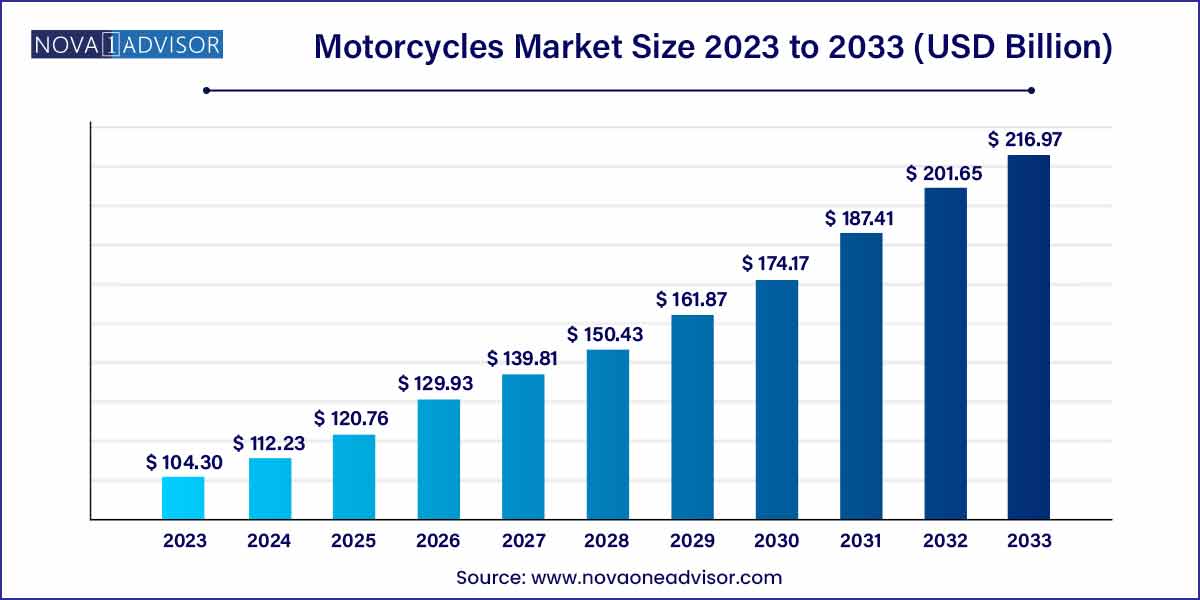

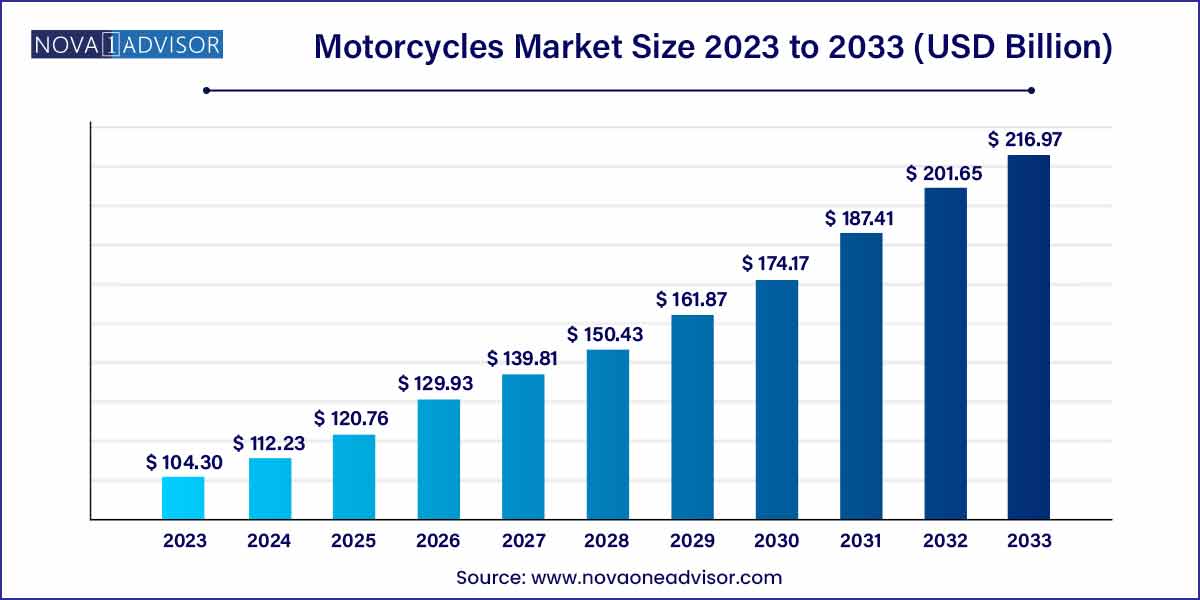

The global motorcycles market size was exhibited at USD 104.30 billion in 2023 and is projected to hit around USD 216.97 billion by 2033, growing at a CAGR of 7.6% during the forecast period of 2024 to 2033.

Key Takeaways:

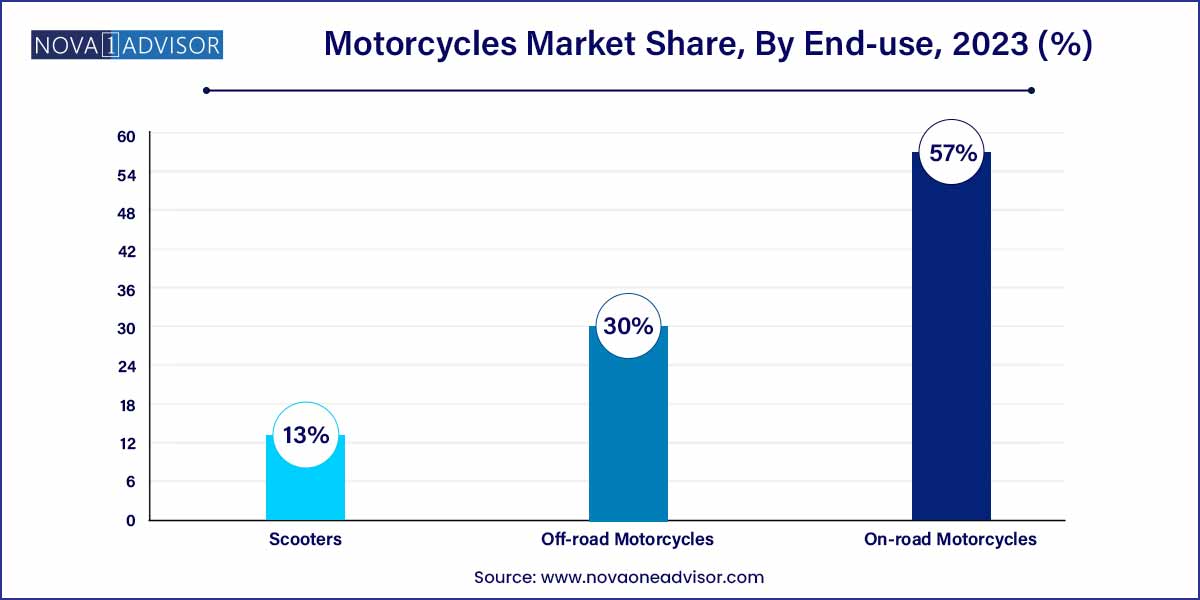

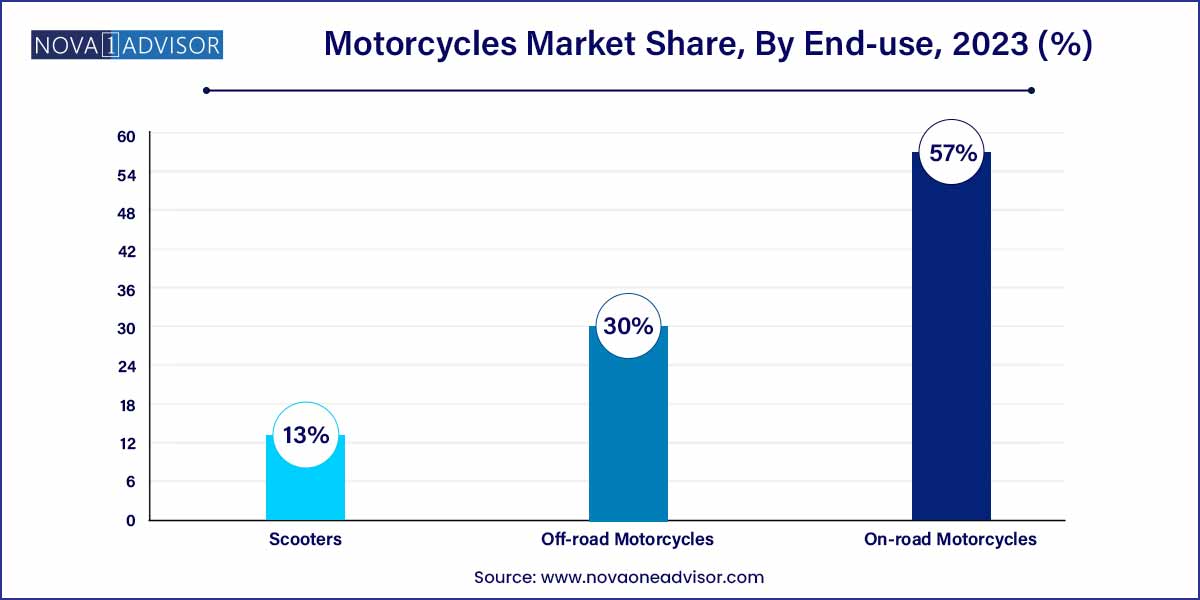

- The on-road motorcycles segment dominated the market and contributed a revenue share of around 57% in 2023

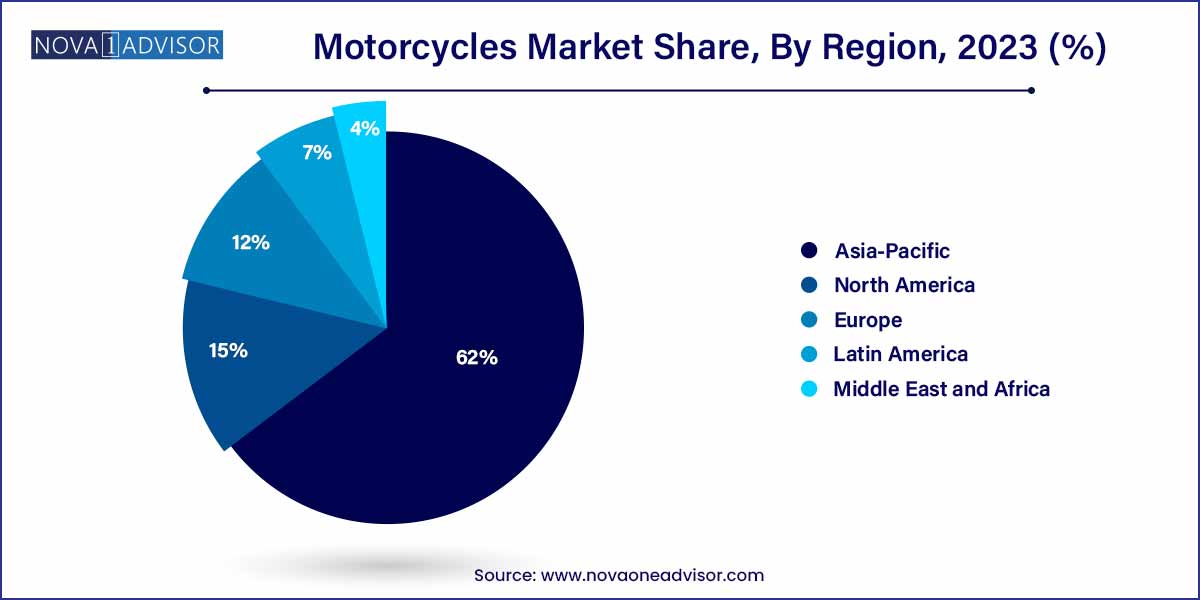

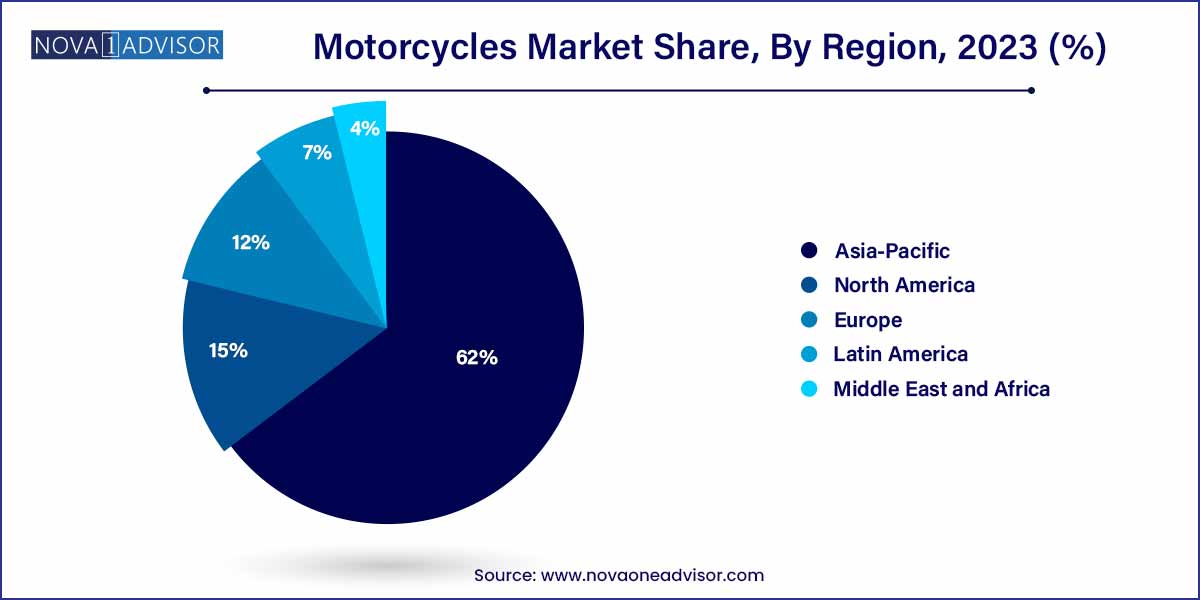

- Regional analysis revealed that the Asia Pacific region accounted for a significant market revenue share of more than 62% in 2023.

Market Overview

The global motorcycles market represents a dynamic and rapidly evolving segment within the broader mobility industry. Motorcycles are no longer perceived merely as economic alternatives to four-wheelers, especially in developing countries. They have now diversified into lifestyle products, performance machines, and urban mobility solutions. Offering affordability, convenience in traffic-congested urban areas, and lower environmental impact, motorcycles continue to appeal to a broad and diverse demographic. From high-performance sports bikes to electric scooters designed for last-mile delivery, motorcycles are becoming central to personal mobility and urban logistics strategies.

As cities become more congested and environmental awareness rises, motorcycles offer a practical solution, particularly in regions where public transportation is underdeveloped or inconsistent. Moreover, growing disposable incomes in emerging markets, coupled with a strong cultural affinity for two-wheelers in regions like Southeast Asia and Latin America, are pushing sales. Simultaneously, premiumization in developed markets is also creating a lucrative niche, with brands such as Harley-Davidson, Ducati, and BMW Motorrad targeting adventure and touring segments. Technological integration, such as advanced braking systems (ABS), connectivity features, and smart dashboards, are further enhancing rider safety and appeal.

The rise of electric motorcycles is another transformative element, driven by stringent emissions regulations, government subsidies, and advances in battery technology. Urban dwellers and commercial delivery services are increasingly adopting electric two-wheelers for their lower operational costs and convenience. As a result, the motorcycles market is witnessing a broad spectrum of evolution from affordable commuter bikes to high-tech electric sports machines—positioning it for sustained growth and diversification over the next decade.

Major Trends in the Market

-

Electrification of Two-Wheelers: The market is experiencing a wave of electric motorcycle launches targeting both urban commuters and environmentally-conscious riders.

-

Integration of Smart Features: Motorcycles now come equipped with digital dashboards, Bluetooth connectivity, and navigation tools.

-

Expansion of Adventure and Touring Segments: A growing demand for motorcycles capable of long-distance travel and off-road performance.

-

Rise of Subscription and Rental Models: Especially in urban centers, bike rentals and subscription-based ownership are gaining popularity.

-

Customization Culture: Enthusiasts are investing heavily in bike customization, creating a thriving aftermarket parts segment.

-

Focus on Safety Technologies: ABS, traction control, and AI-enabled crash detection systems are becoming more common.

-

Lightweight and High-Performance Materials: Use of carbon fiber and aluminum alloys in performance bikes to improve efficiency and speed.

-

Urban Last-Mile Logistics: Growth of food delivery and e-commerce is spurring demand for scooters and low-speed electric bikes.

Motorcycles Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 104.30 Billion |

| Market Size by 2033 |

USD 216.97 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Harley-Davidson Incorporation; Yamaha Motor Co., Ltd.; Yadea Group Holdings Ltd.; Honda Motor Co. Ltd.; Piaggio & C. SpA; BMW AG; Suzuki Motor Corporation; Hero MotoCorp Limited; Bajaj Auto Ltd.; TVS Motor Company. |

Motorcycles Market Dynamics

- Technological Advancements Driving Innovation:

The motorcycles market dynamics are significantly influenced by rapid technological advancements. The integration of smart connectivity features, advanced safety systems, and the emergence of electric propulsion are reshaping the industry landscape. Manufacturers are investing heavily in research and development to meet consumer demands for cutting-edge technologies, providing motorcycles with enhanced safety, performance, and sustainability. This dynamic shift towards innovation not only fosters competition among key players but also opens avenues for new entrants, propelling the industry into an era of unprecedented technological sophistication.

- Sustainable Practices and Regulatory Impact:

The motorcycles market is undergoing a transformative phase with a heightened focus on sustainability and adherence to stringent regulatory standards. Governments worldwide are implementing measures to curb emissions, pushing manufacturers to explore eco-friendly alternatives, such as electric motorcycles. This shift towards sustainability not only aligns with global environmental initiatives but also shapes consumer preferences. The regulatory landscape, marked by stringent emission norms and safety standards, plays a pivotal role in determining the direction of product development and market strategies. As manufacturers navigate these regulatory challenges, opportunities arise for those embracing sustainable practices, positioning the industry on a trajectory towards a greener and more compliant future.

Motorcycles Market Restraint

- Economic Uncertainties and Supply Chain Disruptions:

The motorcycles market faces challenges stemming from economic uncertainties and supply chain disruptions. Global economic fluctuations, geopolitical tensions, and unforeseen events, such as the recent pandemic, impact consumer purchasing power and overall market stability. These uncertainties create challenges for manufacturers in terms of production planning, pricing strategies, and market forecasting. Additionally, supply chain disruptions, including shortages of key components and raw materials, can lead to production delays and increased costs. Navigating these economic uncertainties and establishing resilient supply chains are critical for sustained growth in the motorcycles market.

- Transitioning Consumer Preferences and Market Saturation:

Shifting consumer preferences pose a restraint on the motorcycles market as manufacturers grapple with the evolving demands of riders. The industry must adapt to changes in preferences for specific types of motorcycles, features, and customization options. Moreover, in mature markets, there is a risk of saturation, where the existing consumer base may be less inclined to upgrade or purchase new motorcycles. To overcome this restraint, manufacturers need to continually innovate, anticipate changing trends, and introduce products that resonate with the dynamic preferences of a diverse consumer base. Balancing tradition with innovation becomes crucial in navigating the challenge posed by transitioning consumer preferences and potential market saturation.

Motorcycles Market Opportunity

- Expanding Market Reach in Emerging Economies:

One significant opportunity within the motorcycles market lies in expanding market reach in emerging economies. As these regions experience rapid urbanization and rising disposable incomes, there is a growing appetite for recreational and commuter motorcycles. Manufacturers can strategically position themselves to tap into this emerging consumer base by offering diverse product portfolios that cater to the specific needs and preferences of consumers in these regions. Establishing a strong presence in emerging markets not only fuels revenue growth but also enables companies to build long-term brand loyalty.

- Rising Demand for Electric Motorcycles:

The increasing global emphasis on environmental sustainability presents a promising opportunity within the motorcycles market—specifically, the rising demand for electric motorcycles. With governments incentivizing electric vehicles and consumers becoming more environmentally conscious, there is a growing market for electric-powered two-wheelers. Manufacturers investing in research and development of electric motorcycles stand to gain a competitive advantage. This opportunity extends beyond meeting regulatory requirements; it aligns with consumer preferences for eco-friendly alternatives, offering a pathway for market leaders to position themselves as pioneers in the era of sustainable mobility.

Motorcycles Market Challenges

- Economic Downturns and Consumer Spending Constraints:

The motorcycles market faces persistent challenges, particularly during economic downturns when consumer spending is constrained. Economic uncertainties, recessions, and global financial crises can lead to reduced purchasing power and discretionary spending among potential buyers. This poses a significant challenge for manufacturers, as the demand for motorcycles, often considered discretionary purchases, tends to decline during periods of economic instability. Navigating these challenges requires strategic pricing, targeted marketing efforts, and potentially diversifying product offerings to cater to varying consumer budgets.

- Rapid Technological Obsolescence and Innovation Costs:

The motorcycles market is characterized by the rapid pace of technological advancements, leading to challenges associated with the obsolescence of existing technologies. Manufacturers face the constant pressure to invest in research and development to stay competitive, introducing new features and innovations. However, this pursuit of innovation comes with substantial costs, both in terms of research and development expenses and potential write-offs of obsolete technologies. Balancing the need for innovation with cost management is a delicate challenge, requiring companies to anticipate market trends and technological shifts while ensuring financial sustainability.

Segments Insights:

Type Insights

On-road motorcycles dominated the global motorcycles market, comprising the largest market share in 2024. These bikes include commuter motorcycles, sports bikes, cruisers, and touring models. Their versatility, combined with better road handling, performance range, and fuel efficiency, make them a preferred choice across geographies. Commuter bikes (ranging between 100–250cc) dominate in emerging markets, especially in countries like India, Indonesia, and Bangladesh, where affordability and mileage are top priorities. Meanwhile, mid- and high-performance on-road bikes appeal to enthusiasts and professional riders in North America and Europe. The segment continues to expand with the introduction of models like the Yamaha MT-09 (2024), which blends sporty performance with urban practicality.

Off-road motorcycles are the fastest-growing segment, particularly among adventure and motorsports enthusiasts. This growth is driven by the rise in recreational motorcycling, motocross tournaments, and a broader cultural appreciation for outdoor exploration. Off-road bikes are lightweight, durable, and designed for rugged terrains, making them ideal for trail riding, camping, and mountainous regions. Brands such as KTM, Husqvarna, and Honda are investing heavily in this space, with innovations in suspension systems and lightweight frames. With eco-tourism and camping trends on the rise post-pandemic, off-road motorcycles have become a lifestyle choice among affluent consumers seeking adrenaline experiences.

Regional Insights

Asia-Pacific dominates the motorcycles market, contributing to over 60% of global sales by volume. This is largely due to the region's dense populations, growing middle class, and economic reliance on two-wheel mobility. Countries like India, China, Indonesia, Vietnam, and Thailand have established themselves as both the largest consumers and producers of motorcycles. For example, India alone saw more than 17 million motorcycle registrations in 2024. Leading brands like Hero MotoCorp, Bajaj Auto, and TVS Motor have tailored their models to meet regional needs, focusing on affordability, fuel efficiency, and service accessibility. Additionally, domestic R&D and government incentives are spurring electric motorcycle adoption in the region.

Latin America is emerging as the fastest-growing region in the motorcycles market, driven by high urbanization, deteriorating public transportation, and a rapidly growing delivery economy. Countries like Brazil, Colombia, and Mexico are witnessing a surge in two-wheeler adoption, especially in the scooter and commuter bike categories. Motorcycles are essential tools for gig workers involved in e-commerce and food delivery. In 2024, Colombia reported a 12% YoY growth in two-wheeler sales, with scooter registrations increasing disproportionately. Brands like Italika, Yamaha, and Bajaj are leveraging this demand by expanding dealership networks and financing options tailored for low- to middle-income consumers.

Some of the prominent players in the Motorcycles market include:

- Harley-Davidson Incorporation

- Yamaha Motor Co., Ltd.

- Yadea Group Holdings Ltd.

- Honda Motor Co., Ltd.

- Piaggio & C. SpA

- BMW AG

- Suzuki Motor Corporation

- Hero MotoCorp Limited

- Bajaj Auto Ltd.

- TVS Motor Company

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global motorcycles market.

Type

- On-road Motorcycles

- Off-road Motorcycles

- Scooters

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)