Piperacillin Sodium Market Size, Share, Growth, Report 2025 to 2034

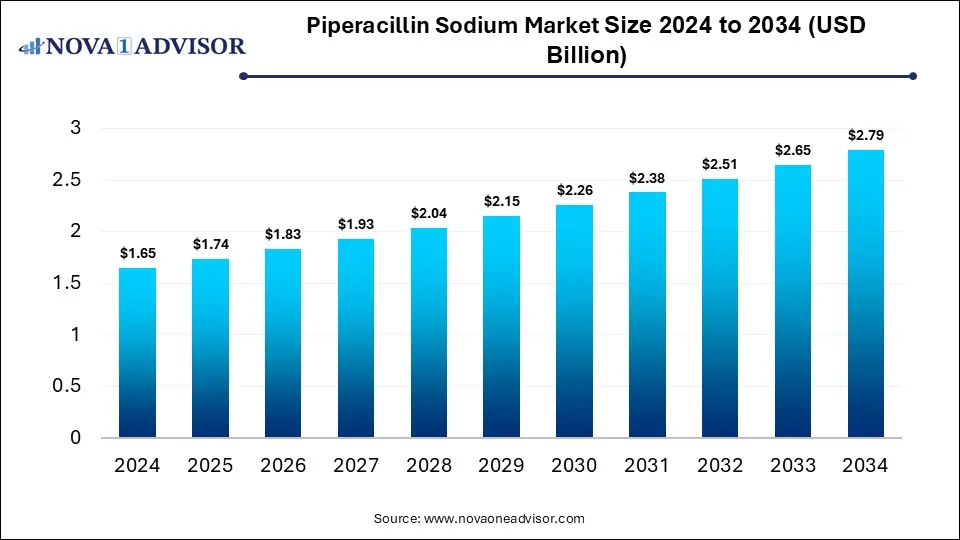

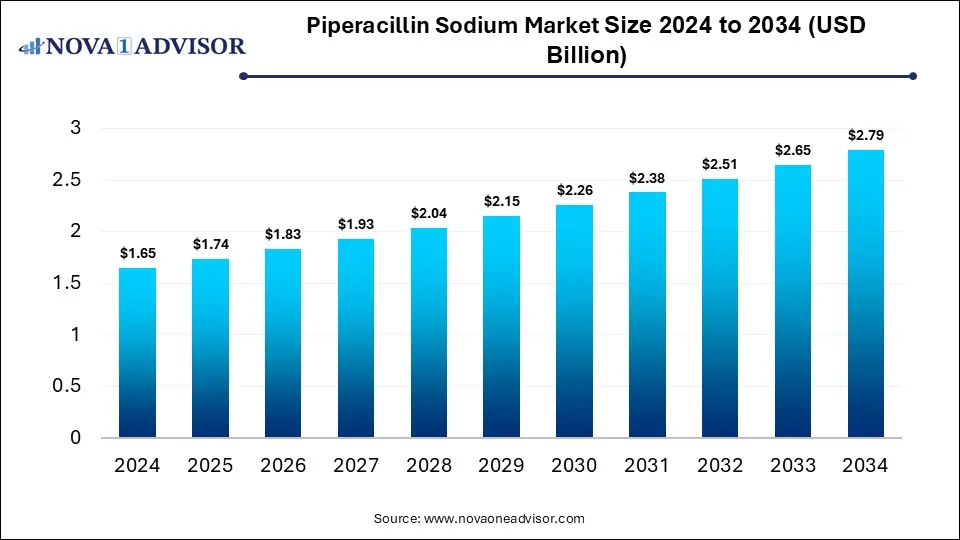

The global piperacillin sodium market size was estimated at USD 1.65 billion in 2024 and is expected to reach USD 2.79 billion by 2034, expanding at a CAGR of 5.4% during the forecast period of 2025 to 2034. The growth of the market is driven by rising incidences of bacterial infections, increasing surgical procedures, and growing demand for broad-spectrum antibiotics in hospital settings.

Piperacillin Sodium Market Key Takeaways

- By region, North America held the largest share of the piperacillin sodium market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By formulation type, the lyophilized powder segment dominated the market in 2024.

- By formulation type, the ready-to-use solutions segment is expected to grow at the fastest CAGR during the projection period.

- By application, the hospital-acquired infections segment led the market in 2024.

- By application, the intra-abdominal infections segment is expected to grow at a significant rate in the upcoming period.

- By distribution channel, the hospital pharmacies segment dominated the market in 2024.

- By distribution channel, the online pharmacies segment is likely to expand at the highest CAGR in the coming years.

- By end user, the hospitals segment contributed the largest market share in 2024.

- By end user, the CROs segment is expected to grow at a rapid pace over the forecast period.

How is AI Impacting the Piperacillin Sodium Market?

AI is significantly impacting the market by streamlining drug development, optimizing manufacturing processes, and enhancing supply chain management. Machine learning algorithms are being used to predict bacterial resistance patterns, enabling more targeted and effective use of piperacillin sodium, especially in combination therapies. In manufacturing, AI-driven systems help monitor quality control and predict equipment maintenance needs, reducing downtime and ensuring consistent product quality. Additionally, AI is aiding in demand forecasting and inventory optimization, helping manufacturers and distributors better manage supply in hospital and pharmacy settings. As antibiotic resistance continues to rise, AI is playing a crucial role in advancing antibiotic stewardship and accelerating research on drug efficacy.

Market Overview

The piperacillin sodium market refers to the global trade and production of a broad-spectrum β-lactam antibiotic widely used to treat serious bacterial infections, particularly in hospital settings. Piperacillin sodium is highly effective against Gram-negative and Gram-positive bacteria and is commonly used in combination with tazobactam to combat resistant infections such as pneumonia, sepsis, intra-abdominal infections, and urinary tract infections. Its advantages include rapid bactericidal activity, broad therapeutic coverage, and proven efficacy in treating hospital-acquired and surgical site infections. The market is experiencing significant growth due to the rising prevalence of antimicrobial-resistant infections, increasing hospital admissions, advancements in injectable formulations, and expanding healthcare infrastructure in emerging markets. Regulatory support from health bodies is also likely to boost the growth of the market.

- For instance, in January 2024, the FDA has completed its review of the Clinical and Laboratory Standards Institute's (CLSI) rationale document on "Piperacillin-Tazobactam Breakpoints for Pseudomonas aeruginosa." The updated breakpoints, published in the 33rd edition of CLSI M100 in 2023, aim to address concerns regarding the effectiveness of piperacillin-tazobactam against resistant strains of P. aeruginosa.

What are the Major Trends in the Piperacillin Sodium Market?

- Growing Preference for Ready-to-Use Injectable Forms: Hospitals are increasingly adopting ready-to-use (RTU) piperacillin sodium injections to save time, reduce preparation errors, and improve patient safety. This trend is driving innovation in formulation and packaging.

- Market Expansion in Emerging Economies: Countries in Asia Pacific, Latin America, and the Middle East are seeing rapid growth in piperacillin sodium demand, fueled by improving healthcare access, rising infection rates, and expanding hospital infrastructure.

- Focus on Antimicrobial Stewardship Programs: To combat antibiotic resistance, hospitals are implementing stewardship programs that encourage the appropriate and judicious use of broad-spectrum antibiotics like piperacillin sodium, especially in critical care units.

- Increase in Multidrug-Resistant Infections: The rise of multidrug-resistant (MDR) organisms is pushing the demand for powerful antibiotics like piperacillin sodium. Its broad-spectrum activity makes it a go-to treatment in ICU and emergency settings.

- Outsourcing and Contract Manufacturing Growth: Pharmaceutical companies are increasingly outsourcing piperacillin sodium production to contract manufacturing organizations (CMOs), especially in India and China, to reduce costs and meet global demand efficiently.

Report Scope of Piperacillin Sodium Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.74 Billion |

| Market Size by 2034 |

USD 2.79 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Formulation Type, By Application, By Distribution Channel, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Incidence of Hospital-Acquired Infections (HAIs)

The rising incidence of hospital-acquired infections (HAIs) is a major factor driving the growth of the piperacillin sodium market. These infections, often caused by drug-resistant pathogens, require potent broad-spectrum antibiotics like Piperacillin Sodium for effective treatment, especially in intensive care and post-surgical settings. Its proven efficacy against Gram-negative and Gram-positive bacteria makes it a preferred choice in managing conditions such as pneumonia, sepsis, and intra-abdominal infections. With increasing patient admissions, surgical procedures, and use of invasive devices, the demand for reliable antibiotics in hospitals continues to grow. This surge in HAI cases is prompting healthcare providers to stock essential injectable antibiotics, further boosting market growth.

- According to the World Health Organization (WHO), HAIs are among the most common adverse events in healthcare, affecting about 1 in 10 patients. Rates are often higher in low- and middle-income countries and among high-risk groups like ICU patients.

Increased Surgical Procedures and ICU Admissions

The rise in surgical procedures and ICU admissions is directly contributing to the growing demand for piperacillin sodium in healthcare settings. Post-operative and critically ill patients are at higher risk of developing serious infections, including hospital-acquired and opportunistic bacterial infections, which require broad-spectrum antibiotic treatment. Piperacillin sodium, often used in combination with tazobactam, is a preferred choice due to its strong efficacy against a wide range of pathogens commonly found in surgical and ICU environments. As healthcare systems handle more complex cases and aging populations, the need for effective, fast-acting intravenous antibiotics is increasing. This trend is driving hospitals to maintain adequate supplies of piperacillin sodium to manage infection risks and improve patient outcomes.

- Between 2018 and 2020, 12 EU countries and one EEA country reported 19,680 SSIs from over 1.25 million surgeries. SSI rates ranged from 0.6% in knee prosthesis to 9.5% in open colon surgery, with incidence density varying from 0.1 to 5.0 per 1,000 post-op patient-days, depending on the procedure.

Government Initiatives on Antimicrobial Stewardship

Government initiatives on antimicrobial stewardship are playing a key role in driving the growth of the piperacillin sodium market. These programs aim to ensure the appropriate use of antibiotics to combat rising antimicrobial resistance, leading to more targeted and regulated use of broad-spectrum agents like piperacillin sodium. Hospitals are increasingly adopting stewardship protocols that prioritize effective, evidence-based treatments, where piperacillin sodium, especially in combination with tazobactam, remains a recommended option for severe infections. As a result, demand for high-quality and guideline-compliant antibiotics is rising, supporting market growth while aligning with public health objectives.

Restraints

Rising Antimicrobial Resistance (AMR)

Rising antimicrobial resistance (AMR) is a significant factor restraining the growth of the market. As bacteria evolve to resist commonly used antibiotics, including broad-spectrum agents like piperacillin sodium, the drug’s effectiveness in treating infections diminishes. This leads to increased caution among prescribers and a shift toward alternative or newer antibiotics with better resistance profiles. Additionally, regulatory bodies and healthcare institutions are tightening antibiotic usage guidelines to prevent further resistance, which may limit the widespread use of piperacillin sodium. These factors collectively reduce the drug’s long-term utility and hamper market growth despite its current clinical relevance.

Stringent Regulatory Requirements

Stringent regulatory requirements pose a challenge to the growth of the piperacillin sodium market by increasing the complexity and cost of drug approval and manufacturing processes. Compliance with rigorous quality standards, safety evaluations, and clinical trial protocols can delay product launches and limit the entry of new manufacturers. These regulations also require ongoing monitoring and reporting, which adds to operational expenses and can deter smaller players from entering the market. Consequently, such regulatory hurdles can slow market expansion and restrict the availability of piperacillin sodium products.

Side Effects of Piperacillin Sodium Availability of Alternative Antibiotics

The side effects associated with piperacillin sodium, such as allergic reactions, gastrointestinal disturbances, and potential kidney toxicity, can limit its use among certain patient populations, restraining market growth. Additionally, the availability of alternative antibiotics with fewer side effects or broader antimicrobial spectra offers healthcare providers more options, reducing reliance on Piperacillin Sodium. These alternatives may also be preferred in cases where bacterial resistance to Piperacillin is suspected or confirmed. Together, concerns about adverse effects and competition from other antibiotics contribute to a more cautious approach in prescribing piperacillin sodium, affecting market growth.

Opportunities

Rising Demand and Development of Combination Therapies

The rising demand and development of combination therapies are creating significant growth opportunities in the piperacillin sodium market. Combining piperacillin sodium with β-lactamase inhibitors like tazobactam enhances its effectiveness against resistant bacterial strains, making it a preferred treatment for complex and hospital-acquired infections. This synergy improves patient outcomes and expands the drug’s clinical applications, driving higher adoption in healthcare settings. As antimicrobial resistance continues to rise, healthcare providers increasingly rely on such combination therapies to combat infections effectively. Consequently, ongoing innovation and demand for these therapies are fueling market growth and encouraging further research and product development.

- On April 9, 2025, B. Braun Medical Inc. announced FDA approval of Piperacillin and Tazobactam for use in its DUPLEX® Drug Delivery System, with a full launch forthcoming. This ready-to-activate, two-compartment container keeps medication and diluent separate until bedside reconstitution, simplifying administration. The system reduces process time by nearly four minutes per dose, offering significant labor savings compared to traditional compounding and other delivery systems.

Research into New Applications

Research into new applications of piperacillin sodium is opening up growth opportunities by expanding its potential uses beyond traditional bacterial infections. Ongoing studies are exploring its efficacy in treating emerging resistant strains and complex infections, which could broaden its clinical indications. This research also supports the development of novel formulations and delivery methods, enhancing its therapeutic value and patient compliance. As a result, new application areas increase market demand by attracting interest from healthcare providers seeking effective treatment options. This continued innovation positions piperacillin sodium as a versatile antibiotic with growing relevance in modern medicine.

Development of Novel Formulations

Another major opportunity for the growth of the piperacillin sodium market lies in the development of novel formulations of piperacillin sodium. Innovations such as ready-to-use injectable solutions and lyophilized powders simplify dosing and reduce preparation time, making the drug more convenient for healthcare providers. These advancements also enhance the drug’s shelf life and efficacy, addressing key challenges in hospital settings. As hospitals and clinics seek more efficient and safer antibiotic options, novel formulations of piperacillin sodium are gaining preference, thereby expanding the market.

What Macroeconomic Factors Impact the Piperacillin Sodium Market?

Gross Domestic Product (GDP) Growth

GDP growth positively impacts the growth of the market by increasing healthcare spending and improving access to advanced medical treatments. As economies expand, more resources are allocated to hospital infrastructure and pharmaceutical procurement, boosting demand for antibiotics like piperacillin sodium. Conversely, slower GDP growth can restrain market expansion by limiting healthcare budgets and reducing patient access to costly medications.

Inflation Rates

Inflation rates generally restrain the growth of the market by increasing the costs of raw materials, manufacturing, and distribution, which can lead to higher drug prices. Elevated prices may reduce affordability and limit access, especially in price-sensitive markets. However, moderate inflation coupled with economic growth may be manageable, but persistent high inflation poses a significant challenge to market expansion.

Currency Exchange Rates

Fluctuations in currency exchange rates can both drive and restrain the growth of the market depending on the direction of change. A strong local currency can reduce import costs for raw materials and finished products, making piperacillin sodium more affordable and boosting market growth. Conversely, a weak currency increases costs and can limit purchasing power, restraining market expansion, especially in countries reliant on imports.

Demographic Trends

Demographic trends, such as population growth, aging populations, and increasing urbanization, generally drive the growth of the market by increasing the prevalence of infections and the demand for healthcare services. Older adults and larger urban populations often require more medical interventions, including antibiotic treatments, which boosts market growth. However, demographic shifts alone may not be sufficient to sustain growth if not supported by adequate healthcare infrastructure and access.

Segment Outlook

Why Did the Lyophilized Powder Segment Dominate the Market in 2024?

The lyophilized powder segment dominated the piperacillin sodium market with a major revenue share in 2024. This is mainly due to its superior stability, extended shelf life, and ease of storage compared to liquid formulations. This form is widely preferred in hospital and clinical settings, where precise dosing and reconstitution flexibility are essential for treating severe infections. Additionally, lyophilized powder allows for easier transportation and reduced risk of contamination, making it suitable for large-scale supply chains and emergency use. Its compatibility with various combination therapies, particularly with tazobactam, further enhanced its demand in critical care environments.

The ready-to-use solutions segment is expected to grow at the fastest CAGR during the forecast period due to increasing demand for convenience, speed, and safety in drug administration. These pre-mixed formulations reduce preparation time, minimize dosing errors, and lower the risk of contamination, making them highly suitable for emergency and outpatient settings. As healthcare facilities seek to improve workflow efficiency and patient safety, the adoption of ready-to-use antibiotics is rising steadily. Additionally, the growing preference for ambulatory care and home-based treatments is further fueling demand for these easily administered solutions.

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Injectable Solutions |

0.50 |

0.51 |

0.54 |

0.56 |

0.58 |

0.60 |

0.62 |

0.65 |

0.67 |

0.70 |

0.73 |

| Lyophilized Powder |

1.02 |

1.06 |

1.09 |

1.13 |

1.16 |

1.20 |

1.24 |

1.28 |

1.32 |

1.36 |

1.40 |

| Ready-to-Use Solutions |

0.13 |

0.17 |

0.21 |

0.25 |

0.29 |

0.34 |

0.40 |

0.46 |

0.52 |

0.59 |

0.67 |

By Application

What Made Hospital-Acquired Infections the Leading Segment in the Piperacillin Sodium Market?

The hospital-acquired infections segment led the market while holding the largest share in 2024 due to the high prevalence of severe, resistant infections in clinical settings, such as ventilator-associated pneumonia, bloodstream infections, and surgical site infections. Piperacillin Sodium, often used in combination with tazobactam, is a preferred broad-spectrum antibiotic for treating these complex infections in hospitalized patients. The increasing burden of antimicrobial resistance (AMR) further drove demand for effective therapies like piperacillin sodium in intensive care units and emergency departments. Moreover, strict infection control protocols and the need for immediate, potent treatment options in hospitals contributed to the segment’s leading market share.

The intra-abdominal infections segment is expected to grow at a significant rate in the coming years, owing to the rising incidence of gastrointestinal surgeries, perforations, and complicated appendicitis cases. These infections often require broad-spectrum antibiotic coverage, making Piperacillin Sodium a preferred choice, especially in combination therapies. The increasing prevalence of antibiotic-resistant pathogens in abdominal infections has further highlighted the need for effective and reliable treatments. Additionally, advancements in diagnostic techniques and growing awareness among clinicians are driving early detection and prompt antibiotic intervention. This trend, combined with expanding healthcare access in emerging markets, is fueling the growth of this segment.

By Distribution Channel

What Made Hospital Pharmacies the Dominant Segment in the Market in 2024?

The hospital pharmacies segment dominated the piperacillin sodium market in 2024 due to the piperacillin sodium’s primary use in treating severe infections that require inpatient care and close medical supervision. Hospital pharmacies are the main distribution point for injectable antibiotics, especially for conditions like hospital-acquired infections and post-surgical complications. The need for immediate access to high-potency antibiotics in emergency and critical care units further reinforced their dominance. Additionally, strong procurement systems, adherence to treatment protocols, and availability of skilled healthcare professionals within hospital settings supported consistent demand. These factors made hospital pharmacies the leading channel for piperacillin sodium distribution.

The online pharmacies segment is likely to expand at the highest CAGR during the projection period. This is mainly due to the increasing shift toward digital healthcare and the convenience of home delivery services. As patients and healthcare providers seek faster and more accessible ways to obtain medications, especially for outpatient or follow-up care, online platforms are becoming a preferred option. Additionally, the expansion of telemedicine and e-prescription services has made it easier to order prescription antibiotics like Piperacillin Sodium online. Improved regulatory frameworks and growing trust in licensed e-pharmacies are also contributing to this trend. This digital transformation in healthcare is driving segmental growth.

By End User

How Does Hospitals Contribute the Largest Market Share in 2024?

The hospitals segment held the largest share of the piperacillin sodium market in 2024 due to the high demand for broad-spectrum antibiotics for treating severe and life-threatening infections within inpatient settings. Hospitals are the primary centers for managing conditions such as hospital-acquired infections, post-operative complications, and resistant bacterial infections, all of which often require intravenous antibiotic therapy like piperacillin sodium. The availability of advanced diagnostic tools and trained healthcare professionals ensures accurate administration and monitoring of such treatments. Additionally, the higher patient footfall and greater access to critical care services in hospitals further contributed to the segment’s leading position.

The CROs segment is expected to grow at a rapid pace in the upcoming period, owing to the increasing trend of outsourcing clinical trials and drug development activities by pharmaceutical companies. CROs offer specialized expertise, cost-efficiency, and faster turnaround times, making them ideal partners for conducting antibiotic research, including efficacy and safety studies for piperacillin sodium. As the demand for novel antibiotic combinations and resistance management strategies rises, CROs are playing a pivotal role in supporting regulatory submissions and large-scale clinical evaluations. Additionally, the growing focus on antibiotic stewardship and innovation is driving more collaborative research through CROs.

Regional Analysis

What Made North America the Dominant Region in the Piperacillin Sodium Market in 2024?

North America registered dominance in the piperacillin sodium market by capturing the largest share in 2024. This is primarily due to its advanced healthcare infrastructure, high prevalence of hospital-acquired infections, and strong demand for broad-spectrum antibiotics. The region benefits from well-established hospital networks, robust antibiotic stewardship programs, and widespread use of combination therapies like piperacillin-tazobactam. Additionally, the presence of leading pharmaceutical companies, ongoing clinical research, and favorable regulatory policies supported consistent market growth. High healthcare spending and early adoption of advanced treatment protocols further solidified North America's leading position in the global market.

The U.S. is the major contributor to the North America piperacillin sodium market due to its advanced healthcare infrastructure and strong demand for effective, broad-spectrum antibiotics. The country has a large number of tertiary care hospitals and critical care units where piperacillin sodium is frequently used to treat severe bacterial infections. Additionally, strong support for antibiotic research, presence of key pharmaceutical players, and high healthcare expenditure further fuel its market dominance. The widespread adoption of combination therapies, strict infection control protocols, and high infection rates in hospital settings also contribute to the high consumption of piperacillin sodium in the U.S.

- For instance, at any time, 1 in 31 hospital inpatients has a healthcare-associated infection, causing tens of thousands of deaths and costing the U.S. healthcare system billions annually.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to experience the fastest growth in the coming years due to increasing healthcare infrastructure development, rising prevalence of bacterial infections, and growing awareness of advanced antibiotic treatments. Rapid urbanization and expanding hospital networks in countries like China, India, and Southeast Asia are driving higher demand for broad-spectrum antibiotics. Additionally, improving access to healthcare services and increasing government initiatives to combat antimicrobial resistance are fueling market growth. The rising adoption of combination therapies and increased investments by pharmaceutical companies in the region further support market expansion.

China is the major contributor to the Asia Pacific piperacillin sodium market due to its large patient population, rapidly expanding healthcare infrastructure, and increasing prevalence of infectious diseases. The country’s significant investments in hospital modernization and rising number of surgical procedures drive the demand for broad-spectrum antibiotics like Piperacillin Sodium. Additionally, growing awareness about antimicrobial resistance and government initiatives to improve infection management are boosting the use of advanced antibiotic therapies. The presence of numerous pharmaceutical manufacturers and increasing access to healthcare in both urban and rural areas further support China’s leading position in the regional market.

India significantly contributes to the Asia Pacific piperacillin sodium market through its large and growing patient base, increasing prevalence of infections, and expanding healthcare infrastructure. Rising government focus on antimicrobial stewardship and infection control further supports market growth in India. Additionally, the country’s strong pharmaceutical manufacturing sector and ongoing regulatory improvements facilitate the development and availability of piperacillin sodium products.

- In June 2025, India's Central Drug Standard Control Organisation (CDSCO) advised Gufic Bioscience to submit additional scientific literature supporting their proposed fixed-dose combination (FDC) of Piperacillin, Tazobactam, and Sodium Chloride. The committee requested more peer-reviewed data to justify the waiver of bioequivalence and Phase III clinical trial requirements.

Region-Wise Breakdown of the Piperacillin Sodium Market

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 0.7 Bn |

5.79% |

Advanced healthcare infrastructure; high incidence of hospital acquired infections; strong antibiotic stewardship; presence of key pharma players, and rising R&D investments |

Regulatory hurdles; pressure to control antibiotic resistance and cost constraints; reimbursement issues; pricing pressures in mature markets |

Dominant region with steady growth |

| Asia Pacific |

USD 0.5 Bn |

6.5% |

Expanding healthcare infrastructure; rising incidence of infectious diseases; growth in hospital access & spending; increasing awareness of antimicrobial resistance; and growth in pharma manufacturing capacity |

Pricing pressures; infrastructure gaps in rural areas; regulatory variability; supply chain challenges; and affordability constraints in lower income countries |

Fastest-growing region |

| Europe |

USD 0.4 Bn |

9.63% |

Mature healthcare systems; strong focus on managing antibiotic resistance; good reimbursement; and high adoption of hospital protocols and newer formulations

|

Strict regulatory oversight; competition from generics and lower cost producers; and market saturation in some countries |

Stable growth, but less rapid than Asia Pacific |

| Latin America |

USD 0.1 Bn |

6.5% |

Rising healthcare expenditure; increasing hospital infrastructure; growing burden of infections; and expanding access in urban regions

|

Economic instability; reimbursement/purchase power limitations; limited regulatory harmonization; and distribution/logistics challenges |

Emerging region with moderate growth |

| MEA |

USD 0.1 Bn |

0.0% |

Growing burden of infectious diseases; improving healthcare access; government initiatives; investments in infrastructure in GCC countries; and rising awareness of antimicrobial resistance |

Lack of consistent regulatory frameworks; price sensitivity; supply chain/distribution gaps; and lower per capita healthcare spend in many African countries |

Considerable and steady growth prospects |

Piperacillin Sodium Market Value Chain Analysis

1. Raw Material Procurement

The value chain begins with the procurement of high-quality raw materials, primarily beta-lactam compounds and related chemical precursors needed for synthesizing piperacillin sodium. Suppliers must comply with Good Manufacturing Practices (GMP) and regulatory standards to ensure consistency, purity, and safety of materials, as any deviation can directly impact drug efficacy and patient safety.

2. Manufacturing & Formulation

At this stage, piperacillin sodium is chemically synthesized and then processed into different formulations such as lyophilized powder or ready-to-use solutions. Advanced manufacturing technologies and sterile environments are essential to maintain product integrity and meet regulatory compliance, particularly for injectable forms used in hospital settings.

3. Quality Control & Regulatory Compliance

Quality control is critical throughout the manufacturing process, with stringent testing for potency, sterility, stability, and absence of contaminants. Compliance with regional and international regulatory standards is essential for market approval and distribution, requiring robust documentation, bioequivalence data, and adherence to safety protocols.

4. Packaging & Labeling

Piperacillin sodium products are packaged in sterile vials or ampoules, with accurate and compliant labeling that includes dosage, storage instructions, and expiry dates. Packaging must also prevent contamination and ensure product stability during storage and transit, while incorporating tamper-proof or anti-counterfeit features for safety.

5. Distribution & Logistics

Efficient logistics and supply chain management are essential for timely delivery to hospitals, pharmacies, and wholesalers. In many cases, piperacillin sodium requires temperature-controlled transportation and storage, making cold chain infrastructure critical to preserve drug efficacy and meet regulatory standards during distribution.

6. Marketing & Sales

Marketing efforts typically involve clinical data dissemination, physician education, and hospital tendering processes. Companies often promote combination therapies (e.g., Piperacillin-Tazobactam) based on treatment efficacy, positioning the product for specific infections and resistance profiles in line with antibiotic stewardship programs.

7. End Use/Application

The final stage involves drug administration, primarily in hospitals for treating serious bacterial infections such as hospital-acquired pneumonia, intra-abdominal infections, and sepsis. Proper usage protocols, guided by antimicrobial stewardship and clinician training, are critical to ensure therapeutic effectiveness and minimize resistance development.

Key Players Operating in the Piperacillin Sodium Market

1. Pfizer Inc.

Pfizer is a major innovator, especially known for its branded combination therapy piperacillin/tazobactam (Zosyn), which commands significant share and trust in clinical settings. Its strong R&D, global distribution, and regulatory portfolio help set benchmarks for efficacy and quality in injectable antibiotic formulations.

2. Qilu Pharmaceutical

Qilu is a major supplier of highâ€purity piperacillin sodium API and formulations, particularly strong in the Chinese and emerging markets. Its strong production capacity and competitive pricing give it an advantage in volume and market reach.

3. Fresenius Kabi AG

Fresenius Kabi specializes in sterile injectable formulations, fulfilling hospital demand for ready to use and high quality Piperacillin injections. Its network of aseptic filling facilities and adherence to stringent quality and safety standards make it a trusted supplier in many regions.

4. Aurobindo Pharma Limited

Aurobindo is strong in generics and affordable versions of piperacillin sodium; its large manufacturing capacity helps meet high demand in both developed and emerging markets. It also supports market expansion through regulatory approvals in multiple countries.

5. Sandoz (Novartis division)

Sandoz leverages Novartis’s infrastructure to supply generic antibiotic APIs and finished dosage forms, often competing on volume and regulatory compliance. It plays a key role in ensuring access, especially in markets where cost is a critical factor.

6. NCPC (North China Pharmaceutical Group Corporation)

NCPC is a large integrated manufacturer in China with capabilities spanning chemical intermediates, APIs, and finished antibiotic products. Its scale and vertical integration help reduce costs and improve supply reliability for the local and export markets.

7. REYOUNG Group

REYOUNG is focused on specialty antibiotic APIs and high purity manufacturing, often supplying to formulators who demand strict quality and purity. It contributes by filling the niche between basic generics and highly specialized, higher margin injectable products.

8. Yuhan Corporation

Yuhan maintains a regional stronghold in East Asia, offering both API production and finished injectable products, often servicing local hospital demands. Its breadth of product offerings helps it cater both to generic markets and more premium hospitalâ€grade antibiotic supply needs.

9. Nectar Lifesciences

Nectar is known for contract API manufacturing as well as generic finished doses; it helps scale up antibiotic availability in cost sensitive markets. Its capability in compliance and regulatory filing enables it to serve customers in multiple geographies.

10. Rajasthan Antibiotics

Rajasthan Antibiotics is a key public and private sector player in India, supplying piperacillin sodium API and finished forms domestically and for export. It contributes to price competitiveness and accessibility in the Indian and neighboring markets.

11. Sterile India

Sterile India focuses on injectable and sterile drug formulations, important for maintaining safety, quality, and efficacy in hospital settings. By producing sterile forms of piperacillin sodium, it satisfies regulatory demands and hospital requirements for injectable therapy.

12. Suanfarma

Suanfarma is a European generics player that helps maintain competitive pricing and supply within Europe and to some export markets. Its presence encourages market accessibility and diversity in product sources.

Recent Development

- In April 2024, Baxter International Inc. announced the U.S. launch of ZOSYN (piperacillin and tazobactam) Injection, available in its proprietary single-dose Galaxy containers. ZOSYN premix is indicated for treating multiple infections caused by susceptible bacteria. This launch strengthens Baxter’s portfolio of essential anti-infective medications addressing critical healthcare needs.

Segments Covered in the Report

By Formulation Type

- Injectable Solutions

- Lyophilized Powder

- Ready-to-Use Solutions

By Application

- Community-Acquired Infections

- Hospital-Acquired Infections

- Intra-Abdominal Infections

- Skin and Soft Tissue Infections

- Urinary Tract Infections

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By End User

- Academic Research Institutions

- Contract Research Organizations

- Diagnostic Laboratories

- Hospitals

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

-

Table 1: U.S. Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 2: U.S. Piperacillin Sodium Market, by Application, 2024–2034

-

Table 3: U.S. Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 4: U.S. Piperacillin Sodium Market, by End User, 2024–2034

-

Table 5: Canada Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 6: Canada Piperacillin Sodium Market, by Application, 2024–2034

-

Table 7: Canada Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 8: Canada Piperacillin Sodium Market, by End User, 2024–2034

-

Table 9: Mexico Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 10: Mexico Piperacillin Sodium Market, by Application, 2024–2034

-

Table 11: Mexico Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 12: Mexico Piperacillin Sodium Market, by End User, 2024–2034

-

Table 13: Germany Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 14: Germany Piperacillin Sodium Market, by Application, 2024–2034

-

Table 15: Germany Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 16: Germany Piperacillin Sodium Market, by End User, 2024–2034

-

Table 17: France Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 18: France Piperacillin Sodium Market, by Application, 2024–2034

-

Table 19: France Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 20: France Piperacillin Sodium Market, by End User, 2024–2034

-

Table 21: UK Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 22: UK Piperacillin Sodium Market, by Application, 2024–2034

-

Table 23: UK Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 24: UK Piperacillin Sodium Market, by End User, 2024–2034

-

Table 25: Italy Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 26: Italy Piperacillin Sodium Market, by Application, 2024–2034

-

Table 27: Italy Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 28: Italy Piperacillin Sodium Market, by End User, 2024–2034

-

Table 29: Rest of Europe Piperacillin Sodium Market, by Segments, 2024–2034

-

Table 30: China Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 31: China Piperacillin Sodium Market, by Application, 2024–2034

-

Table 32: China Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 33: China Piperacillin Sodium Market, by End User, 2024–2034

-

Table 34: Japan Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 35: Japan Piperacillin Sodium Market, by Application, 2024–2034

-

Table 36: Japan Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 37: Japan Piperacillin Sodium Market, by End User, 2024–2034

-

Table 38: South Korea Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 39: South Korea Piperacillin Sodium Market, by Application, 2024–2034

-

Table 40: South Korea Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 41: South Korea Piperacillin Sodium Market, by End User, 2024–2034

-

Table 42: India Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 43: India Piperacillin Sodium Market, by Application, 2024–2034

-

Table 44: India Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 45: India Piperacillin Sodium Market, by End User, 2024–2034

-

Table 46: Southeast Asia Piperacillin Sodium Market, by Segments, 2024–2034

-

Table 47: Rest of Asia Pacific Piperacillin Sodium Market, by Segments, 2024–2034

-

Table 48: Brazil Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 49: Brazil Piperacillin Sodium Market, by Application, 2024–2034

-

Table 50: Brazil Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 51: Brazil Piperacillin Sodium Market, by End User, 2024–2034

-

Table 52: Rest of Latin America Piperacillin Sodium Market, by Segments, 2024–2034

-

Table 53: GCC Countries Piperacillin Sodium Market, by Formulation Type, 2024–2034

-

Table 54: GCC Countries Piperacillin Sodium Market, by Application, 2024–2034

-

Table 55: GCC Countries Piperacillin Sodium Market, by Distribution Channel, 2024–2034

-

Table 56: GCC Countries Piperacillin Sodium Market, by End User, 2024–2034

-

Table 57: Turkey Piperacillin Sodium Market, by Segments, 2024–2034

-

Table 58: Africa Piperacillin Sodium Market, by Segments, 2024–2034

-

Table 59: Rest of MEA Piperacillin Sodium Market, by Segments, 2024–2034

-

Figure 1: U.S. Piperacillin Sodium Market Share, by Formulation Type, 2024–2034

-

Figure 2: U.S. Piperacillin Sodium Market Share, by Application, 2024–2034

-

Figure 3: U.S. Piperacillin Sodium Market Share, by Distribution Channel, 2024–2034

-

Figure 4: U.S. Piperacillin Sodium Market Share, by End User, 2024–2034

-

Figure 5: Canada Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 6: Mexico Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 7: Germany Piperacillin Sodium Market Share, by Formulation Type, 2024–2034

-

Figure 8: France Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 9: UK Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 10: Italy Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 11: China Piperacillin Sodium Market Share, by Formulation Type, 2024–2034

-

Figure 12: Japan Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 13: South Korea Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 14: India Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 15: Brazil Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 16: GCC Countries Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 17: Turkey Piperacillin Sodium Market Share, by Segments, 2024–2034

-

Figure 18: Africa Piperacillin Sodium Market Share, by Segments, 2024–2034