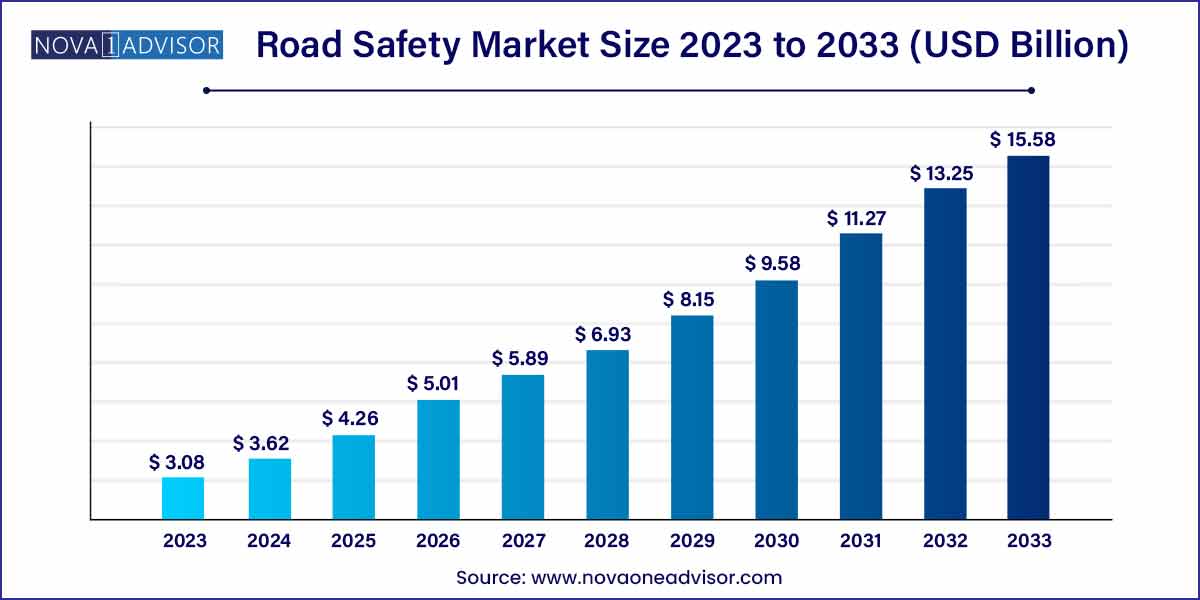

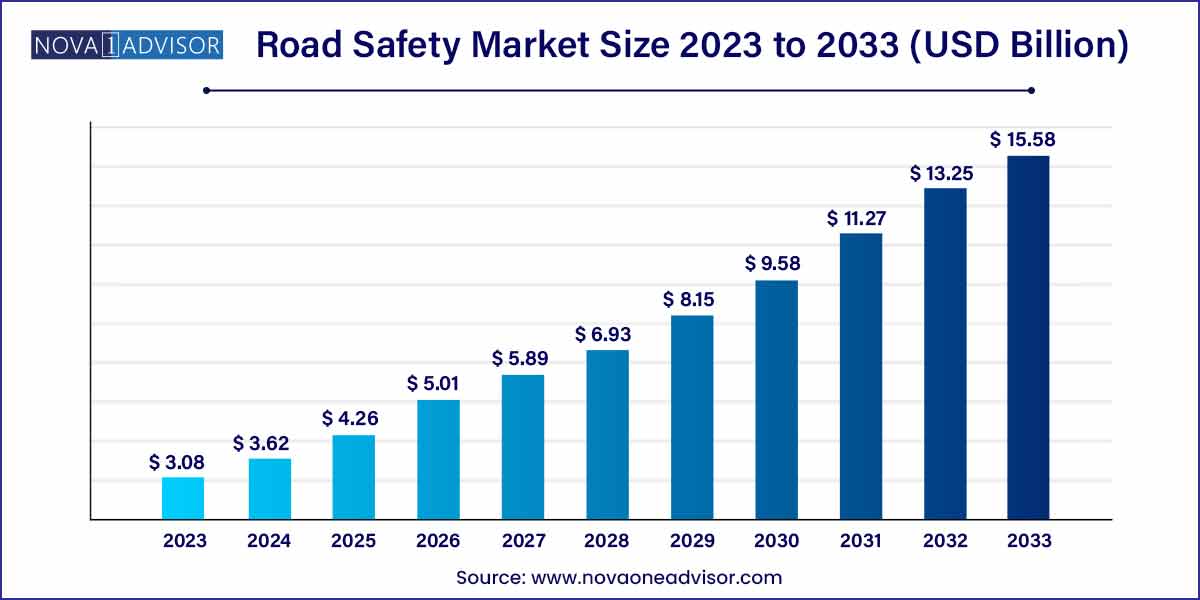

The global road safety market size was exhibited at USD 3.08 billion in 2023 and is projected to hit around USD 15.58 billion by 2033, growing at a CAGR of 17.6% during the forecast period of 2024 to 2033.

Key Takeaways:

- Europe held the major share of 28.0% of the target market in 2023.

- The professional service segment accounted for the largest market share of 81.0% in 2023.

- The red light & speed enforcement segment accounted for a market share of 56.19% in 2023.

Road Safety Market: Overview

The road safety market is a vital component in the broader effort to reduce traffic accidents, fatalities, and injuries globally. It encompasses a diverse range of technologies, services, and systems aimed at enhancing driver, pedestrian, and vehicle safety. Governments, transport authorities, and private stakeholders are increasingly investing in road safety solutions as part of smart city initiatives, regulatory mandates, and sustainability goals.

Rapid urbanization, growing vehicle density, and the rising number of road mishaps have amplified the need for effective road safety systems. Solutions such as red light and speed enforcement systems, automatic number plate recognition (ANPR/ALPR), and intelligent incident detection and response platforms are gaining widespread adoption. Simultaneously, the integration of IoT, AI, and data analytics into road safety infrastructure is transforming traditional reactive approaches into proactive, predictive safety strategies.

Road Safety Market Growth

The growth of the road safety market is propelled by various factors contributing to its expansion.Technological advancements, particularly in intelligent transportation systems and connected vehicle technologies, are revolutionizing road safety measures, enhancing accident prevention and traffic management capabilities. Furthermore, the increasing emphasis on data-driven insights is facilitating informed decision-making and targeted interventions to address road safety challenges effectively. Moreover, rising urbanization and smart city initiatives worldwide are driving the demand for innovative road safety solutions, creating lucrative opportunities for market players. Additionally, public-private partnerships (PPP) are playing a vital role in accelerating the deployment of advanced road safety technologies by leveraging complementary expertise and resources. These growth factors collectively contribute to the continuous evolution and expansion of the road safety market, fostering safer and more sustainable transportation systems globally

Road Safety Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.08 Billion |

| Market Size by 2033 |

USD 15.58 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 17.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Solution, Service, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

American Traffic Solutions (Verra Mobility); Conduent; Cubic Corporation; Dahua Technology; FLIR Services, Inc.; IDEMIA; Jenoptik; Kapsch TraficCom; Motorola Solutions; Redflex Holdings; Sensys Gatso Group AB; Siemens; Swarco; Teledyne FLIR; Vitronic. |

Road Safety Market Dynamics

- Technological Advancements Driving Innovation:

The road safety market is witnessing a significant transformation driven by rapid technological advancements. Intelligent transportation systems (ITS), encompassing technologies such as artificial intelligence, IoT, and advanced analytics, are revolutionizing the way road safety is approached. These innovative solutions offer real-time monitoring, predictive maintenance, and smart traffic management capabilities, enhancing overall transportation efficiency and safety. Additionally, the adoption of connected vehicle technologies, including vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, is reshaping road safety strategies by enabling proactive accident prevention and traffic management.

- Regulatory Frameworks and Policy Initiatives:

The road safety market dynamics are significantly influenced by regulatory frameworks and policy initiatives implemented by governments and regulatory bodies worldwide. Increasingly stringent regulations pertaining to vehicle safety standards, road infrastructure requirements, and driver behavior contribute to shaping the road safety landscape. These regulations often drive the adoption of advanced safety technologies and promote the integration of safety features in vehicles and infrastructure. Moreover, governments' emphasis on public awareness campaigns, education programs, and enforcement measures aimed at promoting responsible driving behaviors further underscores the importance of regulatory interventions in improving road safety.

Road Safety Market Restraint

- Infrastructure Limitations Hindering Implementation:

One of the significant restraints facing the road safety market is the presence of inadequate infrastructure, particularly in developing regions. Poorly designed roads, lack of signage, and insufficient lighting pose significant challenges to the effective implementation of road safety measures. These infrastructure limitations not only increase safety risks for road users but also hinder the deployment of advanced safety technologies and solutions. Furthermore, the lack of investment in upgrading and maintaining road infrastructure exacerbates safety concerns, limiting the effectiveness of road safety initiatives.

- Human Factors and Behavioral Challenges:

Despite technological advancements and regulatory interventions, human factors remain a persistent restraint in the road safety market. Human error, including speeding, distracted driving, and driving under the influence, continues to be a leading cause of road accidents globally. Changing entrenched behaviors and promoting responsible driving habits among road users present significant challenges for road safety stakeholders. Moreover, cultural differences, varying levels of awareness, and resistance to change further complicate efforts to address behavioral challenges. Overcoming these human factors requires multifaceted approaches that combine education, enforcement, and technological interventions to foster a culture of safety and responsibility on the roads.

Road Safety Market Opportunity

- Rising Demand for Integrated Solutions:

The road safety market presents a compelling opportunity for companies offering integrated solutions that encompass hardware, software, and services. As stakeholders increasingly seek comprehensive approaches to address road safety challenges, there is a growing demand for end-to-end solutions that combine multiple components seamlessly. Integrated solutions not only offer convenience and efficiency but also enable holistic management of road safety initiatives, from real-time monitoring and predictive analytics to proactive intervention strategies.

- Urbanization and Smart City Initiatives:

The global trend of rapid urbanization, coupled with the proliferation of smart city initiatives, presents lucrative opportunities for the road safety market. As urban populations grow and cities become more densely populated, there is an increasing need for innovative solutions to manage traffic congestion, enhance pedestrian safety, and reduce the risk of accidents. Governments and municipalities worldwide are investing in smart infrastructure and intelligent transportation systems to address these challenges and create safer, more efficient urban environments.

Road Safety Market Challenges

- Infrastructure Limitations:

A predominant challenge in the road safety market revolves around inadequate infrastructure, particularly prevalent in developing regions. Insufficient road design, absence of proper signage, and inadequate lighting significantly heighten safety risks for road users. Moreover, substandard road infrastructure impedes the effective deployment of advanced safety technologies and solutions. The lack of investment in upgrading and maintaining road infrastructure exacerbates safety concerns, hampering the efficacy of road safety initiatives.

- Human Factors and Behavioral Challenges:

Despite technological advancements and regulatory interventions, human factors remain a persistent challenge in the road safety market. Human errors, such as speeding, distracted driving, and driving under the influence, continue to be leading causes of road accidents globally. Modifying entrenched behaviors and promoting responsible driving habits among road users pose significant challenges for road safety stakeholders. Moreover, cultural disparities, varying levels of awareness, and resistance to change further complicate efforts to address behavioral challenges. Overcoming these human factors demands multifaceted approaches that blend education, enforcement, and technological interventions to foster a culture of safety and responsibility on the roads.

Segments Insights:

Service Insights

Professional services dominated the road safety services market, encompassing consulting, system integration, and training. The need for customized road safety strategies, site surveys, regulatory compliance consulting, and system deployment assistance places professional services at the forefront. Governments and private sector entities seek expertise in selecting, deploying, and optimizing the right mix of solutions for specific environments, ensuring maximum ROI.

On the other hand, managed services are the fastest-growing service category. With the growing complexity of road safety ecosystems, many organizations prefer outsourcing the operation, monitoring, maintenance, and continuous optimization of their road safety solutions to expert service providers. Managed services allow municipalities to access cutting-edge technology, skilled personnel, and real-time analytics without the burden of owning and managing infrastructure themselves.

Solution Insights

Red light and speed enforcement solutions dominated the road safety market in 2024, reflecting governments' prioritization of reducing dangerous driving behaviors. Automated enforcement technologies like speed cameras, red-light cameras, and average-speed enforcement systems have proven effective in reducing speeding and intersection-related accidents. Countries like Australia, the UK, and the UAE have rolled out extensive red-light and speed camera networks, achieving measurable declines in traffic fatalities.

Meanwhile, incident detection and response systems are the fastest-growing solution segment. The ability to monitor traffic conditions in real time and detect accidents, stalled vehicles, or hazardous conditions enables quicker emergency responses and congestion management. Innovations in AI-powered video analytics and sensor fusion technologies are enhancing the accuracy and speed of incident detection, encouraging broader adoption in smart cities and along high-risk highway corridors.

Regional Insights

Europe dominated the road safety market in 2023, owing to its strict regulatory frameworks, mature smart city initiatives, and early adoption of advanced road safety technologies. European countries like Sweden, the Netherlands, and Germany have implemented extensive speed enforcement systems, intelligent traffic management centers, and pedestrian safety enhancements. Initiatives such as the "EU Road Safety Policy Framework 2021-2030" and "Vision Zero" strategies continue to drive investments across the continent.

Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, rising vehicle ownership, and an urgent need to improve traffic safety in densely populated cities. Countries like China, India, and Indonesia are witnessing soaring investments in traffic management systems, surveillance infrastructure, and AI-powered enforcement solutions. Government programs such as India's "Safe City" initiative are supporting large-scale road safety projects, presenting lucrative opportunities for domestic and international market players.

Some of the prominent players in the road safety market include:

- American Traffic Solutions (Verra Mobility)

- Conduent

- Cubic Corporation

- Dahua Technology

- FLIR Services, Inc.

- IDEMIA

- Jenoptik

- Kapsch TraficCom

- Motorola Solutions

- Redflex Holdings

- Sensys Gatso Group AB

- Siemens

- Swarco

- Teledyne FLIR

- Vitronic

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global road safety market.

Solution

- Red Light & Speed Enforcement

- Incident Detection & Response

- Automatic Number/License Plate Recognition (ANPR/ALPR)

- Others

Service

- Professional Services

- Managed Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)