Topical Drug Delivery Market Size and Growth 2026 to 2035

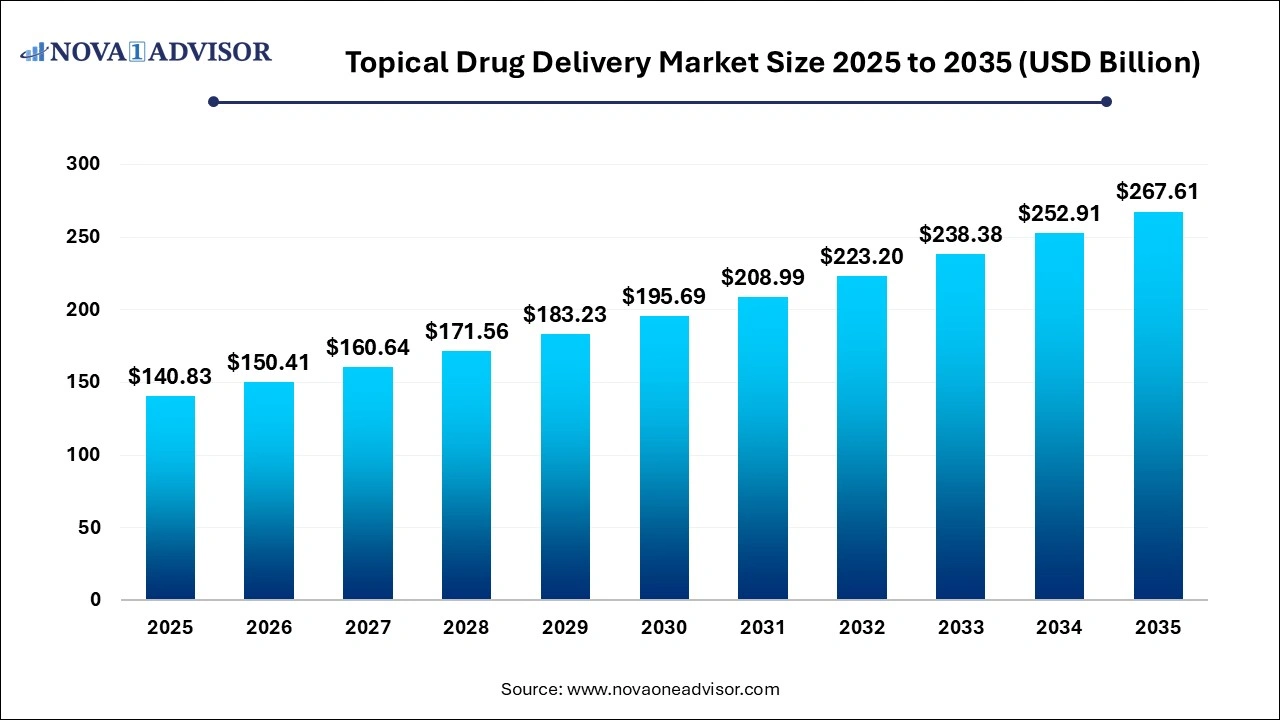

The global topical drug delivery market size was valued at USD 140.83 billion in 2025 and is anticipated to reach around USD 267.61 billion by 2035, growing at a CAGR of 6.63% from 2026 to 2035.

Topical Drug Delivery Market Overview

The topical drug delivery market is a critical segment within the pharmaceutical industry, characterized by the administration of medications through the skin or mucous membranes. This method offers numerous advantages, including localized treatment, reduced systemic side effects, and improved patient compliance. The market's growth is driven by several factors: technological advancements in formulation techniques that enhance drug permeation and bioavailability; rising prevalence of skin disorders, chronic diseases, and conditions requiring localized treatment; increasing consumer preference for non-invasive drug delivery methods; and expanding applications in dermatology, pain management, and cosmetic treatments. Key players in the market are investing heavily in research and development to introduce innovative formulations and improve therapeutic outcomes. Regulatory support and initiatives to streamline approval processes further bolster market expansion. As a result, the topical drug delivery market is poised for continued growth, driven by advancements in science, evolving patient needs, and expanding therapeutic applications.

Topical Drug Delivery Market Growth

The topical drug delivery market is experiencing significant growth driven by several key factors. Firstly, advancements in formulation technologies have enabled the development of more effective topical treatments with enhanced drug absorption and sustained release capabilities. This has expanded the range of conditions that can be effectively treated through topical applications, including dermatological disorders, pain management, and wound care. Secondly, the increasing prevalence of chronic diseases such as arthritis and diabetes has boosted the demand for localized and targeted therapies that minimize systemic side effects. Additionally, growing consumer preference for non-invasive drug delivery methods, coupled with the convenience and ease of use offered by topical formulations, has further fueled market expansion. Moreover, favorable regulatory initiatives and investments in research and development by pharmaceutical companies are expected to drive innovation and market growth in the coming years.

Topical Drug Delivery Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 150.41 Billion |

| Market Size by 2035 |

USD 267.61 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.63% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, Route of Administration, Application, By End User |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Johnson & Johnson, Novartis International AG, F. Hoffmann-La Roche AG, Pfizer Inc., Bayer AG, Antares Pharma, Inc., GlaxoSmithKline plc, 3M (US), Merck & Co., Inc., Sanofi, Amgen, Inc. |

U.S. Topical Drug Delivery Market Size, Share & Growth Analysis Report 2035

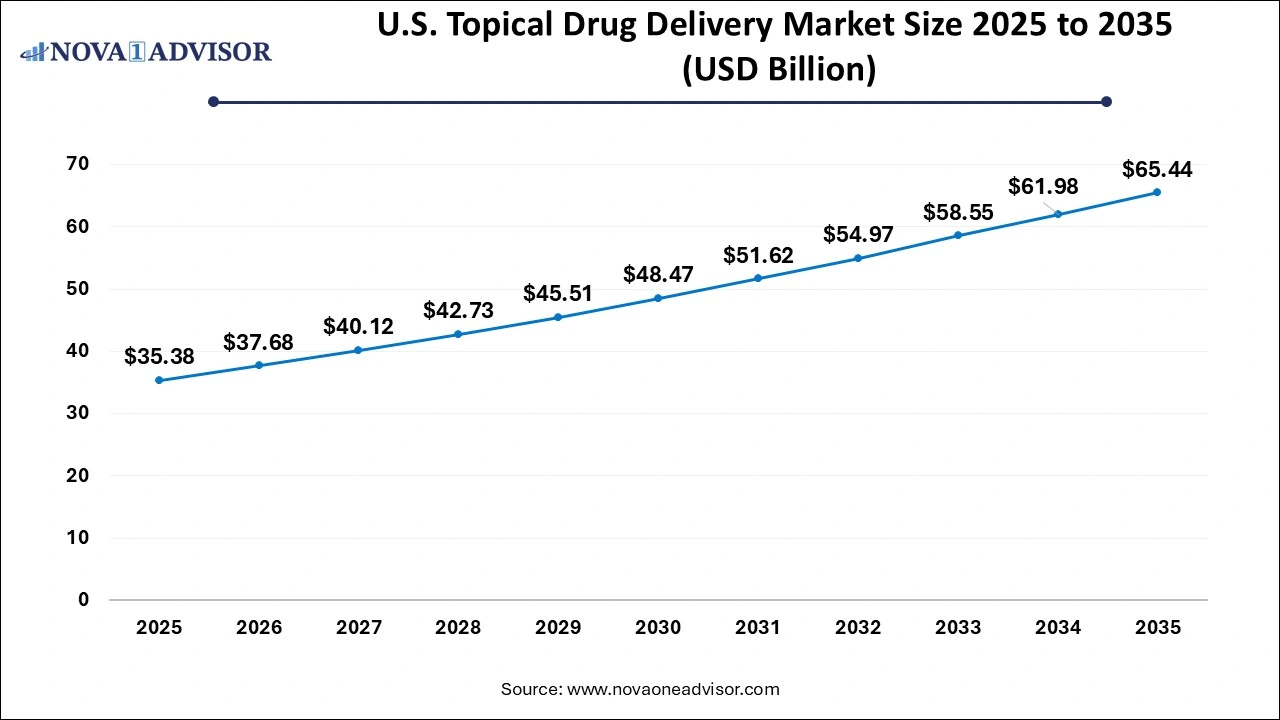

The U.S. topical drug delivery market size was valued at USD 35.38 billion in 2025 and is projected to surpass around USD 65.44 billion by 2035, registering a CAGR of 6.34% over the forecast period of 2026 to 2035.

North America leads the global topical drug delivery market, primarily due to its advanced healthcare infrastructure, high prevalence of dermatological and chronic pain conditions, and strong presence of pharmaceutical innovators. The U.S. accounts for the majority share, fueled by high healthcare spending, favorable reimbursement policies for prescription topical therapies, and a strong consumer market for OTC skincare products.

Regulatory clarity from the FDA and a large base of dermatologists and primary care providers further supports market maturity. Companies like Pfizer, GlaxoSmithKline, and Johnson & Johnson have robust topical portfolios targeting conditions from eczema to migraines. The rapid uptake of transdermal systems for hormone therapy and pain management is also driving innovation and clinical acceptance.

Asia-Pacific is the fastest-growing market, propelled by expanding middle-class populations, growing awareness about skincare and chronic disease management, and increased investment in healthcare infrastructure. Countries like India, China, and South Korea are experiencing a rise in dermatological conditions due to pollution, changing lifestyles, and urbanization, which fuels demand for both prescription and OTC topical therapies.

Local pharmaceutical companies are innovating cost-effective solutions and leveraging e-commerce channels to reach rural and underserved regions. Moreover, supportive government initiatives, the rise of aesthetic dermatology, and increased adoption of transdermal patches for conditions like hypertension and pain management are contributing to this region’s rapid growth trajectory.

Topical Drug Delivery Market Dynamics

Driver: High Incidence of burn injuries

The treatment of burn injuries is one of the major application areas of topical drugs. Topical antimicrobial agents such as Fenistil (GSK), Sulfamylon cream (Mylan), Bactroban (GSK), and Silvadene (Pfizer) are considered the first line of treatment for burn injuries in patients.

According to the Lancet Public Health, in 2021, burns were one of the major causes of disability, with more than 8 million disability-adjusted life-years (DALYs). The high incidence of burn injuries in major regional segments across the globe has resulted in sustained demand for topical drugs for effective burn treatment and management. Many topical antimicrobial agents are used to cure burns. An antimicrobial agent such as silver sulfadiazine cream is used to treat wound infections in second and third-degree burns patients. However, patients with severe burns or burns over a large area are treated in a hospital. There are many other antibiotic ointments for burns, such as over-the-counter options for an uncomplicated burn.

Restraint: Continuous irritation on skin and allergies caused by topical drugs

Many topical formulations are available over the counter and include antibacterial & antifungal preparations, anti-inflammatory & pain-relief preparations, and cleansing & moisturizing agents. Topical corticosteroids are used in many inflammatory rashes. However, in some cases, topical corticosteroid sensitivity produces allergic reactions. Usually, this is seen as a failure to cure dermatitis or to worsen existing dermatitis treated with corticosteroids. Very rarely, corticosteroid allergy may appear as an eczematous rash in a completely different area of the body from the original dermatitis. Some topical antibiotics may also cause contact allergies, such as bacitracin, which is used to prevent minor skin injuries such as cuts, scrapes, and burns. Benzocaine and salicylate are some of the active ingredients in topical formulations which causes allergies. These allergies caused by such drugs can be diagnosed by a patch test that can detect contact allergens. Allergy to topical medications is more common in older patients, but some patients with pre-existing skin conditions are at a higher risk of developing allergic reactions to topical medications. These allergies caused by the topical drugs are one of the limitations of the usage of such medicines. In most cases, patients adopt another type of drug delivery system or go for other forms of medicine.

Opportunity: Rising demand for self-administration and home care

Self-administration of drugs within home care settings is expected to provide significant growth opportunities for players operating in the market. This is mainly due to the rising geriatric population and closing regular OPDs for a few months during COVID-19. Elderly individuals form a large consumer base for topical drugs in-home care. This factor also increases the need for inhalation, topical, and transdermal drug products designed to cater to the needs of caregivers and patients. Transdermal drug delivery enhances the ease of administration of drugs as it uses a transdermal patch that can be easily self-administered. It provides suitable and painless self-administration for patients. This approach helps reduce healthcare costs by reducing the duration of hospital stays. Also, in the case of transdermal patches, caregivers can easily determine if a patch is placed securely. This acts as one of the main opportunities to increase the demand for transdermal patches, boosting the growth of topical drug deliveries.

Challenge: Topical formulation for drugs with limited plasma concentration

Topical drug delivery refers to the application of medication to the surface of the skin or within the layers of skin or mucous membrane. Skin acts as a barrier and prevents the penetration of many APIs, even though it is an ideal site to achieve both local and systemic effects via the delivery of drug substances. However, drugs that have a larger particle size are not easily absorbed through the skin. To facilitate skin absorption, the molecular weight of a compound should be under 500 Dalton when developing drug substances for use in topical dermatological therapies. These high molecular weight drugs are poorly lipid-soluble and cannot achieve the desired therapeutic effect and action. Percutaneous absorption decreases with high molecular weight. This decreased therapeutic effect of topical medicines limits the adoption of topical drug delivery.

Topical Drug Delivery Market Segment Insights

By Product Insights

Semi-solid formulations dominate the topical drug delivery market, especially creams and ointments. These are preferred due to their ease of application, high patient compliance, and effectiveness across a broad range of indications such as infections, inflammation, and dermatological disorders. Creams, being emulsions, are favored for both cosmetic and medical purposes due to their non-greasy feel and faster absorption. Ointments, though greasier, are highly effective for deep penetration and long-term moisturization, especially in chronic skin conditions like psoriasis.

Transdermal products are the fastest-growing segment, particularly transdermal patches. These systems are increasingly used for hormone replacement therapy, pain management (e.g., fentanyl), and smoking cessation (e.g., nicotine patches). Their ability to deliver drugs systemically over prolonged periods, bypass first-pass metabolism, and reduce dosing frequency makes them a valuable option. Innovations such as microneedle-based patches and electronically controlled patches are expanding therapeutic indications and enhancing patient convenience, propelling rapid growth in this segment.

By Route of Administration Insights

Topical route remains dominant, reflecting the core nature of this market. It includes direct skin applications for both local effects (like eczema treatment) and systemic absorption (as in hormone patches). The topical route is non-invasive, avoids gastrointestinal side effects, and enhances patient adherence, especially in chronic dermatologic and musculoskeletal conditions.

Transmucosal and nasal routes are emerging as the fastest-growing administration paths. These offer rapid absorption and are being explored for neurological drugs, hormone therapies, and vaccines. For instance, transmucosal buprenorphine and nasal sumatriptan for migraine treatment are gaining clinical and commercial traction. The convenience of non-injectable delivery with fast onset makes these routes attractive for acute and chronic disease management, positioning them for significant future expansion.

By Distribution Channel Insights

Retail pharmacies dominate the distribution segment, accounting for the highest sales volume due to over-the-counter availability of a wide range of topical formulations such as antifungal creams, anti-inflammatory gels, and dermatological products. Accessibility, affordability, and patient trust make retail channels the first point of contact for self-medicated conditions.

Online pharmacies are the fastest-growing distribution channel, driven by increased digital health adoption, convenience, and the rise of direct-to-consumer (DTC) telemedicine brands. The pandemic has further accelerated e-commerce adoption for healthcare, with brands like Hims, Hers, and Nurx offering prescription topical products via virtual consultations. Online platforms also enable home delivery, refill reminders, and access to discreet services, driving growth especially in urban populations.

Key Market Developments

-

March 2025: GSK launched a new topical anti-inflammatory gel incorporating nano-lipid technology to improve penetration for treating osteoarthritis-related pain, enhancing its Voltaren product line.

-

January 2025: Pfizer partnered with a biotech startup specializing in smart wearable patches to co-develop electronically controlled transdermal delivery systems for cardiovascular drugs.

-

November 2024: Teva Pharmaceuticals received FDA approval for a generic version of Diclofenac Sodium Topical Gel 1%, entering the U.S. market with a cost-effective alternative to branded formulations.

-

September 2024: Sanofi launched a digital adherence monitoring patch for hormone replacement therapy in partnership with a med-tech firm, integrating AI to guide patient dosing.

-

June 2024: Lupin announced the expansion of its topical manufacturing facility in India to serve increasing export demand for corticosteroid creams and antifungal ointments.

Topical Drug Delivery Market Top Key Companies:

- Johnson & Johnson

- Novartis International AG

- F. Hoffmann-La Roche AG

- Pfizer Inc.

- Bayer AG

- Antares Pharma, Inc.

- GlaxoSmithKline plc

- 3M (US), Merck & Co., Inc.

- Sanofi

- Amgen, Inc.

Topical Drug Delivery Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Topical Drug Delivery market.

By Product

- Semi-Solid Formulations

- Creams

- Ointments

- Lotions

- Gels

- Pastes

- Liquid Formulations

- Solid Formulations

- Transdermal Products

- Transdermal Patches

- Transdermal Semi-solids

By Route of Administration

- Oral

- Injectable

- Topical

- Ocular

- Pulmonary

- Implantable

- Transmucosal

- Nasal

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By End User

- Home Care Settings

- Hospitals & Clinics

- Burn Centers

- Other Facilities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)