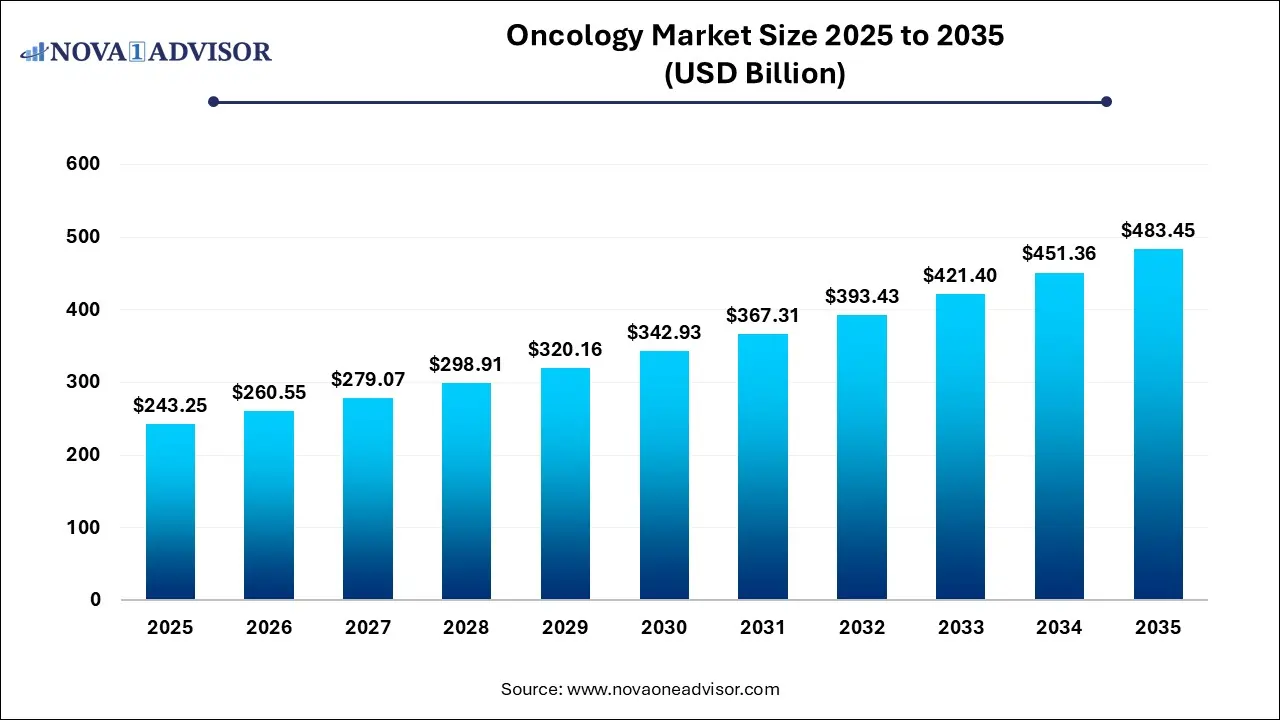

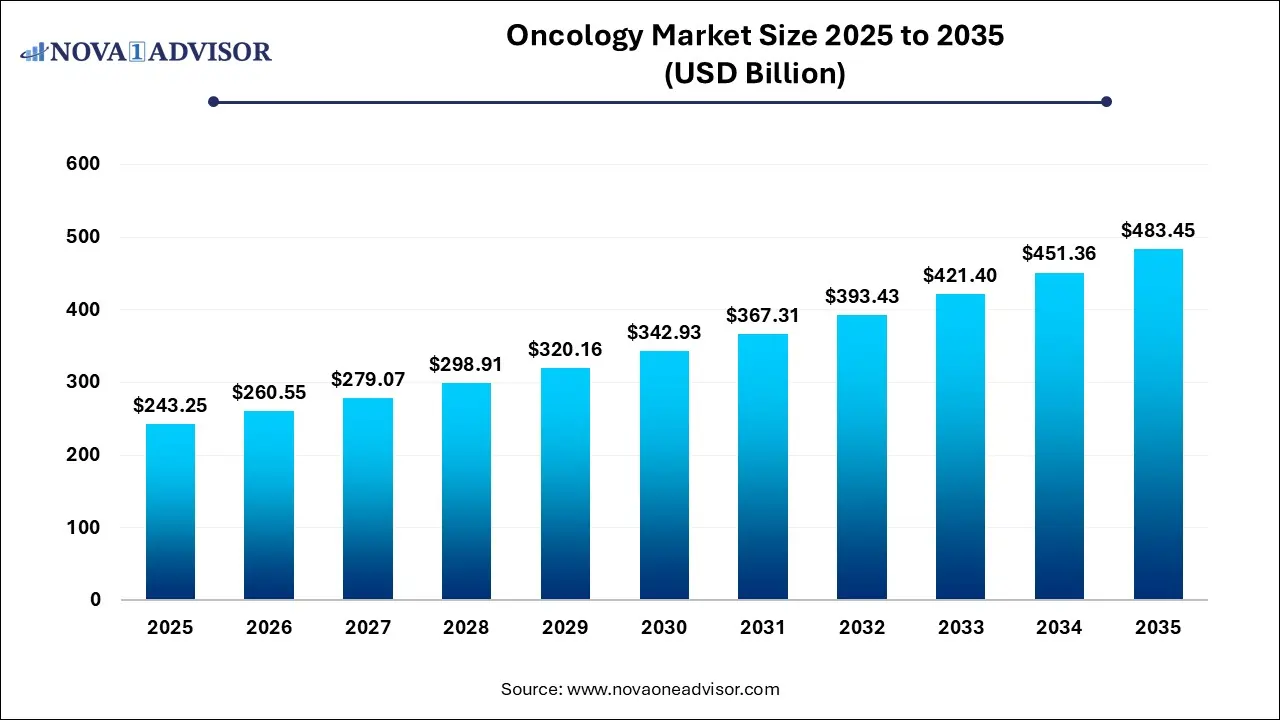

Oncology Market Size and Growth 2026 to 2035

The global oncology market size was estimated at USD 243.25 billion in 2025 and is projected to hit around USD 483.45 billion by 2035, growing at a CAGR of 7.11% during the forecast period from 2026 to 2035.

Key Takeaway:

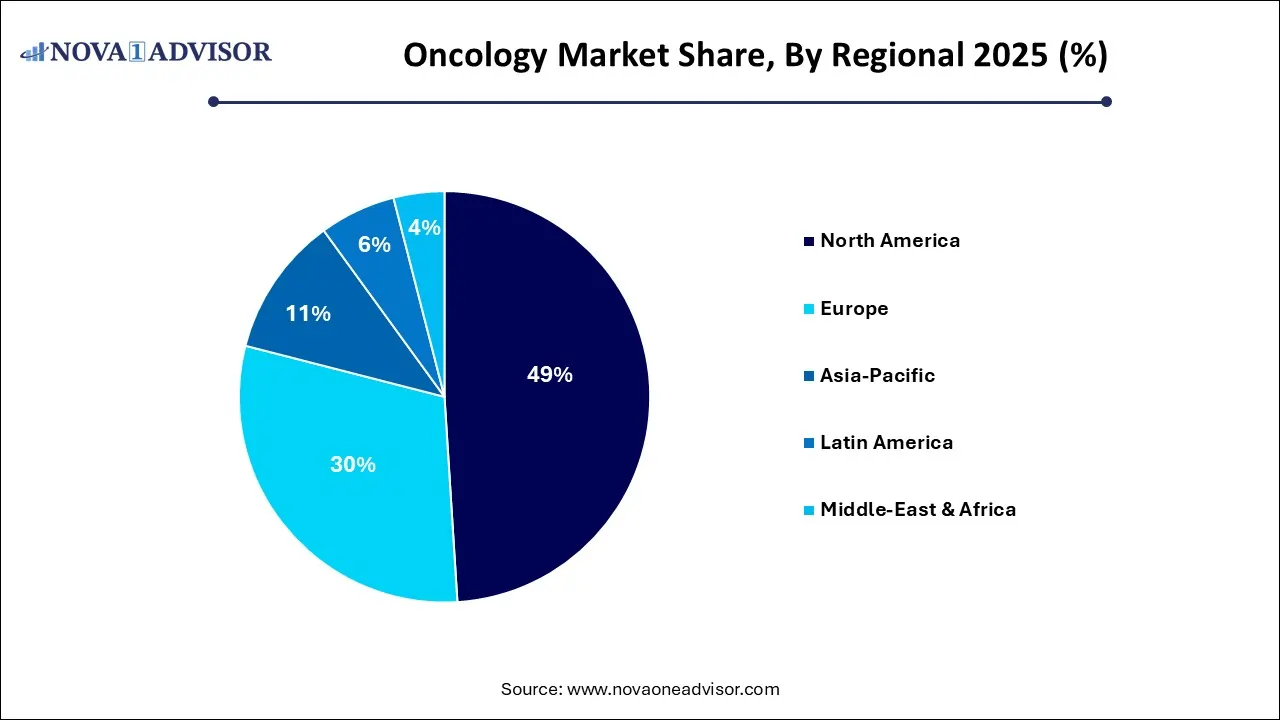

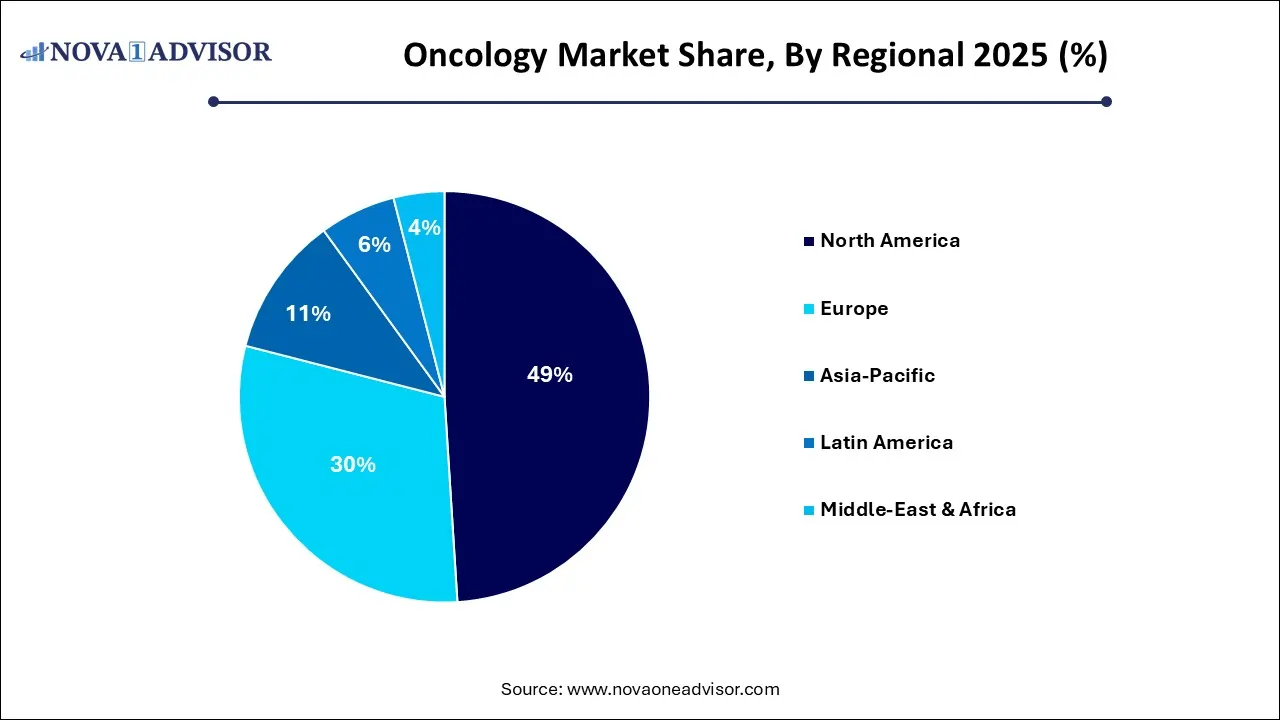

- North America region has reached 49% of total market share in 2025.

- Europe is anticipated to be the most opportunistic market during the forecast period.

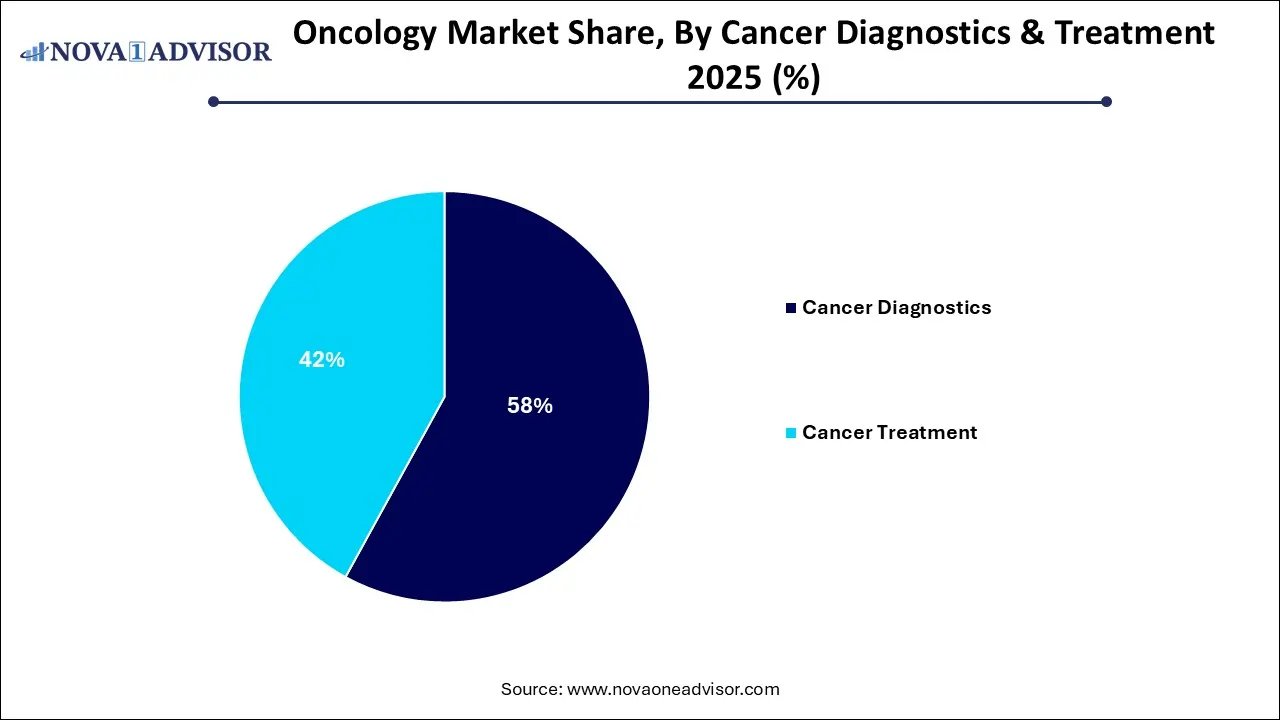

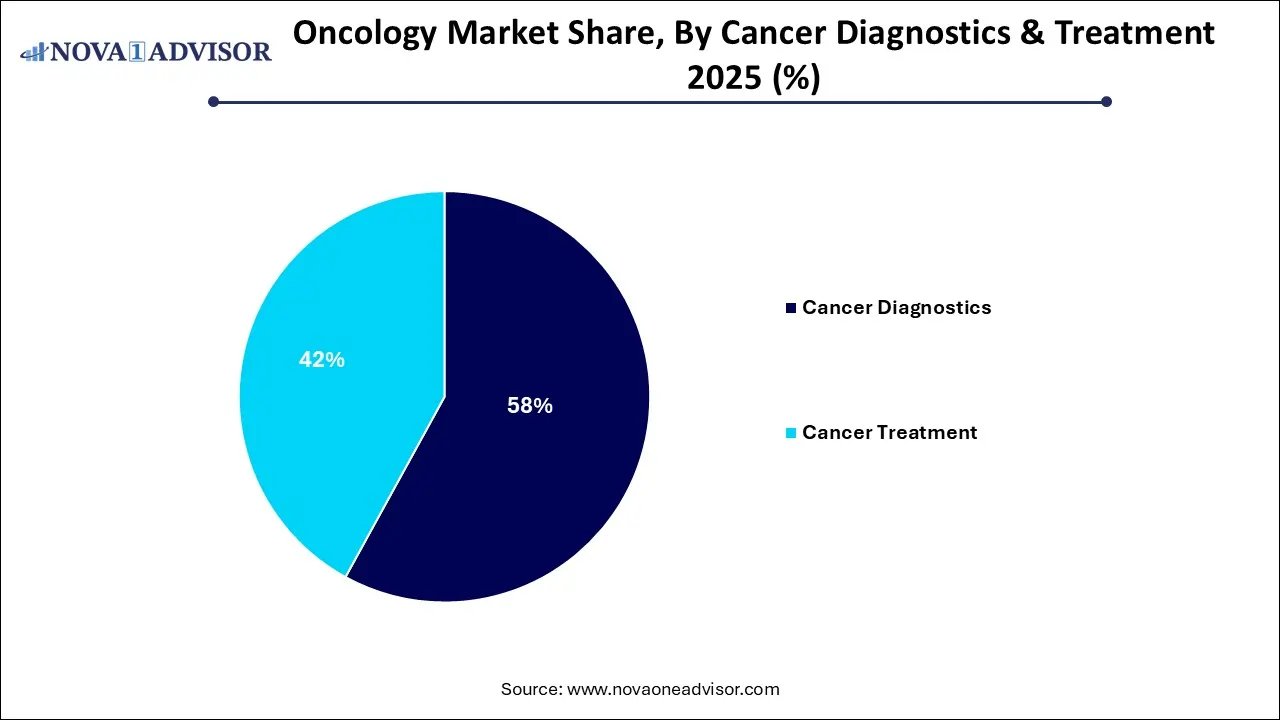

- The cancer treatment segment dominated the oncology market in 2025, garnering a market share of around 57%.

- The cancer diagnostic segment has accounted 58% of the total market share in 2025

- The hospitals segment dominated the market in 2025 with a revenue share of 69%

- Hospital segment is growing at a CAGR of 10.9% from 2026 to 2035.

- Breast cancer market was valued at USD 60.23 billion in 2025.

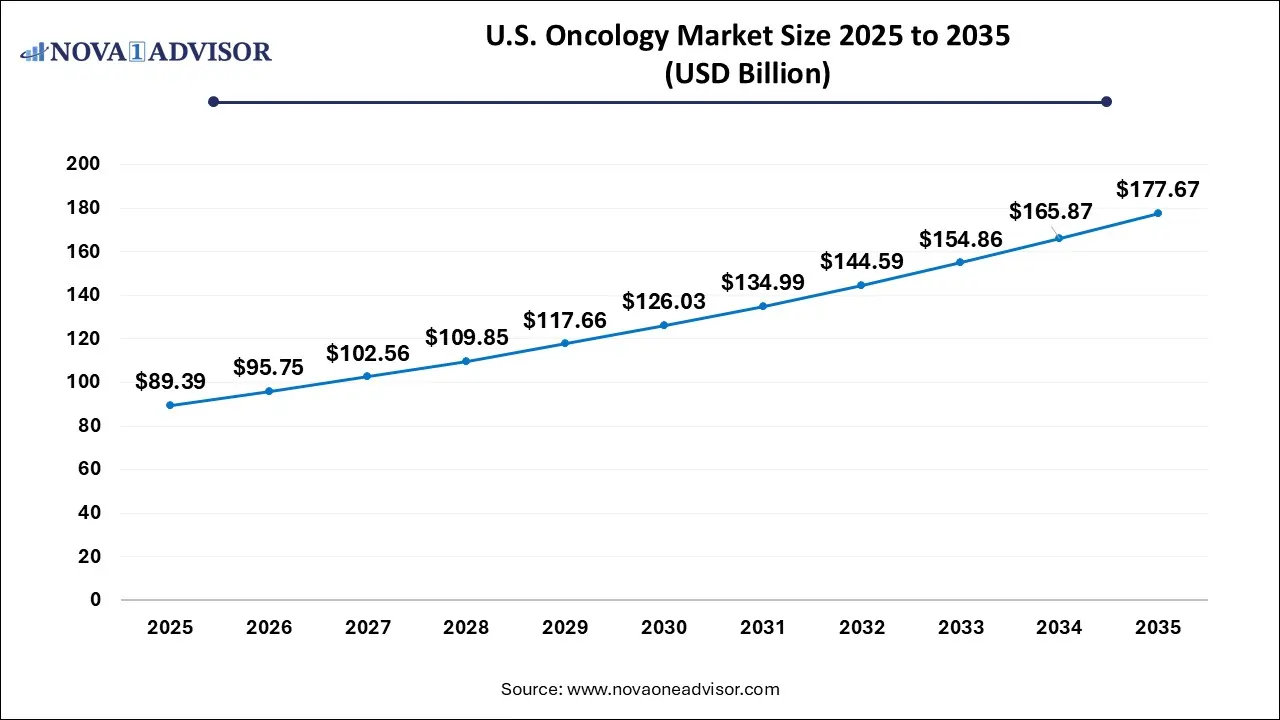

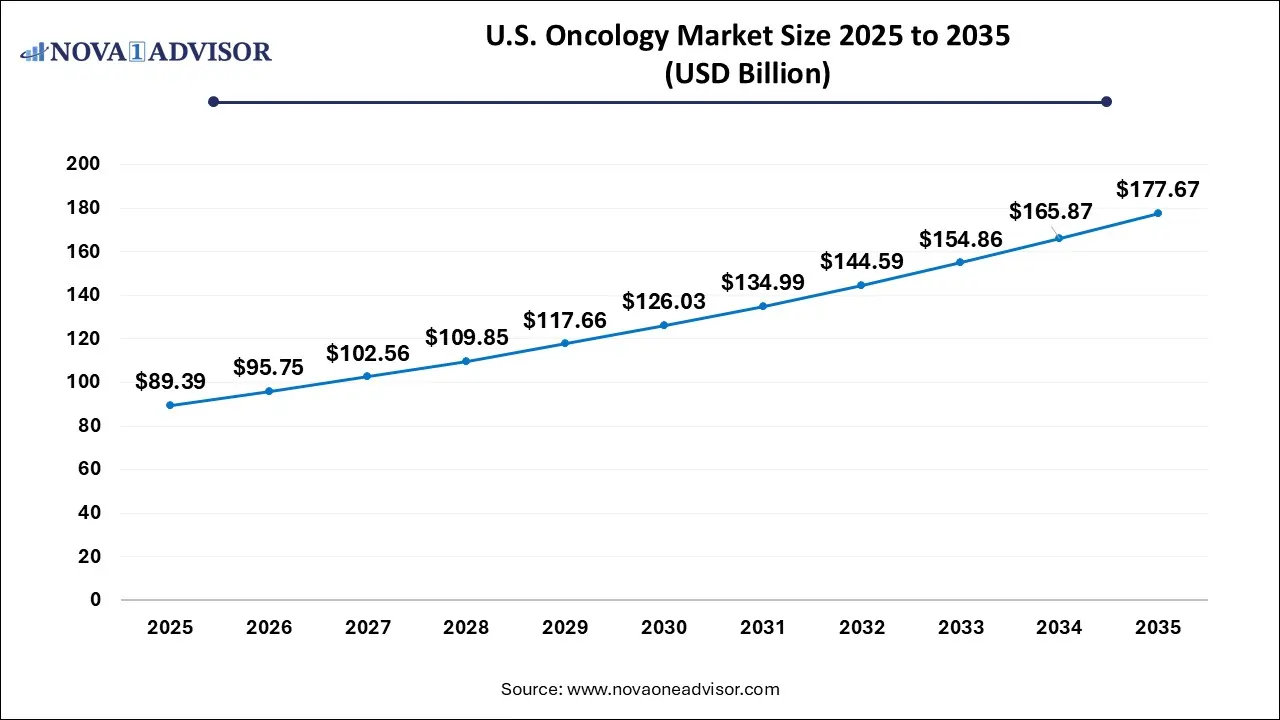

Oncology Market Size in U.S. 2026 to 2035

The U.S. oncology market size was valued at USD 89.39 billion in 2025 and is anticipated to reach around USD 177.67 billion by 2035, growing at a CAGR of 6.44% from 2026 to 2035.

North America dominated the market and accounted for a 49.0% share in 2025. This can be attributed to the increased prevalence of cancer in the major market like US. According to the American Cancer Society, over 1.8 million new cancer cases and 606,520 deaths were reported in the US in 2020. The most prominent type of cancer in North America includes lungs cancer, colorectal cancer, breast cancer, and the prostate cancer. The North America oncology market is expected to sustain its significance owing to the presence of developed healthcare infrastructure and the increased healthcare expenditure. The increased adoption of the oncology treatments in US has resulted in a decline of cancer deaths by around 29% since 1991.

Europe is anticipated to be the most opportunistic market during the forecast period. This is attributable to the rising technological advancements in the diagnostics of various cancers. Moreover, the rising prevalence of cancer across Europe and growing number of cancer deaths is expected to foster the growth of the Europe oncology market in the forthcoming years.According to the European Commission, approximately 2.7 million new cancer cases and about 1.3 million cancer deaths were recorded in 2020.

Oncology Market Growth

The rising oncology burden across the globe owing to the increased consumption of alcohol and tobacco is driving the growth of the global oncology market. The International Agency for Research on Cancer (IARC), in its report GLOBOCAN, has stated that approximately 19.3 million new cancer cases and about 10 million deaths related to cancer were recorded in 2020, across the globe. The IARC has estimated that the new cancer cases are expected to rise by 47% all over the globe from 2020 to 2040. Therefore, the growing prevalence of cancer is expected to foster the adoption of the oncology diagnostics and oncology treatment across the globe, thereby boosting the growth of the global oncology market. Furthermore, the rising initiatives of government and various non-profit organizations in spreading the awareness regarding the prevention of cancer is expected to fuel the growth of the market. For instance, World Health Organization’s Global Action Plan for Prevention and Control of Non-Communicable Diseases, aims at decreasing the premature death due to cancer, cardiovascular diseases, chronic respiratory diseases, and diabetes by around 25% by the year 2025. The rising prevalence of the various chronic diseases has augmented the demand for the early diagnostics and treatment of cancer across the globe.

The rising investments and developments in the biopharmaceutical industry is encouraging the development of various innovative drugs and therapeutics, which fosters the demand for the oncology treatment and oncology diagnostics. The growing awareness among the population regarding the availability of various drugs and diagnostics related to oncology is expected to drive the global oncology market growth. The oncology therapeutics alone accounts for around 20% of the global sales of the pharmaceuticals. Therefore, the rising importance and higher potential of profit is attracting the market players to invest in the oncology market.

Oncology Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 260.55 Billion |

| Market Size by 2035 |

USD 483.45 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.1% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Cancer Diagnostics & Treatment, Indication, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Aegerion Pharmaceuticals Inc., Abbvie Inc., Ability Pharma, Acadia Pharmaceuticals Inc., Amgen Inc., Takeda Oncology, Aslan Pharmaceuticals Ltd., Aspen Pharmacare Holdings Limited., Astrazeneca, Athenex, Inc. |

Segments Insights:

By Cancer Diagnostics & Treatment Insights

The cancer treatment segment dominated the oncology market in 2025, garnering a market share of around 58.0%. This is attributable to the increased adoption of the traditional chemotherapy and immunotherapy for the treatment of cancer across the globe. People are now increasingly adopting the targeted therapy and immunotherapy for the treatment as they are more convenient, effective, and has low side-effects as compared to that of the traditional chemotherapy. The low toxicity and the ability of the targeted therapy to specifically target the cancer cells without harming the normal cells is boosting the growth of the cancer treatment segment significantly. Moreover, the rising awareness among the population regarding the benefits of the targeted therapy, hormonal therapy, and the immunotherapy is fueling the demand for these cancer treatments among the global cancer patients.

On the other hand, the cancer diagnostics segment is estimated to be the most opportunistic segment. The increased awareness among the population regarding the cancer disease is augmenting the demand for the cancer diagnostics across the globe. The rising preferences of the people to detect cancer as early as possible is propelling the growth of the cancer diagnostics segment. The availability of various non-invasive and convenient diagnostic tools is expected to drive the growth of this segment during the forecast period.

By Indication Insights

Based on the indication, the lungs cancer segment dominated the market in 2025, owing to the increased cases of lungs cancer across the globe. According to the International Agency for Research on Cancer, around 1.19 million deaths were recorded due to lungs cancer in 2020. Lungs cancer is the most diagnosed type of cancer among the global population and it accounts for around 18% of the cancer deaths all over the globe. It is recognized as the leading cause of cancer deaths. The increased prevalence of smoking around the globe is a major factor that boosts the growth of this segment.

Breast cancer, on the other hand, is anticipated to be the fastest-growing market during the forecast period. This is due to the growing prevalence of the breast cancer among the female population. As per the IARC, breast cancer has surpassed the lungs cancer as the most diagnosed type of cancer in 2020. Around 2.3 million or 11.7% of the new cancer cases reported as the breast cancer in 2020.

By End-use Insights

The hospitals segment dominated the market in 2025 with a revenue share of 70.0%, The growth can be attributed to the strong presence of highly trained professionals in these settings for handling advanced cancer diagnosis equipment. The increased deployment of technologically developed biopsy and devices for the diagnosis of cancer has, in turn, led to the surged number of diagnoses performed in hospitals. The growing introduction of favourable reimbursement policies for various cancer treatment surgeries in hospital facilities will further influence the industry outlook.

.webp)

The various developmental strategies such as mergers, partnerships, acquisitions, and collaborations significantly contributes towards the market growth. The major players in the market are collaborating for the research and development purposes and heavily investing in the areas of oncology for the development of the innovative oncology diagnostics and treatment therapies. These market players are striving to exploit the prevailing market opportunities and focusing on gaining market share by introducing innovative oncology solutions.

Some of the prominent players in the global oncology market include:

- Aegerion Pharmaceuticals Inc.

- Abbvie Inc.

- Ability Pharma

- Acadia Pharmaceuticals Inc.

- Amgen Inc.

- Takeda Oncology

- Aslan Pharmaceuticals Ltd.

- Aspen Pharmacare Holdings Limited.

- Astrazeneca

- Athenex, Inc.

Recent Developments

-

In April 2025, CRISPR Therapeutics and Vertex Pharmaceuticals announced the initiation of a Phase III trial for exa-cel, a CRISPR-based gene therapy for beta-thalassemia and sickle cell disease.

-

In February 2025, bluebird bio received RMAT designation from the FDA for its LentiGlobin gene therapy targeting cerebral adrenoleukodystrophy (CALD).

-

In January 2025, Novartis launched a global Phase II/III trial of a next-gen CAR-T therapy for relapsed diffuse large B-cell lymphoma (DLBCL).

-

In November 2024, Sarepta Therapeutics expanded enrollment for its Phase II gene therapy trial in Duchenne muscular dystrophy to include ambulatory patients under 12.

-

In September 2024, Beam Therapeutics announced positive preliminary data from its base-editing gene therapy trial in chronic hepatitis B.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Oncology market.

By Cancer Diagnostics & Treatment

- Cancer Diagnostics

- Biopsy

- Imaging

- Immunohistochemistry

- Tumor Biomarkers Test

- In Situ Hybridization

- Liquid Biopsy

- Cancer Treatment

- Targeted Therapy

- Chemotherapy

- Hormonal Therapy

- Immunotherapy

- Others

By Indication

- Lungs Cancer

- Colorectal Cancer

- Breast Cancer

- Liver Cancer

- Bladder Cancer

- Head & Neck Cancer

- Prostate Cancer

- Others

By End-use

- Hospitals

- Diagnostic laboratories

- Diagnostic imaging centers

- Academia

- Specialty clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.webp)