechanisms and validating new drug targets. Its application in experimental studies allows scientists to visualize protein interactions and disease progression with greater clarity. Growing emphasis on precision medicine research, coupled with increased funding from government and private institutions, is accelerating the adoption of the IHC technique in laboratories, driving strong growth prospects for this segment.

- For Instance, In 2025, the American Cancer Society estimated more than 2 million new cancer cases in the U.S., underscoring the rising need for advanced diagnostic methods. This surge is expected to accelerate the adoption of IHC solutions in cancer research, driving strong growth of the segment.

How did the Hospitals and Diagnostics Laboratories Segment Dominate the Immunohistochemistry Market in 2025?

In 2025, the hospitals and diagnostic laboratories segment held the leading share of the market due to their central role in routine pathology and large-scale patient testing. These facilities handle the majority of tissue examination, ensuring reliable detection and classification of diseases. The presence of specialized equipment, adoption of high-throughput technologies, and growing patient inflow for cancer and chronic disease screening further reinforced their dominance, positioning them as the top end-user IHC solutions.

The research institutes segment is projected to grow at the fastest pace during the forecast period, driven by the rising focus on innovative studies in oncology, neuroscience, and molecular biology. These institutions increasingly rely on IHC to analyze protein expression, study disease progression, and test novel therapeutic approaches. Expanding research grants, academic-industry partnerships, and advancements in imaging technologies are boosting the adoption of IHC, making research institutions a key driver of future market expansion.

Regional Insights

How is North America Contributing to the Expansion of the Immunohistochemistry Market?

North America led the market in 2025, supported by a growing patient base requiring precise diagnostics and early detection methods. Strong funding for medical research, rapid uptake of digital pathology, and the presence of leading biotech and pharmaceutical companies boosted regional demand. Additionally, well-established clinical laboratories, higher healthcare spending, and continuous product launches in cancer diagnostics reinforced North America’s dominant share in the global immunohistochemistry market.

- For Instance, In August 2024, Agilent Technologies received FDA approval for its MAGE-A4 IHC 1F9 pharmDx assay, designed to detect MAGE-A4 expression in synovial sarcoma tissue, which helps identify patients eligible for the TECELRA T-Cell therapy. This demonstrates how rising cancer cases are boosting the demand for IHC-based companion diagnostics, fueling market growth.

How is Asia-Pacific Accelerating the Market?

Asia-Pacific is projected to witness the fastest CAGR in the immunohistochemistry market as countries in the region experience rising healthcare modernization and greater accessibility to diagnostic services. The growing burden of cancer and chronic illnesses has accelerated the need for accurate and affordable testing methods. Expanding pharmaceutical research, increasing collaborations with global biotech firms, and higher government spending on healthcare innovation are further fueling demand, making the region a key growth hotspot for IHC adoption.

- For Instance, In September 2023, Cell Signaling Technology (CST) introduced SignalStar Multiplex IHC, a high-throughput platform developed to improve efficiency in laboratory workflows. The technology enhances diagnostic precision and addresses the increasing demand for reliable cancer detection solutions.

Key Companies & Market Share Insights

With the rising demand for IHC assays in cancer diagnostics, the key players are undertaking various strategic initiatives in the field of immunohistochemistry, including new product launches, mergers & acquisitions, and regional expansion, to meet the market needs.

For instance, in March 2023, Aptamer Group launched a new reagent solution, Optimer-Fc for use in automated immunohistochemistry workflows. The company expects this launch to open new avenues for emerging biomarkers in diagnostics and research. In addition, in January 2021, Abcam and Shuwen Biotech (Shuwen) entered into a strategic alliance for developing and commercializing companion diagnostics (CDx). Under the agreement, Abcam is providing recombinant rabbit monoclonal antibodies to Shuwen Biotech for further immunohistochemical verification. Some prominent players in the global immunohistochemistry market include:

Recent Developments

- In April 2025, Roche received FDA Breakthrough Device Designation for its VENTANA TROP2 RxDx Device, an AI-driven diagnostic designed for non-small cell lung cancer (NSCLC). By integrating immunohistochemistry with artificial intelligence, the tool enhances diagnostic accuracy and supports better patient selection for targeted therapies.

- In June 2025, Diagnostic BioSystems received approval from the Saudi Food and Drug Authority for its immunohistochemistry product range, allowing the company to directly supply laboratories across the GCC region.

Immunohistochemistry Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Immunohistochemistry market.

By Product

- Antibodies

- Primary Antibodies

- Secondary Antibodies

- Equipment

- Slide Staining System

- Tissue Microarrays

- Tissue Processing Systems

- Slide Scanners

- Others

- Reagents

- Histological stains

- Blocking Sera & Reagents

- Chromogenic Substrates

- Fixation Reagents

- Organic Solvents

- Proteolytic Enzymes

- Diluents

- Other Reagents

- Kits

By Application

- Diagnostics

- Cancer

- Infectious Diseases

- Cardiovascular Diseases

- Autoimmune Diseases

- Diabetes Mellitus

- Nephrological Diseases

- Research

By End-use

- Hospitals & Diagnostic Laboratories

- Research Institutes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)