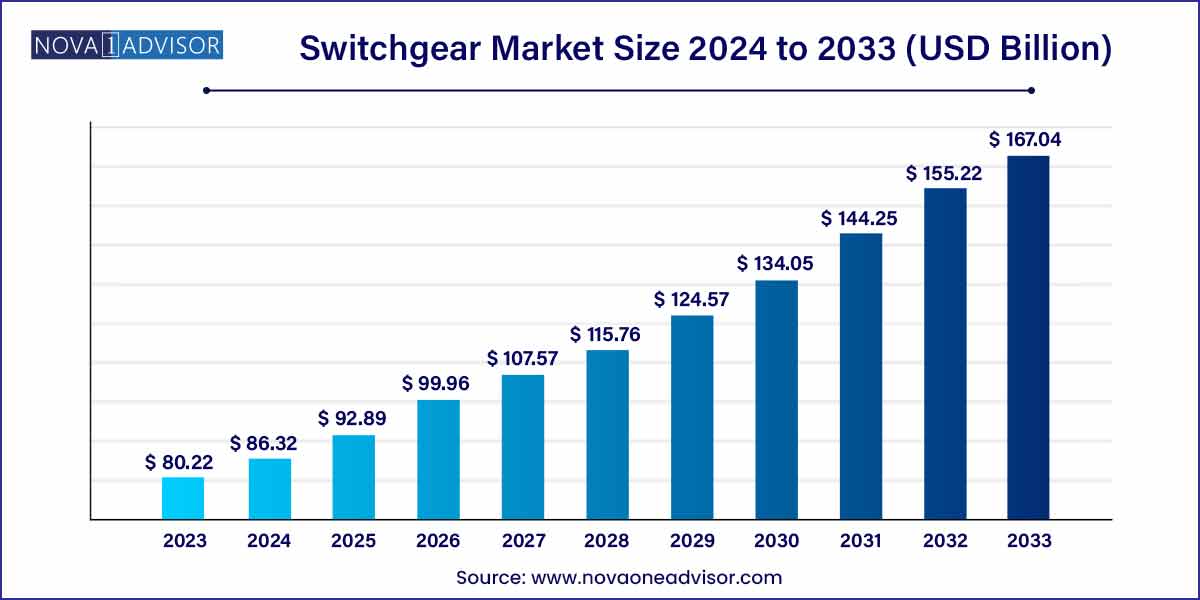

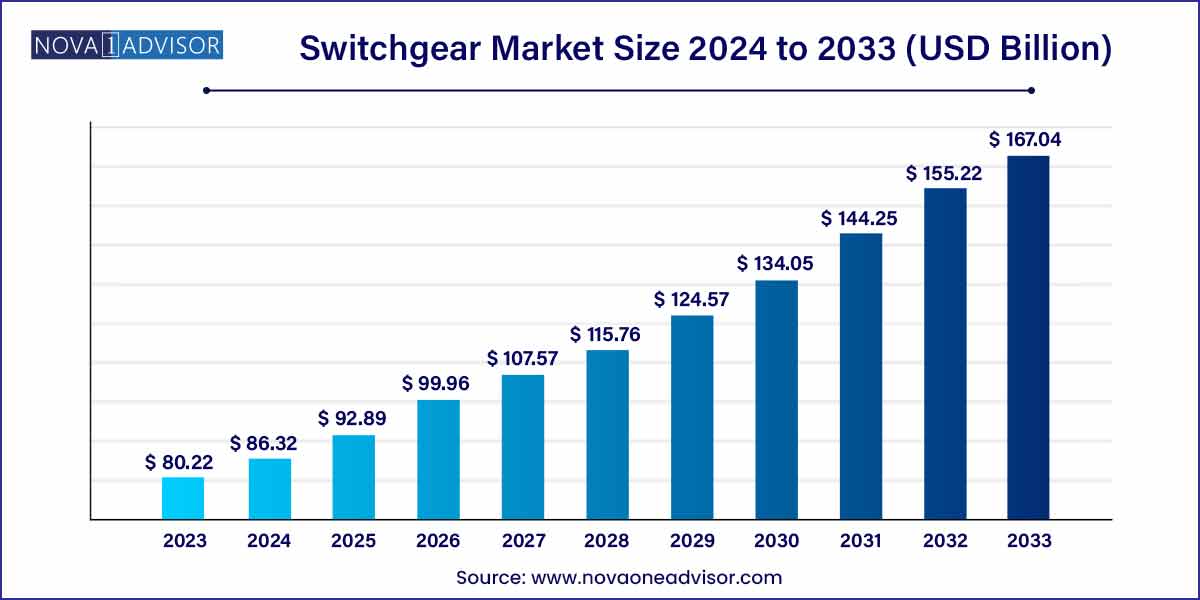

The global switchgear market size was exhibited at USD 80.22 billion in 2023 and is projected to hit around USD 167.04 billion by 2033, growing at a CAGR of 7.61% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific led the global market with the highest market share in 2023.

- The Europe region is estimated to expand the fastest CAGR between 2023 and 2032.

- By voltage, the medium and high voltage segments will hold the largest market share in 2023.

- Insulation, the air insulation segment, captured the biggest revenue share in 2023.

- By installation, the outdoor segment is estimated to hold the highest market share in 2023.

- By end user, the transmission & distribution segment registered the maximum market share in 2023.

Switchgear Market: Overview

The switchgear market plays a pivotal role in ensuring the efficient and reliable operation of electrical power systems by controlling, protecting, and isolating electrical equipment. This overview aims to provide insights into the current state of the switchgear market, key trends driving its growth, and the industry outlook for stakeholders.

Switchgear Market Growth

The growing investments in the replacement of old power infrastructure and rising focus on the renewable energy are the most prominent factors that are expected to drive the market growth during the forecast period. The government initiatives and subsidies play a crucial role in the market growth. The government has established certain standards for the distributors that make the distributors to provide continuous and convenient electricity to the end consumers. The distributors receive incentives based on their performances. Such government schemes in various countries are expected to drive the growth of the global switchgear market in the forthcoming years. The rapid electrification of the rural areas and the continuously rising need for electricity in remote areas has fueled electricity generation, which in turn fosters the demand for the electrical equipment across the globe. The power generation plants using offshore and onshore solar, hydro, and wind power sources are expected to drive the need for the new distribution lines, which will positively impact the growth of the switchgear market. Moreover, rapid urbanization and growing investments in construction activities is significantly augmenting the demand for the switchgear across the developing regions. Furthermore, the innovations and the new product launches is exponentially driving the sales of the switchgear. For example, Eaton launched a switchgear in two parts.

The increasing energy demand across the globe is fueled the demand for the stable and reliable transmission and distribution network. The uninterrupted supply of power can be provided through the systems that can efficiently handle sudden power drop and spikes. The extended power shortages can result in huge losses to the businesses. The major reason behind the rising power outages is the lack of proper policies to modernize power grid and the aging power infrastructure. Therefore, the rising investments in the replacement of aging infrastructure in the developed and developing regions are expected to significantly drive the growth of the global switchgear market. The switchgear helps to safeguard the electrical equipment from sudden power spikes and drops. The switchgear isolates the circuits from the power supply that enables the easy repair and maintenance. These features of the switchgear results in high costs. Furthermore, the switchgear involves various components such as fuses, circuit breakers, switches, control panels, and protective relays that makes the cost of the switchgear high. Therefore, the high costs of the switchgear may hinder the market growth during the forecast period.

Switchgear Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 80.22 Billion |

| Market Size by 2033 |

USD 167.04 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.61% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Voltage, By Insulation, By Installation, and By End User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Caterpillar, Powell Industries, ABB Ltd., WEG SA, Eaton Corporation, Alstom, Toshiba Corporation, IEM, Siemens AG, BHEL, TIPECO, Crompton Greeves, Hitachi Limited, Fuji Electric, Meta Switchgear. |

Driver: Rising Investments in Power Infrastructure Development

A key driver for the switchgear market is the rising investments in power infrastructure development globally. As countries upgrade aging grids and expand their electricity networks to accommodate growing urban populations and industrial activities, the demand for switchgear is surging.

Infrastructure projects like smart grid rollouts, high-voltage direct current (HVDC) transmission systems, and rural electrification programs rely heavily on advanced switchgear systems. For instance, India's "Revamped Distribution Sector Scheme" (RDSS) and the U.S. "Infrastructure Investment and Jobs Act" both include massive allocations for grid modernization and resilience improvement, directly benefitting switchgear demand. Furthermore, the integration of renewable energy sources requires flexible and resilient grids, where modern switchgear ensures stability, fault tolerance, and optimized load management.

Restraint: High Cost of Advanced Switchgear Technologies

Despite the promising growth outlook, high costs associated with advanced switchgear technologies present a significant market restraint. Innovations such as eco-friendly SF6 alternatives, smart switchgear with remote sensing capabilities, and hybrid high-voltage switchgear involve substantial research, development, and production expenses.

These high costs often translate into expensive end-products, which can deter adoption, particularly among cost-sensitive utilities and industries in developing economies. Furthermore, integrating new-generation switchgear into existing electrical networks can involve significant retrofitting or upgrading costs. Without strong financial incentives or regulatory mandates, the transition to advanced switchgear solutions may face slower uptake, particularly in regions where budget constraints are pronounced.

Opportunity: Expansion of Renewable Energy Projects

An emerging opportunity within the switchgear market is the expansion of renewable energy projects across the globe. As governments and corporations commit to aggressive decarbonization targets, renewable energy capacity especially solar and wind s growing at an unprecedented pace.

Switchgear is critical for connecting renewable energy assets to transmission and distribution networks while ensuring safety and performance. Offshore wind farms, utility-scale solar parks, and distributed generation installations all require specialized switchgear designed to handle variability, remote monitoring, and grid synchronization challenges. Companies investing in renewable energy infrastructure increasingly demand high-reliability, low-maintenance switchgear solutions, opening up new revenue streams for manufacturers. Notably, massive projects like Saudi Arabia's NEOM, Europe's North Sea Wind Power Hub, and India's Green Energy Corridor illustrate the magnitude of switchgear market opportunities linked to renewable growth.

Segments Insights:

Voltage Insights

The high-voltage segment dominated the switchgear market, capturing the largest revenue share in 2024. High-voltage switchgear (above 36kV) is primarily deployed in power generation stations, high-capacity transmission networks, and large industrial plants. The demand is propelled by grid expansion projects, HVDC system installations, and cross-border interconnection projects aimed at enhancing grid reliability and integrating renewable energy at scale. For example, China's "West-East Electricity Transmission" project significantly drives high-voltage switchgear demand.

The medium-voltage segment is the fastest-growing voltage segment. Ranging typically from 1kV to 36kV, medium-voltage switchgear is crucial for distribution networks and industrial facilities. Its growth is fueled by increasing urbanization, industrialization, and the construction of commercial complexes requiring resilient and decentralized power systems. Innovations like Ring Main Units (RMUs) and compact switchgear are gaining popularity in this segment, offering easy installation and minimal maintenance, particularly attractive for expanding urban infrastructures in emerging economies.

Insulation Insights

The gas-insulated switchgear (GIS) segment dominated the insulation type segment. GIS is preferred for its compact footprint, high reliability, and ability to operate efficiently in extreme environmental conditions. Its adoption is especially high in urban substations where space constraints are critical, as well as in offshore wind substations requiring robust environmental protection. Developments in eco-friendly gas alternatives are also propelling GIS adoption while addressing environmental concerns.

Vacuum-insulated switchgear is the fastest-growing segment, thanks to its high dielectric strength, low maintenance needs, and suitability for medium-voltage applications. Vacuum insulation eliminates the use of greenhouse gases like SF6, aligning with sustainability goals. Industries and utilities seeking environmentally friendly, cost-effective, and long-lasting solutions are increasingly shifting towards vacuum-based technologies.

Installation Insights

Outdoor switchgear installations dominated the market, given their widespread use in transmission substations, renewable energy plants, and large-scale infrastructure projects. Outdoor switchgear units are designed to withstand harsh environmental conditions and are often favored for grid expansion in rural and semi-urban areas. Projects like Africa's "Desert to Power" initiative demonstrate outdoor switchgear's critical role in vast, open landscapes.

Indoor switchgear installations are growing rapidly, particularly in urban environments where space constraints, aesthetic considerations, and noise regulations necessitate compact, enclosed electrical infrastructure. Indoor switchgear is commonly installed in commercial buildings, data centers, manufacturing plants, and underground substations. Innovations in compact GIS and modular switchgear systems are further boosting indoor adoption.

End User Insights

The transmission and distribution (T&D) utility segment dominated the end-user segment, driven by massive investments in grid modernization, expansion, and renewable energy integration. Utilities globally are deploying advanced switchgear to enhance network reliability, reduce transmission losses, and manage decentralized energy resources. Projects like the European "Ten-Year Network Development Plan" (TYNDP) heavily focus on upgrading switchgear installations.

The industrial segment is the fastest-growing end-user, fueled by rising demand for continuous and quality power supply in manufacturing, oil & gas, mining, and processing industries. Industries require customized switchgear solutions that ensure minimal downtime, optimal protection against faults, and remote monitoring capabilities. The drive towards Industry 4.0 and smart factories is further boosting demand for digital and automated switchgear systems.

Regional Analysis

Asia-Pacific dominated the global switchgear market, accounting for the largest share in 2024. The region's rapid urbanization, burgeoning population, and ambitious energy infrastructure development plans are primary drivers. China leads the market, with its extensive grid expansion, renewable energy integration, and HVDC projects. India's "Power for All" initiative and Southeast Asia's rural electrification programs further bolster regional growth. Technological advancements, local manufacturing capabilities, and supportive regulatory frameworks ensure Asia-Pacific's leadership in switchgear demand.

Middle East & Africa (MEA) is the fastest-growing regional market, propelled by infrastructure investments, smart city projects, and renewable energy developments. Countries like Saudi Arabia, the UAE, South Africa, and Egypt are undertaking massive projects, such as Saudi Arabia's Vision 2030, which emphasizes clean energy and grid modernization. The electrification of rural and semi-urban areas across Africa also demands robust, affordable, and scalable switchgear solutions, creating immense opportunities for market players.

Key Market Developments

-

April 2025: ABB Ltd. launched its ecoGIS range, a portfolio of eco-friendly gas-insulated switchgear solutions replacing SF6 with a sustainable alternative.

-

March 2025: Schneider Electric announced the deployment of its SM AirSeT switchgear technology at a major commercial complex in Paris, offering SF6-free, digitalized operations.

-

February 2025: Siemens Energy secured a contract to supply GIS for a major offshore wind project in the North Sea, enhancing renewable energy connectivity.

-

January 2025: Eaton Corporation expanded its medium-voltage switchgear manufacturing facility in India to meet rising demand in Asia-Pacific.

-

December 2024: Mitsubishi Electric Corporation introduced a new range of digital substations incorporating intelligent switchgear for enhanced monitoring and maintenance capabilities.

Some of the prominent players in the Switchgear market include:

- Caterpillar

- Powell Industries

- ABB Ltd.

- WEG SA

- Eaton Corporation

- Alstom

- Toshiba Corporation

- IEM

- Siemens AG

- BHEL

- TIPECO

- Crompton Greeves

- Hitachi Limited

- Fuji Electric

- Meta Switchgear

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global switchgear market.

By Voltage

By Insulation

By Installation

By End User

- Transmission & Distribution Utility

- Industrial

- Residential & Commercial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)