Obesity Clinical Trials Market Size and Growth 2025 to 2034

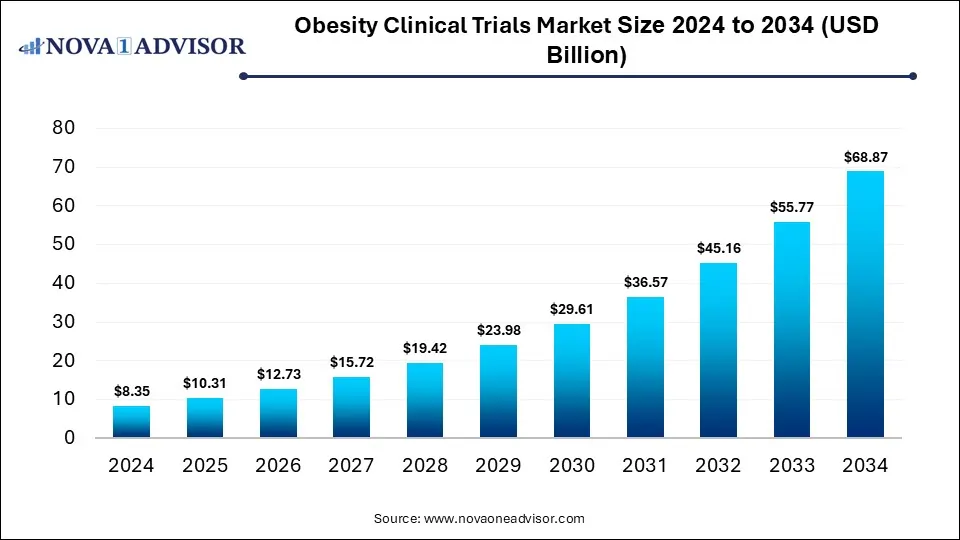

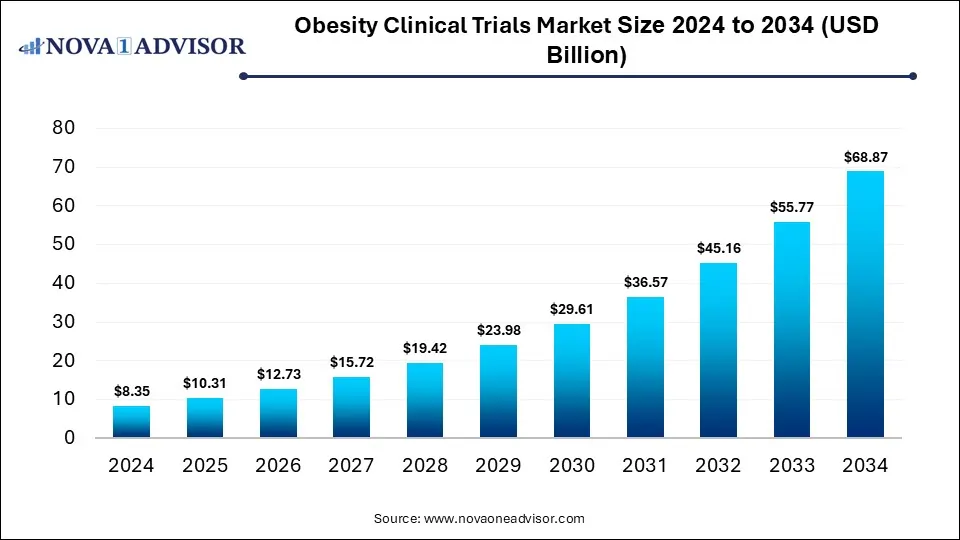

The global obesity clinical trials market was valued at USD 8.35 billion in 2024 and is projected to hit around USD 68.87 billion by 2034, expanding at a CAGR of 23.49% during the forecast period of 2025 to 2034. The growth of the market is driven by rising global obesity rates, increased focus on innovative pharmacological treatments like GLP-1 receptor agonists, and expanding investments in lifestyle and surgical intervention research.

Obesity Clinical Trials Market Key Takeaways

- By region, North America held the largest share of the obesity clinical trials market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By phase, the phase II segment dominated the market in 2024.

- By phase, the phase III segment is expected to grow at the fastest rate during the forecast period.

- By study design, the interventional trials segment led the market in 2024.

- By study design, the observational studies segment is expected to expand at the fastest CAGR in the upcoming period.

- By intervention/therapy type, the pharmacological treatments segment dominated the market in 2024.

- By intervention/therapy type, the combination therapies segment is expected to expand at the highest CAGR over the projection period.

- By sponsor, the pharmaceutical & biotechnology companies segment contributed the largest market share in 2024.

- By sponsor, the academic & research institutions segment is likely to expand at a rapid pace in the coming years.

Impact of AI on the Obesity Clinical Trials Market

AI is significantly transforming the market for obesity clinical trials by improving trial design, patient recruitment, and data analysis. Machine learning algorithms can identify suitable candidates more efficiently by analyzing large datasets, including electronic health records and genetic information. AI also enhances remote monitoring through wearable devices and apps, enabling real-time tracking of patient behavior, adherence, and response to treatment. Additionally, predictive analytics help optimize dosing strategies and reduce trial durations. Overall, AI is accelerating drug development while lowering costs and improving trial outcomes.

Market Overview

The obesity clinical trials market focuses on research studies aimed at evaluating new treatments, drugs, and interventions for managing or reducing obesity, a chronic and increasingly prevalent global health issue. This market is driven by the rising incidence of obesity-related conditions such as diabetes, cardiovascular diseases, and certain cancers, which are fueling the demand for innovative therapies. Growth is further supported by increased R&D investment from pharmaceutical companies, advancements in drug development technologies, and supportive regulatory initiatives. Additionally, heightened public awareness and government health initiatives are encouraging greater participation in clinical trials, contributing to market expansion.

What are the Major Trends in the Obesity Clinical Trials Market?

- Rise of GLP-1 Receptor Agonists in Trials: Drugs like semaglutide (Ozempic/Wegovy) and tirzepatide have gained prominence in clinical research due to their effectiveness in weight loss and metabolic regulation. These compounds are setting new benchmarks for efficacy and are driving a wave of similar investigational drugs.

- Growing Focus on Combination Therapies: Researchers are increasingly exploring the effectiveness of combining anti-obesity drugs with lifestyle interventions or other medications. This trend aims to achieve more sustainable and effective long-term weight management solutions.

- Expansion into Emerging Markets: With obesity rates rising globally, clinical trials are expanding into Asia-Pacific, Latin America, and the Middle East. These regions offer large, diverse patient pools and lower operational costs, making them attractive for trial sponsors.

- Emphasis on Personalized Medicine: There is a growing trend toward tailoring obesity treatments based on genetic, metabolic, and behavioral profiles. Precision medicine approaches are expected to improve treatment outcomes and reduce adverse effects in clinical trials.

Report Scope of Obesity Clinical Trials Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 10.31 Billion |

| Market Size by 2034 |

USD 68.87 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 23.49% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Phase, By Study Design, By Intervention/Therapy Type, By Sponsor, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Global Obesity Prevalence

The rising global prevalence of obesity is a major factor driving the growth of the obesity clinical trials market, as it significantly increases the demand for effective treatment options. With obesity now recognized as a global health crisis affecting both developed and developing countries, healthcare systems and pharmaceutical companies are under pressure to find new, safe, and effective therapies. This surge in cases has led to greater investment in clinical research to explore novel drugs, behavioral interventions, and combination therapies. Additionally, the growing burden of obesity-related comorbidities such as diabetes, cardiovascular disease, and certain cancers further emphasizes the need for clinical trials.

- Obesity is one of the most urgent global health challenges, affecting over 1 billion people (13%) worldwide in 2022. Since 1975, obesity rates have tripled, with projections showing 1.9 billion adults (25%) is projected to be affected by 2035. By 2050, this number could reach 3.8 billion, impacting more than half of the global adult population.

Government and Private Funding

Government and private funding play a crucial role in driving the growth of the market by providing the financial resources needed to support large-scale, long-term studies. Public health agencies and international organizations are increasingly allocating funds to tackle the obesity epidemic, recognizing its impact on healthcare systems and economies. At the same time, private sector investment from pharmaceutical and biotech companies is rising, driven by the commercial potential of successful obesity treatments. This influx of funding accelerates the development of innovative drugs, advanced trial methodologies, and global research collaborations. Ultimately, increased financial backing helps overcome barriers such as high trial costs and complex regulatory requirements, fueling overall market expansion.

- In September 2025, Biophytis announced key progress in preparing its Phase 2 OBA trial of BIO101 for obesity-related muscle wasting. The company secured funding from EMBRAPII, a government-backed innovation agency in Brazil dedicated to fostering industrial R&D collaboration and accelerating clinical innovation, and partnered with top Brazilian research centers FARMAVAX-UFMG and FMRP-USP to support the trial.

Restraints

High Clinical Trial Costs

High clinical trial costs restrain the growth of the obesity clinical trials market, as they can limit the number of trials initiated and reduce participation by smaller biotech firms. Obesity trials often require large, diverse patient populations and extended study durations to assess long-term safety and efficacy, driving up operational expenses. Additionally, costs related to patient recruitment, monitoring, data management, and regulatory compliance further increase the financial burden. These high costs can deter investment and slow down the pace of innovation in obesity treatment. As a result, only well-funded organizations are able to sustain ongoing research, limiting the diversity and volume of clinical studies in the market.

Patient Recruitment Challenges & Stringent Regulatory Requirements

Patient recruitment challenges and stringent regulatory requirements create challenges in the market. Recruiting suitable participants can be difficult due to factors like strict eligibility criteria, low patient motivation, and social stigma associated with obesity, which may reduce willingness to enroll or adhere to trial protocols. Additionally, regulatory agencies impose rigorous safety and efficacy standards, requiring extensive data and long trial durations that increase complexity and costs. Navigating diverse regulatory landscapes across different countries further complicates trial approvals and timelines. Together, these factors slow down clinical development and limit the number of successful obesity trials.

Opportunities

Advancements in Trial Design

Advancements in trial design are creating significant opportunities in the obesity clinical trials market by making studies more efficient, cost-effective, and patient-centric. Innovative approaches like adaptive trial designs, decentralized trials, and the integration of digital health technologies allow for real-time data collection and more flexible protocols. These improvements help overcome traditional challenges such as patient recruitment and retention while providing richer, more accurate data. Additionally, the use of AI and predictive analytics enables better patient stratification and personalized treatment assessment. Together, these advancements accelerate drug development and increase the likelihood of successful trial outcomes.

Increased Use of Digital Health Technologies

The increased use of digital health technologies is opening new opportunities in the market by enhancing patient monitoring and engagement. Tools such as wearable devices, mobile apps, and remote sensors enable continuous tracking of physical activity, diet, and vital signs, providing real-time, accurate data that improves trial quality. These technologies also facilitate decentralized and virtual trials, reducing the need for frequent clinic visits and making participation more convenient for patients. Enhanced data collection and patient adherence ultimately lead to more robust trial outcomes and faster decision-making. As a result, digital health innovations are helping to lower costs and expand patient access, fueling the growth of the market.

What Macroeconomic Factors are Impacting the Growth of the Obesity Clinical Trials Market?

GDP and economic growth positively impact the market by increasing the availability of funding and resources for healthcare and research. In economically stable regions, governments and private sectors are more likely to invest in clinical trials, infrastructure, and advanced technologies. Conversely, during economic downturns or in low-GDP countries, limited funding and healthcare priorities may delay or reduce trial activity.

Demographic trends significantly drive the growth of the market, especially with the global rise in aging populations and urbanization. Older adults are more prone to obesity-related comorbidities, increasing the demand for targeted treatments and related clinical research. Additionally, lifestyle shifts and growing middle-class populations in emerging markets contribute to higher obesity rates, expanding the patient pool for trials.

High inflation rates generally restrain the growth of the market by increasing operational costs, including expenses for staffing, equipment, and patient recruitment. These rising costs can limit the number of trials initiated, especially for smaller biotech firms with constrained budgets. Additionally, inflation may lead to reduced investment in research and development as funding becomes more expensive and less predictable.

- Monetary and Fiscal Policies

Monetary and fiscal policies can both drive or restrain the growth of the market, depending on how they are implemented. Expansionary policies, such as increased government healthcare spending or low interest rates, can boost funding for clinical research and encourage investment in obesity trials. In contrast, restrictive policies, budget cuts, or high interest rates can limit available capital and reduce incentives for R&D, thereby slowing market growth.

Segment Outlook

By Phase Insights

What Made Phase II the Dominant Segment in the Obesity Clinical Trials Market?

The phase II segment dominated the market with a significant share in 2024 due to the rising number of promising anti-obesity drug candidates entering this critical stage of development. Phase II trials are designed to assess the efficacy and optimal dosing of new treatments, making them a key step before large-scale testing in Phase III. The growing interest in novel pharmacological therapies, such as GLP-1 receptor agonists and combination treatments, has led to an increase in Phase II studies. Additionally, the surge in biotech and pharma investments targeting obesity has accelerated pipeline activity at this stage. This concentration of innovation and funding positioned Phase II as the most active and dominant phase in 2024.

The phase III segment is expected to grow at the fastest rate during the projection period due to the increasing number of advanced drug candidates progressing from earlier phases. As obesity treatments, especially novel pharmacological options like GLP-1 receptor agonists and combination therapies, show promising results in Phase II, more companies are initiating large-scale Phase III trials to validate efficacy and safety in diverse populations. Regulatory bodies require robust Phase III data for drug approval, prompting higher investment and trial activity in this phase. Moreover, the growing global demand for effective, long-term obesity management solutions is encouraging sponsors to accelerate late-stage trials.

- In June 2025, Novo Nordisk announced plans to begin Phase 3 trials of its experimental weight-loss drug amycretin, in both injectable and oral forms, in early 2026. The decision follows positive regulatory feedback after completing mid-stage trials.

By Study Design Insights

How Does the Interventional Trials Segment Lead the Market?

The interventional trials segment led the obesity clinical trials market in 2024, owing to the high volume of studies focused on evaluating the effectiveness of new treatments, particularly pharmacological and surgical interventions. These trials involve actively assigning participants to specific therapies or procedures, making them essential for testing the safety and efficacy of emerging anti-obesity drugs like GLP-1 receptor agonists. With rising investment from pharmaceutical companies and growing regulatory pressure for evidence-based solutions, interventional trials have become the preferred study design. Their structured methodology allows for controlled outcomes and clearer insights, which are critical for gaining drug approvals.

The observational studies segment is expected to grow at the fastest CAGR in the coming years. This is mainly due to the increasing demand for real-world evidence on long-term treatment outcomes and patient behavior. As more anti-obesity drugs and interventions receive regulatory approval, researchers and healthcare providers are focusing on understanding how these therapies perform outside controlled clinical settings. Observational studies are valuable for monitoring safety, adherence, and effectiveness over time, especially in diverse and larger patient populations. Additionally, growing interest in personalized medicine and data-driven healthcare is encouraging the use of observational research to capture lifestyle, genetic, and environmental factors influencing obesity. This shift toward real-world data is expected to significantly boost the number of observational trials throughout the forecast period.

By Intervention/Therapy Type Insights

Why Did the Pharmacological Treatments Segment Dominate the Market in 2024?

The pharmacological treatments segment dominated the obesity clinical trials market in 2024. This is primarily due to the rapid development and strong clinical interest in novel anti-obesity drugs, particularly GLP-1 receptor agonists like semaglutide and tirzepatide. These medications have shown significant weight loss benefits in clinical studies, leading to increased investment from pharmaceutical companies and a surge in trials focused on drug efficacy and safety. The growing prevalence of obesity worldwide has heightened the demand for effective, non-invasive treatment options, making pharmacological approaches highly attractive. Additionally, regulatory approvals and expanding indications for these drugs have further accelerated clinical activity in this segment.

The combination therapies segment is expected to expand at the highest CAGR over the forecast period. The growth of the segment is attributed to the increasing recognition that multifactorial conditions like obesity require multi-pronged treatment approaches. Combining pharmacological treatments with behavioral interventions or surgical procedures has shown greater efficacy in achieving sustained weight loss and improving metabolic health compared to single-modality therapies. As clinical evidence supporting the synergy of combination treatments grows, more trials are being designed to evaluate their long-term benefits and safety.

Additionally, rising demand for personalized and holistic obesity management solutions is encouraging innovation in this space. This shift toward integrated care is expected to significantly boost the number of combination therapy trials through the studied years.

Why Did Pharmaceutical & Biotechnology Companies Hold the Largest Market Share in 2024?

The pharmaceutical & biotechnology companies segment held the largest share of the obesity clinical trials market in 2024 due to their substantial investment in the development of innovative anti-obesity drugs and therapies. These companies have been at the forefront of launching large-scale clinical trials, particularly for promising pharmacological treatments like GLP-1 receptor agonists and other metabolic modulators that have demonstrated significant efficacy in weight reduction. With obesity becoming a global health crisis, pharma and biotech firms are aggressively expanding their pipelines to address the growing demand for effective medical solutions. Their strong financial resources, R&D capabilities, and regulatory expertise allow them to drive a majority of interventional and late-phase trials.

The academic & research institutions segment is expected to expand at the fastest rate in the upcoming period due to increasing public health interest, grant funding, and collaborative research initiatives aimed at understanding the complex causes of obesity. These institutions play a critical role in exploring behavioral, genetic, and environmental factors that contribute to obesity, often conducting early-phase or observational studies that are less commercially driven. With a growing emphasis on real-world evidence and preventative strategies, academic centers are expanding their focus beyond drug trials to include multidisciplinary and community-based interventions. Moreover, partnerships between academia, governments, and industry are enhancing research capacity and accelerating innovation.

By Regional Analysis

What Made North America the Dominant Region in the Obesity Clinical Trials Market?

North America dominated the obesity clinical trials market by capturing the largest share in 2024. This is mainly due to its high obesity prevalence, well-established clinical research infrastructure, and strong presence of leading pharmaceutical and biotechnology companies. The region, particularly the U.S., has been at the forefront of developing and testing innovative anti-obesity drugs, supported by significant funding and favorable regulatory frameworks. Access to a large and diverse patient population allows for efficient recruitment in trials, while advanced healthcare systems and academic institutions facilitate high-quality research. Additionally, growing public health initiatives and government-backed programs targeting obesity have further driven clinical trial activity.

The U.S. is the major contributor to the North America obesity clinical trials market due to its advanced healthcare infrastructure, strong pharmaceutical industry presence, and high prevalence of obesity. The U.S. hosts numerous leading research institutions and clinical trial centers, which facilitate large-scale and diverse obesity studies. Additionally, substantial funding from both government agencies like the NIH and private sectors supports extensive clinical research activities. The country’s well-established regulatory framework and government initiatives also encourage rapid initiation and completion of trials.

- The Trump administration is considering a five-year pilot program to cover weight-loss drugs under Medicare and Medicaid, marking a shift from earlier policy. According to The Washington Post, the plan would include coverage for Wegovy, Ozempic (Novo Nordisk) and Zepbound, Mounjaro (Eli Lilly). The pilot could start in April 2026 for Medicaid and January 2027 for Medicare. Such proposed Medicare and Medicaid coverage for weight-loss drugs significantly drive the growth of the market by increasing both demand and investment in new treatments.

What Makes Asia Pacific the Fastest-Growing Market for Obesity Clinical Trials?

Asia Pacific is the fastest-growing market, as governments and healthcare systems in the region are increasingly prioritizing obesity as a public health concern, leading to more funding and policy support for clinical research. The region offers a large, treatment-naïve population and lower operational costs, making it an attractive destination for global clinical trial sponsors. Growing collaborations between international pharmaceutical companies and local research institutions are further accelerating trial activity. Additionally, increased prevalence of obesity, rapid urbanization, and lifestyle changes across countries like China, India, and Japan drive the growth of the market.

- In 2024, globally, an estimated 35 million children under the age of 5 were overweight, with nearly half residing in Asia. Once considered a problem primarily in high-income countries, childhood overweight is now increasing rapidly in low- and middle-income nations, especially across Asia.

China is the major contributor to the Asia Pacific obesity clinical trials market due to its large and rapidly growing obese population driven by urbanization, changing diets, and sedentary lifestyles. The country has been investing heavily in healthcare infrastructure and research capabilities, attracting both domestic and international pharmaceutical companies to conduct clinical trials. Additionally, favorable government policies and increasing healthcare expenditure support obesity research and drug development. China’s vast, treatment-naïve patient pool also enables efficient recruitment for clinical studies, contributing to market growth.

Region-Wise Breakdown of the Obesity Clinical Trials Market

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 3.5 Bn |

5.79% |

High obesity prevalence, advanced healthcare/clinical research infrastructure; regulatory approvals (FDA), reimbursement pathways; strong biotech/pharma presence; rising demand for effective therapies |

High cost of drugs; limited insurance / reimbursement in some states; regulatory & safety concerns; patient adherence issues; access disparities in lower income / rural areas |

Dominant region in 2024 and is likely continuing to lead between 2025 and 2034 |

| Asia Pacific |

USD 2.4 Bn |

7.28% |

Rapid urbanization; rising disposable incomes; growing incidence of obesity and related comorbidities; increasing healthcare access; more public awareness; governments integrating obesity treatment in health policy; willingness to adopt new therapies

|

Regulatory and reimbursement hurdles in some countries; lower awareness / smaller budgets in rural areas; issues with supply chain; potential cost sensitivity; infrastructure gaps for specialist obesity care |

Fastest-growing region |

| Europe |

USD 1.9 Bn |

10.14% |

Rising obesity incidence; strong public health initiatives; supportive regulatory and reimbursement environment in many countries; established health systems; increasing adoption of pharmacotherapy alongside lifestyle interventions |

Heterogeneous reimbursement across countries; stricter regulatory requirement; cost containment pressures on health systems; social stigma / lower patient uptake in certain areas |

Steady growth |

| Latin America |

USD 0.7 Bn |

4.19% |

Increasing awareness; rising obesity rates; improving healthcare infrastructure; growing middle class; more international pharma interest |

Limited healthcare spending; less access / delayed approval of new treatments; reimbursement limitations; socio-economic constraints; lack of specialist centers |

Moderate growth |

| MEA |

USD 0.4 Bn |

3.75% |

Growing public health focus; rising obesity prevalence; government investments in healthcare; development of private sector; |

Healthcare infrastructure gaps; limited access and affordability; regulatory delays; lower per capita spending |

Gradual growth with strong potential |

Obesity Clinical Trials Market Value Chain Analysis

1. Research & Preclinical Development

This initial stage involves fundamental research to understand the biological pathways of obesity and identify potential drug or treatment targets. Preclinical studies, including in vitro (cell-based) and in vivo (animal-based) models, are conducted to evaluate the safety and efficacy of candidate therapies before they enter human trials.

2. Clinical Trial Design & Planning

In this stage, sponsors and clinical research organizations (CROs) design trial protocols, define study populations (e.g., patients with obesity or related comorbidities), determine dosage strategies, and set primary/secondary endpoints. Regulatory strategies, ethical approvals, and site selection are also finalized here. This phase ensures that the trial is scientifically sound, ethically compliant, and statistically robust.

3. Trial Execution & Data Collection

This is the core operational phase where the clinical trial is conducted in phases (I–IV), involving recruitment, patient enrollment, drug administration, and continuous monitoring. Data on safety, efficacy, and tolerability are gathered using digital tools, clinical trial management systems (CTMS), and electronic data capture (EDC) systems.

Hospitals, clinical trial sites, CROs, and investigators are central to this process.

4. Data Analysis & Interpretation

After data collection, biostatisticians and data scientists analyze trial outcomes to assess whether the treatment meets its intended endpoints. This includes statistical analysis, subgroup evaluation, and monitoring of adverse events. The insights gained determine whether the treatment is viable for regulatory submission or requires further research.

5. Regulatory Submission & Approval

Once a trial demonstrates efficacy and safety, sponsors compile results into a comprehensive regulatory dossier for submission to health authorities such as the FDA (U.S.), EMA (Europe), or PMDA (Japan). Approval processes may include advisory committee reviews and additional data requests before a treatment is authorized for public use.

6. Commercialization & Post-Marketing Surveillance

After regulatory approval, pharmaceutical companies initiate marketing, distribution, and sales of the obesity treatment. Meanwhile, post-marketing studies (Phase IV) and pharmacovigilance activities monitor long-term safety, effectiveness, and patient outcomes in real-world settings. This helps identify rare side effects, refine usage guidelines, and potentially expand indications.

Key Players Operating in the Obesity Clinical Trials Market

Altimmune is actively developing ALT-801, a dual GLP-1/glucagon receptor agonist for the treatment of obesity and metabolic diseases. The company is advancing clinical trials with promising early-stage results suggesting significant weight loss potential.

Amgen is developing MariTide (AMG 133), a GLP-1 receptor and GIPR agonist aimed at treating obesity. The candidate has shown encouraging Phase 1 results, positioning Amgen as an emerging competitor in the next generation of anti-obesity drugs.

AstraZeneca is involved in obesity-related research through its metabolic disease pipeline and strategic collaborations. The company is exploring therapies that target cardiometabolic risks, often associated with obesity, through various clinical development programs.

Boehringer Ingelheim is running clinical trials in collaboration with Zealand Pharma to evaluate dual agonists like BI 456906, targeting GLP-1 and glucagon receptors. Their research focuses on treating both obesity and NASH (non-alcoholic steatohepatitis), with multiple studies in advanced phases.

Eli Lilly is a key player in the obesity clinical trials space with its blockbuster drug Mounjaro (tirzepatide), which showed impressive weight loss in clinical trials. The company is now advancing Zepbound, expanding its obesity-focused pipeline with several ongoing studies.

- GlaxoSmithKline (GSK plc)

GSK contributes through its experience in metabolic disorders and has marketed Alli (orlistat), one of the few FDA-approved over-the-counter obesity drugs. While less active in newer trials, GSK continues to explore broader applications in weight management and metabolic health.

Novo Nordisk leads the obesity clinical trials market with Wegovy (semaglutide) and Ozempic, both GLP-1 receptor agonists with strong clinical backing. The company is also investing in next-gen molecules and oral obesity treatments, cementing its position as a global frontrunner.

Pfizer has been working on oral GLP-1 receptor agonists, although some candidates were discontinued due to tolerability issues. The company is engaged in obesity and metabolic trials, seeking to introduce novel administration routes and combination therapies.

- Rhythm Pharmaceuticals, Inc.

Rhythm Pharmaceuticals focuses on rare genetic obesity disorders and developed Imcivree (setmelanotide), which is FDA-approved for specific conditions like POMC and LEPR deficiency. The company is conducting ongoing trials to expand the indication to broader obesity-related genetic mutations.

Roche has re-entered the obesity drug development space through acquisitions and partnerships, including rights to emerging candidates like Petrelintide. Its strategic focus includes combining obesity treatment with broader metabolic and cardiovascular health interventions.

Recent Developments

- In August 2025, Eli Lilly announced positive topline results from the Phase 3 ATTAIN-2 trial of orforglipron, an investigational oral GLP-1 receptor agonist for adults with obesity or overweight and type 2 diabetes. All three doses met the primary and key secondary endpoints, showing significant weight loss, A1C reductions, and improved cardiometabolic risk factors over 72 weeks. The 36 mg dose led to an average 10.5% weight loss (22.9 lbs) vs. 2.2% (5.1 lbs) with placebo. With ATTAIN-2 completed, Lilly is now positioned to begin global regulatory submissions for orforglipron.

- In September 2024, Terns Pharmaceuticals reported positive Phase 1 results for TERN-601, showing it was well tolerated and led to dose-dependent, significant weight loss in overweight or obese adults. In the 28-day study, the highest dose (740 mg QD) achieved a 4.9% placebo-adjusted mean weight loss (p<0.0001), with 67% of participants losing 5% or more of their baseline weight.

Segments Covered in the Report

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional Trials

- Observational Studies

- Expanded Access Trials

By Intervention/Therapy Type

- Pharmacological Treatments

- Surgical Interventions

- Behavioral Therapies

- Combination Therapies

By Sponsor

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Government Organizations

- Medical Device Companies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Global Obesity Clinical Trials Market Size (USD Billion), 2024–2034

- Global Market Share by Phase, 2024 & 2034

- Global Market Share by Study Design, 2024 & 2034

- Global Market Share by Intervention/Therapy Type, 2024 & 2034

- Global Market Share by Sponsor, 2024 & 2034

- Global Market Share by Region, 2024 & 2034

- North America Obesity Clinical Trials Market Size, by Country, 2024–2034

- U.S. Market Size, by Phase, 2024–2034

- Canada Market Size, by Phase, 2024–2034

- Mexico Market Size, by Phase, 2024–2034

- North America Market Size, by Study Design, 2024–2034

- North America Market Size, by Intervention/Therapy Type, 2024–2034

- Europe Obesity Clinical Trials Market Size, by Country, 2024–2034

- Germany Market Size, by Phase, 2024–2034

- France Market Size, by Phase, 2024–2034

- U.K. Market Size, by Phase, 2024–2034

- Italy Market Size, by Phase, 2024–2034

- Rest of Europe Market Size, by Phase, 2024–2034

- Asia Pacific Obesity Clinical Trials Market Size, by Country, 2024–2034

- China Market Size, by Phase, 2024–2034

- Japan Market Size, by Phase, 2024–2034

- South Korea Market Size, by Phase, 2024–2034

- India Market Size, by Phase, 2024–2034

- Southeast Asia Market Size, by Phase, 2024–2034

- Rest of Asia Pacific Market Size, by Phase, 2024–2034

- Latin America Obesity Clinical Trials Market Size, by Country, 2024–2034

- Brazil Market Size, by Phase, 2024–2034

- Rest of Latin America Market Size, by Phase, 2024–2034

- Middle East & Africa Obesity Clinical Trials Market Size, by Country, 2024–2034

- Turkey Market Size, by Phase, 2024–2034

- GCC Countries Market Size, by Phase, 2024–2034

- Africa Market Size, by Phase, 2024–2034

- Rest of MEA Market Size, by Phase, 2024–2034

- Global Obesity Clinical Trials Market Outlook, 2024–2034 (USD Billion)

- Global Market Share, by Phase, 2024

- Global Market Share, by Study Design, 2024

- Global Market Share, by Intervention/Therapy Type, 2024

- Global Market Share, by Sponsor, 2024

- Global Market Share, by Region, 2024

- North America Market Share, by Country, 2024

- U.S. Market Share, by Phase, 2024

- Europe Market Share, by Country, 2024

- Germany Market Share, by Phase, 2024

- Asia Pacific Market Share, by Country, 2024

- China Market Share, by Phase, 2024

- Latin America Market Share, by Country, 2024

- Brazil Market Share, by Phase, 2024

- Middle East & Africa Market Share, by Country, 2024

- GCC Countries Market Share, by Phase, 2024

- Comparative Growth Rate of Obesity Clinical Trials Market across Regions, 2024–2034