Sufentanil API Market Size, Share, Growth, Report 2025 to 2034

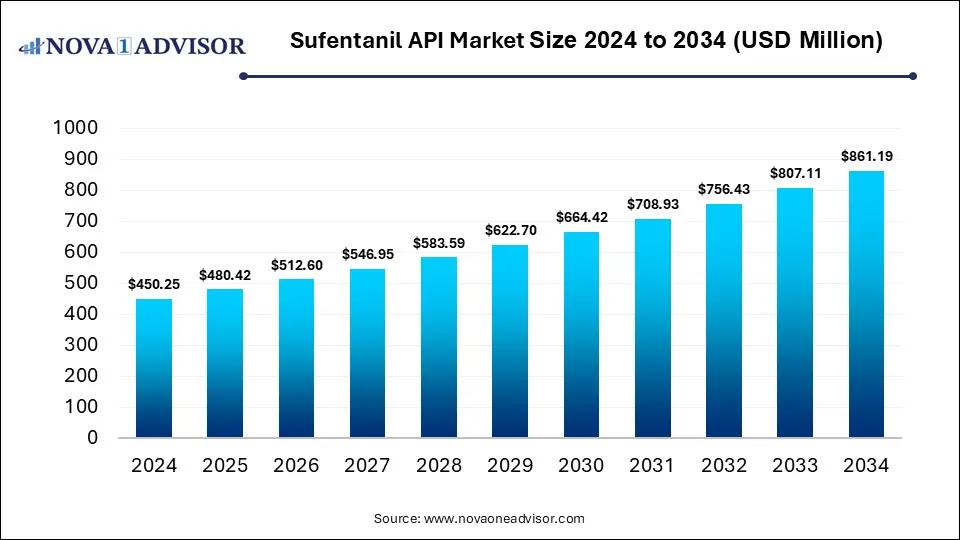

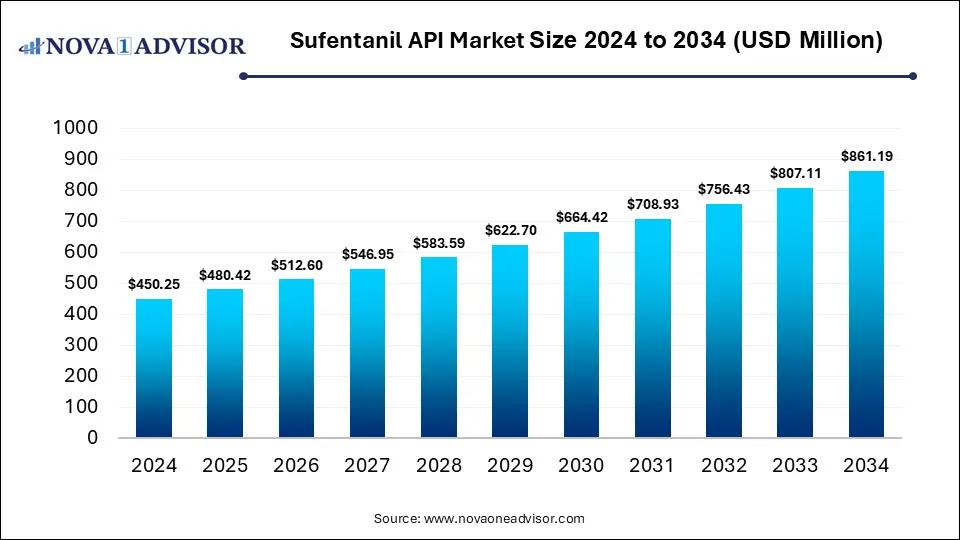

The global sufentanil API market size was estimated at USD 450.25 million in 2024 and is expected to reach USD 861.19 million in 2034, expanding at a CAGR of 6.7% during the forecast period of 2025 and 2034. The market growth is driven by rising surgical volumes, increasing prevalence of chronic pain and cancer, and ongoing innovation in drug delivery technologies.

Sufentanil API Market Key Takeaways

- By region, North America held the largest share of the sufentanil API market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By purity level, the purity 99% segment led the market in 2024.

- By purity level, the purity 98% segment is expected to expand at the highest CAGR over the projected timeframe.

- By application, the injection segment led the market in 2024.

- By application, the capsule segment is expected to expand at the highest CAGR over the projection period.

- By route of administration, the intravenous (IV)segment led the market in 2024.

- By formulation, the injectable solutions segment held the dominant share in 2024.

- By end user, the hospitals segment led the market in 2024.

- By distribution channel, the hospital pharmacies segment dominated the market with the largest share in 2024.

Impact of AI on the Sufentanil API Market

AI is increasingly reshaping the Sufentanil API market by optimizing synthesis and production processes, improving yield, and reducing impurities. AI driven retrosynthetic tools help identify efficient reaction pathways, lowering costs and enhancing scalability. Real time process monitoring powered by machine learning allows early detection of deviations, reducing batch failures and downtime. Furthermore, AI improves quality control by analyzing complex spectral data to spot subtle impurity peaks and ensure regulatory compliance. In pharmaceutical supply chains, AI is improving demand forecasting and inventory management, ensuring the timely availability of critical APIs like Sufentanil.

Market Overview

The rising number of surgical procedures, increasing demand for effective pain management solutions, and advancements in drug formulation technologies. Additionally, expanding healthcare infrastructure and an ageing population contribute to market growth. Sufentanil API refers to the active pharmaceutical ingredient of sufentanil, a very potent synthetic opioid analgesic used chiefly in anesthesia and severe pain management (especially in surgeries, ICU settings, and during critical care). It is the substance that provides the pharmacological effect and is formulated into injectables, sublingual/nasal/sometimes transdermal delivery forms. Known for being significantly more powerful than fentanyl, sufentanil offers advantages such as rapid onset, high efficacy in pain management, and lower dosage requirements, making it ideal for surgeries and critical care. Its application in both human and veterinary medicine further enhances its market relevance.

What are the Major Trends in the Sufentanil API Market?

- Rising Demand for Potent Analgesics

With the growing number of complex surgeries and chronic pain conditions, there is an increasing need for highly potent analgesics like sufentanil, which offer rapid and effective pain relief at lower dosages.

- Advancements in Drug Delivery Systems

New formulations such as sublingual tablets and transdermal systems are enhancing the efficacy and safety profile of sufentanil, improving patient compliance and expanding its use beyond traditional injectable forms.

- Expansion of Critical Care Infrastructure

The global expansion of ICUs, emergency care units, and surgical centers, especially in developing countries, is boosting the demand for strong opioids like sufentanil for pain management in critical settings.

- Increased Focus on Regulatory Compliance

Stricter global regulations around opioid manufacturing and distribution are pushing API manufacturers to adopt better quality control systems, documentation, and traceability technologies.

- Integration of AI and Automation in Manufacturing

Pharmaceutical companies are leveraging AI and automation to optimize the synthesis of sufentanil, reduce production costs, and maintain consistency in API purity and yield, driving operational efficiency.

Report Scope of Sufentanil API Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 480.42 Million |

| Market Size by 2034 |

USD 861.19 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 6.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Purity / Type, By Application / Use Case, By Route of Administration, By Formulation / Product Type, By End User, By Distribution Channel, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Growing Number of Surgeries

The growing volume of surgeries worldwide drives the growth of the sufentanil API market. Sufentanil, known for its rapid onset and high potency, is widely used in surgical procedures to manage pain and maintain patient sedation, particularly in complex or high-risk operations. As ageing populations and chronic disease prevalence grow, surgical interventions are becoming more frequent, especially in cardiovascular, orthopedic, and oncology fields. This surge in surgical volume directly boosts the need for reliable and effective APIs like sufentanil. Furthermore, the expansion of advanced surgical centers and critical care units worldwide supports sustained market demand.

- According to the American College of Surgeons, approximately 15 million Americans undergo surgery each year.

High Efficacy and Potency

The high efficacy and potency of sufentanil are key factors driving the growth of its API market, especially in medical settings requiring strong, fast-acting pain relief. Sufentanil is significantly more potent than fentanyl, allowing for effective analgesia at lower doses, which reduces the risk of side effects and improves patient outcomes. Its rapid onset and reliable performance make it a preferred choice in surgeries, intensive care units, and emergency procedures. These advantages make it highly valuable in critical care environments where precise and controlled pain management is essential. As healthcare providers continue to prioritize effective and efficient treatments, the demand for potent APIs like sufentanil is expected to grow.

Restraint

Stringent Regulatory Environment

The tight controls on production, distribution, and prescription of high-potency opioids significantly restrain the growth of the market. Due to its classification as a controlled substance, manufacturers must comply with complex regulatory frameworks, including strict licensing, security measures, and detailed record-keeping, which increase operational costs and limits flexibility. Regulatory scrutiny has intensified in response to the global opioid crisis, leading to tighter restrictions and reduced prescribing rates, even in legitimate medical settings. These hurdles can delay product approvals and discourage new market entrants, especially smaller manufacturers. As a result, despite high demand, regulatory barriers significantly slow market expansion.

Opportunities

Innovation in Drug Delivery Systems

Advances in drug delivery systems are enhancing the safety, efficiency, and convenience of administration. Advancements such as sublingual tablets, transdermal patches, and controlled-release formulations allow for more precise dosing and reduced risk of misuse, which is especially critical given sufentanil's high potency. These technologies not only improve patient compliance and outcomes but also expand the drug’s application beyond traditional hospital settings into ambulatory and outpatient care. Additionally, innovative delivery methods can help differentiate products in a competitive market, encouraging investment and development. As healthcare systems seek safer and more effective pain management options, these novel delivery platforms are driving renewed interest and growth in the sufentanil API market.

Expansion into Emerging Markets

As countries in the Asia-Pacific, Latin America, and parts of the Middle East invest in expanding surgical and critical care capabilities, the demand for potent anesthetics like sufentanil is rising. Additionally, growing healthcare spending, an increasing middle-class population, and a higher incidence of chronic illnesses are driving the need for effective pain management solutions in these regions. Regulatory environments in some emerging markets are also becoming more supportive, attracting pharmaceutical manufacturers seeking to expand their footprint. This combination of economic growth and healthcare modernization is positioning emerging markets as key drivers of future demand in the sufentanil API industry.

How Macroeconomic Variables Influence the Sufentanil API Market?

Economic Growth and GDP

Economic growth and rising GDP positively impact on the market by increasing healthcare spending and investment in advanced medical infrastructure. As economies expand, hospitals and surgical centers are better equipped to adopt high-potency analgesics like sufentanil for critical care and complex procedures. Additionally, improved public and private healthcare funding supports broader access to essential medications, further boosting demand for APIs such as sufentanil.

Inflation

It can negatively affect the market by increasing production costs and squeezing profit margins for manufacturers. Rising raw material, labor, and logistics costs make it more expensive to produce high-quality APIs, while regulatory and public scrutiny over opioid pricing limits the ability to pass these costs onto buyers. This financial strain can discourage investment and innovation in the market, particularly affecting smaller manufacturers and suppliers.

Exchange Rates

Exchange rate fluctuations can negatively affect manufacturers and buyers involved in international trade. A weak domestic currency increases the cost of importing raw materials or finished APIs, while unfavorable exchange rates can reduce profit margins for exporters. These financial uncertainties can disrupt supply chains, limit cross-border investments, and create pricing instability, ultimately slowing market expansion.

Segment Outlook

Purity Level Insights

Why Did the Purity 99% Segment Lead the Market in 2024?

The purity 99% segment led the sufentanil API market in 2024 due to its superior quality and consistency, which are critical for ensuring the drug's safety and efficacy in clinical applications. High-purity sufentanil allows for precise dosing with minimal impurities, reducing the risk of adverse effects and enhancing patient outcomes, especially in sensitive surgical and intensive care settings. Manufacturers and healthcare providers prefer this segment because it meets stringent regulatory standards and supports the production of injectable and other high-potency formulations. Additionally, the increasing demand for effective pain management solutions in hospitals worldwide further drives the preference for the 99% purity grade. This combination of clinical reliability and regulatory compliance solidifies its leading position in the market.

The purity 98% segment is expected to expand at the highest CAGR in the coming years. This is mainly due to its offering a cost-effective alternative for applications where ultra-high purity is not critically required. This segment caters to emerging markets and smaller healthcare facilities that prioritize affordability without compromising acceptable quality standards. Additionally, ongoing advancements in formulation and delivery technologies enabling effective use of slightly lower purity sufentanil in oral or capsule forms, broadening its application beyond traditional injections. As demand for flexible and accessible pain management options rises globally, especially in cost-sensitive regions, the 98% purity segment is poised for rapid expansion.

Application Insights

Why Did the Injection Segment Dominate the Sufentanil API Market in 2024?

The injection segment dominated the market with the largest share in 2024. This is mainly due to its widespread use in hospitals and surgical centers where rapid and precise pain management is crucial. Injectable sufentanil provides a fast onset of action and allows for controlled dosing, making it ideal for anesthesia during complex surgeries and critical care settings. This mode of administration is preferred by healthcare professionals for its reliability and effectiveness in managing acute pain. Furthermore, the extensive adoption of minimally invasive surgeries and increasing surgical volumes globally continue to drive demand for injectable formulations. The established clinical protocols and regulatory approvals for injections also reinforce this segment’s leading market position.

The capsule segment is expected to grow at the fastest CAGR during the projection period, owing to increasing demand for convenient, non-invasive drug delivery methods. Capsules offer greater ease of administration compared to injections, making them more suitable for outpatient settings and long-term pain management, especially in palliative care. As healthcare systems shift toward patient-centered care and home-based treatments, oral formulations like capsules are gaining popularity. Technological advancements in sustained release and targeted delivery are also enhancing the effectiveness and safety of oral sufentanil. Additionally, expanding access to pain management in emerging markets is fueling demand for more accessible and cost-effective dosage forms like capsules.

Route of Administration Insights

What Made Intravenous (IV) the Dominant Segment in the Market?

The intravenous (IV) segment dominated the sufentanil API market in 2024 and is expected to continue its upward trajectory over the projection period. This is due to its critical role in delivering rapid, controlled analgesia during surgeries and in intensive care units. IV administration allows for precise dosing and immediate onset of action, which is essential in acute pain management and anesthesia. Hospitals and surgical centers prefer IV formulations of sufentanil because of their reliability in high-risk or time-sensitive procedures. Additionally, well-established clinical protocols and regulatory approvals for IV use further reinforce its widespread adoption.

How Does the Injectable Solutions Segment Lead the Market in 2024?

The injectable solutions segment led the sufentanil API market in 2024 due to the widespread use in hospitals and surgical settings where immediate and reliable pain relief is essential. These formulations are preferred for their fast onset of action, precise dosing, and ease of administration during surgeries, intensive care, and trauma management. Injectable solutions are also favored by healthcare professionals because they are compatible with existing intravenous delivery systems and align with established clinical protocols. Their dominance is further reinforced by regulatory approvals and their role as the standard of care in acute pain treatment. As a result, injectable solutions remain the most utilized and trusted formulation type for sufentanil.

The capsule segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the rising demand for non-invasive and patient-friendly pain management options. As healthcare shifts toward outpatient care and home-based treatment, capsules offer greater convenience and compliance, especially for chronic or palliative care patients. Advances in controlled-release and oral delivery technologies are making it safer and more effective to administer potent opioids like sufentanil in capsule form. Additionally, expanding access to pain relief medications in emerging markets is driving demand for more affordable and easy-to-use formulations. This shift in treatment settings and patient preferences positions the capsule segment for rapid growth.

End User Insights

Why Did the Hospital Segment Lead the Market in 2024?

The hospital segment led the sufentanil API market in 2024 due to its central role in conducting high-risk surgeries, trauma care, and intensive pain management, where potent opioids like sufentanil are essential. Hospitals have the infrastructure, trained personnel, and regulatory clearance required to safely administer and monitor such high-potency drugs. sufentanil’s rapid onset and high efficacy make it the preferred choice for use in operating rooms, ICUs, and emergency departments. Additionally, the growing number of surgical procedures and critically ill patients globally continues to drive demand within hospital settings. This consistent, high-volume usage firmly establishes hospitals as the primary end-users in the market.

The ambulatory surgical centers (ASCs) segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the rising shift toward outpatient surgeries that require efficient, short-acting anesthesia. ASCs offer cost-effective, high-quality surgical care with quicker patient turnover, making fast-acting opioids like sufentanil ideal for use in these settings. The growing number of minimally invasive procedures and increasing demand for pain management in same-day surgeries are further accelerating the use of sufentanil in ASCs. Additionally, advancements in healthcare infrastructure and reimbursement policies are supporting the expansion of ASCs, especially in developed and emerging markets. This trend positions ASCs as a high-growth segment for sufentanil demand.

Distribution Channel Insights.

Why Did the Hospital Pharmacies Segment Lead the Market in 2024?

The hospital pharmacies segment led the sufentanil API market in 2024 because they serve as the primary distribution point for controlled substances used in surgical, emergency, and intensive care settings. Given sufentanil’s high potency and regulatory restrictions, its administration is tightly monitored and typically confined to hospital environments where pharmacy departments manage secure storage and dispensing. Hospital pharmacies ensure compliance with stringent handling protocols while supporting real-time demand for injectable formulations during surgeries and critical care. Their integration within clinical workflows allows for immediate availability and accurate dosing, which is crucial for effective pain management. This centralized and controlled distribution system makes hospital pharmacies the leading channel in the sufentanil API market.

The online pharmacies segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing digitalization of healthcare and the growing acceptance of e-pharmacy platforms. As telemedicine expands and home-based care becomes more common, demand for convenient, discreet, and timely access to prescription medications, including pain management therapies, is rising. In regions where regulations allow, online pharmacies offer easier access to finished sufentanil formulations for patients with chronic or palliative care needs. Additionally, advancements in secure e-prescriptions and controlled substance monitoring systems are making online distribution more feasible and compliant.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the sufentanil API market while holding the largest share in 2024. The region’s dominance is primarily attributed to the advanced healthcare infrastructure and high volume of surgical procedures requiring potent analgesics. The presence of well-established regulatory frameworks ensures the safe and effective use of sufentanil, particularly in hospitals and ambulatory surgical centers. Additionally, significant healthcare spending, widespread adoption of innovative drug delivery systems, and increasing prevalence of chronic pain and critical care cases drive strong demand. The U.S., being a major market player, contributes heavily through extensive research, development, and manufacturing capabilities.

The U.S. is a major contributor to the North American sufentanil API market due to the large and advanced healthcare system. High surgical volumes, extensive use of anesthesia in hospitals, and strong research and development activities fuel demand for sufentanil. Additionally, favorable reimbursement policies and well-established regulatory frameworks support market growth. The country’s leadership in pharmaceutical manufacturing and innovation further strengthens its dominant position in the region.

- Dsuvia (formerly Zalviso) was developed by AcelRx Pharmaceuticals in collaboration with the U.S. Department of Defense to address the need for a rapid-acting, non-invasive analgesic for acute pain in medically supervised settings, such as hospitals and military combat zones. The sublingual formulation offers advantages over intravenous opioids, which require IV access and continuous monitoring, making them impractical in many situations.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for sufentanil API. This is due to the rapidly expanding healthcare infrastructure and increasing access to advanced surgical procedures across emerging economies like China and India. Rising awareness of effective pain management, growing prevalence of chronic diseases, and an expanding middle-class population are driving demand for potent analgesics such as sufentanil. Additionally, government initiatives to improve healthcare facilities and rising medical tourism contribute to market expansion. The region’s cost advantages in manufacturing and increasing investments by global pharmaceutical companies also support faster market growth compared to mature regions.

China is a major player in the Asia Pacific sufentanil API market due to its rapidly growing healthcare sector and increasing number of surgical procedures. The country’s large population and rising prevalence of chronic and acute pain conditions create strong demand for effective analgesics. Additionally, significant government investments in healthcare infrastructure and reforms aimed at improving access to advanced medications further boost the market. China’s expanding pharmaceutical manufacturing capabilities also play a key role in driving its leadership position in the region.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR (2025–2034) |

Growth Drivers |

Restraints |

Growth Overview |

| North America |

USD 187.3 Million |

5.87% |

Advanced healthcare infrastructure, high surgical volumes, and strong regulatory frameworks |

Regulatory constraints, opioid abuse concerns |

Dominated by the U.S. and Canada, with extensive use in hospitals and surgical centers. The region benefits from high demand for injectable formulations and ongoing regulatory support for novel opioid alternatives. |

| Asia Pacific |

USD 131.5 Million |

7.04% |

Rising surgical procedures, expanding healthcare access, and government-backed manufacturing |

Regulatory challenges, varying healthcare standards |

China leads with over 38% of regional consumption, driven by large surgical volumes and local API production initiatives. India and Japan are also significant contributors, with India emerging as a key supplier of high-purity sufentanil APIs. |

| Europe |

USD 105.1 Million |

9.94% |

Hospital-based anaesthesia programs, expanding day-care surgeries, and a strong pharmaceutical industry |

Economic constraints, regulatory complexities |

Countries like Germany, France, and Italy are key markets, with increasing adoption in day-care surgeries and hospital settings. The region benefits from a well-established pharmaceutical industry and regulatory support for pain management therapies. |

| Latin America |

USD 36.3 Million |

4.71% |

Regulatory reform, hospital expansion, and increasing adoption in urban hospital networks |

Limited healthcare infrastructure in rural areas, economic disparities |

Brazil and Argentina are leading markets, with Brazil seeing increased adoption of injectable sufentanil in large urban hospital networks. Argentina is emerging as a key player in pharmaceutical formulation, with contract manufacturing facilities upgrading to meet export-grade standards. |

| Middle East & Africa |

USD 23.1 Million |

3.38% |

Public health investments, rising demand in trauma and emergency care, and logistics connectivity |

Political instability, limited healthcare access in certain regions |

The UAE, Saudi Arabia, and South Africa are key markets, with the UAE positioning itself as a regional hub for specialty pharmaceuticals. South Africa is experiencing increased demand due to rising trauma and emergency care cases. |

Sufentanil API Market Value Chain Analysis

- Upstream (Raw Materials & Intermediates)

This stage includes sourcing and supplying key chemical starting materials, reagents, and intermediate compounds required to synthesize sufentanil. Because sufentanil is a potent opioid, purity of intermediates and solvents is critical, plus supply-chain reliability matters due to regulatory scrutiny and quality control.

- Midstream (API Synthesis and Manufacture)

This is where the actual chemical synthesis, purification, crystallization, and conversion into active pharmaceutical ingredient (API) takes place. Facilities here must ensure high yields, strict control of impurities (especially genotoxic, residual solvents), meet Good Manufacturing Practices (GMP) standards, and may also incorporate innovations like continuous flow chemistry or AI assisted optimization.

- Quality Control & Regulatory Compliance

Although sometimes folded into midstream, this stage is significant in its own right: testing for purity, stability, residual solvents, analytical validation, and ensuring compliance with regulatory authorities (FDA, EMA, etc.). Delays or failures here can affect the rest of the chain, so robust QC and regulatory teams are essential.

- Downstream (Formulation & Delivery, Distributors, Hospitals/Clinics)

Once the API is manufactured and approved, it gets converted/formulated (e.g. injectable solutions, capsules, sublingual forms), packaged, distributed via wholesalers/traders, then finally used by hospitals, surgical centers, specialty clinics, emergency settings, etc. The downstream stage determines market uptake, influenced by factors like cost, delivery method convenience, safety, and brand/trust in supply.

Sufentanil API Market Companies

Johnson Matthey Fine Chemicals

Johnson Matthey has expanded its controlled substances production capacity, ensuring supply security and high-purity APIs that meet stringent GMP standards.

They also partner with hospital networks to align their API production with regulatory requirements and clinical demand for high-potency analgesics.

Cambrex Corporation

Cambrex has increased its manufacturing scale for opioid APIs like sufentanil, investing in facility expansions (especially in Europe) to support global demand.

They also focus on enhancing regulatory compliance and offering clients downstream formulation capabilities, which helps reduce time to market for hospitals and pharmaceutical customers.

Mallinckrodt Pharmaceuticals

Mallinckrodt is leveraging its long legacy in pain management to develop advanced sufentanil delivery systems (e.g., resistant injectables) that address abuse concerns while maintaining efficacy.

They also prioritize strong quality assurance and regulatory alignment, being among the leaders in meeting global standards, which helps reassure institutional buyers.

Janssen Pharmaceuticals (Johnson & Johnson)

Janssen invests in innovation for both formulations (e.g. sublingual or nasal) and supportive technologies such as dosage monitoring platforms to improve patient safety and compliance.

Their global reach and established regulatory track record allows them to be early movers in markets with strictly controlled substance requirements.

Hameln RDS

Hameln RDS is noted for developing pre-filled injectable versions of sufentanil for controlled hospital distribution, which helps reduce risks in handling and dosing.

They also focus heavily on regulatory compliance across distribution and manufacturing, contributing to improved safety profiles in the market.

Kern Pharma

Kern Pharma is known for its reliable production of high sufentanil API and adherence to EU GMP standards, helping supply sufentanil API to regulated markets.

They also appear in business intelligence reports as a growing player with strong R&D and the ability to respond to emerging demand for lower cost APIs in purity 98% segments.

Cristalia

Cristalia contributes through regional manufacturing strength in Latin America, filling demand, especially where local or regional sourcing is valued.

They maintain competitive positioning via product quality and regulatory certifications, helping meet export requirements and serving both domestic and neighboring markets.

Recent Development

- In March 2023, AcelRx announced the divestment of DSUVIA to Alora, while retaining royalty rights (15% on commercial sales, 75% on Department of Defence sales). Dsuvia is a 30 µg sublingual sufentanil tablet indicated for adults in certified, medically supervised settings (e.g. hospitals, surgical centers, emergency departments) to treat acute pain that is severe enough to require an opioid and for which other options are inadequate.

Segments Covered in the Report

By Purity / Type

By Application / Use Case

By Route of Administration

- Intravenous (IV)

- Subcutaneous (SC)

- Epidural

- Transdermal

- Inhalational

By Formulation / Product Type

- Powder

- Liquid

- Injectable Solutions

- Pre-filled Syringes or Depot injections

- Capsules/Tablets

By End User

- Hospitals

- Ambulatory Surgical Centres (ASCs)

- Clinics / Pain Management Clinics

- Nursing Facilities / Long Term Care

- Pharmaceutical Companies

- Home Care

By Distribution Channel

- Direct Sales

- Distributors / Wholesalers

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Table 1: Global Sufentanil API Market Size (USD Million) by Purity / Type, 2024–2034

- Table 2: Global Sufentanil API Market Size (USD Million) by Application / Use Case, 2024–2034

- Table 3: Global Sufentanil API Market Size (USD Million) by Route of Administration, 2024–2034

- Table 4: Global Sufentanil API Market Size (USD Million) by Formulation / Product Type, 2024–2034

- Table 5: Global Sufentanil API Market Size (USD Million) by End User, 2024–2034

- Table 6: Global Sufentanil API Market Size (USD Million) by Distribution Channel, 2024–2034

- Table 7: North America Market Size (USD Million) by Purity / Type, 2024–2034

- Table 8: North America Market Size (USD Million) by Application / Use Case, 2024–2034

- Table 9: North America Market Size (USD Million) by Route of Administration, 2024–2034

- Table 10: North America Market Size (USD Million) by Formulation / Product Type, 2024–2034

- Table 11: North America Market Size (USD Million) by End User, 2024–2034

- Table 12: North America Market Size (USD Million) by Distribution Channel, 2024–2034

- Table 13: U.S. Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 14: Canada Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 15: Mexico Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 16: Europe Market Size (USD Million) by Purity / Type, 2024–2034

- Table 17: Europe Market Size (USD Million) by Application / Use Case, 2024–2034

- Table 18: Germany Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 19: France Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 20: UK Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 21: Italy Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 22: Asia Pacific Market Size (USD Million) by Purity / Type, 2024–2034

- Table 23: Asia Pacific Market Size (USD Million) by Application / Use Case, 2024–2034

- Table 24: China Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 25: Japan Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 26: India Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 27: South Korea Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 28: Southeast Asia Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 29: Latin America Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 30: Brazil Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 31: Middle East & Africa Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 32: GCC Countries Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 33: Turkey Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 34: Africa Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Figure 1: Global Market Share by Purity / Type, 2024

- Figure 2: Global Market Share by Application / Use Case, 2024

- Figure 3: Global Market Share by Route of Administration, 2024

- Figure 4: Global Market Share by Formulation / Product Type, 2024

- Figure 5: Global Market Share by End User, 2024

- Figure 6: Global Market Share by Distribution Channel, 2024

- Figure 7: North America Market Share by Purity / Type, 2024

- Figure 8: North America Market Share by Application / Use Case, 2024

- Figure 9: North America Market Share by Route of Administration, 2024

- Figure 10: North America Market Share by Formulation / Product Type, 2024

- Figure 11: North America Market Share by End User, 2024

- Figure 12: North America Market Share by Distribution Channel, 2024

- Figure 13: U.S. Market Share by Purity / Type, 2024

- Figure 14: U.S. Market Share by Application / Use Case, 2024

- Figure 15: Canada Market Share by Purity / Type, 2024

- Figure 16: Canada Market Share by Application / Use Case, 2024

- Figure 17: Mexico Market Share by Purity / Type, 2024

- Figure 18: Mexico Market Share by Application / Use Case, 2024

- Figure 19: Europe Market Share by Purity / Type, 2024

- Figure 20: Europe Market Share by Application / Use Case, 2024

- Figure 21: Germany Market Share by Purity / Type, 2024

- Figure 22: Germany Market Share by Application / Use Case, 2024

- Figure 23: France Market Share by Purity / Type, 2024

- Figure 24: France Market Share by Application / Use Case, 2024

- Figure 25: UK Market Share by Purity / Type, 2024

- Figure 26: UK Market Share by Application / Use Case, 2024

- Figure 27: Italy Market Share by Purity / Type, 2024

- Figure 28: Italy Market Share by Application / Use Case, 2024

- Figure 29: Asia Pacific Market Share by Purity / Type, 2024

- Figure 30: Asia Pacific Market Share by Application / Use Case, 2024

- Figure 31: China Market Share by Purity / Type, 2024

- Figure 32: China Market Share by Application / Use Case, 2024

- Figure 33: Japan Market Share by Purity / Type, 2024

- Figure 34: Japan Market Share by Application / Use Case, 2024

- Figure 35: India Market Share by Purity / Type, 2024

- Figure 36: India Market Share by Application / Use Case, 2024

- Figure 37: South Korea Market Share by Purity / Type, 2024

- Figure 38: South Korea Market Share by Application / Use Case, 2024

- Figure 39: Southeast Asia Market Share by Purity / Type, 2024

- Figure 40: Southeast Asia Market Share by Application / Use Case, 2024

- Figure 41: Latin America Market Share by Purity / Type, 2024

- Figure 42: Latin America Market Share by Application / Use Case, 2024

- Figure 43: Brazil Market Share by Purity / Type, 2024

- Figure 44: Brazil Market Share by Application / Use Case, 2024

- Figure 45: Middle East & Africa Market Share by Purity / Type, 2024

- Figure 46: Middle East & Africa Market Share by Application / Use Case, 2024

- Figure 47: GCC Countries Market Share by Purity / Type, 2024

- Figure 48: GCC Countries Market Share by Application / Use Case, 2024

- Figure 49: Turkey Market Share by Purity / Type, 2024

- Figure 50: Turkey Market Share by Application / Use Case, 2024

- Figure 51: Africa Market Share by Purity / Type, 2024

- Figure 52: Africa Market Share by Application / Use Case, 2024