North America Topical Drugs CDMO Market Size and Research

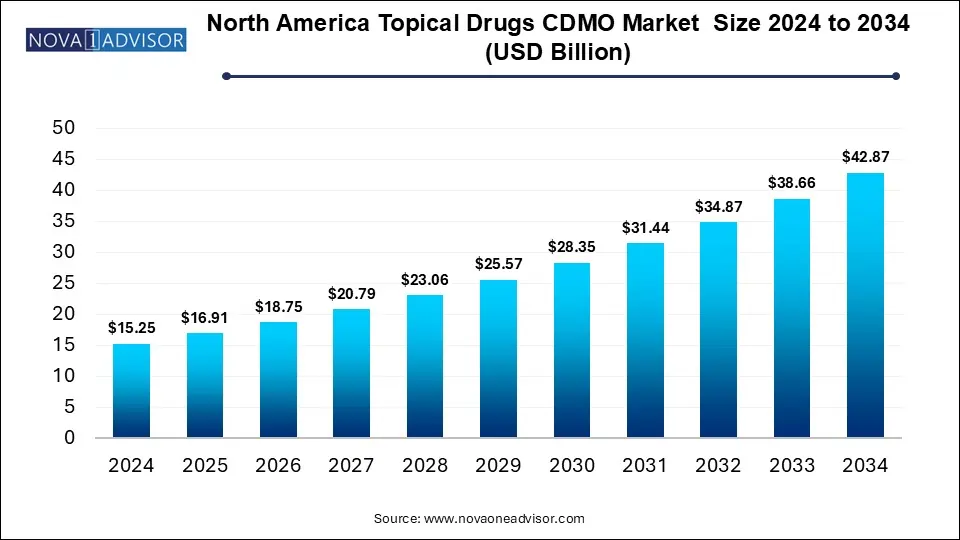

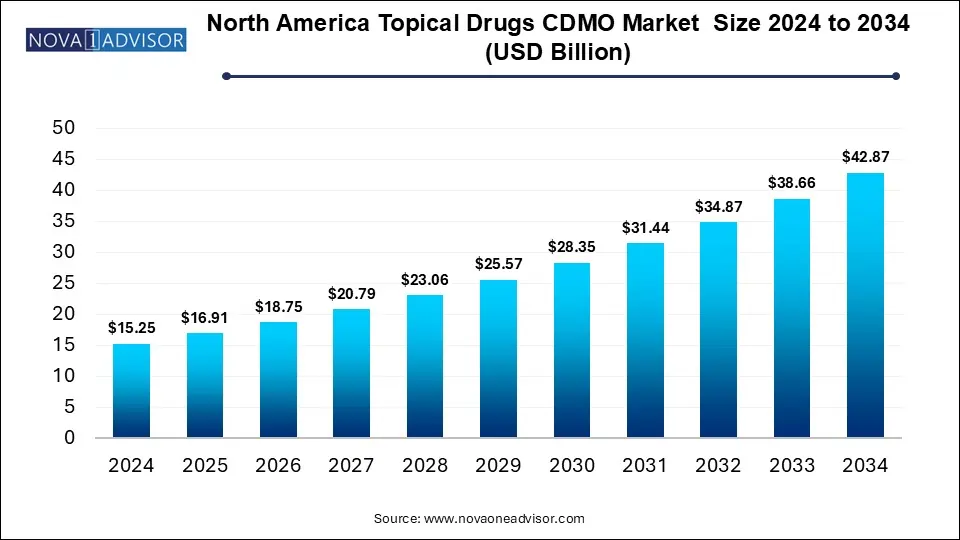

The North America topical drugs CDMO market size was exhibited at USD 15.25 billion in 2024 and is projected to hit around USD 42.87 billion by 2034, growing at a CAGR of 10.89% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, the United States emerged as the leading contributor to the North America topical drugs CDMO market, capturing approximately 86% of the total revenue.

- Pharmaceutical companies represented the largest end-user segment in 2024, generating 40.0% of the overall market revenue.

- The contract manufacturing segment held the dominant position in the market during 2024.

- Semi-solid formulations were the most widely used product type in 2024, accounting for a substantial 67% share of the market revenue.

Market Overview

The North America topical drugs contract development and manufacturing organization (CDMO) market is undergoing significant transformation as pharmaceutical and biopharmaceutical companies increasingly turn to external partners to streamline drug development processes and reduce time to market. CDMOs offer end-to-end services ranging from formulation and analytical testing to clinical and commercial-scale manufacturing. The topical drug segment specifically benefits from CDMOs’ specialized capabilities, particularly in dealing with complex formulations and ensuring consistent drug delivery through the skin.

Topical drug delivery has emerged as a patient-friendly and effective route for treating a range of dermatological, musculoskeletal, and chronic pain conditions. In North America, the rising prevalence of skin disorders such as eczema, psoriasis, and acne alongside increasing demand for advanced drug delivery platforms has bolstered the market. The cost-efficiency and speed offered by CDMOs are crucial in an increasingly competitive pharmaceutical landscape, prompting both large pharmaceutical companies and smaller biopharma firms to outsource their topical drug development and manufacturing needs.

Major Trends in the Market

-

Growing preference for semi-solid dosage forms such as creams and ointments for dermatological and pain management therapies.

-

Increased investments in transdermal drug delivery systems for sustained release and improved patient compliance.

-

Rising demand for end-to-end CDMO solutions integrating development, testing, and commercial manufacturing.

-

Growing outsourcing trend among small and mid-size biotech firms lacking in-house infrastructure.

-

Integration of Quality by Design (QbD) and regulatory-compliant analytical testing methodologies by CDMOs.

-

Technological innovations such as microemulsion and nanotechnology-based topical formulations.

-

Expansion of U.S.-based CDMOs to Canada and Mexico to serve regional pharmaceutical clients.

-

Increased focus on biosimilar topical formulations and personalized dermatological therapies.

Report Scope of North America Topical Drugs CDMO Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 16.91 Billion |

| Market Size by 2034 |

USD 42.87 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.89% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Service, End use, and Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

The Lubrizol Corporation; Cambrex Corporation; Contract Pharmaceuticals Limited; Bora Pharmaceutical CDMO; Ascendia Pharmaceuticals; Pierre Fabre S.A.; Piramal Pharma Solutions; DPT Laboratories, LTD.; MedPharm Ltd.; Zenvisionpharma |

Market Driver: Increasing Prevalence of Dermatological Disorders

One of the primary growth drivers in the North America topical drugs CDMO market is the increasing prevalence of dermatological diseases such as acne, psoriasis, rosacea, and eczema. According to the American Academy of Dermatology, more than 50 million people in the U.S. are affected by acne each year, and over 8 million people suffer from psoriasis. These conditions require long-term topical treatments, which amplifies demand for effective and patient-compliant formulations. Consequently, pharmaceutical companies are expanding their dermatological product pipelines, often in partnership with CDMOs that can deliver innovative formulations and ensure consistent quality. This demand creates a robust pipeline of topical drug development projects, stimulating the need for both development and manufacturing services across the region.

Market Restraint: Regulatory Complexity and Compliance

The North America topical drug CDMO market is also constrained by complex and evolving regulatory frameworks. The U.S. FDA, Health Canada, and COFEPRIS (Mexico) impose rigorous standards on topical drug formulations concerning bioequivalence, safety testing, and labeling. CDMOs must comply with Current Good Manufacturing Practice (cGMP) regulations and often face delays due to regulatory audits and approvals. Moreover, as topical drugs interact with the skin and have direct exposure risks, stringent testing is required to avoid adverse reactions or allergic responses. These regulatory demands elevate operational costs and timelines, particularly for CDMOs that cater to multiple markets with varying standards, thereby posing a significant operational and financial challenge.

Market Opportunity: Rising Demand for Transdermal Drug Delivery Systems

An emerging opportunity in the North America topical drugs CDMO market is the growing demand for transdermal drug delivery systems (TDDS). Transdermal patches offer numerous advantages, including sustained drug release, improved bioavailability, and reduced gastrointestinal side effects. These systems are particularly suited for chronic conditions like hypertension, chronic pain, and hormone replacement therapy. CDMOs with expertise in transdermal technologies are seeing increased interest from pharmaceutical firms aiming to differentiate their product offerings and extend patent lifecycles. For instance, the growing interest in cannabidiol (CBD)-infused transdermal patches has led to specialized formulation development, representing a lucrative opportunity for CDMOs with innovation capabilities.

Segmental Analysis

Product Outlook

Semi-solid formulations dominated the product segment in 2024 and are projected to retain their lead throughout the forecast period. These include creams, ointments, and lotions, which are widely used for dermatological applications. Creams, in particular, are preferred due to their non-greasy texture and ease of absorption. Ointments, while thicker, are ideal for prolonged skin contact and are widely used in wound healing and treatment of chronic skin conditions. Lotions, although lighter, are favored in pediatric and geriatric segments due to better spreadability. This widespread applicability across therapeutic areas such as anti-inflammatory, antifungal, and corticosteroid treatments ensures a consistent demand for semi-solid formulations.

Transdermal products are expected to be the fastest-growing product category in the market. These products deliver active ingredients through the skin directly into systemic circulation and are becoming popular due to their convenience and extended drug-release profile. Transdermal patches are increasingly being adopted for pain management, smoking cessation, and hormone therapies. With technological advancements such as microneedle patches and iontophoresis systems, CDMOs are leveraging their capabilities to manufacture complex transdermal systems. The shift towards minimally invasive drug delivery routes contributes to this segment’s rapid growth trajectory.

Service Outlook

Contract manufacturing dominated the service segment, especially commercial-scale production, due to rising outsourcing by large pharmaceutical firms. These firms are keen to leverage CDMOs’ expertise and infrastructure to scale up production cost-effectively while ensuring compliance with regulatory standards. Commercial manufacturing services for topical drugs require specialized equipment and cleanroom capabilities, which CDMOs are continuously investing in. Additionally, with the expiration of several dermatological drug patents, CDMOs are receiving increased contracts for manufacturing generic and branded reformulations.

Contract development services are expected to grow at the fastest rate during the forecast period. This includes formulation development, analytical testing, and stability testing services. As drug formulation becomes increasingly complex due to combination therapies and customized topical agents, companies are relying on CDMOs for preclinical development support. Analytical testing services, including microbiological testing and skin permeation studies, have also seen growing demand. CDMOs are expanding their development capabilities to serve both early-stage biotech startups and large pharmaceutical firms seeking innovative delivery formats.

End-Use Outlook

Pharmaceutical companies were the dominant end-users in 2024, holding a major share of CDMO service utilization. These companies often outsource to reduce in-house operational burdens and focus more on R&D and commercialization. Established pharmaceutical players, especially those in the dermatology and pain management space, contract with CDMOs for both development and manufacturing services to expedite go-to-market timelines and mitigate risks.

Biopharmaceutical companies are projected to be the fastest-growing end-user segment. The increasing number of biotech startups in North America, particularly in Canada and the U.S., has led to a growing demand for flexible, cost-effective CDMO partnerships. These companies often lack manufacturing infrastructure and rely heavily on third-party development and production partners. Biopharmaceutical firms are also exploring novel excipients and biological molecules for topical application, prompting increased collaboration with CDMOs specializing in high-potency and biologics-compatible topical drug formats.

Country-Level Analysis

United States

The United States holds the lion’s share of the North America topical drugs CDMO market. This dominance is driven by the country’s large pharmaceutical base, a high burden of dermatological conditions, and the presence of major CDMOs such as Catalent, Patheon, and Cambrex. The U.S. FDA’s stringent quality requirements also encourage pharma firms to partner with experienced CDMOs. Additionally, the rise of niche biotech startups focusing on dermatological therapeutics has propelled demand for development services in the region.

Canada

Canada is emerging as a promising CDMO hub due to supportive government regulations, a growing number of life science clusters, and increased R&D investments. Canadian CDMOs such as Apotex Pharmachem and Accucaps have expanded their topical drug manufacturing capabilities. Furthermore, the country’s favorable tax policies and proximity to the U.S. market make it a strategic outsourcing destination.

Mexico

Mexico is seeing steady growth in the topical CDMO space owing to its cost-efficient manufacturing environment and improving regulatory framework. With rising healthcare investments and pharmaceutical expansion in the region, Mexican CDMOs are upgrading their capabilities. In particular, international pharmaceutical firms are setting up nearshore operations in Mexico to reduce supply chain risks and leverage lower labor costs.

Some of The Prominent Players in The North America Topical Drugs CDMO Market Include:

- The Lubrizol Corporation

- Cambrex Corporation

- Contract Pharmaceuticals Limited

- Bora Pharmaceutical CDMO

- Ascendia Pharmaceuticals

- Pierre Fabre S.A.

- Piramal Pharma Solutions

- DPT Laboratories, LTD.

- MedPharm Ltd.

- Zenvisionpharma

Recent Developments

-

Catalent (U.S.) announced the opening of a new clinical supply facility in San Diego in March 2025, which will support early-phase topical drug development activities.

-

Tergus Pharma, a leading topical CDMO, expanded its R&D and manufacturing footprint in North Carolina with a new state-of-the-art facility in November 2024, aimed at supporting both semi-solid and transdermal projects.

-

LGM Pharma announced the acquisition of formulation development assets from Nexgen Pharma in January 2025, strengthening its position in the topical and transdermal CDMO market.

-

Kindeva Drug Delivery partnered with a Canadian biotech firm in December 2024 to develop a novel transdermal delivery platform for chronic pain management.

-

MedPharm Ltd., although UK-based, signed a strategic partnership with a U.S. dermatology company in February 2025 to provide specialized analytical testing for topical drugs aimed at the North American market.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

-

- Creams

- Ointments

- Lotions

- Others

- Solid Formulations

- Transdermal Products

By Service

-

- Formulation Development

- Analytical Testing

- Stability Testing

- Others

By End Use

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Others

By Country