North America Office Furniture Market Size and Research

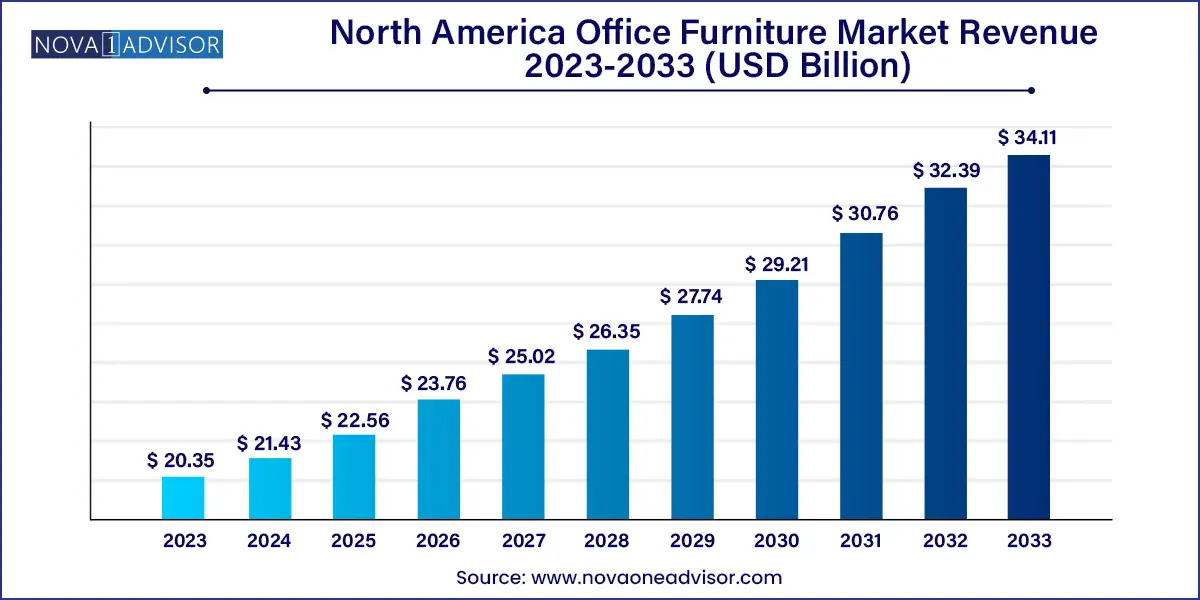

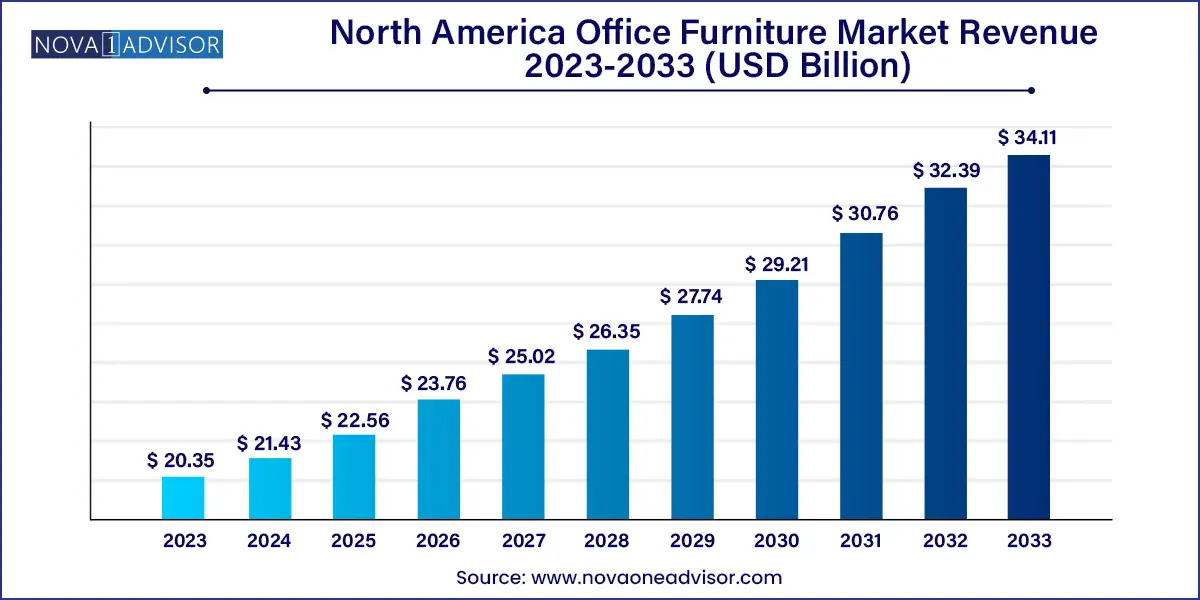

The North America office furniture market size was exhibited at USD 20.35 billion in 2023 and is projected to hit around USD 34.11 billion by 2033, growing at a CAGR of 5.3% during the forecast period 2024 to 2033.

North America Office Furniture Market Key Takeaways:

- In 2023, seating furniture held around 35% revenue share of the market.

- The demand for storage & organization office furniture is projected to grow at a CAGR of 6.4% from 2024 to 2033.

- In 2023, corporate office segment accounted for the revenue share of around 46%.

- The demand for office furniture for institutional segment is projected to grow at a CAGR of 6.0% from 2024 to 2033.

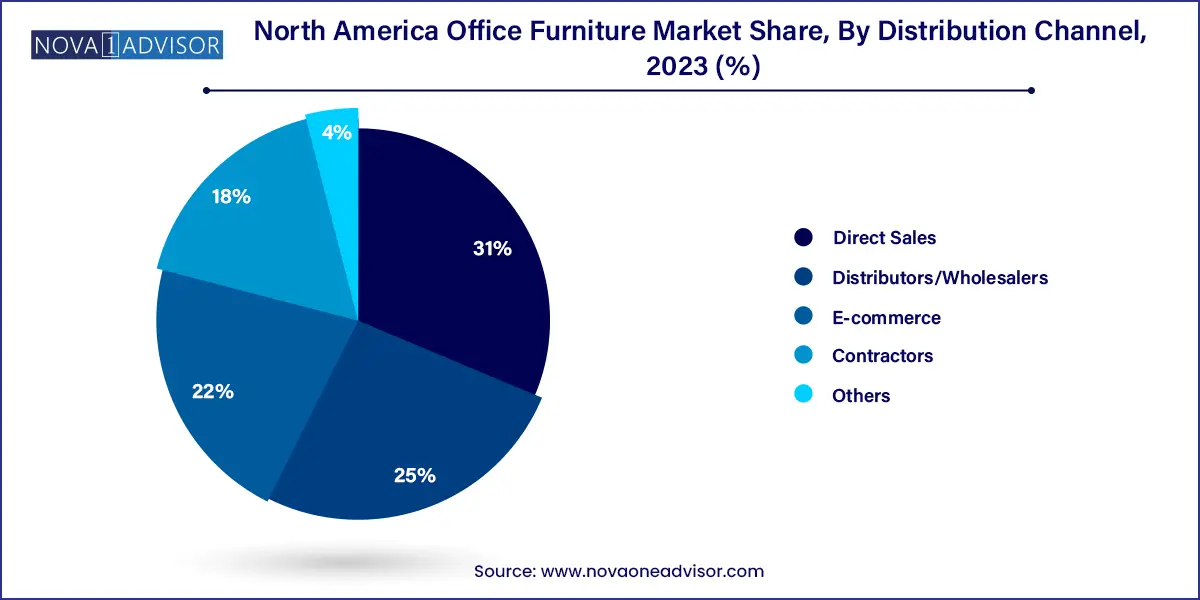

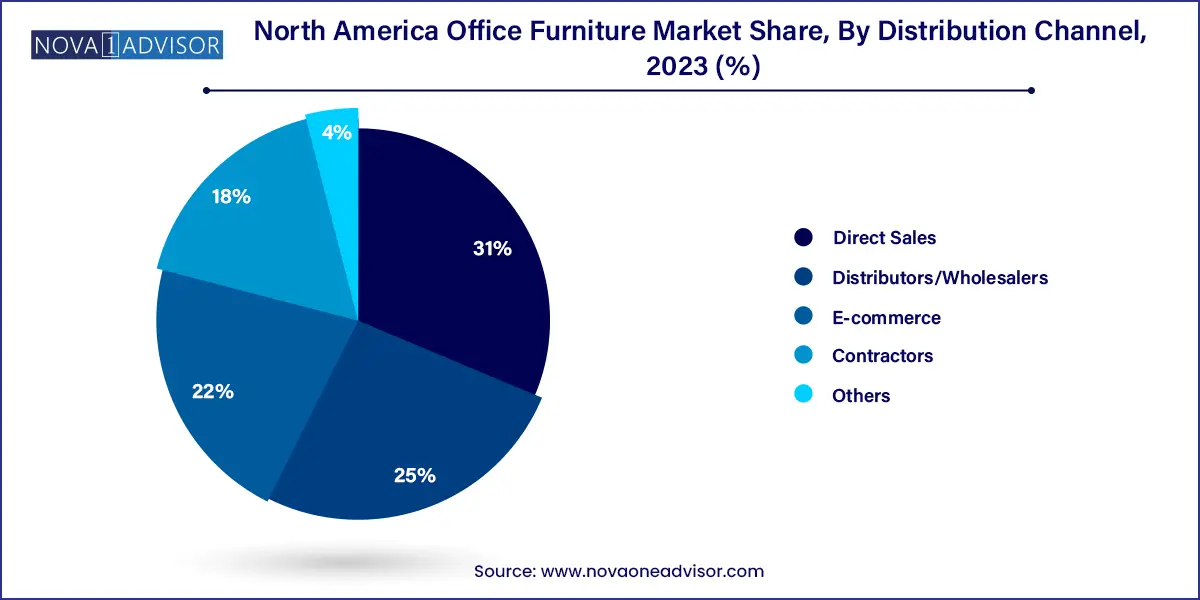

- In 2023, the direct sales channel accounted for a revenue share of around 31% share.

- The e-commerce channels segment is expected to grow at a CAGR of 6.7% from 2024 to 2033.

Market Overview

The North America office furniture market stands as a dynamic and evolving industry shaped by changing work environments, technological integration, and the continuous demand for ergonomic and functional workspaces. Encompassing a wide array of products such as seating solutions, desks, storage systems, partitions, and workstations, the market is intricately tied to economic activity, commercial real estate trends, and employment rates across the corporate, government, institutional, and healthcare sectors.

The post-pandemic transformation of office settings has particularly reshaped the landscape. Hybrid and remote work models have led to a recalibration of office design, emphasizing flexibility, comfort, and health-focused features. Employers are increasingly investing in modular, adaptable furniture that caters to collaborative environments and socially distanced layouts. At the same time, the rise in home office setups has fueled demand for compact, aesthetically pleasing, and multifunctional furniture, especially through e-commerce channels.

The North American market—anchored by the U.S. and followed by Canada and Mexico—is supported by a mature manufacturing ecosystem, high awareness of workplace wellness, and a strong B2B procurement culture. While large corporations dominate in volume, small and medium-sized enterprises (SMEs), co-working spaces, and startups are key contributors to market growth due to their evolving furnishing needs. Additionally, sustainability and circular economy initiatives are prompting companies to innovate with recycled materials, non-toxic finishes, and eco-conscious sourcing.

Major Trends in the Market

-

Ergonomics and Wellness-Centric Design: Growing emphasis on employee well-being is driving demand for furniture that supports posture, reduces fatigue, and minimizes health risks.

-

Hybrid and Flexible Work Models: Office furniture is being redesigned to support both in-office collaboration and remote productivity, with modular and foldable options gaining popularity.

-

Sustainable and Recyclable Materials: Manufacturers are shifting toward eco-friendly inputs such as bamboo, recycled plastic, and FSC-certified wood to align with green building standards.

-

Smart and Tech-Integrated Furniture: Integration of technology like height-adjustable desks with memory settings, cable management systems, and built-in charging ports is gaining traction.

-

Rise of Aesthetic and Minimalist Designs: Inspired by residential styles, office furniture is increasingly being designed with clean lines, muted colors, and natural textures to enhance visual appeal.

-

Growth of E-Commerce and D2C Models: Online platforms are reshaping procurement channels, offering convenience, configurability, and access to reviews and virtual product demos.

-

Co-Working and Shared Workspaces: Expansion of flexible office spaces is prompting demand for furniture that is mobile, customizable, and easy to reconfigure.

-

Increased Focus on Sound Management: Acoustic panels, privacy booths, and noise-reducing furniture are gaining importance in open office layouts.

Report Scope of North America Office Furniture Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 21.43 Billion |

| Market Size by 2033 |

USD 34.11 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End-use, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S, Canada, Mexico |

| Key Companies Profiled |

Herman Miller Inc.; Steelcase Inc.; HNI Corporation; Ashley Furniture Industries Inc.; Haworth Inc.; Teknion; Global Furniture Group; OKAMURA CORPORATION; Virco Inc.; 9to5 Seating LLC |

Market Driver: Rising Focus on Workplace Productivity and Employee Wellness

A key driver for the North America office furniture market is the rising emphasis on enhancing workplace productivity and promoting employee wellness. Employers are becoming increasingly aware that well-designed office furniture directly impacts employee satisfaction, concentration, and long-term health. Ergonomic seating that reduces back strain, sit-stand desks that combat sedentary behavior, and well-organized workstations that reduce clutter all contribute to improved performance.

Moreover, corporate wellness programs have expanded their scope to include ergonomic evaluations and furnishing upgrades, often tied to reduced absenteeism and insurance costs. In sectors such as tech, finance, and creative industries, where innovation and efficiency are paramount, investing in high-quality office furniture is seen not just as an operational necessity, but as a strategic asset.

Market Restraint: Volatility in Raw Material Prices and Supply Chain Disruptions

Despite robust demand, the market faces a significant challenge in the form of fluctuating raw material costs and global supply chain disruptions. Materials such as wood, steel, foam, and upholstery fabrics are subject to international price volatility due to geopolitical events, trade policies, and environmental factors. The COVID-19 pandemic further exposed vulnerabilities in supply chains, causing delays, cost inflation, and inventory shortages across the industry.

These issues are particularly burdensome for small and mid-sized furniture manufacturers who lack the scale or resources to absorb or hedge against such volatility. Moreover, delivery lead times are often extended, affecting contract fulfillment in projects with tight deadlines. The reliance on imported components and specialized fittings also adds to cost uncertainty, challenging profitability and procurement planning.

Market Opportunity: Growth in Co-Working and Flexible Office Solutions

One of the most promising opportunities in the North America office furniture market is the rapid expansion of co-working spaces and flexible office solutions. With startups, freelancers, and remote teams seeking collaborative and cost-effective workspaces, co-working facilities are mushrooming across urban centers. This has opened up demand for innovative furniture that supports adaptability, mobility, and high-utilization environments.

Furniture tailored for co-working setups must be multifunctional, easy to rearrange, and durable enough for frequent use by different users. Mobile desks, modular seating pods, privacy screens, and charging-integrated tables are examples of products in high demand. Furniture providers who specialize in this niche—offering customizable layouts and short lead times—are well-positioned to capitalize on the gig economy and startup boom.

North America Office Furniture Market By Product Insights

Seating dominated the product segment, reflecting the central role of ergonomic chairs, lounge seating, and task chairs in modern office setups. With employees spending hours seated, comfort, adjustability, and support are paramount. High-back chairs with lumbar support, mesh backs for ventilation, and cushioned armrests are standard in corporate procurement lists. Brands are also offering seating options that cater to different body types and health conditions. Lounge seating is becoming popular in collaborative zones and visitor areas, blending aesthetics with comfort. Executive seating remains a premium category, emphasizing style and personalization.

Partitions and dividers are the fastest-growing product segment, driven by the need to balance openness with privacy in hybrid workspaces. Open-plan offices, while efficient, often suffer from distractions and noise. Acoustic partitions, desk-mounted screens, and mobile dividers provide a flexible solution that enhances focus without the need for permanent walls. In the post-COVID workplace, these solutions are also being adopted to create safe zones and manage occupancy without full redesigns. As offices evolve to host fewer people but more collaborative spaces, flexible partitions are becoming indispensable.

North America Office Furniture Market By End-use Insights

Corporate offices dominate the end-use segment, owing to their scale, structured procurement processes, and recurring renovation cycles. Multinational corporations, regional headquarters, and large service providers invest heavily in furniture that promotes brand image, employee engagement, and productivity. Their preference for customizable, scalable, and brand-aligned solutions drives demand for high-value offerings. Furniture in this segment often incorporates brand colors, modular layouts, and technology integration to support presentations, teleconferencing, and data security.

Healthcare emerged as the fastest-growing end-use segment, reflecting an increase in administrative zones, patient support areas, and wellness-oriented office designs within medical facilities. Hospitals, private clinics, and rehabilitation centers require furniture that combines durability with comfort and infection control. Anti-microbial surfaces, easy-to-clean upholstery, and bariatric seating are key features in demand. Furthermore, healthcare administration has grown rapidly, necessitating functional office layouts that support both clinical and clerical work.

North America Office Furniture Market By Distribution Channel Insights

Direct sales dominated the distribution channel, particularly in large-scale furnishing projects where businesses collaborate with manufacturers or exclusive suppliers. Direct engagement allows for customization, bulk discounts, and installation support. Government tenders, multinational office setups, and institutional projects often rely on direct sourcing to ensure compliance and continuity. Many furniture companies have established B2B teams and showrooms that facilitate direct consultations and site-specific recommendations.

E-commerce is the fastest-growing distribution channel, driven by the rise of online furniture retailers and digital-savvy buyers. Businesses and individuals are increasingly purchasing through platforms like Wayfair, Amazon Business, and specialized D2C websites. E-commerce offers convenience, price comparison, and access to a wider variety of styles and configurations. Virtual showrooms, AR product visualizers, and user-generated reviews have helped build trust in online furniture purchases. Particularly for startups, home offices, and freelancers, online buying is the preferred mode due to quick shipping and minimal overhead.

Country Insights

United States

The U.S. is the largest and most influential market for office furniture in North America, supported by a robust corporate sector, high rate of office renovations, and technological integration. Tech hubs like Silicon Valley, New York, and Austin are trendsetters in hybrid and wellness-driven office design. The rise of remote work has also boosted demand for home office furniture across suburban and rural areas. Regulations such as LEED certification and ergonomic mandates shape procurement policies. Major U.S.-based manufacturers benefit from localized production and strong branding.

Canada

Canada’s office furniture market is characterized by its emphasis on sustainability, inclusive design, and government procurement. Public sector purchases play a key role, and eco-label certifications are often mandatory. Urban centers like Toronto, Vancouver, and Montreal are witnessing growth in co-working spaces and SME offices. The home office trend is also robust in Canada, where extreme weather encourages flexible working arrangements. Canadian manufacturers often prioritize recyclable materials and acoustic-friendly furniture due to space-sharing in metropolitan buildings.

Mexico

Mexico is emerging as a cost-effective production base and a growing consumer market, especially in urban centers like Mexico City, Guadalajara, and Monterrey. As multinational companies expand their regional offices and call centers in Mexico, demand for high-quality yet affordable office furniture is rising. The Mexican government and education sectors also contribute significantly to the demand. Local manufacturers are collaborating with global brands to enhance design and quality while keeping prices competitive. E-commerce is on the rise, with platforms offering pre-assembled or flat-pack solutions for small businesses and entrepreneurs.

North America Office Furniture Market Recent Developments

-

January 2025: Herman Miller introduced its "FutureFlex Workstation Series," a modular, tech-integrated furniture line designed to adapt to hybrid workspaces and dynamic office layouts.

-

February 2025: Steelcase announced a partnership with Canadian wellness firm EQ Office to co-develop ergonomic furniture specifically designed for co-working environments.

-

March 2025: Knoll Inc. launched a new sustainable furniture collection using reclaimed wood and eco-friendly finishes, aligned with LEED and WELL certification standards.

-

January 2025: Teknion expanded its D2C e-commerce operations in Mexico, aiming to reach SMEs and startups with cost-effective modular office solutions.

-

February 2025: Haworth unveiled its first AI-configured office planning tool, enabling clients to visualize and customize furniture layouts digitally before placing orders.

Some of the prominent players in the North America office furniture market include:

- Herman Miller Inc.

- Steelcase Inc.

- HNI Corporation

- Ashley Furniture Industries Inc.

- Haworth Inc.

- Teknion

- Global Furniture Group

- OKAMURA CORPORATION

- Virco Inc.

- 9to5 Seating LLC

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America office furniture market

Product

- Seating

- Desks & Tables

- Storage & Organization

- Partitions and Dividers

- Workstation & Cubicles

- Others

End-use

- Government

- Corporate Offices

- Institutional

- Healthcare

- Others

Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Contractors

- E-commerce

- Others

Country